Risk Management: Bafin to Credit Institutions

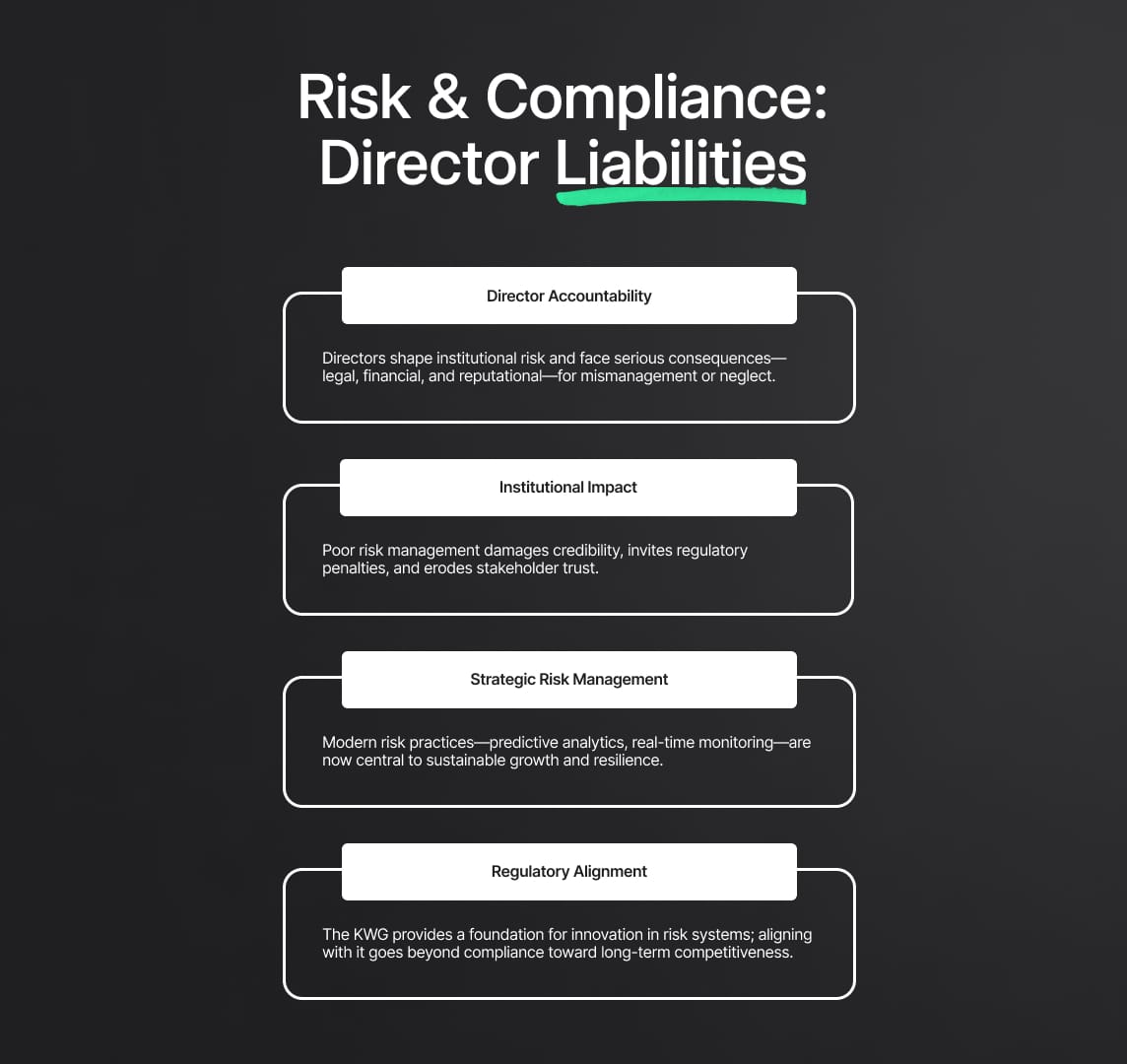

Risk management is pivotal in credit institutions, with BaFin's rigorous oversight ensuring compliance and systemic stability. Directors bear immense responsibility, balancing growth with risk mitigation. Trust is paramount, and lapses in risk management can erode stakeholder confidence.

BaFin Emphasizes Risk Management in Credit Institutions Through Recent Directives

The importance of strict business organization standards has been emphasized by the Federal Financial Supervisory Authority (BaFin), which is dedicated to strengthening risk management in credit institutions. BaFin has recently warned two board members of a prominent credit institution; this action is indicative of the regulatory body's determination to make sure these organizations follow the laws and operational guidelines that are essential to risk management.

Credit institutions must maintain a strong structure that not only complies with statutory requirements but also upholds the fundamentals of efficient risk management, as stipulated by Section 25a, paragraph 1 of the German Banking Act (KWG). The continued preservation of credit institutions' risk-bearing capacity, which is essential to their operational integrity, is made possible in large part by this legal framework.

Establishing a thorough bank control framework and sufficient risk control procedures is crucial for financial institutions. These institutions' ability to precisely identify, monitor, and pragmatistically handle their risk portfolios is critical to the efficacy of risk management. As such, credit institutions bear the responsibility of exhibiting proficiency in their organizational procedures, especially with regard to risk management.

BaFin oversees operations closely and conducts thorough audits of credit institutions' risk management systems. This comprehensive analysis also includes an evaluation of these businesses' ability to manage potential risk factors. Poor corporate governance, particularly when it comes to risk management, is a reason for BaFin's regulatory action, which usually starts with warnings to the directors of the corporation.

There are serious repercussions for noncompliance; BaFin may be forced to impose directorial dismissals if there is ongoing disregard or willful omission after a warning. Moreover, it retains the power to order any director who consistently disregards the necessary risk management procedures to cease their professional duties.

It is clear from the current regulatory environment that BaFin is committed to doing more than just doing superficial examinations to guarantee the stability of business organization in credit institutions. Maintaining a sound operating environment is a laborious task, as risk management is not only necessary for compliance but also a fundamental component of long-term, ethical financial practices.

Risk Management Scrutiny in Credit Institutions by BaFin

In the world of financial institutions, risk management is a dynamic and constantly changing discipline. This discipline has been greatly influenced by the Federal Financial Supervisory Authority, or BaFin, particularly in Germany's financial industry. The importance of careful risk management has increased recently, partly due to changes in the economy, advances in technology, and increased awareness of systemic weaknesses in the financial industry.

In addition to oversight, one of BaFin's responsibilities is to direct institutions toward best practices. Their actions serve as a sharp reminder of the strict standards established by the regulator, as demonstrated by the most recent one involving a well-known credit institution. BaFin's proactive approach is a response to previous financial crises as well as a safeguard against new ones. Credit institutions face a complex array of obstacles, such as fluctuations in the market and cyberattacks, but BaFin's watchfulness guarantees that risk management stays at the top of their operational plans.

Repercussions for Directors: The Balance of Risk and Compliance

The direction that credit institutions take is greatly influenced by the directors in charge of them. The risk profile of the institution is shaped by their operational and strategic choices. Because of its crucial role, making sure that risk management is of the highest caliber is not only required by law but also serves as a cornerstone for long-term success. The latest warning from BaFin to two directors emphasizes how serious this obligation is.

Understanding the subtleties of risk management requires more than just technical expertise for directors. It's about creating an environment where taking calculated risks is valued rather than avoided. A director's error, whether from carelessness or purposeful omission, can have far-reaching effects. The stakes are quite high, ranging from serious financial losses to reputational harm. Directors must be astutely aware of the changing risk picture in order to fulfill their dual role of assuring growth while minimizing risks and making decisions that are in line with both corporate goals and regulatory requirements.

Implications for Credit Institutions: Trust, Business, and Penalties

The ability of credit institutions to handle risk effectively is a key factor in determining their credibility. An institution's capacity to handle risks is intrinsically linked to its dependability and long-term sustainability by its stakeholders, who range from customers to stockholders. Similar to the current warnings, BaFin's interventions are important industry bellwethers that highlight the effects of inadequate risk management.

Even a single instance of risk mismanagement can damage an institution's reputation in the fast-paced digital era of today, potentially costing it money and undermining stakeholder confidence. Furthermore, there may be severe financial penalties and operational limitations associated with non-compliance with regulations. Therefore, there is a clear commercial case for credit institutions to invest in cutting edge risk management systems, personnel, and procedures in order to ensure regulatory compliance and strengthen stakeholder trust.

Effective Risk Management: The Cornerstone for Credit Institutions

Risk management has evolved in the complex world of finance from being a supporting role to a vital strategic pillar for credit institutions. The BaFin event highlights this shift and serves as a wake-up call. A strong risk management framework helps financial institutions steer toward growth possibilities and securely navigate through possible pitfalls. It functions similarly to a navigation compass.

Modern risk management goes beyond traditional reactive measures by including predictive modeling, real-time data monitoring, and advanced analytics, enabling organizations to be proactive and forward-thinking. Because the stakes are so high, organizations are realizing more and more that risk management needs to be ingrained in their organizational DNA and influence every aspect of their business, from front-line operations to board decisions.

Future Directions for Credit Institutions: Aligning with KWG Risk Management Standards

The German Banking Act (KWG) is evidence of how important risk management is in financial organizations. It serves as a regulatory compass, outlining the benchmarks and best practices that organizations ought to strive toward. Recent efforts by BaFin highlight how urgently these KWG standards need to be aligned. However, mere compliance isn't the end aim for institutions that look forward.

Rather, they see the KWG's guidelines as a base for creating creative and durable risk management systems. Credit institutions can position themselves for success in an increasingly complex financial environment by incorporating the KWG's tenets into their operations, strategies, and culture.

Reduce your

compliance risks