PRIIPS Modernization: European Parliament's ECON Report

On March 26, 2024, the ECON Committee released a report proposing amendments to modernize the key information document under Regulation (EU) No 1286/2014.

On March 26, 2024, the European Parliament’s Committee on Economic and Monetary Affairs (ECON) released a pivotal report concerning the proposed Regulation to modernize Regulation (EU) No 1286/2014, particularly focusing on the key information document. This report underscores the crucial role of the Capital Markets Union (CMU) in fostering consumer empowerment within the investment landscape. Aimed at ensuring that consumers can effectively harness the opportunities presented by capital markets, the report emphasizes the necessity of a robust regulatory framework that bolsters financial literacy and safeguards investor interests across the European Union (EU). Central to this effort is the refinement of definitions pertinent to packaged retail investment products (PRIPs), as outlined in Article 4 of Regulation (EU) No 1286/2014, to align with the evolving market dynamics while prioritizing transparency and protection for retail investors.

When retail customers are presented with a plethora of investment options through Packaged Retail Investment and Insurance Products (PRIIPs), important information about these options could be dispersed throughout multiple documents. Retail investors find it difficult to determine the entire cost of PRIIPs due to this fragmentation, which makes it more difficult for them to make well-informed investment decisions. In order to tackle this problem, it is necessary to provide retail investors with resources, such as modeling tools, that make it easier for them to obtain and compare the total costs of PRIIPs before deciding on a particular investment option. In order to improve transparency on the overall expenses of PRIIPs, more specific regulations governing their use are being put into place, but with some leeway for their use.

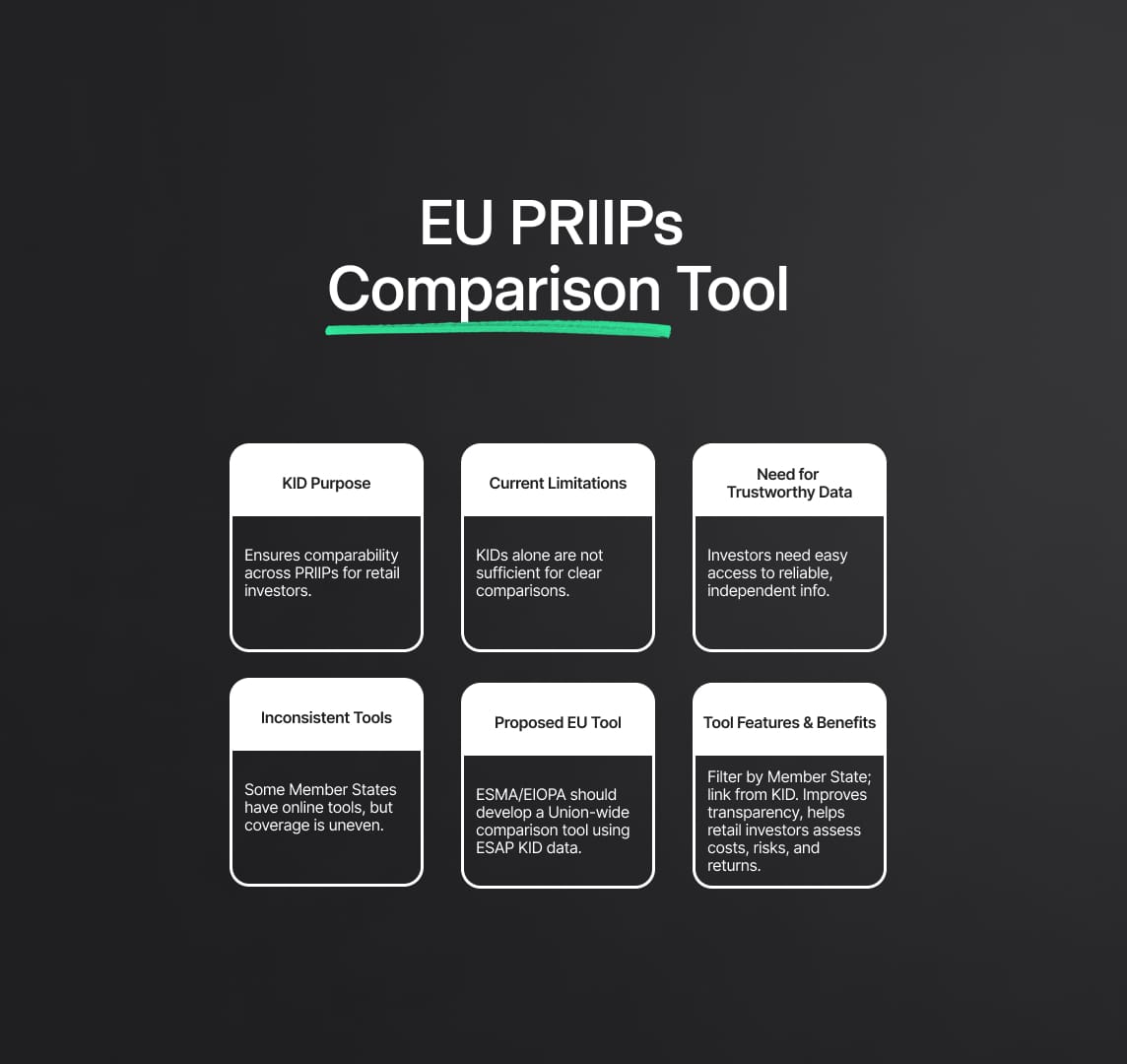

Enhancing Retail Investor Empowerment: Establishing a Union-wide Comparison Tool for PRIIPs

The key aspects of the proposal are aimed at enhancing retail investor empowerment through the establishment of a Union-wide comparison tool for Packaged Retail Investment and Insurance Products (PRIIPs). This proposal addresses the challenges faced by retail investors in effectively comparing PRIIPs and emphasizes the need for accessible, reliable information. Below are the main points highlighted in this proposal:

- KID Goal: To guarantee comparability between Packaged Retail Investment and Insurance Products (PRIIPs), the Key Information Document (KID) was created.

- Difficulties with KID: Although the KID was created with good intentions, retail investors have found it challenging to compare PRIIPs efficiently with just this document.

- Need for Reliable Information: By comparing the various PRIIPs offered in the Union, retail investors should have easy access to independent, trustworthy sources of information that will help them make well-informed investment decisions.

- Online resources now in use: Although some Member States have access to online resources already, their availability differs throughout the Union.

- Suggestions for a Union-wide Comparative Instrument: It is suggested that an impartial Union online comparison tool be developed by the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA). The European Single Access Point's KID data will serve as the foundation for this tool.

- Tool functionality: Retail investors should be able to filter product categories by Member State using the comparison tool. A link to this tool should be revealed in the KID as soon as it becomes available.

- Benefits of the Tool: By giving retail investors a convenient, transparent, and trustworthy source of information about the qualitative features, costs, risks, and returns on investment for each commercialized product, the tool's implementation would make it easier for them to participate in the capital markets.

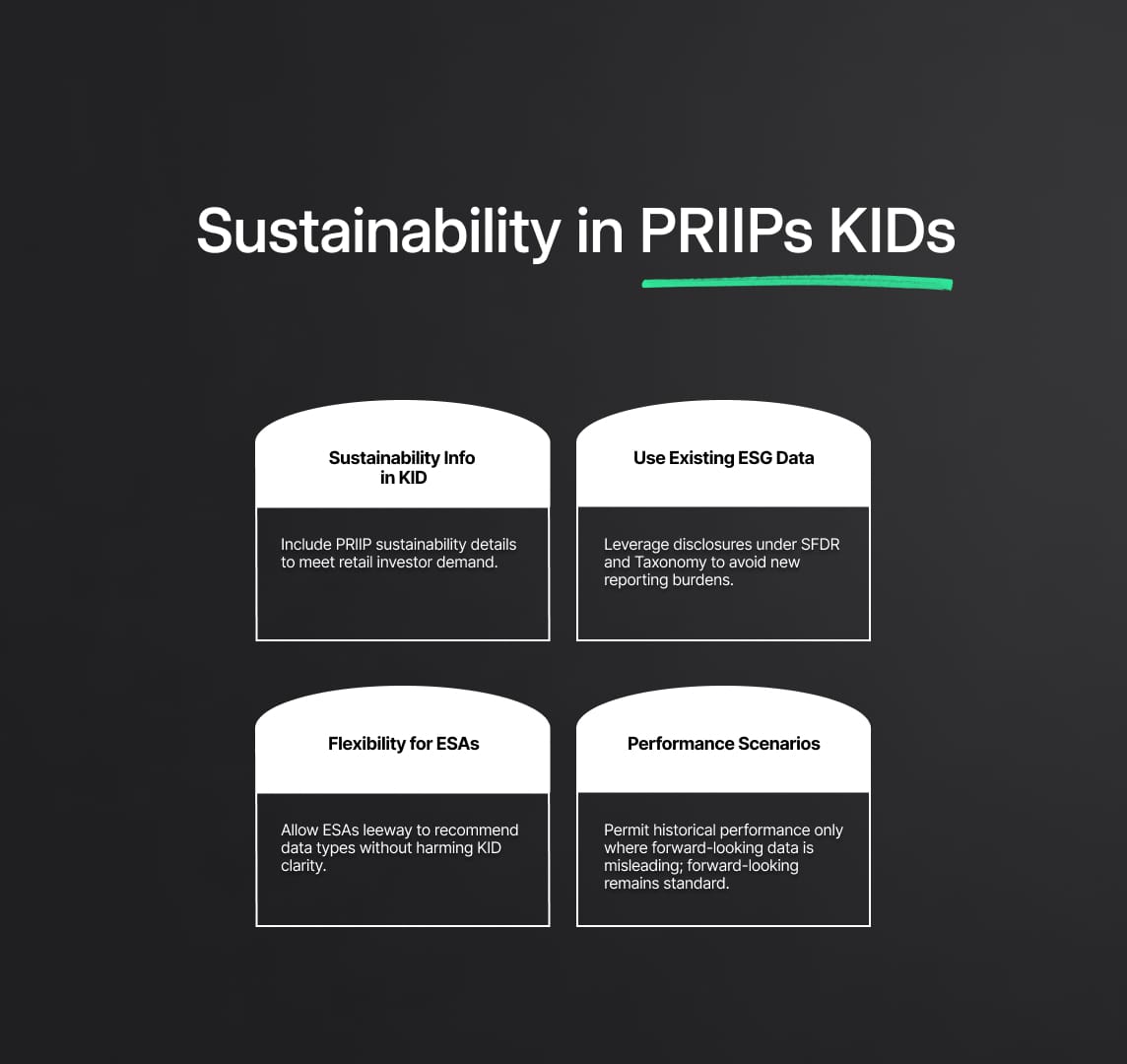

Empowering Retail Investors: Incorporating Sustainability Disclosures into PRIIPs' Key Information Documents

In the forthcoming section, we delve into the key highlights of an amendment designed to enhance transparency within the investment landscape, particularly focusing on the integration of sustainability disclosures into the Key Information Documents (KID) for Packaged Retail Investment and Insurance Products (PRIIPs).

- Integrating Sustainability Information: In response to the increasing demand for this kind of information from retail investors, the amendment suggests including details regarding the sustainability profile of PRIIPs in the key information document (KID).

- Leveraging Current Disclosures: The proposed amendment recommends using ESG (Environmental, Social, and Governance) data from product manufacturer disclosures made in accordance with Regulation (EU) 2019/2088 and Regulation (EU) 2020/852 in order to reduce the need for new reporting expenses.

- Flexibility in Recommendations: The amendment asks for greater latitude in the European Supervisory Authorities' (ESAs') suggestions about the kinds of data that should be included in the KID's performance section. This is to make sure that the document's readability and significance are not compromised by the additional sustainability information.

- Performance Scenarios: Although the amendment permits the inclusion of historical performance in a restricted number of circumstances—particularly those in which forward-looking scenarios may be deceptive for pertinent PRIIPs—the majority of cases would still contain forward-looking performance scenarios in the KID.

Opportunities: Enhancing Retail Investor Access with Digitalization in PRIIPs Provision

There are many opportunities to modernize and streamline important operations as PRIIPs become more digitally integrated. Investor accessibility and convenience are given priority by supporting the preference for electronic delivery of PRIIPs Key Information Documents (KIDs) while guaranteeing that paper versions are available upon client request at no additional cost. Regulating bodies like Regulation (EU) No 1286/2014, for example, do not have the flexibility needed to fully utilize digital methods to efficiently communicate important information to investors. More flexibility in electronic forms is desperately needed to allow for customized PRIIPs feature presentations that reduce visual overload and improve comprehension for individual investors.

Because of this flexibility, investors can tailor their investment preferences—for example, the amount or the holding period—without PRIIPs providers having to conduct individual assessments. The manufacturer's website still offers access to the typical three-page KID, but it can also present its critical information to retail investors in a flexible and customized way that guarantees usability and transparency.

Targeted area of supervision of PRIIPs provision

This proposal's targeted area of supervision is mostly concerned with updating and putting into effect the laws that control the distribution of Key Information Documents (KIDs) for Packaged Retail Investment and Insurance Products (PRIIPs). Its specific goal is to strengthen oversight of the electronic KID provision, guaranteeing adherence to rules and utilizing digitalization to increase accessibility and comprehension for individual investors. In order to ensure transparency and compliance with regulatory requirements, the plan also aims to monitor the modification and personalization of information distribution to investors via electronic means.

Regulatory changes of PRIIPs Provision

- Extension of the Definition of Securities: The amendment adds a new definition to point (d) of Article 2(2), encompassing securities as mentioned in particular points of Regulation (EU) 2017/1129, relating to the requirements for prospectuses for securities offered to the public or admitted to trading on a regulated market. It also includes a new point (h) to cover immediate annuities, which are pension contracts that are annuities without an accumulation phase.

- Application of Regulations: Article 3 is modified to make it clear that PRIIPs producers who are subject to both regulations are covered by the PRIIPs Regulation and Regulation (EU) 2017/1129 on prospectus obligations.

- Explanation of Variations Definition: To make it clear that fluctuations attributable only to the addition of a make-whole clause—as that term is defined in Directive 2014/65/EU—should not be regarded as fluctuations for the purposes of PRIIPs, Article 4(1) is supplemented.

- Definition Updates: In accordance with Directive 2014/65/EU, a new point (7a) is included to define "electronic format" and Point (5) of Article 4 is replaced to define "PRIIP distributor."

- Specifications for the Key Information Document (KID): Many changes are made to Article 6 concerning the KID, including guidelines for its presentation, content, and structure. Notably, it states that the KID must not contain suggestions for investments or cross-references to marketing materials; rather, it must be a stand-alone document. In order to encourage comparability and readability, it also permits a general description of investment possibilities and stipulates that the KID should not be longer than four A4-sized pages.

- Introduction of Product Dashboard: PRIIPs must include a dashboard that summarizes important details about them, such as their type, summary risk indicator, total costs, suggested holding period, and insurance benefits. This is mandated by a new section called "Product at a glance," which is added to Article 8.

Empowering Retail Investors: Strengthening Transparency in PRIIPs paragraph 3

A number of improvements to the information contained in Key Information Documents (KIDs) for Packaged Retail Investment and Insurance Products (PRIIPs) are among the adjustments made in paragraph 3.

- Additional Warnings: In light of Point (b), it is now necessary to provide pertinent cautions regarding particular hazards connected to sophisticated or high-risk financial instruments or insurance-based investment products.

- Introduction of Online Comparison Tool: Under the proposal, ESMA and EIOPA are required to work with National Competent Authorities (NCAs) to create an independent online comparison tool. This tool will make it easier to compare and examine statistics about the performance, risk level, suggested holding time, and expenses of PRIIPs. Within a year of the KID becoming available, the tool—which will make use of KID data from the European Single Access Point—must be made accessible. A link to the tool will be included in the KID itself.

- Enhanced Content in KIDs: The KIDs' content requirements now include a number of additions, such as:

- A greater understanding of financial goals and strategies for reaching them.

- Introduction of data on the product's environmental sustainability, encompassing information on related economic activities, the intensity of greenhouse gas emissions, and the assessment of unfavorable sustainability effects.

- A link to more disclosure information on products covered by Regulation (EU) 2019/2088 is included.

- Change to give relevant performance data based on performance scenarios in which future performance is given.

- Creation of Regulatory Technical Standards: The ESAs will create draft regulations that explain how each information element is presented and what material it contains, how risks and rewards are presented, and how costs are calculated. These guidelines will guarantee that the KID criteria are applied consistently while accounting for the numerous PRIIP kinds, their variations, and the capacities of retail investors.

The overall goal of these modifications is to enhance the thoroughness and clarity of the data presented in PRIIPs' KIDs, enabling retail investors to make well-informed decisions.

The proposed changes to Packaged regular Investment and Insurance Products (PRIIPs) represent a major advancement in the financial environment in terms of promoting transparency and empowering regular investors. Key Information Documents (KIDs) are being improved, and new regulations—including the creation of an impartial online comparison tool and improvements to KID content—are being implemented. These actions are intended to provide investors with the thorough, easily comprehensible information they need to make wise investment choices. By means of cooperative endeavors between regulatory agencies and relevant parties, these developments aim to foster equity, lucidity, and truthful information distribution, thereby augmenting the trust and involvement of individual investors in the market.

Reduce your

compliance risks