PSD3: Payments Service Directive Regulation

The European Commission has revealed new regulatory drafts impacting the payment industry, including the Payment Services Directive 3 (PSD3), Payment Services Regulation (PSR), Financial Data Access Regulation, and Digital Euro Regulation.

PSD3: EU New Payment Service Regulations

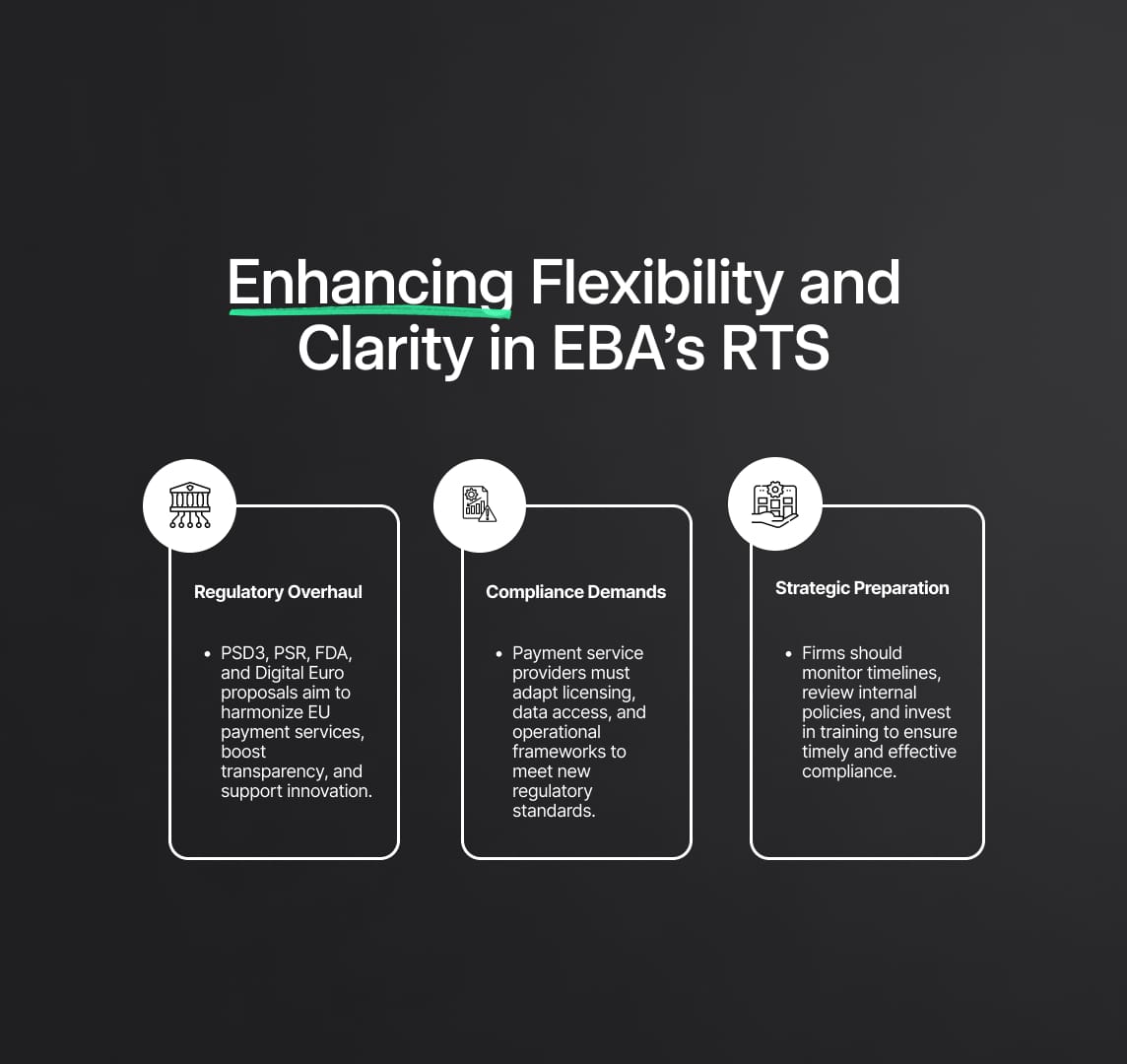

The European Commission recently introduced a series of new regulatory drafts that significantly impact the payment industry. The drafts include Payment Services Directive 3 (PSD3), Payment Services Regulation (PSR), Financial Data Access Regulation (FDA Regulation), and Digital Euro Regulation. The PSD3 and PSR, replacing the previous directives PSD1 and PSD2, aim to further harmonize payment services across the EU. PSD3 will regulate the granting of licenses and regulatory requirements for payment institutions, including those conducting emoney businesses. Meanwhile, the PSR will address transparency and information requirements for all categories of payment service providers.

The FDA Regulation extends the legal framework for accessing and using financial data beyond payment account data. It creates a new service known as the financial information services provider service. All these regulations are expected to go through the further European legislative process and will come into force 20 days after publication in the Official Journal of the European Union.

PSD3: Unveiling Europe's Regulatory Revolution in the Payment Industry

The European Commission's recent introduction of new regulatory drafts is set to significantly reshape the payment industry in Europe. The drafts encompass a range of regulations including Payment Services Directive 3 (PSD3), Payment Services Regulation (PSR), Financial Data Access Regulation (FDA Regulation), and Digital Euro Regulation. These regulations aim to harmonize payment services across the European Union, enhance transparency and information requirements, extend access to financial data, and pave the way for the introduction of a digital euro.

The combined effect of these regulations will have a profound impact on financial institutions operating in the payment industry. Payment service providers, including those conducting emoney businesses, will need to adapt and comply with the new rules outlined in PSD3 and PSR. This will involve obtaining licenses and meeting regulatory requirements, all with the objective of achieving greater harmonization and efficiency in payment services. As a result, we can expect to see a more unified payment landscape in Europe, promoting increased competition, innovation, and growth within the industry.

The introduction of the FDA Regulation brings additional opportunities and challenges for financial institutions and fintech companies. This regulation expands the legal framework for accessing and utilizing financial data, going beyond payment account data. It introduces the financial information services provider service, which opens up new avenues for leveraging a broader range of financial data. While this expansion can lead to the development of more personalized and efficient financial services for consumers, it also raises concerns regarding data privacy and security. Payment service providers will need to implement robust measures to safeguard consumer data and address these potential risks.

The European legislative process will determine the timeline for the implementation of these regulations. Once published in the Official Journal of the European Union, they are expected to come into force 20 days later. Payment service providers should closely monitor the progress of these regulatory drafts and remain informed about the final versions of the regulations. It is crucial for institutions to conduct internal reviews, identify any gaps or areas requiring attention, and update their policies, procedures, and systems accordingly. Providing comprehensive training and education to employees will help ensure compliance with the new regulatory requirements. Collaboration with industry associations and active participation in discussions will allow payment service providers to influence the implementation process and address any potential challenges.

In summary, the introduction of these regulatory drafts in the payment industry reflects the European Commission's efforts to harmonize services, promote transparency, extend financial data access, and embrace digital advancements. Financial institutions must adapt to these changes, align their operations with the new regulations, and seize the opportunities they present. By doing so, they can not only meet compliance requirements but also position themselves for success in an evolving and competitive European payment landscape.

Read More

Reduce your

compliance risks