Corporate Sustainability Due Diligence: EU Adoption

In our latest article we will delve in the CSDD directive, learning the core set of rules that it will introduce for companies and the impact that these choices will have in the European Landscape.

The news article discusses the adoption of a proposal for a Directive on corporate sustainability due diligence by the European Parliament's Legal Affairs Committee. The proposed directive aims to hold companies accountable for identifying and mitigating the negative impact of their activities on human rights and the environment. It expands the scope of responsibility to include not only suppliers but also activities related to sale, distribution, and transport.

The article also highlights the extended application of the rules to EU-based companies and non-EU companies generating significant revenue in the EU. The proposed directive emphasizes supervision, sanctions, and the establishment of detailed guidelines to ensure compliance. Furthermore, it emphasizes the need for companies to engage with stakeholders, introduce a grievance mechanism, and implement a transition plan compatible with climate change goals.

Sustainability Due Diligence: Key Points

- MEPs on the Legal Affairs Committee adopted a position on corporate sustainability due diligence, with a significant majority in favor.

- Companies would be required to identify, prevent, end, or mitigate the negative impact of their activities on human rights and the environment.

- The due diligence obligation would extend to value-chain partners and encompass activities beyond suppliers.

- The rules would apply to EU-based companies and non-EU companies generating substantial revenue in the EU.

- Non-compliant companies could face damages, fines, and potential exclusion from public procurement.

- The proposal includes provisions for national helpdesks, detailed guidelines, and engagement with stakeholders.

- Company directors would be responsible for implementing a transition plan compatible with a 1.5°C global warming limit.

- Rapporteur Lara Wolters emphasizes the need for binding rules, alignment with international best practices, and legal consequences for non-compliance.

- The European Parliament has consistently called for mandatory due diligence legislation.

- The proposal sets the stage for negotiations with the Council on the final text of the legislation.

Implications, Consequences, and Hurdles:

The adoption of the proposed directive on corporate sustainability due diligence carries several implications, consequences, and potential hurdles:

-

Increased Corporate Accountability: The directive would hold companies accountable for their impact on human rights and the environment, requiring them to identify and mitigate negative effects. This could result in a more responsible and sustainable business conduct.

-

Improved Transparency and Stakeholder Engagement: The directive emphasizes engaging with stakeholders affected by a company's actions, such as human rights defenders and environmental activists. The introduction of a grievance mechanism and monitoring effectiveness would promote transparency and dialogue.

-

Potential Compliance Challenges: Implementing the due diligence obligations across complex value chains may pose challenges for companies. Ensuring compliance and adapting business models accordingly may require significant effort and resources.

-

Enhanced Supervision and Sanctions: The proposal suggests establishing supervisory authorities with the power to impose sanctions. Non-compliant companies could face fines, damages, and exclusion from public procurement. However, the effectiveness of supervision and enforcement will depend on robust implementation and cooperation among member states.

-

Legal Consequences and Access to Justice: Victims of harm resulting from non-compliant companies would have the opportunity to seek justice in court. This provision aims to ensure accountability and provide remedies for those affected.

-

Transition to Climate-Compatible Business Models: The rule highlights the role of companies in combating climate change. Directors of companies with over 1000 employees would be directly responsible for implementing a transition plan aligned with a 1.5°C global warming limit. This may require significant changes in business strategies and practices.

-

Potential Economic Impact: The introduction of stricter due diligence requirements and potential fines could have financial implications for companies, particularly larger ones. Compliance costs and the need for extensive monitoring may affect business operations and profitability.

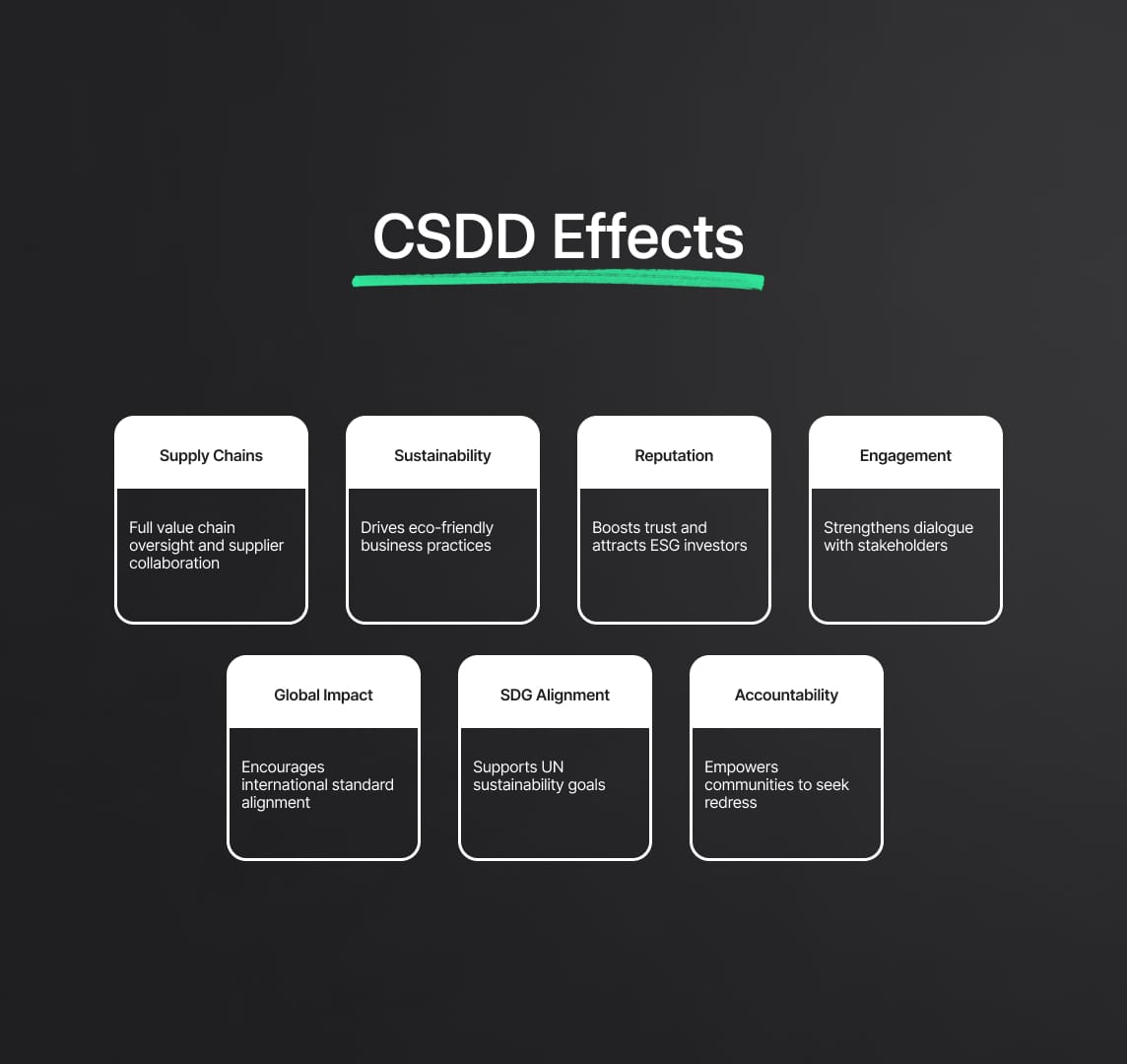

CSDD Effects

The proposed directive on corporate sustainability due diligence can have far-reaching ripple effects on the relevant industry and beyond. Here are some potential ripple effects:

Supply Chain Transformation: expansion of due diligence obligations to value-chain partners, including activities related to sale, distribution, and transport, would likely lead to a significant transformation in supply chain management practices. Companies would need to assess and monitor their entire value chain for compliance with human rights and environmental standards, potentially leading to increased scrutiny and collaboration with suppliers and partners.

Shift Towards Sustainable Practices: emphasis on mitigating negative impacts on human rights and the environment would likely drive companies to adopt more sustainable practices. This could include investing in renewable energy, reducing emissions, improving waste management, and ensuring responsible sourcing of raw materials. The ripple effect of these actions could contribute to broader industry-wide sustainability efforts.

Competitive Advantage and Reputation: companies that proactively implement robust due diligence measures and demonstrate a commitment to sustainability may gain a competitive advantage. Consumers and investors are increasingly conscious of corporate responsibility, and companies adhering to the proposed directive's standards may attract a more environmentally and socially conscious customer base and secure sustainable investment.

Enhanced Collaboration and Dialogue: the requirement for companies to engage with stakeholders, including human rights defenders and environmental activists, could foster greater collaboration and dialogue between businesses, civil society, and affected communities. This engagement may lead to better understanding of the impacts, more effective remediation efforts, and the identification of innovative solutions.

Global Influence and Harmonization: The proposed rule focus on sustainability and responsible business conduct could have a ripple effect beyond the EU. It may inspire other regions and countries to consider similar legislation and contribute to the harmonization of international standards for corporate due diligence. This alignment could facilitate global efforts to address human rights abuses, environmental degradation, and climate change.

Integration of Sustainable Development Goals (SDGs): alignment with the United Nations' Sustainable Development Goals, providing a framework for companies to contribute to the achievement of these goals. By incorporating SDGs into their due diligence processes, companies can demonstrate their commitment to sustainable development and contribute to broader societal and environmental objectives.

Stakeholder Empowerment: focus on stakeholder engagement and the introduction of a grievance mechanism empowers affected individuals and communities. It provides a platform for their voices to be heard and enables them to hold companies accountable for any harm caused. This empowerment can lead to a more inclusive and equitable business environment.

Key Assessments and Probabilities

| Assessment | Probability | Justification |

|---|---|---|

| Adoption of the directive by the EP | 0.9 | MEPs on the Legal Affairs Committee have already adopted their position, indicating a high probability. |

| Inclusion of extended application | 0.8 | MEPs extended the application of the rules, suggesting a reasonable probability. |

| Establishment of supervisory authorities | 0.7 | The article mentions MEPs' intention to establish supervisory authorities, indicating a moderate probability. |

| Compliance challenges for companies | 0.8 | Implementing due diligence across complex value chains can be challenging, suggesting a reasonable probability. |

| Economic impact on companies | 0.6 | The introduction of stricter requirements and potential fines may have financial implications, indicating a moderate probability. |

| Shift towards sustainable practices | 0.9 | The emphasis on mitigating negative impacts would likely drive companies to adopt more sustainable practices, indicating a high probability. |

| Competitive advantage and reputation | 0.7 | Companies implementing robust due diligence measures may gain a competitive advantage, indicating a moderate probability. |

| Global influence and harmonization | 0.6 | The proposed directive's focus on sustainability could influence global standards, suggesting a moderate probability. |

Directive on Corporate Sustainability Due Diligence: Thoughts from Grand Compliance

The proposed directive on corporate sustainability due diligence reflects the growing global emphasis on responsible business conduct. By holding companies accountable for their impact on human rights and the environment, the directive seeks to create a more sustainable and equitable business landscape. The inclusion of value-chain partners and engagement with stakeholders expands the scope of responsibility and encourages collaboration.

However, the implementation of the directive may pose challenges for companies, particularly in complex value chains. Ensuring compliance, adapting business models, and managing potential economic impacts will require significant effort and resources. The establishment of supervisory authorities and the imposition of fines aim to enforce compliance but will depend on effective implementation and cooperation among member states.

The regulatory proposal presents an opportunity for companies to transform their supply chains and adopt more sustainable practices. By integrating due diligence into policies and engaging with stakeholders, companies can enhance their reputation and gain a competitive advantage in a market where sustainability is increasingly valued.

While it represents a significant step forward in promoting corporate sustainability and accountability, there are potential challenges ahead. Balancing the compliance burden with the needs of small and medium enterprises (SMEs) will be crucial, as they are not directly within the scope of the proposal. Ensuring that the directive's implementation does not disproportionately burden SMEs will be important for fostering inclusivity and avoiding unintended negative consequences.

Overall, the regulation reflects a broader societal shift towards responsible business practices and sustainability. It signifies the growing recognition that companies have a significant role to play in addressing pressing global challenges, such as human rights abuses, environmental degradation, and climate change. By establishing clear obligations, sanctions, and guidelines, the directive aims to create a more transparent, accountable, and sustainable business environment.

Reduce your

compliance risks