Basel’s Counterparty Credit Risk Guidelines (CCR): GFMA’s View

GFMA urges Basel to adopt a flexible, risk-based counterparty credit risk (CCR) framework with tailored due diligence, selective stress testing, and adaptive governance.

The Global Financial Markets Association (GFMA) has provided critical feedback on the Basel Committee’s proposed "Guidelines for Counterparty Credit Risk Management" (CCR), highlighting the need for a more flexible, risk-based regulatory framework for counterparty credit risk. GFMA argues that the current CCR guidelines are overly prescriptive, which could drive up compliance costs and hinder effective counterparty credit risk management by limiting banks' ability to tailor their practices to specific CCR risks.

Their recommendations focus on making the CCR guidelines more practical and proportionate, emphasizing customised due diligence, selective stress testing, and adaptive governance approaches. GFMA’s suggestions aim to balance regulatory oversight with operational flexibility, ensuring that counterparty credit risk management aligns with market realities while avoiding unnecessary burdens on financial institutions.

Source

[1]

Overview and Attitudes Towards the Basel CCR Guidelines

GFMA, representing the world’s leading financial and capital market participants, supports the overarching objectives of the Basel CCR guidelines, which aim to enhance counterparty credit risk management. However, GFMA criticizes the guidelines for being excessively prescriptive, which could lead to risk avoidance rather than effective CCR management. GFMA argues that while consistency and comparability are essential, the CCR guidelines should allow for adaptability and nuanced decision-making tailored to the specific counterparty and risk exposure.

Key Themes and Technical Concerns

Prescriptiveness vs. Flexibility: The GFMA criticizes the Basel counterparty credit risk (CCR) guidelines for being overly prescriptive, which restricts banks from implementing risk-based, proportional decision-making. GFMA argues that the rigid nature of these CCR guidelines could inadvertently increase compliance costs and push capital market activities into less regulated or unregulated sectors. GFMA’s feedback emphasizes the need for CCR guidelines that support nuanced and flexible approaches, allowing financial institutions to assess counterparty credit risks and rewards effectively, rather than adhering to a one-size-fits-all mandate.

Specifically, GFMA proposes modifications to the Basel CCR guidelines to incorporate a principles-based approach, allowing banks the discretion to apply their internal counterparty credit risk management frameworks. The association highlights that banks should be able to prioritize CCR risk factors based on the nature, size, and complexity of their exposures, without being compelled to adhere to uniform requirements that may not be relevant to all counterparties.

Impact of Prescriptive Measures: The GFMA underscores that overly prescriptive CCR guidelines could result in inefficiencies and increased systemic fragility within the financial system. For example, the requirement for banks to document every non-standard contractual term and enforce uniform information collection protocols across all counterparties could overwhelm financial institutions. These measures often add administrative burdens without proportionate enhancements in CCR management effectiveness. GFMA stresses that such exhaustive requirements may discourage banks from engaging with counterparties or innovating in the management of counterparty credit risk, as resources are diverted towards compliance rather than risk mitigation.

Nuanced Risk-Based Approaches: GFMA strongly supports a risk-based and proportional approach to CCR management, advocating for banks to tailor their practices based on the materiality of exposure and specific CCR risks posed by individual counterparties. The association argues that mandating uniform comprehensive stress testing, data collection, and other regulatory requirements for every counterparty, regardless of size, complexity, or risk level, is both impractical and resource-intensive.

GFMA recommends a stratified approach where high-risk counterparties undergo more rigorous assessments, while low-risk counterparties are subject to streamlined CCR processes. This would enable banks to focus resources on areas of greatest counterparty credit risk, enhancing overall CCR management effectiveness.

These suggested changes reflect GFMA’s broader advocacy for a more adaptive, principles-based regulatory framework that enhances the ability of financial institutions to manage counterparty credit risk dynamically and proportionally. This approach is seen as critical to maintaining the resilience of the financial system while avoiding unnecessary regulatory burdens that do not contribute to effective CCR mitigation.

Technical Recommendations

GFMA provides specific recommendations to make the Basel CCR guidelines more effective:

Due Diligence and Monitoring: GFMA emphasizes that the scope of information collection and review should be proportional to the materiality and risk profile of the counterparty credit risk (CCR) exposure. They argue that mandating comprehensive data collection for all counterparties, regardless of their risk level, is impractical and not beneficial to effective CCR management. GFMA contends that due diligence practices should be tailored to the bank’s overall risk appetite and the specific risk characteristics of the counterparty.

For high-risk or highly leveraged counterparties, GFMA supports a thorough data collection approach that includes financial statements, qualitative assessments, and stress-test results. However, for low-risk or non-material counterparties, the association suggests limiting the due diligence to essential financial information and regular performance reviews, thereby aligning data collection efforts with the actual level of CCR posed by the counterparty.

Use of Verbal Information: GFMA recommends that banks should be permitted to rely on verbal information when necessary, particularly in fast-paced markets or crisis situations where written documentation may not be immediately available. The association argues that verbal assurances can play a critical role in real-time decision-making, especially when managing CCR in volatile or stressed market environments.

GFMA highlights that while verbal information should not replace documented evidence, it should be considered an acceptable supplement, especially when immediate CCR decisions are required. This approach offers more flexibility and responsiveness in managing counterparty credit risk, allowing banks to react swiftly to rapidly changing conditions without being hampered by procedural delays.

Stress-Testing Requirements: GFMA contends that stress-testing should be strategically targeted at large, complex counterparties and areas with significant counterparty credit risk concentrations. The association argues that requiring comprehensive stress tests for all counterparties, regardless of their size or complexity, would be excessively burdensome and of limited utility. Instead, GFMA proposes a tiered approach where CCR stress testing is applied based on the materiality of the exposure.

For counterparties that present a lower risk profile, GFMA suggests focusing on simplified scenario analyses rather than full-scale CCR stress tests, thus saving resources while maintaining adequate risk oversight. This proportional approach aligns the stress-testing requirements with the risk significance, ensuring that testing efforts are concentrated where they are most impactful.

Third-Party Verification Services: GFMA advises against the mandatory use of third-party verification services for information validation during the onboarding process. They argue that such CCR requirements could introduce unnecessary complexities, increase costs, and pose confidentiality concerns, particularly in the context of sensitive counterparty credit risk data. GFMA emphasizes the importance of maintaining the flexibility for banks to choose the most appropriate methods of CCR information verification based on their internal risk assessment frameworks.

The association suggests that reliance on internal verification processes or selectively engaging third-party services should be at the discretion of the institution, ensuring that sensitive CCR information is handled securely and efficiently.

Customization of Margin Levels: GFMA stresses that margin requirements should be customized according to the size, complexity, and risk profile of the counterparty, rather than implementing a standardized, granular approach across all CCR exposures. The association argues that such customization would enable banks to better manage counterparty credit risk by adjusting margin levels to reflect the actual risks posed by each counterparty, rather than applying a blanket approach that may be either overly conservative or insufficient.

GFMA’s position is that tailoring margin requirements can enhance the effectiveness of CCR management, allowing institutions to allocate capital more efficiently and avoid the unnecessary cost burdens associated with uniform margin standards.

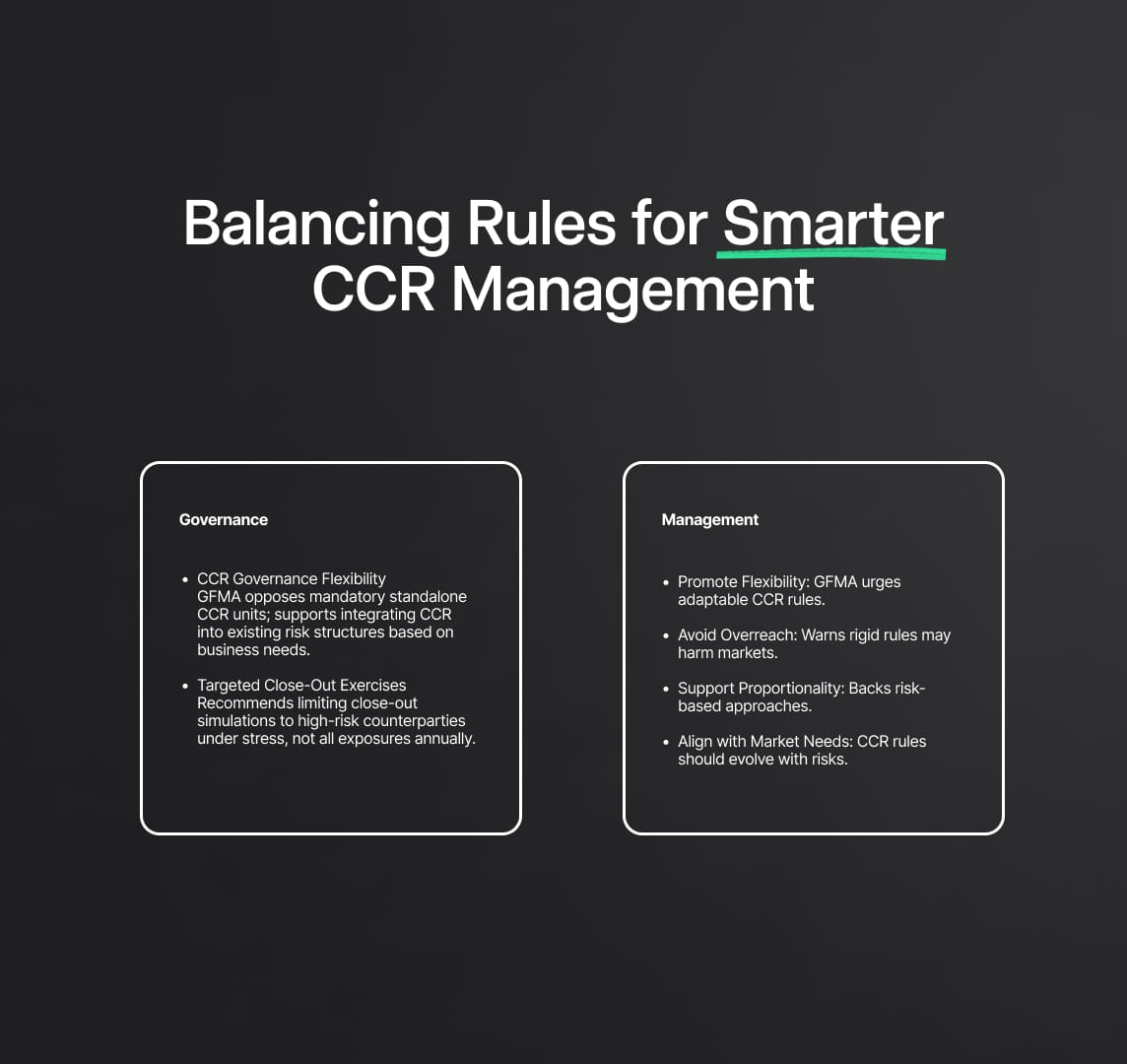

Governance of CCR

GFMA opposes the mandatory establishment of a standalone CCR management function within banks, advocating instead for flexibility in the design of CCR risk management structures based on individual business models. GFMA suggests that CCR oversight should ideally be integrated within existing governance frameworks and managed by senior management, rather than requiring direct board involvement in every counterparty credit risk decision.

This approach allows banks to leverage existing expertise and risk oversight structures, promoting a more cohesive and efficient management of CCR. GFMA also emphasizes the importance of aligning CCR governance with the overall risk culture and strategic objectives of the institution, ensuring that counterparty credit risk management is proportionate and tailored to the specific operational context.

Close-Out Practices: GFMA recommends limiting the frequency and scope of close-out exercises to those involving large, complex counterparties and under reasonable stress scenarios. The association argues that conducting annual mock close-out exercises for all counterparties is unnecessary and resource-intensive, suggesting instead a more risk-based approach that focuses on areas of greatest CCR exposure. GFMA proposes that close-out simulations be employed primarily for counterparties that pose a significant counterparty credit risk, and that the frequency of these exercises be determined by the size and complexity of the exposure. This targeted approach would help banks to prioritize their resources effectively and enhance the overall quality of CCR management practices.

Balancing Regulatory Approaches for Effective CCR Management

GFMA's commentary underscores the critical need for Basel’s CCR guidelines to balance prescriptiveness with flexibility. By pushing for a framework that allows for adaptive, risk-sensitive decision-making, GFMA aims to ensure that counterparty credit risk management evolves in line with market conditions without imposing undue burdens on banks. The association’s detailed and technical feedback provides a comprehensive critique that highlights the potential negative impacts of overly stringent regulatory approaches on the availability of critical capital market services and the broader financial system’s stability.

GFMA’s letter reflects a broader industry stance that while effective CCR management is crucial, it must be supported by guidelines that promote, rather than stifle, nuanced CCR management practices. This perspective is vital for stakeholders engaged in ongoing discussions around counterparty credit risk and financial stability.

Reduce your

compliance risks