Regulatory Technical Standards: Market Risk Consultation

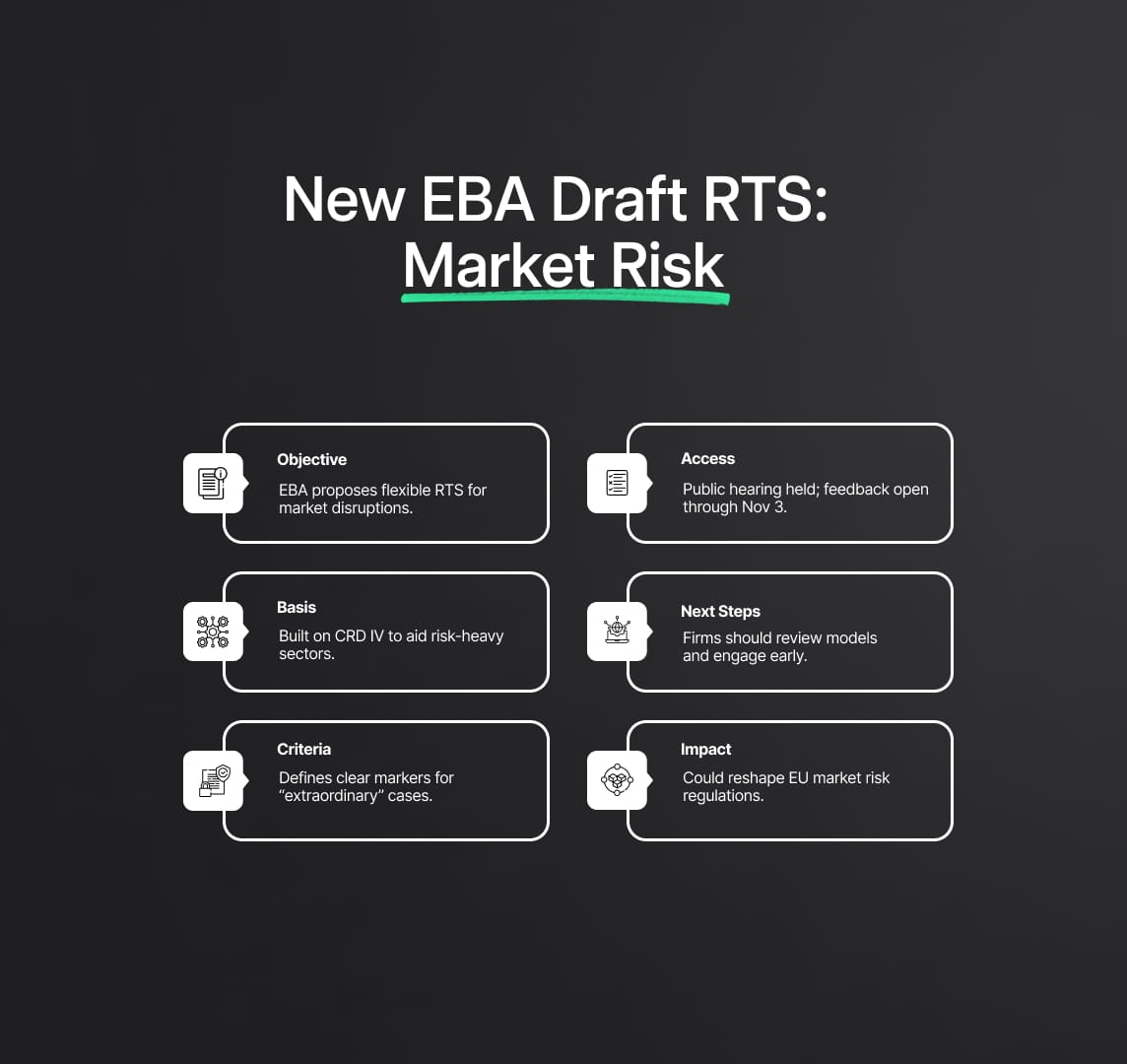

The EBA introduces flexible draft RTS for market risk management, allowing deviations in exceptional circumstances. Transparent conditions acknowledge unique challenges in diverse sectors. Stakeholders actively participate via webinar for a balanced regulatory framework. Deadline: Nov 3, 2023.

EBA Launches Consultation on Regulatory Technical Standards: MArket Risk

The European Banking Authority (EBA) is working to improve market risk laws, with a particular emphasis on providing for exceptional situations. A public consultation on draft Regulatory Technical Standards (RTS) has been initiated to identify exceptional conditions that have the potential to disrupt markets. With the help of this endeavor, market participants—including publishers—will be able to forego some criteria when determining how much money they personally have to risk on the market using internal models. The deadline for this consultation process is November 3, 2023. Crucially, the draft RTS lays out the requirements and signs that must exist in order to detect such extreme circumstances. This may permit organizations to keep utilizing their in-house models as trading desks even in cases where they don't pass the profit and loss attribution test or don't meet backtesting standards. Open to all interested parties, a public hearing in the form of a webinar is scheduled for September 20, 2023.

EBA's New Draft Regulatory Technical Standards for Market Risk Management

The European Banking Authority (EBA) is leading an initiative that aims to give financial institutions and market participants—most notably publishers—more flexibility and resilience as part of a progressive move to redefine market risk laws. The public consultation on proposed Regulatory Technical Standards (RTS) for recognizing unusual circumstances, which was recently issued by the EBA, has the potential to significantly impact the European financial sector, particularly banks that use internal models to calculate market risk.

With its foundation solidly established in the Capital standards Directive IV (CRD IV), the new draft RTS provides room for market participants to depart from standard standards in special cases. For organizations that can be severely harmed by unanticipated market disruptions, such as banks and publishers, this predicted regulatory change may prove to be a lifeline. It might increase the resilience of these industries, enabling smooth operations free from onerous regulatory restrictions.

In addition, the draft RTS lays forth a precise set of prerequisites and markers for identifying these exceptional occurrences. This move in the direction of greater transparency may lead to a more practical regulatory environment that recognizes the particular difficulties faced by a variety of industries, including publishing.

In addition, the draft RTS lays forth a precise set of prerequisites and markers for identifying these exceptional occurrences. This move in the direction of greater transparency may lead to a more practical regulatory environment that recognizes the particular difficulties faced by a variety of industries, including publishing.

Recognizing the importance of the digital age, the EBA decided to hold a public hearing through webinar. This action improves accessibility by allowing participants from different places to participate in the discussion and contribute to a shared regulatory vision.

Publishing companies, financial institutions, and other market participants need to be proactive in order to assure compliance and adjust to these possible legislative changes. Important steps in this journey will include taking part in the consultation process, improving internal risk models and processes, and putting in place tools to monitor and react to "extraordinary circumstances."

With a public hearing scheduled on September 20, 2023 and a consultation period ending on November 3, 2023, all eyes will be on the EBA's novel approach to market risk regulation. Following consultation, these new regulations would normally take several months to a year to implement, which would be a significant shift in European financial policy.

The EBA's innovative step towards a more adaptable and durable framework for managing market risk is evidence of how the financial regulatory environment is changing. Understanding and adjusting to these developments will be crucial for market participants and financial organizations hoping to prosper in the new era of European banking regulation as they take place.

Reduce your

compliance risks