Global Risk Management with AI-Enhanced GRC Tools

Traditional GRC software has often been criticized for being like "Excel + reminders + folders" with extra steps. As geopolitical risks rise AI-powered risk management tools, like those from Grand Compliance, offer real-time tracking, analysis, and actionable insights.

Office Automation, CRM, and ERP software have been widely adopted across almost all industries, giving rise to industry giants such as Oracle and SAP.

However, for a long time, GRC software, particularly traditional risk management software, has remained insignificant within the software industry. Many users sarcastically describe it as:

"They’re all basically just a prettier, more expensive version of Excel + Reminders + Folders; but with extra steps."

From a software engineering perspective, this criticism is not without merit.

Traditional GRC software is more akin to a variant of Office Automation systems and does not represent a revolutionary innovation in software design. However, this does not mean that businesses, especially large enterprises, do not need risk management tools. On the contrary, we live in a world where geopolitical risks are accelerating, and these risks have already inflicted significant losses on large European enterprises, particularly financial ones, over the past years and are expected to cause even greater damage in the future.

Risks and Their Impact on European Financial Landscape

The Russia-Ukraine War

The Russia-Ukraine war, which broke out in 2022, dealt a heavy blow to the European economy. Financial sanctions on Russia immediately cut off Europe’s long-standing reliance on Russian energy supplies, causing a surge in energy prices across the continent. The high energy costs severely impacted industries such as transportation, chemicals, and metallurgy, leading to numerous European businesses shutting down or relocating production lines, even prompting deindustrialization in Germany.

According to calculations by the European Council using the National Institute Global Econometric Model (NiGEM), this war reduced the EU’s annual GDP growth rate by 1.5%, amounting to an annual loss of €255 billion.

Under the requirements of sanctions, European financial institutions had to immediately terminate business relations with their long-established Russian clients. Coupled with stock market turbulence caused by the war, mutual asset freezes between Russia and Europe, and other factors, many European financial institutions suffered enormous losses.

Austria’s Raiffeisen Bank International faced a total risk exposure of approximately €22.9 billion in Russia, leading to a more than 40% drop in its stock price. Large asset management firms such as BlackRock lost over $17 billion on Russian securities. UniCredit bank faced potential losses of around €5.3 billion, causing its stock price to plummet by 35% after the war broke out. Société Générale incurred €3.1 billion in losses by selling its Russian subsidiary Rosbank to exit the Russian market.

Another unexpected risk was the massive IT attacks launched by Russian hackers on numerous European businesses, including banks, following the outbreak of the war. These cyberattacks caused significant economic losses as well.

The Red Sea Crisis

The Red Sea Crisis, triggered by the October 2023 Israel-Hamas war, saw Houthi rebels, supported by Iran, indiscriminately attacking all cargo ships passing through the Red Sea. This crisis forced ships traveling between Europe and Asia to abandon the Suez Canal as a fast route and instead detour around Africa. The crisis significantly increased logistics costs between Europe and Asia and severely disrupted global trade. Despite US military efforts against the Houthi rebels, the results were limited.

According to Germany’s Allianz Trade, the increased logistics costs and delays caused by this crisis reduced Europe’s GDP growth by 0.9%, equating to a loss of €153 billion. Not only were businesses reliant on imports and exports affected, but European financial institutions, such as insurance companies and banks, also saw profits decline as a result of the crisis.

These two geopolitical crises have significantly weakened the EU’s economic growth and dealt a heavy blow to the European economy. However, this is not the end. On the contrary, more geopolitical risks, with even greater potential to harm Europe’s economy, are brewing.

More Upcoming Global Financial Risks

Trump’s Tariff War

Newly re-elected President Trump has announced plans to start a tariff war, imposing tariffs of up to 60%-70% on China and an additional 10% tariff on all goods exported to the United States from Europe.

The US is the EU’s largest trading partner, with the majority of Europe’s exports to the US being high-value goods such as machinery and chemicals. Trade with the US contributes a net surplus of EUR 156.7 billion (0.9% of GDP) annually to the EU.

If Trump does impose these tariffs, ABN Amro analysts, including head of macro research Bill Diviney, warn that tariffs "would cause a collapse in exports to the US," with trade-oriented economies such as Germany and the Netherlands likely to be hardest hit. According to the Dutch bank, Trump's tariffs would shave approximately 1.5 percentage points off European growth, translating to a potential €260 billion economic loss based on Europe’s estimated 2024 GDP of €17.4 trillion.

This would undoubtedly further weaken the European economy, pushing it into a full-blown recession.

Moreover, the risks of Trump’s tariff war extend beyond Europe-US trade. His tariffs on China could trigger a series of highly risky chain reactions, further threatening Europe’s economic growth.

China’s Economic Recession

China has long been the EU’s second most important trading partner and the largest profit source for Germany’s automotive industry. However, with the collapse of China’s real estate bubble, the country is now facing a prolonged economic recession that threatens the stability of its financial system. This recession will undoubtedly reduce China’s purchasing power and increase the Chinese government’s incentive to dump cheap products abroad, threatening Europe’s exports to China and profits in the Chinese market.

For example, German carmakers in the Chinese market face a dual challenge of declining local consumer purchasing power and competition from local low-cost electric vehicle manufacturers. This has caused profits from the Chinese market to plummet, leading to mass layoffs by Volkswagen in Germany, which in turn could trigger political instability in Germany.

According to Reuters, China is preparing to significantly devalue the renminbi following Trump’s tariffs to boost exports. EU officials warn that this could shock Europe’s economy, widen Europe’s trade deficit, and even lead to a trade war between China and the EU. A China-EU trade war would severely impact French and Dutch agriculture.

Additionally, Trump’s tariff war could further fuel rising nationalist sentiment in China, intensify US-China conflicts, and push the two nations closer to the brink of armed conflict.

A US-China War Over Taiwan

The possibility of China invading Taiwan has become one of the most frequently discussed topics in global media. A significant amount of intelligence from authoritative sources indicates that Chinese leaders are preparing for an invasion of Taiwan. Both the US and the EU have started recognizing this danger as increasingly imminent. At the same time, both China and the US are fully preparing for this war, with Trump’s hawkish team likely to exacerbate China’s hostility.

Economically, the consequences of this war would be catastrophic, far exceeding the impact of the Russia-Ukraine war. After all, Russia is merely an energy supplier, and Europe can find alternative suppliers from the Middle East and other regions. However, China is at the core of global manufacturing, and Taiwan produces 68% of the world’s chips. The Taiwan Strait is also the busiest waterway in the world.

If a Taiwan Strait war breaks out, Bloomberg Economics estimates the global economic cost to be approximately $10 trillion, equal to about 10% of global GDP.

To address this risk, many US companies have begun relocating their supply chains from China and Taiwan to Vietnam, India, Mexico, or the US. However, many European companies, particularly German industrial giants like Volkswagen and BMW, continue to ignore warnings from the German government and have increased investments in China. Chemical giant BASF has even invested tens of billions of euros in building production facilities in China. For these European companies, such moves represent enormous potential risks.

AI-Enhanced Risk Management Softwares in a Global Related Risk Environment

There is no doubt that the surge in geopolitical risks in the future will likely make risk management software a must-have tool for businesses, just like CRM or ERP. However, can traditional risk management software help large enterprises mitigate these potential risks?

The answer is no.

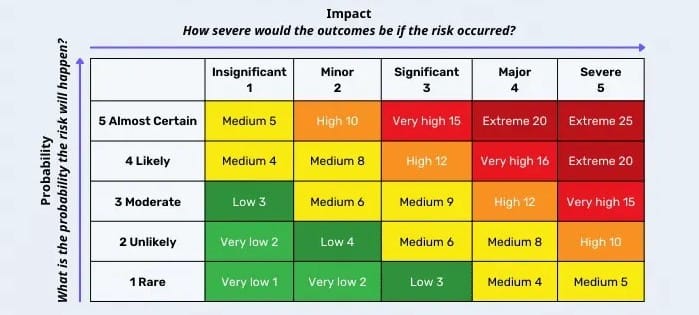

Current risk management software relies on risk assessment matrices to identify risks. However, it has the following problems:

- Dependence on Subjective Judgments by Risk Assessors

Risk matrices rely on individuals to rate the likelihood and impact of risks. These ratings are often based on experience or assumptions, lacking objective data support. Assessors may easily overlook potential risks or ignore potential connections between risks. - Inability to Quantitatively Assess Risk Impact

Unlike CRM or ERP software, which can use large volumes of accurate data to profile customer groups or supply chains and make data-driven decisions, traditional risk management tools lack sufficient data. They cannot describe or quantitatively analyze the various risks faced by a company. - Difficulty Handling Complex Situations

In reality, the importance of different risks is dynamically changing at all times. However, risk managers find it difficult to constantly track the escalation or mitigation of various risks. This makes these tools incapable of responding to risk changes in dynamic environments, especially in rapidly evolving industries like fintech or cybersecurity.

These shortcomings make today’s risk management tools resemble Excel + Reminders + Folders, unable to effectively identify and mitigate risks.

How AI Can Strengthen Risk Management Tools?

AI can undoubtedly enhance risk management software, addressing its shortcomings and making it more practical. Grand Compliance is already using AI to help compliance teams track European financial regulatory developments, using AI to read large volumes of regulatory documents and compile actionable Regulatory Obligations Inventories (ROI). These AI applications can be applied to risk management tools in the future:

- Proactive Risk Identification

AI assistants can generate a list of risks that may cause losses to clients based on their industry and location, helping clients identify potential risks. - Real-Time Risk Tracking

AI assistants can continuously track rapid changes in risks, alerting managers to respond promptly. - Comprehensive Risk Analysis

AI assistants can scan and analyze the subsidiaries, asset allocations, or supply chains of large enterprises, identifying potential risk points and their likely impact. This helps businesses stay informed about their risk exposure.

The primitive and crude nature of current risk management software stems from the fact that, during the booming development of the software industry in recent decades, Western enterprises did not face significant geopolitical risks. However, in an era of frequent geopolitical crises, the AI-enhanced risk management software industry is bound to experience rapid growth.

Reduce your

compliance risks