Crisis Management and Deposit Insurance (CMDI) package

Launched by the European Commission on April 2, 2024, the CMDI package strengthens EU financial stability by amending key directives like DGSD, SRM, and BRRD. This critical legislation enhances the resilience of the EU's banking sector, ensuring robust crisis management and deposit insurance.

The Crisis Management and Deposit Insurance (CMDI) package, a crucial legislative proposal, was unveiled by the European Commission (Commission) on April 2, 2024. This extensive package of laws represents a major advancement in strengthening the EU's framework for credit institution recovery and resolution. This legislative package, which consists of several carefully drafted amending proposals, is intended to improve the resilience and effectiveness of the EU financial system. Fundamentally, the CMDI package tackles important aspects of deposit insurance and crisis management, demonstrating the Commission's steadfast dedication to supporting the integrity and stability of the EU banking sector.

The CMDI package ushers in a new era of regulatory refinement and adaptability in response to changing financial landscapes by amending important directives and regulations, such as the Deposit Guarantee Schemes Directive (DGSD), the Single Resolution Mechanism (SRM) Regulation, and the Bank Recovery and Resolution Directive (BRRD). This introduction lays the groundwork for a thorough examination of the legislation package's revolutionary potential and strategic imperatives.

Source

[1]

EU Financial Stability: Key Foundations of BRRD and SRM Regulations

Following the global financial crisis of 2007–2008, the European Union (EU) put important structures in place to protect its financial sector from future disasters. The Single Resolution Mechanism (SRM) Regulation and the Bank Recovery and Resolution Directive (BRRD) are two of the main cornerstones of this regulatory framework. The European Commission's enactment of these guidelines has had a substantial impact on how credit institutions in the EU handle and resolve crises. Let's examine the core ideas and important rules that each of these regulatory regimes established.

Key establishments:

- Bank Recovery and Resolution Directive (BRRD):

- Creation of a thorough framework for the rescue and dissolution of systemically important investment companies and EU credit institutions.

- Mandate that systemically important investment businesses and lending institutions create strong recovery plans so they can foresee and avert future disasters.

- Encouraging (national) resolution authorities to act and resolve failing or likely to fail (FOLF) companies in order to protect the stability of the financial system.

- Single Resolution Mechanism (SRM) Regulation:

- The establishment of the Single Resolution Mechanism, which is relevant to all credit institutions that are active in the Banking Union member states of the European Union.

- Alignment with the BRRD's resolution framework, but with the Single Resolution Board (SRB) taking on important responsibilities usually given to national resolution bodies.

- The Single Resolution Fund (SRF) was established in order to support the Banking Union's financial stability and enable the orderly resolution of failing banks.

Enhancing EU Banking Regulations: Proposed Amendments and Objectives

The European Union (EU) maintains its resolve to strengthen the stability of its banking industry by putting out proposals to improve the regulatory frameworks that are currently in place. This approach demonstrates a proactive attempt to increase the efficacy of resolution and deposit protection procedures for EU banks, as well as a planned reaction to flaws within the current regime that have been highlighted. Let's examine the main goals of these suggested changes and how they may affect the stability of the EU financial system.

Main Aims of the Proposed Amendments:

- Resolving Identified Deficiencies: A thorough examination of the current regulatory framework revealed several flaws, which the proposed revisions aim to address. The reforms aim to improve the overall resilience and flexibility of the regulatory framework that oversees banks in the European Union by identifying and addressing these shortcomings.

- Enhancing Effectiveness: Increasing the efficiency of the EU banks' deposit protection and resolution processes is one of the main goals of the proposed modifications. This involves optimizing procedures, strengthening early intervention systems, and strengthening security measures to guarantee quick and effective resolution in case of financial difficulties.

- Improving Financial Stability: The proposed reforms imply a dedication to bolstering the EU's financial stability. The reforms seek to promote a more robust banking industry that can withstand economic shocks and protect depositor interests by correcting flaws and enhancing the efficacy of regulatory systems.

These proposed changes demonstrate the EU's steadfast commitment to upholding a strong and stable financial ecosystem by taking a proactive step to strengthen the regulatory framework governing EU banks.

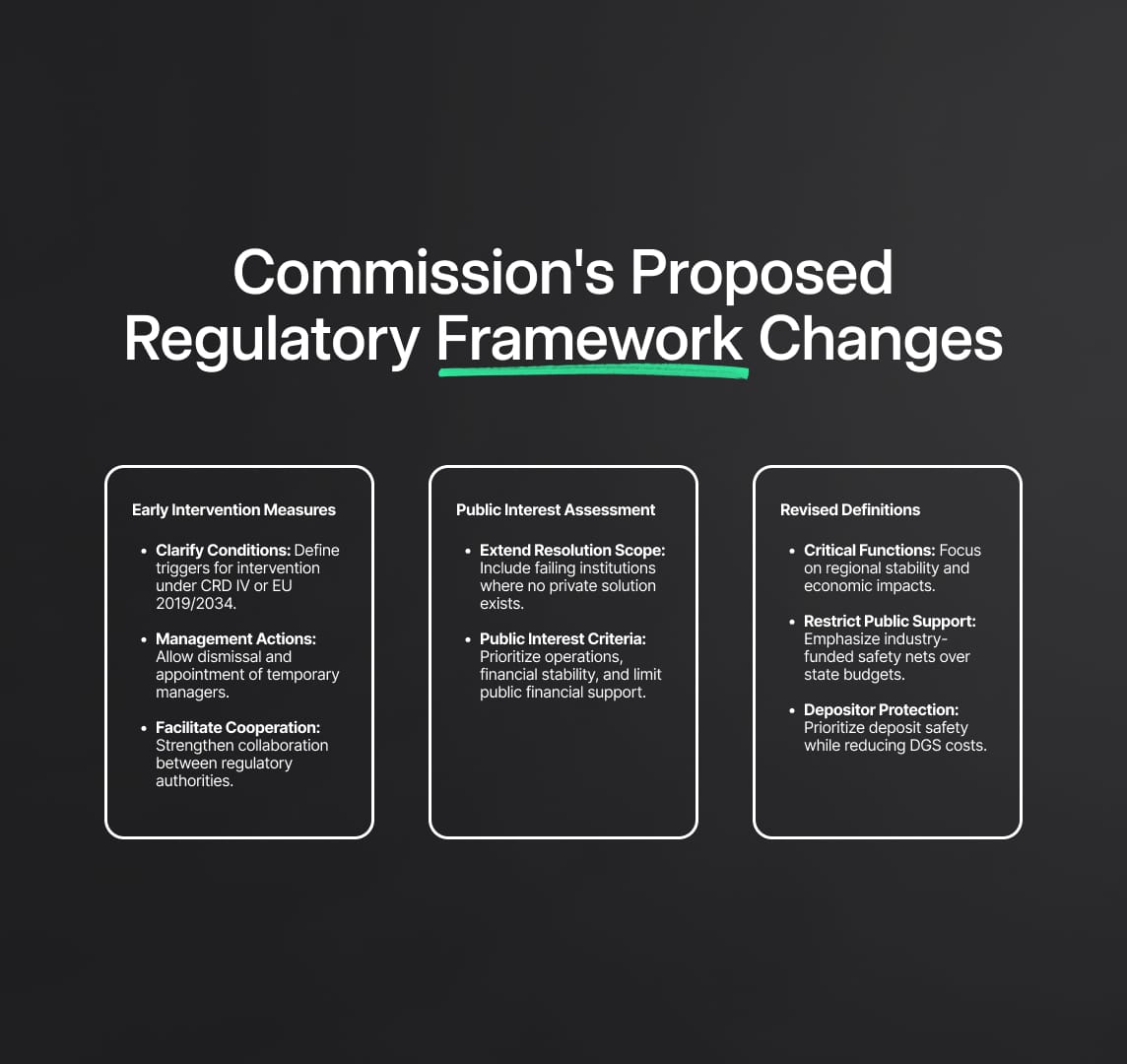

Commission's Suggested Changes to the Current Regulatory Framework

Early intervention measures:

- Clarification of Conditions: To eliminate confusion, the Commission recommends changing the requirements for implementing early intervention measures. This entails defining the conditions that allow early intervention measures to be put into place. For example, when the Investment Firms Directive (EU) 2019/2034 or the Capital Requirements Directive IV (CRD IV) require supervisory measures, but the institution has not implemented them or deems them insufficient to address issues that have been identified.

- Removal of Management and Appointment of Temporary Managers: As early intervention strategies, the recommendations call for the dismissal of management and the hiring of temporary managers. The goal of this is to make methods and rules for interfering in the management of financially troubled organizations more transparent.

- Facilitation of Cooperation: Cooperation between Competent Authorities and Resolution Authorities is to be facilitated by the proposed modifications to the Bank Recovery and Resolution Directive (BRRD). In order to effectively manage and resolve crises, cooperation amongst the regulatory authorities tasked with managing financial instability is crucial for improved coordination and communication.

Public interest assessment

- Extension of Resolution Scope: The plan proposes to examine the public interest assessment in order to extend the resolution's reach. In particular, where no private solution is available, this involves determining whether there is a public interest in resolving a credit institution that has been judged failing or likely to fail (FOLF).

- Public Interest Criteria: If it is decided that the public interest would be served, the resolution authorities will step in utilizing BRRD mechanisms. This covers goals including safeguarding the credit institution's vital operations, financial stability, and utilization of extraordinary public financial support to a minimum.

- Revised definitions:

- Critical Functions: The term "critical functions" is defined to highlight how disruptions affect regional financial stability and the actual economy.

- Restricting Public Support: To emphasize the preference for industry-funded safety nets over taxpayer-funded support, the goal of restricting the use of extraordinary public support now specifically mentions support given by a Member State's budget.

- Depositor Protection: It is made clear that the goal of depositor protection is to safeguard depositors as much as possible while limiting losses for deposit guarantee schemes (DGS). This suggests that resolution is preferred over insolvency if it would result in lower costs for the DGS.

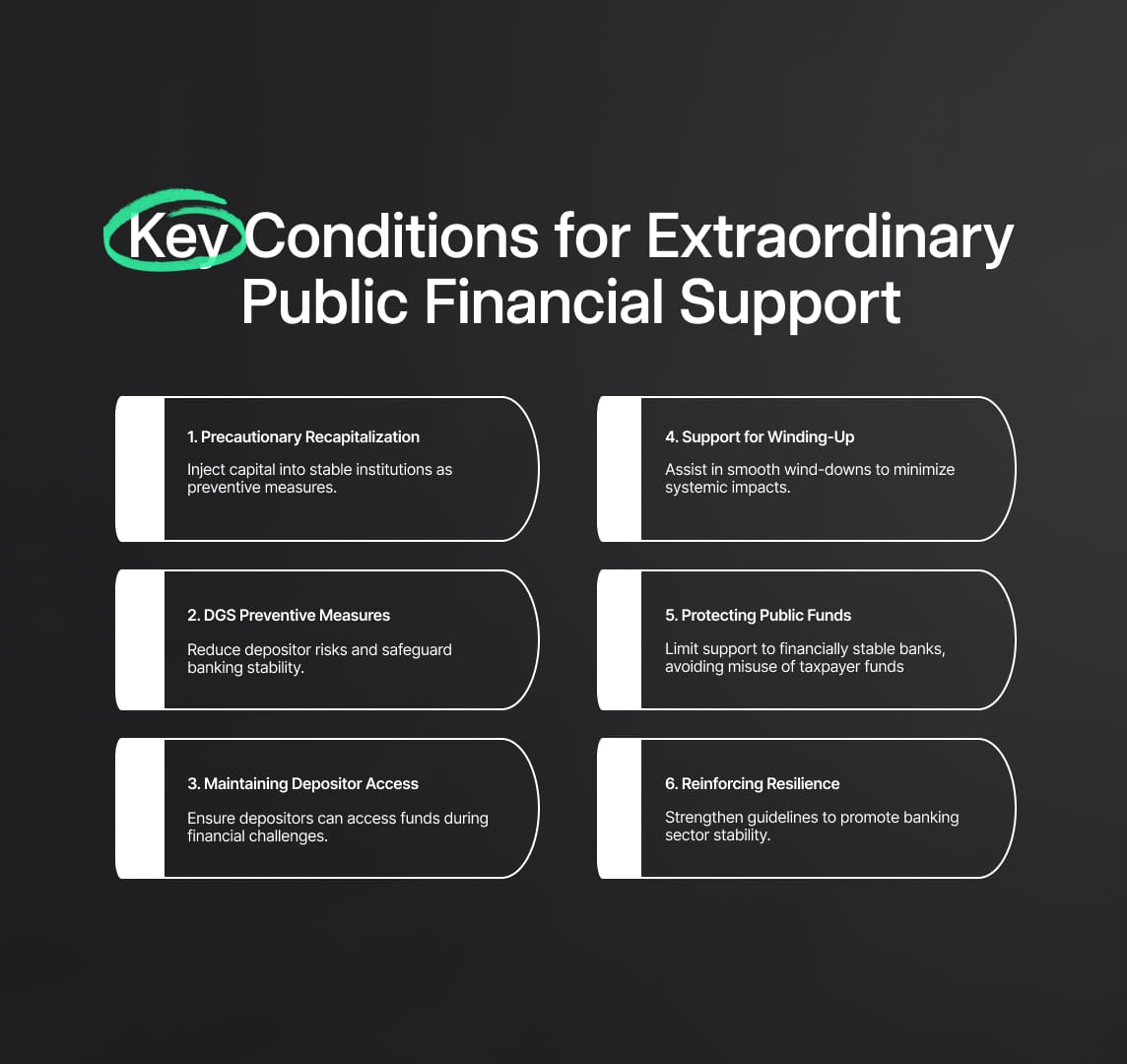

Key Conditions for Providing Extraordinary Public Financial Support:

In the course of maintaining financial viability and stability in the banking sector of the European Union, the Commission has put out proposals to improve the criteria for granting exceptional public financial support. The aforementioned modifications aim to institute stringent guidelines that will regulate the use of public funds, guaranteeing that they are distributed prudently and solely to establishments that exhibit financial stability. Let's examine the main features of the Commission's plan, which are designed to protect taxpayer interests and strengthen the banking industry's resilience.

- Precautionary Recapitalization: According to the idea, instances of precautionary recapitalization should be the only ones that receive public funding outside of resolution. In order to support a financial institution's financial stability and viability, capital is injected into it as a preventive measure.

- Preventive Measures of Deposit Guarantee Schemes (DGS): In order to maintain the long-term survival and financial stability of credit institutions, the Commission recommends that extraordinary public financial support be given through DGS preventive measures. These steps are intended to reduce risks to depositors and preserve the stability of the banking industry.

- Maintaining Depositor Access: DGS's extraordinary financial assistance may also include actions taken to protect depositors' access to their money. In difficult financial circumstances, this guarantees the availability of banking services and upholds depositor faith.

- Assistance during Winding-Up processes: The idea suggests that additional forms of assistance provided during winding-up processes might be taken into account when determining exceptional public financial assistance. These steps could be taken to help ensure a smooth wind-down and reduce any negative effects on the financial system.

These requirements are meant to protect against the supply of support to financially non-viable banks and to ensure the judicious and focused use of public funds, all the while fostering the stability and resilience of the banking industry.

Depositor Preference

In order to improve uniformity and clarity in the depositor preference hierarchy, the Commission is proposing changes to Article 108 of the Bank Recovery and Resolution Directive (BRRD). At the moment, BRRD sets up a three-tiered structure that gives covered deposits and Deposit Guarantee Scheme (DGS) claims priority over preferred non-covered deposits. By creating a single-tier depositor preference and granting legal preference to all deposits—including non-covered, non-preferred deposits like corporate deposits exceeding EUR 100,000—the proposed amendment seeks to simplify the hierarchy. By ensuring that all deposits, regardless of category, are given priority over regular unsecured claims, this modification helps to maintain stability and justice in the insolvency process. The modification also removes DGS/covered deposits' super-preferred, creating a consistent depositor preference structure in which all deposits are ranked equally and above regular unsecured claims.

MREL Enhancements: Minimum Requirements for Own Funds and Eligible Liabilities

As part of resolution planning, resolution authorities are essential in identifying preferred and alternative resolution methods and preparing the application of pertinent instruments for efficient execution. Bail-in, which involves writing down and converting own funds and eligible liabilities to absorb losses and recapitalize the bank after resolution, is typically recommended for large and complicated institutions. There is no comprehensive regulation for transfer strategies in the existing framework, despite its focus on the Minimum Requirement for Own Funds and Eligible Liabilities (MREL) calibration for bail-in schemes. In order to give a better legal foundation for differentiating between MREL calibration for transfer methods, the Commission has proposed modifications.

Additionally, amendments clarify that this power should be applied based on the estimation of the combined buffer requirement specified by a delegated act, addressing a legal ambiguity regarding resolution authorities' authority to forbid certain distributions when entities fail to meet the required combined buffer. The proposed modifications mandate that the European Banking Authority draft this methodology.

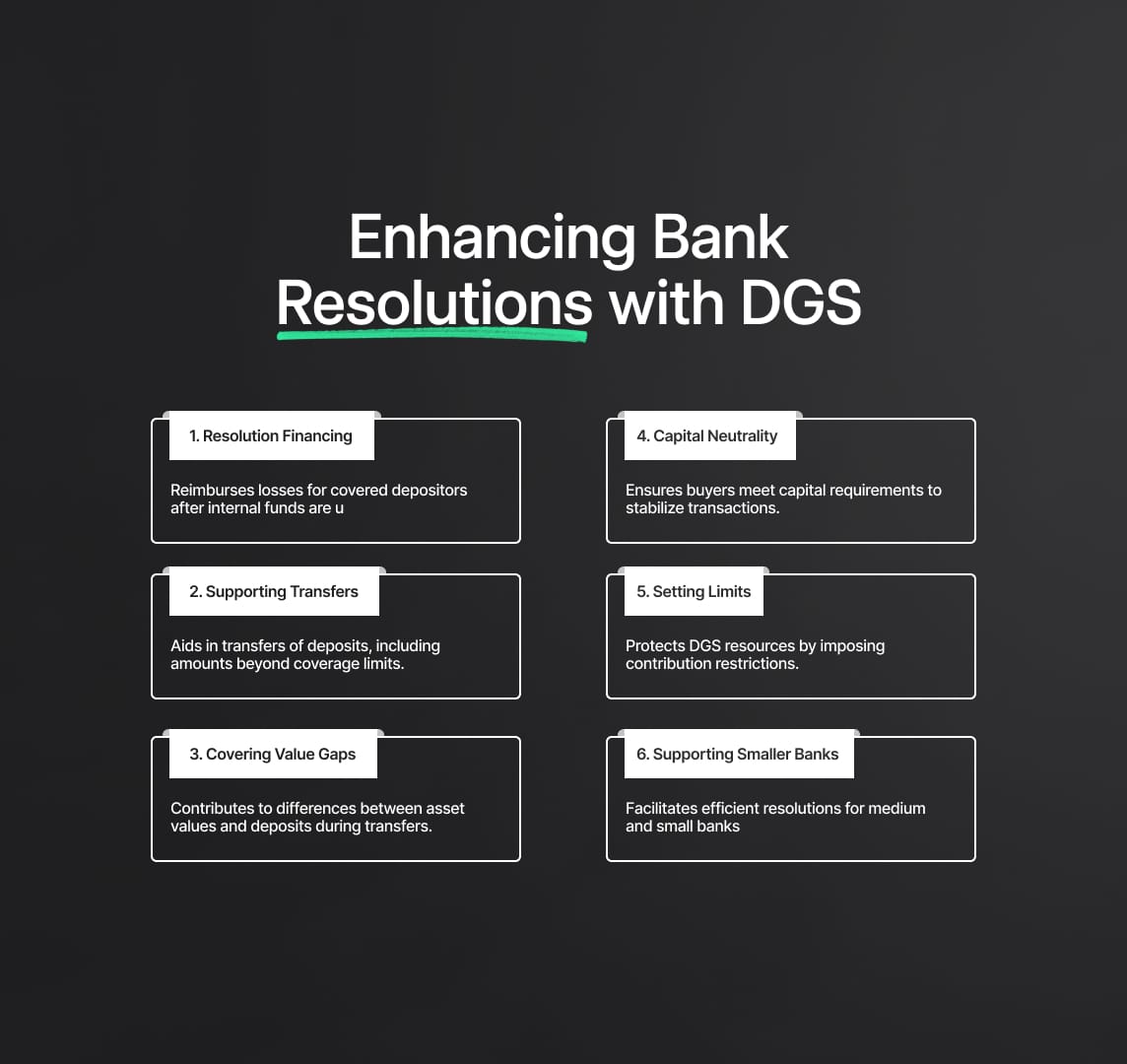

Improving Bank Resolution Proportionality: Making Use of Deposit Guarantee Schemes (DGS)

The application of Deposit Guarantee Schemes (DGS) is essential for preserving financial stability and protecting depositor interests in the context of bank resolution. The Commission's proposed amendments aim to improve the resolution framework's DGS usage's proportionality and clarity. The purpose of these revisions is to ensure the maintenance of DGS functioning and resources while facilitating more efficient resolution processes, especially for smaller or medium-sized banks. These are the ways that DGS can be used in resolution:

- Complementing Resolution Financing Arrangements: According to the BRRD framework, the bank's internal resources must provide the majority of the funds for resolution. However, resolution financing mechanisms, such as the DGS, might be used when a specific amount of the bank's capital and liabilities have been used. DGS can specifically be utilized to reimburse covered depositors for losses they otherwise would have incurred.

- Supporting Transfer Transactions: It is made clear by Article 109 BRRD that DGS is able to assist with transfers involving covered deposits. Furthermore, DGS may, under specific circumstances, cover eligible deposits above the coverage threshold as well as deposits that are not covered by the DGS guarantee. Smoother resolution procedures are guaranteed by this clause, particularly for smaller or medium-sized banks looking to enter the market.

- Covering Value Differences: In a resolution, the DGS may contribute all or a portion of the difference that exists between the value of transferred assets and the value of deposits made to a buyer or bridging institution. This guarantees the protection of depositors' interests and aids in maintaining stability during transfers.

- Ensuring Capital Neutrality: DGS is allowed to contribute in transactions when the buyer is required to make a contribution in order to maintain capital neutrality and comply with their capital requirements. In addition to preserving the buyer's financial stability, this makes resolution procedures run more smoothly.

- Setting limits: Contributions to resolution are nonetheless subject to a number of restrictions in order to guard against depletion and guarantee the DGS's continuous operation. By taking this precaution, DGS resources are protected and their ability to successfully carry out their duties is preserved.

Single Resolution Mechanism Regulation (SRMR): Addressing CMDI Review Proposals

The changes that have been proposed for the Bank Recovery and Resolution Directive (BRRD) and the Single Resolution Mechanism Regulation (SRMR) are highly similar, highlighting the connections between these two pieces of legislation. By addressing a number of concerns raised by the Crisis Management and Deposit Insurance (CMDI) study, these changes hope to improve the resolution framework's efficacy and coherence. The governance structure, the duties of the Single Resolution Board (SRB), the ranking of claims under the Single Resolution Fund (SRF), and the information sharing between competent and resolution authorities are among the other changes included in the SRMR review plan. The CMDI legislative package has been sent to the European Parliament and the Council for consideration going forward. The impending elections to the European Parliament in May 2024 may have an impact on the legislative process.

Reduce your

compliance risks