Capital Requirements Regulation: RTS on Extraordinary Circumstances

The Capital Requirements Regulation (CRR), Regulation (EU) No 575/2013, ensures EU financial stability with strict standards on capital, risk management, and liquidity. EBA RTS updates add flexibility under market stress.

The Capital Requirements Regulation (CRR), formally known as Regulation (EU) No 575/2013, stands as a fundamental pillar of the European Union's regulatory framework for credit institutions and investment firms. Enforced with the objective of safeguarding financial stability and enhancing the resilience of the financial system, the CRR imposes stringent prudential standards that institutions must adhere to. These standards encompass a wide range of requirements, including capital adequacy, risk management, and liquidity controls, all designed to mitigate systemic risks and promote sound financial practices.

Source

[1]

[2]

Importance of CRR in Financial Stability

The CRR is pivotal in maintaining the integrity of the EU banking sector. By setting rigorous capital requirements, the CRR ensures that banks hold sufficient capital to absorb losses during periods of economic stress, thereby protecting depositors and maintaining confidence in the financial system. The regulation's emphasis on leverage ratios and liquidity standards further strengthens the sector's resilience by preventing excessive risk-taking and ensuring that institutions can meet their short-term obligations.

Recent Developments: EBA Final Draft RTS

In response to the dynamic nature of financial markets and the lessons learned from recent financial crises, the European Banking Authority (EBA) has been proactive in refining the regulatory framework. The publication of the final draft Regulatory Technical Standards (RTS) marks a significant step in this ongoing process. These RTS are designed to define the specific conditions and indicators for determining extraordinary circumstances under which certain regulatory requirements can be adjusted. This flexibility is crucial for maintaining regulatory effectiveness during periods of extreme market stress or systemic disruptions.

Technical Aspects and Implications

This article delves into the technical aspects of the EBA's final draft RTS, offering a comprehensive analysis of the conditions and indicators that constitute extraordinary circumstances. By exploring these technical details, we aim to elucidate how the RTS will be applied and what implications they hold for financial institutions.

Objectives of the CRR RTS

The RTS are crafted with the objective of providing a clear and structured methodology for identifying extraordinary circumstances. This involves a meticulous assessment of market conditions, volatility levels, and systemic disruptions that could justify regulatory adjustments. The RTS aim to balance the need for regulatory rigor with the necessity of flexibility, ensuring that the banking sector can adapt to unforeseen challenges without compromising on stability and risk management principles.

The Capital Requirements Regulation (CRR)

The Capital Requirements Regulation (CRR), formally designated as Regulation (EU) No 575/2013, plays a crucial role in fortifying the stability and resilience of the European Union's banking sector. The CRR achieves this by implementing stringent standards across three key areas: capital requirements, leverage ratios, and liquidity standards.

Objectives and Scope

Objectives of the CRR: The primary goal of the CRR is to ensure the robustness of the EU banking sector against potential financial crises. By mandating rigorous capital requirements, the CRR aims to ensure that banks hold sufficient capital to absorb losses and continue operations during economic downturns. This is pivotal for maintaining market confidence and protecting depositors.

- Capital Requirements: Banks are required to maintain a minimum amount of capital relative to their risk-weighted assets. This ensures that they can absorb unexpected losses and continue to operate without requiring external intervention.

- Leverage Ratios: The CRR sets limits on the extent to which banks can leverage their equity, thus preventing excessive borrowing that could lead to instability.

- Liquidity Standards: To ensure that banks have enough liquid assets to cover short-term obligations, the CRR imposes strict liquidity requirements. This helps prevent liquidity crises, where banks might otherwise struggle to meet their short-term debts.

Articles 325az(5), 325az(10), and 325bf(6) of the CRR

Extraordinary Circumstances Provisions: The CRR includes specific articles that allow for regulatory flexibility under extraordinary circumstances, acknowledging that rigid compliance might not always be feasible during severe market disruptions.

- Article 325az(5) and 325bf(6): These articles permit Member State competent authorities to grant temporary derogations from certain regulatory requirements. This flexibility is vital during periods of financial instability or significant market stress, as it avoids the need for cumbersome legislative changes that might not be timely or sufficient to address the crisis.

- Article 325az(10): This article mandates the EBA to define the conditions and indicators for determining what constitutes extraordinary circumstances. By setting clear criteria, the EBA helps ensure that competent authorities across the EU can make consistent and informed decisions about when to apply these derogations.

Role of the EBA

European Banking Authority's Mandate: The EBA plays a central role in the operationalization of the CRR's provisions for extraordinary circumstances.

- Article 325az(9): This article entrusts the EBA with the responsibility of determining when extraordinary circumstances are present. The EBA must issue an opinion on such occurrences, providing a unified and authoritative assessment that supports consistent application across Member States.

EBA's High-Level Framework: The EBA's final draft RTS introduce a comprehensive framework for identifying extraordinary circumstances. This framework includes detailed conditions and indicators that guide the assessment process:

- Conditions: The RTS specify that only significant cross-border financial market stress or major regime shifts qualify as extraordinary circumstances. This ensures that the derogations are applied only in genuinely severe situations, maintaining the overall integrity of the CRR.

- Indicators: The RTS outline key indicators such as volatility levels, correlation changes, and the speed of manifestation of financial stress. These indicators provide measurable criteria that competent authorities can use to evaluate the presence of extraordinary circumstances.

EBA Final Draft RTS on Extraordinary Circumstances

High-Level Framework for Identifying Extraordinary Circumstances

The EBA's final draft Regulatory Technical Standards (RTS) present a comprehensive and structured approach to identifying and managing extraordinary circumstances under the Capital Requirements Regulation (CRR). These standards are meticulously designed to ensure that only situations involving significant cross-border financial market stress or major regime shifts qualify as extraordinary circumstances. This stringent criteria is crucial to maintain the integrity of the regulatory framework while providing necessary flexibility during periods of severe financial distress.

Conditions for Qualification

The RTS outline specific conditions that must be met for an event to be classified as extraordinary circumstances:

- Cross-Border Financial Market Stress:

- This condition is defined by significant disruptions affecting multiple financial markets across different countries. Such disruptions must be severe enough to compromise the reliability of internal models used for assessing market risk.

- For instance, a sudden and extensive liquidity crisis impacting several major economies could meet this condition. The interconnectedness of global markets means stress in one region can quickly propagate across borders, necessitating coordinated regulatory responses.

- Regime Shifts:

- Regime shifts refer to substantial changes in the financial environment that alter the fundamental assumptions underlying market risk models. These shifts must be significant enough to challenge the validity of regulatory tests and models.

- An example could be a dramatic and sustained change in interest rate policies by major central banks, which fundamentally affects market dynamics and risk calculations.

Indicators of Extraordinary Circumstances

To support the identification of extraordinary circumstances, the RTS detail several key indicators that competent authorities must consider:

- Volatility Levels:

- High levels of market volatility are primary indicators of financial stress. The RTS require a comprehensive assessment of volatility, including both historical volatility and forward-looking measures such as implied volatility.

- Volatility indices like the VIX (CBOE Volatility Index) and VSTOXX (Euro STOXX 50 Volatility Index) are critical tools in this assessment. These indices provide a real-time measure of market expectations for volatility and can signal rising financial stress.

- Correlations:

- Changes in the correlations between different financial instruments can signal systemic disruptions. The RTS emphasize evaluating these correlations to understand their implications for market risk models.

- For instance, during periods of financial stress, correlations between asset classes such as equities and bonds might increase, indicating a breakdown in diversification benefits and a potential for systemic risk.

- Speed of Manifestation:

- The rate at which financial stress or regime shifts occur is another critical factor. Rapid changes can have profound effects on the stability and reliability of internal models.

- A sudden market crash, like the one experienced during the onset of the COVID-19 pandemic, exemplifies how quickly financial conditions can deteriorate, necessitating swift regulatory adjustments.

Assessment Process

The assessment process detailed in the RTS involves a rigorous and detailed analysis of the conditions and indicators mentioned above. Competent authorities are required to evaluate the specific circumstances thoroughly to determine if they meet the criteria for extraordinary circumstances. This evaluation process ensures that regulatory flexibility is applied consistently and objectively across the EU, maintaining the balance between regulatory rigor and necessary flexibility during times of financial stress.

The RTS mandate a multi-faceted approach, considering both quantitative data (like volatility and correlation metrics) and qualitative factors (such as market sentiment and geopolitical developments). This holistic assessment framework is designed to capture the complexity and interconnectedness of modern financial markets, ensuring that the regulatory response is both timely and appropriate.

CRR Draft RTS: Financial Institutions

Enhanced Flexibility

The implementation of the EBA's final draft RTS on extraordinary circumstances under the Capital Requirements Regulation (CRR) offers financial institutions enhanced flexibility during periods of significant market stress. This regulatory flexibility is crucial for maintaining stability and continuity in operations, particularly when internal models might otherwise fail to meet standard regulatory requirements.

- Use of Internal Models: Financial institutions typically rely on sophisticated internal models for calculating market risk and determining capital requirements. These models include Value-at-Risk (VaR) and the profit and loss attribution test (PLAT). Under normal circumstances, these models are subject to strict back-testing to ensure their accuracy and reliability.

- Regulatory Adjustments: During extraordinary circumstances, such as extreme market volatility or systemic financial disruptions, these models may produce results that do not accurately reflect the institution's risk profile. The RTS allow for temporary deviations from standard requirements, enabling institutions to continue using their internal models even if they fail certain regulatory tests.

- Operational Continuity: By permitting such flexibility, the RTS help prevent sudden shifts to less sophisticated standardised approaches, which could lead to significantly higher capital requirements and operational disruptions.

- Harmonization Across Jurisdictions: The RTS provide a unified framework that all Member State competent authorities must follow when determining extraordinary circumstances. This harmonization is crucial for preventing regulatory arbitrage and ensuring a level playing field.

- Objective Criteria: The criteria set forth in the RTS, such as volatility levels, correlation changes, and speed of manifestation, are designed to be objective and measurable. This ensures that all competent authorities use the same standards when assessing market conditions, leading to more predictable and transparent regulatory outcomes.

- Strategic Planning: Consistent application across the EU allows financial institutions to better anticipate regulatory responses and incorporate these expectations into their risk management and strategic planning processes.

Tailored Permissions

Competent authorities have the discretion to grant tailored permissions to institutions under extraordinary circumstances. These permissions are designed to address specific needs and challenges faced by individual institutions, ensuring that regulatory responses are both effective and proportionate.

- Continuation of Internal Models: Institutions may be allowed to continue using their internal models for risk calculation despite failing certain regulatory tests. This prevents the need for abrupt transitions to standardised approaches, which might not accurately reflect the institution's risk profile.

- Calculation Adjustments: Permissions can include adjustments such as limiting the calculation of add-ons to overshootings under hypothetical changes, or excluding certain overshootings from the add-on calculation altogether. These adjustments help maintain the integrity of the risk models while accounting for the exceptional market conditions.

- Specific Criteria and Conditions: The tailored permissions are granted based on specific criteria and conditions set by the competent authorities. This ensures that the flexibility provided is justified and that institutions remain accountable for their risk management practices.

Impact on Different Institutions

Extraordinary circumstances can impact financial institutions in various ways and to different extents. The RTS acknowledge this variability and provide a framework for competent authorities to analyze and respond to the specific impacts on their supervised entities.

- Institution-Specific Analysis: Competent authorities are required to conduct detailed analyses of the impact of extraordinary circumstances on their supervised entities. This includes assessing how market disruptions affect different portfolios and business models.

- Tailored Responses: Based on their analyses, competent authorities can tailor their regulatory responses to address the specific needs and challenges of individual institutions. This might involve granting temporary relief from certain regulatory requirements or adjusting capital add-ons to reflect the institution's unique risk profile.

- Ensuring Accountability: Even with tailored permissions, institutions must continue to address and rectify known deficiencies in their internal models. The RTS ensure that any flexibility granted does not compromise the overall robustness of the risk management framework.

Capital Requirements Regulation (CRR): Implementation of the RTS

The implementation of the Regulatory Technical Standards (RTS) under the Capital Requirements Regulation (CRR) involves a rigorous process. The draft RTS, once finalized, will be submitted to the European Commission for endorsement. Following this, they will undergo thorough scrutiny by both the European Parliament and the Council of the EU. This meticulous review process ensures that the RTS meet all necessary regulatory and legal standards before becoming enforceable.

- European Commission Endorsement: The European Commission reviews the RTS to ensure they align with EU legislation and policy objectives. This step includes evaluating the technical robustness and practical implications of the standards.

- Parliamentary and Council Scrutiny: The European Parliament and the Council of the EU examine the RTS, providing an additional layer of oversight. This scrutiny ensures that the RTS are not only technically sound but also politically and economically feasible.

- Official Publication: Once approved, the RTS will be published in the Official Journal of the European Union. This official publication is crucial as it marks the point at which the RTS become legally binding across all EU Member States.

- Entry into Force: The RTS will apply 20 days after their publication, giving institutions a short window to prepare for compliance.

Period of Extraordinary Circumstances

The RTS define a period of extraordinary circumstances to ensure that financial institutions have clear guidelines on how long they can apply the regulatory flexibility provided. This period includes the stress event itself and an additional 'impact period' of up to 250 business days. This extended timeframe is critical for addressing the lingering effects of the stress event on financial stability.

- Stress Period: This is the initial period during which significant financial stress or a regime shift occurs. It encompasses the most acute phase of the market disruption.

- Impact Period: The impact period follows the stress period and can last up to 250 business days. This duration allows institutions to manage the residual effects of the stress event, ensuring that they can stabilize and adjust their operations without abrupt regulatory shifts.

- Continuous Assessment: During both the stress and impact periods, competent authorities are required to continuously assess market conditions and the effectiveness of the regulatory adjustments. This ongoing evaluation helps ensure that the flexibility provided remains appropriate and effective.

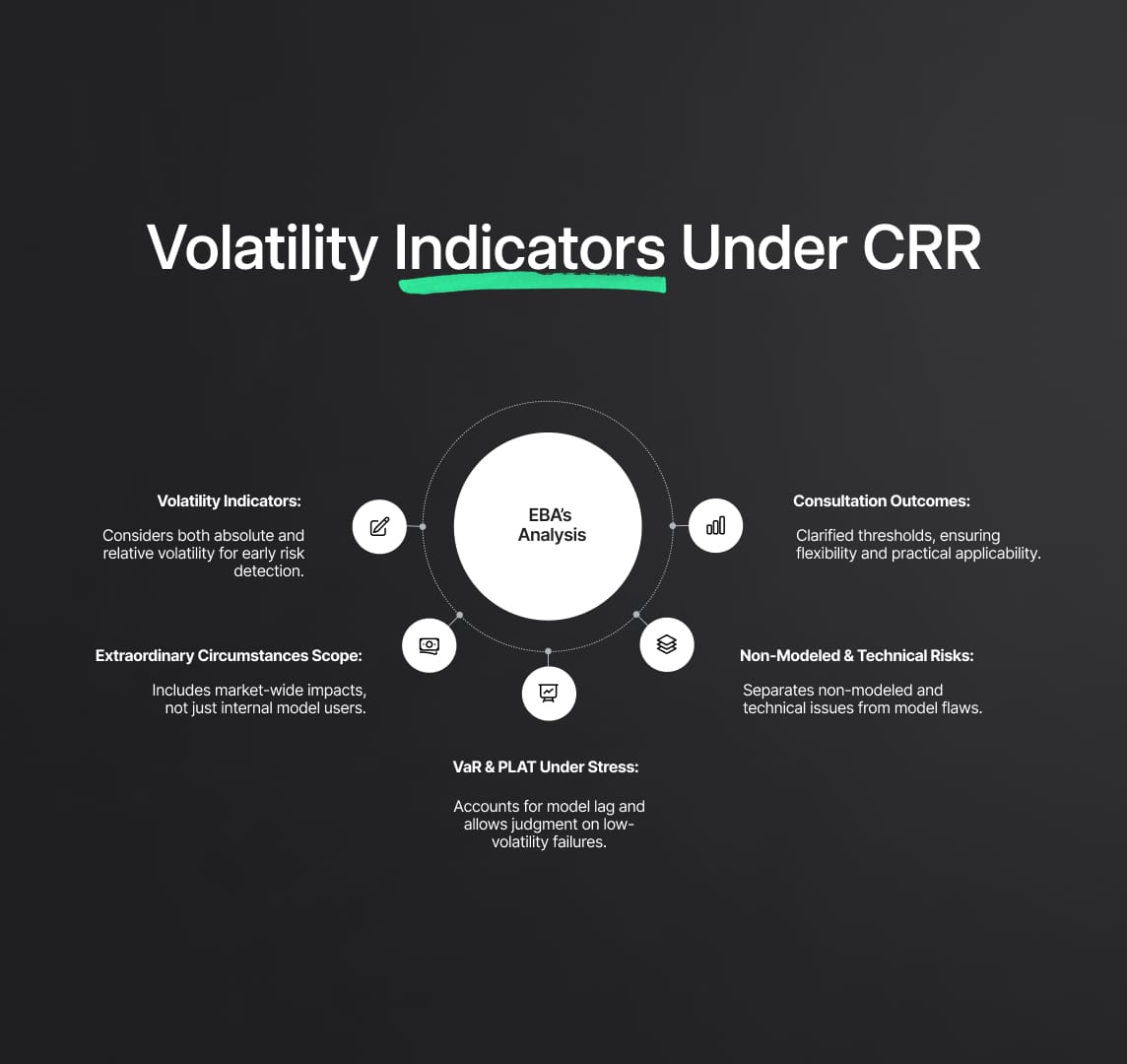

Feedback on the Public Consultation

The European Banking Authority (EBA) conducted a comprehensive public consultation on the draft RTS, which lasted for three months and concluded on November 3, 2023. The consultation process is a critical component of regulatory development, as it allows stakeholders to provide input and ensures that the RTS are both practical and effective.

- Summary of Responses: The EBA received detailed feedback from various stakeholders, including financial institutions, industry associations, and other market participants. This feedback is invaluable for refining the RTS.

- EBA's Analysis: The EBA meticulously analyzed the responses, identifying common themes and specific concerns. This analysis ensures that the final RTS address the practical challenges and operational realities faced by financial institutions.

- Revisions Based on Feedback: The EBA made several minor revisions to the draft RTS based on the feedback received. These revisions aimed to clarify the conditions under which extraordinary circumstances can be recognized and to strike a balance between regulatory clarity and flexibility.

General Comments on the Definition of Extraordinary Circumstances

The consultation highlighted several key points regarding the definition of extraordinary circumstances. One significant observation was that the EBA's approach is stricter than the Basel Committee on Banking Supervision (BCBS) standards, which list significant cross-border financial market stress or major regime shifts as examples, not exclusive justifications.

- Stricter Thresholds: The RTS set a high threshold for triggering extraordinary circumstances, ensuring that such designations are reserved for truly exceptional events. This approach maintains the integrity of the regulatory framework.

- Inclusion of Local or Regional Crises: Some respondents suggested including local or regional economic crises as potential extraordinary circumstances. The EBA, however, maintained that institutions should manage local crises as part of normal business operations, reserving the extraordinary circumstances framework for more widespread, systemic events.

- Impact on Non-EU/EEA Institutions: Concerns were raised about the RTS not adequately covering trading desks with significant exposure to non-EU/EEA markets. The EBA clarified that the RTS primarily focus on EU-based entities, though subsidiaries outside the EU might benefit if the crisis is recognized at the EU level.

Amendments to the Proposals

Based on the feedback received, the EBA made several amendments to the draft RTS to clarify the recognition conditions for extraordinary circumstances and to ensure a balanced approach between regulatory clarity and flexibility.

- Clarification of Conditions: The amendments included more precise definitions of the conditions under which extraordinary circumstances can be recognized, ensuring that competent authorities have clear guidance.

- Balanced Flexibility: The revisions aimed to balance the need for regulatory flexibility with the requirement to maintain robust risk management standards. This ensures that the flexibility provided does not undermine the overall stability and resilience of the financial system.

Specific Indicators for Identifying Extraordinary Circumstances

The consultation process also confirmed the usefulness of certain indicators in identifying extraordinary circumstances. These indicators help competent authorities to make informed decisions based on objective, measurable criteria.

- Volatility and Correlation Indicators: Volatility indices like VIX (US) and VSTOXX (Europe) are recognized as useful indicators of significant cross-border financial market stress. Correlation indicators are also essential for reflecting market dislocations and systemic risk.

- Liquidity Indicators: Indicators such as jumps in risk-free rates (RFRs) or overnight indexed swap (OIS) rates were considered but not included in the presumptive list. However, they remain relevant and can be used in specific assessments.

- Market Deviations and Trading Restrictions: Unusual deviations between safer and riskier assets, as well as restrictions on trading or delivery of financial instruments, were also highlighted. These factors can be considered in assessing extraordinary circumstances, providing a comprehensive view of market conditions.

CRR: Definition of Indicators and Absolute Levels of Volatility

The feedback received during the consultation on the Capital Requirements Regulation (CRR) highlighted critical insights regarding the definition of indicators and the use of absolute levels of volatility. The respondent commended the EBA's choice of Option 1b, which establishes general criteria for recognizing significant financial market stress or major regime shifts. This approach provides the necessary flexibility to address unique characteristics of different crises. However, the respondent suggested that the RTS should not strictly reference absolute volatility levels observed during past crises like the global financial crisis or the COVID-19 pandemic. They argued that sudden spikes in volatility after periods of low volatility could indicate financial stress, even if the absolute levels are not as high as those witnessed during historical crises.

Technical Analysis and Recommendations

EBA’s Analysis: The European Banking Authority (EBA) acknowledged that significant increases in volatility are essential indicators of financial stress but are not sufficient on their own to declare extraordinary circumstances. Absolute volatility levels from historical crises serve as useful benchmarks, providing context for evaluating current market conditions. However, in response to feedback, the EBA agreed to incorporate relative changes in volatility levels as an additional reference point. This adjustment ensures that sudden and significant increases in volatility, regardless of their absolute levels, are adequately considered when assessing market stress.

- Relative vs. Absolute Volatility: The EBA's inclusion of relative volatility changes means that both sudden spikes in volatility and sustained high volatility levels are considered. This dual approach allows for a more nuanced understanding of market conditions, ensuring that regulatory responses are appropriately calibrated.

- Historical Context: While historical volatility levels provide a benchmark, the inclusion of relative changes ensures that emerging patterns of financial stress are not overlooked. This approach enhances the flexibility and responsiveness of the regulatory framework.

Reference Population for Determining Extraordinary Circumstances

The respondent recommended that the criteria for extraordinary circumstances should encompass impacts on multiple portfolios and banks, irrespective of whether they employ internal models. This suggestion aims to ensure a comprehensive assessment of market-wide stress and its systemic implications.

Technical Analysis and Recommendations

EBA’s Analysis: The conditions outlined in the RTS require that systemic stress or regime shifts impact markets at a broad level, affecting entities within the EU. The focus is on market-wide conditions rather than the specifics of individual institutions' modeling approaches. However, the EBA recognized that the impact on institutions using internal models would be a critical consideration in subsequent assessments.

- Systemic Stress Assessment: The RTS mandate that competent authorities evaluate market stress based on broad indicators that reflect systemic conditions. This approach ensures that the recognition of extraordinary circumstances is based on comprehensive market data.

- Internal Models Impact: While the primary assessment focuses on market conditions, the subsequent analysis includes the impact on entities using internal models. This layered assessment ensures that the regulatory response is both comprehensive and targeted.

Impact of Regime Shifts on Back-Testing and PLAT

Delayed Recognition in VaR

Value-at-Risk (VaR) models may not immediately capture extreme market shifts, leading to back-testing overshootings as the models adjust over time. This delay can obscure the immediate recognition of stress conditions.

- VaR Model Adjustments: The EBA’s approach ensures that the temporal dynamics of VaR models are considered. This means that both immediate and lagged responses to market stress are factored into the regulatory framework.

- Back-Testing Overshootings: By accounting for delayed recognition, the RTS provide a more accurate reflection of an institution's risk exposure during periods of rapid market changes.

PLAT Failures in Low Volatility

Profit and Loss Attribution Test (PLAT) failures could occur in periods of low volatility due to blurred correlation assessments. This issue can complicate the interpretation of test results.

- Correlation Assessments: The RTS emphasize the need for careful analysis of correlation changes. Even in low volatility periods, significant shifts in correlations can indicate underlying stress, providing an early warning of potential issues.

- Flexibility in Assessments: The RTS framework allows competent authorities to apply professional judgment in interpreting PLAT results, ensuring that regulatory decisions are well-informed and context-specific.

Risks Not in the Model

Non-modeled risks could significantly impact PLAT during stress periods, posing challenges to accurately capturing an institution's risk exposure.

- Comprehensive Risk Assessment: The RTS encourage a holistic approach to risk assessment, considering both modeled and non-modeled risks. This ensures that all potential risk factors are evaluated, enhancing the robustness of the regulatory framework.

- Case-by-Case Flexibility: By allowing for tailored assessments, the RTS enable competent authorities to respond effectively to unique risk profiles and emerging threats.

Technical Issues

Technical issues unrelated to model deficiencies could cause back-testing overshootings during stress periods. These issues need to be considered separately from model-related risks.

- Technical vs. Model Risks: The RTS framework distinguishes between technical issues and model deficiencies, ensuring that regulatory responses address the root cause of back-testing overshootings.

- Regulatory Flexibility: Competent authorities are equipped with the flexibility to consider technical issues in their assessments, ensuring that the regulatory framework remains comprehensive and adaptable.

Reduce your

compliance risks