What are the Capital Requirements Regulation Amendments?

EU's CRR amendments strengthen banking sector resilience and financial stability. Updates to CRD and CRR introduce stricter capital and liquidity requirements, enhanced risk management, and measures to reduce bank failures. Expected full implementation by 2023 for more robust EU financial system.

Grand “Answer”:

The Capital Requirements Regulation (CRR) amendments in the EU are aimed at strengthening the banking sector's resilience and ensuring financial stability. These amendments primarily involve changes to the Capital Requirements Directive (CRD) and the adoption of the Capital Requirements Regulation (CRR) itself [1][2]. The updated regulations include new capital and liquidity requirements, improving risk management, and introducing measures to reduce the risk of bank failures [1]. These changes are expected to be fully implemented by 2023, further enhancing the resilience of banks within the European Union. [3] Overall, the CRR amendments contribute to a more robust and stable financial system in the EU [1].

Source

[1]

[2]

Consolidated Compliance: Capital Requirements Regulation (CRR III)

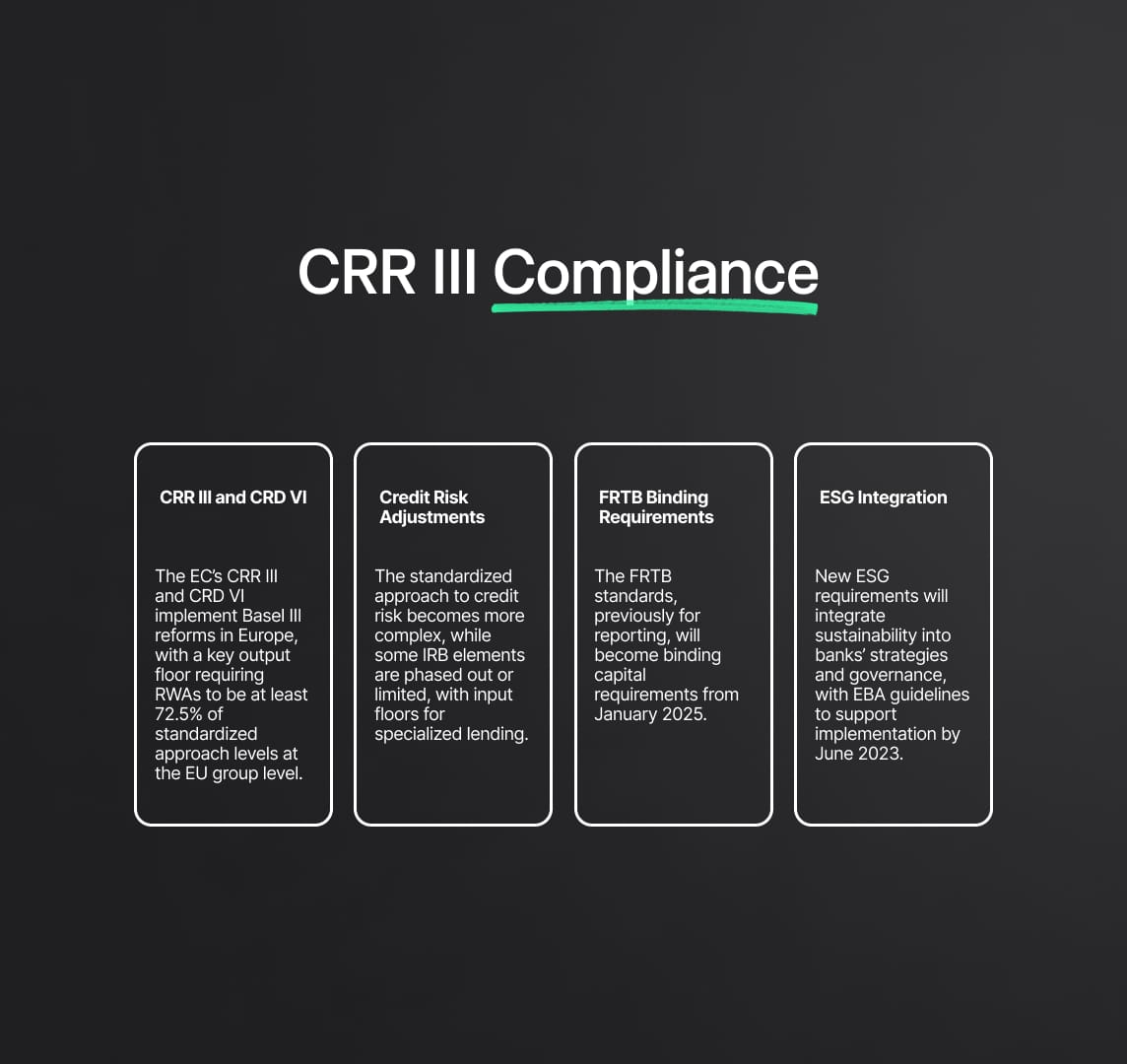

The European Commission (EC) has unveiled the Capital Requirements Regulation III (CRR III) and Capital Requirements Directive VI (CRD VI), which introduce significant Basel III reforms to the European banking sector. A key component of these reforms is the introduction of an output floor that requires risk-weighted assets (RWAs) to be at least 72.5% of the level calculated under the non-modeled standardized approach. Notably, the output floor is enforced primarily at the consolidated EU level, affecting group entities within the EU and their parent companies.

Under these new regulations, credit risk rules have become more risk-sensitive. The standardized approach to credit risk has seen an increase in complexity with additional tiers, categories, and requirements. Diverging from the Basel recommendations, the EC has proposed changes to benefit unrated corporates with a probability of default (PD) less than 0.5% and high-quality unrated object finance exposures.

Moreover, alterations to the internal ratings-based (IRB) approach to credit risk include the removal of the advanced-IRB (A-IRB) approach option for certain exposures and a phased introduction of an input floor for specialized lending and leasing exposures. Significantly, the Fundamental Review of the Trading Book (FRTB) standards, initially included in CRR II for reporting purposes, are proposed to become binding capital requirements from January 2025.

In addition to these reforms, the EC has introduced stringent Environmental, Social, and Governance (ESG) requirements. These require banks to incorporate ESG considerations into their strategies, internal capital needs evaluations, and governance structures. To facilitate this, the European Banking Authority (EBA) is tasked to publish guidelines by June 2023, covering areas such as the identification, management, monitoring of ESG risks, and criteria for stress testing scenarios and methodologies.

Regulatory Compliance, CRR III and the Evolution of European Banking Landscape

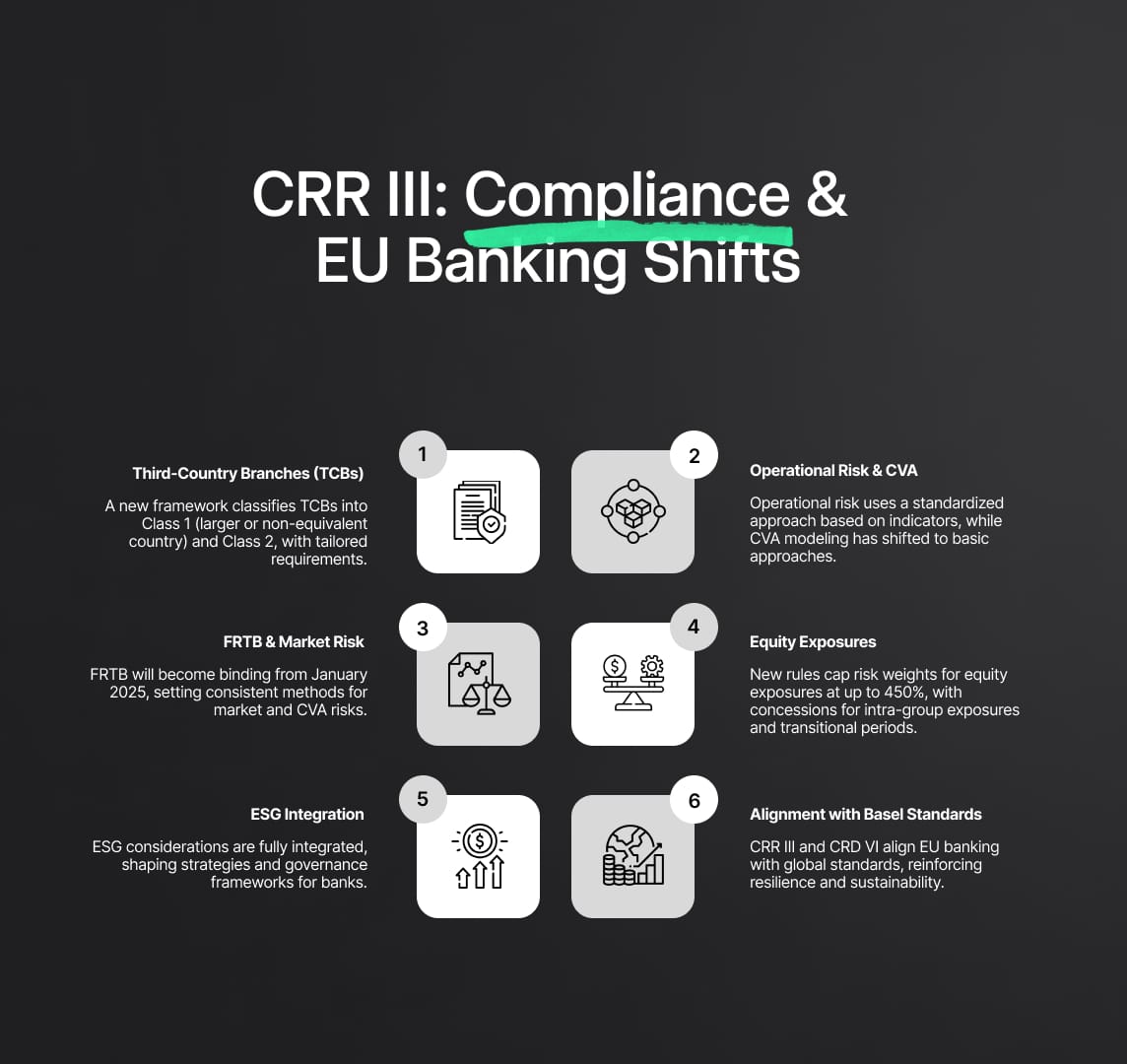

Coupled with ESG considerations, a new regulatory framework addressing third-country branches (TCBs) in the EU has been unveiled. This new classification system categorizes TCBs into two classes: Class 1 includes branches with assets exceeding €5 billion, receiving retail deposits, or from a non-equivalent country, while Class 2 comprises all other branches. Based on their classification, branches must adhere to specific authorization, regulation, and supervision requirements.

Simultaneously, the EC has incorporated Basel III changes to operational risk and credit valuation adjustment (CVA) with a bid to strengthen the resilience of the banking sector. Operational risk measurement has been revamped with a non-modeled standardized approach based on a business indicator component (BIC), replacing the previously used advanced measurement approach (AMA). With CVA, the Basel proposals have prompted the abolishment of internal modeled approaches, replaced with either a standardized or basic approach. This alignment sets a more consistent method of measuring CVA risk.

The EC has also made definitive strides towards the full implementation of the Fundamental Review of the Trading Book (FRTB). Even though initial plans intended FRTB standards to be part of CRR II, the revised standards released by the BCBS in 2019 and the updated timelines necessitated the inclusion of FRTB in CRR III as binding capital requirements for market risk and CVA from January 2025.

Moreover, Basel's changes to the treatment of equity exposures have been adopted. Under the new rules, equity exposures can only be treated as standardized, with risk weights set at levels up to 450%. However, concessions have been proposed: intra-group equity exposures will retain a 100% risk weight, and a transition period for adjustment to the new Basel risk weights has been suggested.

In conclusion, CRR III and CRD VI represent pivotal steps in aligning European banks with global banking standards. They introduce critical changes to credit risk, operational risk, equity exposures, and importantly, the incorporation of ESG factors into banking practices. Through these extensive reforms, the European Commission aims to foster a resilient, sustainable, and future-ready European banking sector.

Grand Answer: Your AI Partner

Designed to support compliance officers, legal counsels, and other professionals responsible for adhering to regulatory standards, Grand Answer aims to facilitate an efficient and straightforward compliance process.

Reduce your

compliance risks