Regtech: Compliance Innovation

Regulatory Technology (RegTech) simplifies compliance through advanced technologies like AI, ML, and Blockchain. It enhances operational efficiency, ensures compliance, and fosters consumer protection in the face of complex regulations.

Regulatory Technology, more commonly known as RegTech, is a dynamic field that originated from the aftermath of the 2008 financial crisis, which saw the world gripped by economic instability and uncertainty. The crisis triggered a global overhaul of financial regulations, with authorities imposing stricter rules to mitigate the risk of such a crisis recurring. Consequently, these tightened regulations made compliance more complex, driving innovation and sparking the birth of the RegTech industry.

In the years following the 2008 crisis, from 2008 to 2020, the volume of regulatory publications and updates proliferated by a mind-boggling 750%. With such a vast array of regulations to keep track of, the need for efficient, accurate, and reliable regulatory compliance systems has never been more pressing. Indeed, non-compliance carries a hefty price tag; in 2019 alone, businesses globally forked out a whopping $524 billion in non-compliance fees, underscoring the fiscal consequences of falling short of regulatory expectations.

Regulatory Technology, colloquially known as RegTech, signifies an assembly of technological solutions designed to address regulatory challenges in diverse industries, with a special focus on financial services. A convergence of dynamic tools and technologies, RegTech's primary goal is to reduce noncompliance costs, enhance process efficacy, and bolster confidence in reporting accuracy. Various definitions exist for RegTech, but essentially, it comprises tools for risk management and regulatory compliance, deployed by regulated entities and supervisory authorities.

RegTech is an industry-agnostic term, its use prevalent in the financial services sector where compliance costs can be significant. The term 'SupTech' refers to regulatory tools used by supervisory authorities. Still, this discussion will primarily focus on RegTech and the technologies that underpin it.

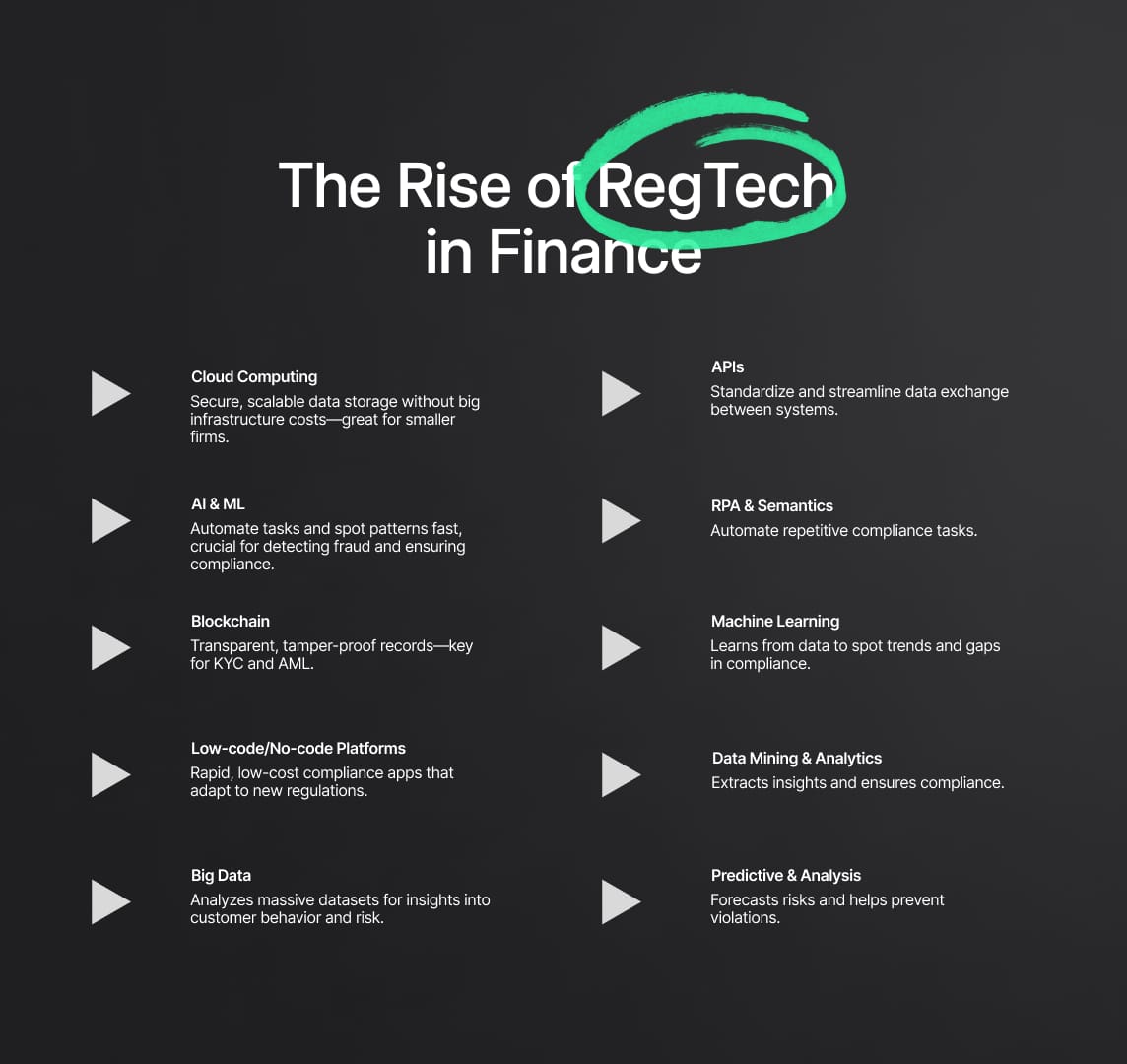

Emerging technologies are increasingly being adopted in the financial sector, including RegTech. The core technologies that enable RegTech solutions are versatile and data-driven. These solutions help drive innovation and cost-efficiency in risk and compliance functions. We can anticipate that RegTech solutions will continue to leverage technologies like:

-

Cloud computing: This is an essential part of RegTech solutions. It provides regulated entities with the ability to securely and efficiently store and process vast volumes of data and offers access to cloud-based solutions. This functionality allows regulated entities to rapidly and easily scale their operations without heavy investment in infrastructure, which is especially beneficial for smaller entities that lack the resources for extensive data centers or high-priced hardware.

-

Artificial Intelligence (AI) and Machine Learning (ML): These are impactful technologies capable of automating business processes, detecting patterns, and generating insights swiftly and accurately. By analyzing large amounts of data, AI-based solutions can quickly and efficiently spot patterns and abnormalities, enabling regulated entities to prevent fraud. As financial transactions continue to multiply, AI-powered solutions offer regulated entities efficient means to gather, process, and analyze the data used in various regulatory reports.

-

Blockchain: This decentralized and distributed digital ledger used for recording transactions securely and transparently, has gained traction in the RegTech industry due to its ability to ensure transparency, immutability, and security in record-keeping. Blockchain can create a tamper-proof audit trail of regulatory reports, ensuring that the submitted information is accurate and verifiable. This technology has seen significant use in Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance by offering a secure, decentralized database for sharing customer and financial information.

-

Low-code and No-code platforms: These are software development platforms that allow users to create applications without extensive programming knowledge. These platforms, which offer pre-built components and templates customizable to specific needs, can cut down the time and cost of developing new compliance applications. Low-code platforms also include built-in features for testing, deployment, and maintenance, which further streamline the development process. In RegTech, these technologies help solution providers streamline compliance workflows and nimbly adapt to changing regulatory requirements.

-

Big Data: The concept concerns the massive quantities of both structured and unstructured information amassed and processed by corporations. In the realm of regulatory technology (RegTech), this voluminous data is harnessed to facilitate adherence to regulatory guidelines through offering deep insights into customer conduct, risk evaluation, and regulatory surveillance.

-

Application Programming Interface (API): This is a compilation of protocols, methods, and software-building tools. APIs standardize the interaction among software elements, enabling disparate applications to exchange data and work in harmony. They serve to simplify communication between multiple software applications, whether they reside within a single system or are spread across the internet.

-

Robotic Process Automation (RPA) and Semantics: These are powerful tools that automate manual tasks and processes, particularly in areas where accuracy and speed are of the essence. In regulatory compliance, RPA can be used to automate routine tasks, such as data collection and validation, report generation, and compliance checks.

-

Machine Learning: This is a branch of artificial intelligence, utilized to train computers to learn from data and improve their performance over time. Machine Learning algorithms can ingest and process vast amounts of regulatory information from various sources, building knowledge maps and identifying trends or patterns that humans might overlook.

-

Data mining and analytics: These technologies are used to sift through large amounts of data to identify patterns and derive meaningful insights. In the realm of RegTech, data mining can be used to analyze regulatory requirements and assess the level of compliance within an organization.

-

Predictive analysis tools: These are used to forecast future outcomes based on historical data. These tools provide real-time monitoring, visualization, and alerts, enabling organizations to identify and prevent potential regulatory violations.

RegTech, as a concept, is an innovative solution designed to streamline and enhance the regulatory compliance process. Despite the challenges associated with implementing these technologies, the potential benefits – both in terms of compliance and business performance – make RegTech an increasingly attractive option for organizations navigating the complex and ever-changing regulatory landscape. As we look ahead, it is clear that the evolution and maturation of RegTech will continue to be influenced by the continuous development and integration of innovative technologies.

Regtech Adoption: Challenges and Benefits

While RegTech provides a beacon of hope in the dense fog of regulatory compliance, the path to its adoption is fraught with challenges. For an organization to fully leverage the advantages of RegTech, a comprehensive understanding of the multifaceted regulatory landscape is essential. Incomplete comprehension can lead to sub-optimal outcomes and inefficiencies.

Despite these inherent challenges, the benefits of RegTech adoption are compelling and substantial. RegTech solutions are designed to be adaptable across various jurisdictions, fostering interoperability of data and processes. This adaptability facilitates efficient information exchange, helping businesses consolidate and interpret data from diverse sources, thereby improving reporting quality and bolstering decision-making capabilities. The enhanced transparency and traceability brought about by such consolidation instill confidence in stakeholders, enhancing trust in business operations.

The financial advantages of RegTech implementation are another significant benefit. According to studies, companies can expect to see returns on investment skyrocket by up to 600% within three years of embracing RegTech, a testament to its considerable economic potential.

Regtech Impact on Regulatory Reporting and Governance

RegTech's growing adoption is exerting a transformative influence on several operational areas, one of the most prominent being identity management. Thanks to e-KYC (Electronic Know Your Customer) technologies, the customer onboarding process has become remarkably streamlined and secure. These digital tools leverage AI and incorporate advanced protocols such as biometric and multi-factor authentication to verify customers' identities efficiently and accurately, significantly reducing the risk of identity fraud.

Regulatory reporting, a traditionally labor-intensive process requiring businesses to submit copious reports to regulatory bodies, has been revolutionized through RegTech. RegTech tools have the capacity to standardize data requirements and automate reporting processes, including validation checks and controls, to ensure reliable and efficient regulatory reporting. These improvements significantly reduce human error and streamline the regulatory compliance process.

RegTech also plays a pivotal role in enhancing governance. Technologies such as board management software facilitate collaborative decision-making and provide tracking systems to monitor stakeholder responsibilities, fostering increased transparency and accountability. In turn, these enhancements to compliance, risk, and governance management boost operational efficiency and business resilience.

In the world of risk management, which is perpetually evolving in response to global events and developments, RegTech plays a crucial role. Advanced predictive analytics and machine learning capabilities allow businesses to anticipate and mitigate risks proactively, creating a safer business environment. By leveraging data to identify trends and potential hazards, businesses can act in a timely manner to protect themselves and their stakeholders from unforeseen threats.

However, it's essential to note that RegTech is not a panacea. Its implementation should be pursued alongside a steadfast commitment to data security, robust governance, and ethical conduct. As the regulatory environment continues to evolve, so too must the tools we use to navigate it. In this context, RegTech emerges as a powerful ally for modern businesses, enabling them to remain agile, efficient, and compliant in an increasingly complex regulatory landscape.

Let’s make

compliance fun again

Grand is not your average GRC platform. Our primary focus is to make the lives of GRC practitioners easier and more fun. We do this by reducing workload through workflow automation, collaboration, advanced AI and all the rest, but what truly sets us apart is our continuous feed of out-of-the-box content that has been curated by industry leading experts.

Reduce your

compliance risks