UK AML Compliance: High-Risk Countries & Regulatory Changes

2024 UK AML Regulations Guide provides comprehensive insights into Anti-Money Laundering compliance, focusing on High-Risk Countries and strategic AML/CTF practices. It emphasises proactive compliance strategies and robust adaptation to regulatory changes for financial institutions

Changes to Schedule 3ZA, which went into force on December 5, 2023, have recently altered the UK's anti-money laundering (AML) compliance laws. These modifications have resulted in the addition of Nigeria, South Africa, Vietnam, Bulgaria, Cameroon, and Croatia to the list of high-risk nations [1]. However, the Cayman Islands, Panama, Jordan, and Albania have been taken from the list [1]. Barbados is currently one of the nations classified as high-risk [1]. These modifications are essential to comprehending how AML compliance is changing in the UK.

Source

[1]

[2]

After the implementation of the Money Laundering and Terrorist Financing (High-Risk Countries) (Amendment) Regulations 2024, the financial landscape experiences a major upheaval in 2024. This historic law ushers in a new phase in the UK's fight against Counter-Terrorism Financing (CTF) and Anti-Money Laundering (AML), with a focus on high-risk jurisdictions. This move, which reflects a greater comprehension of the subtleties and complexity of contemporary money laundering and terrorist funding strategies, is more than just a regulatory update; it marks a strategic turning point in the UK's continuous fight against financial crimes.

Financial institutions in the UK, including those in England, Wales, Scotland, and Northern Ireland, can utilise this book as a vital resource. It carefully combines a thorough analysis of the UK's AML regulatory framework with the most recent regulatory revisions. By doing thus, it provides an all-encompassing viewpoint that is essential for companies functioning in the linked financial world of today. This guide is intended to offer useful insights and doable tactics, regardless of your experience level in the compliance industry. This will guarantee that your company is not only compliant but also in the forefront of the battle against financial crimes.

The content is thoughtfully organized to improve readability and engagement, which makes difficult-to-understand regulatory knowledge more approachable. The adjustments have been divided into digestible pieces, each of which focuses on important facets of the modifications and how they affect businesses. Our strategy is to provide financial institutions with clarity and insight so they can effectively and confidently handle these changes.

Furthermore, a variety of financial entities acknowledge the significance of these regulations according to this advice. The implications of these shifts are extensive, affecting everything from established banks to newly formed FinTech businesses, as well as investment firms and insurance companies. In order to ensure that all sectors can achieve and maintain compliance, we provide personalized advice that addresses the particular opportunities and challenges that these regulations bring for various types of financial institutions.

Overview of the 2024 UK AML Regulatory Framework

The Money Laundering and Terrorism Financing (High-Risk Countries) (Amendment) Regulations 2024, a significant change to the UK's anti-money laundering (AML) regulatory framework, are thoroughly examined in this section. Businesses and financial institutions seeking full compliance with AML requirements must comprehend these adjustments. We aim to clarify the subtleties of these modifications and their wider consequences.

Key Aspects of the 2024 Amendment:

- Redefining High-Risk Third Countries: We go into detail on how the 2024 amendment modifies the definition of high-risk third countries. Organizations engaged in international finance and those carrying out business with nations that might present greater risks of money laundering and terrorist funding need to pay close attention to this modification. We describe the new definition's criteria and how it complies with international AML regulations.

- Effects of Schedule 3ZA Removal from MLRs: A major change in the classification and handling of high-risk nations is represented by the removal of Schedule 3ZA from the Money Laundering Regulations. We examine the implications of this development for financial institutions and the ways in which it streamlines the evaluation and reduction of risks related to various countries.

Integrating with the Broader AML Regulatory Landscape:

- In relation to the 2017 Regulations on Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer): We offer a contextual explanation of how the 2017 Regulations' AML framework, which is currently in place, interacts with the 2024 amendment. This involves assessing the consistency and modifications brought forth by the amendment to make sure companies are using the most recent AML procedures.

- Analysis of Later revisions: In order to provide a comprehensive perspective, we also go over the later revisions to the 2017 Regulations, showing how they have changed over time and what effects they have on businesses. This research assists companies in comprehending the evolution of AML legislation in the United Kingdom and becoming ready for upcoming compliance mandates.

Importance for Businesses Aiming for Full Compliance:

- Thorough comprehension of AML obligations: To guarantee compliance, we stress how crucial it is for organizations to comprehend these rules completely. This entails understanding the spirit and goal of these amendments in addition to following the text of the legislation.

- Practical Implications for Business Operations: This section offers information on how these regulatory changes may affect regular business operations in a practical way. This include modifications to risk assessment protocols, compliance tactics, and due diligence methods.

- Preparing for Regulatory Shifts: We stress that companies must be proactive and knowledgeable about the constantly changing landscape of anti-money laundering laws. This entails keeping a close eye on regulatory revisions and modifying internal rules and processes as necessary.

FATF's High-Risk Countries List: Tailoring UK AML Strategies for Global Compliance

In this crucial segment, we offer a thorough analysis of the Financial Action Task Force's (FATF) roster of high-risk nations, an indispensable resource for companies engaged in global finance that aim to maximize their Anti-Money Laundering (AML) tactics. For worldwide financial safety and compliance, it is not only necessary to comply with regulations, but also strategically imperative to comprehend the subtleties of each country on this list.

Understanding FATF’s High-Risk Countries

The FATF updates its list of high-risk jurisdictions on a regular basis, including nations that are explicitly designated as high-risk or are subject to heightened scrutiny. This list is an essential tool for locating regions with serious AML shortcomings. We dissect the current ranking, including comprehensive analyses of the unique AML difficulties faced by each nation. Businesses must have this thorough awareness in order to minimize potential financial risks and maintain compliance with UK AML legislation.

Country-Specific AML Challenges and Compliance Requirements

Every nation on the FATF list faces different AML difficulties. Some may have worse legal systems, while others may have weaker financial regulatory agencies or be more corrupt. We explore these nation-specific issues in this part, providing a comprehensive understanding of the complexities involved. By using this method, firms may create customized risk management plans by learning about the unique AML and CTF risks connected to each country.

Tailoring AML Strategies for Each Jurisdiction

There isn't a single-size-fits-all approach to effective AML compliance. Different strategies are needed for different jurisdictions. This section focuses on how companies should modify their AML strategy to suitably handle the hazards connected to each high-risk nation. We offer advice on carrying out risk analyses, putting due diligence processes into place, and setting up monitoring systems that comply with the particular regulations of each country.

Enhancing Global Risk Management Processes

The significance of incorporating the knowledge gleaned from the FATF list analysis into international risk management procedures is emphasized in this section. By doing this, companies may improve their entire risk management plans and make sure they are protected against international financial dangers as well as UK AML rules. We go over how maintaining an advantage in the ever-changing world of international finance requires constant observation and frequent strategy reevaluation.

Adapting to High-Risk Country Identification UK AML Regulation

The 2024 amendment to the UK's anti-money laundering legislation, namely the removal of Schedule 3ZA, represents a major change in the way financial institutions have to identify countries that pose a risk to their operations. This significant modification necessitates a review and reinforcement of enhanced due diligence (EDD) procedures. In order to keep businesses at the forefront of AML compliance, this section is intended to assist them in navigating the intricacies of this transformation.

Understanding the Shift in High-Risk Country Identification

The elimination of Schedule 3ZA from the AML laws represents a shift in the methodology used to designate high-risk nations, making it more flexible and agile. The Financial Action Task Force's (FATF) regular updates and listings are increasingly more crucial for financial institutions to rely on. This shift necessitates a sophisticated comprehension of FATF's standards and procedures for designating nations as high-risk. To guarantee that their AML strategies are continuously in line with the most recent international regulations, businesses must include this understanding into their operations.

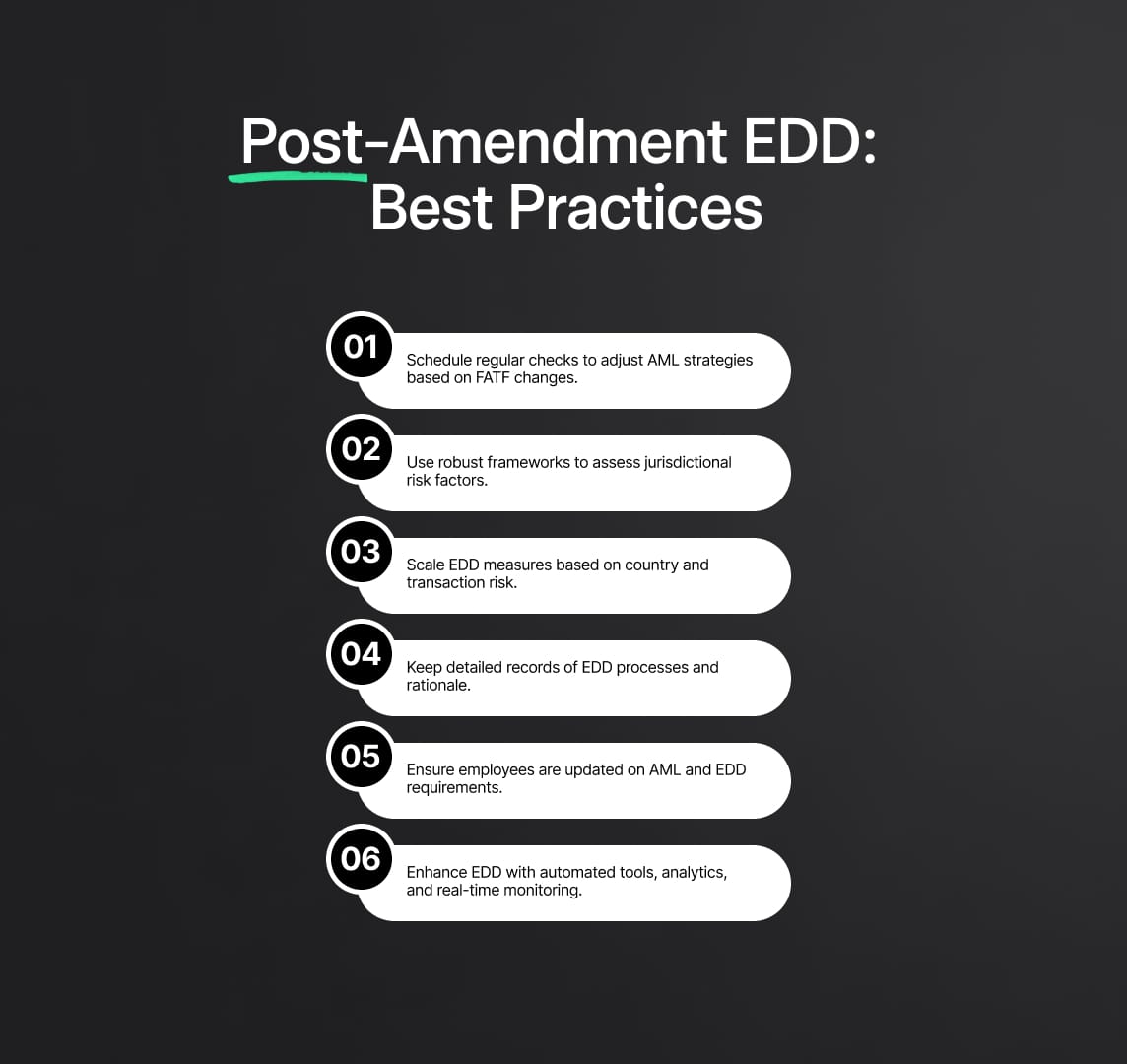

Best Practices for Enhanced Due Diligence Post-Amendment

Under the current regulatory framework, enhanced due diligence is even more important. The best practices for EDD are described in this part, with special attention to the difficulties that the 2024 amendment presents:

- Frequent Review of FATF Updates: It's more important than ever to stay up to date on the FATF's listings and recommendations. Companies should set up routine review procedures to keep an eye on and assess FATF changes, so they can promptly modify their anti-money laundering tactics.

- Risk Assessment and Categorization: To effectively evaluate and classify the risks associated with various jurisdictions, financial institutions need to establish a strong system. This entails examining the sociocultural, political, and economic elements that influence a nation's risk profile.

- Customized Due Diligence Processes: Companies have to modify their due diligence processes based on the degree of risk associated with a given transaction or nation. This could entail more thorough background investigations, improved transaction tracking, and a closer examination of commercial partnerships.

- Record-keeping and Documentation: Keeping thorough records of EDD procedures is essential to compliance. This entails recording the methods used for due diligence, the justification for risk classifications, and any conclusions that have an impact on business choices.

- Employee Education and Awareness: It is crucial to make sure that employees have received enough education and are aware of the new EDD regulations. It should be adopted to provide regular training sessions and provide updates on AML regulations and procedures.

- Leveraging Technology for EDD: The efficacy and efficiency of EDD procedures can be greatly increased by utilizing cutting-edge AML software and technology. This covers data analysis, automated risk assessments, and real-time monitoring systems.

Adapting Compliance Strategies for Proactive AML Efforts

Following the 2024 amendment, modifying compliance tactics is now more than simply a matter of reacting to new regulations; it's also a matter of remaining ahead of the curve when it comes to AML initiatives. Companies must take a proactive stance, foreseeing future difficulties and formulating plans to deal with them. This entails integrating new technology, maintaining an ongoing evaluation of AML policies, and encouraging an organizational compliance culture.

The 2024 revisions have broad ramifications that impact a variety of financial organizations, including modern FinTech firms, cryptocurrency exchanges, and conventional banking institutions. This section delves into the distinct effects on different financial industries and provides customized approaches for each to guarantee compliance with the latest AML regulations. This focused strategy aids companies in the financial sector in successfully navigating the challenges of AML compliance.

Evaluating Impact and the Importance of AML/CTF Regulations: A Strategic Perspective

The Money Laundering and Terrorism Financing (High-Risk Countries) (Amendment) Regulations 2024 represent a significant development in the financial regulatory framework of the United Kingdom. The Treasury expects these measures to have little direct effect on the business, but they will have a significant wider impact on the security and integrity of the financial system. This part explores the vital significance of these AML and CTF rules and promotes a proactive, watchful attitude to compliance. It emphasizes how important it is for financial institutions to comprehend the strategic importance of these rules in preserving the integrity of the global financial system in addition to following them for legal compliance.

Understanding the Broader Implications of AML/CTF Regulations

These rules are significantly more significant than just being required by law. They are an aggressive step toward protecting the banking industry from the ever-present threats of money laundering and terrorist funding, which are becoming more sophisticated and complex every day. The significance of comprehending and adjusting to these shifts for preserving the integrity and stability of the financial markets is emphasized in this section. It draws attention to how important AML/CTF laws are in stopping financial crimes, which can have serious repercussions for both domestic and global economic security and stability.

The Role of Financial Institutions in Safeguarding the Financial Industry

Financial institutions are essential to the fight against money laundering and the funding of terrorism. This section explores the best ways for firms to implement the new AML requirements, highlighting their critical role in defending the financial sector from new threats. It talks about how having a strong compliance plan is crucial for both complying with regulations and preserving stakeholders' and consumers' confidence.

Preparing for the Future of AML Compliance

The UK's continued commitment to maintaining strict AML requirements is demonstrated by the Money Laundering and Terrorism Financing (High-Risk Countries) (Amendment) Regulations 2024. This guidance is a vital tool for financial institutions trying to properly manage the intricacies of UK requirements as the financial landscape changes. By ensuring that companies are not only compliant but also prepared to handle future compliance issues, it plays a vital part in preserving the stability and integrity of the financial sector.

Reduce your

compliance risks