Three Lines of Defense (3LOD) in Modern Risk & Compliance Management

We explored the intricacies of the Three Lines of Defense (3LOD) model, emphasizing its pivotal role in modern risk management. The discussion underscored the importance of integrating technology, ensuring clear governance, and evolving risk strategies.

Introduction to the Three Lines of Defense (3LOD) Model

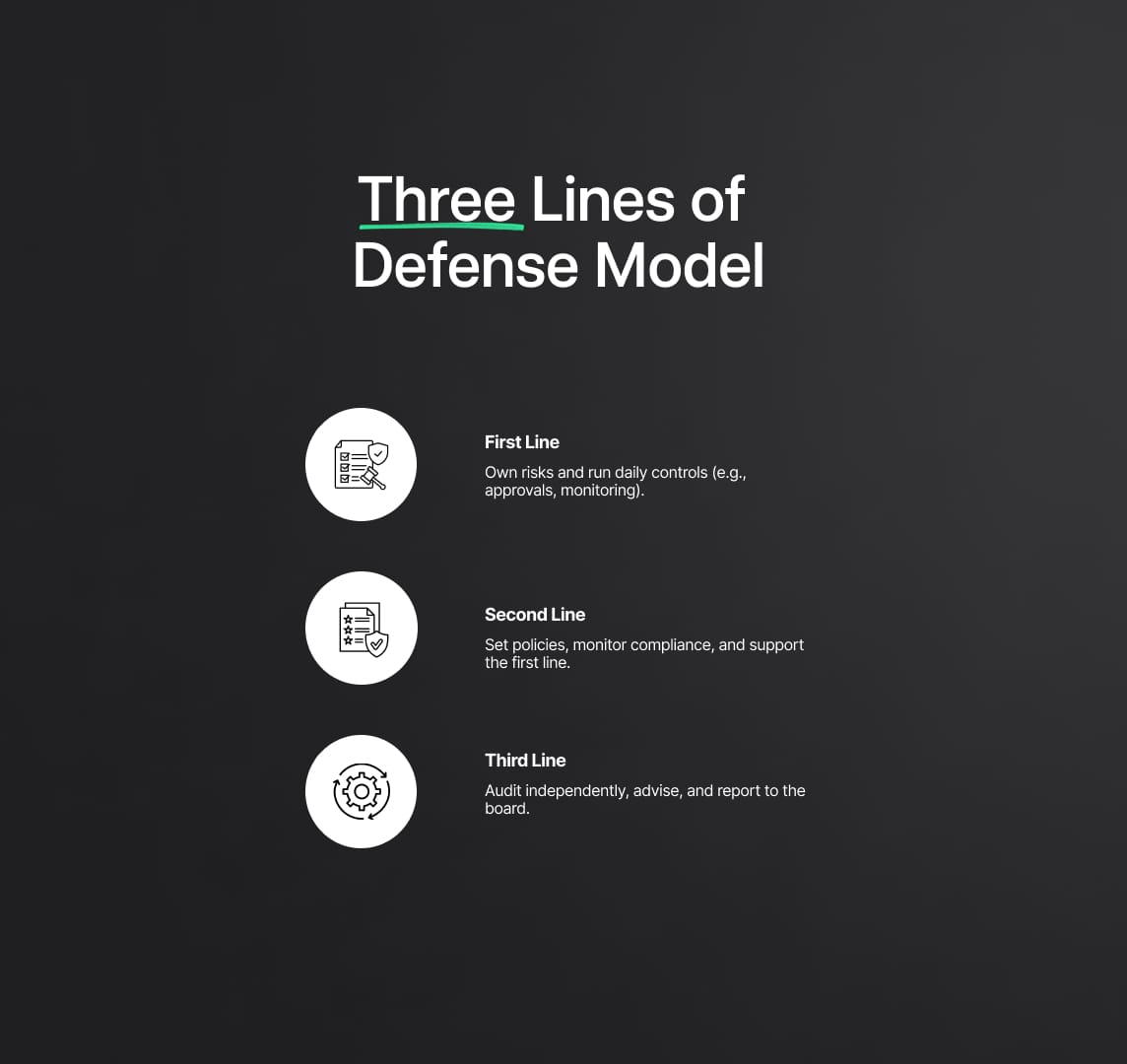

The Three Lines of Defense (3LOD) model is a foundational framework for risk management and compliance in organizations. By clearly defining three distinct layers of responsibility, operational management, risk oversight, and independent assurance, the model ensures that risks are identified, assessed, and monitored effectively. Originally endorsed by the Institute of Internal Auditors (IIA) and widely adopted across financial services, the Three Lines of Defense approach specifies:

- First Line (Operational Management): Business units and process owners that own and manage risks day-to-day.

- Second Line (Risk Oversight): Risk management and compliance functions that set policies, provide guidance, and monitor adherence.

- Third Line (Independent Assurance): Internal audit or equivalent assurance providers that validate the effectiveness of risk controls and governance.

Over time, the 3LOD framework has evolved to address emerging challenges such as cybersecurity threats, data privacy regulations, and ESG (environmental, social, governance) reporting. Today’s compliance professionals must integrate global standards, like COSO ERM, ISO 31000, and NIST CSF, while incorporating advanced technologies (AI, machine learning, blockchain) to strengthen each line of defense.

Three Lines of Defense Model – Roles and Responsibilities

The Three Lines of Defense (3LOD) framework establishes a clear, hierarchical structure for managing risk and compliance within an organization. By defining three distinct “lines” of responsibility, the model ensures comprehensive oversight, accountability, and collaboration. Each line contributes unique perspectives and functions, yet all three work together to safeguard business objectives and strengthen governance. Below is an SEO-optimized, detailed overview of each line’s roles and responsibilities:

First Line of Defense: Operational Management (Risk Owners)

Core Responsibilities

- Risk Ownership & Control Execution

- Operational managers and business unit leaders (for example, department heads, project managers, IT operations teams) own and manage risks as part of daily activities.

- They implement, execute, and continuously maintain internal controls, such as approval workflows, access permissions, or quality checkpoints, to address risks at the source.

- Example: In a financial institution, front-office managers ensure transaction limits are enforced and unusual trades are flagged immediately, actively managing credit or market risks “on the ground.”

- Policy Implementation

- The first line is responsible for translating high-level risk policies into detailed, operational procedures that align with organizational goals.

- Mid-level managers and team leads ensure staff adhere to company-wide risk policies by embedding controls, such as safety protocols in manufacturing or compliance checks in sales.

- Example: A manufacturing plant manager enforces safety protocols (e.g., machine lockout/tagout procedures), while a sales manager oversees client onboarding checklists to maintain regulatory compliance.

- Performance Monitoring & Early Intervention

- Operational teams monitor Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs) to detect deviations or emerging threats.

- If an indicator (for instance, a surge in transaction errors or vendor Service Level Agreement breaches) signals elevated risk, first-line managers take corrective action or escalate issues.

- Value: This real-time oversight enables rapid response and prevents small issues from evolving into significant control failures.

Distinctive Value of the First Line

- The first line is closest to the “ground truth”, teams possess intimate knowledge of processes, systems, and business activities.

- They balance risk and reward by pursuing strategic opportunities (e.g., product innovation, new market entry) while embedding controls to keep risk exposures within approved limits.

- In the 3LOD model, the mantra is: “The first line owns the risk and designs & executes controls to respond to those risks.” This active approach transforms risk management from a passive checklist into a core part of achieving objectives.

Second Line of Defense: Risk Management & Compliance Functions

Key Functions & Expertise

- Risk Oversight & Methodology Development

- Second-line teams, typically led by a Chief Risk Officer (CRO), Chief Compliance Officer (CCO), or equivalent, develop and maintain the enterprise risk management (ERM) framework.

- They set the risk appetite, establish policies, and design risk assessment methodologies to help business units quantify, prioritize, and monitor risks (e.g., credit, market, operational, regulatory).

- Example: An ERM team facilitates risk workshops across the organization, guiding departments on risk assessment techniques and scoring models.

- Policy Enforcement & Monitoring

- Second-line functions translate regulatory requirements (such as data privacy rules, anti-money laundering regulations, or environmental mandates) into specific control checkpoints.

- They conduct control testing (e.g., sampling transactions for compliance checks), track incidents, and report on emerging trends (e.g., loss events, near misses).

- Example: A Compliance office runs periodic reviews to confirm adherence to GDPR or HIPAA, raising alerts when noncompliance is detected. A Risk Management team monitors credit exposures against preapproved limits and performs stress tests.

- Guidance, Training & Collaboration

- Modern second-line teams act as advisors and partners, offering training, tools, and best practices to first-line managers.

- They help embed risk and compliance controls early in project lifecycles, ensuring consistent implementation across all business units.

- Example: A Data Protection Officer (second line) collaborates with marketing (first line) to conduct a privacy impact assessment for a new campaign, providing templates and advice to ensure compliance.

Distinctive Value of the Second Line

- The second line provides an independent management perspective, separate from day-to-day operations, yet remains under executive oversight (often reporting to the CEO or a Risk Committee).

- By focusing on “expertise, support, monitoring, and challenge,” second-line teams act as a safety net, catching control gaps before they escalate.

- Typical functions in the second line include:

- Risk Management (ERM, credit risk, market risk, operational risk)

- Compliance (regulatory interpretation, compliance monitoring programs)

- Legal & Finance Control (controllership, financial reporting accuracy)

- Quality Assurance & Security (quality control processes, information security standards)

- Although second-line functions do not own risks directly, they ensure that first-line controls are adequate, effective, and aligned with the organization’s risk appetite. This dual role, enforcer and advisor, strengthens the overall 3LOD model by fostering collaboration and consistency.

Third Line of Defense: Internal Audit & Independent Assurance

Core Responsibilities

- Independent Assurance & Objective Evaluation

- The third line comprises the Internal Audit function (and any other truly independent assurance providers) tasked with offering an objective, enterprise-wide appraisal of governance, risk management, and internal controls.

- Internal auditors conduct risk-based audits to verify that:

- First-line management is effectively identifying and treating risks.

- Second-line oversight functions are providing adequate monitoring and guidance.

- The overall internal control environment is operating as designed.

- Reporting: Findings and recommendations are reported directly to the Board’s Audit Committee (or equivalent governing body) to preserve independence from management.

- Advisory Role & Forward-Looking Insights

- Beyond traditional compliance reviews, modern internal audit functions provide consultative advice on process improvements, highlighting emerging risks, control enhancements, and governance best practices.

- They may analyze risk culture and ethics across the organization, offering strategic insights (e.g., how AI-driven decision-making might introduce new oversight challenges).

- Example: Internal audit might assess the effectiveness of a newly implemented cybersecurity control, then advise on enhancements without directly managing the controls themselves.

- Escalation & Coordination with External Parties

- The third line has a dual reporting relationship: administratively to the CEO but functionally to the Board (Audit Committee). This structure ensures that auditors can escalate significant issues—such as major cyber vulnerabilities or fraudulent activities, directly to the highest governance level.

- Internal audit also coordinates with external auditors and regulatory bodies, often representing the “last line of defense” before external scrutiny. Some frameworks even refer to external bodies as a “Fourth Line of Defense” for additional, external assurance.

Distinctive Value of the Third Line

- Unbiased perspective: With unrestricted access to all organizational records, internal audit brings objectivity that neither the first nor second lines can fully achieve.

- Reinforcing Accountability: Knowing that independent assurance is forthcoming motivates first- and second-line teams to maintain strong controls and transparent processes.

- Stakeholder Confidence: Independent third-line evaluations build trustworthiness among investors, regulators, and the board, confirming that risk management and compliance efforts are reliable and effective.

Visualization & Interactions Across the Three Lines

- Board & Senior Management (Tone at the Top): Sets the overall risk appetite, approves policies, and receives information from all three lines.

- First Line (Operational Management): Implements controls and responds to risks in real time.

- Second Line (Risk Oversight & Compliance): Designs risk frameworks, monitors controls, and advises the first line.

- Third Line (Internal Audit & Independent Assurance): Evaluates first- and second-line effectiveness, reports directly to the Board, and provides strategic recommendations.

This segmented yet interconnected structure ensures layered protection:

- If the First Line misses a risk, the Second Line may detect it.

- If both the First and Second Lines fail to identify an issue, the Third Line will likely catch it before external parties become involved.

Evolution to the Three Lines Model – Collaboration over Defense

The Three Lines of Defense (3LOD) framework has evolved into the Three Lines Model (3LM) to reflect a more collaborative, risk-enabling philosophy. Rather than strictly “defending” against threats, the updated model focuses on cooperation, strategic alignment, and governance integration. Below is an SEO-optimized, concise overview that retains every essential detail:

Shift in Mindset: From Defense to Governance

- Renaming and Rationale: In 2020, the Institute of Internal Auditors (IIA) dropped “Defense” to signal cultural change. The move from “3LOD” to “Three Lines Model (3LM)” emphasizes that risk management is not adversarial or siloed.

- Governance Ecosystem: The Board (Governing Body) is explicitly integrated into the model, setting risk appetite, ensuring accountability, and driving cross-line communication. Instead of isolated lines, all three groups operate within a unified governance framework that both defends and enables strategic objectives.

Emphasis on Governance & Strategy

- Board’s Active Role: The updated model positions the Governing Body at the center, tasked with approving risk appetite, overseeing the Three Lines, and promoting transparent reporting.

- Offensive and Defensive Balance: Risk management now serves a dual purpose: protecting assets and enabling value creation. Rather than merely avoiding negative outcomes, the framework encourages prudent risk-taking in support of organizational goals.

- Expert Insight: As Richard Chambers (former IIA CEO) stated, “Risk management goes beyond mere defense; it must enable achievement of objectives and support strong governance.”

Collaboration & Blended Roles

- De-emphasized Silos: The new guidance allows First Line (management) and Second Line (risk oversight) roles to be “separated or blended,” provided accountability remains clear.

- Embedded Risk Specialists: In some organizations, risk managers or compliance officers may sit within business units to advise at the decision point, blurring lines but improving real-time risk management.

- From Watchdog to Partner: Instead of “policing” first-line activities, the Second Line now provides hands-in-hand support, training, tools, and advice, while still monitoring controls.

Removal of “Defense” Terminology

- Semantic Shift: Eliminating “Defense” underscores that risk and compliance functions are not blockers; they are enablers of value creation.

- Cultural Impact: By removing adversarial language, the model promotes a mindset where risk ownership is shared, encouraging business units to view the Three Lines as collaborators, not obstacles.

Principles-Based, Adaptive Approach

- Flexible Design: The Three Lines Model is framed by principles—governance, management responsibility, independent assurance, and coordination, rather than a rigid structure.

- Tailored Implementation:

- Startups & Small Enterprises: Roles may overlap, founders, risk leads, or compliance champions might perform multiple line functions.

- Large Enterprises & Regulated Industries: Clear demarcation exists between operational, oversight, and assurance teams.

- No One-Size-Fits-All: Organizations adapt the model to their size, complexity, industry, and culture, ensuring that fundamental duties (risk management, oversight, assurance) are preserved and independence is protected.

Implications for Risk Leaders

- Frequent Communication: Encourage regular touchpoints among First, Second, and Third Lines, joint workshops, shared dashboards, and coordinated risk reviews.

- Integrated Audits & Reviews: During audits, Third Line (Internal Audit) can involve Second Line compliance experts to leverage subject-matter expertise, while still maintaining objectivity in final judgments.

- Cross-Line Participation: First Line managers attending risk committee meetings fosters direct dialogue, accelerating issue escalation and resolution.

Regulatory Expectations & External Stakeholder Confidence

- Regulator Focus: Supervisors now assess not only whether a 3LOD structure exists, but how effectively it operates in a coordinated, dynamic manner. Strict formality (merely having departments) is insufficient; regulators expect evidence of:

- Timely Escalation: Rapid reporting of emerging risks.

- Effective Challenge: Second Line constructively challenging First Line assumptions.

- Collaborative Problem-Solving: All lines working together to address issues proactively.

- Stakeholder Trust: Demonstrating a holistic, agile risk governance approach builds confidence among investors, regulators, and boards—showing that risk is managed end-to-end without critical blind spots.

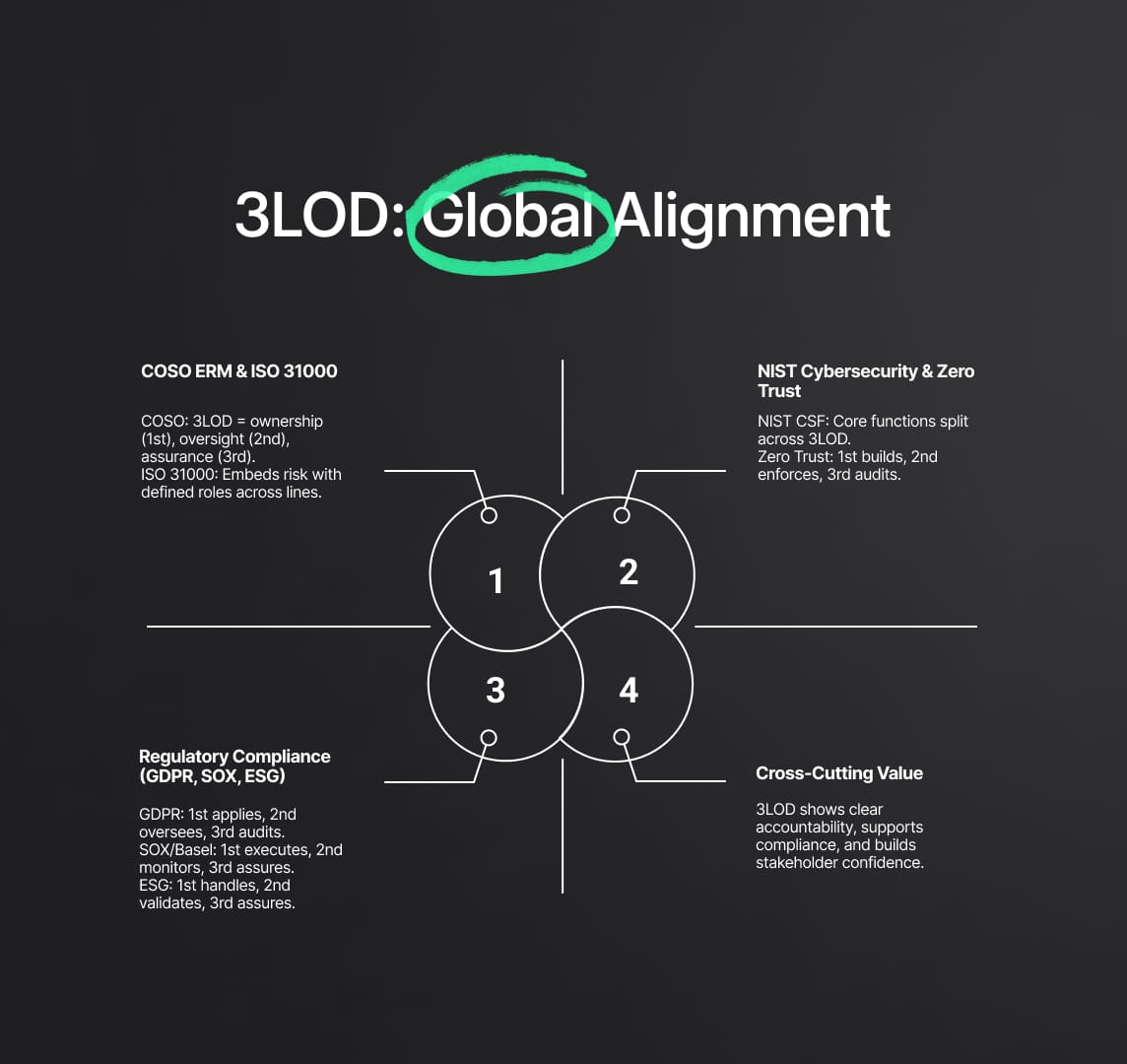

3LOD: Alignment with Global Standards and Frameworks

The Three Lines of Defense (3LOD) model gains traction because it complements and structures many international risk, cybersecurity, and compliance frameworks. By mapping the Three Lines’ roles to leading standards, such as COSO ERM, ISO 31000, NIST CSF, GDPR, and ESG reporting, organizations ensure their 3LOD implementation meets global best practices and satisfies regulatory expectations.

COSO Enterprise Risk Management & ISO 31000

- COSO ERM (2017):

- Principles: Integrate risk with strategy-setting, performance, and governance.

- 3LOD Mapping:

- First Line (Risk Owners): “Risk owners” align with COSO’s requirement that management identifies and manages risks to achieve objectives. They embed internal control activities (e.g., approval workflows, operational controls) to maintain risk appetite.

- Second Line (Oversight): ERM and compliance functions develop the risk management framework, set risk appetite, facilitate risk assessments, and monitor risk aggregation.

- Third Line (Assurance): Internal audit validates that ERM processes operate effectively, confirming appropriate segregation of duties, control design, and consistent risk reporting to the Board.

- Value: Implementing 3LOD operationalizes COSO’s call for layered review. First-line managers own risk-taking; second line provides expertise/support; third line assures governance and links risk to value creation.

- ISO 31000:2018:

- Principles & Guidelines: Emphasize that risk management must be embedded in all organizational processes; roles, authorities, and responsibilities must be clear.

- 3LOD Mapping:

- First Line: Accountable for embedding risk thinking into everyday activities, identifying and treating risks within their domain.

- Second Line: Establishes risk management policies, facilitates stakeholder engagement, and monitors risk performance. Ensures risk considerations inform decision-making.

- Third Line: Provides independent review of the risk management framework, ensuring continual improvement (audit of processes, controls, reporting).

- Value: Aligning 3LOD with ISO 31000 demonstrates a risk-aware culture: clear ownership (first line), oversight (second line), and assurance (third line). A common practice is to map each ISO 31000 principle to the responsible line, revealing and eliminating blind spots.

NIST Cybersecurity Framework & Zero Trust Security

- NIST Cybersecurity Framework (CSF): Organized into five core functions, Identify, Protect, Detect, Respond, Recover, each can be distributed across the Three Lines:

- Identify:

- First Line: IT asset owners and business managers catalog critical systems, data, and associated risks.

- Second Line: Security risk function ensures enterprise-wide risk identification processes exist and are consistent.

- Protect & Detect:

- First Line: IT and security teams deploy and operate safeguards (firewalls, access controls, intrusion detection) and continuously monitor logs and network traffic.

- Second Line: Security governance sets policies (password requirements, encryption standards), conducts cyber risk assessments, and monitors control performance.

- Respond & Recover:

- First Line: Incident response teams and business continuity coordinators execute breach response or disruption recovery plans.

- Second Line: Develops response plans, coordinates regulatory notifications (e.g., breach reporting), and ensures alignment with risk appetite.

- Third Line: Audits post-incident to verify plan effectiveness and recommend improvements.

- Identify:

- CISO Positioning:

- The CISO role may sit in IT (First Line) or in Risk/Compliance (Second Line). Trade-offs include operational influence versus objective reporting. Regulators increasingly expect clear segregation: IT implements controls, a risk function (or CISO) oversees, and internal audit provides independent assurance.

- Zero Trust Security:

- Principles: No implicit trust—strict identity verification, network segmentation, continuous monitoring.

- 3LOD Mapping:

- First Line: IT teams implement identity management systems, micro-segmentation, multi-factor authentication, and other Zero Trust technologies.

- Second Line: Security governance enforces policies (e.g., least privilege, continuous authentication) and monitors compliance through dashboards or compliance checks.

- Third Line: Internal audit reviews Zero Trust controls, validates policy enforcement, and ensures no exceptions undermine security posture.

Regulatory Compliance (GDPR, Financial Regulations, ESG Reporting)

- GDPR & Privacy Compliance:

- First Line: Departments handling personal data (e.g., marketing, HR, IT) embed GDPR controls—obtaining consent, securing databases, enforcing retention policies. They own day-to-day data protection measures.

- Second Line: Data Protection Officer (DPO) and privacy team establish the privacy framework, develop policies, provide training, and conduct oversight (e.g., data protection impact assessments, periodic audits).

- Third Line: Internal audit evaluates the privacy program’s effectiveness, checking that both business units and the DPO fulfill their roles. Audit findings reinforce GDPR’s “accountability” principle and can help mitigate penalties by demonstrating a strong governance approach.

- Financial Services & SOX Compliance:

- Basel & Banking Regulations: Regulators often mandate 3LOD—first line (trading desks, loan officers) take risk; second line (risk management, compliance) sets limits and monitors exposures; third line (internal audit) reviews controls and reports to the Board.

- SOX (Sarbanes-Oxley):

- First Line: Management designs and operates internal controls over financial reporting.

- Second Line: Internal control or compliance functions coordinate control documentation, testing, and remediation.

- Third Line: Internal audit and/or external consultants independently test controls before external auditors render their opinion. Clear segregation ensures the same individual does not both prepare and test financial data.

- Fourth Line (External Assurance): External auditors and regulators provide an additional layer of oversight beyond 3LOD. Their existence underscores the need for robust internal lines.

- ESG Reporting & Sustainability:

- Regulatory Drivers: Recent rules (e.g., SEC climate disclosure, EU CSRD) require detailed, reliable ESG metrics, extending financial reporting controls to non-financial data.

- First Line: Business units (operations, facilities, HR) collect and manage ESG data (emissions, diversity metrics, supply chain impacts) and execute initiatives to meet sustainability targets. They own ESG risks and opportunities.

- Second Line: A dedicated ESG or Sustainability function (often part of risk management) establishes reporting frameworks, selects methodologies (e.g., carbon accounting), monitors progress, and ensures consistency across lines.

- Third Line: Internal audit extends its assurance to ESG, validating data accuracy, control effectiveness, and process integrity. In many cases, internal audit coordinates with external assurance providers for ESG disclosures.

Value Across Regulatory Domains:

- Demonstrating 3LOD in GDPR, SOX, Basel, and ESG shows regulators and stakeholders that:

- Expertise exists to manage specific regulatory requirements (second line functions).

- Authoritativeness is built through clear accountability and segregation of duties.

- Trustworthiness is reinforced by independent audit (third line) and transparent reporting.

Implementation Tip: Maintain an obligations register linking each regulatory requirement (e.g., GDPR articles, SOX controls, ESG metrics) to first-line owners and second-line overseers. This mapping ensures no compliance gaps and provides a documented audit trail for internal and external reviewers.

Modern Industry Practices and Technology Integration for the 3LOD

GRC Platforms and Automation

Modern Governance, Risk & Compliance (GRC) suites create a centralized repository of risks, controls, incidents, and audit findings, effectively institutionalizing 3LOD in one system. First-line managers record risks (for example, “Customer Data Breach”), assign control owners, and document remediation activities. Second-line teams configure policies, automate risk assessments, and monitor key metrics via workflow engines. Third-line auditors leverage the same repository to plan and execute audit procedures without rebuilding information, tracking findings back to specific controls and owners.

GRC platforms also enable issue tracking: if a control test fails, the system routes a notification to the second-line risk owner, who collaborates with the first-line manager to develop a remediation plan. Automated reminders ensure timely policy attestations and quarterly risk-assessment updates. Regulatory mapping functions allow second-line compliance to link each regulatory requirement (such as data privacy rules) to internal controls, facilitating immediate policy updates and evidence gathering for audits. Integration with IT systems, like HR directories or vulnerability scanners—feeds continuous control data into the GRC platform, so if an employee lacks mandatory compliance training or a server misses a security patch, the tool flags the exception to the relevant line.

Below is a simplified table showing how core GRC features serve each line:

| GRC Feature | First Line (Ownership & Execution) | Second Line (Oversight & Monitoring) | Third Line (Assurance & Audit) |

|---|---|---|---|

| Risk & Control Repository | Enter risk profiles, document controls, assign ownership | Configure policies, assign oversight roles, review control maturity | Access records to plan audits, validate control design and execution |

| Workflow Automation | Log incidents and control failures | Receive alerts, review issues, assign remediation tasks | Track audit findings linked to risk/control records |

| Regulatory Mapping | View updated compliance requirements, update control checklists | Maintain regulation-to-control linkage, push changes to first line | Verify mapping completeness, extract evidence of compliance for reporting |

| IT System Integration | Automatic monitoring of employee training and system vulnerabilities | Monitor dashboards for risk-limit breaches, aggregate KRI/KPI data | Use integrated data to perform continuous audits (e.g., test control samples) |

Data Analytics, AI/ML, and Continuous Monitoring

Data analytics and AI/ML transform risk management by enabling continuous monitoring and proactive controls. In the first line, operational teams deploy scripts or RPA tools to flag transactional anomalies, duplicate payments, unusual expense claims, or process breakdowns, in near real time. DevSecOps practices embed automated security scans into the software development lifecycle, alerting first-line engineers to code vulnerabilities before deployment. The data generated by these proactive controls feeds upward, allowing second-line risk managers to see aggregated incident trends immediately.

Second-line teams leverage continuous control monitoring (CCM) systems to automatically scan communications (emails, chat logs) for insider-risk indicators or data leakage patterns using natural language processing. Quantitative AI models can continuously re-evaluate credit exposures or operational risk levels as new inputs arrive, replacing periodic, sample-based reviews with ongoing oversight. These models predict emerging risks, such as spikes in customer complaints that often correlate with compliance breaches, allowing second-line functions to intervene before issues escalate. RegTech solutions, including blockchain-based smart contracts, automate compliance steps (e.g., verifying vendor due diligence before payment).

For the third line, continuous auditing uses data analytics tools monitor segregation-of-duties conflicts, test entire transaction populations for red flags, and identify outliers that traditional sampling might miss. Internal audit teams build dashboards (“audit control rooms”) showing real-time indicators, such as high-risk journal entries or exception reports, enabling auditors to shift from annual assessments to risk-focused, continuous assurance. For example, in anti-money laundering (AML) monitoring, compliance systems flag suspicious transactions (second line), while internal audit independently validates alerts by running its own analytics, ensuring the detection models function correctly and no critical patterns are overlooked.

Because AI/ML can introduce bias and false positives, the second line typically oversees model governance, validating algorithmic performance, maintaining transparency, and ensuring data privacy. The third line audits the governance around AI/ML tools, confirming that models are validated, outputs interpreted correctly, and controls exist to mitigate technology-related risks. Coordinating these analytics efforts across lines prevents duplication (e.g., second-line AI-driven alerts feeding directly into third-line audit planning) and breaks down data silos, ensuring a unified risk view.

Blockchain and Emerging Technology for Compliance

Blockchain and other emerging technologies, while still maturing in governance contexts, offer unique benefits for tamper-proof audit trails and automated control enforcement. By recording compliance events (e.g., approval of high-risk transactions, user access changes) on an immutable ledger, organizations create a parallel, verifiable record that third-line auditors and regulators can trust. For instance, logging all privileged access modifications on blockchain ensures that if an internal log is altered, auditors can compare against the ledger to detect tampering.

Smart contracts automate compliance rules: in procurement, a smart contract might require second-line compliance approval (digital signature) before releasing vendor payments, enforcing segregation of duties without manual intervention. Pilot projects in trade finance embed AML screening directly into blockchain-based transaction platforms, preventing payments from proceeding until sanction checks pass. As regulators experiment with shared ledgers (SupTech), companies may need to feed certain data, such as transaction logs or audit evidence, into a common blockchain, offering near-real-time external oversight.

Other emerging trends include Internet of Things (IoT) sensors feeding operational risk data (e.g., health and safety alerts) to first and second lines, drones for remote compliance inspections, and privacy-enhancing technologies (like differential privacy) that allow auditors to access sensitive data while preserving confidentiality. Each innovation must be governed: second-line functions validate and monitor new tools for ethical use, while third-line auditors assess the effectiveness and integrity of these controls.

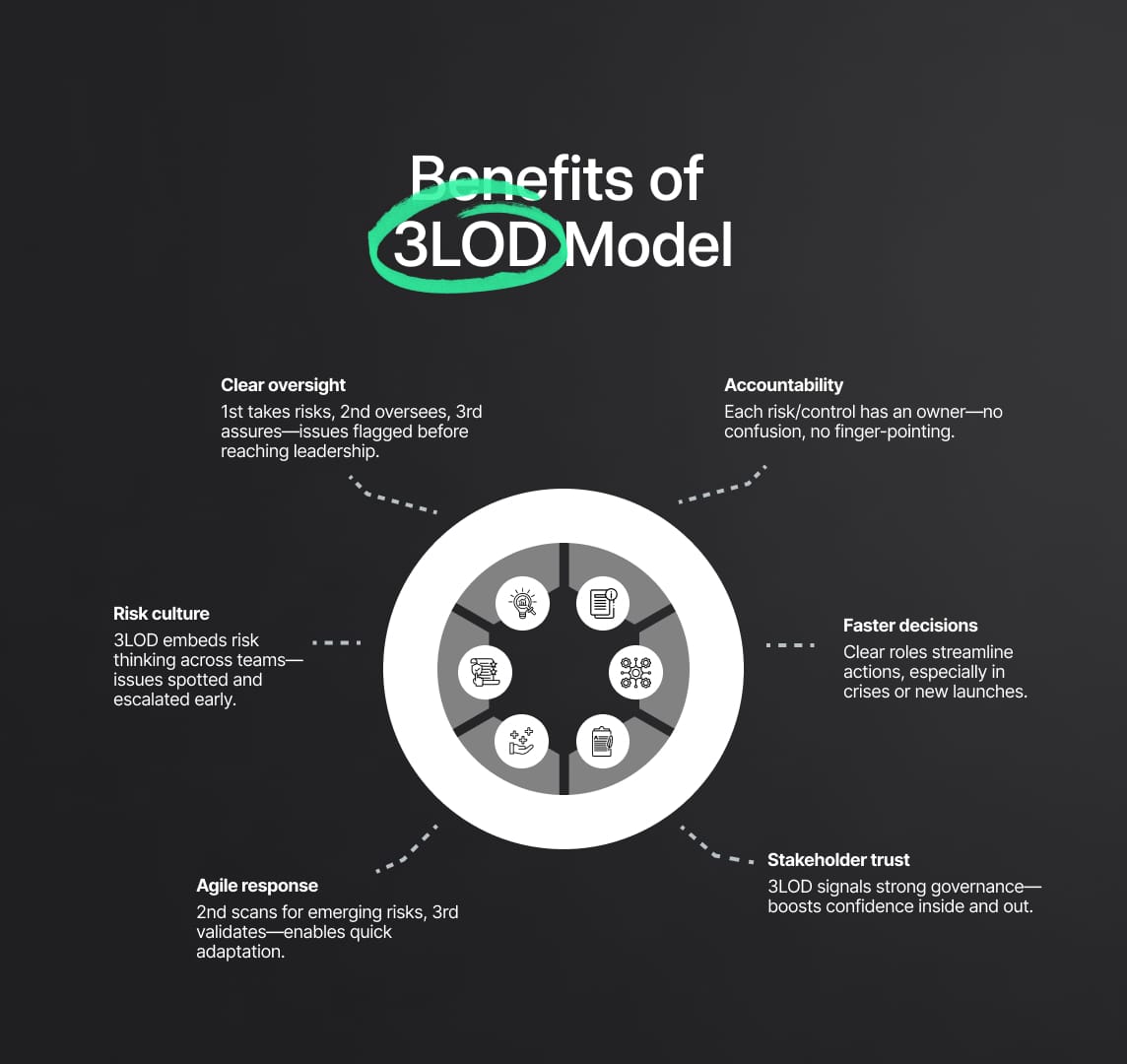

Benefits of a Robust Three Lines of Defense Model

A mature Three Lines of Defense (3LOD) or Three Lines Model (3LM) consistently yields significant governance and performance advantages. Below is a concise, yet detailed overview of key benefits, structured for SEO and readability.

Improved Risk Oversight and Governance

By separating risk-taking (First Line), risk oversight (Second Line), and independent assurance (Third Line), the organization creates clear checkpoints at each level. Executives can focus on strategic objectives, knowing that First-Line managers manage day-to-day risks, Second-Line functions monitor adherence to risk appetite, and Third-Line auditors alert the Board to serious concerns. This layered structure greatly reduces the chance that a major issue reaches senior leadership unvetted. In turn, Boards fulfill their fiduciary duties more effectively, and regulators gain confidence in the institution’s control environment.

Enhanced Accountability and Role Clarity

A core strength of 3LOD is eliminating ambiguity around “who owns what.” Every risk and control has a designated owner (First Line) and a corresponding oversight function (Second Line). This clarity prevents the common “someone else must be handling it” syndrome. When issues arise, it is straightforward to determine whether the First Line failed to execute, the Second Line failed to monitor, or the Third Line failed to audit. Over time, this accountability culture encourages employees to take ownership of risk management, rather than deferring responsibility to compliance teams.

Stronger Risk Culture and Compliance

Embedding 3LOD across the organization fosters a pervasive risk-aware culture. First-Line teams become proactive in integrating risk considerations into daily decisions, understanding that they are the first safeguard. Second-Line teams engage regularly with business units, reinforcing compliance and ethical behavior. As a result, small issues or ethical concerns are more likely to be identified and escalated early. Organizations that strengthen their Three Lines often see fewer compliance breaches or detect violations at an early stage, thanks to this cultural shift.

Increased Efficiency in Decision-Making

Although adding layers might seem bureaucratic, well-defined roles actually streamline decisions. When a risk issue arises, stakeholders know exactly who to consult: First-Line managers provide operational details, Second-Line experts offer context on regulatory or risk-appetite implications, and Third-Line auditors can verify controls if needed. Consider a new product launch: the product team (First Line) has already scoped out key risks, the compliance function (Second Line) has reviewed them, and senior management can decide quickly based on that groundwork. During crises, pre-established responsibilities (e.g., First Line leads incident response; Second Line coordinates communications; Third Line audits the post-mortem) enable a faster, more cohesive response.

Adaptability to Emerging Risks

A robust Three Lines structure ensures continuous monitoring (Second Line) and independent evaluation (Third Line), making it easier to spot and adapt to new threats. Second-Line teams scan the horizon for regulatory changes, technology risks, or shifting market conditions, and guide the First Line’s response. Third-Line auditors may prompt scenario analyses for risks not yet on management’s radar. When environments change suddenly, such as a rapid shift to remote work or a new regulatory regime, established risk-management chains enable a swift, coordinated response. Historical examples include organizations with strong 3LOD protocols navigating the COVID-19 disruption more effectively: First-Line units reported operational impacts immediately, Second Line coordinated mitigation, and Third Line validated crisis plans.

Trust and Confidence with Stakeholders

Externally, regulators, investors, and partners place greater trust in companies with a formal 3LOD model that demonstrably works. References to “Three Lines of Defense” in annual reports or investor decks signal governance maturity. Internally, employees gain confidence that raising concerns will be addressed by the correct channel, avoiding issues being ignored or mishandled. First-Line teams know they have backup from Second Line, and that Third-Line auditors will catch critical oversights, creating a sense of empowered accountability rather than working in a vacuum.

6. Common Challenges and Pitfalls (and How to Overcome Them)

| Common Challenge | Why It Happens | How to Overcome |

|---|---|---|

| Silo Mentality & Poor Collaboration | Teams view each other as “outsiders”; lack of shared data creates mistrust | Cross-train and co-locate risk staff in business units; host joint risk huddles; deploy a shared GRC dashboard for transparency; celebrate joint successes to reinforce partnership. |

| Role Ambiguity & Overlap | Unclear definitions of First, Second, Third Line roles; duplicated or missed responsibilities | Document charters, job descriptions, and process guidelines; develop a Three Lines policy listing ownership for each risk process; use RACI charts; provide regular model training. |

| Insufficient Resources or Expertise | Under-staffed lines; skill gaps in risk, compliance, or audit roles | Build a business case for additional hires; outsource or co-source specialized tasks; invest in training for First-Line risk awareness and Second/Third-Line technical skills; automate routine tasks to free capacity; conduct periodic coverage reviews. |

| Cultural Resistance | Employees perceive 3LOD as bureaucracy or mistrust; middle management fails to reinforce behavior | Secure executive sponsorship; embed risk KPIs into performance evaluations; communicate success stories showing how 3LOD enabled business outcomes; deliver engaging, scenario-based training; align incentives so that collaboration is rewarded. |

| Overly Rigid or Bureaucratic Implementation | Excessive sign-offs, separate committees, and redundant risk forums slow down decision-making | Apply proportionality—tailor process formality to risk size; integrate risk checks into existing workflows; solicit feedback from First-Line users to prune unnecessary steps; leverage automation (e.g., automated risk-assessment triggers) so controls feel built-in, not bolt-on. |

| Rapidly Evolving Risk Landscape | New domains (crypto, AI, supply chain shocks) outpace established roles; Second/Third Lines lack expertise | Treat 3LOD as a living framework; form cross-functional risk squads for emerging issues; update Second-Line charters to cover new risks; train or hire specialists; have Third Line audit early-stage processes and champion continuous improvement; perform regular environmental scans to detect and address gaps promptly. |

7. Implementing and Optimizing 3LOD in Your Organization

Translating the theoretical Three Lines of Defense (3LOD) model into a practical, sustainable framework requires a structured, phased approach. Whether you are establishing 3LOD from scratch or refining an existing system, the following steps and best practices will help ensure clarity, accountability, and continuous improvement.

7.1 Defining Roles, Policies, and Communication Channels

Three Lines Charter/Policy

Begin by drafting a formal charter or policy, approved by senior leadership or the board, that clearly outlines each line’s scope and responsibilities. For example:

- First Line (Operational Management): Business unit managers and process owners are responsible for identifying, assessing, and managing risks in their day-to-day activities. They must document how they execute controls and resolve issues when they arise.

- Second Line (Risk Oversight & Compliance): The Risk Management and Compliance functions develop risk frameworks, set risk appetite, monitor exposures, and provide guidance to the first line. They translate regulations into concrete controls and coordinate policy updates.

- Third Line (Internal Audit & Independent Assurance): The Internal Audit department provides independent validation of governance, risk management, and control effectiveness. They report directly to the Audit Committee or board to preserve objectivity.

Naming specific job titles or departments in the charter prevents confusion. When disputes or overlaps occur, the charter serves as an authoritative reference.

Risk and Control Taxonomy

Establish a shared vocabulary for core concepts, terms such as “risk owner,” “control owner,” “issue,” and “incident” should carry consistent definitions across the organization. Categorize risks (strategic, operational, financial, compliance, cybersecurity, etc.) and indicate which second-line function oversees each category (e.g., Compliance owns regulatory risk; IT Security owns cyber risk). A unified taxonomy helps ensure that first-line managers and second-line specialists speak the same “risk language” when logging events or configuring GRC tools.

Communication and Reporting Flows

Define how information moves between lines and up to leadership:

- Risk/Compliance Committee: A standing committee where second-line leaders present key risk indicators and first-line managers review their risk profiles. The third line may attend as an observer, receiving minutes to stay informed without influencing management decisions.

- Escalation Matrix: Document when, and how, risks escalate. For example:

- Low Risk: First Line resolves internally and informs Second Line post-resolution.

- Medium Risk: First Line notifies Second Line immediately; Second Line tracks mitigation.

- High or Material Risk: Second Line escalates to senior management or board within a defined timeframe (e.g., 24 hours).

- Audit Reporting: Internal Audit reports findings directly to the Audit Committee, with management’s remediation plans tracked by both First and Second Lines.

Well-defined communication flows prevent delays or “lost” issues. Create simple process maps that show which documents, dashboards, or meetings carry risk information from one line to the next.

Collaboration Protocols

Although independence is essential, especially between the second and third lines, establishing formal collaboration protocols avoids duplication and fosters efficiency. Examples include:

- Joint Planning: Second Line shares its compliance-monitoring calendar with Internal Audit so audit plans avoid redundant reviews.

- Shared Workpapers: Second Line’s control-testing evidence can be made available to Third Line auditors, reducing preparation time for audits.

- Crisis Response Roles: Predefine responsibilities in major incidents (e.g., fraud, cyber breach). First Line leads remediation; Second Line liaises with regulators; Third Line conducts a post-event review.

Document these collaboration protocols in an internal guide or wiki. Training sessions should walk staff through typical scenarios—such as when a compliance review should transition to an audit—so everyone understands the handoffs.

Visual Organization Chart Overlay

Consider creating a color-coded organizational chart that maps each department to its line—First Line (operations, business units), Second Line (risk, compliance, legal, security), Third Line (internal audit). Including reporting lines to the CEO and board in this chart provides a quick reference for new hires and cross-functional teams.

Phased Implementation Approach

Implementation typically unfolds over three phases, ensuring each step builds on the last:

- Assessment & Design

- Current-State Analysis: Inventory existing risk and compliance activities. Identify gaps—such as functions performing multiple line roles—and assess maturity.

- Stakeholder Engagement: Conduct interviews or workshops with business leaders, risk officers, and auditors to understand pain points and gain buy-in.

- Design Blueprint: Draft the 3LOD charter, taxonomy, communication flows, and collaboration protocols. Validate with Board and executive leadership.

- Pilot & Rollout

- Pilot in One Business Unit: Select a high-impact area (e.g., a single product line or region) to pilot the new 3LOD framework. Document lessons learned, particularly around role definitions, handoffs, and system integrations.

- Refine Based on Feedback: Adjust procedures, update the charter, and tune GRC platform configurations based on pilot insights.

- Enterprise-Wide Rollout: Launch the refined 3LOD model across all business units in waves, ensuring training materials and support (FAQs, helpdesk) are available at each site.

- Continuous Improvement & Governance

- Periodic Reviews: Schedule annual or biannual risk-governance effectiveness assessments. Metrics might include audit coverage percentages, average time to escalate a high-risk issue, or number of near-misses reported by First Line.

- Benchmarking: Compare your 3LOD maturity against industry standards or peer organizations to identify areas for enhancement.

- Update Governance Documents: Whenever new regulations emerge (e.g., an AI ethics framework) or organizational structures change, revisit and update the 3LOD charter, taxonomies, and communication flows.

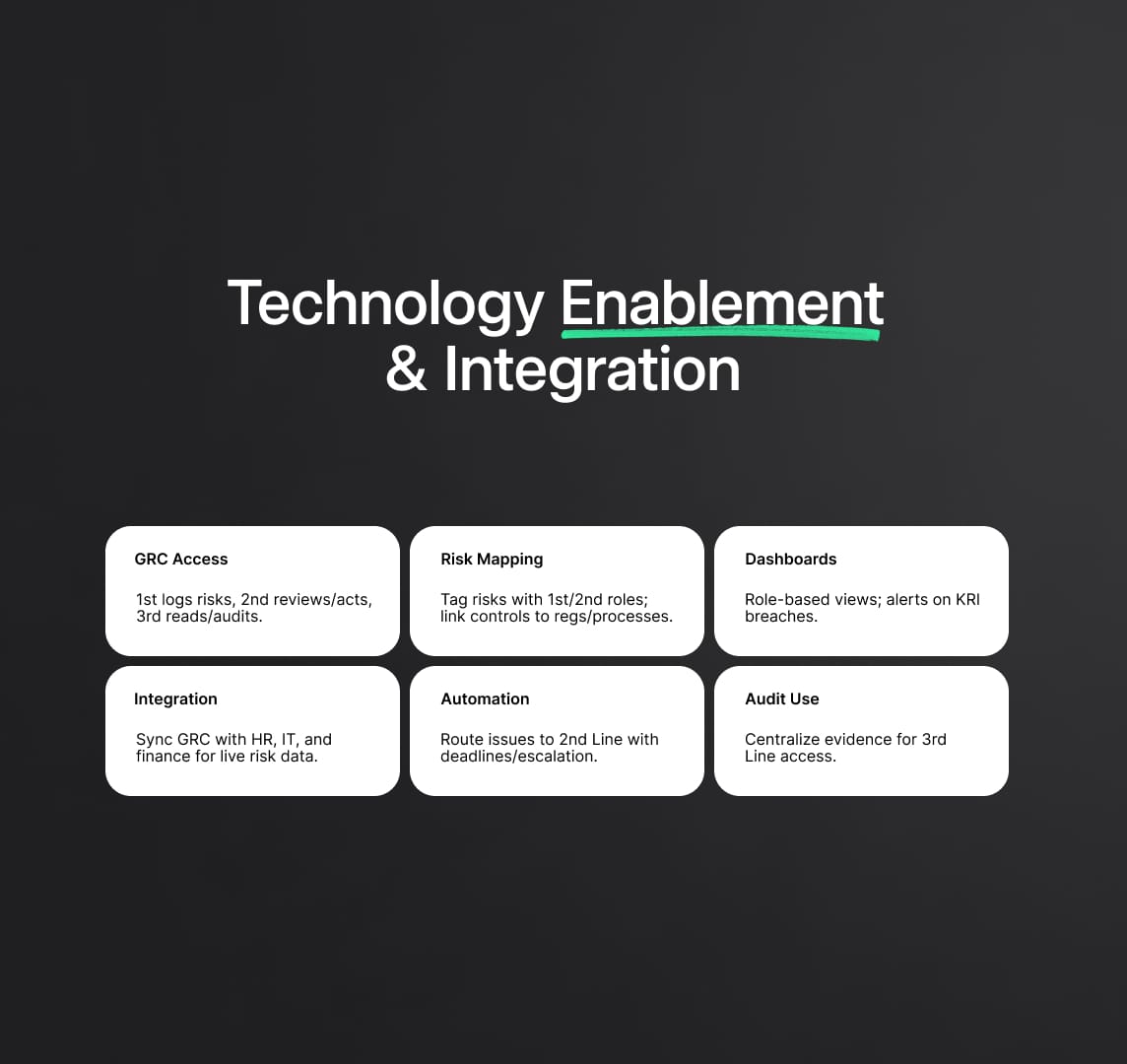

Technology Enablement & Integration

GRC Platform Configuration

- Role-Based Access Controls: Grant First-Line users permission to log risks, update control statuses, and escalate issues. Assign Second-Line managers rights to adjust policies, review risk reports, and trigger new risk assessments. Reserve Third-Line roles for read-only audit planning and report creation.

- Risk-Control Mapping: Ensure each risk entry is tagged with First-Line owners and Second-Line oversight roles. Link controls to relevant regulations and business processes in the system.

- Dashboards & Alerts: Set up tiered dashboards, First Line sees their own risk and control metrics; Second Line sees aggregated metrics across business units; Third Line sees high-level risk heat maps and audit pipelines. Automated alerts notify line managers when KRIs breach thresholds.

Data Integration & Automation

- System Interfaces: Integrate GRC with HR (for onboarding and training compliance), IT security (for vulnerability scanning results), and finance (for transaction monitoring). This feeds near-real-time data into risk dashboards, reducing manual updates and increasing timeliness.

- Automated Workflows: Build workflows that automatically route control failures or compliance gaps to designated Second-Line managers, requiring remediation plans with due dates. Escalate overdue tasks to senior management according to your escalation matrix.

- Reporting & Evidence Repository: Leverage the GRC platform as a central repository for control evidence, audit workpapers, and remediation updates. This enables Third Line auditors to extract evidence directly when planning and executing audits.

7.4 Training, Change Management, and Cultural Reinforcement

Executive Sponsorship & Messaging

- Top-Down Endorsement: Have the CEO and Board members publicly endorse the 3LOD initiative, through town halls, intranet articles, or videos, emphasizing how it protects value and supports growth.

- Consistent Messaging: Use consistent language in all communications: explain that 3LOD is about enabling better decision-making, not creating bureaucracy. Share real-life examples of how risk management has facilitated successful projects or prevented losses.

Role-Specific Training

- First-Line Workshops: Provide scenario-based training where managers learn to identify emerging risks, log them in the GRC system, and execute controls. Include hands-on exercises that simulate near-miss events requiring escalation.

- Second-Line Seminars: Focus on advanced risk-assessment methodologies, regulatory interpretation, and how to configure and monitor dashboards in the GRC platform. Teach collaboration skills to embed risk-oversight specialists within business units.

- Third-Line Certifications: Offer advanced audit training, covering data analytics for continuous auditing, sampling techniques, and how to evaluate AI/ML models or blockchain-based controls. Make sure auditors understand the nuances of both First and Second Line processes.

Ongoing Reinforcement

- Risk & Compliance Newsletters: Publish monthly or quarterly newsletters highlighting notable risk issues, control success stories, or lessons learned. Recognize teams that successfully prevented a major risk event or remediated a control failure promptly.

- Community of Practice: Create a cross-functional forum where risk, compliance, and audit professionals share best practices, new regulatory updates, and case studies. This fosters peer learning and continuous improvement.

- Performance Metrics: Tie a portion of individual performance metrics to 3LOD participation, such as timely risk assessment completion (First Line), policy update turnover (Second Line), or audit cycle coverage (Third Line).

The Three Lines of Defense (3LOD) model, renewed as the Three Lines Model (3LM), remains a cornerstone for robust governance, risk management, and compliance. By clearly delineating responsibilities, First Line for risk ownership and control execution, Second Line for oversight and guidance, and Third Line for independent assurance, organizations build a resilient structure that supports strategic objectives and fosters stakeholder trust.

Key Takeaways for Compliance Professionals:

- Strategic Asset, Not Cost Center: A well-implemented Three Lines Model drives value by embedding risk considerations into everyday decisions, rather than merely reacting to threats.

- Alignment with Global Standards: Integrating frameworks such as COSO ERM, ISO 31000, and NIST CSF ensures your 3LOD approach meets international benchmarks and satisfies regulatory expectations.

- Technology as an Enabler: Leveraging GRC platforms, automation, AI/ML, and even blockchain strengthens each line’s ability to detect, monitor, and remediate risks in real time.

- Continuous Adaptation: The risk landscape evolves rapidly, emerging domains like ESG governance, AI ethics, and digital transformation demand ongoing updates to charters, taxonomies, and training curricula.

Looking Ahead:

- Blurring Lines, Preserving Principles: As organizations embrace agile or cross-functional structures, first and second line roles may blend. However, the core principles of accountability, independent oversight, and transparent reporting will endure.

- Emerging Second-Line Functions: Areas such as ESG risk and AI ethics governance may spawn dedicated second-line functions. These will slot into the Three Lines Model, ensuring that new risk domains receive structured oversight.

- Regulatory Momentum: Global regulators increasingly reference the Three Lines construct in guidance, ranging from banking authorities to corporate governance codes—making it a universal language for risk roles. Demonstrating a mature 3LOD framework can differentiate your organization in the eyes of investors, partners, and regulators.

Reduce your

compliance risks