Compliance in Money Laundering and Terrorist Financing

The European Banking Authority (EBA) has introduced revamped compliance guidelines, emphasizing stringent oversight and deep risk assessments to combat money laundering and terrorist financing.

EBA Guidelines: Risk Factors and Compliance Obligations in Money Laundering and Terrorist Financing

The European Banking Authority (EBA) issued new compliance guidelines under Articles 17 and 18(4) of Directive (EU) 2015/849. These guidelines aim to determine factors credit and financial institutions should consider when assessing the risk of money laundering and terrorist financing (ML/TF). The letters associated with individual business relationships and occasional transactions. The guidelines, which replaced the previous ones from 2017, set out the EBA’s view of appropriate supervisory practices within the European System of Financial Supervision. They also clarify how Union law should be applied in this particular area. Notably, the guidelines require competent authorities and financial institutions to make every effort to comply with them. They must also report their compliance status to the EBA, with non-compliance leading to potential punitive measures.

EBA Compliance Landscape: Money Laundering and Terrorist Financing

The financial world is no stranger to evolving regulations. Yet, the European Banking Authority's (EBA) recent overhaul of its compliance guidelines, specifically under Directive (EU) 2015/849’s Articles 17 and 18(4), warrants special attention. By aiming a spotlight on the identification and mitigation of money laundering and terrorist financing (ML/TF) risks, these guidelines usher in a new era of stringent oversight, aimed at reinforcing the resilience of the European financial sector.

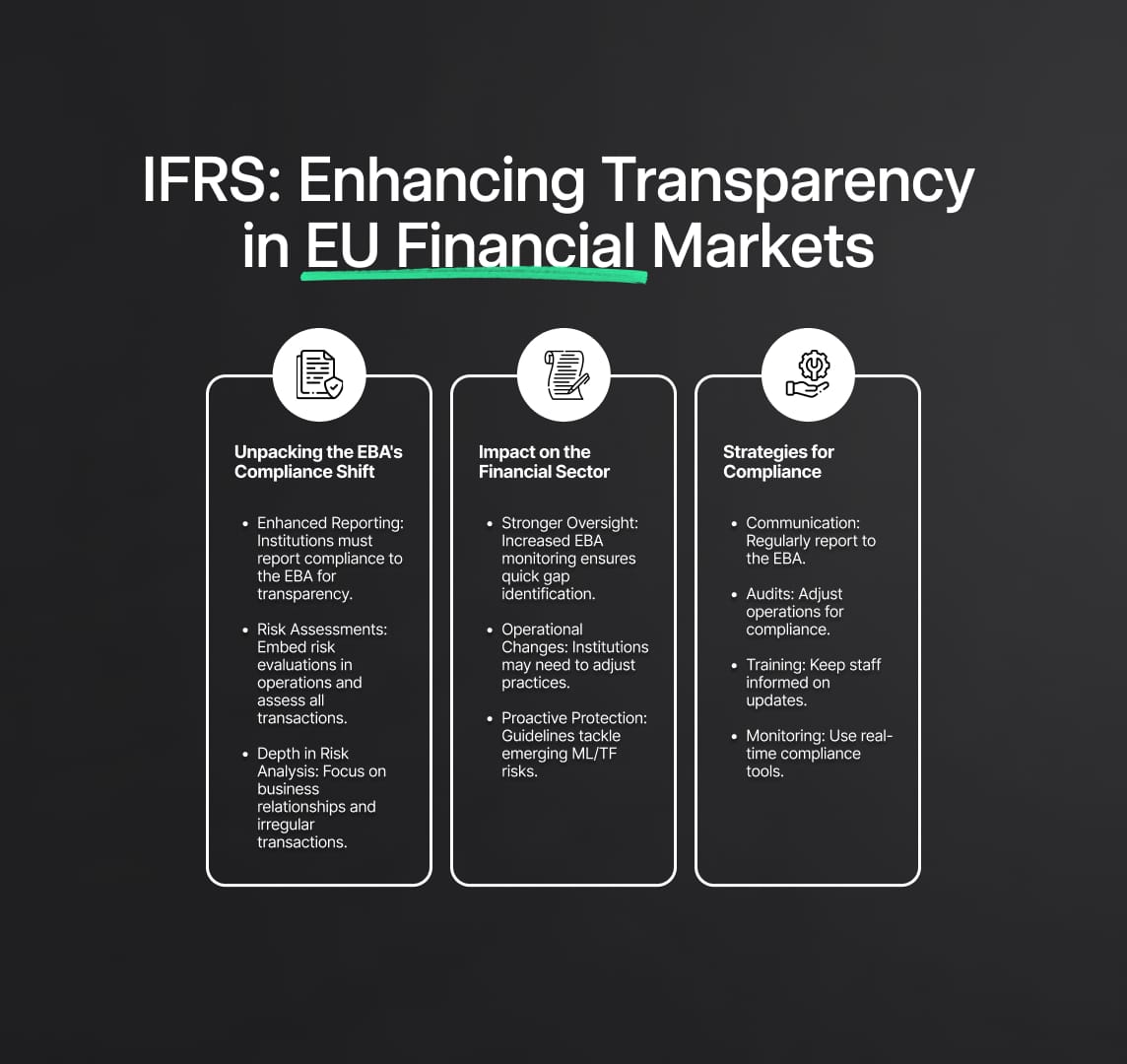

Unpacking the EBA's Compliance Shift

The EBA's new guidelines are not merely a refresh of previous regulations. Instead, they bring forth:

- Enhanced Reporting Measures: Institutions must now actively report their compliance status to the EBA, fostering an atmosphere of transparency and responsibility.

- Integrative Risk Assessments: There's a distinct move towards embedding risk evaluations within an institution's operational fabric, potentially challenging established practices and necessitating reviews of legal foundations.

- Depth in Risk Analysis: The guidelines champion a multi-dimensional approach to risk, urging institutions to assess not only broader business relationships but also sporadic transactions.

What does this regulatory pivot signify for the European financial arena?

Robust Oversight: By increasing the emphasis on regular reporting and compliance, the EBA aims to maintain a tighter grip on the sector's activities. This ensures that gaps in oversight are promptly addressed.

Operational Evolution: Financial institutions might find themselves revisiting and reshaping foundational aspects of their operations to remain aligned with the guidelines.

Protective Forefront: The new guidelines can be seen as a proactive measure, gearing up the sector to face the emerging challenges of ML/TF head-on.

Strategies for Seamless Transition

Staying compliant in this shifting terrain requires financial institutions to be proactive and strategic.

- Frequent Communication with the EBA: Establish dedicated channels for regular reporting and open dialogue.

- Operational Restructuring: Engage in internal audits to pinpoint areas requiring adjustments or overhauls to meet the risk assessment criteria.

- Training & Development: Invest in comprehensive training modules that keep staff updated about the nuances of the guidelines. This ensures a consistent application across the institution.

- Continuous Monitoring Mechanisms: Implement robust compliance tools and platforms that offer real-time insights. This allows for swift action when deviations occur.

Adapting to the EBA's guidelines isn't a one-off task. It calls for sustained effort, vigilance, and an acceptance of the dynamic nature of financial regulations. As the EBA accentuates the significance of timely compliance reporting and constant adaptability, institutions must foster a culture of continuous learning and evolution.

In summation, the EBA's revamped guidelines present both a challenge and an opportunity. Financial institutions that effectively navigate compliance regulations can gain not only regulatory adherence but also enhanced trust and reputation in the complex financial world.

Reduce your

compliance risks