MiCA Regulation: Application to ARTs and EMTs

The Markets in Crypto-assets Regulation (MiCA), effective 30 June 2024, establishes an EU framework for crypto-assets, focusing on Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs).

The Markets in Crypto-assets Regulation (MiCA) represents a significant regulatory milestone within the European Union. Effective from 30 June 2024, MiCA aims to create a harmonised regulatory framework for crypto-assets, focusing particularly on Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs). This article delves into the technical specifics of MiCA regulation, the European Banking Authority’s (EBA) supervisory priorities, and the implications for various stakeholders.

Source

[1]

Scope of MiCA Regulation

MiCA covers a broad spectrum of crypto-assets, including ARTs and EMTs, both of which play pivotal roles in the digital finance ecosystem.

- Asset-Referenced Tokens (ARTs): These are tokens that aim to maintain a stable value by referencing multiple currencies, commodities, or a basket of assets. MiCA sets out specific requirements for the issuance and management of ARTs, including capital requirements, reserve assets, and transparent governance structures.

- E-money Tokens (EMTs): These tokens are designed to function similarly to electronic money and aim to maintain a stable value by referencing a single fiat currency. MiCA imposes strict regulatory standards on EMT issuers, including the need to be authorized as an e-money institution and to maintain full backing of the issued tokens with fiat currency reserves.

Key Features of MiCAR

- Authorisation and Supervision: MiCA requires issuers of ARTs and EMTs to obtain authorisation from relevant national competent authorities. This involves a thorough assessment of their business models, governance structures, and financial stability. Entities are subject to ongoing supervision to ensure compliance with MiCA standards.

- Operational Resilience: The regulation mandates that issuers implement robust operational resilience measures to protect against technological risks, including cyber threats and system outages. This includes regular testing and updating of their IT systems and contingency planning for potential disruptions.

- AML and CTF Compliance: MiCA enforces stringent anti-money laundering (AML) and counter-terrorist financing (CTF) requirements. Issuers and service providers must conduct thorough customer due diligence, monitor transactions for suspicious activity, and report any findings to relevant authorities.

- Transparency and Disclosure: MiCA emphasizes the importance of transparency and disclosure to ensure market participants are well-informed. Issuers must provide comprehensive information in white papers, including the token's functionality, rights attached to it, and associated risks. This information must be clear, accurate, and readily accessible to potential investors.

- Consumer Rights and Protection: MiCA ensures that consumers' rights are protected through clear contractual terms and conditions. Issuers must handle complaints efficiently and provide mechanisms for consumers to seek redress. Additionally, MiCA includes provisions for the redemption of tokens, ensuring that consumers can convert their tokens back into fiat currency under specified conditions.

EBA's Statement on MiCA Regulation

1. Compliance with MiCA from 30 June 2024

The European Banking Authority (EBA) mandates that any entity intending to commence activities involving Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs) must be fully compliant with MiCA Regulation by 30 June 2024. This directive is pivotal to ensure that all market participants align their operations with MiCA's comprehensive regulatory framework, thereby enhancing market integrity and consumer protection across the European Union.

Full Compliance for Issuers and Service Providers: Issuers of ARTs and EMTs, along with service providers such as exchanges and custodians, are required to adhere strictly to MiCA's regulatory standards. This involves a thorough overhaul of existing business practices to meet the stringent criteria set forth by MiCA.

- Operational Adjustments: Entities must implement significant operational adjustments to comply with MiCA. This includes updating their technological infrastructure, enhancing governance frameworks, and ensuring robust risk management practices are in place.

- Legal and Regulatory Alignment: Compliance also necessitates aligning all legal and regulatory documentation, such as white papers, governance documents, and customer agreements, with MiCA’s requirements.

2. Transitional Arrangements for ARTs

MiCA provides transitional arrangements for issuers who have legally issued ARTs before the 30 June 2024 deadline, as specified in Article 143(4) and (5). These arrangements offer a grace period for these issuers to conform to the new regulatory environment established by MiCA. However, it is critical to note that no such transitional arrangements are available for EMTs, which means immediate compliance is mandatory.

- Grace Period for ART Issuers: The transitional arrangements allow ART issuers to continue their operations temporarily while they adjust to the new regulatory requirements. This period is crucial for issuers to restructure their practices, ensuring they meet the standards set by MiCA.

- Immediate Compliance for EMT Issuers: Unlike ARTs, EMT issuers must comply with MiCA regulations immediately by 30 June 2024. This involves an expedited process to align their operations with MiCA’s requirements without the benefit of a grace period.

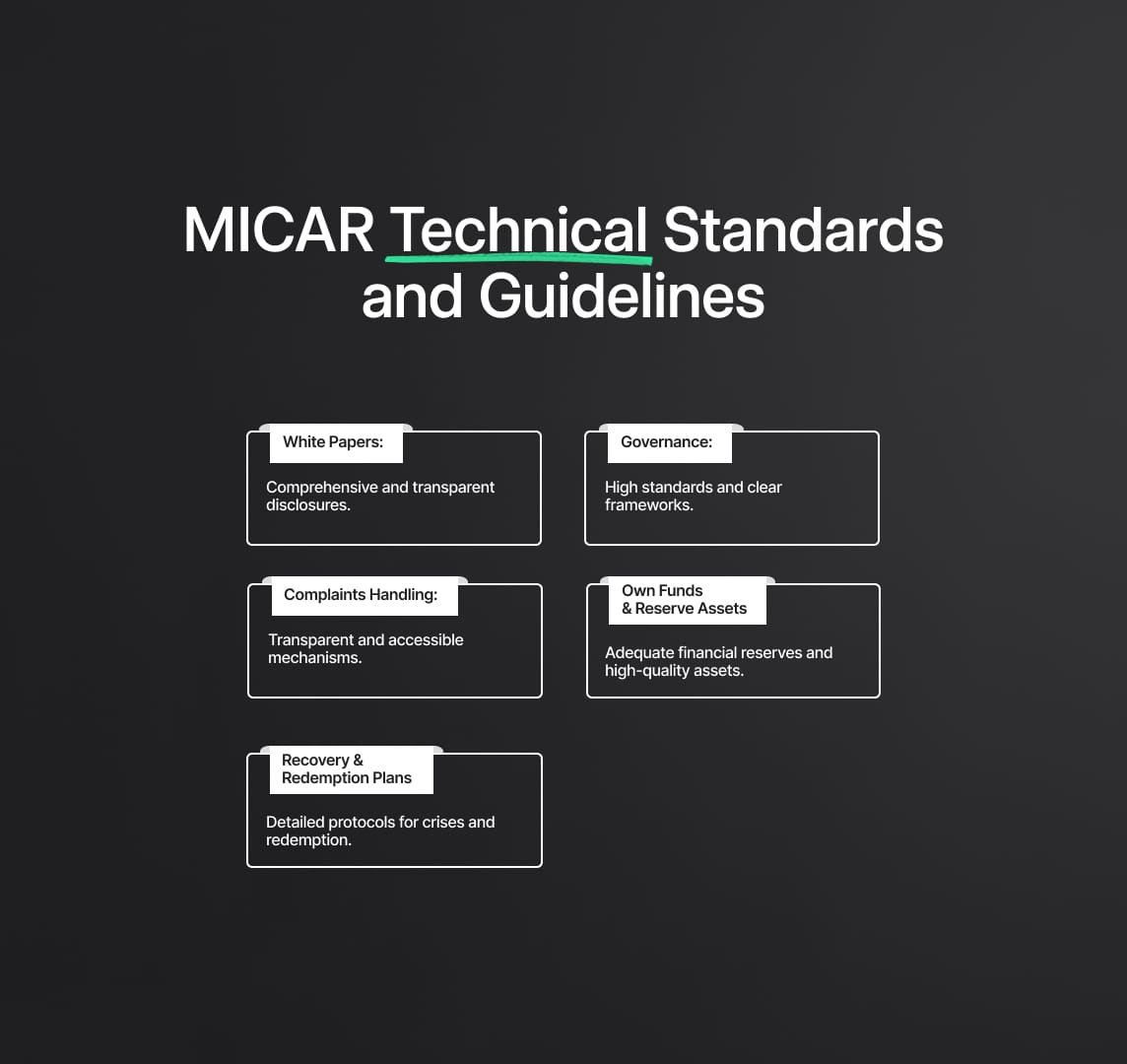

3. MICAR Technical Standards and Guidelines

The EBA emphasises the critical importance of adhering to regulatory and implementing technical standards and guidelines, which are accessible on the EBA’s website. Issuers and offerors are expected to consider these documents meticulously and operate as if these measures are fully applicable, even if some technical standards are pending adoption by the European Commission and publication in the Official Journal of the European Union.

- White Papers: MiCA mandates comprehensive requirements for white papers, ensuring full disclosure and transparency. White papers must detail the nature of the token, the rights attached to it, the underlying technology, and the associated risks. This transparency is crucial for informed decision-making by investors and other stakeholders.

- Governance: MiCA sets high standards for organizational structure and oversight. Issuers must establish clear governance frameworks that delineate responsibilities and ensure accountability. This includes having a qualified management team with relevant expertise and a robust system for internal controls and audits.

- Complaints Handling: Effective procedures for addressing consumer grievances are mandatory. Issuers and service providers must implement transparent and accessible complaints handling mechanisms to resolve issues promptly and efficiently, ensuring consumer trust and protection.

- Own Funds: Issuers are required to maintain adequate financial reserves to cover their liabilities. This involves meeting specific capital requirements to ensure financial stability and the ability to absorb losses. MiCA outlines the precise calculations and conditions for maintaining these funds.

- Reserve Assets: Rules for maintaining asset reserves are stringent. Issuers must ensure that the reserve assets backing their tokens are of high quality and liquidity. This requirement is designed to protect token holders and ensure the issuer can fulfill redemption requests.

- Recovery and Redemption Plans: MiCA mandates detailed protocols for managing crises and ensuring token redemption. Issuers must have comprehensive recovery plans in place to handle financial distress and provide a clear process for token holders to redeem their tokens for fiat currency or other assets.

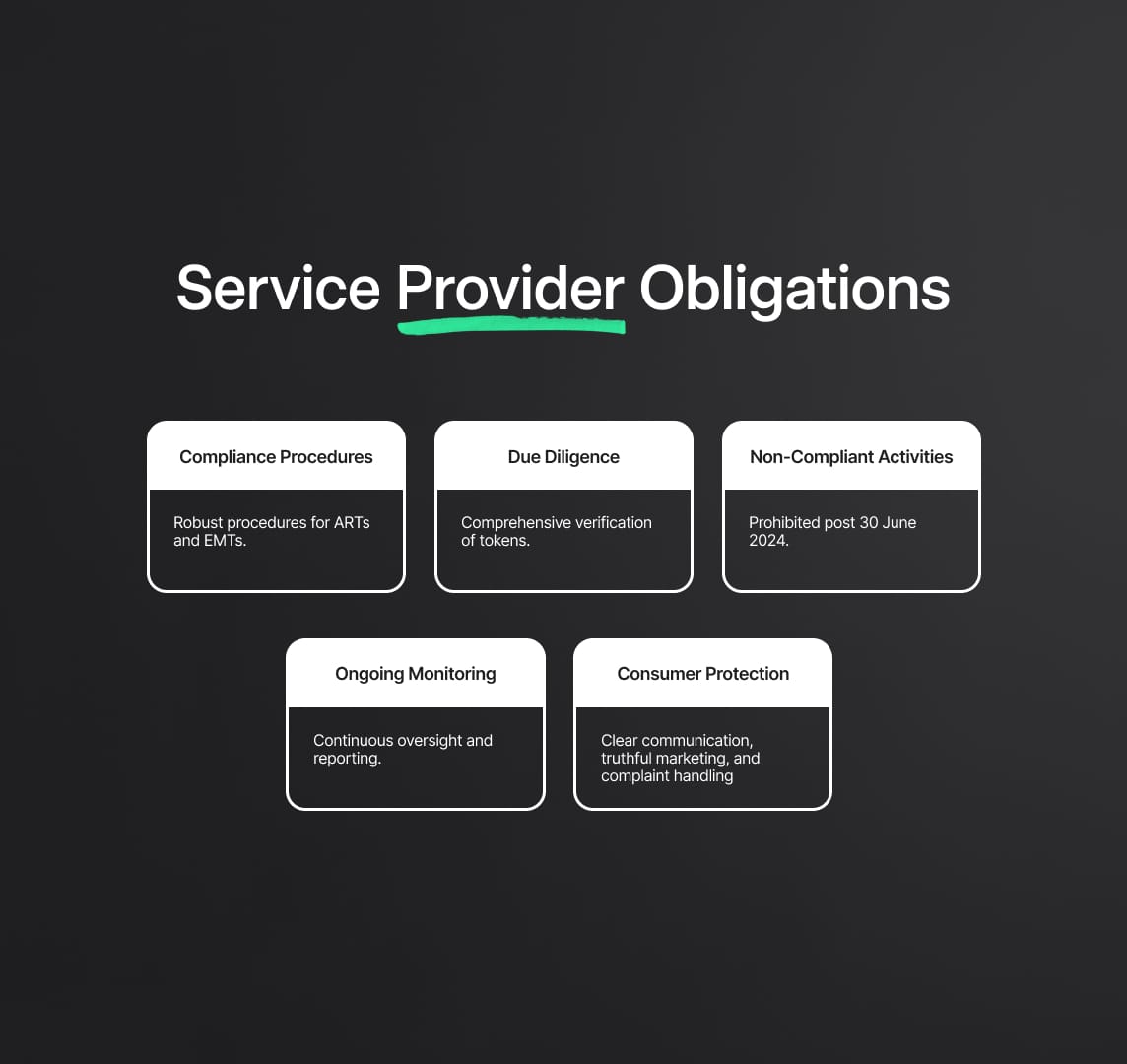

4. Service Provider Obligations under MiCA Regulation

The MiCA Regulation imposes stringent obligations on crypto-asset service providers, including those involved in exchange and transfer services. These entities play a crucial role in the crypto-asset ecosystem, and their compliance with MiCA's requirements is essential for maintaining market integrity and protecting consumers.

Establishing Compliance Procedures: Service providers must develop and implement robust compliance procedures to ensure that all ARTs and EMTs they handle are fully compliant with MiCA regulations. This includes conducting thorough due diligence on the tokens they list or facilitate transactions for, ensuring they meet the necessary legal and technical standards set by MiCA.

- Due Diligence and Verification: Service providers are required to perform comprehensive due diligence to verify that ARTs and EMTs comply with MiCA before offering them to the public. This involves assessing the white papers, governance structures, financial resilience, and reserve assets backing the tokens. Detailed records of these assessments must be maintained to demonstrate compliance.

- Prohibition of Non-Compliant Activities: Post 30 June 2024, service providers are prohibited from engaging in activities such as the public offering, seeking admission to trading, or placing ARTs and EMTs that do not comply with MiCA. This prohibition is critical to prevent market manipulation and protect consumers from investing in non-compliant and potentially risky assets.

- Ongoing Monitoring and Reporting: Service providers must establish ongoing monitoring mechanisms to ensure continued compliance of the ARTs and EMTs they deal with. Any changes in the status or compliance of these tokens must be promptly reported to the relevant authorities. This continuous oversight helps in maintaining transparency and trust in the market.

- Consumer Protection Measures: Service providers are also tasked with implementing consumer protection measures, including clear communication of the risks associated with crypto-asset investments and ensuring that all marketing materials are truthful and not misleading. They must also provide mechanisms for handling consumer complaints and disputes effectively.

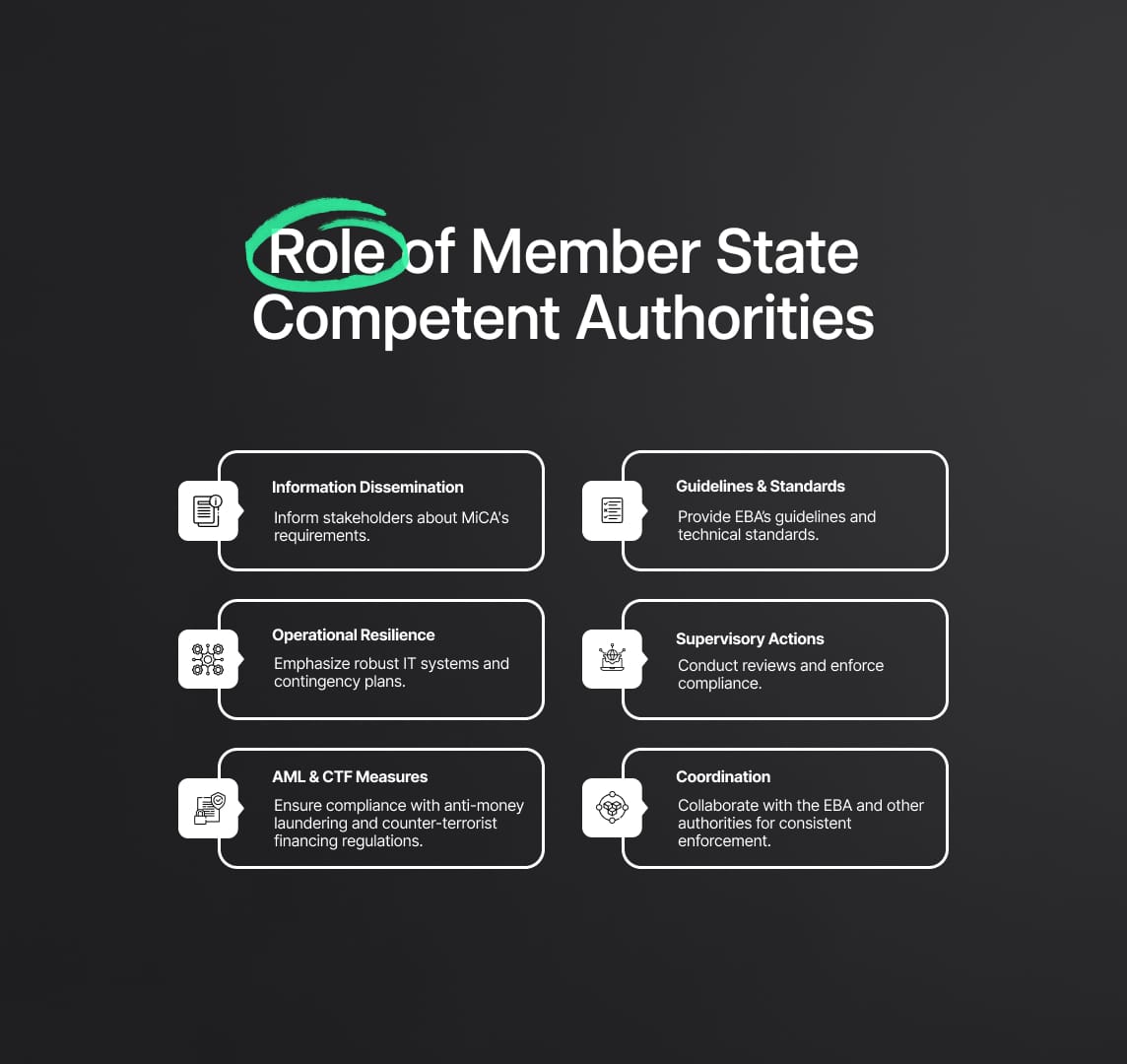

5. Role of Member State Competent Authorities under MiCA Regulation

The EBA expects national competent authorities to take proactive steps to ensure entities within their jurisdictions are fully informed and compliant with MiCA's requirements. This involves disseminating comprehensive guidelines, technical standards, and other relevant regulatory measures.

- Proactive Dissemination of Information: Competent authorities must actively inform issuers, service providers, and other stakeholders about MiCA’s requirements. This includes providing clear and accessible guidelines on the regulatory standards and compliance obligations under MiCA. Authorities should utilize various channels, including official websites, industry seminars, and direct communications, to disseminate this information effectively.

- Guidelines and Technical Standards: Authorities are responsible for making the EBA’s guidelines and technical standards readily available to entities within their jurisdiction. This includes providing detailed instructions on how to comply with these standards, such as requirements for white papers, governance structures, complaints handling, own funds, reserve assets, and recovery and redemption plans.

- AML and CTF Measures: Competent authorities must ensure that entities comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations as part of their obligations under MiCA. This involves providing guidance on the implementation of AML and CTF measures, conducting regular audits, and taking enforcement actions against non-compliant entities.

- Operational Resilience: Authorities should emphasize the importance of operational resilience among issuers and service providers. This includes ensuring that entities have robust IT systems, cybersecurity measures, and contingency plans in place to handle potential disruptions and threats.

- Supervisory and Enforcement Actions: Competent authorities are tasked with conducting regular supervisory reviews and taking enforcement actions to ensure compliance with MiCA. This involves conducting audits, inspections, and investigations as necessary to monitor compliance and address any violations promptly.

- Coordination and Cooperation: To ensure consistent and effective enforcement of MiCA across the EU, competent authorities must coordinate with the EBA and other European Supervisory Authorities (ESAs). This cooperation includes sharing information, best practices, and enforcement strategies to foster a harmonized regulatory environment.

Stakeholders under MiCAR

1. Issuers, Offerors, and Traders

Entities involved in issuing, offering, or seeking trading admission for Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs) face significant responsibilities under the MiCA Regulation. By 30 June 2024, these entities must ensure full compliance with MiCA, which involves a comprehensive set of regulatory and technical standards designed to promote market integrity, enhance consumer protection, and ensure financial stability.

- Regulatory and Technical Standards: Issuers and offerors must adhere to stringent regulatory and technical standards outlined in MiCA. This includes comprehensive requirements for white papers, governance structures, financial reserves, and operational practices. White papers must provide detailed disclosures about the token’s purpose, the rights of token holders, the underlying technology, and the associated risks. These documents must be clear, accurate, and readily accessible to potential investors.

- Operational Adjustments: Entities must review and adjust their operational practices to align with MiCA’s standards. This involves implementing robust governance frameworks, enhancing risk management systems, and ensuring that all financial and operational activities are conducted transparently and securely. For instance, issuers must establish clear lines of responsibility within their organizational structures and ensure that their management teams have the necessary expertise and experience in the crypto sector.

- Financial Requirements: MiCA mandates specific financial requirements for issuers of ARTs and EMTs. Issuers must maintain adequate own funds to cover their liabilities and ensure financial resilience. Additionally, they must hold a reserve of high-quality liquid assets to back the tokens they issue. These reserves must be managed in a way that guarantees they can meet redemption requests from token holders at any time.

- Governance and Compliance Frameworks: Issuers must establish comprehensive governance and compliance frameworks that include mechanisms for internal controls, audits, and compliance monitoring. These frameworks should ensure that the entity adheres to all regulatory requirements and can effectively manage and mitigate risks.

- Transparency and Reporting: Transparency is a cornerstone of MiCA. Issuers must provide regular updates and reports to regulatory authorities, detailing their compliance status and any significant changes in their operations. This includes periodic financial disclosures, updates on the status of reserve assets, and any material events that could impact the token holders.

- Technology and Cybersecurity: Given the digital nature of ARTs and EMTs, issuers must implement robust technological solutions to manage operational risks. This includes cybersecurity measures to protect against cyber threats, ensuring the integrity and security of their IT systems, and establishing contingency plans to handle potential disruptions.

2. Consumers

The MiCA Regulation significantly enhances consumer protection by establishing stringent requirements for transparency, disclosure, and risk management. The EBA’s statement emphasizes the importance of consumers remaining vigilant and informed about the regulatory status and compliance of the crypto-assets they engage with.

- Verification of Compliance: Consumers should verify that the crypto-assets they invest in comply with MiCA regulations. This can be done by reviewing the issuer’s white paper, checking the issuer’s website for compliance statements, and consulting relevant registers maintained by the European Securities and Markets Authority (ESMA) or national competent authorities. These registers provide information on authorized issuers and the compliance status of various tokens.

- Risk Awareness: While MiCA aims to enhance consumer protection, it is crucial for consumers to be aware of the risks associated with crypto-assets. These risks include market volatility, technological vulnerabilities, and the potential for fraud or mismanagement by issuers. Consumers should conduct thorough due diligence and seek to understand the specific characteristics and risks of the crypto-assets they intend to purchase.

- Consumer Rights: MiCA provides significant protections for consumers, including the right to clear and accurate information about the tokens they invest in and mechanisms for resolving complaints. Consumers should familiarize themselves with these rights and ensure that they are engaging with issuers and service providers who adhere to MiCA’s standards.

Supervisory Priorities under MiCA Regulation

The European Banking Authority (EBA) has delineated key supervisory priorities under the Markets in Crypto-assets Regulation (MiCA) to ensure a robust and secure framework for the issuance and management of Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs). These priorities, reviewed annually based on risk assessments, market developments, and regulatory changes, aim to enhance the stability, integrity, and transparency of the crypto-asset market within the European Union. Here is a deeper look into each supervisory priority area:

1. Internal Governance and Risk Management

A robust internal governance structure and comprehensive risk management framework are fundamental requirements for entities under MiCA Regulation. This priority ensures that organizations have the necessary frameworks to manage their operations effectively and mitigate potential risks.

- Clear Organizational Structures: Entities must establish well-defined organizational structures that delineate roles, responsibilities, and reporting lines. This clarity ensures accountability and facilitates efficient decision-making processes.

- Effective Oversight Mechanisms: Governance frameworks must include effective oversight mechanisms, such as independent boards or committees, to oversee management actions and ensure compliance with regulatory requirements. These mechanisms should also provide for regular audits and reviews.

- Comprehensive Risk Assessment Procedures: Entities are required to implement thorough risk assessment procedures to identify, evaluate, and manage risks. This includes financial, operational, and reputational risks. Regular risk assessments help entities adapt to evolving market conditions and regulatory changes.

- Management Suitability: Supervisors will assess the suitability of management teams, focusing on their skills, knowledge, and experience in the crypto sector. Entities must ensure that their management personnel possess the necessary expertise to navigate the complexities of the crypto-asset market.

- Conflict of Interest Management: Entities must have robust policies to identify, prevent, manage, and disclose conflicts of interest. This is particularly crucial for entities engaged in multiple activities or those with significant interconnections with other financial entities or crypto-asset service providers.

- Complaints Handling Procedures: Effective complaints handling procedures are mandatory. Entities must establish transparent and accessible mechanisms for consumers to file complaints, ensuring timely and fair resolution of issues.

2. Financial Resilience

Financial resilience is crucial to ensure that entities can withstand market volatility and continue to operate effectively, thereby safeguarding consumer interests and maintaining market stability.

- Own Funds Requirements: Entities must maintain sufficient own funds to cover their liabilities. MiCA specifies the calculation methods and thresholds for these funds, ensuring that entities are adequately capitalized to absorb losses and support ongoing operations.

- Reserve Assets Management: Issuers of ARTs and EMTs are required to hold reserve assets of high quality and liquidity to back the tokens they issue. These assets must be managed prudently to ensure they are readily available to meet redemption requests from token holders.

- Capitalization and Liquidity Assessments: Supervisors will rigorously assess entities’ compliance with capitalization and liquidity requirements. This includes verifying the quality, composition, and management of reserve assets to ensure they meet MiCA standards.

- Stress Testing and Scenario Analysis: Entities should conduct regular stress testing and scenario analysis to evaluate their financial resilience under adverse market conditions. This helps in identifying potential vulnerabilities and implementing corrective measures proactively.

3. Technology Risk Management

Given the inherently digital nature of ARTs and EMTs, managing technology-related risks is a paramount concern under MiCA Regulation. This priority focuses on safeguarding the technological infrastructure supporting crypto-assets.

- ICT Risk Assessments: Entities must conduct comprehensive assessments of their Information and Communication Technology (ICT) systems to identify potential risks. This includes evaluating the security of their digital infrastructure, software, and hardware.

- Cybersecurity Measures: Robust cybersecurity measures are essential to protect against cyber threats such as hacking, data breaches, and other malicious activities. Entities must implement advanced security protocols, regular vulnerability assessments, and incident response plans.

- System Integrity and Operational Continuity: Ensuring the integrity and continuity of IT systems is crucial. Entities must have mechanisms in place to maintain operational continuity, including disaster recovery plans and backup systems to mitigate the impact of potential disruptions.

- Distributed Ledger Technologies (DLTs): For entities utilizing DLTs, specific criteria must be met to ensure the reliability and security of these technologies. This includes assessing the scalability, interoperability, and resilience of the DLT platforms used for storing and transferring crypto-assets.

- Contingency and Backup Plans: Entities must establish comprehensive contingency and backup plans to address potential disruptions in their technological infrastructure. These plans should include detailed procedures for system recovery and continuity of operations during and after a technological failure.

4. Financial Crime Risk Management

Mitigating financial crime risks is a critical priority under MiCA Regulation, given the potential for crypto-assets to be exploited for money laundering, terrorist financing, and other illicit activities.

- AML and CTF Compliance: Entities must adhere to stringent anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. This involves conducting thorough customer due diligence (CDD), including Know Your Customer (KYC) processes, to verify the identity of clients and assess their risk profiles.

- Ongoing Monitoring and Reporting: Continuous monitoring of transactions is required to detect and report suspicious activities. Entities must implement robust monitoring systems and have procedures in place for promptly reporting suspicious transactions to relevant authorities.

- Financial Crime Controls: Supervisors will evaluate the adequacy of financial crime controls, including policies, procedures, and technologies used to prevent and detect financial crime. This includes assessing the effectiveness of AML/CFT measures and the entity's ability to comply with regulatory requirements.

- Collaboration with AML/CFT Authorities: Entities are expected to collaborate closely with AML/CFT authorities, sharing information and best practices to strengthen financial crime prevention measures. This collaboration helps in building a cohesive approach to combating financial crime across the crypto-asset market.

Supervisory Priorities under MiCA Regulation

Proportionate and Risk-Based Approach

The implementation of supervisory priorities for Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs) under the MiCA Regulation requires a proportionate and risk-based approach. This approach ensures that supervisory activities are tailored to the specific risks and operational contexts of different entities, thereby enhancing the efficiency and effectiveness of regulatory oversight.

- Proportionality in Supervision: The principle of proportionality is embedded within the MiCA Regulation’s legal framework and technical standards. Supervisors are expected to apply this principle by considering the size, complexity, and risk profile of each entity. For instance, smaller entities with limited market impact may be subject to less intensive supervisory scrutiny compared to larger, more complex organizations that pose higher systemic risks.

- Risk-Based Supervision: Supervisory activities should prioritize the most significant risks identified through comprehensive risk assessments. This involves evaluating entities' risk profiles, maturity levels, and compliance cultures. High-risk areas, such as financial crime vulnerabilities or technological infrastructure, should receive more focused attention to mitigate potential threats effectively.

Key Elements of Implementation:

- Regular Risk Assessments: Entities must conduct regular risk assessments to identify and evaluate potential threats to their operations. These assessments should consider various factors, including market volatility, technological vulnerabilities, and financial stability. Supervisors will review these risk assessments to ensure that entities are adequately prepared to manage and mitigate identified risks.

- Customized Supervisory Plans: Based on the outcomes of risk assessments, supervisors should develop customized supervisory plans tailored to the specific needs and risk profiles of each entity. These plans should outline the scope, frequency, and intensity of supervisory activities, ensuring that resources are allocated efficiently to address the most critical risks.

Adapting to Market Changes

The dynamic nature of the crypto-asset market necessitates that both supervisors and entities remain agile and responsive to changes in market conditions, technology, and the regulatory environment. This adaptability is crucial for maintaining regulatory relevance and effectiveness.

- Monitoring Market Developments: Continuous monitoring of market developments is essential for identifying emerging trends, risks, and opportunities. Supervisors should leverage market intelligence, data analytics, and stakeholder feedback to stay informed about the latest developments in the crypto-asset market.

- Regulatory Updates and Guidance: As market conditions evolve, the EBA and other regulatory bodies may issue updates and guidance to address new challenges and opportunities. Entities must stay informed about these updates and incorporate them into their compliance frameworks promptly.

- Agility in Supervision: Supervisors must demonstrate agility in their supervisory practices, adjusting their approaches and priorities in response to changing market dynamics. This may involve revising supervisory plans, reallocating resources, and enhancing collaboration with other regulatory authorities.

Promoting Cooperation and Coordination

Effective implementation of MiCA Regulation relies on robust cooperation and coordination among competent authorities, the EBA, and other European Supervisory Authorities (ESAs). This collaborative approach ensures consistent enforcement of MiCA across the EU and fosters a stable and transparent crypto-asset market.

- Ongoing Dialogue: Continuous dialogue between competent authorities and the EBA is essential for addressing emerging issues, sharing insights, and aligning regulatory strategies. Regular meetings, joint working groups, and information-sharing platforms facilitate this dialogue.

- Sharing Authorization Decisions: Competent authorities should share information about authorization decisions and market developments to ensure transparency and consistency. This sharing helps prevent regulatory arbitrage and promotes a level playing field across the EU.

- Monitoring Market Developments: Joint monitoring of market developments by the EBA and competent authorities enables timely identification of systemic risks and coordinated regulatory responses. This proactive approach helps maintain market stability and protect investor interests.

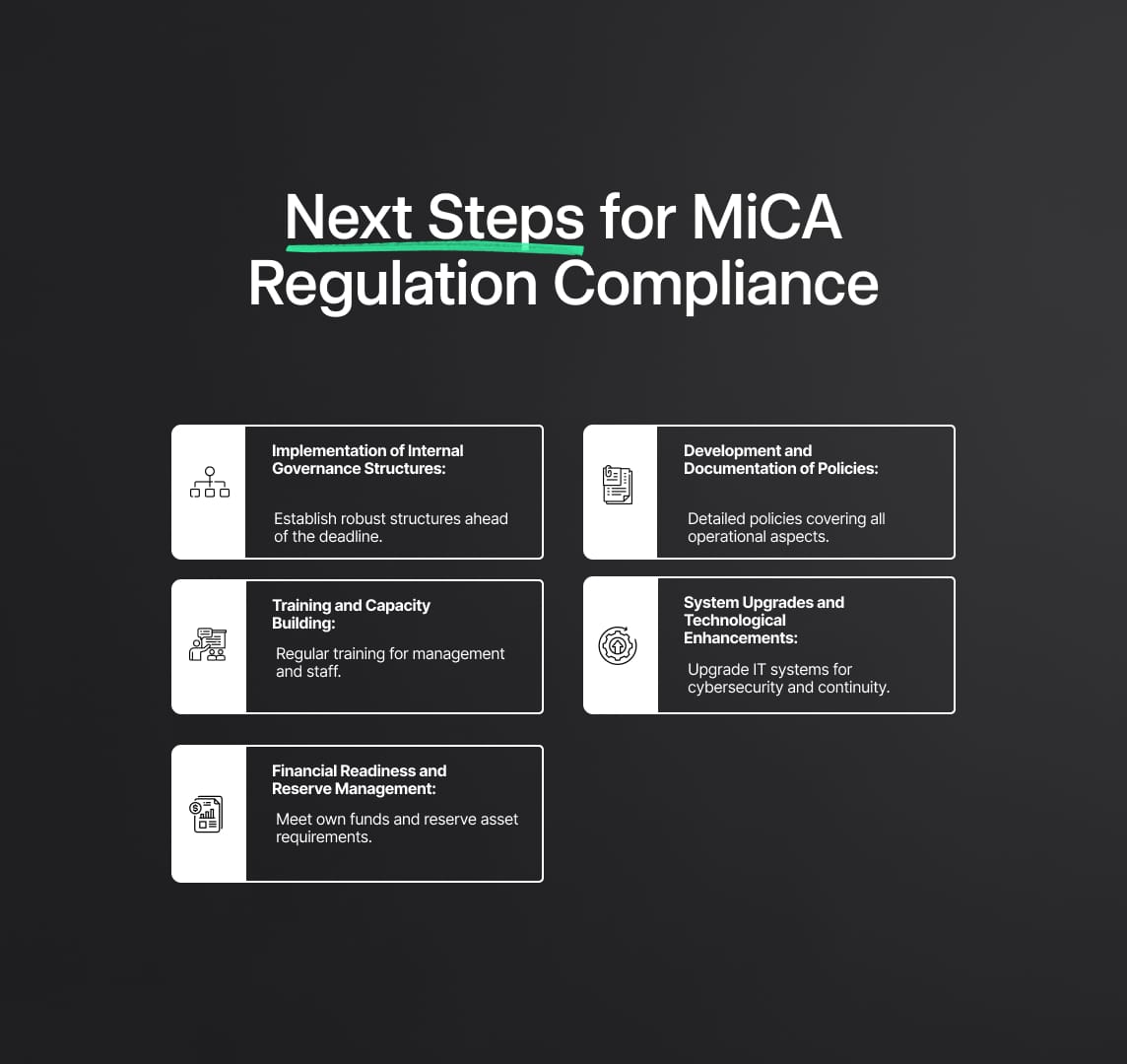

Next Steps for MiCA Regulation Compliance

The European Banking Authority (EBA) underscores the importance of timely preparations for compliance with the Markets in Crypto-assets Regulation (MiCA). With the regulatory framework set to take full effect for Asset-Referenced Tokens (ARTs) and E-money Tokens (EMTs) from 30 June 2024, entities involved in these activities must undertake comprehensive preparatory measures to align their operations with MiCA's stringent requirements.

- Implementation of Internal Governance Structures: Entities must establish robust internal governance structures well ahead of the compliance deadline. This involves defining clear organizational hierarchies, delineating roles and responsibilities, and setting up oversight committees to ensure adherence to MiCA guidelines.

- Development and Documentation of Policies: Issuers and service providers need to develop detailed policies and procedures covering all aspects of their operations, from risk management to consumer protection. These documents should be readily available for review by regulatory authorities to demonstrate compliance.

- Training and Capacity Building: Regular training sessions should be conducted for management and staff to ensure they are fully aware of MiCA requirements and equipped to implement necessary changes. This includes understanding technical standards, handling complaints, managing risks, and ensuring financial crime controls are in place.

- System Upgrades and Technological Enhancements: Given the emphasis on technology risk management, entities must upgrade their IT systems to enhance cybersecurity measures, ensure system integrity, and maintain operational continuity. This involves investing in advanced security technologies and conducting regular system audits.

- Financial Readiness and Reserve Management: Entities must ensure they meet the own funds and reserve asset requirements specified by MiCA. This includes conducting stress tests and liquidity assessments to ensure financial resilience under varying market conditions.

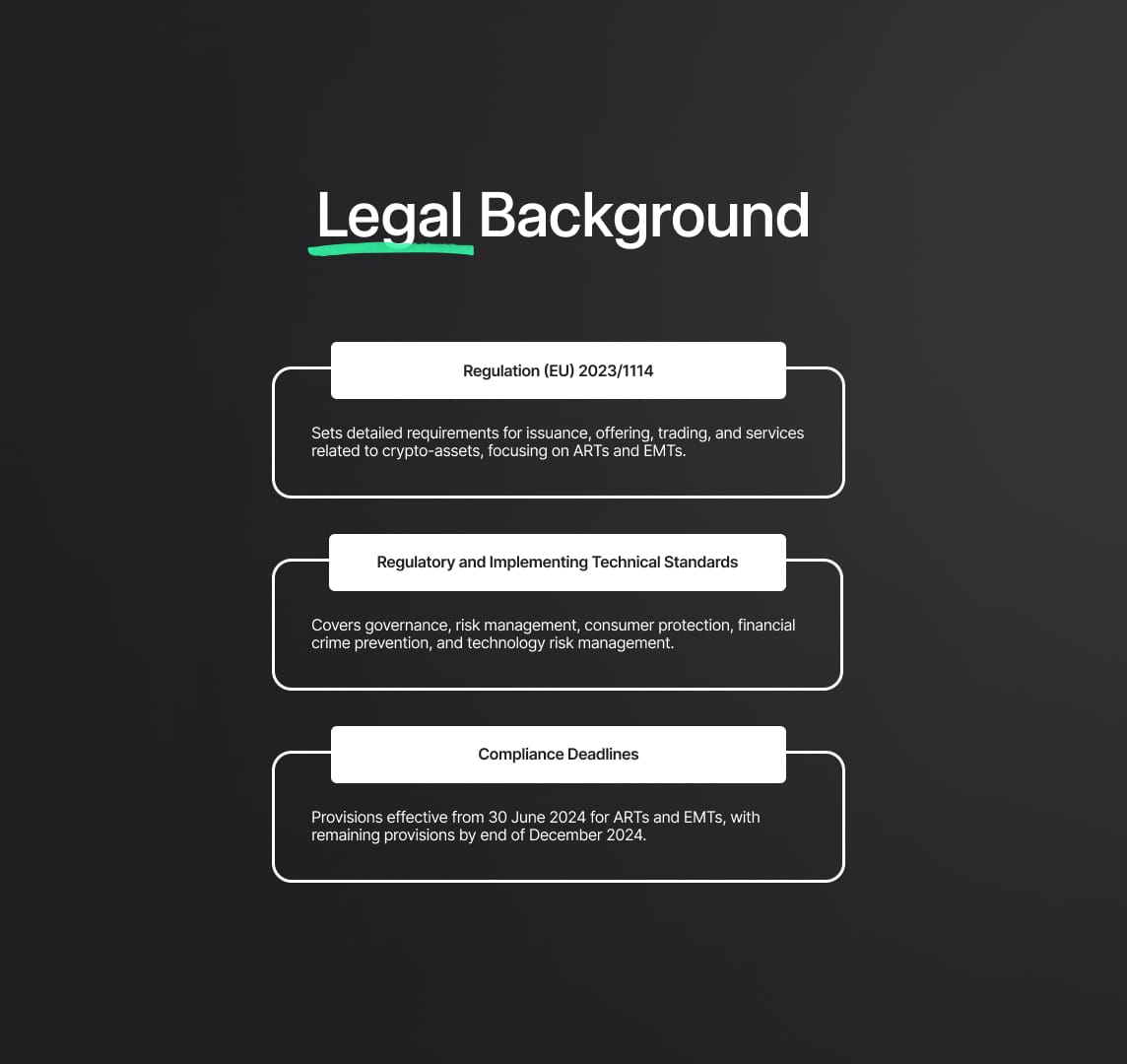

Legal Background

MiCA establishes a comprehensive legal framework for the regulation and supervision of crypto-assets within the EU. This framework is designed to provide a secure, transparent, and stable environment for crypto-asset activities, ensuring that all market participants adhere to stringent regulatory standards.

MiCA's Legal Framework:

- Regulation (EU) 2023/1114: MiCA is officially known as Regulation (EU) 2023/1114. It sets out detailed requirements for the issuance, offering, admission to trading, and provision of services related to crypto-assets, with a particular focus on ARTs and EMTs.

- Regulatory and Implementing Technical Standards: The regulation is supported by a comprehensive set of regulatory and implementing technical standards. These standards cover various aspects of crypto-asset activities, including governance, risk management, consumer protection, financial crime prevention, and technology risk management.

- Compliance Deadlines: The majority of MiCA provisions come into force on 30 June 2024 for ARTs and EMTs, with the remaining provisions becoming effective by the end of December 2024. Entities must ensure full compliance with these deadlines to avoid regulatory penalties.

Reduce your

compliance risks