UCITS Market Net Inflows, AIFs Steady Growth in 2024

EFAMA reports strong July 2024 inflows for UCITS, led by bonds, while AIFs enhance diversification with alternative assets, highlighting their role in managing volatility and supporting growth.

The European Fund and Asset Management Association (EFAMA) released its statistical report for July 2024, revealing significant net inflows across all UCITS (Undertakings for Collective Investment in Transferable Securities) categories, with bond UCITS taking the lead. This performance highlights the continued investor confidence in both UCITS and AIFs (Alternative Investment Funds) as reliable investment vehicles in fluctuating and challenging market conditions. The report underscores how investors are increasingly prioritizing stability and liquidity while keeping an eye on potential growth opportunities, even amidst ongoing global economic uncertainties.

Source

[1]

UCITS & AIFs: Overall Market Performance

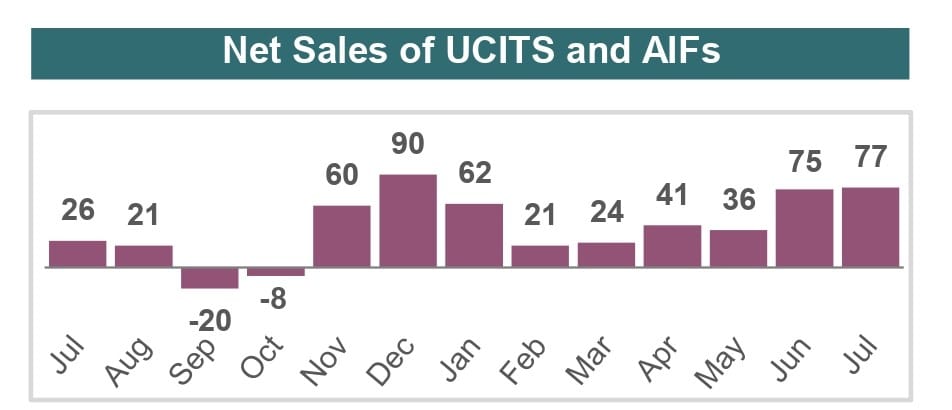

According to the report, UCITS and AIFs collectively attracted €77 billion in net inflows during July 2024, up from €75 billion in June. This growth highlights the ongoing strength of these fund vehicles despite the economic uncertainties that continue to affect global markets. Investors, particularly in Europe, are increasingly turning to UCITS and AIFs for their mix of stability, liquidity, and growth potential, which are essential qualities during times of heightened market volatility.

The fact that UCITS and AIFs continue to experience strong inflows signals that these vehicles are perceived as safe havens for both retail and institutional investors. UCITS, in particular, have long been favored due to their regulatory oversight, transparency, and ability to provide liquidity, making them an essential component in diversified portfolios. On the other hand, AIFs, with their exposure to alternative assets like private equity and infrastructure, offer additional diversification benefits and uncorrelated returns, which are especially attractive during periods of uncertainty.

Bond UCITS Dominate

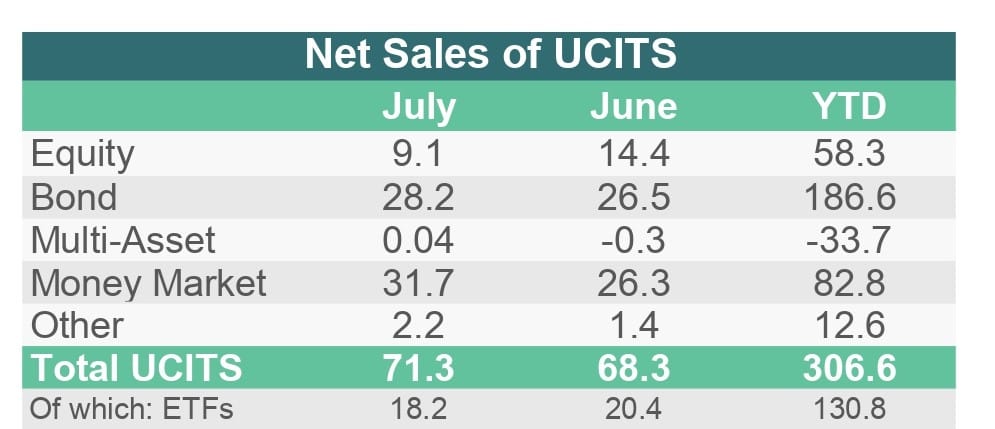

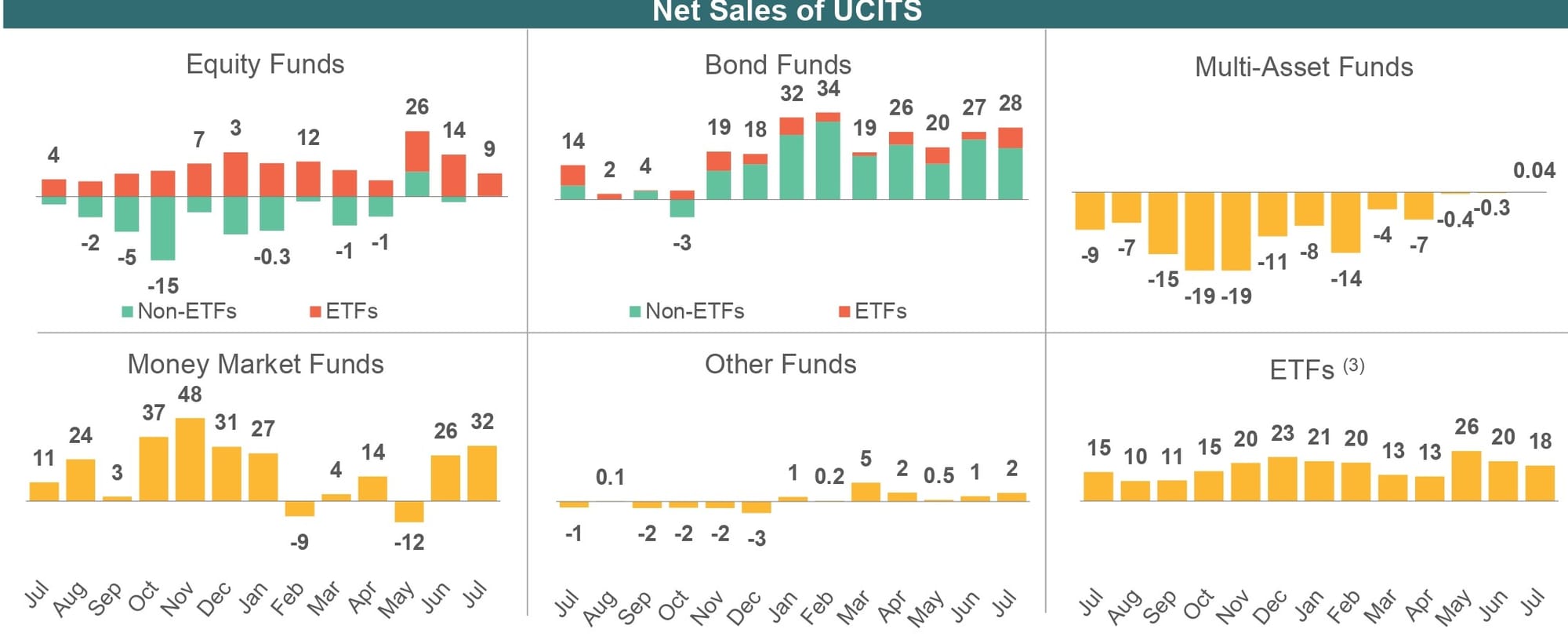

Among the different UCITS categories, bond funds continued to dominate the landscape, benefiting from expectations of future interest rate cuts by central banks. In July alone, bond UCITS registered €28 billion in net inflows, up from €27 billion in June. This makes bond UCITS the best-selling long-term fund category for the month.

Investor confidence in the fixed-income market reflects a broader sentiment that central banks, particularly in Europe and the U.S., might ease interest rates in the near future as a way to combat slowing economic growth and ongoing inflationary pressures. With inflation still at the forefront of investors' minds, bond UCITS are becoming an increasingly attractive option for those seeking income while maintaining relative safety. The potential for rate cuts makes bonds even more appealing, as declining interest rates often lead to higher bond prices and, consequently, increased returns for fixed-income investors.

The demand for bond UCITS highlights a significant shift towards more defensive investment strategies as investors look to minimize risk amidst global economic volatility. This trend has been supported by the cautious stance taken by central banks, which continue to focus on controlling inflation while maintaining growth. Bond funds offer a relatively safe haven during times of economic uncertainty, providing stable returns with lower risk compared to equities. This inflow into bond UCITS reflects the broader market sentiment that bonds are a safer option in the current climate.

Long-Term UCITS and Equity Funds

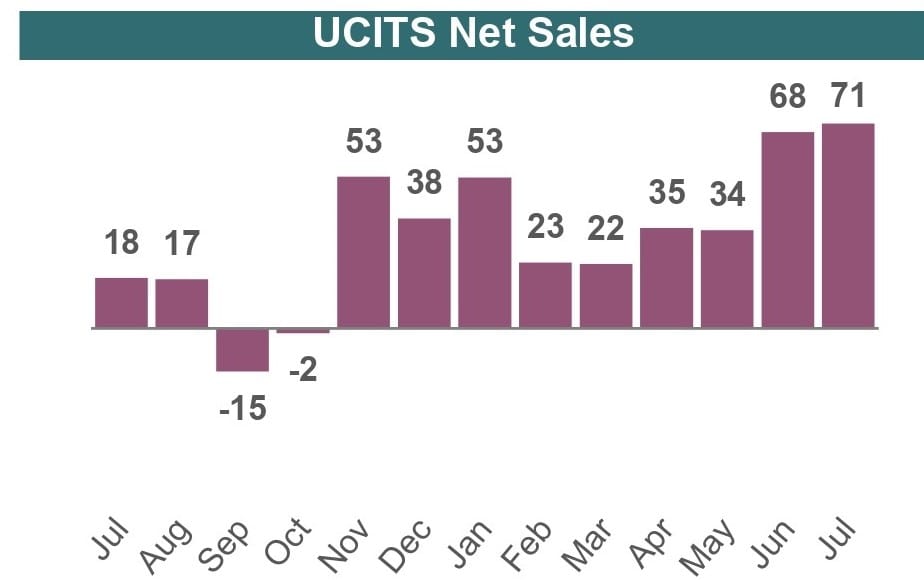

Long-term UCITS, excluding money market funds, recorded €40 billion in net inflows in July, down slightly from €42 billion in June. Despite this minor dip, the inflows into long-term UCITS remain strong, demonstrating that these vehicles continue to be a cornerstone of investor portfolios. Long-term UCITS offer investors access to a broad range of asset classes, including equities and bonds, while providing the stability that comes from professional management and diversified investment strategies.

For investors with a longer time horizon, these UCITS funds are attractive due to their potential for stable returns over extended periods. The continued demand for long-term UCITS reflects that investors are willing to commit capital to long-term growth strategies despite short-term market turbulence. In an environment where uncertainty is prevalent, long-term UCITS offer the benefit of diversification, with exposure to both growth and income-generating assets, which can provide a more balanced portfolio approach.

On the other hand, equity UCITS experienced reduced inflows in July, totaling €9 billion, down from €14 billion in June. This reduction likely reflects a more cautious sentiment among investors towards equities, driven by ongoing market volatility and concerns over the broader economic outlook. Investors have been more hesitant to increase their exposure to equities due to several factors, including concerns over inflation, potential recessions in major economies, and disruptions in global supply chains. These macroeconomic concerns have weighed heavily on equity markets, making investors more reluctant to take on additional risk.

Nonetheless, equities still hold a critical place in diversified UCITS portfolios, particularly for investors seeking long-term growth potential. While short-term volatility has dampened enthusiasm for equities, the €9 billion in net inflows indicates that investors have not entirely abandoned this asset class. The sectors most likely to attract continued attention include technology, healthcare, and renewable energy, which are expected to benefit from long-term secular growth trends.

Multi-Asset UCITS: A Cautious Return

Interestingly, multi-asset UCITS returned to positive territory in July for the first time since February 2023, with modest net inflows of €0.04 billion. This small but notable increase suggests that some investors are regaining confidence in diversified portfolios that balance risk across various asset classes. Multi-asset UCITS typically combine investments in equities, bonds, and occasionally alternative assets, offering a balanced approach to portfolio management.

The return to positive inflows in multi-asset UCITS indicates that investors are once again seeking a middle ground between risk and safety. These funds provide the potential for growth while mitigating the downside risks associated with a concentrated exposure to any single asset class. By diversifying across multiple types of investments, multi-asset UCITS offer a more balanced risk-return profile, which can be especially appealing during periods of heightened market uncertainty.

This renewed interest in multi-asset UCITS could signal that investors are looking for ways to navigate volatile markets while maintaining some exposure to growth opportunities. As economic conditions fluctuate, the demand for balanced strategies that can provide both security and potential upside is expected to grow.

Rising Demand for Money Market UCITS

Money market UCITS, known for their liquidity and lower risk, experienced a notable surge in demand during July, attracting €32 billion in net inflows—up from €26 billion in June. These funds offer investors a safe haven for capital during times of uncertainty, providing liquidity while minimizing risk. The significant increase in inflows into money market UCITS suggests that investors are increasingly looking for short-term investment vehicles that prioritize security and liquidity.

The rise in money market inflows is likely a direct response to heightened caution among investors. With central banks maintaining a cautious approach to interest rates and signaling that further rate increases may be on the horizon, many investors are choosing to park their capital in highly liquid, low-risk money market funds while waiting for more favorable investment conditions. This trend is indicative of the broader market sentiment that prioritizes capital preservation during periods of uncertainty.

In addition, money market UCITS have become more attractive as interest rates have risen, providing slightly higher yields while maintaining their status as low-risk investments. For risk-averse investors, the combination of liquidity, stability, and modest returns has made money market UCITS an increasingly popular choice. As the global economic environment remains uncertain, these funds are expected to continue playing a key role in helping investors manage their short-term liquidity needs.

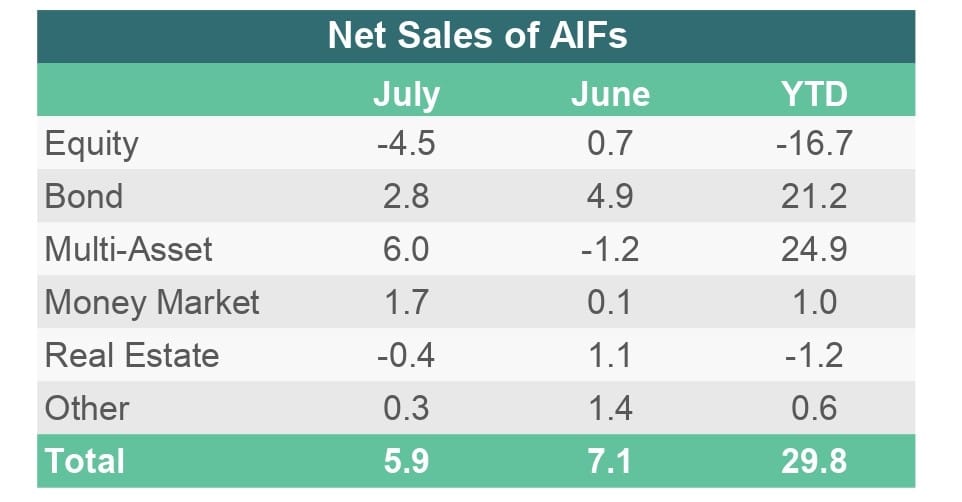

AIFs: Steady Growth

In the alternative investment fund (AIF) space, AIFs saw net inflows of €6 billion in July 2024, down slightly from €7 billion in June. Despite this marginal decline, AIFs remain a crucial component of the European investment landscape, offering unique opportunities for portfolio diversification and long-term growth. These steady inflows into AIFs demonstrate that institutional investors, including pension funds and insurance companies, are increasingly turning to alternative asset classes such as real estate, private equity, infrastructure, and hedge funds. These asset classes provide diversification beyond what UCITS (Undertakings for Collective Investment in Transferable Securities) typically cover, making AIFs essential for investors seeking broader exposure.

One of the primary attractions of AIFs lies in their ability to provide access to less liquid, higher-potential assets. Real estate investments, which serve as a hedge against inflation, and private equity, known for its long-term capital appreciation opportunities, are key components of many AIFs. Infrastructure investments are also appealing for their stable cash flows and long-term growth potential. Additionally, hedge funds within the AIF framework offer sophisticated strategies that manage risks and exploit market inefficiencies, making them ideal for investors looking for uncorrelated returns during periods of market volatility.

Furthermore, AIFs have become increasingly important in supporting institutional investors' long-term growth strategies. As traditional assets like equities and bonds face greater volatility and offer lower returns, investors are turning to AIFs to fill the gap. The steady demand for AIFs highlights a growing confidence in these alternative investment vehicles as a critical component of portfolio diversification, especially during uncertain economic conditions. As central banks worldwide adopt conservative monetary policies to combat inflation, AIFs offer alternative strategies that provide steady returns and risk mitigation.

Despite the slight decline in inflows from €7 billion in June to €6 billion in July, AIFs continue to play a vital role in maintaining diversified portfolios. The demand for alternative assets underscores the importance of strategies that generate returns while insulating portfolios from the risks associated with conventional market downturns. AIFs offer investors access to niche investments that are less affected by market fluctuations, providing stability during turbulent economic times.

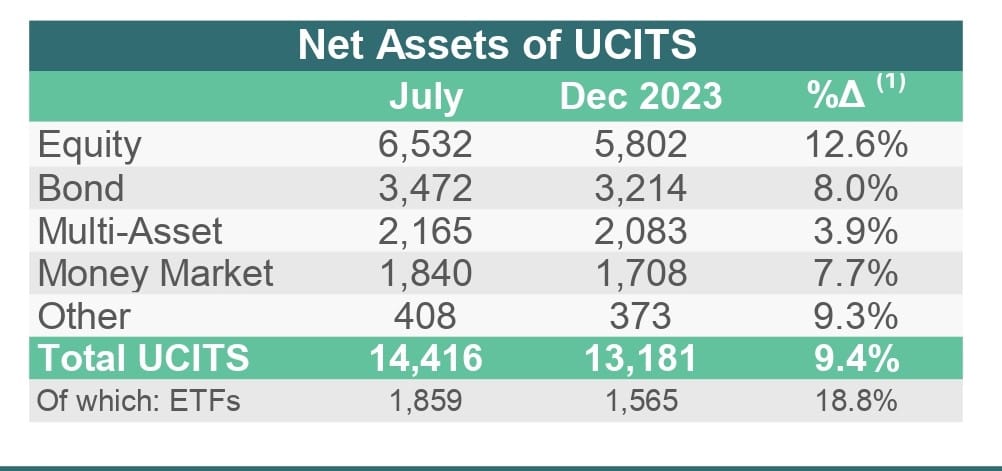

Total Net Assets of UCITS

The total net assets of UCITS and AIFs grew by 1% in July 2024, reaching €22.37 trillion. This steady rise in net assets highlights the resilience of the European fund industry, even in the face of ongoing macroeconomic challenges. The continued growth in total net assets demonstrates that both UCITS and AIFs remain highly appealing to investors. The ability of these vehicles to adapt to changing market conditions and retain investor trust has been key to their success.

The consistent growth in net assets across UCITS and AIFs reflects the versatility of these investment vehicles in navigating volatile economic environments. UCITS continue to attract strong inflows due to their regulatory oversight, transparency, and liquidity, making them an ideal choice for both retail and institutional investors. UCITS are particularly favored for providing exposure to a wide range of asset classes while maintaining a focus on security and growth potential.

Meanwhile, AIFs have become an increasingly important tool for institutional investors seeking alternative strategies that provide both diversification and the potential for higher returns. As traditional asset classes like equities and bonds face more challenges, AIFs are filling the gap by offering access to alternative investments that can generate stable returns in a low-interest-rate environment. Real estate, private equity, and infrastructure are particularly attractive to investors looking for inflation protection, steady income generation, and long-term capital appreciation.

The €22.37 trillion in net assets across UCITS and AIFs reflects not only the strength of these fund vehicles but also the growing confidence investors have in their ability to provide long-term value. The consistent inflows into both UCITS and AIFs underscore the importance of these funds as integral parts of European portfolios. The rise in total net assets demonstrates that these investment vehicles have become essential pillars of the European financial markets, providing the flexibility, security, and growth potential needed to navigate challenging market conditions.

Conclusion

July 2024 proved to be another strong month for the UCITS market, with inflows across all categories reflecting sustained investor confidence. Bond UCITS continued to dominate, driven by expectations of interest rate cuts, while money market UCITS attracted significant inflows as investors sought safe-haven assets during a turbulent economic environment. The steady demand for bond UCITS and money market UCITS highlights the broader market sentiment that prioritizes stability and security in the face of inflation and uncertain economic conditions.

Despite a slight dip in equity UCITS, the overall market performance remained robust, supported by strong interest in ETFs and long-term UCITS. These funds have maintained their appeal due to their ability to offer diversified exposure to both growth and income-generating assets. As equities faced greater volatility, investors increasingly turned to the security of bond UCITS and money market UCITS, signaling a more conservative approach to investing in the current market environment.

In the alternative investment fund space, AIFs experienced steady growth, even with a slight decline in net inflows from €7 billion in June to €6 billion in July. The continued inflows into AIFs underscore their critical role as part of a diversified investment strategy, particularly for institutional investors seeking long-term growth and protection from traditional market risks. AIFs remain essential for providing access to alternative asset classes such as real estate, private equity, and infrastructure, which are not typically covered by UCITS but offer substantial growth potential and income stability.

The resilience of AIFs in the European investment landscape is further evidenced by the growing demand for alternative strategies that offer uncorrelated returns and serve as hedges against market volatility. In this sense, AIFs have carved out a distinct role in European portfolios, providing investors with a valuable avenue for diversification, particularly in times of market uncertainty.

The EFAMA report for July 2024 showcases the resilience of both UCITS and AIFs in navigating a challenging global economic environment. As investors continue to face macroeconomic headwinds, these vehicles provide the flexibility, security, and growth potential needed to manage risk and seize opportunities in the market. The steady growth in total net assets, reaching €22.37 trillion, underscores the continued appeal of both UCITS and AIFs, cementing their status as key pillars of the European investment ecosystem.

As we move forward, UCITS will likely remain the foundation for many portfolios, offering liquidity, transparency, and regulatory safeguards, while AIFs will continue to play an increasingly important role in providing access to alternative investments. Together, UCITS and AIFs offer investors a balanced approach to managing risk and capturing long-term growth opportunities. Their complementary strengths make them essential tools for investors seeking to navigate an evolving financial landscape while maintaining diversified portfolios.

Reduce your

compliance risks