SA-CCR: How it Affects Counterparty Credit Risk?

The Standardised Approach for Counterparty Credit Risk (SA-CCR) is a method used for calculating credit risk in OTC derivatives, exchange-traded derivatives, and long settlement transactions. Developed by BCBS, it addresses previous method flaws, providing a risk-sensitive measure.

Grand “Answer”:

The Standardised Approach for Counterparty Credit Risk (SA-CCR) is a regulatory framework used to calculate the counterparty credit risk associated with over-the-counter (OTC) derivatives, exchange-traded derivatives, and long settlement transactions. This approach was developed by the Basel Committee on Banking Supervision (BCBS) to address the shortcomings of previous methods and to provide a more risk-sensitive measure.[1][2] The new model aims to reflect the potential future exposure more accurately and incorporates various risk factors such as the potential for risk offset within netting sets, the maturity factor, and the collateral.[2][3] It's important for financial institutions to understand and implement this approach as it directly affects the capital requirements set by regulatory bodies.[1][3]

Source

[1]

SA-CCR: EU Integration and Regulatory Standards

Counterparty Credit Risk (CCR) is a complex financial term referring to the potential for financial loss occurring if a counterparty fails to meet their obligations in a derivative contract before the final settlement of the transaction's cash flows. This potential loss is the exposure at default (EAD), which can fluctuate significantly depending on market conditions and changes in the derivative’s value. To regulate this risk, the Basel Committee on Banking Supervision (BCBS) initiated the standardized approach for counterparty credit risk (SA-CCR) in March 2014. This happened as part of the broader Basel III reforms introduced after the financial crisis of 2008 to improve banking supervision and risk management.

The SA-CCR was designed to replace earlier standardized methods like the Current Exposure Method (CEM) and the Standardized Method (SM). These previous approaches, although useful, had limitations regarding risk sensitivity and recognition of risk-mitigating factors. The SA-CCR aimed to provide a more nuanced measure by improving risk sensitivity through considering the volatility of diverse risk factors, recognizing the risk-reducing effect of netting sets (groups of trades with a single counterparty that can be netted against each other), and hedging sets while avoiding unnecessary complexity.

The latest Basel regulations have provided financial institutions with the option to choose between the SA-CCR and the Internal Model Method (IMM) for calculating their CCR risk-weighted assets (RWAs). The IMM approach allows for a more customized, risk-sensitive estimation of CCR that reflects an institution's unique portfolio characteristics, hedging strategies, and risk management policies.

However, SA-CCR isn’t simply applicable to less sophisticated or non-IMM banks. The SA-CCR exposure metric is a key component of the leverage ratio calculation, regardless of whether an institution has an IMM waiver or not. Furthermore, with the introduction of Basel IV's standardized output floor, institutions using internal models are also required to calculate standardized RWAs using the SA-CCR. As a result, mastering the intricacies of SA-CCR and understanding its primary risk drivers has become a vital aspect of every bank's capital management framework.

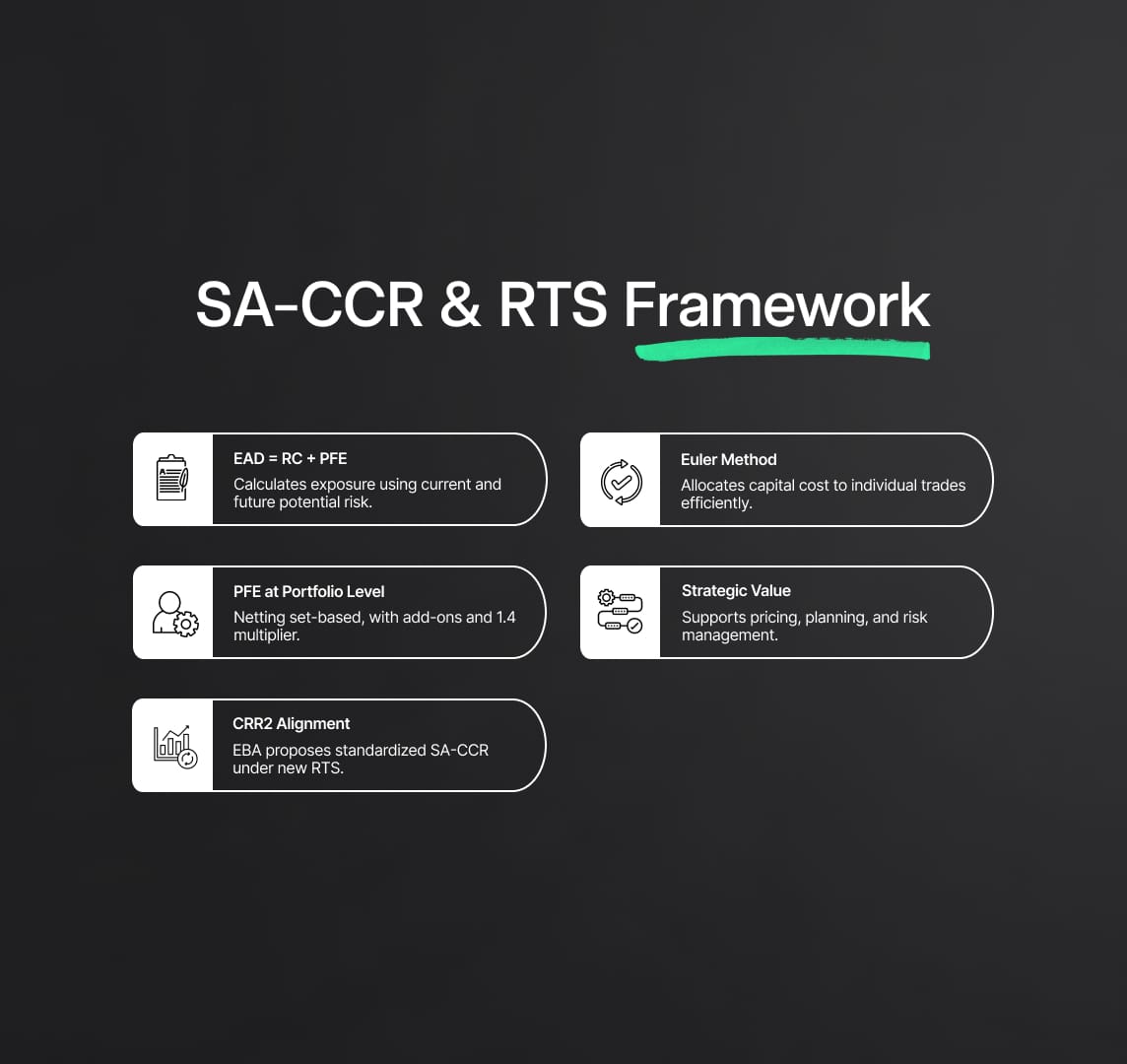

The modifications to Regulation (EU) No 575/2013 (the updated Capital Requirements Regulation – CRR2) incorporated the Standardised Approach for Counterparty Credit Risk (SA-CCR) into EU legislation. This was largely achieved through the dedicated efforts of the European Banking Authority (EBA), which crafted preliminary regulatory technical standards (RTS) based on the suggested legislative language of CRR2, adjusting the draft to suit the final CRR2 language. In addition to these adjustments, the EBA introduced further changes into the draft RTS to address the comments received during the consultation process.

The assignment of each derivative transaction to one or multiple risk categories, a new approach compared to the initial Capital Requirements Regulation (CRR), must be carried out while considering the significant risk factors of each derivative transaction. To assist with this, the EBA has been assigned to create regulatory technical standards outlining the method for identifying these substantial risk factors. Following the consultation paper issued in May 2019 and building on the method suggested in the 2017 Discussion Paper, the EBA proposed a threefold method for categorizing a derivative transaction into a risk category.

SA-CCR: Framework & Focus on the EU's Regulatory Technical Standards

The SA-CCR calculates the exposure at default (EAD) by incorporating two elements: the replacement cost (RC) and the potential future exposure (PFE). The RC is the loss that would occur if a counterparty were to default immediately and is calculated as the total mark-to-market (current market value) of the contract if positive. The PFE is the additional exposure expected to potentially accrue over the lifetime of a transaction or a set of transactions, depending on future changes in market prices.

The PFE under SA-CCR is defined as a portfolio measure, meaning it is calculated at the netting set level. It is calculated by adding the weighted add-on amounts of individual transactions and a multiplier alpha (fixed at 1.4) that scales the add-on to cover potential extreme changes in exposure. Add-ons are calculated for each transaction and represent the potential change in exposure for different risk factors, i.e., interest rates, credit spreads, foreign exchange rates, commodity prices, and equity prices.

The SA-CCR offers a more nuanced approach to calculating the PFE, accounting for the hedging benefits within a netting set and across asset classes. For instance, offsetting exposures in the same risk category and netting set can lower the PFE. This is beneficial in situations where an entity has multiple derivative contracts with a single counterparty, with some contracts being "in the money" and others "out of the money".

To facilitate this, many institutions have adopted the Euler method for capital attribution. Named after the 18th-century Swiss mathematician Leonhard Euler, the Euler method provides a sophisticated mechanism for SA-CCR capital attribution. The method allows for a fast and analytical application of the SA-CCR add-on formula, resulting in additive contributions that reflect both trade-level characteristics and netting-set level diversification.

The Euler method's beauty lies in accurately attributing SA-CCR capital costs down to trade level. It can provide important insights into the drivers of a bank's counterparty credit risk exposure. Consequently, this approach has paved the way for an informed decision-making process. It provides critical inputs for trade pricing, portfolio construction, strategic planning, and the identification of excessive capital usage.

In the wake of the SA-CCR's implementation, the Euler method has brought about a paradigm shift in how banks manage capital. It helps them tread the path towards better risk management and robust banking supervision, shaping the evolution of counterparty credit risk management in the banking industry. Thus, SA-CCR, along with tools like the Euler method, is not just a regulatory requirement but a strategic cornerstone for banks' efficient capital management and risk mitigation.

In conclusion, the EBA specifies a method suitable for determining the direction of the position in a significant risk driver in the present CP, in line with the definition given in CRR2. The proposed draft RTS are anticipated to result in a more standardized computation of own funds requirements for counterparty credit risk under CRR2. Thus, the SA-CCR continues to evolve and adapt to the changing landscape of banking and finance, reinforcing its vital role in managing counterparty credit risk effectively.

Reduce your

compliance risks