Risk Data Aggregation and Reporting

ECB seeks public input on its Guide for risk data aggregation & reporting to strengthen banks' risk management. It emphasizes timely improvements in risk data frameworks & governance to address structural deficiencies. Industry best practices shared to foster a robust financial system.

ECB Calls for Improvement in Risk Data Aggregation and Reporting

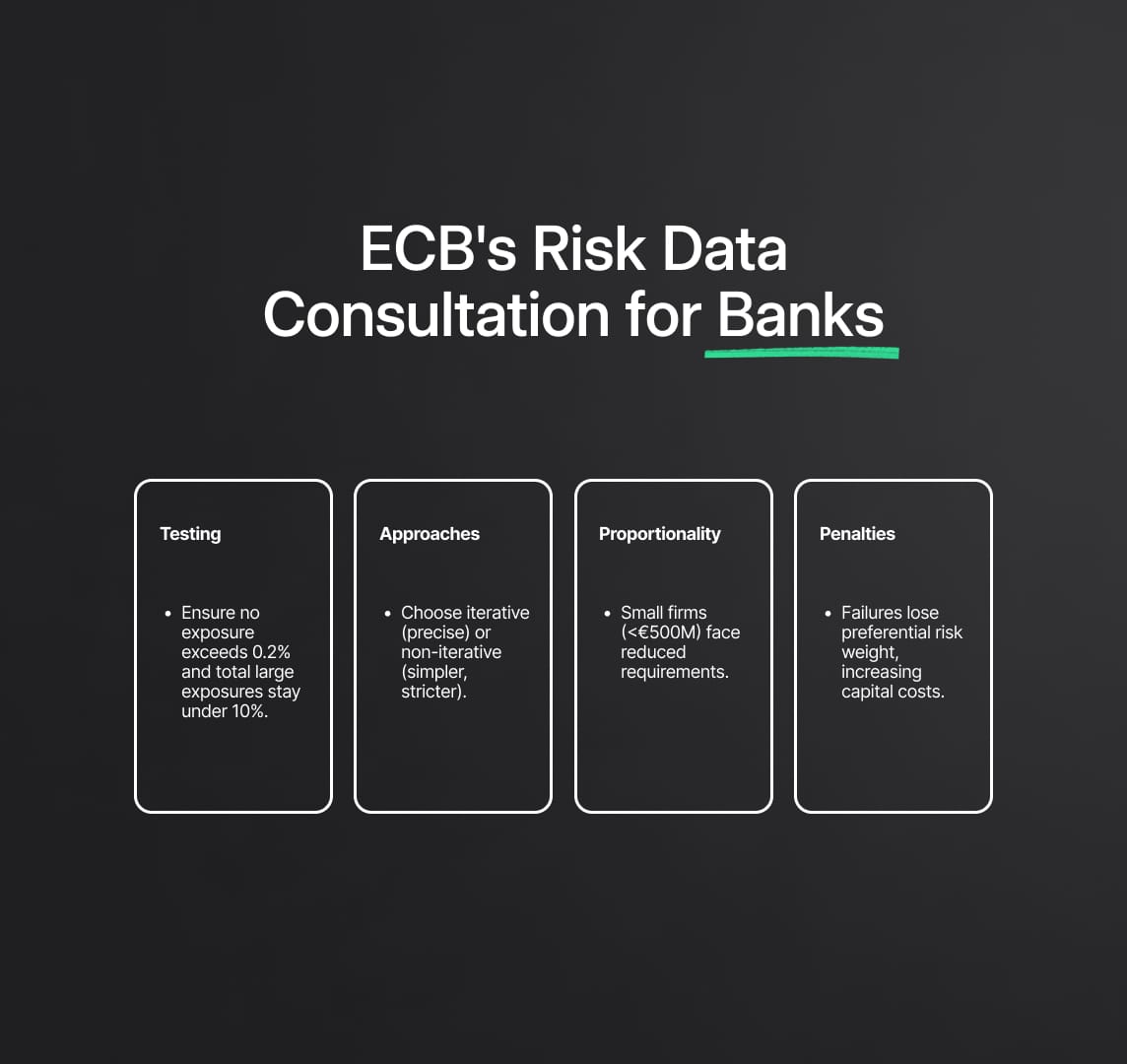

The European Central Bank (ECB) has begun a public consultation process on its Guide on effective risk data aggregation and risk reporting. The guide provides details on how banks can enhance their risk management and governance, while also sharing the best industry practices. The ECB is encouraging banks and other stakeholders to provide comments on the guide, with the hope that banks will increase their efforts to improve their capabilities in this sector. The guide is designed to assist banks in strengthening their capabilities by building on good practices observed in the industry, and to reinforce supervisory expectations. The guide emphasizes the need for banks to improve their risk data aggregation frameworks and governance framework in a timely manner, and is part of a broader strategy to address structural shortcomings in risk data aggregation.

Strengthening the Banking Sector: ECB's Consultation on Risk Data Aggregation and Reporting Practices

In a significant move that underscores the importance of data management in the banking industry, the European Central Bank (ECB) has commenced a public consultation process on its guide for effective risk data aggregation and risk reporting. This initiative is poised to have a profound impact on the banking industry, particularly for commercial banks under the Eurozone's Single Supervisory Mechanism and the ECB itself. By extending an invitation for feedback from banks and stakeholders, the ECB is propelling an industry-wide commitment to fortifying risk management and governance frameworks.

The ECB's heightened emphasis on data management and risk assessment mirrors the regulatory compliance parameters outlined in the Basel III's Principle for Effective Risk Data Aggregation and Risk Reporting (BCBS 239). Banks that promptly align with the ECB's initiative and adapt their risk data aggregation and governance frameworks could find themselves more adept at identifying, monitoring, and reporting risks, leading to enhanced risk governance and a robust banking sector equipped to handle future financial crises.

The initiative could also serve as a catalyst for innovation in the banking sector, ushering in advanced data management and risk assessment technologies. Investment in this area could yield more sophisticated tools for risk data aggregation and reporting, thereby contributing to the industry's resilience and compliance capabilities.

In response to the ECB's guide, regulators may raise the bar for data management and risk assessment, potentially heralding an era of stringent regulatory oversight within the EU and particularly the Eurozone countries. Consequently, regulatory scrutiny for banks may intensify, underscoring the need for proactive investment in risk data aggregation capabilities and the adoption of best industry practices.

Mitigating efforts to maintain compliance with BCBS 239 could include active participation in the ECB's public consultation process and periodic reviews of risk data aggregation and reporting systems. Implementing best practices as suggested by the ECB, along with regular updates to risk management and governance frameworks, could ensure that banks stay at the forefront of industry standards and regulatory changes.

The timeline for the transition to these new standards, however, remains fluid. Given that public consultations often take several months to a year before a final regulation is published and implemented, banks are presented with an opportunity to make strategic changes that could strengthen their position in a rapidly evolving regulatory environment. The ECB's consultation process thus signifies a critical juncture in the industry's journey towards improved data management, risk assessment, and regulatory compliance.

Read More

Reduce your

compliance risks