SFDR Regulation: Q&A and Compliance Requirements

The Sustainable Finance Disclosure Regulation (SFDR), Regulation (EU) 2019/2088, enhances transparency in financial markets by mandating disclosures on sustainability risks and impacts.

The Sustainable Finance Disclosure Regulation (SFDR), formally known as Regulation (EU) 2019/2088, is a cornerstone of the European Union's sustainable finance strategy. SFDR Regulation aims to enhance transparency in financial markets by mandating financial market participants (FMPs) to disclose how they integrate sustainability risks and consider principal adverse impacts (PAIs) on sustainability factors. This comprehensive guide delves into various aspects of the SFDR regulation, focusing on financial product disclosures, taxonomy-aligned investments, and multi-option products (MOPs), providing financial market participants with critical insights for compliance.

Source

[1]

Financial Product Disclosures under SFDR Regulation

Financial product disclosures are a central component of the SFDR Regulation, requiring FMPs to provide clear and comprehensive information on how sustainability risks are integrated into their investment processes. This includes detailing the methodologies used to assess and measure sustainability risks and the potential impacts on the financial returns of their products. FMPs must differentiate between products promoting environmental or social characteristics (Article 8) and those with a sustainable investment objective (Article 9).

Article 8 and Article 9 Financial Products:

- Article 8 Products: These products promote environmental or social characteristics, provided the companies in which investments are made follow good governance practices. The disclosure must explain how these characteristics are met, including the methodologies and strategies employed, such as exclusions, screening, or best-in-class approaches. It's crucial that Article 8 products not only integrate sustainability risks but also substantiate how these risks contribute to their promoted characteristics.

- Article 9 Products: These products have a sustainable investment as their primary objective. They must ensure that the investments qualify as 'sustainable investments' under Article 2(17) of the SFDR. This involves a thorough assessment to confirm that the investments do not significantly harm any environmental or social objectives (DNSH criteria) and that the investee companies follow good governance practices.

Taxonomy-Aligned Investments

The SFDR Regulation works in tandem with the EU Taxonomy Regulation, which provides a classification system for environmentally sustainable economic activities. This synergy ensures that financial products claiming to be sustainable are genuinely contributing to sustainability goals.

Key Requirements for Taxonomy-Aligned Investments:

- Technical Screening Criteria: For Article 9 products that are partly taxonomy-aligned, disclosures must refer to the technical screening criteria for the taxonomy-aligned part. This ensures investments meet the necessary conditions to be considered environmentally sustainable.

- Proportion of Taxonomy-Aligned Investments: As of January 2022, FMPs must disclose the proportion of their investments that align with the EU Taxonomy. This includes using equivalent information from investee companies or third-party providers when direct data is unavailable. In cases where reliable data is not available, complementary assessments and prudent estimates are permitted.

- Methodologies for Calculation: The methodologies for calculating the share of taxonomy-aligned investments can be based on turnover, capital expenditure (CapEx), or operating expenditure (OpEx). These metrics must be consistently applied in pre-contractual disclosures and periodic reports to provide a clear picture of the investment’s alignment with sustainability goals.

Multi-Option Products (MOPs)

MOPs, such as insurance-based investment products and certain pension products, require special consideration under the SFDR Regulation due to their inherent complexity and variety of underlying investment options.

Disclosure Requirements for MOPs:

- Pre-Contractual and Periodic Disclosures: MOPs must include disclosures for each underlying investment option. Hyperlinks can be used for pre-contractual disclosures if the number of options is high, but periodic disclosures must be explicit and detailed for each investment option.

- Taxonomy-Aligned Options: If a MOP includes one or more options that partially invest in line with the EU Taxonomy, these must be disclosed accordingly. The overall classification of the MOP will depend on the extent to which the underlying options align with the sustainability criteria.

SFDR: Principal Adverse Impact (PAI) Disclosures

The SFDR Regulation mandates FMPs to disclose principal adverse impacts (PAIs) on sustainability factors at both entity and product levels. This includes a set of mandatory indicators covering various environmental, social, and governance (ESG) aspects.

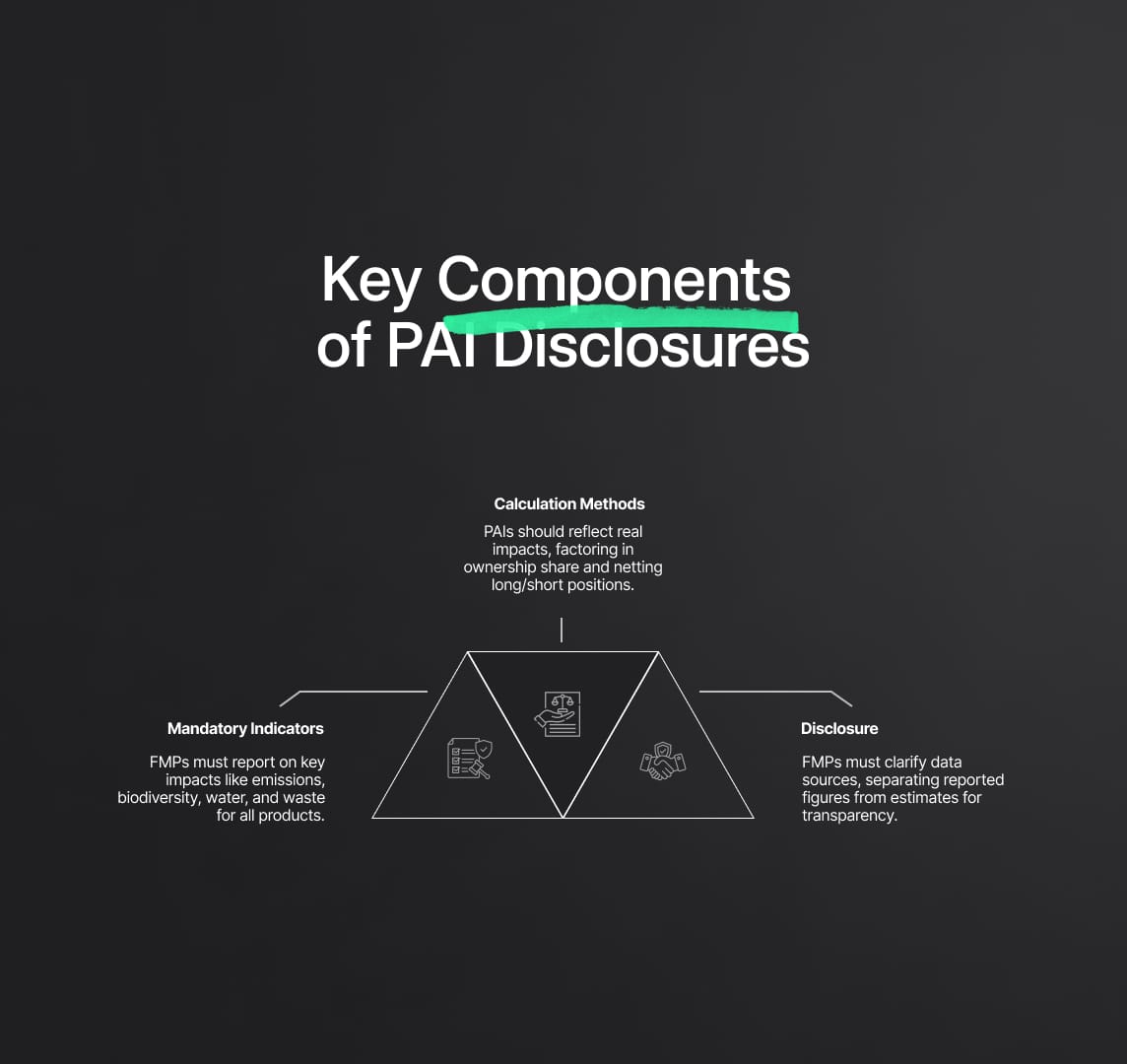

Key Components of PAI Disclosures:

- Mandatory Indicators: These include metrics such as greenhouse gas emissions, biodiversity impacts, water usage, and waste management. FMPs must report these indicators for all relevant financial products, ensuring a comprehensive view of their adverse impacts on sustainability.

- Calculation Methodologies: PAIs must be calculated using robust methodologies that reflect the actual impacts of investments. This includes considering the percentage of ownership in investee companies and incorporating both long and short positions to provide a net impact view.

- Disclosure Practices: FMPs should disclose the sources of their PAI data, distinguishing between reported data and estimates. This transparency helps investors understand the reliability and scope of the reported impacts.

Updates and Implications from the SFDR Q&A

Website Requirement for Registered AIFMs

Under the Sustainable Finance Disclosure Regulation (SFDR), registered Alternative Investment Fund Managers (AIFMs) offering products classified under Article 8 or Article 9 must establish and maintain a website that complies with Article 10 of the SFDR and Chapter IV of the SFDR Delegated Regulation. This requirement ensures transparency and accessibility of sustainability-related disclosures, aligning with the SFDR’s overarching goal of promoting informed investment decisions.

- Article 10 Compliance: AIFMs must ensure their websites are structured to provide comprehensive, clear, and up-to-date information on their sustainability practices. This includes pre-contractual disclosures, periodic disclosures, and any significant updates related to their sustainability strategies.

- Chapter IV Details: The SFDR Delegated Regulation Chapter IV outlines specific content that must be included, such as the methodologies for assessing and measuring sustainability risks, the data sources used, and the overall impact of their investments on sustainability factors.

- Operational Adjustments: AIFMs without an existing website will need to invest in creating and maintaining an online platform, incurring additional compliance costs. This includes IT infrastructure, content management, and regular updates to ensure ongoing compliance.

Implications for Transparency and Decision-Making:

- Enhanced Investor Information: By providing detailed sustainability disclosures online, AIFMs enhance the ability of investors to make informed decisions based on the sustainability profile of financial products.

- Regulatory Alignment: Ensuring that sustainability-related disclosures are readily accessible aligns AIFMs with the broader regulatory landscape of the EU’s sustainable finance framework.

Disapplication of Sustainability Risks Obligations

The SFDR explicitly prohibits financial market participants from using disclosures under Article 6(1) to circumvent other obligations related to sustainability risks embedded in EU law, such as those outlined in Article 18(5) of Commission Delegated Regulation (EU) No 231/2013.

Key Points of Integration:

- Comprehensive Risk Integration: Financial market participants must integrate sustainability risks into their investment decision-making processes comprehensively. This involves not only acknowledging these risks in disclosures but also ensuring they are factored into all aspects of the investment lifecycle.

- Robust Due Diligence: The requirement for robust due diligence processes is reinforced, necessitating thorough evaluations of how sustainability risks impact investments and ensuring these risks are managed in accordance with broader EU regulatory requirements.

Technical and Operational Considerations:

- Holistic Approach: FMPs must adopt a holistic approach to sustainability risk integration, which includes updating internal policies, training staff, and implementing systems that capture and analyze sustainability risk data effectively.

- Compliance Verification: Regular audits and compliance checks are necessary to ensure that sustainability risks are not only disclosed but are also actively managed and mitigated in accordance with all relevant EU regulations.

SFDR Regulation: Calculation of the 500-Employee Threshold

The calculation of the 500-employee threshold under Article 4(4) of Regulation 2019/2088 must include employees from both EU and non-EU entities within a group. This comprehensive headcount ensures that the due diligence statement covers the entire group at a consolidated level.

Detailed Calculation and Scope:

- Group-Wide Inclusion: The employee count must encompass all entities within the group, including subsidiaries and affiliates located outside the EU. This ensures that the threshold calculation reflects the full scale of the group’s operations and workforce.

- Consolidated Due Diligence: The due diligence statement must address sustainability risks and principal adverse impacts across the entire group, adopting a global perspective. This involves consolidating data from all entities to provide a comprehensive view of the group’s sustainability practices and impacts.

Implications for Financial Market Participants:

- Global Perspective: FMPs are required to adopt a global perspective in their sustainability disclosures, recognizing the interconnected nature of their operations and the cumulative impact of their activities.

- Enhanced Accountability: By including both EU and non-EU entities, the regulation ensures that large financial market participants are held accountable for their global sustainability impacts, fostering greater transparency and responsibility.

Operational Adjustments and Compliance Strategies:

- Data Collection and Reporting: FMPs must implement robust data collection and reporting mechanisms that capture employee data across all entities. This requires coordination and integration of HR systems, ensuring accurate and timely data aggregation.

- Policy Updates and Training: Policies must be updated to reflect the inclusive approach to employee counting, and staff across the organization should be trained to understand and comply with these requirements.

SFDR Technical Insights for Compliance

Use of 'Equivalent Information'

One of the critical aspects of compliance under the SFDR Regulation involves the use of 'equivalent information' when taxonomy-alignment data is not available from investee companies. This provision ensures that Financial Market Participants (FMPs) can meet reporting requirements even in the absence of direct data, maintaining the integrity and accuracy of sustainability disclosures.

Detailed Requirements and Application:

- Definition and Scope: 'Equivalent information' refers to data that provides the same content and granularity as direct taxonomy-alignment reporting. This can include third-party data, sectoral benchmarks, or estimations based on similar entities or activities.

- Data Sources: Acceptable sources for equivalent information include industry reports, data from environmental organizations, or other reliable third-party providers. The chosen sources must be transparent, credible, and capable of providing data that meets the standards of the SFDR.

- Granularity and Accuracy: The information must be detailed enough to match the specificity of direct taxonomy-alignment data. This includes alignment with the economic activities listed in the Delegated Acts of Regulation (EC) 2020/852 and ensuring that the data covers substantial contribution and 'Do No Significant Harm' (DNSH) criteria.

Implementation Strategy:

- Data Integration: FMPs should integrate equivalent information into their existing reporting frameworks, ensuring consistency across all disclosures. This may involve updating data management systems to accommodate third-party data and developing methodologies for estimating taxonomy-alignment.

- Methodological Transparency: Clear documentation of the methodologies used to derive equivalent information is crucial. FMPs must explain the basis for their estimates, the sources of their data, and any assumptions made during the process. This transparency helps maintain trust and credibility with stakeholders.

- Compliance Monitoring: Regular audits and reviews should be conducted to ensure the continued accuracy and relevance of the equivalent information used. This includes staying updated with any changes in available data sources or industry standards.

Implications for Compliance:

- Maintaining Accuracy: The use of equivalent information ensures that FMPs can continue to provide accurate and reliable sustainability disclosures even when direct data is unavailable. This helps prevent any gaps in reporting and maintains the integrity of sustainability claims.

- Regulatory Alignment: Adopting equivalent information aligns FMPs with the broader regulatory requirements of the SFDR, ensuring they remain compliant with all aspects of the regulation despite data limitations.

Taxonomy-Alignment of Green Bonds and Derivatives

For financial products involving green bonds and derivatives, the SFDR Regulation provides specific guidelines to ensure accurate taxonomy-alignment reporting.

Detailed Guidelines:

- Green Bonds: Only the projects financed by green bonds should be considered for taxonomy-alignment. This means that the alignment is based on the specific environmental projects funded by the bond proceeds, not the overall activities or sustainability practices of the bond issuer.

- Derivatives: Derivatives should not be included in the numerator for calculating the taxonomy-alignment of a financial product. This is because derivatives represent financial instruments rather than direct investments in sustainable activities, which could otherwise lead to misleading representations of taxonomy-aligned investments.

Implementation Strategy:

- Project-Level Reporting: For green bonds, FMPs must track and report the taxonomy-alignment at the project level. This involves detailed monitoring of how the bond proceeds are used and ensuring that these projects meet the necessary criteria for environmental sustainability.

- Exclusion of Derivatives: FMPs should develop clear policies and reporting frameworks that exclude derivatives from the taxonomy-alignment calculations. This ensures that the reported alignment accurately reflects direct investments in sustainable economic activities.

Implications for Compliance:

- Preventing Misrepresentation: By focusing on the projects financed by green bonds and excluding derivatives, FMPs ensure that their taxonomy-alignment reporting is accurate and not misleading. This maintains the credibility of their sustainability claims and supports investor confidence.

- Regulatory Adherence: These guidelines help FMPs adhere to the specific requirements of the SFDR, avoiding potential compliance issues related to misreporting or misclassification of investments.

Reporting for Real Estate and Infrastructure Investments

Financial products that invest in real estate or infrastructure assets have unique reporting requirements under the SFDR Regulation to ensure accurate and comparable sustainability disclosures.

Detailed Reporting Requirements:

- Market Value Reporting: For taxonomy-alignment purposes, financial products must report the market value of real estate and infrastructure assets. This approach provides a clear and standardized valuation method that enhances comparability across different investments.

- Key Performance Indicators (KPIs): In addition to market value, FMPs must include other relevant KPIs such as turnover, capital expenditure (CapEx), and operating expenditure (OpEx) in their periodic disclosures. These KPIs provide a comprehensive view of the sustainability performance of the investments.

Implementation Strategy:

- Valuation and Data Collection: FMPs should establish robust processes for valuing real estate and infrastructure assets, ensuring that market values are accurately captured and reported. This may involve working with external appraisers or using standardized valuation models.

- Comprehensive KPI Reporting: Collecting and reporting data on turnover, CapEx, and OpEx requires effective data management systems. FMPs must ensure that these KPIs are consistently tracked and integrated into their periodic disclosure reports.

Implications for Compliance:

- Enhanced Transparency: Reporting the market value along with other KPIs provides a transparent and comprehensive view of the sustainability performance of real estate and infrastructure investments. This helps investors make informed decisions based on reliable data.

- Standardization and Comparability: Using standardized valuation methods and KPIs ensures that sustainability disclosures are comparable across different financial products and investment types. This enhances the overall consistency and reliability of sustainability reporting in the financial markets.

Detailed Examination of PAI Disclosures

Timing Misalignment in PAI Calculations

Principal Adverse Impact (PAI) disclosures under the SFDR Regulation require a precise methodology to account for the timing misalignment in investment valuations. The SFDR mandates that quarterly impacts be based on the current value of investments at the end of each quarter. This value is derived from the fiscal year-end valuation of each investment, such as the share price, multiplied by the number of investments held at the end of each quarter. This approach ensures that the valuation reflects both the composition of investments at quarter-end and the fiscal year-end valuation, providing a consistent and accurate measure of adverse impacts.

- Quarterly Valuation: FMPs must update the value of each investment at the end of every quarter. This involves calculating the current market price and multiplying it by the number of units held.

- Fiscal Year-End Adjustment: The fiscal year-end valuation serves as a baseline, adjusted quarterly to reflect changes in the number of units held. This method accommodates market fluctuations and changes in investment holdings.

- Consistency and Comparability: By aligning quarterly and fiscal year-end valuations, this method ensures consistency across reporting periods, making it easier to compare PAI metrics over time.

Reporting Workdays Lost in PAI Indicators

For indicators like workdays lost due to injuries, the SFDR Regulation specifies that metrics should be expressed as a weighted average and ideally reported in relative terms, such as per million EUR invested. This standardized approach ensures consistency and comparability across different disclosures and helps stakeholders better understand the adverse impacts of investments on labor practices.

- Weighted Average Calculation: The metric should account for the total number of workdays lost, weighted by the size of each investment. This involves calculating the proportion of workdays lost relative to the total investment amount.

- Relative Reporting: Reporting in relative terms, such as per million EUR invested, normalizes the data, allowing for comparisons across investments of varying sizes. This helps identify patterns and trends in labor-related adverse impacts.

- Data Integration: FMPs must integrate these metrics into their broader PAI disclosures, ensuring that labor-related impacts are comprehensively reported alongside other adverse indicators.

Use of Enterprise Value in Carbon Footprint Calculations

The SFDR Regulation mandates the use of Enterprise Value Including Cash (EVIC) in calculating carbon footprints for financial undertakings. Despite potentially resulting in unconventional values for financial institutions, this definition ensures an appropriate allocation mechanism for carbon footprint calculations.

- Enterprise Value Definition: EVIC includes the market capitalization of ordinary shares, preferred shares, and the book value of total debt and non-controlling interests, without deducting cash or cash equivalents.

- Allocation Mechanism: Using EVIC standardizes the carbon footprint calculation across different types of financial undertakings, ensuring a fair allocation of carbon emissions relative to the enterprise value.

- Consistency in Reporting: This method allows for consistent and comparable carbon footprint disclosures across various financial entities, enhancing the overall transparency and reliability of sustainability reporting.

SFDR: Financial Product Disclosures

Requirements for Article 9 Financial Products

Under the SFDR Regulation, financial products categorized under Article 9 are required to have sustainable investment as their primary objective. These products can invest in a wide range of underlying assets, provided they qualify as 'sustainable investments' according to Article 2(17) SFDR. The regulation does not mandate a specific methodology for accounting for sustainable investments, allowing flexibility in investment strategies.

- Sustainable Investment Definition: According to Article 2(17) SFDR, sustainable investments are those that contribute to environmental or social objectives, do not significantly harm any of these objectives, and follow good governance practices.

- Diverse Investment Strategies: Article 9 products can include investments for hedging or liquidity purposes, as long as these meet minimum environmental or social safeguards and align with the sustainable investment objective.

- Disclosure Requirements: FMPs must clearly explain how their mix of investments complies with the sustainable investment objective and the 'no significant harm' principle, providing detailed disclosures on the methodologies used.

Naming and Characteristics of Article 8 Financial Products

Financial products under Article 8 of the SFDR promote environmental or social characteristics and adhere to good governance practices, but do not necessarily have sustainable investment as their primary objective. These products must disclose how they achieve their promoted characteristics and can utilize various market practices, tools, and strategies, such as screening and exclusion.

- Promotion of Characteristics: Article 8 products must specify the environmental or social characteristics they promote and detail the strategies used to achieve these characteristics. This can include thematic investing, ESG integration, or specific exclusion criteria.

- Good Governance Practices: Investments must follow good governance practices, which encompass sound management structures, employee relations, remuneration of staff, and tax compliance.

- Transparency and Disclosure: Detailed disclosures are required to explain the methodologies and tools used to promote the stated characteristics. This includes information on the selection criteria for investments, the monitoring processes, and the performance metrics used to assess the effectiveness of the strategies.

Applicability and Scope Issues under SFDR Regulation

Applicability to Registered and Non-EU AIFMs

The Sustainable Finance Disclosure Regulation (SFDR) has broad applicability, covering both registered Alternative Investment Fund Managers (AIFMs) and non-EU AIFMs that market sustainable EU Alternative Investment Funds (AIFs) under a National Private Placement Regime. This expansive scope ensures that all relevant AIFMs adhere to the SFDR’s stringent transparency and disclosure requirements.

- Scope of SFDR: The regulation mandates that AIFMs, regardless of their geographic location, comply with SFDR if they market sustainable EU AIFs. This includes non-EU AIFMs, ensuring a level playing field and consistent disclosure standards.

- Disclosure Obligations: Registered AIFMs are required to provide detailed disclosures to investors both pre-contractually and periodically. This includes information on sustainability risks, the integration of sustainability into investment decisions, and the adverse impacts on sustainability factors.

- Documentation Requirements: Pre-contractual documentation must clearly outline the sustainability objectives and how these are integrated into the investment process. Periodic documentation should provide updates on the performance against these objectives, ensuring ongoing transparency.

Counting of Employees for Exemptions

Under Article 17 of Regulation (EU) 2019/2088, the employee count for determining exemptions must be comprehensive. This includes not only full-time employees but also self-employed staff, owner-managers, and part-time employees.

- Comprehensive Headcount: The SFDR requires a thorough headcount to ensure accurate determination of exemptions. This prevents any potential circumvention of regulatory obligations by underreporting staff numbers.

- Inclusion Criteria: All types of employment relationships are included in the count, ensuring that the total number of employees reflects the true size of the organization.

- Implications for Exemptions: Accurate employee counting is crucial for determining whether an entity qualifies for specific exemptions under the regulation. This ensures that all entities subject to SFDR comply with its disclosure requirements.

Addressing Data Discrepancies in SFDR Disclosures

Data discrepancies pose a significant challenge in SFDR compliance. Financial institutions must ensure their annual Principal Adverse Impact (PAI) disclosures are based on the average impacts of all investments at the end of each quarter. This requires using the latest available information and making reasonable assumptions when necessary.

- Quarterly Averaging: Institutions should calculate PAI indicators based on quarterly data points, ensuring that the average reflects the most current information available at the end of each quarter.

- Use of Latest Information: The regulation mandates that institutions use the latest data for these calculations, promoting accuracy and relevance in disclosures.

- Reasonable Assumptions: In cases where data is incomplete or not up-to-date, institutions must make reasonable assumptions to fill gaps. These assumptions should be documented and justifiable to ensure transparency.

Current Value of All Investments in PAI and Taxonomy-Aligned Disclosures

The “current value” of all investments, as applied to PAI indicators for investee companies, must align with the definition of "enterprise value" specified in point (4) of Annex I of the Delegated Regulation. This approach ensures a consistent and holistic valuation for reporting purposes.

- Enterprise Value Definition: Enterprise value includes the market capitalization of ordinary shares, preferred shares, and the book value of total debt and non-controlling interests, excluding cash or cash equivalents. This comprehensive valuation provides a complete picture of the company's financial health.

- Holistic Valuation: By including all relevant financial components, this valuation method ensures that PAI disclosures accurately reflect the economic reality of investee companies.

- Consistency in Reporting: Adopting this standardized approach across all institutions ensures consistency in PAI and taxonomy-aligned disclosures, facilitating comparability and reliability of the reported data.

Incorporation of Short Positions in PAI Indicators

The European Supervisory Authorities (ESAs) recommend netting the principal adverse impacts of long and short positions at the level of the individual counterpart. This approach ensures clarity and consistency in PAI reporting.

- Netting Long and Short Positions: Institutions must calculate the net adverse impacts by considering both long and short positions for each investee undertaking, sovereign, supranational, or real estate asset.

- Regulatory Framework: The methodology for calculating net short positions should adhere to Article 3(4) and (5) of Regulation (EU) No 236/2012, ensuring regulatory compliance.

- Comprehensive Impact Assessment: By netting these positions, institutions can provide a more accurate and complete assessment of the principal adverse impacts, reflecting the true exposure and impact of their investment activities.

Reduce your

compliance risks