What is Due Diligence Management and Why is it Important?

Due diligence management is a comprehensive and systematic process of researching and evaluating potential investments, products, or business dealings to determine their worthiness and potential risks.

Due diligence management is a comprehensive and systematic process of researching and evaluating potential investments, products, or business dealings to determine their worthiness and potential risks. The goal of due diligence is to make informed investment decisions that minimize the risk of making a costly mistake.

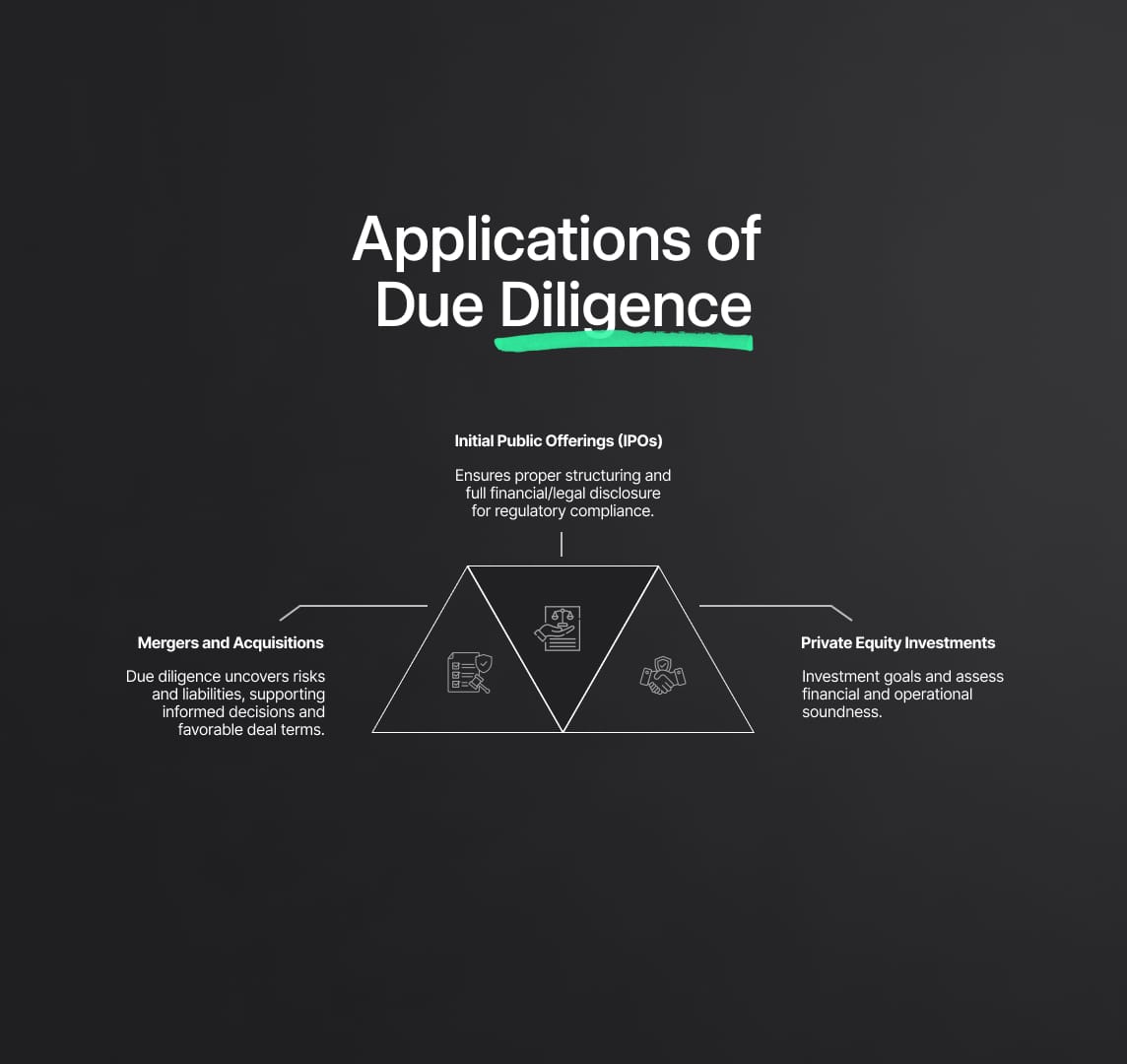

Applications of Due Diligence

- Mergers and Acquisitions: due diligence is crucial in mergers and acquisitions as it helps identify any potential red flags or issues that may impact the success of the operation. This information can help the company make informed decisions and negotiate better terms.

- Initial Public Offerings (IPOs): for companies going public, due diligence is a critical step in ensuring that the IPO is structured properly and that all necessary financial and legal disclosures have been made.

- Private Equity Investments: private equity investors conduct due diligence to identify potential investments that align with their investment criteria and to assess the financial health and operational efficiency of the target company.

Steps of a Comprehensive Due Diligence Process

Gather Information

The first step in a due diligence process is to gather all relevant information about the potential investment or product. This includes financial, legal, and production reports.

Analyze Data

The next step is to analyze the gathered information to identify any potential red flags or issues that may impact the success of the investment or product. This step is critical as it helps the company determine the value and risk associated with the investment.

Conduct Site Visits

In some cases, it may be necessary to conduct site visits to get a firsthand look at the operations of the potential investment. This helps the diligence team gain a better understanding of the target company's operations and identify inefficiencies.

Speak with Key Stakeholders

It is also important to speak with key stakeholders, such as customers and employees, to gather their perspectives on the potential investment . This information can provide valuable insights into the target company's reputation, market position and future prospects.

Review Contracts and Agreements

Finally, it is essential to review all contracts and agreements related to the potential financing in order to ensure that they are in line with the company's objectives and to identify any potential legal or operational threat.

Build a Due Diligence Team

A due diligence team should be composed of experts from various departments, such as finance, legal, and operations. This team should have a clear understanding of the company's objectives and be equipped to effectively communicate their findings to the decision makers. Having a dedicated and experienced team in place can help ensure that the research process is thorough and effective.

Create a Due Diligence Plan

It is also essential to have a well-defined operational plan in place that outlines the scope of the research, the timeline for completion, and the responsibilities of each member. This plan should be regularly reviewed and updated to ensure that it remains relevant and effective. A clear and comprehensive checklist can help streamline the research process and ensure that all important factors are considered.

Compliance and Due Diligence

Compliance and due diligence are two critical components of a company's risk management strategy. The interaction between these activities is essential in ensuring that company's assets are not only profitable but also comply with relevant laws and regulations.

During the due diligence process, the company should consider the compliance risks associated with the investment or product and take steps to minimize these risks. For example, the due diligence team should review contracts and agreements to ensure that they are in line with the company's policies and that the organization is not exposing itself to any legal or regulatory risks.

Furthermore, these activities can help firms to identify any potential threat early on and take steps to address them before they become major problems. If the due diligence process reveals that a potential investment is not in compliance with relevant laws or regulations, the company can take steps to address these issues before proceeding with the investment.

It results clear that due diligence management is a crucial component of any investment or product decision. By taking a comprehensive and systematic approach to the compliance and due diligence processes, a company can reduce the risk of making a costly mistake, increasing the chances of a successful outcome, making informed investment decisions focused on the long term.

Reduce your

compliance risks