DORA Regulation: ICT Risk Management Guidelines

The Digital Operational Resilience Act (DORA) Regulation November 2024 guidelines strengthen ICT risk management and compliance to enhance financial sector resilience and mitigate systemic vulnerabilities.

A New Era for ICT Risk Management: the Digital Operational Resilience Act (DORA)

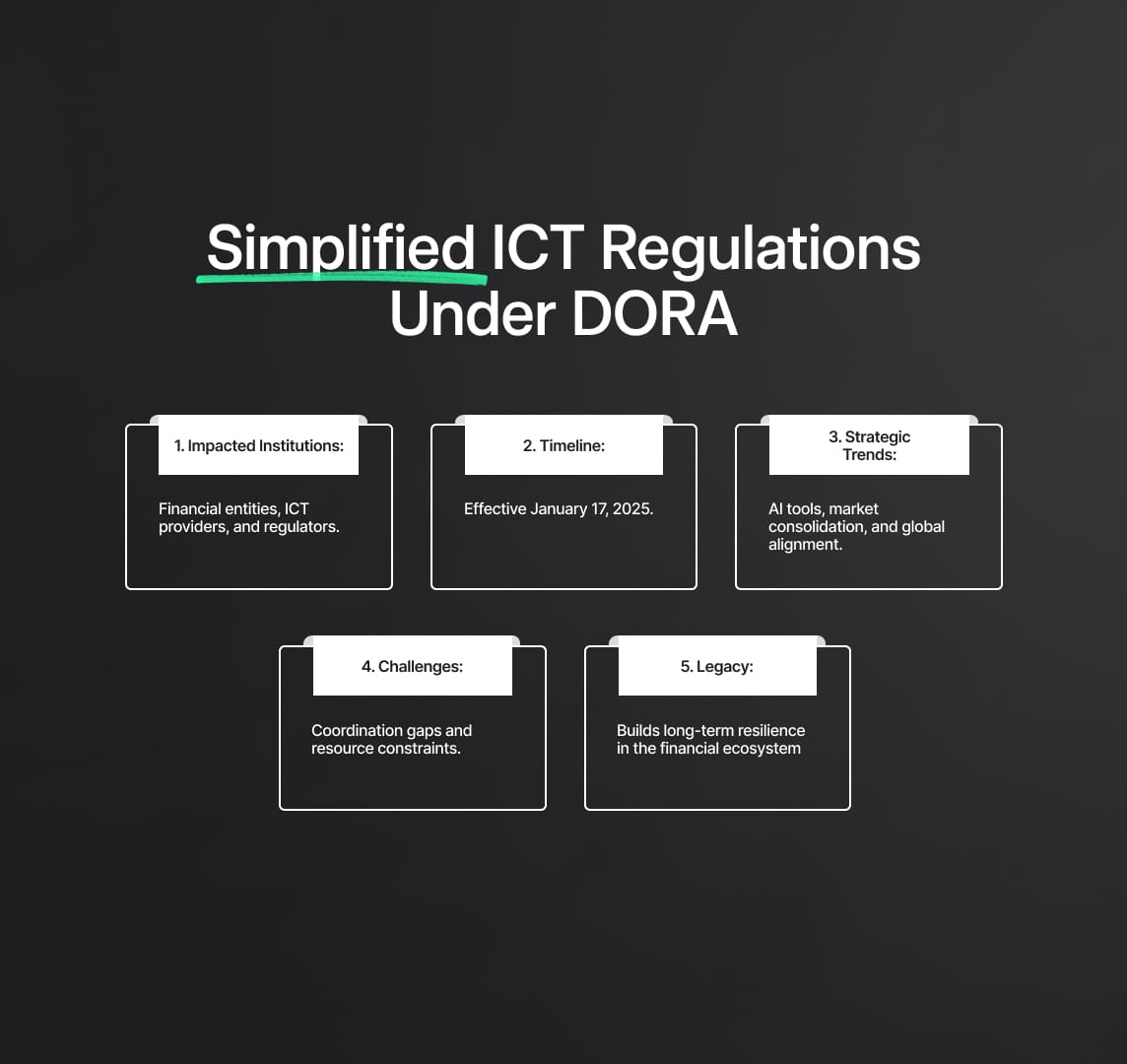

The Digital Operational Resilience Act (DORA), formally known as Regulation (EU) 2022/2554, is a landmark EU legislation set to fundamentally transform ICT Risk Management within the financial services sector. With its full implementation mandated from January 17, 2025, DORA introduces a comprehensive, harmonized framework to strengthen the digital resilience of virtually all EU financial entities and their critical ICT third-party providers. The regulation is a direct response to the financial system's escalating dependence on technology and the growing threat of sophisticated cyber-attacks, which jeopardise individual institutions and the stability of the broader financial ecosystem.

Central to DORA's mandate is a structure built on five critical pillars, which impose detailed obligations on financial entities:

- Comprehensive ICT Risk Management: Establishing a robust and well-documented framework as the foundation of digital resilience.

- Standardised ICT-Related Incident Reporting: Harmonising the process for classifying and reporting significant digital incidents to authorities.

- Advanced Digital Operational Resilience Testing: Implementing a rigorous regime of testing to identify and remediate vulnerabilities.

- Thorough ICT Third-Party Risk Management: Introducing stringent rules for managing risk from service providers, including a pioneering oversight framework for those deemed critical.

- Structured Information-Sharing: Facilitating the exchange of cyber threat intelligence and information between financial entities.

Under DORA, ultimate accountability for an organisation's digital operational resilience rests with its management body. The regulation's high-level principles are translated into granular requirements through specific Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS), detailing everything from governance and strategy to operational controls.

The Digital Operational Resilience Act replaces a fragmented landscape of national rules with a unified, directly applicable legal standard, ensuring consistency and enhancing supervisory cooperation across the EU. While posing significant implementation challenges, DORA presents a strategic opportunity for firms to advance beyond compliance and foster a culture of "resilience by design." In doing so, it aims to fortify the EU financial sector against major digital disruptions, secure financial stability, and build a trusted environment for future innovation.

Source

[1]

1. The Imperative for the Digital Operational Resilience Act (DORA)

The European Union's financial sector is at a pivotal moment, where its deep integration with digital technologies presents both unprecedented opportunities for innovation and significant sources of vulnerability. In response, the EU has established the Digital Operational Resilience Act (DORA). This comprehensive regulatory framework is designed to ensure all financial entities can effectively withstand, respond to, and recover from every type of ICT-related disruption and cyber threat.

1.1. Why DORA Was Created: The Need for Harmonised ICT Risk Management

The financial sector's profound dependence on Information and Communication Technology (ICT) is the primary driver behind DORA. While digital transformation provides benefits, it exposes financial entities to heightened ICT risk, including cyber-attacks and system failures. If not managed through robust strategies, these risks can trigger severe, cross-border disruptions, impacting the entire economy. The threat landscape is in constant flux, with sophisticated attacks like ransomware and supply chain vulnerabilities challenging financial institutions daily.

Prior to DORA, the EU's approach to ICT Risk Management was fragmented, consisting of a patchwork of national rules and inconsistent supervisory expectations. This created regulatory gaps and inefficiencies in addressing systemic, cross-border ICT threats. The Digital Operational Resilience Act rectifies this by creating a single, harmonized legal framework applicable to approximately 21 different types of financial entities and, crucially, their ICT third-party service providers. This ensures a consistent and high level of digital resilience across the Union.

Furthermore, the need for DORA extends to matters of geopolitical and economic security. The financial sector is critical infrastructure, and its stability is vital for public trust and national security. Cyber threats can be leveraged by state actors as a form of economic coercion. By mandating a uniform standard of resilience, DORA strengthens the EU’s collective defense against hybrid threats, ensuring no single Member State becomes a weak link in the Union's financial system.

1.2. DORA Unveiled: Legal Basis, Scope (Article 2), and Key Definitions (Article 3)

The Digital Operational Resilience Act is established by Regulation (EU) 2022/2554, which forms the Level 1 legal foundation of the framework. It is complemented by Directive (EU) 2022/2556, which makes necessary amendments to other directives to ensure alignment.

The core objectives of DORA are to:

- Strengthen and harmonise ICT risk management practices.

- Create a streamlined process for reporting ICT-related incidents.

- Mandate regular and advanced digital operational resilience testing.

- Introduce robust rules for ICT third-party risk, including an oversight framework for critical providers.

- Facilitate voluntary information sharing on cyber threats.

The scope of DORA, detailed in Article 2, is intentionally broad to cover the entire financial ecosystem. It applies to entities including:

- Credit institutions, payment institutions, and electronic money institutions.

- Investment firms and crypto-asset service providers (CASPs).

- Central counterparties (CCPs) and central securities depositories (CSDs).

- Trading venues, trade repositories, and securitisation repositories.

- Insurance/reinsurance undertakings and intermediaries.

- Managers of alternative investment funds (AIFMs) and UCITS.

- Institutions for occupational retirement provision (IORPs).

- Credit rating agencies, audit firms, and crowdfunding providers.

Significantly, DORA also applies directly to ICT third-party service providers designated as "critical." This extensive scope is balanced by the proportionality principle (Article 4), requiring entities to implement the rules in a manner suited to their size, risk profile, and complexity.

Article 3 provides key definitions essential for uniform application, including:

- ICT risk: Any identifiable circumstance related to network and information systems that could cause adverse effects.

- Digital operational resilience: The ability of a financial entity to build, assure, and review its operational integrity and reliability.

- ICT third-party service provider: An undertaking that provides ICT services.

- Critical ICT third-party service provider: A provider designated as critical under Article 31.

- ICT-related incident: An unforeseen event that has an adverse impact on the network and information systems supporting an entity's critical functions.

This broad scope and common lexicon are vital for mitigating systemic risk. By ensuring all actors adhere to the same high standards and use the same definitions, DORA enables effective communication and coordinated responses between financial entities and supervisors, creating a holistic view of threats across the Union.

1.3. The DORA Timeline: Key Milestones to Full Application

The path to full DORA compliance is a structured, multi-year process. The regulation officially entered into force on January 16, 2023, but its provisions will become fully applicable on January 17, 2025. This two-year preparatory phase is critical for both regulators and the industry.

During this 2023-2024 period, the European Supervisory Authorities (EBA, EIOPA, and ESMA) are developing the detailed Level 2 measures (Regulatory Technical Standards - RTS and Implementing Technical Standards - ITS) and Level 3 measures (Guidelines). These technical standards provide the granular rules needed for practical implementation. This phased, consultative approach allows the industry to provide feedback, ensuring the final rules are effective and practical. The designation process for Critical ICT Third-Party Providers (CTPPs) is scheduled to begin in 2025, using the Registers of Information collected from financial entities. This timeline gives entities the necessary period to conduct gap analyses, plan their projects, and prepare for a smooth transition, ultimately leading to a more resilient EU financial sector.

2. Pillar I: ICT Risk Management under DORA (Articles 5-16)

The core of the Digital Operational Resilience Act is its comprehensive pillar on ICT Risk Management, detailed in Articles 5 through 16. This foundational pillar mandates that all financial entities establish, maintain, and continually evolve a robust framework designed to manage and mitigate ICT risk across its full lifecycle: from identification and protection to detection, response, and recovery.

2.1. The ICT Risk Management Framework: Governance, Strategy, and Proportionality (Art. 4, 5)

Under DORA, every financial entity must implement a sound, comprehensive, and well-documented ICT Risk Management framework. This is not a siloed policy but must be fully integrated into the entity's overall risk management system. The framework requires at least an annual review, or more frequently following major ICT-related incidents, and must undergo independent internal audits.

A defining feature of DORA is the principle of ultimate accountability. Article 5 explicitly places full responsibility for managing the entity’s ICT risk on its management body (e.g., Board of Directors). This body must approve the framework, oversee its implementation, and allocate the necessary budget and resources. Furthermore, its members are required to possess and actively maintain sufficient knowledge to understand and assess ICT risk and its strategic impact. This top-down governance model elevates ICT risk from a technical issue to a primary business concern, driving the necessary investment and fostering a company-wide culture of resilience.

The ICT Risk Management framework must contain all strategies, policies, procedures, and tools needed to protect all ICT and information assets, as specified in Article 5(3). In line with the proportionality principle (Article 4), the framework's complexity must be tailored to the entity's size, business model, and risk profile, ensuring requirements are scalable and do not place an undue burden on smaller institutions. The European Supervisory Authorities (ESAs) provide further detail on these requirements through Regulatory Technical Standards (RTS).

2.2. Core Components of the ICT Risk Management Framework (Art. 6-14)

DORA mandates a full-lifecycle approach by defining the essential components of the ICT Risk Management framework:

- Identification (Article 8): Entities must continuously identify all sources of ICT risk. This involves mapping business functions and the ICT assets that support them, maintaining a current inventory, and understanding all system configurations and interdependencies to define the full attack surface.

- Protection and Prevention (Article 9): Implement security policies and tools to ensure the resilience, continuity, and availability of ICT systems. This includes foundational security measures like access controls, encryption, patch management, and network security to protect data and infrastructure.

- Detection (Article 10): Establish mechanisms for the timely detection of anomalous activities and ICT incidents. This requires continuous monitoring and robust logging systems (e.g., SIEM) to enable a swift and effective response.

- Response and Recovery (Articles 11 & 12): Maintain a comprehensive ICT business continuity policy and detailed ICT disaster recovery plans. These plans, covering data backup, system restoration, and recovery procedures, must be tested annually to ensure critical functions can be promptly restored after a disruption.

- Learning and Evolving (Article 13): Create processes to gather intelligence on vulnerabilities and cyber threats. Entities must learn from both internal and external ICT incidents and near misses, using this knowledge to continuously improve the overall ICT Risk Management framework.

- Communication (Article 14): Develop communication plans for disclosing major ICT incidents to clients, counterparts, and the public where necessary. Internal communication plans are also required to inform relevant internal stakeholders.

This structure, spanning Articles 6 to 14, ensures the framework is not a static set of controls but a dynamic, integrated process. The lessons learned from an incident (Article 13) must feed back into risk identification (Article 8) and protection measures (Article 9), creating a cycle of continuous improvement that is essential for achieving sustainable digital operational resilience.

2.3. The Simplified ICT Risk Management Framework (Art. 16)

Recognising the financial sector's diversity, DORA applies proportionality through Article 16, which permits a simplified ICT Risk Management framework for certain entities. This provision is designed for firms with a smaller size, less complex business model, and lower risk profile, such as small and non-interconnected investment firms.

The simplified framework is not an exemption but a tailored application of DORA's rules, ensuring that compliance is not unduly burdensome for smaller participants. The specific criteria for eligibility and the exact elements of this simplified approach are defined further in Regulatory Technical Standards (RTS) from the ESAs. This balanced approach allows DORA to achieve its primary goal of sector-wide resilience while maintaining a competitive and diverse financial ecosystem, ensuring all entities, regardless of size, contribute to overall financial stability.

3. Pillar II: ICT-Related Incident Management and Reporting under DORA (Art. 17-23)

To minimize the impact of digital disruptions and enhance sector-wide awareness, the Digital Operational Resilience Act establishes a second pillar focused on the harmonised management, classification, and reporting of ICT-related incidents. This pillar ensures that financial entities have a clear process for handling crises and that supervisors receive timely, consistent information.

3.1. The Internal Incident Management Process (Art. 17)

Article 17 of DORA mandates that all financial entities implement a robust ICT-related incident management process. The objective is to ensure incidents are promptly detected, managed, and resolved, and that a thorough root cause analysis is performed to prevent recurrence.

The key elements of this internal process must include:

- Early Detection: Procedures to rapidly identify anomalous activities indicating a potential ICT-related incident.

- Management and Escalation: Clear protocols for managing incidents, including severity classification and escalation to the appropriate internal teams.

- Containment and Eradication: Pre-defined steps to limit an incident's impact and remove its underlying cause.

- Recovery: Procedures to restore affected ICT systems and data to normal operations.

- Logging: Maintaining detailed records for all incidents, covering their impact, response, and resolution for audits and reporting.

- Root Cause Analysis: Conducting in-depth post-incident reviews to identify the fundamental causes, which is essential for effective remediation.

A robust internal process under Article 17 is the bedrock for the information-sharing goals of Pillar V (Article 45). High-quality threat intelligence sharing depends on accurate, well-classified, and deeply analysed incident data. Without a solid internal foundation for managing and understanding incidents, any information shared externally would lack the reliability needed for effective collaborative defence.

3.2. Standardised Incident Classification and Materiality Thresholds (Art. 18)

A cornerstone of Pillar II is the requirement under Article 18 for financial entities to classify all ICT-related incidents and cyber threats using a common set of criteria. This standardization is vital for consistent reporting and effective supervision. The classification criteria, further detailed in Delegated Regulation (EU) 2024/1772, include:

- The number of clients or financial counterparts affected.

- The duration of the incident and service downtime.

- The geographical spread of the incident's impact.

- The severity of data losses (integrity, confidentiality, or availability).

- The criticality of the services affected.

- The direct and indirect economic impact.

These criteria are used to determine materiality thresholds that define a "major ICT-related incident." This common yardstick allows regulators across the EU to quickly grasp the severity of reported events and prioritise their oversight. It also enables the aggregation of data to identify sector-wide threat trends and systemic risks that might otherwise go unnoticed, making standardised classification a crucial tool for proactive systemic risk management.

3.3. Harmonised Reporting of Major Incidents (Art. 19-20)

DORA establishes strict, harmonised obligations for reporting major ICT-related incidents to the relevant competent authority. This process follows a clear lifecycle with demanding timelines:

- Initial Notification: An early warning must be sent to the competent authority without delay, and no later than four hours after classifying the incident as major.

- Intermediate Report: Follow-up reports are required to provide updates on the incident's status and the response efforts.

- Final Report: A comprehensive report must be submitted after the root cause analysis is complete, typically within one month of the incident's resolution.

The precise content, templates, and procedures for these reports are defined in Delegated Regulation (EU) 2025/301 (RTS) and Implementing Regulation (EU) 2025/302 (ITS).

Beyond mandatory reporting, DORA also encourages the voluntary notification of significant cyber threats to competent authorities to enhance collective situational awareness (Article 19(2)). Separately, entities must also inform their clients of major incidents that impact their financial interests (Article 14(2)).

This harmonisation of incident reporting is critical for effective cross-border supervision. By standardising timelines and content, DORA ensures that all national and European supervisors receive consistent and actionable data, enabling a swift, coordinated EU-level response to contain systemic threats.

4. Pillar III: Digital Operational Resilience Testing under DORA (Art. 24-27)

To ensure that ICT risk frameworks are practically effective, DORA's third pillar mandates a comprehensive and continuous program of Digital Operational Resilience Testing. This moves beyond theoretical checks to require advanced, intelligence-driven testing for designated financial entities, ensuring defences are robust in practice.

4.1. The DORA Testing Spectrum: From Basic Assessments to Advanced TLPT

As per Article 24, financial entities must establish and maintain a sound Digital Operational Resilience Testing program as an integral part of their ICT Risk Management framework. This program must be proportionate to the entity's size and risk profile and includes a spectrum of testing activities.

1. Basic Testing Requirements (Article 25): At a minimum, all financial entities must annually conduct a full range of appropriate tests on their ICT systems and tools. This includes:

- Vulnerability assessments and scans

- Open-source analyses

- Network security assessments

- Gap analyses and physical security reviews

- Source code reviews (where feasible)

- Scenario-based tests

- Compatibility, performance, and end-to-end testing

2. Advanced Testing: Threat-Led Penetration Testing (TLPT) (Article 26): For financial entities deemed significant and cyber-mature by competent authorities, DORA mandates a more rigorous form of Digital Operational Resilience Testing. These entities must conduct Threat-Led Penetration Testing (TLPT) at least every three years. TLPT is an intelligence-driven simulation of real-world attackers' tactics, techniques, and procedures (TTPs) against an entity's live, critical production systems. This provides a realistic assessment of an organisation's true capabilities to detect, prevent, and respond to a sophisticated cyber-attack, moving far beyond a simple compliance exercise.

4.2. General Requirements for All Resilience Testing (Art. 24-25)

DORA establishes several overarching requirements for all testing activities to ensure their integrity and effectiveness:

- Independence: Tests must be conducted by independent testers, who can be internal or external, to ensure objectivity (Article 24(4)).

- Remediation: All identified vulnerabilities and gaps must be promptly remediated.

- Learning and Validation: Lessons learned from testing must be integrated into the ICT Risk Management framework to drive improvement. After remediation, entities must validate that the fixes are effective (Article 24(6)).

These requirements create a mandatory closed-loop system for continuous improvement. The cycle of testing by an independent party, identifying vulnerabilities, remediating them, and embedding the lessons learned into the overall security posture ensures that Digital Operational Resilience Testing is a genuine catalyst for enhancing an entity's defences.

4.3. Threat-Led Penetration Testing (TLPT): Methodology and Tester Requirements (Art. 26-27)

The TLPT mandated by Article 26 is a highly demanding exercise. It must cover critical functions, involve live production systems, and should align with established methodologies like the TIBER-EU framework. The process often involves "purple teaming," where offensive (red) and defensive (blue) teams collaborate to maximise defensive improvements.

Article 27 sets stringent requirements for those conducting TLPT:

- External Testers: Must have the highest level of expertise and relevant certifications, operate under strict ethical standards, and possess a strong track record.

- Internal Testers: Can only be used for TLPT with prior approval from the competent authority. The entity must prove it has sufficient resources and that the testers are skilled. Crucially, if using an internal team, the entity must engage an external provider for threat intelligence to inform the test scenarios (Article 27(3)).

The emphasis on intelligence-led testing underpins the entire TLPT framework. This reliance on accurate, timely, and actionable threat intelligence—whether sourced commercially or through collaboration with public bodies like ENISA or national CERTs—is essential. The information-sharing arrangements of Pillar V (Article 45) are expected to become a key source of intelligence for informing TLPT scenarios, fostering a stronger collective defence for the entire EU financial sector.

5. Pillar IV: ICT Third-Party Risk Management (TPRM) under DORA (Art. 28-44)

The financial sector's deep reliance on external technology vendors introduces significant dependencies and concentration risks. In response, the Digital Operational Resilience Act's fourth pillar establishes a comprehensive framework for ICT Third-Party Risk Management (TPRM), fundamentally changing how financial entities manage their vendor relationships and introducing a groundbreaking direct oversight regime for providers deemed critical.

5.1. Foundational Principles for Managing ICT Third-Party Risk (Art. 28-29)

Under Article 28 of DORA, financial entities must manage ICT third-party risk as an integral component of their overall ICT Risk Management framework. This requires a strategic and proactive approach based on several key principles:

- Strategy on ICT Third-Party Risk: Entities must adopt and regularly review a formal strategy, including a specific policy on the use of ICT providers that support critical or important functions.

- Comprehensive Due Diligence: Before any engagement, entities must conduct thorough due diligence to assess a provider's suitability, capabilities, and security posture.

- Robust Contractual Arrangements: Contracts must contain specific, DORA-mandated provisions to ensure resilience and enable proper oversight (detailed in Article 30).

- Continuous Monitoring: The performance and risk profile of all ICT third-party providers must be monitored throughout the contract lifecycle.

- Tested Exit Strategies: Entities must develop and test viable exit strategies for critical functions to ensure operational continuity if a contract is terminated or a provider fails.

A foundational principle underpinning this entire pillar is non-delegable accountability. DORA makes it unequivocally clear that while a function can be outsourced, the responsibility for regulatory compliance and operational resilience cannot. Financial entities retain full and ultimate accountability for managing the risks associated with their ICT third-party providers.

Furthermore, Article 29 requires entities to identify and assess ICT concentration risk, evaluating dependencies on single providers or multiple contracts with closely connected providers.

5.2. The Register of Information: A Critical Tool for Oversight (Art. 28)

A key operational mandate of DORA's TPRM framework is the requirement for financial entities to maintain a Register of Information (RoI) covering all contractual arrangements for ICT services (Article 28(3)). This register is a critical tool for both internal risk management and supervisory oversight. It must include details such as the service type, provider identity (LEI), criticality assessment, and data processing locations.

The ESAs have established standardized Implementing Technical Standards (ITS) to provide uniform templates for the RoI, ensuring consistency across the EU. For practical implementation, financial entities should:

- Establish Strong Governance: Create a cross-functional team (IT, risk, legal, business) to own the RoI.

- Prioritise Criticality: Adopt a risk-based approach, focusing first on providers supporting critical or important functions.

- Integrate into Workflows: Embed RoI updates into standard vendor management processes like onboarding and contract renewals.

- Leverage Technology: Use specialized TPRM or GRC platforms to automate data collection and reporting.

The Register of Information is the primary data source for one of DORA's most significant innovations: the designation of Critical ICT Third-Party Providers (CTPPs). The deadline for financial entities to submit their completed RoIs to their National Competent Authorities was April 30, 2025. That data is now being aggregated and transmitted to the ESAs to inform the ongoing CTPP assessment process. By analysing this EU-wide data, regulators can identify ICT providers whose failure would pose a systemic risk to the financial sector, enabling the direct oversight framework detailed in Articles 31 to 44. The accuracy and completeness of each entity's RoI is therefore fundamental to this new EU-wide systemic risk management capability.

To provide practical guidance, key data fields required for the DORA Register of Information, as specified in the relevant ITS, include:

| Regulation Name | Core Objective | Key Impact Areas for Fintech/Regtech | Key Application Dates/Timeline (2024–2026) |

|---|---|---|---|

| MiCA (Markets in Crypto-Assets) | Harmonized EU framework for crypto-assets; transparency, stability, consumer protection, market integrity. | Licensing for CASPs, issuer obligations (white papers), market abuse rules, AML/CFT for crypto, interaction with MiFID II for classification. | ART/EMT rules: June 30, 2024; full application (incl. CASPs): Dec 30, 2024; ESMA/EBA guidelines phased in 2024–2025. |

| DORA (Digital Operational Resilience Act) | Strengthen ICT risk management, incident reporting, operational resilience testing, ICT third-party oversight. | ICT risk management frameworks, incident reporting automation, resilience testing tools, third-party vendor due diligence solutions. | Applicable from Jan 17, 2025. |

| EU AI Act | Harmonized rules for AI development and deployment; risk-based approach (high-risk AI like credit scoring). | Compliance for AI in financial services (risk management, data governance, transparency, human oversight), particularly for high-risk applications. | Entered into force Aug 2024; most provisions applicable Aug 2, 2026; some prohibitions earlier. |

| MiFIR 3 Review Amendments | Update MiFIR transaction reporting, expand scope (e.g., certain centrally-cleared OTC derivatives). | Adaptation of transaction reporting systems, new reportable fields, new identifiers, alignment with EMIR/SFTR. | Regulation (EU) 2024/791 effective Mar 28, 2024; ESMA RTS expected Q1 2025; new formats late 2025/early 2026; MiFID II transposed by Sep 28, 2025. |

| AMLD6 / EU AML Package | Strengthen AML/CFT framework, expand criminal liability, establish EU AMLA, tighter rules for VASPs. | Enhanced KYC/CDD automation, advanced transaction monitoring (AI/ML), cross-border reporting for VASPs, adapting to AMLA oversight. | AMLD6 transposition ongoing; AML Regulation/AMLA phased; direct AMLA supervision from 2028; VASP rules by July 2027. |

| PSD3 / PSR (Payment Services Regulation) | Modernize EU payments framework, develop Open Banking, strengthen consumer protection, enhance SCA. | New payment solutions, API management for Open Finance, fraud prevention tools, SCA implementation. | Proposals published June 2023; legislative process ongoing; full effect likely beyond 2025. |

5.3. Mandatory Contractual Provisions for ICT Services (Art. 30)

DORA significantly elevates the governance of the ICT supply chain by mandating specific, non-negotiable contractual provisions in all agreements with ICT third-party service providers. Article 30 is designed to ensure resilience, security, and auditability are legally enshrined.

Key rights and obligations that must be included in contracts under Article 30(2) include:

- A complete description of all functions and services.

- The specific locations/countries where data will be processed.

- Provisions guaranteeing data availability, authenticity, integrity, and confidentiality.

- Requirements ensuring data access and return in case of provider insolvency or contract termination.

- Clear service level descriptions with quantitative and qualitative performance targets.

- The provider's obligation to assist during an ICT incident, at a pre-determined cost.

- The provider’s duty to cooperate fully with the financial entity's competent authorities.

- Unrestricted rights for the financial entity and its regulators to access, inspect, and audit the ICT provider's systems and data relevant to the service provided.

For ICT services supporting critical or important functions, Article 30(3) imposes even stricter requirements, such as mandatory participation in the entity's Threat-Led Penetration Testing (TLPT) program and more robust exit strategy provisions. This unified market demand, backed by legal force, compels ICT providers to adapt their standard offerings to meet DORA's high standards, raising the bar for transparency and accountability across the vendor landscape.

5.4. The DORA Oversight Framework for Critical ICT Providers (CTPPs) (Art. 31-44)

The most significant innovation within DORA is the direct EU-level Oversight Framework for Critical ICT Third-Party Providers (CTPPs), acknowledging their systemic importance.

1. Designation of CTPPs (Article 31): The ESAs (EBA, EIOPA, ESMA) will designate certain providers as "critical." With the deadline for submitting the Register of Information having passed on April 30, 2025, this designation process is actively underway. Providers are expected to be notified of their potential classification by July 2025, just weeks from now. The designation criteria include systemic impact, the importance of their financial entity clients (e.g., G-SIIs), the criticality of the functions they support, and their substitutability.

2. The Lead Overseer and Direct Powers (Articles 33-42): For each CTPP, an ESA will be appointed as the Lead Overseer with direct supervisory powers, including the authority to:

- Request any relevant information and documentation (Art. 37).

- Conduct general investigations and on-site inspections, including outside the EU (Art. 38-39).

- Issue binding recommendations to CTPPs to remediate ICT risks (Art. 35).

- Impose periodic penalty payments to compel compliance if a CTPP fails to follow recommendations (Art. 35(6)).

3. Oversight Fees and International Cooperation (Articles 43-44): Designated CTPPs will be required to pay fees to cover the ESAs' oversight costs (Art. 43). The framework also includes provisions for cooperation with non-EU authorities to ensure effective global oversight (Art. 44).

This CTPP framework is expected to create a "Brussels Effect," where global ICT providers adopt DORA's high standards as a de facto global baseline. To serve the EU market, major cloud providers will need to meet these stringent resilience requirements, making it operationally efficient to apply these standards globally.

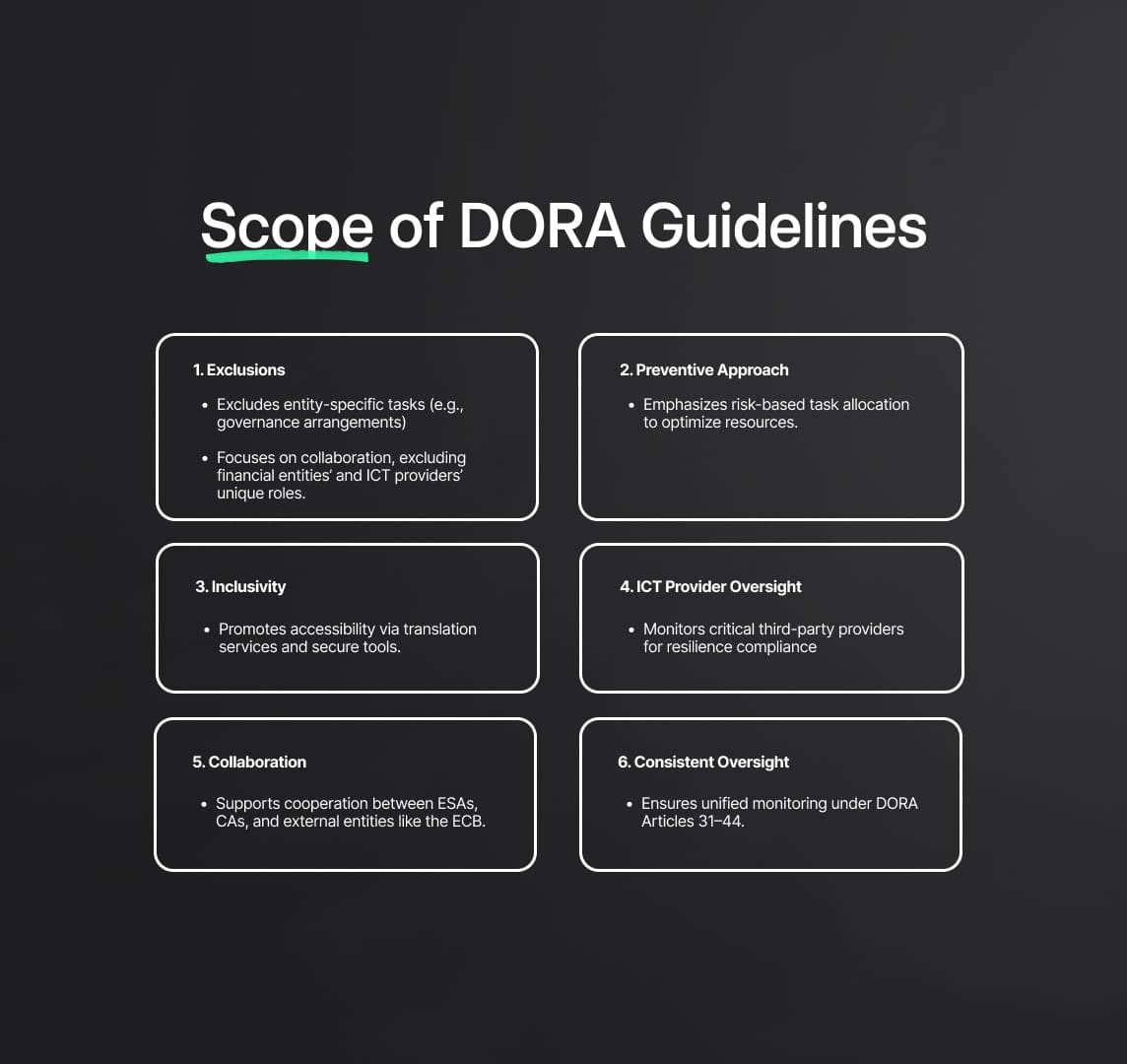

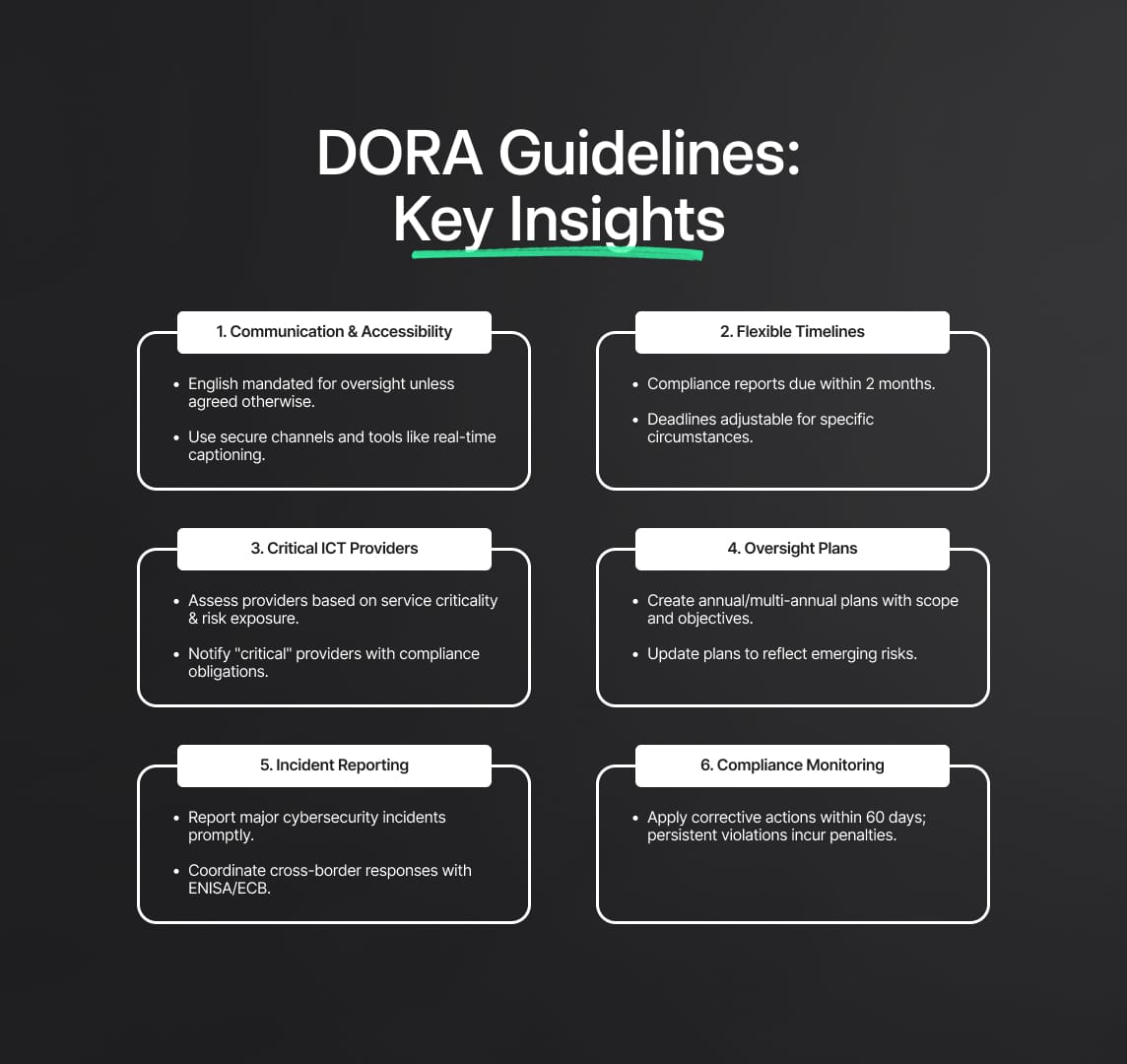

5.5. Operationalising Cooperation: The Joint Guidelines for Information Exchange

Effective oversight of global CTPPs requires seamless cooperation between the three ESAs and numerous National Competent Authorities. The Joint Guidelines on oversight cooperation and information exchange, issued on November 6, 2024, provide the critical operational blueprint for this complex structure.

Key elements of these guidelines include:

- Scope: Establishing procedures for cooperation on all tasks related to CTPP oversight.

- Task Allocation: Using a risk-based approach to allocate tasks between authorities to avoid duplication.

- Communication Protocols: Mandating English as the default language and requiring secure channels for sensitive data.

- Timelines and Flexibility: Setting clear timelines for actions while allowing for documented adjustments.

- Follow-up on Recommendations: Defining the roles of National Authorities (managing communication with financial entities) and the Lead Overseer (managing interactions with the CTPP) in monitoring the implementation of recommendations (Art. 42).

These Joint Guidelines are not mere administrative details; they are the essential protocols that ensure DORA’s multi-layered and ambitious oversight model can function cohesively and effectively across the entire European Union.

6. Pillar V: Information-Sharing Arrangements under DORA (Art. 45)

Recognizing that cyber threats are a collective challenge, the Digital Operational Resilience Act's fifth pillar encourages the voluntary sharing of cyber threat information and intelligence among financial entities to foster a stronger, sector-wide defense.

6.1. Voluntary Sharing of Cyber Threat Intelligence

Article 45 of DORA explicitly permits and promotes the establishment of arrangements for financial entities to exchange cyber threat information and intelligence with each other. The goal is to enhance the collective situational awareness and proactive defence capabilities of the entire financial sector.

The types of information encouraged for sharing include:

- Indicators of Compromise (IoCs): Such as malicious IP addresses, file hashes, or unusual network patterns.

- Tactics, Techniques, and Procedures (TTPs): Detailing the methods used by malicious actors.

- Cybersecurity Alerts: Including threat notifications from trusted sources.

- Vulnerabilities and Remediation Measures: Sharing information on identified weaknesses and effective fixes.

- Configuration and Tooling Information: Details on secure configurations and effective cybersecurity tools.

By sharing this knowledge, financial entities can learn from each other's experiences, anticipate emerging threats, and strengthen their individual and collective digital operational resilience.

6.2. Protocols for Secure and Responsible Information Exchange

While encouraging sharing, DORA mandates that these exchanges must be conducted securely and responsibly within a trusted framework. Key requirements include:

- Trusted Communities: Information exchange must occur within trusted communities of financial entities, governed by clear membership rules.

- Protection of Sensitive Information: Arrangements must protect business confidentiality and strictly adhere to data protection laws like the General Data Protection Regulation (GDPR). Personally identifiable information should not be shared unless absolutely necessary and legally permissible.

- Compliance with Competition Law: The sharing of information must not violate competition law policies.

- Notification to Authorities: Financial entities must notify their competent authority upon joining an information-sharing arrangement.

- Purpose Limitation: The information exchanged must be used exclusively to enhance the digital operational resilience of financial entities.

The Practical Challenge of Pillar V

The successful implementation of this pillar presents a nuanced challenge: balancing the immense benefits of collaborative intelligence with the risks of disclosing sensitive information. Financial entities may hesitate due to reputational concerns, fear of losing a competitive edge, or potential legal liability if data is mishandled. The ultimate success of Article 45 will depend on the development of practical frameworks and secure technological platforms that allow entities to share valuable intelligence while confidently managing these risks. This may require facilitation by supervisory bodies and the creation of robust trust mechanisms, ensuring the benefits of enhanced collective security demonstrably outweigh the risks of disclosure.

7. DORA's Interplay with NIS2, GDPR, and ISO Standards

The Digital Operational Resilience Act (DORA) does not exist in isolation. It intersects with other critical EU regulations and international standards. A clear understanding of these interactions is essential for developing an efficient and holistic compliance strategy.

7.1. DORA vs. the NIS2 Directive

While both DORA and the NIS2 Directive ((EU) 2022/2555) aim to enhance cybersecurity across the EU, they have important distinctions:

- Scope: DORA is a sector-specific regulation (lex specialis) applying exclusively to the financial sector and its critical ICT providers. In contrast, NIS2 is a horizontal directive covering a wide range of other "essential" and "important" sectors like energy, transport, and health.

- Legal Nature: DORA is an EU Regulation, directly applicable in all Member States. NIS2 is an EU Directive, which requires each Member State to transpose it into national law.

For financial entities, the principle of lex specialis applies. This means that for requirements specifically detailed in DORA (such as ICT risk management and incident reporting), the provisions of DORA take precedence over those in NIS2. This legal clarity prevents duplicate or conflicting obligations for the financial sector.

7.2. DORA and GDPR: Intersection in Data Protection

The General Data Protection Regulation (GDPR, (EU) 2016/679) intersects directly with DORA whenever an ICT-related incident involves personal data. Financial entities must integrate their compliance efforts in three key areas:

- Dual Incident Reporting: An event classified as a "major ICT-related incident" under DORA may also be a "personal data breach" under GDPR. This triggers parallel reporting obligations: notification to the financial supervisory authority under DORA and notification to the relevant data protection authority under GDPR (typically within 72 hours).

- Complementary Data Security: DORA's detailed requirements for data protection, encryption, and secure systems (Articles 9, 12) directly support GDPR's principle of "data protection by design" and its mandate for ensuring the security of processing (Article 32 of GDPR). Strong DORA compliance inherently strengthens an entity's GDPR security posture.

- Compliant Information Sharing: When participating in information-sharing arrangements under DORA's Article 45, entities must ensure any exchange of threat intelligence is fully compliant with GDPR's principles of lawfulness, fairness, and purpose limitation.

7.3. Alignment with ISO 27001 and Industry Standards

DORA's requirements for an ICT risk management framework align conceptually with international standards like ISO/IEC 27001, the NIST Cybersecurity Framework (CSF), and COBIT. Financial entities with existing certifications or mature implementations of these frameworks have a significant head start on their DORA compliance journey.

However, adherence to these voluntary standards does not guarantee full DORA compliance. DORA is a legally binding regulation with more prescriptive and novel requirements tailored specifically for the financial sector. Key areas where DORA goes beyond standards like ISO 27001 include:

- The direct EU-level oversight framework for Critical ICT Third-Party Providers (CTPPs).

- Mandatory Threat-Led Penetration Testing (TLPT) for significant entities.

- Specific, harmonised timelines for incident reporting to financial supervisors.

- Highly prescriptive contractual clauses for all ICT third-party service agreements.

Therefore, while leveraging existing certifications is highly beneficial, a comprehensive gap analysis against the specific articles of DORA and its associated technical standards (RTS and ITS) is an essential final step for all financial entities.

Table 2: Comparative Overview of DORA, NIS2, and GDPR Key Requirements

| Feature | DORA (Digital Operational Resilience Act) | NIS2 Directive | GDPR (General Data Protection Regulation) |

|---|---|---|---|

| Scope (Sector/Entity) | Financial sector entities (banks, insurers, investment firms, CASPs, etc.) & critical ICT third-party providers. | “Essential” & “Important” entities across critical sectors (energy, transport, health, digital infra, etc.). | All organizations processing personal data of EU individuals, regardless of sector or location (if targeting EU). |

| Legal Nature | EU Regulation (directly applicable) | EU Directive (requires national transposition) | EU Regulation (directly applicable) |

| Main Focus | Digital operational resilience of the financial sector; ICT risk management; ICT third-party risk. | Cybersecurity of networks & information systems for essential/important services; incident response. | Protection of individuals’ personal data; data privacy rights. |

| ICT/Cyber Risk Management | Comprehensive ICT risk-management framework (Art. 5–16): governance, protection, detection, response/recovery. | Risk-management measures (policies, procedures, technical controls); supply-chain security. | Data protection by design/default; security of processing (Art. 25, 32); Data Protection Impact Assessments. |

| Incident Reporting | Major ICT incident reporting to competent authorities (timelines, templates via RTS/ITS, Art. 19–20). | Significant incident reporting to CSIRTs/NCAs (e.g., 24 h early warning). | Personal-data breach notification to DPA (within 72 h) & to data subjects if high risk. |

| Third-Party/Supply Chain | Extensive third-party risk management (Art. 28–30); oversight of Critical ICT Third-Party Providers (Art. 31–44). | Supply-chain risk-management requirements for essential/important entities. | Requirements for data processors (Art. 28); rules on international data transfers. |

| Resilience Testing | Regular testing; advanced Threat-Led Penetration Testing (TLPT) for significant entities (Art. 24–27). | Security audits and vulnerability assessments may be required. | Regular testing of security measures encouraged. |

| Sanctions/Penalties | Administrative penalties & remedial measures by authorities (Art. 50); periodic penalties for third-party providers. | National laws define penalties, which must be effective, proportionate & dissuasive. | Fines up to €20 million or 4 % of annual global turnover, whichever is higher. |

8. Achieving and Maintaining DORA Compliance: A Strategic Roadmap

With the Digital Operational Resilience Act (DORA) in full effect since January 17, 2025, financial entities must now focus on validating, maintaining, and continuously improving their compliance posture. This requires a holistic and strategic program that embeds digital resilience into the organization's governance, processes, and culture.

8.1. The Foundational DORA Gap Analysis

The foundational step for any compliance program is a comprehensive gap analysis. This involves a meticulous assessment of the entity's current state against the specific requirements of DORA and its associated Regulatory and Implementing Technical Standards (RTS/ITS). For entities still maturing their programs, this remains an urgent priority.

A thorough analysis must cover all five DORA pillars:

- ICT Risk Management: Reviewing the framework, policies, asset inventories, and business continuity/disaster recovery plans.

- Incident Management: Assessing the capabilities for incident detection, classification, and reporting against DORA's strict criteria and timelines.

- Resilience Testing: Evaluating the scope, frequency, and methodology of the testing program, including readiness for Threat-Led Penetration Testing (TLPT) where applicable.

- ICT Third-Party Risk Management: Scrutinizing vendor due diligence, contractual provisions, the completeness of the Register of Information, and exit strategies.

- Information Sharing: Assessing the capability to participate in secure threat intelligence sharing arrangements.

The output must be a clear, risk-prioritized roadmap for remediating any identified gaps.

8.2. Key Elements of a Mature DORA Compliance Program

A mature DORA compliance program should be a strategic, ongoing initiative with clear senior management sponsorship. Key elements include:

- Establish Robust Governance: Assign clear roles for DORA compliance, with active oversight from the management body. Maintain a cross-functional working group (IT, security, risk, legal, business units) to manage implementation.

- Maintain and Refine Policies: Continuously review and update all relevant policies and procedures (e.g., ICT risk management, incident response, TPRM) to align with evolving threats and regulatory guidance.

- Strengthen Third-Party Risk Management: Diligently maintain the Register of Information (RoI). Ensure all contracts with ICT providers contain the DORA-mandated clauses (Article 30) through ongoing review and renegotiation.

- Execute a Comprehensive Testing Program: Conduct the full range of required resilience tests, from vulnerability assessments to TLPT, using qualified independent testers.

- Foster a Resilience Culture: Implement continuous training for all relevant staff on their roles and responsibilities under DORA.

- Monitor, Review, and Adapt: Constantly monitor the effectiveness of controls and regularly update the compliance program in response to new threats or changes in the business.

8.3. Leveraging Technology to Sustain DORA Compliance

Technology is a critical enabler for efficient and sustainable DORA compliance. Key solutions include:

- Governance, Risk, and Compliance (GRC) Platforms: To manage policies, track compliance, and automate audit trails.

- SIEM and SOAR Systems: For real-time threat detection and automated incident response.

- Third-Party Risk Management (TPRM) Tools: To automate vendor assessments and manage the Register of Information.

- Vulnerability Management Platforms: To automate scanning and support resilience testing activities.

8.4. Common Challenges and Strategic Mitigation

Entities face several common challenges on the path to mature DORA compliance.

Common Challenges:

- Coordination Complexity: Breaking down silos between IT, risk, legal, and business units.

- Resource Constraints: Securing the necessary budget and skilled personnel.

- Third-Party Complexity: Managing the scale of vendor relationships and contractual negotiations.

- Technical Complexity: Acquiring the high level of expertise needed for requirements like TLPT.

Strategic Mitigation:

- Strong Governance: Treat DORA compliance as a formal, ongoing program with dedicated leadership.

- Seek Expert Advice: Engage external consultants to supplement internal capabilities.

- Leverage Industry Collaboration: Use industry forums to share best practices and standardized approaches.

- Invest in Upskilling: Develop internal talent through focused training on ICT risk and cybersecurity.

Beyond Compliance: DORA as a Catalyst for Transformation

The journey to mature DORA compliance, while demanding, serves as a powerful catalyst for business transformation. It compels organizations to re-architect systems for resilience, overhaul TPRM processes, improve data governance, and foster deep collaboration between previously siloed departments. Approached strategically, DORA compliance moves beyond a regulatory burden and becomes a driver for creating a more efficient, agile, and resilient business model fit for the digital age.

9. The Future of ICT Resilience: DORA's Strategic Impact

The Digital Operational Resilience Act (DORA) is more than a compliance mandate; it is a strategic imperative shaping the future of the EU financial sector. Now in full effect, its long-term impact extends far beyond initial implementation, influencing technology, market dynamics, and the very culture of resilience.

9.1. Long-Term Impact on the Financial Sector

DORA is embedding digital operational resilience into the core fabric of financial institutions, leading to several long-term benefits:

- Improved Cybersecurity Posture: A sustained focus on mitigating threats and responding to incidents is enhancing the sector's overall security defences.

- Increased Operational Efficiency: Streamlined risk processes and better vendor oversight are reducing redundancies and minimizing disruptions.

- Enhanced Customer Trust: A demonstrated commitment to safeguarding data and ensuring service continuity is bolstering confidence in the digital financial landscape.

- "Resilience by Design" as a Core Principle: DORA is compelling both financial entities and their ICT providers to build resilience into systems from their inception. This proactive approach, driven by a clear regulatory mandate, is ushering in a new generation of financial technologies where resilience is a core architectural principle, not an afterthought.

9.2. Strategic Trends Shaped by DORA

The DORA framework is accelerating several key strategic trends:

- The Rise of AI in Risk Management: DORA's demands are accelerating the adoption of AI and machine learning tools for real-time threat detection, predictive risk analytics, and automated compliance monitoring, aligning with broader regulatory focus on AI governance.

- Market Dynamics and ICT Provider Consolidation: The stringent requirements of the ICT Third-Party Risk Management (TPRM) framework and direct CTPP oversight may favour larger ICT providers who can absorb the compliance costs. This could lead to market consolidation. However, it also creates significant opportunities for a new ecosystem of specialized "RegTech" firms and consultancies focused on providing DORA compliance solutions.

- The Global Alignment of Resilience Standards: DORA is setting a new global benchmark for digital operational resilience. Regulators in other major financial jurisdictions are developing similar frameworks, signaling a move towards a more harmonized international approach to managing ICT risk in finance.

9.3. DORA's Legacy: A Foundation for Trust and Innovation

DORA's ultimate legacy will be the creation of a more resilient, stable, and trustworthy EU financial ecosystem. It forces a fundamental shift in mindset, from viewing ICT risk management as a compliance burden to embracing it as a strategic imperative for success in a digital world.

Looking ahead, DORA provides the secure foundation necessary for future financial innovation. The broader adoption of Decentralized Finance (DeFi), sophisticated AI-driven services, and further digitalization all introduce new and complex ICT risks. By establishing a high, common baseline for digital operational resilience, DORA creates a more stable and predictable environment. This enhanced resilience gives regulators and the market the confidence needed to embrace and integrate new technologies safely and responsibly, ensuring DORA not only defends against today's threats but also enables the sustainable financial innovation of tomorrow.

Reduce your

compliance risks