Sustainable Finance Disclosure Regulation (SFDR): ESA Opinion

The Sustainable Finance Disclosure Regulation (SFDR) boosts transparency in the EU’s sustainable finance. By standardizing information, SFDR helps investors make informed decisions, promoting transparency and integrity in the financial market.

Introduction

The Sustainable Finance Disclosure Regulation (SFDR) is a cornerstone of the European Union's strategy to enhance transparency and promote integrity in sustainable finance. This regulation is a crucial step in combating greenwashing and directing capital towards genuinely sustainable investments. By mandating detailed disclosures about the sustainability characteristics of financial products, the SFDR aims to provide investors with the information they need to make informed decisions, thereby fostering a more transparent and accountable financial market.

Source

[1]

Background and Objectives of the SFDR

The SFDR, effective since March 2021, was established to standardize sustainability-related disclosures across the EU financial sector. It imposes rigorous requirements on financial market participants, including asset managers, insurance companies, pension funds, and financial advisers, to disclose how they integrate environmental, social, and governance (ESG) factors into their investment decisions and advisory processes.

Key objectives of the SFDR include:

- Enhancing Transparency: Ensuring that investors have access to consistent, comparable, and reliable information about the sustainability risks and impacts associated with financial products.

- Preventing Greenwashing: Reducing the risk of misleading claims about the sustainability of financial products, thus protecting investors and maintaining market integrity.

- Promoting Sustainable Investments: Facilitating the flow of capital towards investments that support the EU's climate and sustainability goals, including the European Green Deal.

Regulatory Framework and Legal Basis

The SFDR is embedded within a broader regulatory framework that includes the EU Taxonomy Regulation and the Non-Financial Reporting Directive (NFRD). This framework is designed to create a cohesive approach to sustainability reporting and disclosure across the EU.

- EU Taxonomy Regulation: Provides a classification system for environmentally sustainable economic activities, which serves as a reference for SFDR disclosures.

- Non-Financial Reporting Directive (NFRD): Requires large public-interest companies to disclose non-financial information, including sustainability-related data, which complements the SFDR's requirements.

The legal basis for the SFDR is rooted in several EU regulations:

- Article 16a of Regulations (EU) No 1093/2010, No 1094/2010, and No 1095/2010: These regulations empower the European Supervisory Authorities (ESAs) to develop regulatory technical standards (RTS) and issue opinions to ensure consistent implementation of the SFDR.

SFDR: Recent Developments and ESA Opinion

On June 18, 2024, the ESAs published a comprehensive opinion on the SFDR, highlighting key areas for improvement and providing detailed recommendations to enhance the regulation's effectiveness. This opinion is based on extensive stakeholder consultations and aims to address practical challenges encountered during the SFDR's implementation.

The ESAs' opinion covers several critical aspects:

- Product Classification System: Proposing a clear categorization of financial products based on their sustainability characteristics to aid investors in identifying genuinely sustainable options.

- Sustainability Indicators: Suggesting the development of specific indicators to measure and report on the sustainability performance of financial products, ensuring consistency and comparability.

- Expanded Scope: Recommending the inclusion of additional financial products under the SFDR to create a more comprehensive disclosure framework.

By addressing these areas, the ESAs aim to streamline the SFDR's requirements, reduce ambiguity, and enhance the overall transparency and integrity of the sustainable finance market in the EU.

Implications for Financial Market Participants

The SFDR imposes significant compliance obligations on financial market participants. Firms must implement robust processes to collect, analyse, and disclose sustainability-related data. This includes:

- Integration of ESG Factors: Demonstrating how ESG factors are incorporated into investment decisions and risk management processes.

- Disclosure of Adverse Impacts: Providing detailed information on the principal adverse impacts of investment decisions on sustainability factors.

- Transparency in Marketing: Ensuring that sustainability claims in marketing materials are accurate and substantiated by disclosed data.

Failure to comply with the SFDR can result in reputational damage, legal penalties, and loss of investor trust. Therefore, financial market participants must stay abreast of regulatory developments and continuously enhance their sustainability reporting practices.

Background of SFDR

The Sustainable Finance Disclosure Regulation (SFDR) was introduced by the European Union as a vital component of its broader strategy to promote sustainable finance and transition towards a greener economy. The regulation is designed to steer investors towards more sustainable choices by providing them with transparent and comparable information about the sustainability aspects of financial products.

Objectives of the SFDR

The primary objectives of the SFDR are:

- Enhancing Transparency: The SFDR aims to ensure that investors have access to consistent, comparable, and reliable information regarding the sustainability risks and impacts of financial products. By establishing a standardized framework for sustainability disclosures, the SFDR enhances market transparency and enables investors to make more informed decisions.

- Preventing Greenwashing: Greenwashing, where firms falsely claim their products are environmentally friendly, undermines investor trust and the overall integrity of the market. The SFDR addresses this issue by imposing stringent disclosure requirements, thereby reducing the risk of misleading sustainability claims.

- Promoting Sustainable Investments: The SFDR encourages the flow of capital towards investments that support the EU’s sustainability goals, including the objectives outlined in the European Green Deal. By fostering a more transparent market, the SFDR helps direct funds to genuinely sustainable projects and companies.

Rules for Sustainability Disclosures

The SFDR establishes harmonized rules for transparency regarding sustainability risks and adverse sustainability impacts. These rules apply to a wide range of financial market participants, including:

- Asset Managers: Required to disclose how they integrate sustainability risks into their investment decisions and the adverse impacts of their investments on sustainability factors.

- Insurance Companies: Must provide information on how they incorporate sustainability risks into their underwriting and investment activities.

- Pension Funds: Obliged to disclose how sustainability risks are considered in their investment strategies and the potential impact on returns.

- Financial Advisers: Need to inform clients about how they integrate sustainability risks into their advice and the potential adverse impacts of their recommendations.

Regulatory Framework and Legal Basis

The SFDR operates within a broader regulatory framework aimed at fostering sustainable finance across the European Union. It is closely linked with other key regulations, such as:

- EU Taxonomy Regulation: This regulation provides a classification system for environmentally sustainable economic activities. The Taxonomy serves as a reference point for SFDR disclosures, ensuring that the sustainability claims are backed by scientifically robust criteria.

- Non-Financial Reporting Directive (NFRD): The NFRD requires large public-interest entities to disclose non-financial information, including sustainability-related data. This complements the SFDR by providing a broader context for sustainability disclosures.

The legal foundation of the SFDR is rooted in several EU regulations. The European Supervisory Authorities (ESAs) have a mandate under Article 16a of Regulations (EU) No 1093/2010, No 1094/2010, and No 1095/2010 to develop regulatory technical standards (RTS) and issue opinions to ensure consistent implementation of the SFDR across the EU. These regulations empower the ESAs to enhance the transparency and stability of financial markets by providing detailed guidance on sustainability disclosures.

Recent Developments

On June 18, 2024, the ESAs published an opinion on the SFDR, highlighting key areas for improvement based on extensive stakeholder consultations. The opinion aims to refine the SFDR framework to address practical challenges and enhance its effectiveness. The ESAs' recommendations include the introduction of a product classification system, development of sustainability indicators, and expansion of the SFDR scope to cover more financial products.

Impact on Financial Market Participants

The SFDR imposes significant compliance requirements on financial market participants. Firms must implement robust processes to collect, analyze, and disclose sustainability-related data. This includes:

- Integrating ESG Factors: Firms need to demonstrate how they incorporate environmental, social, and governance (ESG) factors into their investment decisions and risk management processes.

- Disclosing Adverse Impacts: Detailed information on the principal adverse impacts of investment decisions on sustainability factors must be provided.

- Ensuring Marketing Transparency: Sustainability claims in marketing materials must be accurate and substantiated by the disclosed data to prevent greenwashing.

Key Recommendations from the ESAs' Opinion

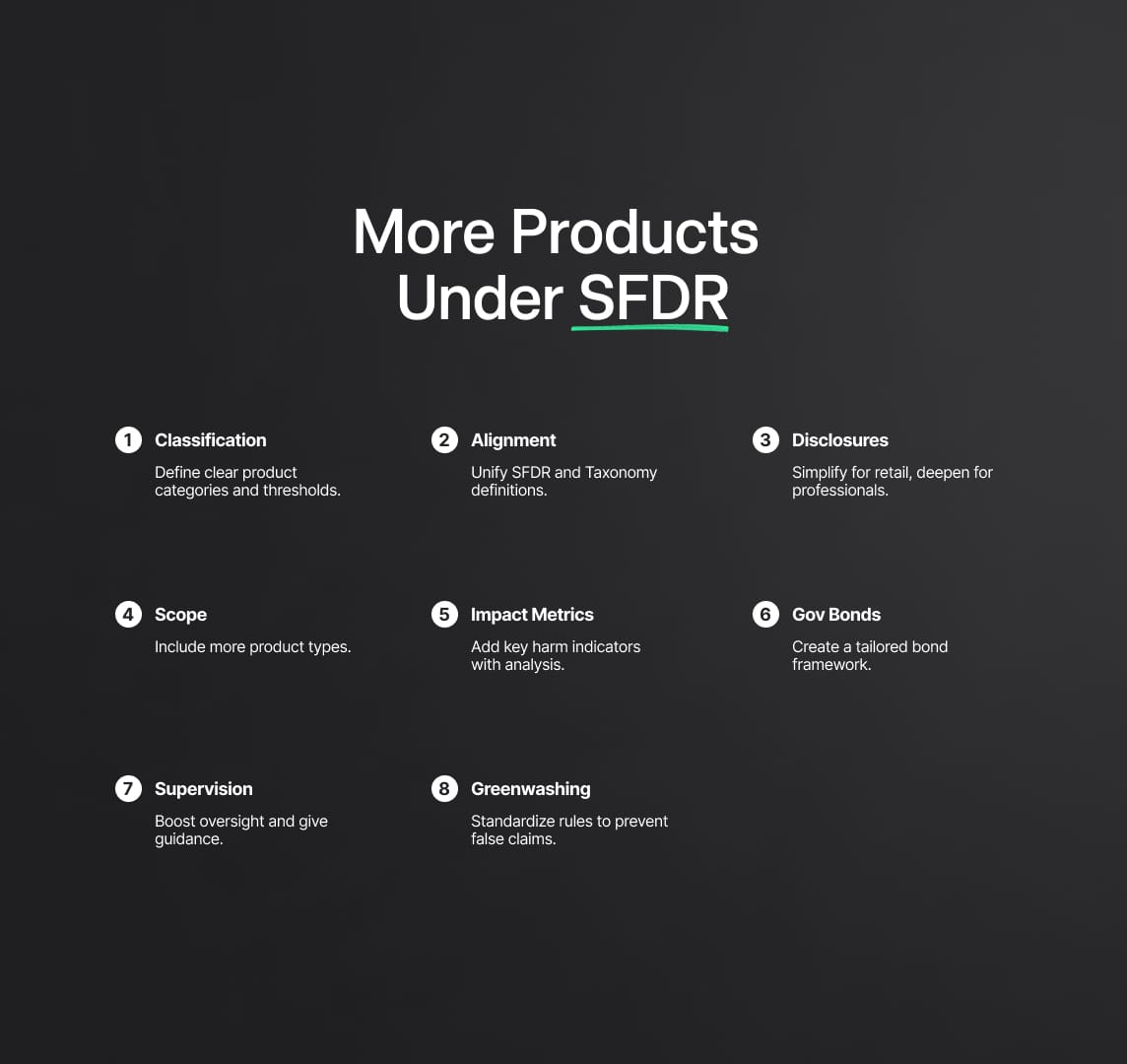

1. Introduction of a Product Classification System

The European Supervisory Authorities (ESAs) propose a robust product classification system as a central improvement to the Sustainable Finance Disclosure Regulation (SFDR). This system is designed to simplify and standardize the categorization of financial products based on their sustainability attributes. The primary goal is to aid consumers in navigating the complex landscape of sustainable finance products and to facilitate the transition to a more sustainable financial system.

Technical Details:

- Regulatory Categories: The classification system will delineate products into distinct regulatory categories. These categories will be based on specific criteria such as the environmental, social, and governance (ESG) characteristics of the investments.

- Objective Criteria and Thresholds: Each category will have clear, objective criteria and thresholds. For example, a product could be categorized based on the percentage of its investments that align with the EU Taxonomy for sustainable activities.

- Sustainability Indicators: The use of sustainability indicators is recommended to provide a quantifiable measure of a product’s sustainability performance. These indicators could include metrics such as carbon intensity, water usage, or social impact scores. They will help investors gauge the sustainability attributes of products on a comparative scale.

2. Revisiting Co-existence of "Sustainable Investment" and Taxonomy-Aligned Investment

The ESAs suggest a critical review of the co-existence of "sustainable investment" as defined in the SFDR and "taxonomy-aligned investment." The aim is to streamline these overlapping concepts to enhance clarity and effectiveness.

Technical Details:

- EU Taxonomy Completion: The recommendation includes completing the EU Taxonomy, which provides a detailed classification system for environmentally sustainable economic activities. This completion should extend to social sustainability aspects to ensure comprehensive coverage.

- Alignment and Integration: Aligning the definitions of sustainable investments in the SFDR with taxonomy-aligned investments will create a more coherent framework. This integration will help in reducing discrepancies and improving the consistency of sustainability reporting and disclosures.

3. Tailored Disclosures for Different Investor Needs

Recognising the diverse needs of investors, the ESAs emphasise the importance of tailoring sustainability disclosures to cater to different audiences.

Technical Details:

- Retail Investors: Disclosures for retail investors should prioritize simplicity and clarity. Using straightforward categories and sustainability indicators will make it easier for these investors to understand and compare the sustainability features of different products.

- Professional Investors: For professional investors, more detailed and granular information is necessary. This could include comprehensive data on sustainability risks, detailed metrics on adverse impacts, and alignment with sustainability benchmarks.

- Consistency Across Channels: Ensuring that sustainability information is consistent across various distribution channels, including digital platforms, will enhance transparency and trust.

4. Expanding the SFDR Scope

The ESAs propose expanding the SFDR to encompass a broader range of financial products, ensuring that sustainability disclosures are comprehensive and standardized across the financial sector.

Technical Details:

- Inclusion of Additional Products: The expansion could include products currently outside the SFDR scope, such as certain types of bonds, structured products, and insurance products.

- Harmonized Disclosures: Establishing harmonized disclosure requirements across all financial products will facilitate easier comparison and improve overall market transparency.

5. Key Adverse Impact Indicators

Incorporating key adverse impact indicators into the SFDR disclosures is recommended, following a thorough cost-benefit analysis.

Technical Details:

- Quantifiable Metrics: Key adverse impact indicators could include metrics such as greenhouse gas emissions, biodiversity loss, and social impacts like labor rights violations.

- Cost-Benefit Analysis: Ensuring that the introduction of these indicators is both justified and beneficial will involve analyzing the potential costs and benefits to financial market participants and investors.

6. Framework for Government Bonds

The ESAs suggest developing a specific framework to assess the sustainability features of government bonds.

Technical Details:

- Unique Characteristics: Government bonds have distinct characteristics that necessitate a tailored approach. This framework will take into account factors such as the use of proceeds, alignment with national sustainability goals, and overall impact on sustainable development.

7. Enhanced Supervision and Practical Application

To ensure effective implementation and monitoring of SFDR disclosures, the ESAs recommend enhanced supervision and practical application guidelines.

Technical Details:

- Coordination with National Authorities: The ESAs will work closely with national competent authorities to supervise compliance with SFDR requirements.

- Practical Application Responses: Providing practical guidance and responses to common questions will help financial market participants understand and meet their disclosure obligations.

8. Addressing Greenwashing and Mis-Selling Risks

The ESAs highlight the importance of addressing greenwashing and mis-selling risks by enforcing uniform disclosure requirements.

Technical Details:

- Uniform Requirements: Implementing consistent disclosure standards across all financial products, regardless of their sustainability claims, will mitigate the risk of misleading information.

- Marketing Transparency: Ensuring that marketing materials accurately reflect the sustainability attributes of financial products will further reduce the likelihood of greenwashing.

Disclosures through Clear Product Categorization and Sustainability Indicators

One of the primary recommendations from the European Supervisory Authorities (ESAs) involves the introduction of a robust product categorization system complemented by comprehensive sustainability indicators. This dual approach aims to streamline and clarify the sustainability disclosures required under the Sustainable Finance Disclosure Regulation (SFDR).

Technical Details:

- Product Categorization System: The proposed system involves defining clear and objective criteria for categorizing financial products. These categories will be based on specific sustainability metrics, ensuring that each product is accurately classified according to its environmental, social, and governance (ESG) attributes. For example, products could be categorized into 'sustainable investments,' 'transition investments,' and 'unsustainable investments,' each with predefined thresholds and criteria.

- Sustainability Indicators: Alongside categorization, the use of sustainability indicators will provide quantifiable metrics that investors can easily understand and compare. Indicators might include carbon footprint, water usage, biodiversity impact, and social metrics such as labor practices and community engagement. These indicators should be standardized to ensure consistency across the market.

- Simplification and Accessibility: The aim is to make sustainability information accessible to all types of investors, from retail to institutional. Simplified indicators and categories will reduce the complexity currently associated with sustainability disclosures, making it easier for investors to make informed decisions.

Align the Definition of "Sustainable Investment" with the Categorisation System

To ensure consistency and clarity, the ESAs recommend a thorough review and alignment of the definition of "sustainable investment" within the SFDR framework.

Technical Details:

- Consistent Definitions: The definition of "sustainable investment" should align with the new product categorization system, ensuring that all stakeholders have a common understanding of what constitutes a sustainable investment. This includes aligning with the EU Taxonomy, which provides a detailed classification of environmentally sustainable economic activities.

- Prescriptive Criteria: Implementing prescriptive criteria for sustainable investments will enhance comparability and transparency. This involves setting clear guidelines on what qualifies as a sustainable investment, including specific environmental and social benchmarks that products must meet.

- Harmonization with EU Taxonomy: The alignment process should harmonize SFDR definitions with the EU Taxonomy to avoid overlapping and conflicting standards. This will provide a unified framework for assessing and reporting sustainability.

Scope Expansion: Including More Products within the SFDR Framework

The ESAs propose expanding the SFDR's scope to cover a wider range of financial products, thereby enhancing the comprehensiveness and impact of the regulation.

Technical Details:

- Inclusion of Additional Products: The expansion could include structured products, derivatives, insurance products, and other financial instruments not currently covered under the SFDR. This ensures that all products with potential sustainability impacts are subject to disclosure requirements.

- Standardized Disclosures: For newly included products, standardized sustainability disclosures should be mandated to maintain consistency. This could involve adapting existing disclosure frameworks to suit different product types while ensuring they meet the SFDR’s objectives.

- Regulatory Harmonization: Ensuring that the expanded scope aligns with other regulatory frameworks will be crucial. This includes considering interactions with the Markets in Financial Instruments Directive (MiFID II) and the Insurance Distribution Directive (IDD) to avoid regulatory fragmentation.

Transparency of Adverse Sustainability Impacts with Justified Requirements

Improving the transparency of adverse sustainability impacts is essential for achieving the SFDR’s goals of promoting sustainable finance and mitigating greenwashing.

Technical Details:

- Principal Adverse Impact (PAI) Indicators: The SFDR mandates disclosures on Principal Adverse Impacts (PAIs). The ESAs recommend enhancing these disclosures by introducing detailed, justified requirements for reporting on PAIs. This involves identifying specific metrics for various environmental and social impacts, such as greenhouse gas emissions, water pollution, deforestation, and social inequalities.

- Cost-Benefit Analysis: To ensure that the requirements are practical and beneficial, a thorough cost-benefit analysis should be conducted. This analysis will help balance the regulatory burden on financial institutions with the benefits of increased transparency for investors.

- Enhanced Reporting Standards: Developing detailed reporting standards for PAIs will improve the quality and consistency of disclosures. This includes specifying methodologies for calculating and reporting impacts, as well as guidelines for the use of data sources and verification processes.

Framework for Assessing the Sustainability of Government Bonds

The ESAs highlight the need for a tailored framework to assess the sustainability features of government bonds, considering their unique characteristics.

Technical Details:

- Assessment Criteria: The framework should establish specific criteria for evaluating the sustainability of government bonds. This could include the alignment of bond proceeds with national and international sustainability goals, such as the Paris Agreement and the Sustainable Development Goals (SDGs).

- Use of Proceeds: Detailed guidelines on the use of proceeds from government bonds should be provided, ensuring that funds are directed towards projects with clear environmental and social benefits.

- Transparency and Reporting: Governments issuing bonds should be required to report on the sustainability outcomes of funded projects, including detailed impact assessments and progress reports. This will enhance investor confidence in the sustainability claims associated with government bonds.

Supervision and Practical Application of the SFDR

Effective supervision is crucial for ensuring compliance with the SFDR and enhancing its practical application.

Technical Details:

- National Competent Authorities (NCAs): The ESAs recommend strengthening the role of NCAs in supervising SFDR disclosures. This includes providing NCAs with the necessary resources and authority to conduct thorough reviews and enforce compliance.

- Practical Guidance: Developing practical application guidelines for financial market participants will help ensure consistent and accurate disclosures. This includes providing templates, best practice examples, and FAQs to assist in the implementation of SFDR requirements.

- Monitoring and Enforcement: Establishing robust monitoring and enforcement mechanisms will be key to ensuring compliance. This could involve periodic audits, spot checks, and the imposition of penalties for non-compliance.

Uniform Disclosure Requirements to Reduce Greenwashing and Mis-Selling Risks

Addressing the risks of greenwashing and mis-selling is a critical component of the ESAs’ recommendations.

Technical Details:

- Uniform Disclosure Standards: Implementing uniform disclosure standards across all financial products, irrespective of their sustainability claims, will help reduce the risk of greenwashing. This involves setting clear, consistent criteria for all disclosures, ensuring that they accurately reflect the sustainability attributes of the products.

- Marketing and Communication: Clear guidelines for marketing and communication materials will be essential. These guidelines should ensure that all sustainability-related claims are substantiated and transparent, preventing misleading information from reaching investors.

- Verification and Assurance: Encouraging or mandating third-party verification and assurance of sustainability claims can further mitigate greenwashing risks. Independent audits and certifications will provide additional credibility to sustainability disclosures.

SFDR Future

The recommendations from the European Supervisory Authorities (ESAs) aim to significantly enhance the effectiveness and clarity of the Sustainable Finance Disclosure Regulation (SFDR), making sustainable finance more accessible and comprehensible for investors. By refining the SFDR, these recommendations are poised to deliver multiple far-reaching benefits:

Better Informed Investors

Simplified Categories and Indicators: The introduction of straightforward categories and sustainability indicators is designed to simplify the complex landscape of sustainable finance. By providing clear, objective criteria for categorizing financial products, investors can more easily identify and compare sustainable investment opportunities.

- Technical Details:

- Product Categorization System: Clear criteria and thresholds will be established for different product categories, such as 'sustainable investments' and 'transition investments,' based on specific environmental, social, and governance (ESG) metrics.

- Sustainability Indicators: These indicators will quantify sustainability attributes like carbon footprint, water usage, and social impact, making it easier for investors to gauge the sustainability performance of financial products.

Enhanced Transparency

Clear and Consistent Disclosures: By ensuring that disclosures are clear, consistent, and comparable, the SFDR will reduce the risk of greenwashing and increase trust in the market. This involves the implementation of standardized reporting frameworks and the alignment of sustainability definitions with the EU Taxonomy.

- Technical Details:

- Standardized Reporting Frameworks: Uniform disclosure templates and guidelines will be developed to ensure that all financial products adhere to the same reporting standards, facilitating easier comparison and assessment.

- Alignment with EU Taxonomy: The SFDR's definitions and criteria will be harmonized with the EU Taxonomy, providing a consistent reference point for assessing the sustainability of economic activities.

Broader Impact

Inclusion of More Products and Government Bonds: Expanding the SFDR's scope to include a wider range of financial products and developing a specific framework for assessing the sustainability of government bonds will significantly broaden the regulation's impact.

- Technical Details:

- Scope Expansion: The SFDR will be extended to cover additional financial products such as structured products, derivatives, and insurance products, ensuring comprehensive sustainability disclosures across the financial sector.

- Government Bonds Framework: A dedicated framework for government bonds will be developed, taking into account the unique characteristics of these instruments and ensuring that bond proceeds are used for sustainable projects.

Addressing Principal Adverse Impacts (PAIs): Enhancing the transparency of adverse sustainability impacts through detailed and justified reporting requirements will provide investors with a clearer understanding of the negative impacts associated with their investments.

- Technical Details:

- PAI Indicators: Specific metrics for reporting Principal Adverse Impacts (PAIs) will be defined, covering areas such as greenhouse gas emissions, water pollution, and social inequalities.

- Cost-Benefit Analysis: The introduction of PAI reporting requirements will be based on a thorough cost-benefit analysis to ensure that the benefits of increased transparency outweigh the compliance costs.

Mitigating Greenwashing: The implementation of uniform disclosure requirements and clear guidelines for marketing and communication will help mitigate the risks of greenwashing and mis-selling, ensuring that all sustainability claims are accurate and substantiated.

- Technical Details:

- Uniform Disclosure Standards: Consistent criteria for all disclosures, irrespective of sustainability claims, will be established to prevent misleading information.

- Marketing Guidelines: Clear rules for marketing materials will be enforced, requiring that all sustainability-related claims are transparent and verifiable.

Enhanced Supervision and Practical Application

Strengthening Supervision: Enhanced supervision by national competent authorities (NCAs) will ensure that the SFDR is effectively implemented and that compliance is rigorously monitored.

- Technical Details:

- Role of NCAs: NCAs will be provided with the necessary resources and authority to conduct comprehensive reviews and enforce compliance with SFDR requirements.

- Practical Guidance: Practical application guidelines, templates, and best practice examples will be developed to assist financial market participants in meeting SFDR obligations.

Digital Adaptation: Adapting disclosures to digital formats will improve accessibility and engagement, particularly for retail investors.

- Technical Details:

- Digital Disclosures: Disclosures will be designed to be compatible with digital platforms, allowing for layered and interactive formats that enhance user understanding and engagement.

Annex II: Product Type by Sustainability Objective

The Sustainable Finance Disclosure Regulation (SFDR) aims to create a robust framework for sustainable finance by categorizing financial products based on their sustainability objectives. The European Supervisory Authorities (ESAs) have provided detailed examples of how different financial products can be categorized under various scenarios, offering a comprehensive guide for financial market participants and investors. This section delves into the technical details of these scenarios and the implications for product disclosures.

Scenario 1: Categories Only

In this scenario, financial products are classified solely based on predefined categories that reflect their sustainability characteristics.

- Product A (High Proportion of Sustainable Investments): This product qualifies for the "sustainable" category due to its substantial share of investments in sustainable activities. The classification is based on strict criteria, such as alignment with the EU Taxonomy, adherence to the "Do No Significant Harm" (DNSH) principle, and contributions to environmental or social objectives.

- Technical Details:

- Criteria for Sustainable Category: Products must demonstrate a high percentage of investments in taxonomy-aligned activities. For instance, a product might be required to have at least 80% of its assets in sustainable investments to qualify.

- DNSH Principle: Products must ensure that their investments do not cause significant harm to any other environmental or social objectives, which requires rigorous assessment and reporting.

- Product B (Transition Investment Focused): This product falls into the "transition" category as it focuses on investments that are not yet fully sustainable but are on a clear path towards sustainability. The criteria include defined thresholds for improvements in sustainability performance over time.

- Technical Details:

- Transition Criteria: Investments should have clear decarbonization trajectories, targeting substantial reductions in carbon emissions within a specified timeframe. For example, a transition product might need to achieve a 50% reduction in carbon emissions over five years.

- Performance Monitoring: Continuous monitoring and reporting on the progress towards sustainability targets are mandatory, including interim milestones and final goals.

- Product C (Profit Participation with Sustainability Features): Initially qualifies for the "transition" category but must increase its share of transition investments over time.

- Technical Details:

- Incremental Improvement: Products must outline a roadmap for gradually increasing their investments in transition activities, with specific targets and deadlines.

- Product D (Generic Equity/Bond with Simple Exclusion): This product does not qualify for any category as it only applies basic exclusion criteria, such as avoiding investments in fossil fuels, without actively promoting sustainability.

- Product E (Generic Equity/Bond with No Sustainability Features): This product is excluded from all categories due to the absence of any sustainability features.

Scenario 2: Indicator Only

This scenario uses a grading system to reflect the sustainability level of financial products, providing a straightforward way for investors to gauge the sustainability performance.

- Product A: Receives the highest grading due to a high level of sustainable investments.

- Technical Details:

- Grading System: A scoring mechanism is applied, where products are graded (e.g., A to E or using a color scale) based on their sustainability metrics, such as carbon footprint, water usage, and social impact.

- Product B: Achieves the second-highest grading due to its focus on transition investments.

- Product C: Assigned a mid-level grade, reflecting moderate sustainability efforts.

- Product D: Receives a low grade, indicating minimal sustainability efforts.

- Product E: Given the lowest grade, indicating no sustainability efforts.

Scenario 3: Combination

Combining both categorisation and grading provides a nuanced approach, offering a comprehensive view of the sustainability performance of financial products.

- Product A: Qualifies for the "sustainable" category with the highest grade in the indicator.

- Product B: Falls into the "transition" category with the second-highest grade due to a lower share of sustainable investments compared to Product A.

- Product C: Initially qualifies for the "transition" category with a mid-level grade.

- Product D: Does not qualify for any category and receives a low grade.

- Product E: Excluded from all categories and given the lowest grade.

The Sustainable Finance Disclosure Regulation: Documentation for Product Disclosures

The ESAs emphasise the importance of tailored and accessible disclosures to meet the diverse needs of investors.

Considerations for Pre-Contractual Disclosures:

- Audience Differentiation: Disclosures should be tailored to the specific needs of retail and sophisticated investors. Retail investors require simplified and clear information, often provided in a Key Investor Document (KID). Sophisticated investors might need more detailed disclosures available through comprehensive documents like prospectuses or digital platforms.

- Technical Details:

- Key Investor Document (KID): For retail investors, the KID should present key information in a concise and understandable format, covering essential sustainability metrics and risks.

- Detailed Disclosures for Sophisticated Investors: These could include in-depth reports on sustainability impacts, methodologies for assessing sustainability, and detailed performance metrics.

- Digital Adaptation: Disclosures should be digitally accessible, allowing for interactive and layered presentations that enhance user engagement and understanding. This includes providing hyperlinks to detailed reports, visual aids like charts and graphs, and interactive tools for scenario analysis.

The Commission should ensure that all relevant financial products, including those currently outside the SFDR scope, are subject to standardised sustainability disclosure requirements to prevent greenwashing.

Challenges and Recommendations:

- Assess Sustainability: It is crucial to evaluate sustainability at both the issuer level and the asset/index level determining the payout. This dual assessment ensures that all facets of a product's sustainability are transparent.

- Ensure Comparability: Standardized metrics and reporting frameworks should be developed to ensure that sustainability disclosures are comparable across different types of financial products, facilitating better investment decisions.

Transparency of Adverse Sustainability Impacts

To enhance transparency and accountability, current regulatory requirements under Articles 4 and 7 of the SFDR need further clarification.

Recommendations:

- Mandatory Consideration of PAIs: Making the consideration of Principal Adverse Impacts (PAIs) mandatory for products qualifying for the new sustainability product category ensures that negative sustainability impacts are acknowledged and addressed.

- Information on PAIs: Minimal disclosures on PAIs should be required for all financial products, ensuring a baseline level of transparency.

- Clarify Language: Ensuring that the language in Article 7(1)(b) related to PAI statements and quantifications is clear and unambiguous will help standardize reporting practices and improve investor understanding.

Annex I: Other Technical Issues

The ESAs highlight several technical issues that need to be addressed to improve the SFDR framework.

Technical Issues and Recommendations:

- Clarification of Article 4 Scope: Amend wording to include unit-linked products in the scope of PAI disclosures, ensuring comprehensive coverage.

- Interaction with CSRD Reporting: Address potential overlaps and discrepancies between SFDR and CSRD reporting frameworks to streamline reporting obligations.

- Naming and Marketing Requirements: Develop specific requirements for sustainability features in product naming and marketing to prevent misleading claims.

- SFDR-related Audit and Depositary Roles: Clarify the auditing standards and roles of fund depositaries concerning SFDR disclosures to enhance compliance.

- Report Frequency under Article 18: Consider reducing the frequency of PAI disclosure assessments to allow for more meaningful analysis and reduce the administrative burden.

- Information Flow to Competent Authorities: Improve the flow of information from fund managers to competent authorities to ensure effective supervision and enforcement.

- Harmonization of Website Disclosures: Standardize the content and presentation of sustainability information disclosed on websites to improve accessibility and comparability.

- Prominent Adviser Disclosures: Ensure that disclosures by financial advisers are easily locatable and prominently displayed to support informed decision-making.

Annex I: Other Technical Issues

The Sustainable Finance Disclosure Regulation (SFDR) is an evolving framework that requires continuous refinement to address emerging challenges and stakeholder feedback. The European Supervisory Authorities (ESAs) have pinpointed several technical issues that warrant attention in the upcoming review. Addressing these issues is crucial to ensuring the SFDR’s effectiveness in promoting sustainable finance and preventing greenwashing. This section delves into these technical aspects, providing detailed recommendations for enhancing the SFDR framework.

Clarification of Article 4 Scope

Scope Expansion for Unit-Linked Products: The current wording of Article 4 should be amended to explicitly include unit-linked products within the scope of Principal Adverse Impact (PAI) disclosures. Unit-linked products, which are investment-linked insurance policies, have significant market presence and their exclusion could lead to information gaps regarding sustainability impacts.

Technical Details:

- Inclusion Criteria: Define clear criteria for what constitutes unit-linked products under SFDR.

- Disclosure Requirements: Establish specific disclosure requirements for unit-linked products to ensure consistency with other financial products.

Interaction with CSRD Reporting

Harmonization with CSRD: The Corporate Sustainability Reporting Directive (CSRD) overlaps with SFDR in several areas. To streamline reporting and reduce the burden on financial market participants, the SFDR should address potential overlaps and discrepancies with CSRD reporting frameworks.

- Alignment of Requirements: Align SFDR and CSRD requirements where possible to avoid duplicative reporting.

- Unified Reporting Templates: Develop unified reporting templates that cater to both SFDR and CSRD obligations.

Naming and Marketing Requirements

Stringent Marketing Standards: To prevent misleading claims, the SFDR should implement stringent requirements for the use of sustainability-related terms in product naming and marketing. This will help combat greenwashing and ensure that product names accurately reflect their sustainability characteristics.

Technical Details:

- Compliance Guidelines: Develop comprehensive guidelines for acceptable sustainability-related terminology.

- Verification Processes: Establish processes for verifying the accuracy of sustainability claims in product marketing.

SFDR-related Audit and Depositary Roles

Enhanced Audit Standards: The roles of auditors and depositaries in relation to SFDR disclosures need clarification to ensure comprehensive oversight and accuracy of reported information.

- Audit Scope: Define the scope of audits required for SFDR disclosures, including sustainability metrics and adherence to regulatory standards.

- Depositary Responsibilities: Clarify the responsibilities of depositaries in monitoring and verifying compliance with SFDR requirements.

Report Frequency under Article 18

Optimising Reporting Frequency: Reducing the frequency of PAI disclosure assessments can allow for more meaningful analysis and reduce administrative burdens on financial institutions.

- Assessment Intervals: Propose longer intervals between PAI assessments, such as annual instead of semi-annual, to provide more comprehensive data.

- Impact Analysis: Conduct impact analysis to determine the optimal reporting frequency that balances oversight with operational feasibility.

Information Flow to Competent Authorities

Improved Data Transfer: Enhancing the flow of information from fund managers to competent authorities is vital for effective supervision and enforcement of SFDR compliance.

- Data Submission Protocols: Establish protocols for data submission to ensure timely and accurate reporting.

- Digital Platforms: Use digital platforms to facilitate real-time data sharing and enhance regulatory oversight.

Harmonization of Website Disclosures

Standardized Online Reporting: Standardizing the content and presentation of sustainability information disclosed on websites can improve transparency and comparability for investors.

- Disclosure Templates: Develop standardized templates for online disclosures, including key sustainability metrics and impact assessments.

- User-Friendly Formats: Ensure that disclosures are presented in user-friendly formats, with interactive elements to enhance accessibility.

Prominent Adviser Disclosures

Visibility of Adviser Information: Ensuring that disclosures by financial advisers are easily locatable and prominently displayed is crucial for informed decision-making by investors.

- Display Standards: Set standards for the placement and visibility of adviser disclosures on digital and physical platforms.

- Content Requirements: Specify the content that must be included in adviser disclosures, emphasizing transparency and clarity.

Reduce your

compliance risks