ELTIF Regulation Enters in Force

European Commission's ELTIF Regulation updates expand investment options, strengthen liquidity management, and mandate cost transparency to enhance EU market appeal and align with ESG goals.

On October 25, 2024, the European Commission published the Delegated Regulation (EU) 2024/2759, which introduces a series of updates to the European Long-Term Investment Funds (ELTIF) regulation. This update, released under the authority of the European Commission and driven by input from the European Securities and Markets Authority (ESMA), focuses on improving the structure, management, and regulatory clarity of ELTIFs to make them more accessible and appealing to a wider range of investors, particularly retail and institutional participants. The revised regulation, along with the ELTIF 2.0 reforms introduced in early 2023, seeks to address previous limitations in the ELTIF framework, expanding eligible investment options, enhancing liquidity management, and establishing more transparent cost structures. Together, these changes aim to foster broader adoption of ELTIFs across the EU investment landscape.

ELTIF Regulation: What is it?

The European Long-Term Investment Funds (ELTIF) Regulation, developed by the European Commission, is designed to support long-term investments in sectors such as infrastructure, real estate, and sustainable finance across the EU. It aims to provide retail and institutional investors access to diversified, long-term investment opportunities, fostering economic growth and supporting environmental, social, and governance (ESG) objectives. Recent updates under Delegated Regulation (EU) 2024/2759 refine investment criteria, strengthen liquidity management, and require greater cost transparency, enhancing the appeal and accessibility of ELTIFs in the European market.

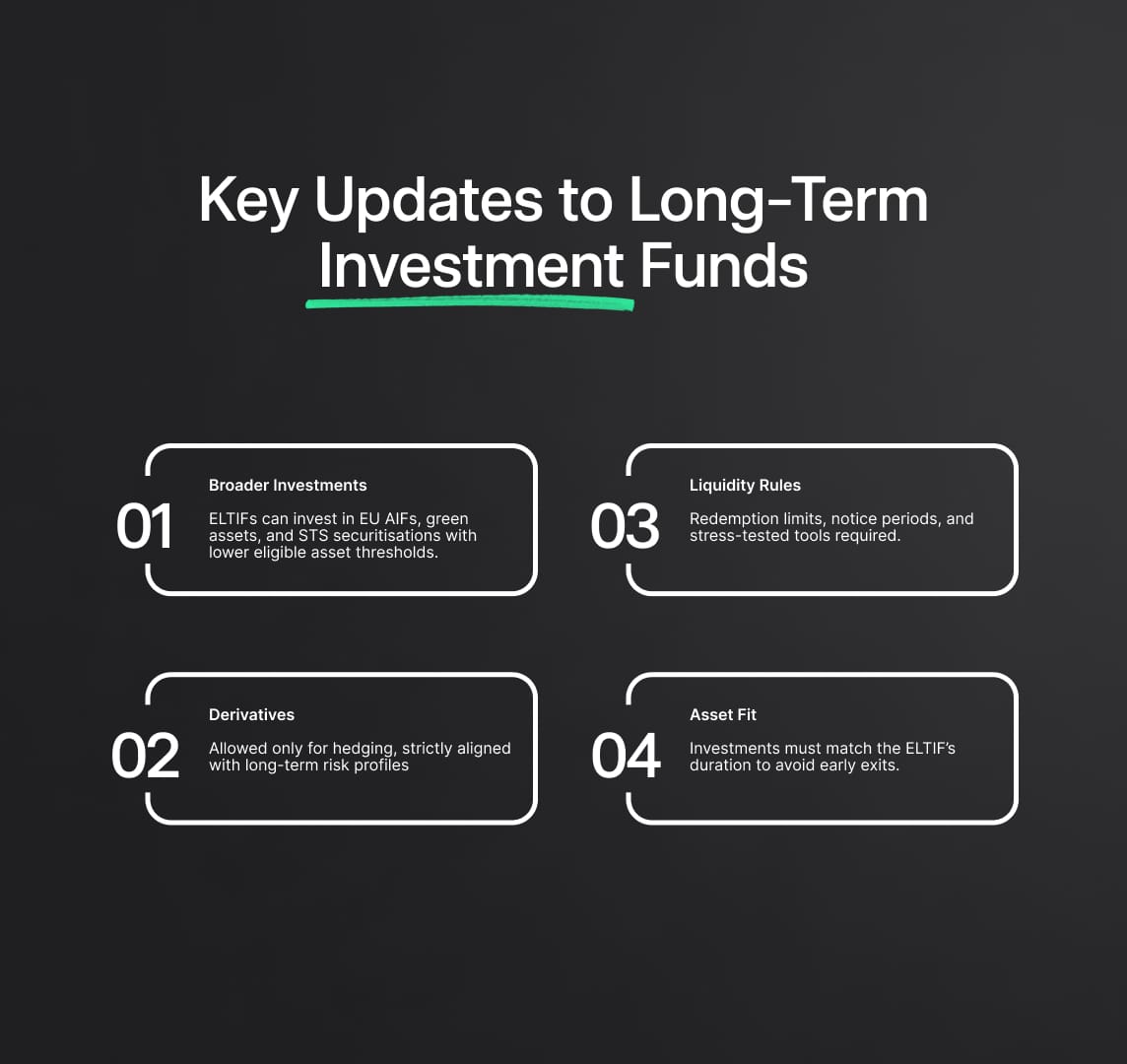

Key Updates of the Long-Term Investment Funds Regulation

Expanded Flexibility in Eligible Investments

ELTIF 2.0, implemented in 2023, introduces broader options for ELTIFs to diversify portfolios. Funds can now invest in other European Union Alternative Investment Funds (EU AIFs), provided they focus on eligible assets such as green bonds and transparent securitisations. The Delegated Regulation clarifies that ELTIFs are now permitted to allocate a portion of their capital toward straightforward, transparent, and standardised (STS) securitisations, expanding investment possibilities.

This broadened investment scope provides ELTIFs with avenues for increased asset diversification and enhanced access to new market segments, appealing to both retail and institutional investors. Additionally, the minimum investment percentage for eligible assets has been reduced from 70% to 55%, enabling more portfolio flexibility and attracting smaller investors. ELTIFs may also invest in sustainable assets in alignment with the EU’s green finance objectives, supporting ESG-focused projects within the European investment ecosystem.

Regulatory Technical Standards (RTS) on Derivative Use

A key addition in the 2024 Delegated Regulation is the clear framework governing the use of derivatives within ELTIFs. These standards strictly limit derivative usage to risk hedging, aligning with ELTIFs’ long-term focus and risk mitigation. To satisfy these requirements, all derivatives must be used exclusively to hedge risks intrinsic to ELTIF investments; speculative derivative activities are strictly prohibited.

For derivatives to be deemed appropriate, they must reduce fund-level risks and align with the ELTIF's specific risk profile. This change aims to uphold the fund’s stability by ensuring derivatives only offset specific exposure risks, maintaining liquidity, and aligning with the assets' lifecycle. ELTIF managers are required to demonstrate the economic appropriateness of the derivatives used, ensuring they effectively mitigate specific identified risks in a manner consistent with the fund’s long-term objectives.

Enhanced Redemption and Liquidity Management Policies

To address liquidity concerns, the Delegated Regulation has established stringent guidelines for redemption policies and liquidity management. ELTIF managers must now demonstrate that liquidity tools and redemption options support the fund’s long-term objectives. Specifically, Article 18 of the Delegated Regulation outlines that ELTIFs offering mid-life redemption options must adhere to strict notice periods, percentage limits on redeemable assets, and liquidity management tools calibrated to stressed market conditions.

The regulation mandates that managers consider asset liquidity profiles, cash flow forecasts, and redemption timelines, enabling ELTIFs to better handle large-scale redemptions even in stressed market conditions. Additionally, funds allowing mid-life redemptions must ensure that policies align with investor interests, improving market stability by reducing sudden liquidity shocks. Managers are also responsible for conducting liquidity stress tests and maintaining records to substantiate the adequacy of the redemption frequency and size limits as outlined in Annexes I and II of the Delegated Regulation, ensuring they can meet redemptions sustainably without undermining the fund’s overall stability.

This improved liquidity framework allows ELTIFs to offer redemptions aligned with liquidity conditions, supporting investors’ needs for liquidity without undermining long-term investments. Managers must establish policies that clearly state the terms for redemptions, including notice periods and maximum redemption amounts, which are calibrated to reduce liquidity risks. For retail-facing ELTIFs, the Regulation specifies that redemption policies must be outlined in accessible language, ensuring transparency and investor comprehension of liquidity mechanisms.

Asset Lifecycle Compatibility with Fund Duration

The Delegated Regulation requires that the lifecycle of an ELTIF aligns with the lifecycle of its constituent assets. Article 2 mandates that ELTIF managers must assess each asset’s liquidity, lifecycle, acquisition and disposal timing, as well as its relevance to the fund’s overall long-term strategy. Managers must evaluate each asset’s liquidity, lifecycle, and acquisition timeline and align it with the ELTIF’s duration.

For instance, long-term infrastructure or real estate investments must match the investment horizon of the ELTIF to avoid premature liquidation that could impact asset valuation. Managers are tasked with considering economic lifecycle factors, including cash flow predictability and projected valuation changes over time, ensuring that the ELTIF’s duration is sustainable without requiring premature divestitures. This ensures the stability of returns and supports the sustainability of long-term investment strategies.

Impacts of ELTIF Regulation Updates

The updated ELTIF framework is expected to foster substantial growth in long-term investment across the EU by appealing to a broader range of investors and investment strategies. The enhanced regulatory framework, which now emphasizes liquidity, transparency, and compatibility with investors’ needs, is likely to drive more asset managers to adopt the ELTIF structure, especially for investments requiring long holding periods, such as real estate, infrastructure, and green finance. By improving access to long-term, illiquid investments, the ELTIF Regulation aligns with the EU’s goals of strengthening cross-border investments and enabling stable returns for both retail and institutional investors.

The framework also positions ELTIFs as a favorable option for retail investors, who previously faced barriers due to high minimum investments and rigid redemption policies. With the removal of minimum ticket sizes and the addition of flexible redemption options, retail investors can now access diverse, long-term investment opportunities. Additionally, the alignment of ELTIFs with sustainable investments, such as green bonds, aligns with the EU’s broader environmental and social governance (ESG) objectives, supporting the EU’s transition to a sustainable economy. By including green finance options within the scope of ELTIFs, the Regulation enables funds to contribute directly to sustainability-focused projects, reinforcing its alignment with the EU’s climate action plans and enhancing its appeal to socially conscious investors.

In conclusion, the ELTIF 2.0 updates and the 2024 Delegated Regulation (EU) 2024/2759 collectively represent a modernization of the ELTIF framework, aligning it with current market dynamics and investor demands. The enhanced flexibility, stringent liquidity and redemption policies, and transparency requirements create a robust framework that is likely to enhance the ELTIF’s appeal, paving the way for wider adoption across Europe. As the ELTIF Regulation enables more diverse investment opportunities and transparent cost structures, it sets the stage for the EU to become a leading market for long-term, sustainable investment vehicles.

Reduce your

compliance risks