ESG Ratings: Transparency and Operations Clarity

On June 13, 2023, the European Commission unveiled a proposal for a Regulation on ESG ratings, aiming to enhance transparency and prevent conflicts of interest among rating providers.

In an effort to create a legal framework for environmental, social, and governance (ESG) evaluations throughout the European Union, the European Commission proposed a Regulation on June 13, 2023. The proposal aims to reduce the danger of conflicts of interest by guaranteeing clarity in the operations of rating providers, improving openness in ESG ratings characteristics and processes. Through the provision of precise standards for grading methodology and characteristics, the Regulation aims to standardize the ESG rating process. It seeks to increase confidence in ESG ratings and encourage more informed decision-making among investors and stakeholders on environmental, social, and governance factors by eliminating possible conflicts of interest within rating agencies.

Scope and Definitions of ESG Ratings Regulation

The proposed Regulation describes how it applies to ESG ratings that are provided by EU providers; it focuses on ratings that are given to regulated financial organizations or that are made publicly available. ESG ratings shared by third parties and those that are private are excluded. According to the Regulation, ESG ratings are assessments of an entity's governance, social, and environmental aspects that have an effect on investment choices as well as societal and environmental results.

ESG Ratings in the EU: Authorisation, Equivalence, and Recognition

The Draft Regulation lays out strict guidelines for EU legal organizations that want to offer ESG ratings, and it requires ESMA approval. It also outlines the processes for third-country providers to be authorized, recognized, and equivalent, guaranteeing regulatory compliance and openness in the EU's ESG rating system:

- EU license: In order to offer ESG ratings on the EU market, legal organizations operating within the EU must first have license from ESMA. The Regulation lays forth the parameters for ESMA's evaluation of ESG rating providers as well as the authorization procedure.

- Third-Country Providers: Under specific circumstances, third-country ESG rating providers are permitted to engage in the EU market. This can involve receiving recognition by ESMA, subject to fulfilling certain qualifying requirements, or becoming the subject of an equivalency decision made by the Commission.

- Equivalency and Recognition: If a third country's regulatory framework is judged to be comparable to EU norms, then the supplier may be able to give ESG ratings within the EU through equivalency. Providers may also apply to ESMA.

- Endorsement: In order to operate in the EU market and guarantee compliance with legal requirements, third-country suppliers may also choose to seek the endorsement of an EU-authorized ESG rating service.

- ESMA Register: To encourage openness and ease regulatory monitoring in the EU ESG rating industry, ESMA is required to create a register with details on approved, acknowledged, and endorsed ESG rating providers.

ESG Rating Organization Guidelines

In order to guarantee the validity and dependability of ESG ratings, the proposed Regulation establishes fundamental organizational standards for ESG rating providers operating within the EU. These requirements place a strong emphasis on concepts like independence, transparency, and efficient operational procedures.

Main organizational requirements:

- Respect for General Principles: ESG rating companies are required to uphold a number of general principles, such as impartiality in rating operations, frequent methodology reviews, and efficient monitoring and assessment programs. On the basis of valid petitions, ESMA is still able to provide exemptions from these principles.

- Activity Segregation: Providers are required to uphold a clear division between their ESG rating operations and their other commercial activities, such as benchmark development, credit rating issuance, and consultation. Workers must be independent, have the necessary experience, and know what it takes.

- Record-Keeping and Complaints Procedure: In order to handle complaints, the proposal creates a complaints procedure and requires record-keeping. Furthermore, it is forbidden to outsource vital operational tasks if doing so would jeopardize the integrity of internal control rules and processes.

- Methodology Transparency: On their website, ESG rating providers are required to reveal their models, methodology, and primary rating assumptions. ESG rating activities are made more transparent and accountable by requiring subscribers and rated organizations to provide separate disclosures.

Ensuring Compliance with ESG Rating Regulation

The important task of approving and monitoring ESG rating companies operating in the EU is entrusted to ESMA by the proposed Regulation. To ensure regulatory compliance, ESMA will be able to collect data, carry out investigations, and conduct on-site inspections. Reinforcing responsibility and respect to regulatory standards, ESMA will also have the power to impose administrative fines on ESG rating providers found to be in violation of the Regulation.

European Parliament's Review of ESG Rating Regulation: Key Amendments and Proposals

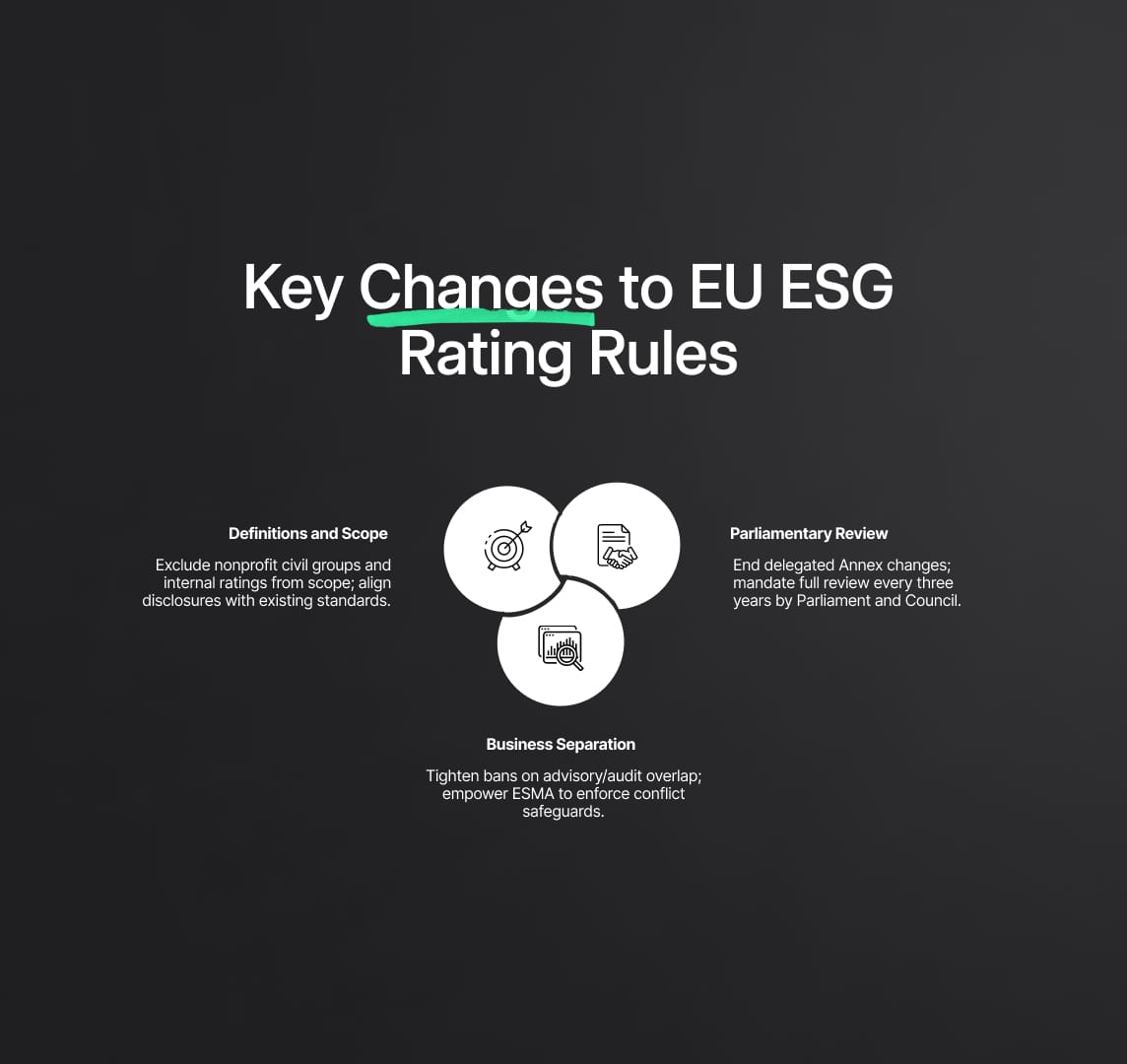

The proposed Regulation on ESG ratings is presently undergoing legislative consideration by the European Parliament. The plan has undergone substantial modifications by rapporteur Aurore Lalucq, who hopes to improve the legislative review procedure, guarantee commercial activity separation, and narrow the idea's scope:

- Definitions and Scope: Lalucq suggests removing nonprofit civil society groups from the Regulation's purview if their rankings are publicly available and not for profit. In addition, she recommends that some disclosures be expressly excluded from the current sustainable finance standards in order to prevent conflicts and unexpected outcomes. Furthermore, services to other businesses in the same group are now included in the scope exclusion for ESG ratings used internally by regulated financial entities in the EU.

- Separation of Business and Activities: Lalucq increases the ban on linked companies and ESG rating agencies providing advisory or audit services to rated companies. She suggests giving ESMA the authority to create comprehensive regulations that guarantee the separation of the ESG ratings industry from other endeavors that could create conflicts of interest.

- Parliamentary Review: Lalucq suggests eliminating the Commission's authority to modify Regulation Annexes through Delegated Regulation, meaning that Annex modifications would henceforth be subject to a comprehensive parliamentary procedure. Rather, she suggests a three-year review period for the entire Regulation, giving the Parliament and the Council additional legislative authority.

Council Review of ESG Rating Regulation: Focus on Third-Country Regime and Proportionality

The proposed ESG Rating Regulation is now being reviewed by member states in the Council, with debates principally focused on two important areas. First, discussions have focused on the third-country regime, with specific attention to procedures of recognition, endorsement, and equivalency. Although equivalency is viewed as a possible path forward, questions have been raised over the endorsement framework's susceptibility to manipulation. Second, given that the Regulation applies to all ESG rating providers, regardless of size, its proportionality is being closely examined. While the Council Presidency attempts to limit ESMA's jurisdiction by proposing a preset list of exclusions specifically targeted for SMEs within the Regulation itself, the Commission advocated ESMA's capacity to exempt SMEs from certain criteria.

Legislative Review Timeline and Potential Delays

It is expected that the June start of the legislative evaluation of the draft Regulation on ESG ratings would take at least a year. The upcoming European Parliament elections in June 2024 present a significant obstacle to the Council and European Parliament's goal of establishing their negotiation positions by Q1 2024. Significant delays are anticipated because the Parliament will most likely be on recess until July. This is especially true if the elections result in a considerable shift in the membership of the ECON Committee, which could lead to changes in the Parliament's negotiating position over the Regulation.

Reduce your

compliance risks