Basel 3.1 Standards: Changes by PRA in PS9/24

The PRA’s PS9/24 implements Basel 3.1 standards in the UK, revising capital requirements, output floor, and reporting to enhance financial stability and growth.

The Basel 3.1 standards represent a significant evolution in the global regulatory framework for banks, aimed at enhancing financial stability, improving risk sensitivity, and supporting economic growth. On 12 September 2024, the Prudential Regulation Authority (PRA) published its near-final Policy Statement PS9/24: Implementation of the Basel 3.1 standards near-final part 2 (PS9/24). This document outlines the PRA's second near-final set of rules for implementing the Basel 3.1 standards in the UK, focusing on credit risk, the output floor, and updated reporting and disclosure requirements. PS9/24 follows the earlier release of PS17/23 in December 2023 and provides further clarity for firms preparing to comply with these new regulatory requirements.

Source

[1]

Overview of Basel 3.1 Standards

The Basel 3.1 standards are part of the Basel Committee on Banking Supervision's efforts to strengthen the global banking system by enhancing the capital adequacy framework. These standards aim to improve the resilience of banks by refining risk-based capital requirements, introducing new capital buffers, and implementing the output floor, which sets a minimum level of capital that banks must hold regardless of internal risk models. The PRA’s implementation of the Basel 3.1 standards through PS9/24 is designed to align UK regulatory practices with international standards while considering the specific needs of the UK’s financial sector.

Key Features of PS9/24: Implementing Basel 3.1 Standards

PS9/24 introduces several key features aimed at aligning the UK’s regulatory framework with the Basel 3.1 standards. This policy statement is crucial for PRA-authorised banks, building societies, investment firms, and financial holding companies, providing them with near-final rules that offer certainty about future capital requirements.

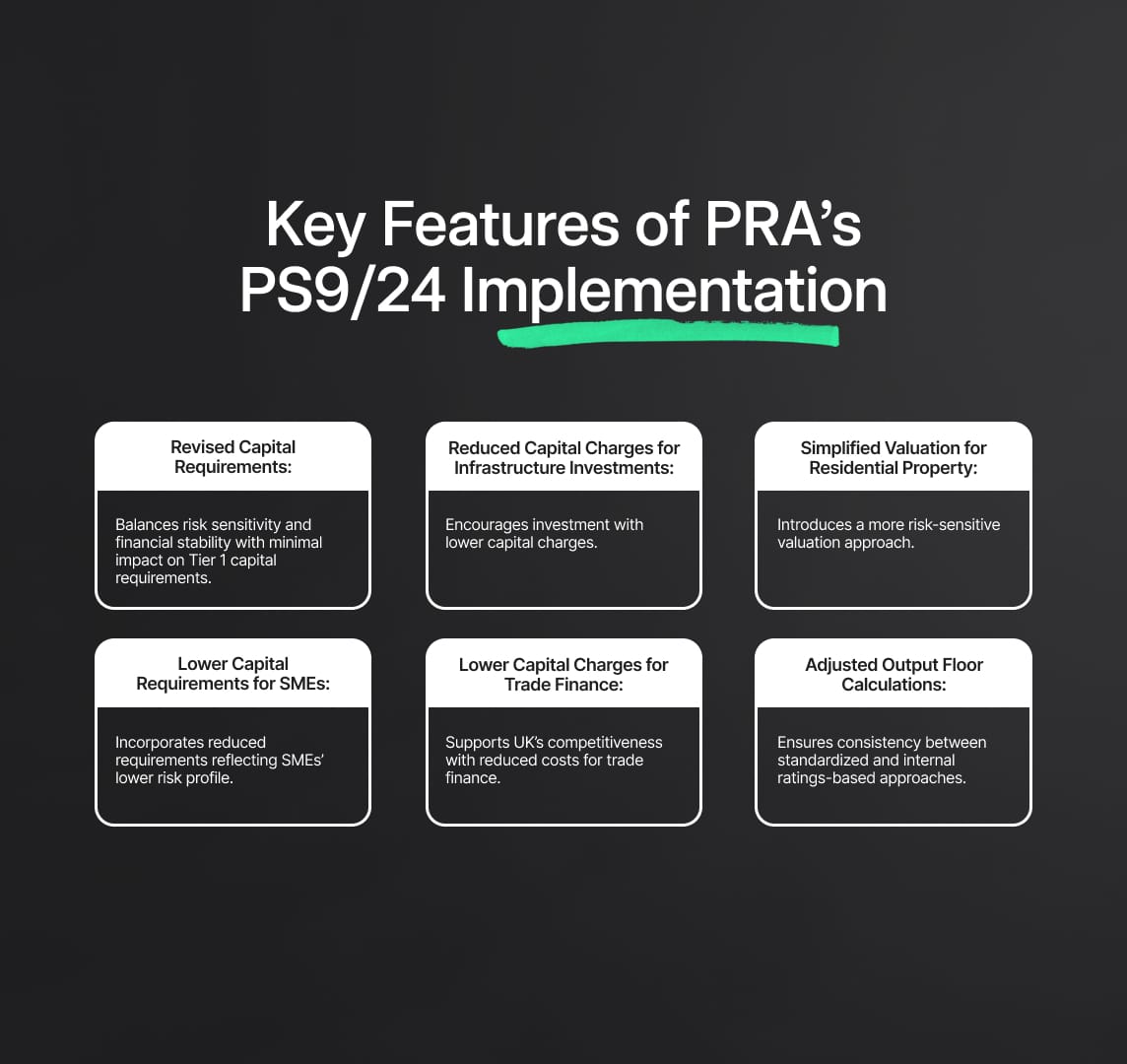

1. Revised Capital Requirements Under Basel 3.1 Standards

The PRA’s approach under PS9/24 seeks to ensure that capital requirements are balanced, risk-sensitive, and support the broader objectives of financial stability and economic growth. Notably, the PRA estimates that the Tier 1 capital requirements for major UK firms will remain “virtually unchanged” with an aggregate increase of less than 1% expected by January 2030 when the transitional arrangements conclude.

Key adjustments to the Basel 3.1 standards as set out in PS9/24 include:

- Lower Capital Requirements for SMEs: The Basel 3.1 standards incorporate reduced capital requirements for small and medium-sized enterprises (SMEs), reflecting their lower risk profile compared to larger corporate exposures. The PRA's amendments include a new structural adjustment to Pillar 2A (the ‘SME lending adjustment’), ensuring the removal of the SME support factor under Pillar 1 does not increase overall capital requirements for SME exposures. Additionally, a simplified definition of SMEs reduces operational burdens for firms, broadening the scope of exposures eligible for preferential treatment.

- Reduced Capital Requirements for Infrastructure Investments: To encourage investment in essential infrastructure, the Basel 3.1 standards under PS9/24 propose lower capital charges for these exposures. A new firm-specific structural adjustment to Pillar 2A (the ‘infrastructure lending adjustment’) ensures that the removal of the infrastructure support factor under Pillar 1 does not raise overall capital requirements for infrastructure exposures. Additionally, a new lower risk weight of 50% for ‘substantially stronger’ project finance exposures under the slotting approach represents a significant reduction from the originally proposed 70% risk weight.

- Lower Capital Charges for Trade Finance: Trade finance activities, particularly those that are short-term and self-liquidating, will benefit from lower capital requirements under the revised Basel 3.1 standards. The PRA’s near-final rules assign a 20% conversion factor (CF) for ‘transaction-related contingent items,’ down from the 50% proposed in earlier drafts. This measure supports the UK’s competitiveness in international trade by reducing the cost of providing trade finance.

- Simplified Valuation Approach for Residential Property: The Basel 3.1 standards under PS9/24 introduce a simpler yet more risk-sensitive approach to valuing residential property. The near-final rules require a ‘backstop’ revaluation event, mandating new valuations after five years (or three years in specific cases) since the last event, ensuring products like lifetime mortgages, which lack natural refinancing events, are not disadvantaged. Additionally, the PRA removed the requirement for firms to adjust property valuations to reflect a sustainable value over the loan’s life, simplifying the revaluation process.

- Adjusted Output Floor Calculations: One of the core elements of the Basel 3.1 standards is the introduction of the output floor, which sets a minimum capital requirement based on standardized risk calculations. PS9/24 refines this approach by adjusting the output floor calculation to reflect different treatments of accounting provisions under the standardized and internal ratings-based (IRB) approaches. This ensures enhanced consistency between the approaches, preventing undue penalization of firms using models that better capture their specific risk profiles.

These changes reflect the PRA's commitment to maintaining financial stability while fostering an environment that supports economic growth and competitiveness. The implementation of the Basel 3.1 standards through PS9/24 marks a critical step in aligning the UK’s regulatory landscape with global practices, ensuring a more risk-sensitive and resilient financial system.

2. Scope of Application of the Basel 3.1 Standards

PS9/24 applies to a broad range of PRA-authorised firms, including banks, building societies, PRA-designated investment firms, and PRA-approved or PRA-designated financial holding companies. However, it specifically excludes UK banks and building societies meeting the Small Domestic Deposit Taker (SDDT) criteria, which choose to adhere to the Interim Capital Regime (ICR). This exclusion reflects a tailored approach under the Basel 3.1 standards, emphasizing the PRA’s commitment to proportionality by recognizing that smaller institutions pose less systemic risk. As such, these institutions are granted a distinct regulatory treatment that is less stringent than the comprehensive Basel 3.1 framework applicable to larger, more complex firms. The PRA’s recognition of the different risk profiles and operational constraints of smaller entities ensures that regulatory compliance does not impose disproportionate burdens on these firms.

The tailored application of the Basel 3.1 standards also extends to specific exposure classes and credit risk approaches, such as adjustments in the risk weights for SMEs and trade finance, which are particularly relevant for smaller institutions. The PRA has refined the capital framework for these exposures to better reflect their risk characteristics, thereby fostering an environment conducive to growth without compromising the integrity of the broader financial system.

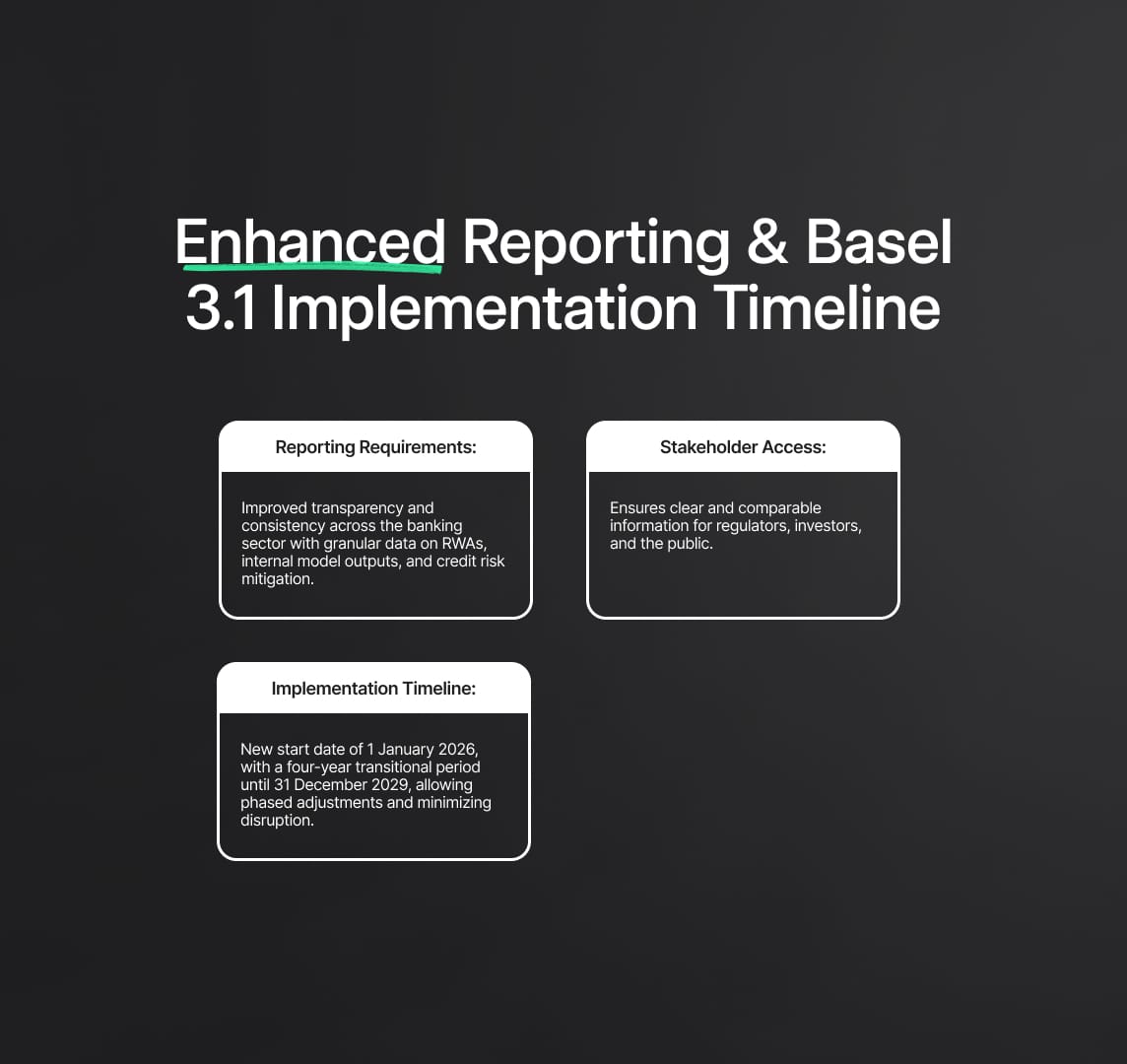

Implementation Timeline for Basel 3.1 Standards

To facilitate a smooth transition to the new Basel 3.1 standards, the PRA has postponed the implementation date by six months, setting the new start date to 1 January 2026. A four-year transitional period will follow, concluding on 31 December 2029. During this period, phased adjustments will allow firms to incrementally align their practices with the Basel 3.1 standards, mitigating potential shocks to capital requirements and internal processes. The phased approach not only aligns with other major jurisdictions, such as the EU and the US, but also helps to ensure a globally coordinated adoption of the Basel 3.1 standards, reducing cross-border regulatory discrepancies and promoting a level playing field.

The extended timeline reflects the PRA’s response to extensive industry feedback, which highlighted the complexities and operational challenges associated with transitioning to the new Basel 3.1 framework. The PRA’s decision to provide additional implementation time is intended to minimize disruption, particularly for firms needing to overhaul their credit risk management systems, reporting processes, and internal models to comply with the new standards.

Growth, Competitiveness, and Financial Stability Objectives

A critical aspect of the PRA’s approach to implementing the Basel 3.1 standards through PS9/24 is its dual focus on fostering growth and competitiveness alongside maintaining financial stability. This strategy aligns with the PRA’s new secondary objective to enhance economic growth and international competitiveness, particularly as the UK seeks to strengthen its position as a global financial hub.

The Basel 3.1 standards under PS9/24 introduce revisions to capital requirements that support lending to sectors pivotal to economic growth, such as SMEs, infrastructure, and trade finance. The tailored adjustments, including specific risk weights and more flexible approaches to credit risk mitigation, are designed to align capital requirements more closely with actual risk profiles. This alignment optimizes the allocation of capital within the financial system, thereby encouraging banks to invest in economically productive activities. For instance, the reduction in capital requirements for trade finance activities acknowledges their lower risk nature, supporting the UK's broader trade and economic objectives.

Furthermore, the Basel 3.1 standards contribute to financial stability by ensuring that banks maintain robust capital buffers, capable of absorbing losses during periods of financial stress. The balanced approach to capital requirements seeks to enhance the resilience of the banking sector without imposing excessive burdens that could impede economic growth. By refining risk-weight calculations and implementing the output floor, PS9/24 ensures that capital buffers are maintained at prudent levels, promoting a stable banking environment even during adverse economic conditions.

Enhanced Reporting and Disclosure Requirements

Aligned with the Basel 3.1 standards, PS9/24 introduces comprehensive enhancements to reporting and disclosure requirements aimed at improving transparency and consistency across the banking sector. These enhanced requirements are critical in ensuring that stakeholders, including regulators, investors, and the public, have access to clear, consistent, and comparable information regarding the risk profiles and capital adequacy of banks. The updated standards mandate more granular data on risk-weighted assets (RWAs), internal model outputs, and other key metrics, which enhance the transparency of banks’ risk management and capital allocation practices.

The new reporting templates and disclosure guidelines introduced under the Basel 3.1 standards are specifically designed to capture detailed insights into how firms manage their capital and risk exposures. For example, firms are required to provide more comprehensive disclosures on credit risk mitigation techniques, the application of the output floor, and adjustments to internal models. This increased level of detail is expected to promote greater market discipline, as stakeholders can more accurately assess the capital positions and risk management effectiveness of individual banks.

Next Steps for Basel 3.1 Standards Implementation

As firms gear up for the implementation of the Basel 3.1 standards, the PRA will maintain ongoing dialogue with industry stakeholders to refine the near-final rules and offer additional guidance as necessary. The PRA recognizes that the evolving nature of the financial landscape may require adaptive regulatory measures, and as such, it remains open to making adjustments based on further industry feedback and emerging market conditions. The near-final nature of PS9/24 reflects this commitment to flexibility, providing firms with a clear framework while allowing room for modifications that address practical challenges in the implementation phase.

The PRA’s approach underscores its commitment to providing regulatory certainty while balancing the need for responsive and adaptive policymaking. The Basel 3.1 standards, as articulated in PS9/24, represent a significant enhancement of the UK’s regulatory framework, aiming to foster a resilient, competitive, and growth-oriented banking sector that meets international best practices.

Reduce your

compliance risks