Blog

Digital Services Act (DSA)

The Digital Services Act (DSA) reshapes EU financial services, mandating transparency in digital operations. Institutions must align with the DSA's stringent content moderation and user protection requirements.

Basel III Impact on Banking Capital Requirements

Basel III revolutionises banking regulations, focusing on robust capital requirements. EU and UK banks must align with new rules by 2025, bolstering financial stability and risk management.

NIS 2 Directive: Relation to DORA Regulation

EU banks navigate complex compliance with NIS2, CER, & DORA. The Swedish Banking Assoc. seeks a harmonised approach to streamline processes, ensure cybersecurity, and bolster operational resilience within the financial sector.

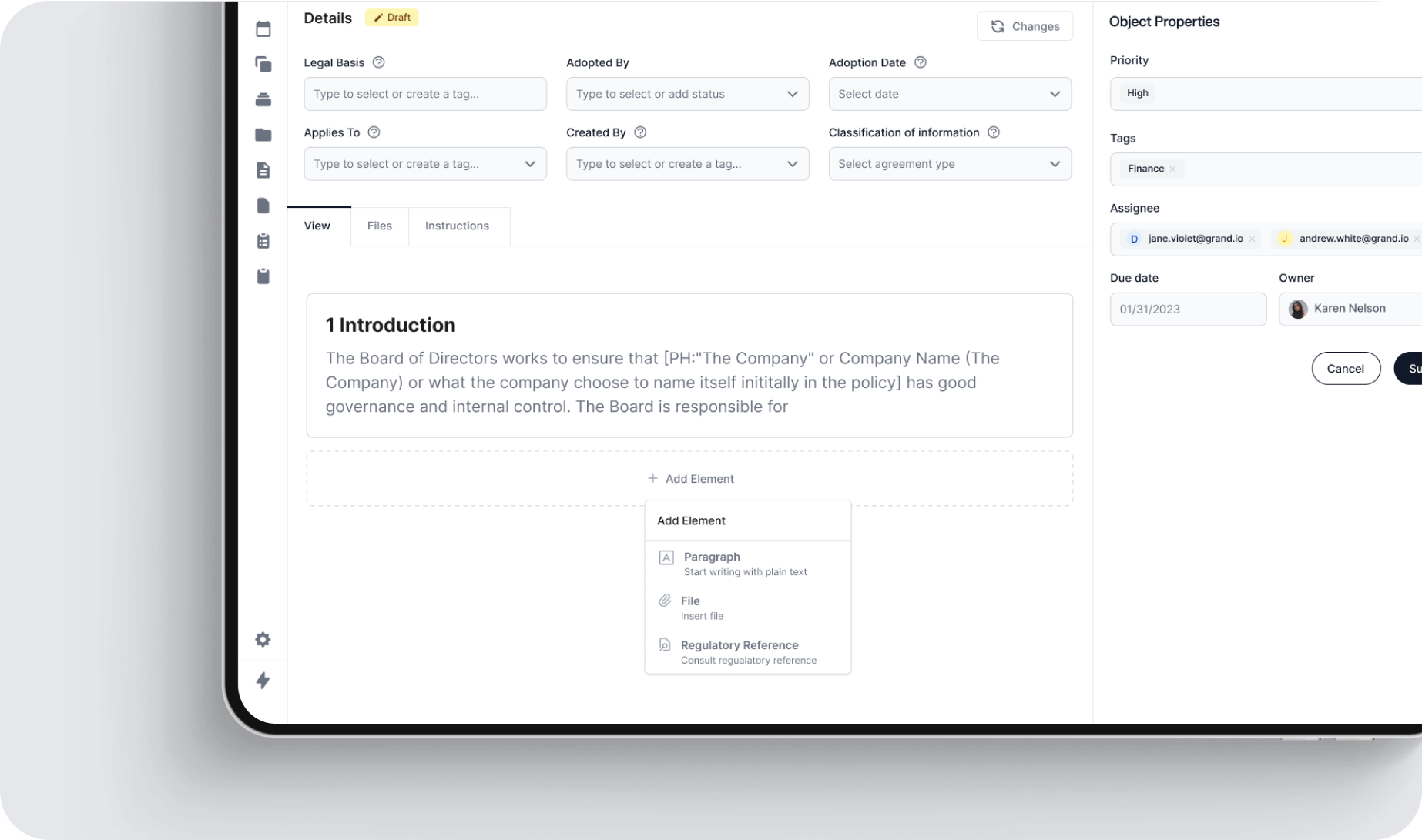

Regulatory Monitoring Software: Regtech Automation

Regulatory monitoring software is pivotal for businesses seeking to navigate complex compliance landscapes, providing critical insights for effective risk management and legal adherence.

Corporate Transparency Act

The UK's new Economic Crime and Corporate Transparency Act (ECCTA) elevates financial regulations, targeting money laundering and enhancing corporate transparency, notably reforming Companies House and strengthening anti-money laundering defenses in the digital era.

Reduce your

compliance risks