UK EMIR Reporting Requirements

UK EMIR Article 9 mandates precise, timely derivative trade reporting, enhancing market transparency. FCA & Bank of England reforms for 2024 ensure regulatory compliance and financial integrity.

Under UK EMIR Article 9, entities must provide complete, accurate, and timely information on their derivative trades [1]. Reporting entities are also accountable for correcting any mistakes or omissions in their reports, aiming to uphold transparency and accuracy in derivative trade reporting and preserve financial market integrity [2].

Source

[1]

The FCA and the Bank of England are collaborating on a major consultation to improve the reporting guidelines of UK EMIR Article 9. This endeavor, announced on March 1, 2024, aims to enhance transparency and regulatory standards in the UK's derivatives market.

Derived from the extensive joint policy statement PS23/2 released on February 24, 2023, the planned revisions will transform the reporting of derivatives transactions, with a goal of full implementation by September 30, 2024. This consultation is a crucial move towards establishing a stronger and more transparent supervision system for the derivatives market, demonstrating the dedication of the FCA and the Bank of England to safeguard market integrity and stability.

The UK's plan to improve EMIR reporting rules is expected to lead to major enhancements in the way derivatives transactions are reported and monitored, establishing a higher standard in market practices. The goal of the regulatory bodies in proposing these changes is to tackle current issues and fill gaps in the current system, keeping the UK at the forefront of financial market regulation. The urgent deadline for implementing these updates underscores the importance of adjusting the UK's regulatory framework to meet changing market demands and global standards.

During this public consultation, stakeholders are encouraged to share their thoughts and opinions, influencing the final result of suggested regulatory changes. This joint effort guarantees that the revised guidelines will be useful and successful, incorporating the knowledge and background of the UK's financial sector. With the deadline for implementation on September 30, 2024, there is growing excitement for a more secure and transparent derivatives market in the UK, supported by strong regulatory supervision.

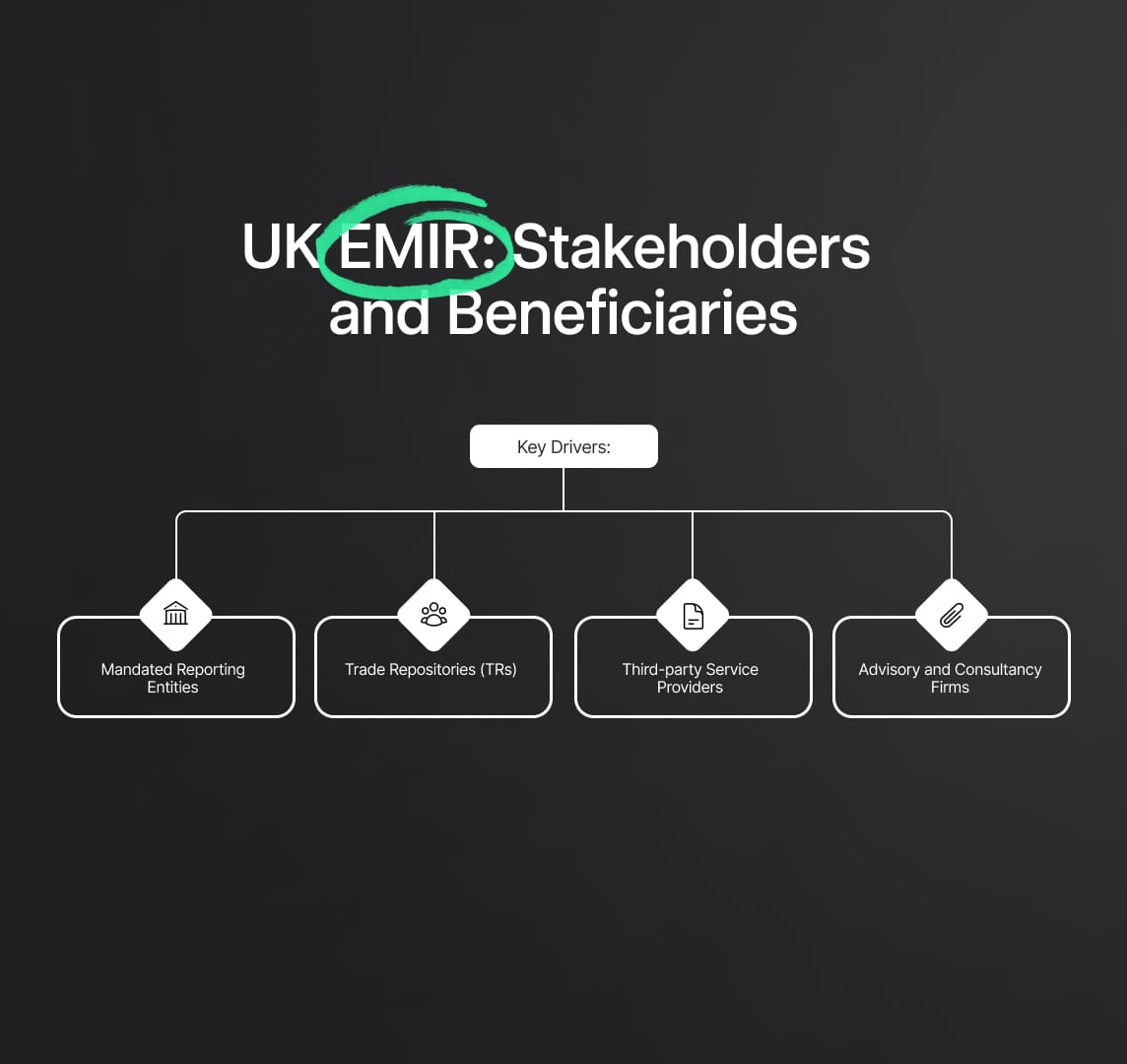

UK EMIR: Stakeholders and Beneficiaries

This initiative casts a wide net, intending to benefit an extensive array of participants within the UK's financial landscape. The carefully crafted draft Q&As, upon finalization, are set to serve as a vital resource for:

- Mandated Reporting Entities: Companies and enterprises that must comply with the UK EMIR reporting requirements.

- Trade Repositories (TRs): Organizations registered or acknowledged by UK EMIR are important in handling reportable transactions through their collection, storage, and dissemination functions.

- Third-party Service Providers: Experts provide custom UK EMIR reporting solutions, aiding entities unable to manage reporting internally to comply.

- Advisory and Consultancy Firms: In addition to trade associations and legal consultancies, these organizations offer necessary assistance and advice to help businesses understand and comply with UK EMIR regulations.

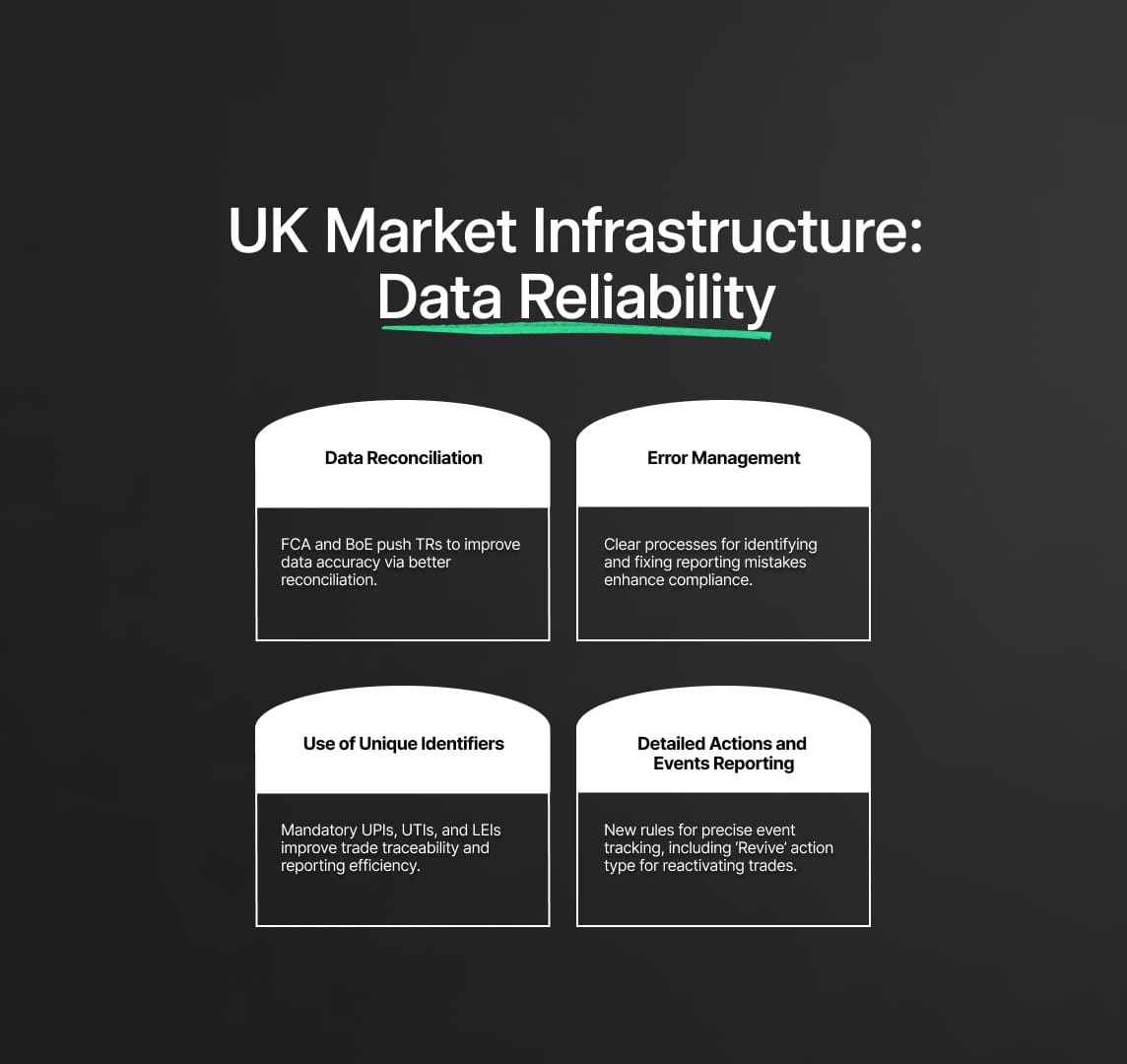

Strategic Enhancements in Data Reconciliation and Error Management

Implementing strong guidelines for data reconciliation between Trade Repositories (TRs) and improving the handling of reporting errors and omissions is a major step in boosting data integrity in the UK EMIR framework. These measures address the intricacies of derivatives data to guarantee that information reported by TRs accurately represents market activities, strengthening the stability and trustworthiness of financial markets.

UK Market Infrastructure Regulation: Data Accuracy and Consistency

- Data Reconciliation Procedures: The FCA and the Bank of England are advocating for advanced procedures for TRs to enhance uniformity and precision in derivatives data reporting. Through rigorous protocols, TRs can better verify the consistency of reported information, improving data quality on reporting platforms.

- Managing Errors and Omissions: By implementing a well-defined method, those participating in derivatives trading can easily spot and rectify reporting errors. This proactive system helps quickly resolve discrepancies, reducing the effects on data accuracy and adherence to regulations.

- Innovative Reporting Enhancements with Unique Identifiers: The regulatory changes require the use of Unique Product Identifiers (UPIs), update guidelines for Unique Transaction Identifiers (UTIs) and Legal Entity Identifiers (LEIs). These identifiers are crucial for improving traceability and identification of trades and entities, making reporting more efficient.

- Refined Reporting of Actions and Events: The enhancements also provide insight into precise reporting of actions and events, introducing the 'Revive' action type for reactivating derivative trades or positions. This inclusion improves the level of detail and specificity in reporting, resulting in a more thorough and detailed record of market activities.

Market Integrity Through Enhanced Reporting Standards

The updates to UK EMIR aim to improve derivatives reporting standards by focusing on data reconciliation, error management, and unique identifiers. The FCA and Bank of England are enhancing the infrastructure for the UK's derivatives market, ensuring compliance with regulations and promoting a transparent, efficient, and resilient financial marketplace.

The FCA and Bank of England are inviting industry participants to provide feedback on the initial draft of Q&As and Validation Rules for UK EMIR reporting standards by March 28, 2024. This collaborative effort aims to improve standards and align them with industry practices for a transparent, compliant, streamlined, and efficient reporting ecosystem.

A Vision for the Future: Building a Comprehensive Reporting Framework

The ongoing consultation marks the initial stage of a thorough plan to improve the UK EMIR reporting structure. This phase highlights the dedication of the FCA and the Bank of England to creating a robust and transparent derivatives reporting system that reflects the intricacies of modern financial markets.

Anticipating Continued Progress

In the future, continued dialogue and consultation in spring 2024 show a persistent commitment to improving the UK's market regulatory systems. This proactive approach reflects a long-term investment in financial market stability and regulation, aiming to create a regulatory environment that meets the evolving needs of the financial sector and reinforces the UK's status as a top financial hub with a well-regulated, transparent, and stable market.

UK EMIR in the Post-Brexit Financial Terrain

UK EMIR’s Strategic Evolution

The UK's adoption of the UK European Market Infrastructure Regulation (EMIR) post-Brexit showcases the nation's steadfastness in upholding a strong financial market. Through meticulous integration using statutory instruments and Binding Technical Standards, the UK ensures continuity in regulating derivatives, central counterparties, and trade repositories. This demonstrates the country's commitment to maintaining financial stability and market integrity amidst regulatory changes.

Comprehensive Insight into UK EMIR

The implementation of UK EMIR after Brexit has become a crucial part of the UK's derivatives regulation strategy, maintaining the core principles of EMIR while adapting to the specific needs of the UK market. UK EMIR aims to optimize financial regulation in the UK while also having an international reach, impacting non-UK entities engaging in derivatives trading. Stringent standards for CCPs and TRs are set to ensure operational excellence.

Navigating the Key Distinctions and Obligations of UK EMIR

In the changing UK financial regulation landscape, UK EMIR aligns with EU EMIR but includes modifications for the post-Brexit environment. It shifts supervisory oversight from ESMA to FCA, with FCA now in charge of overseeing entities under UK EMIR. Dual reporting obligations for firms in both EU and UK markets are a key change, requiring entities to carefully navigate regulatory complexities for compliance.

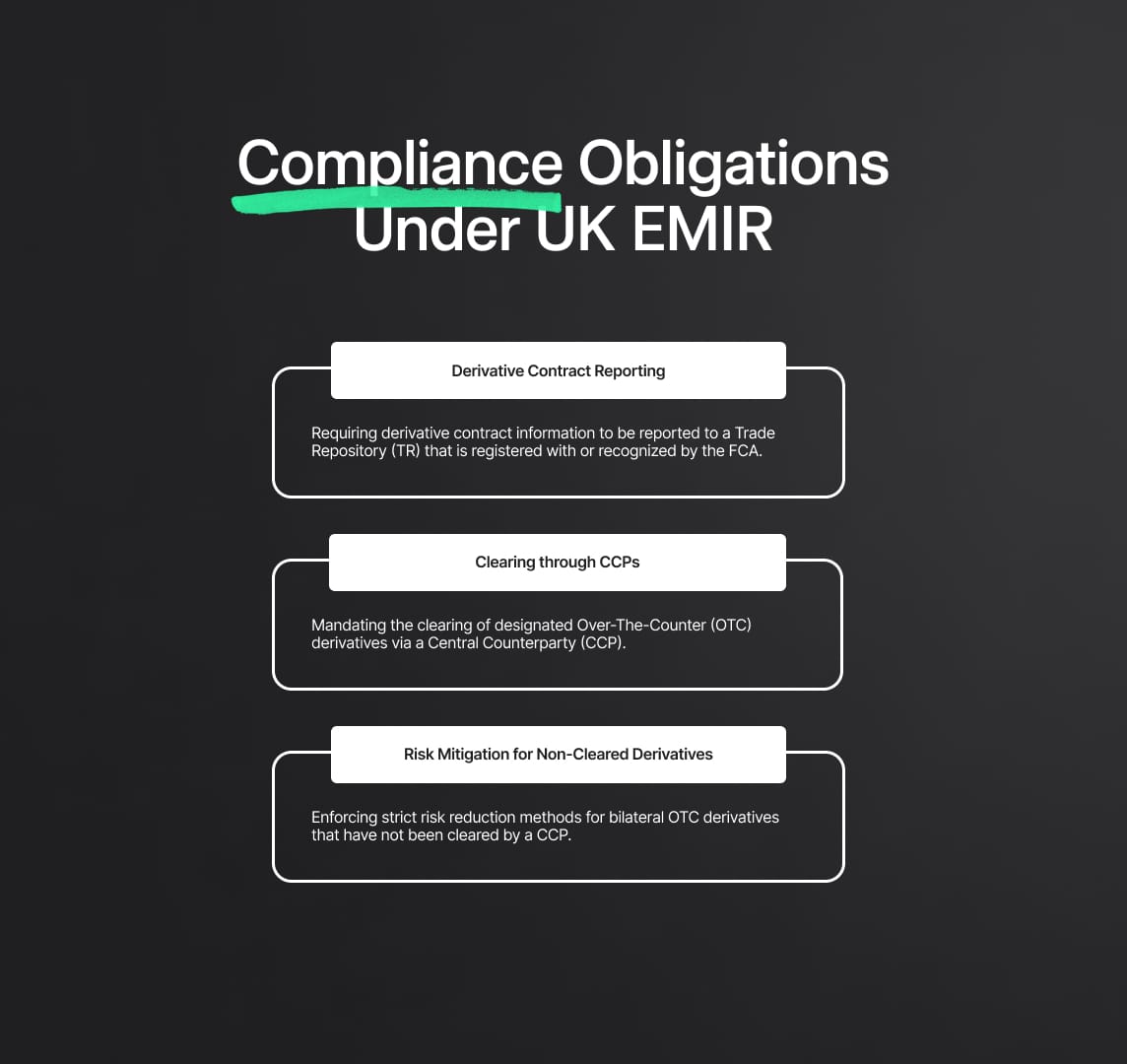

Compliance Obligations Under UK EMIR

Entities involved in derivative contracts must adhere to various important responsibilities according to UK EMIR, which highlights the regulation's emphasis on improving market transparency and decreasing systemic risks. These responsibilities encompass:

- Derivative Contract Reporting: Requiring derivative contract information to be reported to a Trade Repository (TR) that is registered with or recognized by the FCA.

- Clearing through CCPs: Mandating the clearing of designated Over-The-Counter (OTC) derivatives via a Central Counterparty (CCP).

- Risk Mitigation for Non-Cleared Derivatives: Enforcing strict risk reduction methods for bilateral OTC derivatives that have not been cleared by a CCP.

The Role of UK EMIR REFIT on Market Participants

The UK EMIR REFIT amendment is a significant advancement in simplifying the regulatory framework to support small financial and non-financial counterparties, with exemptions from clearing obligations for SFCs, reduced clearing obligations for NFCs, and a streamlined reporting regime for specific transactions, aiming to alleviate compliance burdens on smaller market participants and create a more inclusive financial market environment.

Anticipating Future Regulatory Developments

In the future, the UK Treasury plans to add more improvements to UK EMIR, focusing on creating fair, reasonable, non-discriminatory, and transparent (FRANDT) commercial terms for clearing services. Additionally, a strong emphasis on data reconciliation and validation policies by Trade Repositories demonstrates a commitment to enhancing the reliability of market data. Transitional provisions through the Temporary Transitional Power (TTP) have been vital in adapting to post-Brexit changes, set to remain in effect until December 31, 2024, for a smooth transition and ongoing adjustment to regulatory changes.

Reduce your

compliance risks