PRIIPs: FCA Announce New CCI Framework

Britain announces the new CCI framework replacing PRIIPs, with temporary exemptions for investment trusts to improve cost disclosures and transparency.

On 19 September 2024, HM Treasury (HMT) and the Financial Conduct Authority (FCA) announced comprehensive reforms to the UK's retail disclosure rules, signaling a major departure from the EU-inherited Packaged Retail and Insurance-based Investment Products (PRIIPs) Regulation. These reforms are part of a broader strategy to revitalize the UK’s capital markets, aligning PRIIPs disclosure requirements more closely with the needs of UK firms and investors. The new framework introduces a more tailored and responsive approach, addressing long-standing concerns about PRIIPs compliance and enhancing clarity in investment disclosures.

Source

[1]

[2]

PRIIPs Regulation and Consumer Protection

The PRIIPs Regulation was originally established to promote transparency and protect retail investors within the European Union by providing standardized, easy-to-understand information about investment products. The central tool of this regulation was the Key Information Document (KID), designed to help investors evaluate risks, costs, and potential returns. However, the PRIIPs framework has been widely criticized for its complexity and inflexibility, particularly regarding cost disclosures and risk indicators. These rigid components often failed to capture the nuances of diverse financial products, including investment trusts and other sophisticated investment vehicles.

A significant critique of the PRIIPs Regulation is its reliance on a one-size-fits-all methodology for presenting cost information. This approach has not always accurately represented the actual costs experienced by investors, particularly for products with varying fee structures and levels of complexity. As a result, industry stakeholders have voiced dissatisfaction, leading to calls for a regulatory framework that better aligns with the UK's unique market dynamics. Following the UK’s exit from the EU, the government is taking the opportunity to develop a disclosure regime that is more flexible and responsive to the specific needs of UK markets.

Introduction of the Consumer Composite Investments (CCI) Framework

At the heart of the UK's new retail disclosure overhaul is the introduction of the Consumer Composite Investments (CCI) framework, set to replace the existing PRIIPs Regulation. This marks a significant regulatory shift, addressing many of the criticisms directed at the EU-inherited PRIIPs rules. Specifically, the CCI framework focuses on improving the transparency and accuracy of cost disclosures while providing more flexible and proportionate rules. These reforms are designed to resolve the challenges posed by the inflexibility of the PRIIPs framework, which has hindered the ability to provide product-specific disclosures for complex investment vehicles.

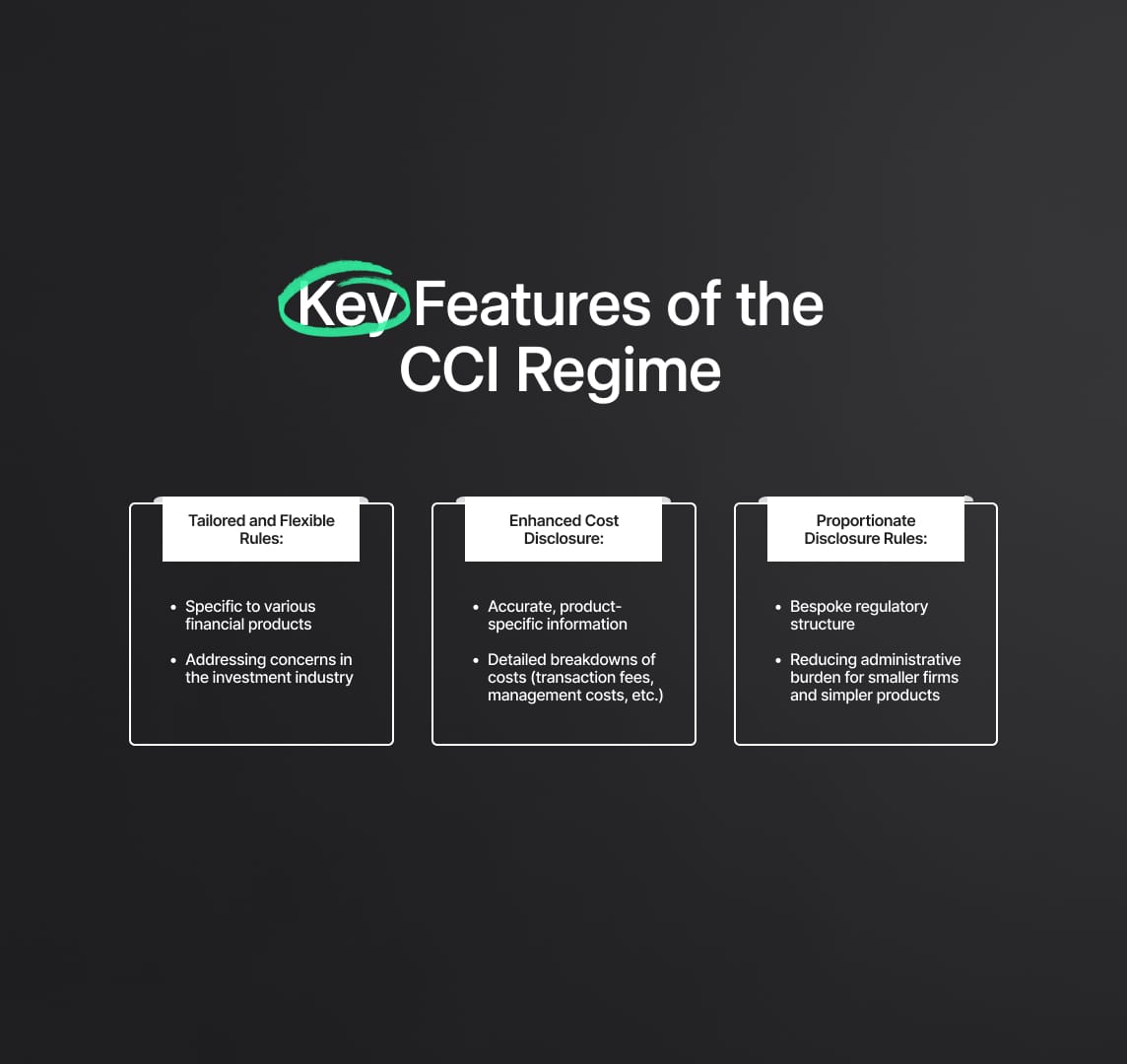

Key Features of the CCI Regime

Tailored and Flexible Rules

One of the most significant improvements under the CCI framework is the introduction of tailored rules that are specific to the characteristics of various financial products. This shift from the rigid one-size-fits-all approach under PRIIPs is critical for addressing concerns in the investment industry, especially for products like investment trusts, which require more customized disclosure standards. Financial products can vary greatly in terms of structure, risk profiles, and fee models, and the tailored approach under CCI allows disclosure rules to adapt accordingly, minimizing the risk of misleading or oversimplified information—a key issue under the PRIIPs regime.

The CCI regime will establish granular disclosure requirements, ensuring that the characteristics of each product are more accurately reflected in the disclosures. For example, in cases where investment trusts or structured products have complex cost structures, the CCI framework will allow these differences to be clearly presented, providing investors with a more accurate understanding of the costs they are incurring.

Enhanced Cost Disclosure

A central problem with the PRIIPs Regulation has been its cost disclosure framework, which has been widely criticized for generating cost information that does not accurately reflect the true costs faced by investors. The PRIIPs methodology often produced figures that were either understated or overstated due to its rigid assumptions. The CCI regime seeks to remedy this by adopting a more nuanced and transparent approach to cost disclosures, ensuring that investors receive accurate, product-specific information.

This improvement is particularly important for products like investment trusts, where the current PRIIPs methodology has often misrepresented actual expenses, leading to distorted cost assessments. Under the new CCI framework, disclosures will include more detailed breakdowns of costs, such as transaction fees, management costs, and other indirect expenses that may not have been sufficiently captured under the PRIIPs system. By offering more transparent and comprehensive cost disclosures, the CCI regime aims to equip investors with meaningful information, improving their ability to make informed investment decisions.

Proportionate and Flexible Disclosure Rules

The proportionate approach embedded within the Consumer Composite Investments (CCI) framework is a significant advancement over the PRIIPs Regulation. The PRIIPs system has often been criticized for being overly burdensome, requiring all products—regardless of their complexity or size—to adhere to the same set of rules. This has led to inefficiencies and placed unnecessary regulatory burdens on smaller firms and providers of simpler financial products.

The CCI framework introduces a bespoke regulatory structure, ensuring that disclosure requirements are proportionate to the nature of the product and the level of investor protection needed. Smaller firms and less complex financial products will benefit from this proportionate approach, reducing the administrative burden and simplifying the disclosure process. The framework ensures that investors receive the right amount of information without being overwhelmed by excessive or irrelevant details, which has been a common issue under PRIIPs.

By focusing on proportionality and flexibility, the CCI regime will create a more streamlined and efficient disclosure process, providing the necessary clarity while maintaining the transparency that investors require to make sound financial decisions.

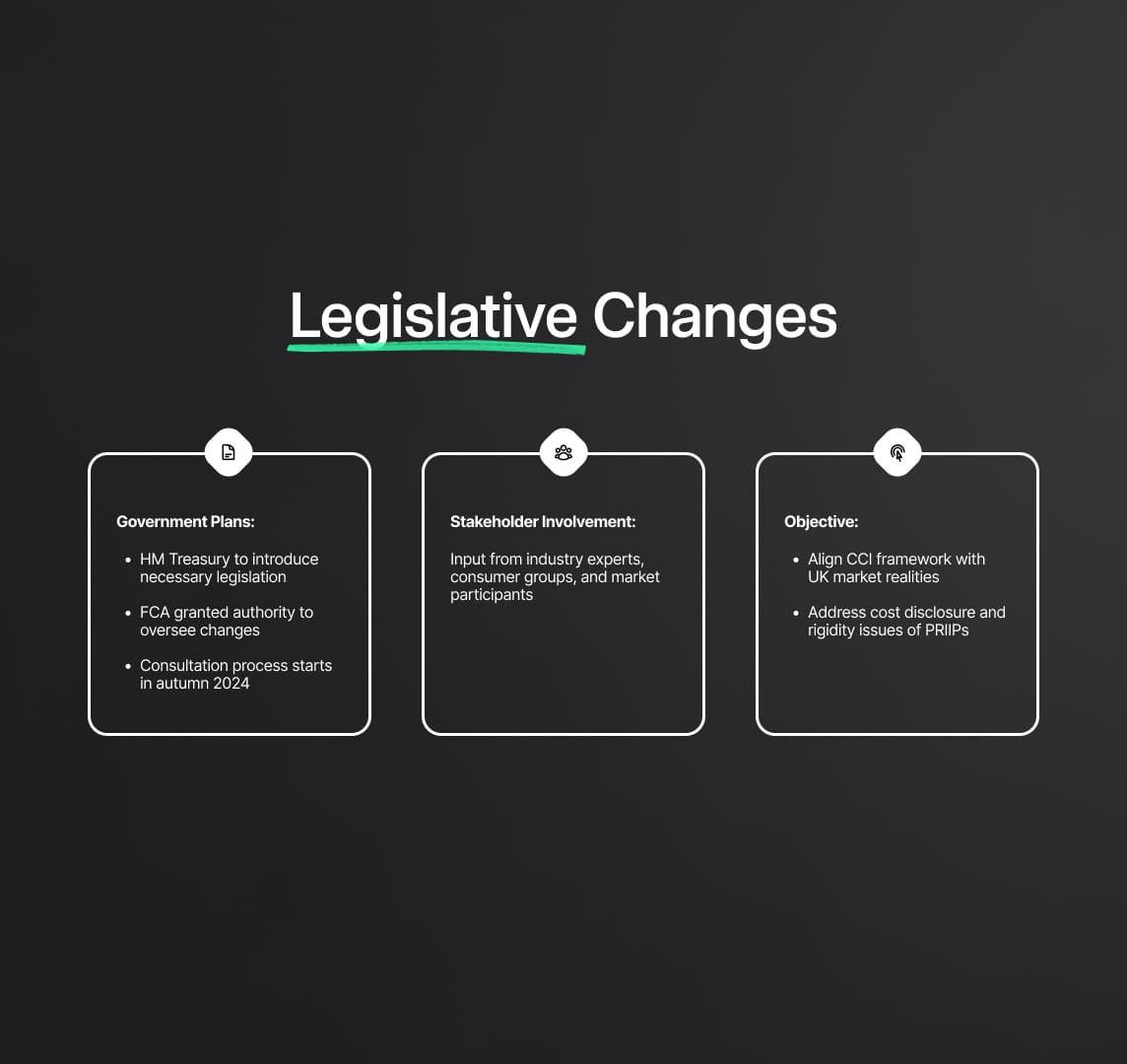

Legislative Changes

HM Treasury has confirmed its plans to introduce the necessary legislation to implement the CCI framework, granting the FCA the authority to oversee these changes. The consultation process for the CCI framework is expected to begin in autumn 2024, with the new regulatory regime anticipated to be in place by the first half of 2025, pending Parliamentary approval.

The consultation process will enable a wide range of stakeholders—including industry experts, consumer groups, and market participants—to provide input on the proposed CCI rules. This will ensure that the new framework addresses the pain points of the PRIIPs system, particularly with regard to cost disclosure methodologies and the rigidity of existing rules. By aligning the CCI framework more closely with the realities of the UK market, the FCA aims to create a disclosure regime that is both transparent and adaptable to the evolving nature of financial products.

Proportionate Approach

The proportionate approach introduced under the Consumer Composite Investments (CCI) framework marks a key advancement over the PRIIPs regime. The PRIIPs framework has long been criticized for its burdensome nature, applying a one-size-fits-all set of rules to all financial products, regardless of complexity or size. This has created inefficiencies and imposed excessive regulatory burdens on smaller firms and providers of more straightforward products.

The new CCI framework will implement a bespoke regulatory structure, ensuring that disclosure requirements are proportionate to the specific nature of each product and the level of investor protection required. This tailored approach benefits smaller firms and simpler financial products, allowing them to avoid the unnecessary complexity often imposed by PRIIPs. By adapting disclosure requirements to the characteristics of the products, the CCI framework ensures that the right level of information is provided without overwhelming investors with excessive or irrelevant details.

Focusing on proportionality, the CCI framework aims to streamline and improve the efficiency of the disclosure process, ensuring investors receive clear, relevant information to make informed decisions. This eliminates the confusion that can arise from overly complex disclosures, a common issue under the PRIIPs regime.

Temporary Exemption for Investment Trusts

One of the most immediate changes announced by HMT and the FCA is the temporary exemption for investment trusts from the current PRIIPs Regulation. Investment trusts are a critical part of the UK’s investment landscape, representing over 30% of the FTSE 250 and managing assets exceeding £260 billion. Given their significance in the UK’s financial markets, a more bespoke regulatory approach is required, particularly in light of the challenges they have faced under the PRIIPs regime.

Issues with PRIIPs and Investment Trusts

Under the existing PRIIPs framework, cost disclosure requirements have posed substantial challenges for investment trusts. The calculation methodologies in the PRIIPs Key Information Documents (KID) often lead to cost presentations that are either unclear or inaccurately reflect the true costs associated with these vehicles. This misrepresentation is largely due to PRIIPs' one-size-fits-all approach, which does not account for the structural complexities of investment trusts. As a result, many investors may have received misleading or incomplete information about the actual expenses they would incur, potentially distorting their investment decisions.

Additionally, the static nature of PRIIPs disclosures has made it difficult for investment trusts to present more nuanced information that reflects their unique features, such as performance-based fees or varying management structures. These issues have prompted strong calls for reform, ultimately leading to the UK government’s decision to temporarily exempt investment trusts from PRIIPs requirements.

Forbearance and Interim Measures

Recognizing these challenges, the government has enacted a forbearance policy for investment trusts. Effective from 19 September 2024, the FCA will not enforce compliance with the existing PRIIPs Regulation for investment trusts. This forbearance policy offers immediate regulatory relief while the new CCI framework is finalized and implemented.

This interim measure provides much-needed certainty to investment trusts, allowing them to operate without the burden of adhering to a regime that has been widely regarded as ineffective in accurately capturing their cost structures. The exemption will remain in place until the CCI framework is fully implemented, ensuring that investment trusts will no longer be subject to the flawed PRIIPs disclosure rules. Once the CCI regime is operational, investment trusts will benefit from the tailored and flexible disclosure requirements the new framework promises to introduce.

Key Objectives of the CCI Framework

Enhanced Investor Protection

The primary goal of the CCI framework is to ensure investors are better protected through more meaningful and accurate disclosures. By refining the methodologies used to present cost and risk information, the CCI framework will enhance investors' ability to make informed choices about their investments. This is especially critical for products like investment trusts, where current disclosure practices under PRIIPs have led to confusion and, in some cases, misleading information.

Reducing Regulatory Burden

Another key objective of the CCI framework is to reduce the regulatory burden on firms, particularly those offering complex financial products like investment trusts. The proportionate approach embedded within the CCI regime allows for bespoke disclosure arrangements, ensuring firms can provide accurate and relevant information without facing excessive complexity or unnecessary administrative burdens. This proportionate structure will be especially beneficial for smaller firms that have struggled under the PRIIPs framework.

Supporting Market Growth

By addressing the concerns of both investors and industry stakeholders, the new disclosure regime aims to support the growth of the UK’s financial markets. A more transparent and investor-friendly system will not only protect consumers but also encourage investment, contributing to the overall health and expansion of the UK capital markets.

Reduce your

compliance risks