Regulation 575/2013: Market Risk Requirement under Basel III

The European Parliament and Council have amended Regulation (EU) No 575/2013 to update requirements for credit risk, credit valuation adjustment risk, operational risk, market risk, and the output floor, ensuring the stability and resilience of the EU banking sector.

A major legislative update occurred in Brussels on May 21, 2024, when Regulation (EU) No 575/2013 was amended by the European Parliament and Council. This amendment focuses on improving standards for credit risk, credit valuation adjustment risk, operational risk, market risk, and the production floor. It is recorded under document 2021/0342(COD) PE-CONS 80/23.

The update is a component of a larger initiative to improve the European Union's financial institutions' prudential framework, which got underway in the wake of the 2008–2009 global financial crisis. Based on the Basel III guidelines set by the Basel Committee on Banking Supervision in 2010, the EU enacted a number of measures after the crisis. The purpose of these reforms was to increase the EU banking sector's resilience.

Even with the advancements, the EU acknowledged that more changes were necessary to solve persistent problems that the financial crisis had brought to light. In order to ensure that the banking industry is resilient and able to weather future economic problems, this amendment aims to strengthen and improve the regulatory standards.

Implementation of Finalized Basel III Framework in EU Banking Regulation

In order to faithfully execute the finalized Basel III framework agreed upon in 2017, the European Union hopes to address remaining concerns from the global financial crisis and honor agreements with international partners. In order to prevent drastically raising the total capital requirements for EU banks, its implementation should be balanced and take into account the particularities of the EU economy.

It is recommended that EU banks make transitional adaptations to foreign norms in order to avoid competitive disadvantages, especially in trading activities. With its implementation, the EU brings a ten-year reform process to a close and orders the European Commission to undertake a comprehensive examination of the banking sector, including the new output floor criteria. The purpose of this evaluation is to determine if the production floor, which is set at 72.5% of the requirements of the standardized method, adequately protects depositors and financial stability. The study will be informed by input from multiple regulatory organizations, including the European Central Bank and the European Banking Authority.

Banks are permitted to determine their capital requirements through the use of internal model techniques or standardized approaches under Regulation (EU) No 575/2013. Internal models, on the other hand, have been shown to understate risks, which results in inadequate capital requirements. By guaranteeing that the capital requirements of internal models are at least 72.5% of those determined by standardised methods, the output floor seeks to solve this and improve confidence and comparability throughout institutions.

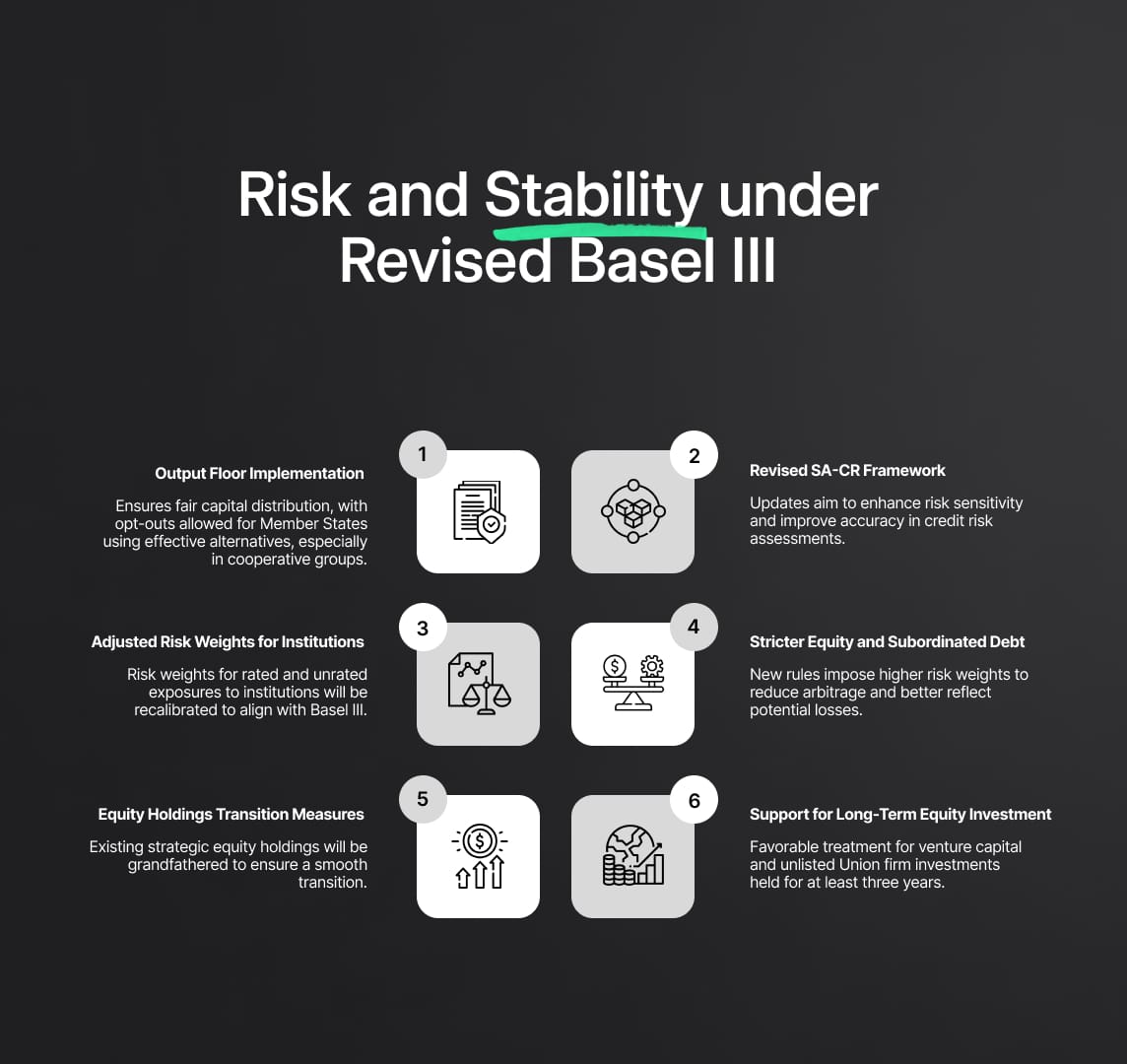

Risk Sensitivity and Stability in EU Banking through Revised Basel III Standards

As part of its efforts to put the final Basel III framework into effect, the European Union is making significant progress in raising the Standardized Approach's (SA-CR) risk sensitivity. In order to preserve stability in the banking industry and safeguard consumer savings, this endeavor makes sure that bank funds are allocated fairly. Significant changes have been made to the regulations to address inaccurate risk calculation and stop regulatory arbitrage:

- The use of the output floor: The output floor is made to make sure that personal funds are dispersed fairly and made available when needed.

All levels of consolidation should be covered, but Member States may choose not to participate if they have more effective alternatives, especially for cooperative groups that have centralized organizations.

- The Standardized Approach for Credit Risk (SA-CR) has undergone revisions: It is believed that the current SA-CR regulations are not risk-sensitive enough, which causes credit risk assessments to be off. To more accurately represent the risk levels of different exposures, the SA-CR will be updated.

- Readjusting the Risk Weights: In order to comply with Basel III requirements, risk weights for rated exposures to institutions will be recalculated. Independent of the risk weight assigned by the central government, unrated exposures to institutions will be treated with a more detailed risk weight.

- Precise and Strict Risk Weights for Exposures to Subordinated Debt and Equity: More restrictive risk weights for equity exposures and subordinated and prudentially assimilated debt will be implemented under new regulations. The purpose of this modification is to minimize regulatory arbitrage between trading and non-trading books and to represent the increased loss risk.

- Transitional and Grandfathering Clauses for Equity Holdings:

Throughout the transitioning phase, current strategic equity holdings will be grandfathered in order to prevent any disruptions. For equity assets under the same institutional protection plan or within the same group, the current regime will be preserved.

- In favor of Extended-Term Equity Investments: Venture capital firms and other investments made in unlisted Union enterprises will get assistance as long as they are retained for a minimum of three years. The objective is to strengthen efforts by the public and private sectors to integrate the financial system and invest in long-term equity.

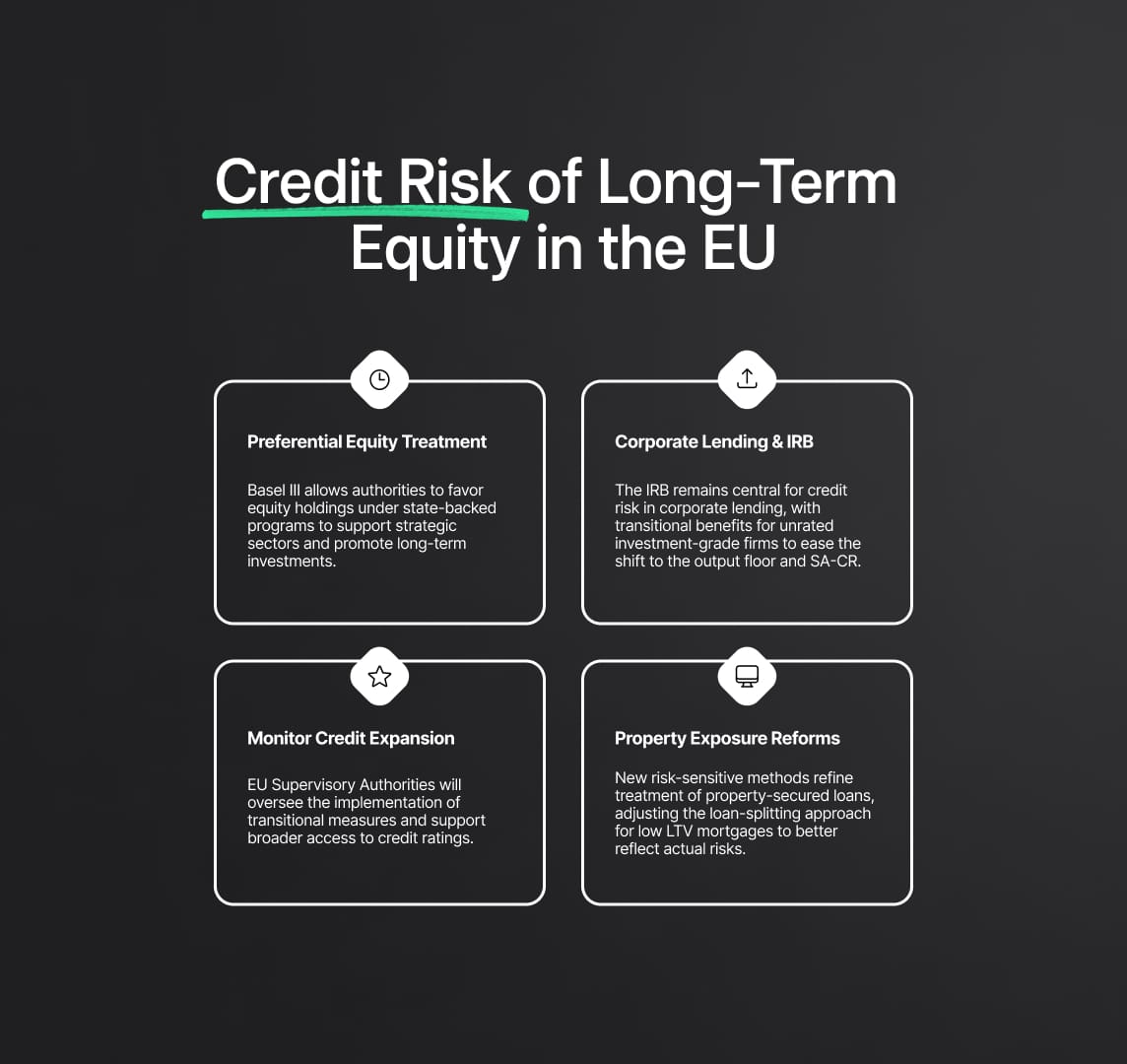

Long-Term Equity Investments and Credit Risk Assessment in EU Banking

The Basel III standards give competent authorities the authority to give preferential treatment to equity holdings obtained through legislative programs involving substantial subsidies and government oversight in order to boost specific economic sectors and promote long-term equity investments. When incorporated into Union law, this discretion seeks to encourage long-term equity investments.

The Internal Ratings Based (IRB) Approach is the main method used in the EU for corporate lending to determine credit risk. These institutions are also required to implement the Standardissed Approach for Credit Risk (SA-CR), which is based on third-party credit evaluations, in conjunction with the new output floor. While attempts are being made to expand credit rating coverage, a transitional period will provide advantageous treatment for investment-grade exposures to unrated enterprises, so as not to disrupt lending to unrated corporates.

In an effort to expand the pool of ratings available to EU corporations, European Supervisory Authorities will keep an eye on the application of transitional agreements as well as developments in the market for external credit assessments.

In order to properly represent funding mechanisms and construction stages, new risk-sensitive methodologies have been developed for property-secured exposures. For low loan-to-value ratio mortgages, the updated loan-splitting approach will be modified to be less cautious, in line with Basel III regulations and addressing flaws shown by the 2008–2009 financial crisis.

Transitional Arrangements and Risk Sensitivity for Mortgage Lending under Basel III

A special transitional arrangement is developed in order to lessen the impact of the output floor on low-risk residential mortgage lending by institutions that employ the IRB Approach. As long as these institutions fulfill the qualifying requirements as confirmed by appropriate authorities, they are able to apply a reduced risk weight to their mortgage exposures throughout the transition.

Member states may choose to implement this structure, with the EBA keeping an eye on them. Furthermore, a specific methodology for finance for speculative real estate is suggested to replace the existing, less precise framework. This new method, which includes provisions for periodical revaluation and adjustments for gains in energy efficiency, intends to stabilize own funds requirements and lessen cyclical impacts on property valuation.

Reduce your

compliance risks