What are the CDD best practice in Europe?

Explore the Customer Due Diligence (CDD) best practices in Europe, a strategy combining a risk-based approach to AML and CTF. Understand the European Banking Authority's (EBA) guidelines and the role of cutting-edge technology in managing financial risk and combating crime.

Customer Due Diligence (CDD) best practices in Europe include adopting a risk-based approach to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF).

The European Banking Authority (EBA) has published guidelines to promote a common understanding of this approach and how it should be applied by credit and financial institutions [1]. These guidelines are in line with the European Union's Anti-Money Laundering Directive [2].

Additionally, regulated organisations are advised to leverage technology such as artificial intelligence, machine learning, and natural language processing to manage risk obligations and counteract financial crime [2]. By following the EBA's guidelines and using advanced technology, financial institutions can ensure adherence to CDD best practices in Europe.

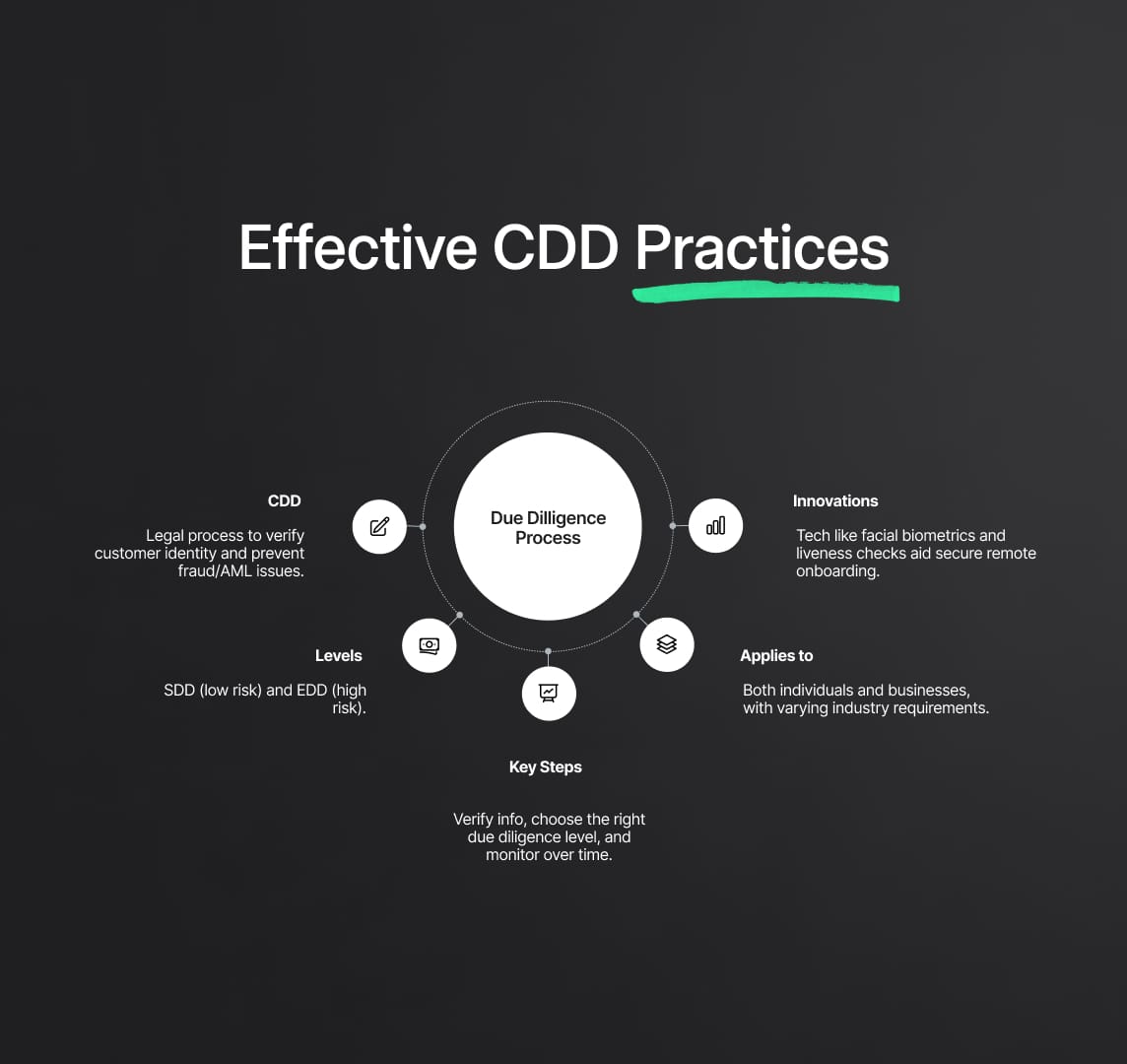

Customer Due Diligence Process

Customer Due Diligence (CDD) is an essential process businesses undertake when establishing a business relationship with a customer. It involves collecting and verifying customer information during onboarding, including the customer's name, address, and other personal data. This safeguard is critical in the financial industry, such as banks or trading

platforms, where it may involve checking a customer's passport before allowing them to create an account and deposit money.

The importance of CDD cannot be overstated. Without it, businesses are left exposed to potential fraud, along with hefty fines for non-compliance with Anti-Money Laundering (AML) requirements.

In certain jurisdictions like Cyprus, failure to comply with AML regulations can lead to penalties exceeding one million euros.

CDD is a specific term within the broader framework of Know Your Customer (KYC) regulations.

While the terminology can vary from jurisdiction to jurisdiction, CDD refers to aspecific list of procedures mandated by law, whereas KYC checks may differ.

The primary goal of both CDD and KYC is to protect businesses and the financial system at large from misuse.

Depending on the level of money laundering risk, different levels of CDD may be required.

In low-risk scenarios, Simplified Due Diligence (SDD) may be appropriate. SDD streamlines the verification process for customers deemed low-risk, such as public enterprises or individuals with reliable sources of funds. However, when higher-risk scenarios are encountered, Enhanced Due Diligence (EDD) comes into play.

These situations could involve customers from high-risk countries, Politically Exposed Persons (PEPs), or cases involving high

transaction amounts.

The CDD process typically involves verifying an individual's full name, residential address, government-issued identification, and tax number, though these requirements can differ across jurisdictions.

For businesses, additional information like registered corporate name,

trading name, registration number, addresses of registered and head offices, and contact details are required.

The objective is to identify and verify the beneficial owners of the

company - those who directly or indirectly own more than 25% of the company or exercise significant control over it.

Executing CDD effectively involves three main steps:

-

Verifying a customer's information.

-

Choosing the appropriate due diligence track (regular, enhanced, or simplified) based on the customer's risk profile.

-

Ongoing monitoring to ensure that the customer's risk profile hasn't changed significantly over time.

While the requirements for CDD are largely similar across industries, nuances exist depending on the specific industry. For instance, banks, fintech firms, and forex companies may have differing CDD requirements.

Regardless of the industry, the ultimate goal of CDD is to ensure secure customer verification, especially when onboarding customers remotely.

Innovative solutions have emerged to enhance the security of remote verification, such as the use of liveness checks for facial biometric verification.

These help prevent fraudsters from using real documents or selfies obtained illicitly. In the ever-evolving landscape of customer-business interactions, such technological advancements paired with robust CDD and KYC practices provide businesses with a powerful line of defense against financial crimes.

Reduce your

compliance risks