DAC 8 & MiCA Regulation

The European Union pioneers in cryptoasset regulations with the DAC8 Directive and MiCA Regulation. These landmark legislations ensure tax transparency, protect consumers, and foster innovation, positioning the EU as a global leader in digital finance governance

DAC8 & MiCA Regulation: Shaping the Future of Cryptoasset Governance and Transparency

As the digital finance landscape undergoes rapid transformation, the European Union (EU) stands at a pivotal juncture, poised to lead the way in establishing robust standards for cryptoasset governance. The introduction of the DAC8 directive, with its emphasis on tax clarity, showcases the EU's forward-thinking approach to navigating the complexities of the crypto world.

However, the DAC8 is not an isolated endeavor. It's a cornerstone of a broader, more encompassing strategy that integrates the MiCA Regulation. Together, these initiatives represent the EU's comprehensive vision for a well-regulated digital asset ecosystem. By harmonizing with the OECD's CryptoAsset Reporting Framework, the EU further demonstrates its commitment to not only setting but also aligning with global benchmarks.

The importance of tax transparency in the realm of digital assets cannot be overstated. Beyond the obvious benefits of ensuring fair revenue collection, it plays a pivotal role in fostering a stable environment where businesses can innovate, investors can participate with confidence, and consumers can transact with a sense of security. The global and decentralized nature of cryptoassets, however, presents inherent challenges. Ensuring consistent oversight, preventing potential misuse, and maintaining trust in such a dynamic environment requires a nuanced and adaptable approach.

This is where the DAC8 steps in, offering a solution tailored to the unique challenges of the digital age. By mandating that cryptoasset service providers operating within the EU maintain meticulous records and report pertinent transactions, the directive seeks to bridge the information gap that often exists in decentralized financial systems. Its comprehensive scope, which extends to areas such as e-money and the emerging domain of central bank digital currencies, underscores the EU's intent to stay ahead of the curve.

When viewed alongside the MiCA Regulation, the DAC8's objectives become even clearer. Together, they aim to establish a cohesive, transparent, and accountable framework for cryptoassets across the EU. This holistic approach not only ensures the protection of member states' fiscal and economic interests but also paves the way for a more streamlined and efficient digital finance ecosystem. By providing clarity and consistency for businesses, investors, and consumers alike, the EU is setting the stage for a future where digital assets are both trusted and integral to the region's financial landscape.

MiCA and DAC8: European Union's Strategic Regulatory Measures

The digital finance realm, pulsating with innovation and potential, witnesses the European Union (EU) at its helm, pioneering cryptoasset regulations. The DAC8 Directive and MiCA Regulation are landmark legislations that stand testament to the EU's visionary approach. For those navigating the EU's cryptoasset landscape or stakeholders aiming to harness its vast potential, understanding these regulations becomes pivotal.

MiCA Regulation

The Markets in Crypto-Assets Regulation (MiCA) is the EU's regulatory masterpiece, designed to address both the challenges and opportunities posed by the burgeoning cryptoasset market. By instilling clarity and consistency, MiCA establishes a framework that stakeholders across the spectrum can rely upon.

1. Diverse Cryptoasset Classification

- Utility Tokens: Often linked to decentralized platforms or applications, utility tokens grant holders access to a particular service or function. Their value isn't derived from underlying assets, but rather their utility within a specific ecosystem.

- Asset-Referenced Tokens: These are tokens whose value is tied to one or multiple external assets. Essentially, they can be perceived as stablecoins, promising stability in a volatile market.

- E-money Tokens: Representing digital versions of fiat currencies, e-money tokens serve electronic transactions and offer a digital storage of value. Given their nature, they come under closer scrutiny to ensure they maintain parity with their underlying fiat representation.

2. Prioritizing Consumer and Investor Safety

By imposing transparent disclosure requirements and insisting on stringent authorization procedures for cryptoasset providers, MiCA champions consumer and investor safety. These measures help avert potential scams, ensuring that only legitimate entities operate within the EU's jurisdiction.

3. Governance and Operational Standards

MiCA mandates cryptoasset service providers to meet exacting operational, organizational, and governance standards. This ensures that these platforms can withstand financial shocks, operational risks, and provide a dependable service to their users.

4. Anti-Money Laundering (AML) & Countering Terrorism Financing (CFT)

Recognizing the potential misuse of cryptoassets for illicit purposes, MiCA integrates robust AML and CFT standards tailored to address the unique challenges posed by the crypto sector.

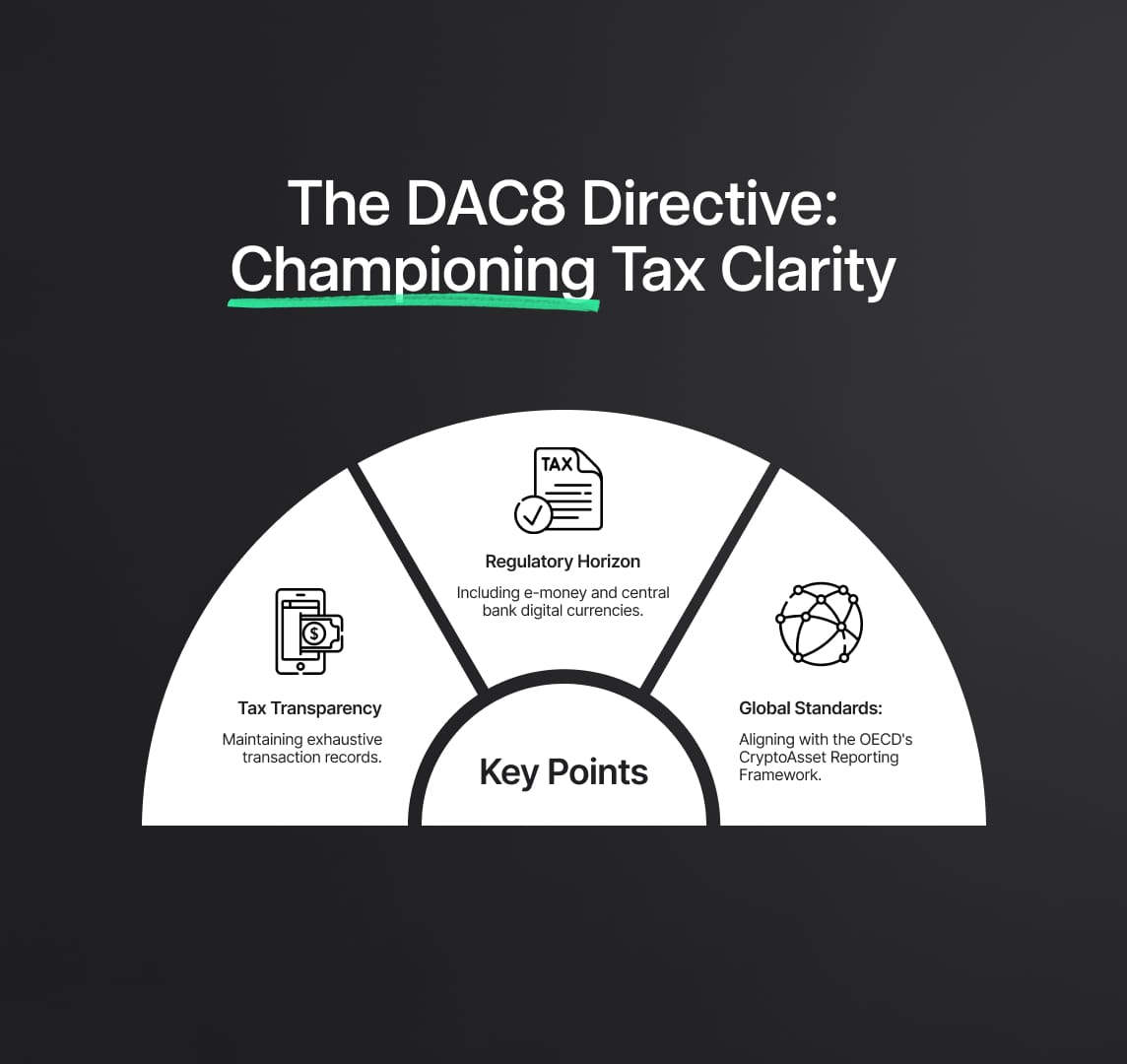

The DAC8 Directive: Championing Tax Clarity in the Digital Era

Building on the EU's ongoing efforts to foster tax transparency, the DAC8 Directive aims to adapt to the challenges introduced by the digital economy. It reflects the EU's commitment to ensuring that the digital realm, including cryptoassets, contributes fairly to public finances.

Key Tenets of DAC8

1. Enhancing Tax Transparency

DAC8 ensures that cryptoasset service providers maintain exhaustive transaction records. This drive towards transparency plugs potential loopholes, ensuring fair taxation and curbing evasion.

2. Expanding the Regulatory Horizon

By including e-money and central bank digital currencies (CBDCs) in its scope, DAC8 positions the EU at the forefront of global digital finance regulation, ensuring every digital asset gets its due attention.

3. Synergy with Global Standards

DAC8's alignment with the OECD's CryptoAsset Reporting Framework showcases the EU's vision of harmonizing its standards with globally accepted benchmarks, paving the way for international cooperation.

Impact Analysis: Envisioning the Future under MiCA and DAC8

1. Boost in Tax Revenues

The combined might of MiCA and DAC8 ensures a comprehensive cover on all taxable crypto transactions, promising an uplift in EU's tax revenues.

2. Legal Clarity and Business Growth

A consistent legal framework attracts enterprises. With the clarity provided by MiCA and DAC8, the EU becomes a magnet for crypto startups and established businesses alike.

3. Market Consolidation Challenges

While the regulations fortify the sector, stringent compliance requirements might pressurize smaller entities, driving potential market consolidations with bigger players taking the lead.

4. Nurturing a Trust-Driven Crypto Ecosystem

Transparency, robust regulations, and consumer safety measures will culminate in a trust-driven environment, catalyzing adoption and confidence in the EU's cryptoasset domain.

The European Union, armed with MiCA and DAC8, is architecting a transparent, robust, and growth-centric digital finance landscape. These regulations, while ensuring consumer protection and fiscal integrity, also nurture innovation, making the EU a global beacon in cryptoasset governance. Stakeholders, be it investors, businesses, or consumers, will find the EU's cryptoasset domain both welcoming and secure, thanks to these regulatory masterstrokes.

Reduce your

compliance risks