Capital Requirement Regulation (CRR): EBA RTS

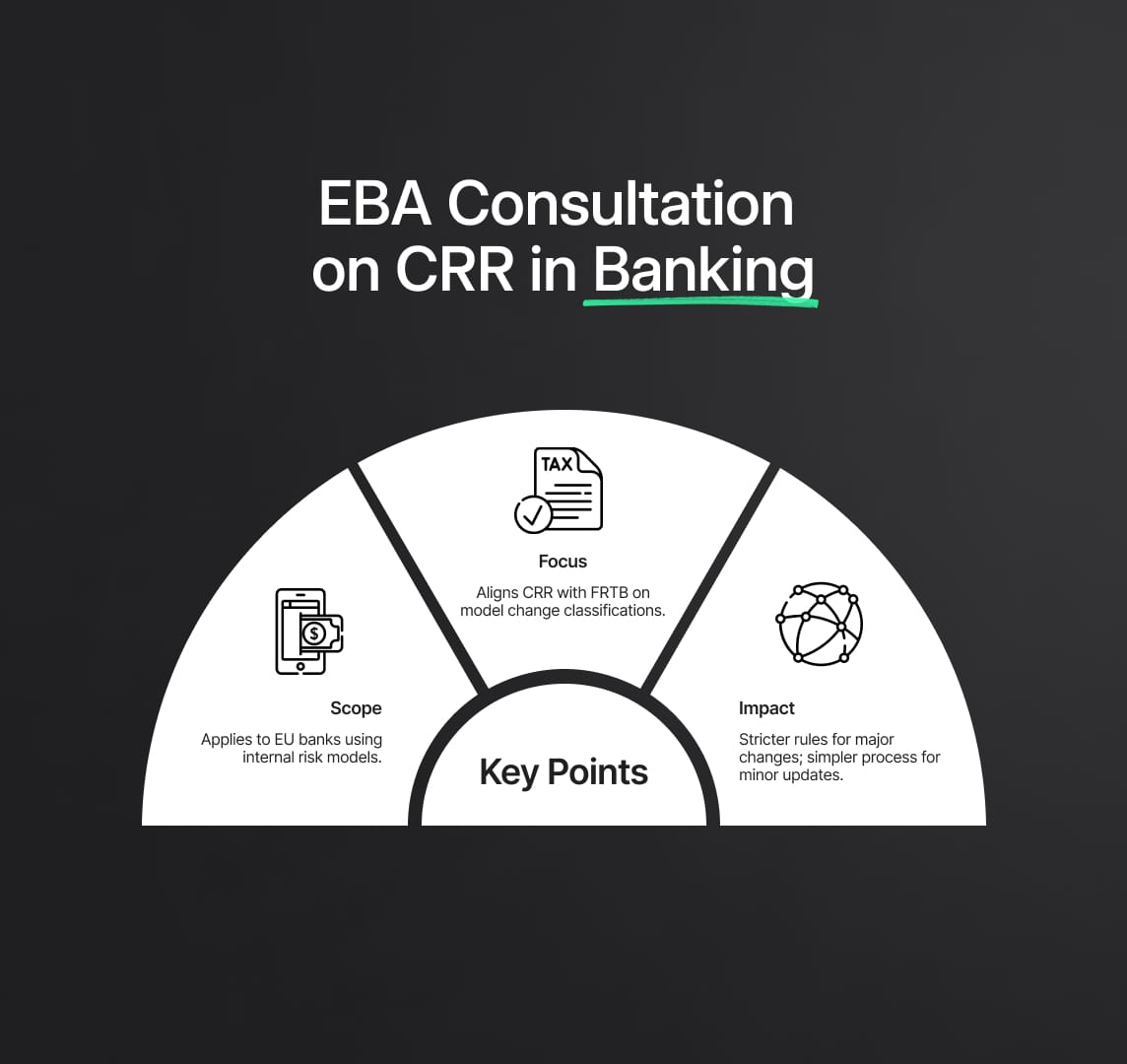

EBA's consultation on the Capital Requirements Regulation (CRR) is pivotal for banks, especially in the EU. It addresses changes in risk models under FRTB, impacting risk management and capital requirements.

Capital Requirement Regulation (CRR): EBA Consultation on Regulatory Technical Standards

Leading a crucial public consultation process, the European Banking Authority (EBA) is presently seeking input on its most recent set of Regulatory Technical Standards (RTS). These criteria are essential for assessing the importance of additions and revisions to internal risk models, especially in accordance with the Fundamental Review of the Trading Book (FRTB) recommendations. This program is an essential aspect of the EBA's larger plan to modernize and improve counterparty and market credit risk regimes in line with current financial issues.

The Capital Requirements Regulation (CRR), which makes a distinct division between significant and small model modifications, plays a key role in this evolution. Big changes need official regulatory body clearance to make sure they adhere to strict guidelines for risk management and financial stability. Less significant modifications, on the other hand, only require reporting to the appropriate authorities, which simplifies the procedure for small changes.

The EBA used a balanced combination of quantitative and qualitative criteria to define these adjustments. The goal of this approach is to offer a thorough framework that precisely classifies the type and significance of every model extension or modification. By doing this, it makes sure that the financial models that banks and other financial organizations employ continue to be reliable, transparent, and compliant with changing regulatory standards.

With a deadline of February 29, 2023, this public consultation offers a great chance for banking and financial industry participants to share their knowledge and viewpoints. To establish a comprehensive and well-informed set of criteria, the EBA encourages involvement from a wide range of professionals, including experts in risk management, financial analysts, and banking executives.

Stakeholders can influence future banking laws, especially those pertaining to the FRTB and CRR frameworks, by participating in this consultation. The European Bank for Asset Management's (EBA) commitment to this consultative process demonstrates its commitment to preserving a stable, effective, and transparent European financial system.

EBA's Consultation for Capital Requirements Regulation (CRR) in Banking

The EBA’s Role in Refining CRR:

Leading a major public consultation process aimed at reshaping banking regulations, especially in relation to the Fundamental Review of the Trading Book (FRTB), is the European Banking Authority (EBA). This effort closely relates to the Capital Requirements Regulation (CRR) and is a cornerstone in the continued improvement of counterparty credit risk and market frameworks.

Financial Institutions and Regulatory Scope:

- Primary Stakeholders: The focus of this development is on banks that use internal risk models and financial institutions that deal with counterparty and market credit risk.

- Geographical Impact: The growing Capital Requirements Regulation (CRR) primarily affects the European Union (EU), which is within the purview of the European Bank of Advocates (EBA).

In-depth Analysis of Relevant Regulations:

- Intersection with FRTB: The consultation critically looks at how CRR and FRTB standards interact, especially when it comes to separating significant from little model changes.

- Impact Highlights:

- Banks may need to overhaul their risk models in line with CRR modifications.

- Major model changes will face stricter regulatory scrutiny, adhering to CRR norms.

- A simplified process for minor model updates will be established, easing compliance with CRR.

- Changes in RTS could recalibrate banks' capital requirements and risk management strategies, ensuring alignment with CRR standards.

Capital Requirements Regulation (CRR) in Banking

Proactive Mitigation Strategies:

- For Banks: They should proactively review and adjust their risk models to be in sync with CRR updates.

- Documentation and Approval: Preparing thorough documentation for major model changes is crucial for meeting CRR compliance.

- Reporting System: Establishing efficient systems for regular reporting of minor model changes, as mandated by CRR.

- Risk Management Alignment: Banks need to engage their risk management and compliance teams to align with CRR’s evolving standards.

A crucial stage in the development of the Capital Requirements Regulation (CRR) is the EBA's consultation process. Important players in the banking industry now have the chance to actively engage and shape the future of banking rules. The goal of this endeavor is to comply with the CRR framework while simultaneously adjusting to the ever-changing financial landscape.

Reduce your

compliance risks