European Commission's CMDI Legislative Package

Commission's CMDI Proposes Enhancing Bank Resolution and Deposit Protection. Parliament adopted its stance; awaiting Council's for trilogue talks. Expected adoption not before early 2025.

The European Commission unveiled its legislative package on crisis management and deposit insurance (CMDI) on April 18, 2023. The EU's framework for managing the recovery and resolution of credit institutions is to be amended by the changes in this package. Along with changes to the Single Resolution Mechanism (SRM) Regulation, it contains directives and rules aimed at updating important directives like the Deposit Guarantee Schemes Directive (DGSD) and the Bank Recovery and Resolution Directive (BRRD).

Source

[1]

[2]

Strengthening Financial Stability: CMDI Legislative Proposals

Important directives like the Single Resolution Mechanism (SRM) Regulation and the Bank Recovery and Resolution Directive (BRRD) are being amended by the CMDI legislative package. With these changes, the effectiveness of the resolution and deposit protection mechanisms for EU banks will be improved and recognized shortcomings will be addressed. The proposed modifications aim to strengthen the resilience of EU credit institutions and systemically important investment enterprises by improving the frameworks put in place during the global financial crisis of 2007–2008.

Proposed Amendments for Early Intervention Measures

For the purpose of supporting financial stability, the European Commission suggests modifying early intervention measures. By making these adjustments, the competent and resolution authorities hope to reduce uncertainty and enhance their collaboration:

- Definition of Conditions: Revisions to the BRRD's Articles 27(1), 28(1), and 29(1) would clarify the need for early intervention actions. These modifications guarantee action in cases when the Investment Firms Directive or CRD IV's supervision requirements are not followed or are not sufficient.

- Elimination of Ambiguity: The plans aim to eliminate any doubt regarding the dismissal of management and the hiring of interim managers.

- Enhanced Cooperation: The goal of the BRRD amendments is to make it easier for competent and resolution authorities to work together more effectively. By simplifying, early intervention strategies for recognized problems are more successful.

Improving Resolution Framework: Public Interest Assessment Amendments

The proposal expands the range of resolution procedures available under the BRRD by introducing changes to the public interest evaluation. When a credit institution is in danger of failing and there are no viable private solutions, this review decides whether to intervene.

Main Aspects of the Assessment:

- Expanded Scope: By examining the public interest assessment, the proposal expands the resolution's purview. The resolution authorities will use BRRD measures to act if a credit institution is failing or about to fail (FOLF) and there is public interest.

- Goals Refinement: Amendments strengthen goals including preserving vital services, safeguarding financial stability, and capping extreme public funding. The definition of critical functions now includes the impact on regional financial stability, and restricting public support means giving preference to industry-funded safety nets over taxpayer-funded alternatives.

- Depositor Protection: Protecting depositors while reducing losses for deposit guarantee systems is the goal of resolution (DGS). When it is less expensive for DGS, it prioritizes settlement over insolvency, which is consistent with the main objective of depositor protection.

Proposed Conditions for Providing Extraordinary Public Financial Support

The European Commission is putting up stringent guidelines pertaining to the granting of exceptional public financial support in response to worries about the responsible use of public funds. These requirements are meant to guarantee that public monies are only used by organizations judged financially stable and when absolutely essential. The purpose of the proposed revisions is to improve financial support mechanisms' accountability and transparency.

Under its recommendation, the Commission specifies the circumstances under which exceptional public financial help may be granted. These include steps to protect depositor access to funds, preventive efforts by Deposit Guarantee Schemes (DGS) to maintain financial stability, and assistance with winding-up procedures. The Commission hopes to maintain the integrity and financial stability of the banking industry while preventing the misappropriation of public funds by enforcing these requirements.

Refinement of Depositor Preference Hierarchy in Banking Regulation

In the event of a bank collapse, covered deposits and claims from Deposit Guarantee Schemes (DGS) take precedence over non-covered preferred deposits under the terms of Article 108 of the Bank Recovery and Resolution Directive (BRRD). Non-covered non-preferred deposits, particularly corporate non-SME deposits beyond the EUR 100,000 coverage threshold, are unclear, nonetheless. The European Commission responds by putting out changes to improve and make the depositor preference framework more clear.

With the proposed modifications, all deposit categories will be treated consistently and a more uniform and transparent system would be established. The reforms, in particular, establish a single depositor preference system that gives legal preference to all deposits—including excluded deposits and those of big corporations. The distinction between covered and non-covered deposits is eliminated by this single-tiered ranking, which places all deposits above standard unsecured claims. As a result, the suggested changes simplify the depositor preference hierarchy, advancing equity and strengthening depositor protection in the banking industry.

MREL Framework: CMDI Amendments and Clarifications

When it comes to the minimum requirement for own funds and eligible liabilities (MREL), resolution authorities are essential in formulating and carrying out preferred resolution strategies for financial institutions. Although bail-in is still the method of choice for breaking up big, complicated banks, there are no specific guidelines in the existing regulatory framework for adjusting MREL in transfer plans. The European Commission has suggested a number of changes to the BRRD in order to close this gap and make clear the authority of resolution authorities with respect to distributions in the event of MREL failure:

- MREL Calibration for Transfer Strategies: The purpose of the proposed revisions is to provide a more precise legal foundation for the calibration of MREL in transfer strategies. Principles for MREL calibration that are unique to transfer methods and not applicable to bail-in scenarios are outlined in a new Article 45ca.

- Distribution Prohibition: In order to clear up any legal uncertainty, the revisions make it clear that resolution authorities have the authority to forbid specific distributions in cases where an organization doesn't comply with both the MREL and the combined buffer requirement. With a delegated act outlining the methodology, Article 16a BRRD is changed to guarantee that this power is based on estimated combined buffer requirements. This approach is to be drafted by the European Banking Authority as part of the proposal.

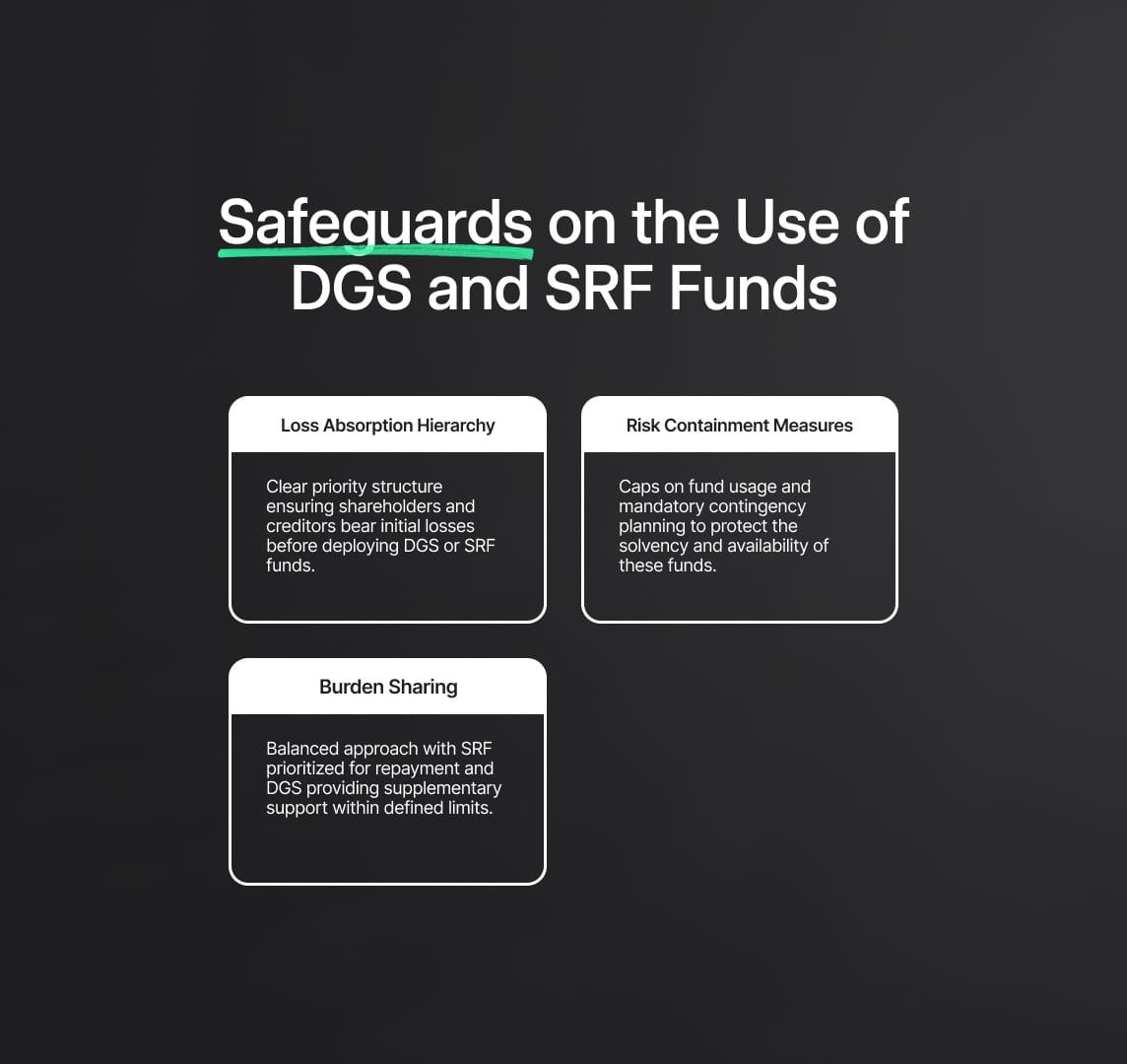

CMDI Proportionality: Clarifying DGS Use in Resolution

According to the BRRD structure, banks must employ internal resources first in resolution scenarios, then resolution finance agreements and the Deposit Guarantee Scheme (DGS). Smaller institutions, however, frequently find it difficult to comply with these demands. In order to clarify the DGS's role in resolution, the European Commission has proposed revisions to Article 109 BRRD.

The proposed modifications highlight that transfer transactions involving covered deposits and, in some cases, eligible and excluded deposits can be supported by the DGS. In order to guarantee capital neutrality for purchasers, the DGS may also help to offset the shortfall between transferred deposits and asset value. Strict limitations are upheld, meanwhile, to keep DGS from running out and guarantee its continuous operation. The purpose of these changes is to improve proportionality in the resolution framework, especially for banks that are smaller or medium-sized.

CMDI Legislative Package: Path Forward Amidst Political Challenges

The legislative process for the CMDI package, which is currently in the hands of the European Parliament and the Council, is expected to be drawn out. Consensus-building is expected to take at least a year, and the impending May 2024 elections for the European Parliament add to the process' complexity. The difficulties in completing the CMDI reforms are highlighted by this predicted delay.

Reduce your

compliance risks