Single Resolution Board (SRB): Minimum Bail-in for EU Banks

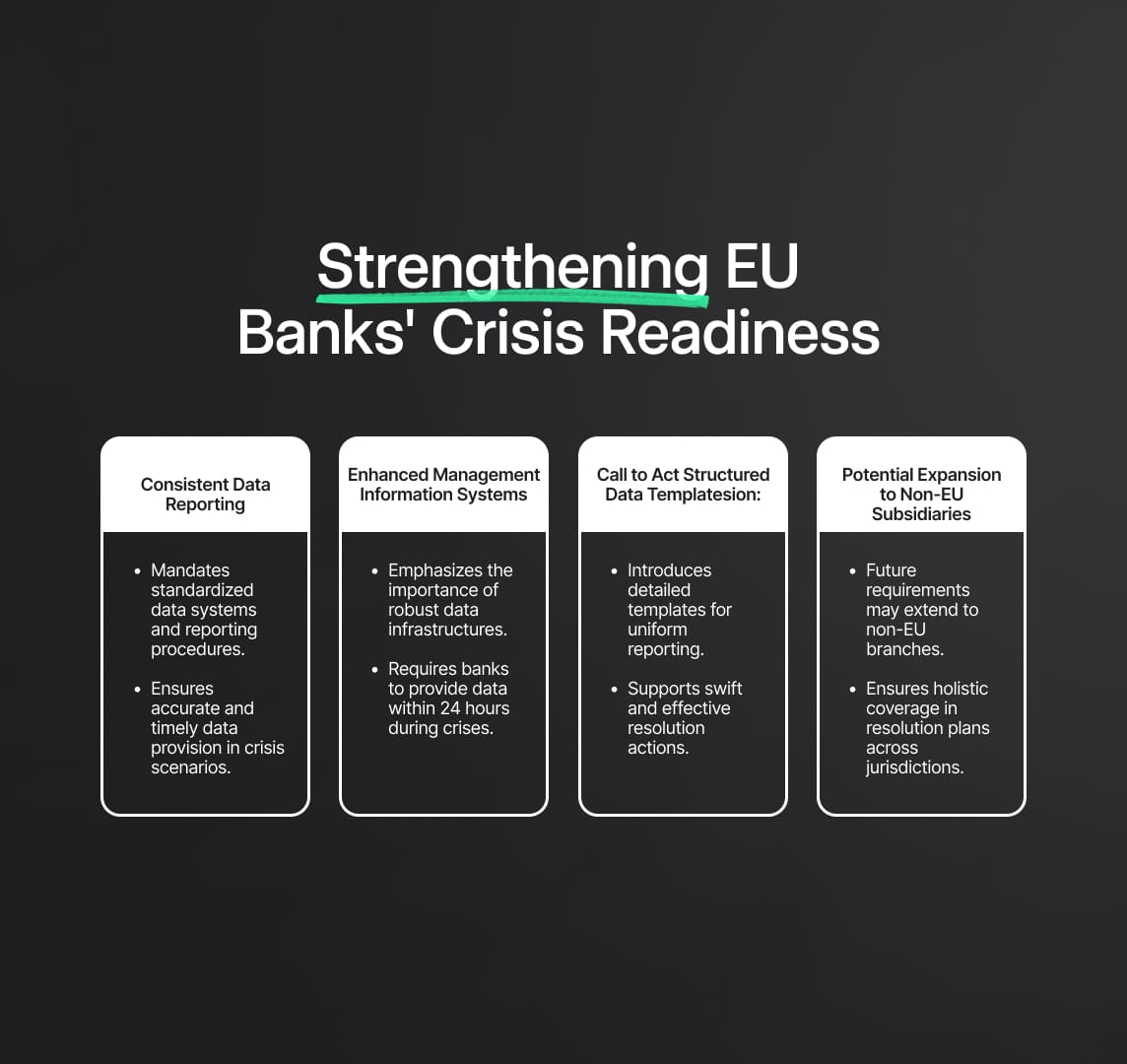

Single Resolution Board (SRB) issues Minimum Bail-in Data Template (MBDT) to strengthen EU banks' crisis readiness and ensure consistent, timely data reporting.

On November 5, 2024, the Single Resolution Board (SRB) issued new guidance on the Minimum Bail-in Data Template (MBDT), aimed at setting a consistent framework for gathering and managing data essential to bail-in processes. As the primary authority responsible for resolution planning in the EU, the SRB seeks to strengthen banks' preparedness for potential crises by establishing standardized data reporting practices.

This guidance mandates that banks align their data systems and reporting procedures, allowing for swift, accurate response in bail-in scenarios. The impacts of this guidance are far-reaching, notably ensuring that data accuracy and timeliness support resolution actions, potentially stabilizing financial systems during economic turbulence. The guidance specifies a required response time of 24 hours for data provision in crisis scenarios, emphasizing the importance of banks' Management Information Systems (MIS) in producing timely, reliable data for the SRB to implement the bail-in tool effectively.

Source

[1]

[2]

What is the Minimum Bail-in Data Template?

The SRB's MBDT guidance reflects the EU's commitment to bolstering the Bank Recovery and Resolution Directive (BRRD), a critical framework for managing failing banks. Previous SRB tools, such as the Bail-in Playbook and the Minimum Bail-in Data Set Instructions, laid foundational expectations; however, the MBDT introduces a more structured data template for uniform reporting across banks in the EU, enhancing data quality and accessibility. Importantly, the guidance underscores that the MBDT does not impose periodic reporting requirements; rather, it serves as an ad hoc framework used in resolution testing exercises, such as dry runs and fire drills, to ensure banks are prepared in real crisis events.

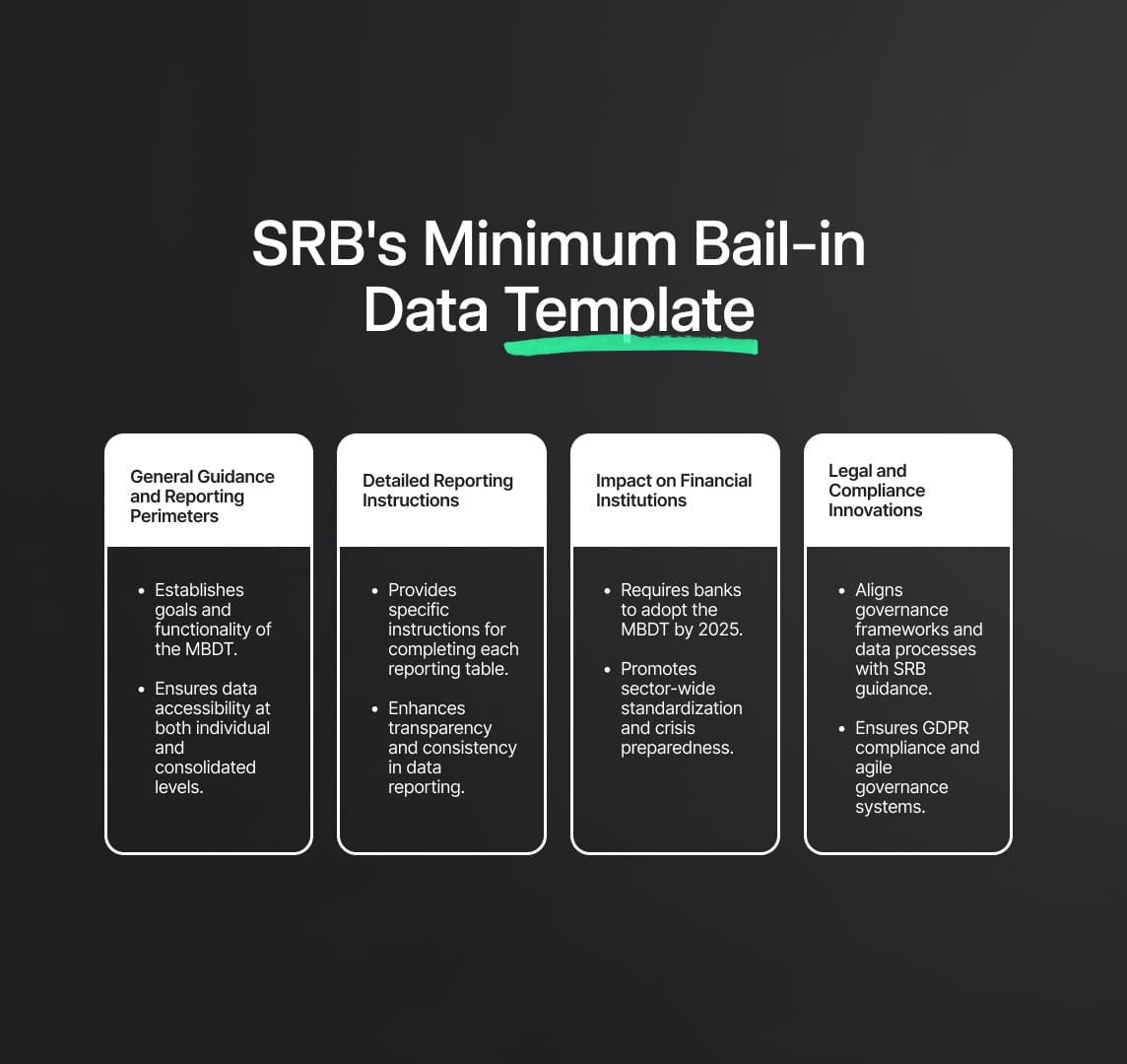

The MBDT guidance is organised as follows:

General Guidance and Reporting Perimeters: This section provides a contextual foundation, describing the goals and functionality of the MBDT. Banks are required to adopt robust data infrastructures to meet the SRB's prompt data availability standards. Specifically, institutions must ensure that relevant data is accessible at both an individual and consolidated level, and they must have systems capable of anonymizing certain data to comply with the General Data Protection Regulation (GDPR). It also emphasizes that country-specific adjustments may apply in certain EU member states, given variations in national legislation and creditor hierarchies, as detailed in MBDT Country Annexes. These annexes cater to unique national requirements and variations in creditor hierarchy, ensuring that institutions comply with local regulations while adhering to SRB's standards.

Single Resolution Board Rules for Completing Templates

Detailed instructions are provided for each reporting table:

- B99.00 – Identification of Report: Details the legal identification and metadata for the reporting institution, including Legal Entity Identifiers (LEIs) and reference dates. This table provides foundational information required for categorizing the reporting entity, such as its status as a resolution or non-resolution entity, and allows the SRB to assess the level at which data should be consolidated or reported individually.

- B01.00 – Aggregate View: Summarizes capital and liabilities at an aggregate level, including liabilities excluded from bail-in. It focuses on informing preliminary assessments and conversion computations. Notably, this section requires categorization of liabilities based on their insolvency ranking and eligibility for bail-in, reflecting the SRB’s precise requirements under Article 27 of the SRMR.

- B02.00 – Main Liabilities: This section, at the heart of the guidance, captures core liability data, covering instruments eligible for bail-in and securing the alignment with the SRB's preferred resolution strategies. It includes a "bail-in cascade" for sequencing the application of the bail-in tool according to the priority stipulated in the BRRD. The table also distinguishes between secured and unsecured liabilities, with separate reporting fields for contingencies such as collateral and lien valuations.

- B03.00 – Derivatives and B04.00 – Securities Financing Transactions: These specialized tables collect data on derivatives and securities-financing transactions relevant to resolution planning. The derivatives table (B03.00) requires netting arrangements and close-out amounts to be documented according to the governing legal frameworks, supporting SRB’s adherence to BRRD requirements. Securities financing transactions (SFTs), detailed in B04.00, capture collateralized financing arrangements and relevant netting sets.

- B05.00 – Guarantees and B06.00 – Liabilities Issued by SPVs: These tabs contain data points specific to guarantees for non-resolution entities and Special Purpose Vehicle (SPV) liabilities, offering SRB a comprehensive view of interconnected financial exposures. Guarantees are documented with maximum exposure amounts and contingent triggers, ensuring that all guarantees within a resolution group are accurately recorded for the SRB’s assessment. Liabilities issued by SPVs require disclosure of any intragroup liabilities, further supporting transparency within resolution planning.

- B90.00 – Counterparties: Critical for mapping exposures, this table identifies entities holding reportable liabilities, supporting the SRB’s objective of transparent counterpart risk management. Intra-group relationships and intra-resolution group classifications are meticulously identified in this table, enabling the SRB to distinguish between external and intragroup liabilities for a more nuanced risk profile.

Annexes and Technical Instructions: The annexes in this guidance map data points to previous SRB templates, facilitating seamless integration for reporting institutions. Technical instructions detail specific country adaptations, providing banks with guidance on national-specific reporting nuances. Annex II offers a detailed mapping to the Liability Data Report (LDR), enabling institutions to align their submissions across SRB templates. Furthermore, technical specifications instruct banks to submit data in CSV format, fostering standardization across the SRB's data collection systems, including the SRB’s Integrated Resolution Information System (IRIS).

How will MBDT Guidance Impact EU Financial Institutions?

The MBDT guidance is expected to shape the EU banking landscape in several strategic ways:

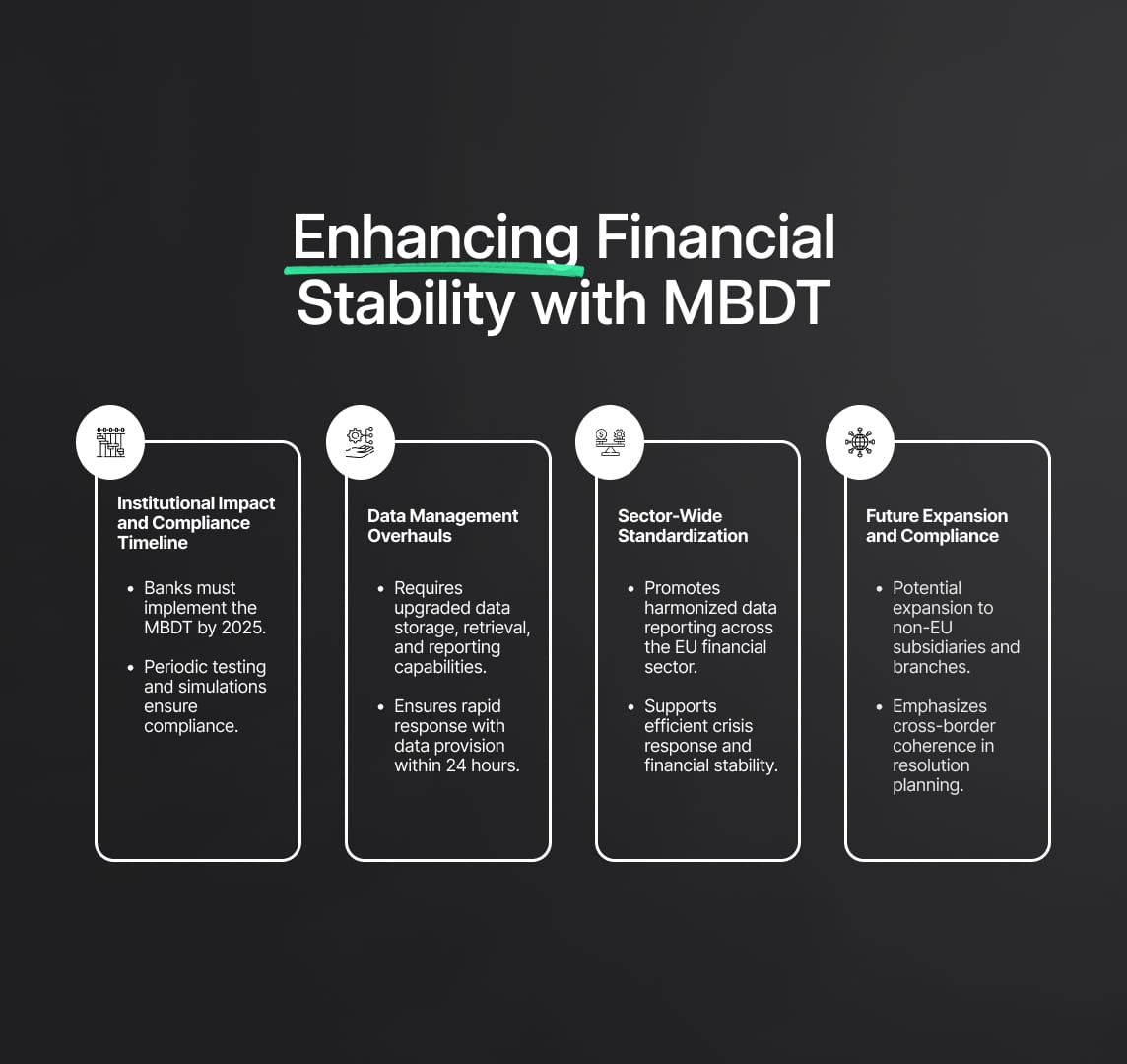

Institutional Impact and Compliance Timeline: Large financial institutions, particularly those designated as resolution entities, must promptly implement the guidance. Banks across the EU are required to adopt the MBDT by 2025, with periodic testing and simulations for compliance assurance. The Single Resolution Board (SRB) emphasizes that these institutions must be prepared to conduct dry-run simulations, scenario walkthroughs, and fire drills to validate their data accuracy and timeliness.

This includes readiness to provide granular data on deposits, counterparty exposure, and aggregate liability data as outlined in tabs like B02.00 (Main Liabilities) and B90.00 (Counterparties). Institutions like Deutsche Bank, BNP Paribas, and other EU-based global players must prioritize data management investments to ensure compliance and establish robust Management Information Systems (MIS) that can generate comprehensive reports in crisis situations.

Data Management Overhauls: The SRB’s guidance necessitates significant data management infrastructure, demanding enhanced data storage, retrieval, and reporting capabilities. Institutions are likely to invest in upgraded MIS that ensure compliance with the 24-hour data availability requirement. This short turnaround aligns with the SRB's expectation that institutions meet ad hoc demands, especially under crisis conditions, with precise, up-to-date data on capital and liabilities eligible for bail-in. The SRB’s stipulation for MBDT data delivery within 24 hours reflects the demand for rapid response capabilities, a trend increasingly visible in global regulatory frameworks. Banks must also ensure compatibility with the SRB's Integrated Resolution Information System (IRIS) for real-time data sharing, which aligns with the SRB's Expectations for Banks (EfB) and the Bank Recovery and Resolution Directive (BRRD).

Sector-Wide Standardization and Crisis Preparedness: The SRB’s MBDT guidance marks a strong push towards harmonization across the EU financial sector, promoting standardized data reporting that can enhance crisis response efficiency. This trend aligns with similar data harmonization efforts by global bodies such as the Financial Stability Board (FSB), underscoring a global movement toward data-driven resolution preparedness. The guidance's structured approach to data, particularly within the Aggregate View (B01.00) and Guarantees (B05.00) templates, is designed to facilitate a coherent application of resolution tools like write-downs and conversions. The SRB also calls for regular MIS self-assessments, ensuring that institutions maintain robust data-reporting frameworks for crisis scenarios.

Potential Expansion to Non-EU Subsidiaries and Branches: EU-based entities with non-EU subsidiaries might face future expansion of the MBDT requirements, with reporting expectations potentially extended to all cross-border branches and subsidiaries to ensure holistic coverage in resolution plans. The SRB’s emphasis on harmonizing data practices across jurisdictions reflects an increasing need for cross-border coherence in resolution planning. The MBDT’s comprehensive template structure, particularly through fields for reporting country-specific data in line with local insolvency laws, aims to support such an expansion, enabling parent entities to gain a consolidated view of liabilities across jurisdictions.

Legal and Compliance Innovations: As the SRB guidance evolves, financial institutions are expected to align their governance frameworks and data governance processes accordingly. Entities will need to closely follow SRB updates to incorporate any amendments to the data requirements promptly, ensuring continuous compliance and preparedness. The SRB anticipates that, in extraordinary circumstances, National Resolution Authorities (NRAs) may introduce more specific adjustments tailored to national legal contexts, as outlined in the MBDT’s Country Annexes. Compliance with GDPR is also essential, with reporting entities required to anonymize data where necessary, such as counterparty details within the Counterparties (B90.00) tab. By building agile governance systems, institutions will be better equipped to adapt to the SRB’s evolving guidance and ensure consistency across their reporting and resolution planning.

The SRB’s MBDT guidance, by mandating unified and comprehensive data reporting, sets a precedent for how resolution planning will evolve across jurisdictions. By investing in robust MIS and data infrastructure, institutions are not only complying with regulatory expectations but also positioning themselves advantageously in an increasingly data-centric financial regulatory environment. This structured, data-intensive approach aims to enhance resilience in EU financial markets, with the SRB’s rigorous framework helping ensure that banks can respond swiftly and decisively in potential resolution scenarios.

Reduce your

compliance risks