What are DORA's key pillars for digital resilience?

DORA, Europe's resilience framework, emerged in response to the digital revolution's challenges in finance. Tailored for entities from large banks to fintechs, its goal is a unified, agile, and resilient financial future. DORA simplifies complex regulations through European Supervisory Authorities.

Grand “Answer”:

DORA, or the Digital Operational Resilience Act, is founded on five key pillars to ensure digital resilience. These pillars are: 1) ICT Risk Management, which involves identifying, managing, and mitigating information and communication technology risks; 2) ICT-related Incident Management, which is the process of responding to and managing ICT-related incidents; 3) Digital Operational Resilience Testing, a process to test the robustness of an organization's digital operations; 4) ICT Third Party Risk Management, which includes managing risks associated with third-party ICT service providers; 5) Information Sharing Arrangements, which involve sharing information about threats and vulnerabilities to strengthen overall digital resilience[1][2]. These pillars form the comprehensive framework that DORA uses to enhance the operational resilience of the EU's financial sector[1][2].

Source

[1]

[2]

DORA: The Critical Importance Of Operational Resilience In The Digital Age

Understanding the Digital Evolution in Finance:The financial world is no stranger to evolution. However, the most profound change it has witnessed in recent years is the migration from traditional analog systems to an advanced digital framework. With the rise of the internet, smart devices, and seamless connectivity, an unprecedented level of convenience has been introduced in the financial sphere. This digital convenience is not just a modern-day luxury; it has become a necessity.

At the core of this evolution lies the customers' desire for swift and simplified access to their financial data. Traditional banking methods, with their long queues and time-consuming processes, are being replaced by digital platforms offering instant access, 24/7 availability, and streamlined operations. This shift is not without its challenges. As banking goes digital, institutions are faced with the mammoth task of ensuring their systems' resilience. The stakes are higher than ever; a minor glitch can lead to substantial financial losses and severely damage an institution's reputation.

Digital Transactions: Redefining Modern Economy:The phrase "time is money" has never been more accurate. In an era where everyone is in a race against time, the need for rapid and efficient transactions is paramount. Digital transactions, therefore, are not a mere by-product of technological advancements but are redefining the very essence of the modern economy.

With online transactions, consumers can make instant purchases, transfer funds across borders, and even invest in global markets, all with a few clicks. This new age convenience has led to a surge in digital transactions, pressing financial institutions to develop robust systems that can handle this surge seamlessly. Security is a major concern. As the volume of digital transactions rises, so does the potential risk of cyber threats, making it imperative for financial platforms to ensure top-tier encryption and security protocols.

The Cloud Computing Paradox in Finance:Cloud computing has been nothing short of a technological marvel for data storage and management. Its potential is well recognized in the finance sector, which deals with enormous data volumes daily. The cloud promises scalability, efficiency, and significant cost savings. However, it's not a magic bullet solution.

Transferring data to the cloud brings about concerns surrounding data breaches, compliance, and loss of control over critical financial information. While cloud service providers ensure high-security standards, the sheer volume of data and its sensitivity in finance makes the industry wary. It's a constant challenge to leverage the benefits of the cloud while also ensuring that the data remains uncompromised.

The Multifaceted Digital Threats:The digital age, while bringing about unmatched convenience and efficiency, has also ushered in a new era of threats. Cybercriminals today are armed with sophisticated tools and techniques aiming to breach even the most secure systems. The finance sector, with its treasure trove of sensitive data, is a prime target.

Phishing attacks, malware, ransomware, and even insider threats have become common challenges that financial institutions grapple with. Building secure systems isn't enough. Continuous monitoring, regular updates, and prompt threat response mechanisms have become essential to counter these ever-evolving threats.

DORA: Strategically Enhancing Operational Resilience

The Blueprint of Resilience:Operational resilience is more than a buzzword in today's digital financial landscape; it's the bedrock on which institutions must build their operations. It's not just about bouncing back from adversities but foreseeing potential challenges and preemptively crafting strategies to mitigate them.

Operational resilience demands a multi-faceted approach. It requires integrating cutting-edge technology, onboarding skilled personnel, devising agile processes, and fostering a culture that places resilience at its core. The goal is to ensure that the institution can not only weather storms but also adapt and grow in their aftermath.

Prioritizing Cybersecurity:In the digital realm, cybersecurity is not just a technical requirement; it's a fundamental business need. Every financial transaction, every piece of data stored, and every customer interaction must be protected by state-of-the-art security measures.

The focus should not be limited to building secure systems. Regular audits, vulnerability assessments, and real-time threat monitoring must be integral components of an institution's cybersecurity strategy. Moreover, fostering a security-centric organizational culture where every employee understands and prioritizes cybersecurity is crucial.

Proactive System Maintenance:With technology advancing at breakneck speeds, what's cutting-edge today might become obsolete tomorrow. Financial institutions can't afford to be complacent. Regular system updates, software patches, and hardware upgrades are essential to ensure the infrastructure is in sync with the latest technological standards.

Moreover, proactive system maintenance isn't just about leveraging new features. It's also about safeguarding against known vulnerabilities. Ensuring that all systems are up-to-date is one of the most effective ways to protect against cyber threats.

Empowering the Human Firewall:Technology, while indispensable, is only as effective as the people who wield it. Human errors, often unintentional, can lead to significant security breaches. It's essential to understand that every employee, from the top executive to the newest recruit, plays a crucial role in an institution's cybersecurity framework.

Investing in regular training sessions, cybersecurity workshops, and awareness campaigns is not just beneficial; it's essential. The aim should be to cultivate a workforce that's not only efficient at its job but also vigilant against potential cyber threats.

Diving Deep Into DORA: Europe's Resilience Framework

The history of financial systems in Europe is as rich and varied as its tapestry of cultures. As the continent grappled with the digital revolution, there was an emerging realization: the financial systems, whilst sturdy, lacked a comprehensive digital resilience structure. DORA was born out of this exact necessity.

The EU's long-standing position as a global financial fulcrum rendered it especially vulnerable to cyber threats. Individual banks, insurances, stock exchanges, and budding fintech startups were each trying to navigate these challenges, often in silos. Inconsistencies in resilience protocols became evident. To harmonize these efforts and ensure collective resilience, the EU leaders recognized the need for a uniform framework. DORA was not just about reacting to existing challenges but also preparing for unforeseen ones. Its creation was an acknowledgment that, in an interconnected digital economy, resilience couldn't be an afterthought; it needed to be the foundational bedrock.

The age of digitization, while replete with innovations, presented its own set of tribulations. Sophisticated cyber-attacks became the norm, targeting not just single entities but often entire networks. The financial costs of these breaches were colossal, but even more daunting was the potential erosion of public trust in financial institutions.

DORA emerged as Europe's answer to this evolving threat landscape. But beyond just being a protective shield, it was also a statement of intent. The EU was signaling its commitment to not just safeguard its own financial systems, but also to provide a blueprint for others. The aim? To create a gold standard of resilience, blending preventive measures with responsive strategies, ensuring that financial institutions could not only weather digital storms but emerge stronger from them.

DORA's Broad Yet Tailored Ambit

Regulation often treads a fine line between standardization and flexibility. DORA's genius lies in its ability to straddle this line effectively. While its principles are universal, applicable to every financial entity within the EU, its implementation is far from monolithic.

DORA appreciates the vast heterogeneity of the European financial ecosystem. A multinational bank's operational dynamics differ vastly from a niche fintech startup. Recognizing this, DORA's provisions are adaptable. It offers a structured yet flexible framework, allowing entities to incorporate resilience measures that align with their scale, operational nuances, and client demographics. This tailored approach ensures that entities remain agile, innovative, and yet, resilient.

European financial standards have often been bellwethers for global trends, and DORA is no exception. Its holistic approach to digital resilience caught the attention of financial regulators worldwide. Countries from Asia to the Americas began dissecting DORA's tenets, seeing how they could be contextualized to their unique landscapes.

DORA's global resonance underscores its robustness. It demonstrates that while the act is firmly rooted in European realities, its principles are universally applicable. It has inadvertently become a lodestar, guiding global efforts towards creating a unified, resilient financial future.

DORA's Essence: Simplified Regulations

In a realm often criticized for its labyrinthine regulations, DORA stands out for its clarity. Its unified framework streamlines multiple guidelines, directives, and advisories, providing a coherent path for institutions to follow.

This simplification doesn't just reduce administrative burdens but also ensures that institutions can pivot their focus from mere regulatory compliance to genuine operational resilience. It provides clear directives, reducing gray areas that can often lead to inadvertent non-compliance. By distilling the essence of digital resilience into a structured format, DORA ensures that compliance is both achievable and beneficial.

A framework, regardless of its merits, is futile without effective enforcement. DORA's architects were cognizant of this. To ensure unwavering adherence, a robust supervisory mechanism was integrated into DORA's fabric.

The European Supervisory Authorities (ESAs) serve as DORA's guardians. Their mandate isn't just punitive; it's also educative. They oversee implementation, ensuring uniformity and consistency, but also assist institutions in understanding and integrating DORA's directives. Penalties for non-compliance, while stringent, are also calibrated to ensure they drive adherence rather than deter innovation.

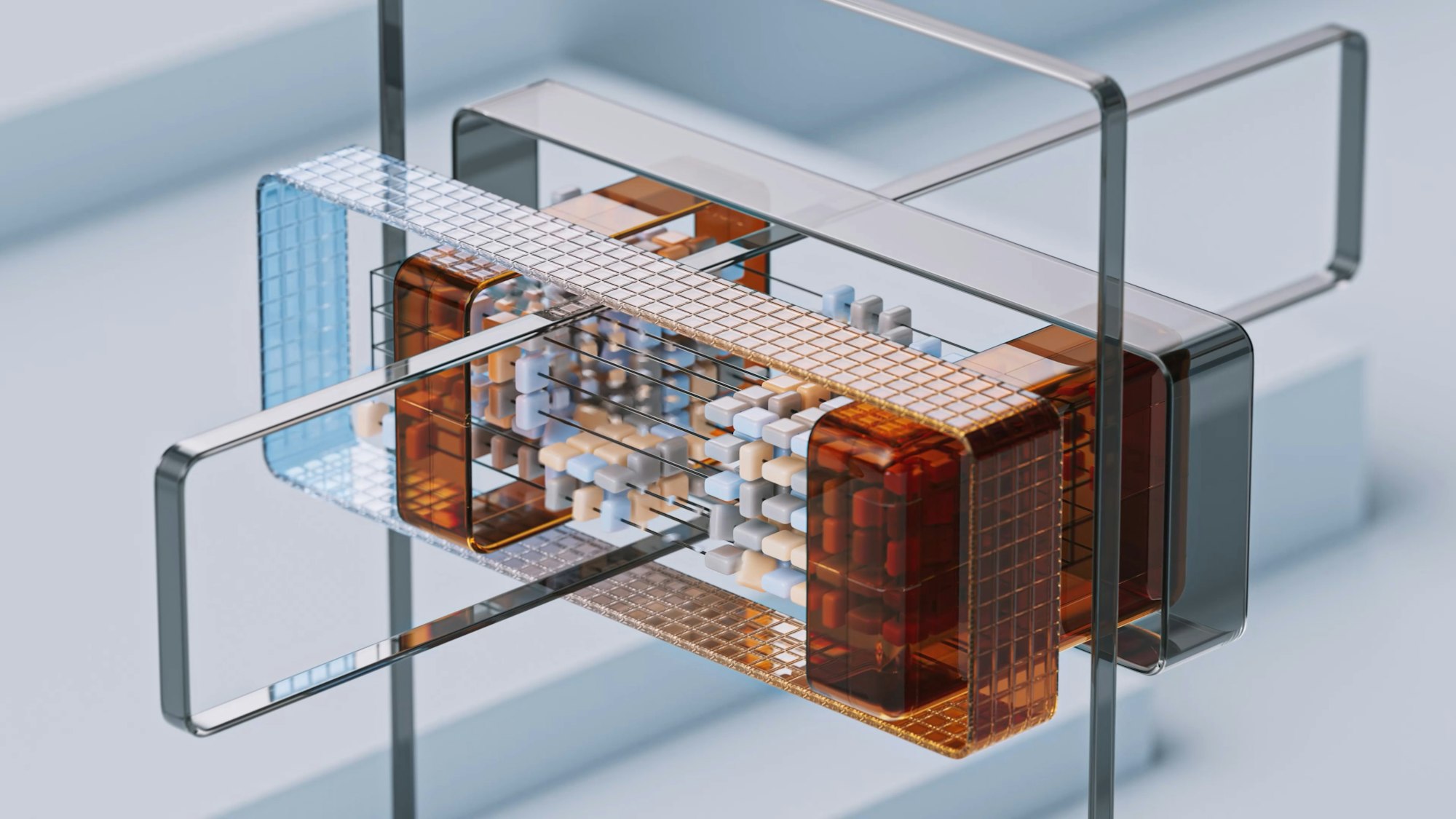

Delving into DORA's Five Pillars

The robustness of DORA is underpinned by its five foundational pillars. These are not mere guidelines but strategic imperatives:

- Governance and Culture: Beyond protocols and systems, resilience is a mindset. DORA emphasizes the role of institutional leadership in inculcating this mindset. By ensuring regular training, simulations, and evaluations, institutions are not just prepared for disruptions but are also adept at foreseeing potential challenges.

- Operational Resilience Testing: Proactivity is DORA's cornerstone. Through rigorous testing and simulations, institutions can pre-empt potential disruptions, ensuring that their operational cadence remains uninterrupted even in the face of unforeseen challenges.

- ICT and Security Risk Management: Digital operations, while efficient, are fraught with ICT risks. DORA provides a structured approach to identify, manage, and mitigate these risks, ensuring that digital operations remain both fluid and fortified.

- Digital Operational Resilience Testing (DORT): Digital assets, from databases to transaction gateways, are constantly under threat. DORT ensures these assets are perpetually battle-ready, equipped to deflect cyber threats, and ensure seamless operations.

- ICT Third-Party Risk Management: Today's financial operations are intertwined with third-party vendors, each introducing potential vulnerabilities. DORA's directives ensure that these relationships, while collaborative, don't compromise on security. Through rigorous vetting and continuous monitoring, institutions can ensure that their operational integrity remains sacrosanct.

By delving deep into each facet of DORA, it's evident that it's not just a regulatory imposition but a visionary blueprint, sculpting the future of a resilient European financial ecosystem.

Grand Answer: Your AI Partner

Designed to support compliance officers, legal counsels, and other professionals responsible for adhering to regulatory standards, Grand Answer aims to facilitate an efficient and straightforward compliance process.

Reduce your

compliance risks