MiFID II and MiFIR: ESMA on Market Structure and Trade Reporting

ESMA updates MiFID II and MiFIR, enhancing market transparency, post-trade reporting, and pre-trade waivers, while introducing the Designated Publishing Entity (DPE) framework to improve EU regulatory compliance.

MiFID II and MiFIR: A Complete Guide to the ESMA Updates

The European Union’s financial landscape is governed by a robust and dynamic regulatory framework. At its core are the Markets in Financial Instruments Directive (MiFID II) and the Markets in Financial Instruments Regulation (MiFIR). These foundational pieces of legislation are meticulously designed to create more transparent financial markets, strengthen investor protection, and uphold the integrity of operations across all EU Member States.

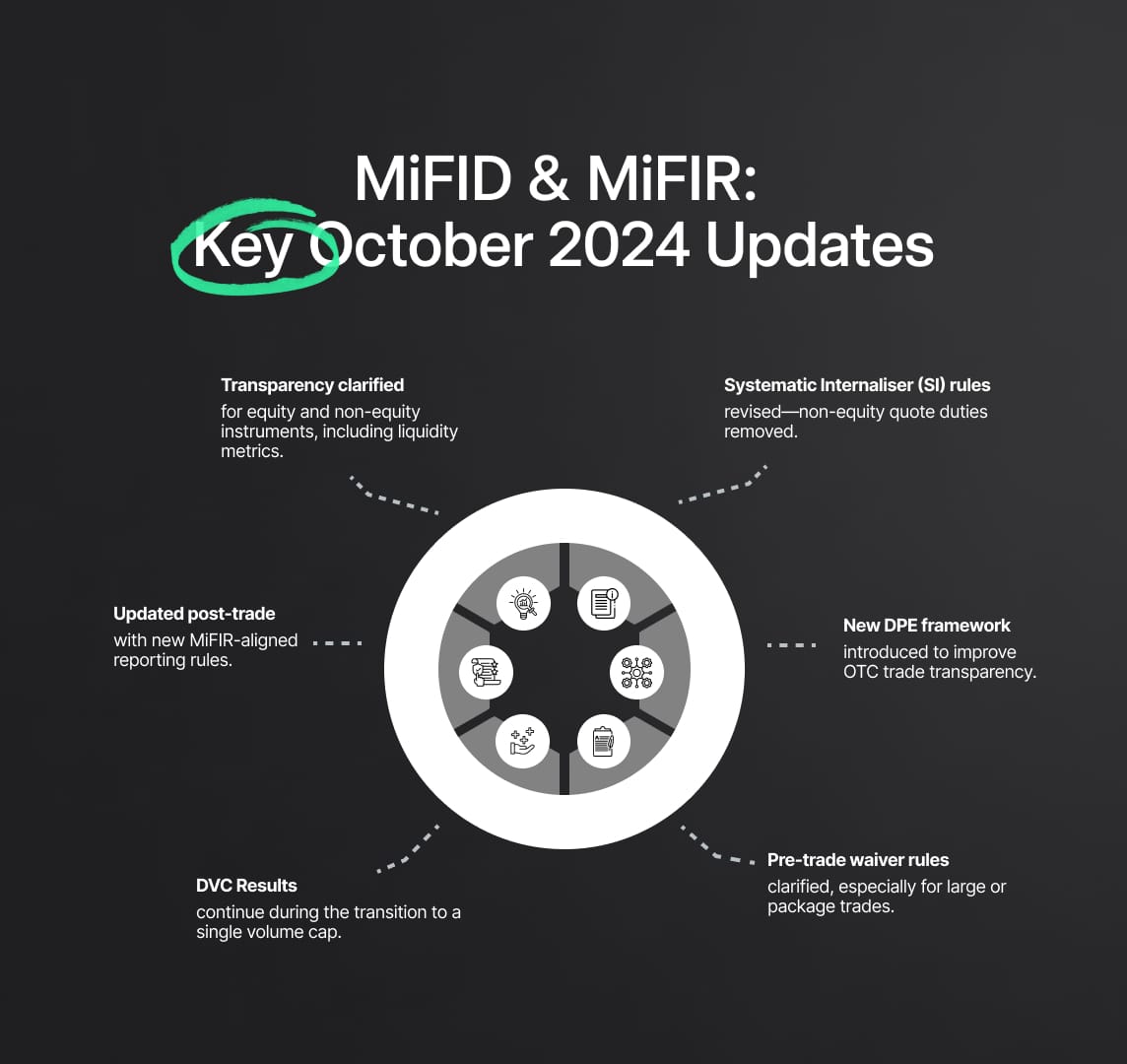

A pivotal development occurred on October 16, 2024, when the European Securities and Markets Authority (ESMA) released a significant package of updates concerning MiFID II and MiFIR. This package, which includes crucial Questions and Answers (Q&As) on transparency, an updated manual on post-trade transparency, and a formal Opinion on pre-trade transparency waivers, is more than a simple adjustment. It represents a critical clarification within the ongoing MiFIR Review, a comprehensive initiative aimed at resolving practical challenges and adapting the rules to modern market realities. This evolution is a key component of the EU's broader ambition to build a resilient and integrated Capital Markets Union (CMU).

This analysis provides an authoritative and in-depth examination of the MiFID II and Markets in Financial Instruments Regulation (MiFIR) frameworks, focusing specifically on the implications of the October 16, 2024, ESMA updates. We will dissect the technical changes, explain their practical impact on market participants, and assess their future role in shaping EU financial markets. The goal is to equip financial professionals, compliance officers, and legal experts with the essential understanding needed to navigate this complex regulatory environment effectively.

Understanding the Core Principles of MiFID II and MiFIR

The Markets in Financial Instruments Directive (MiFID II) and the Markets in Financial Instruments Regulation (MiFIR) serve as the bedrock of the EU's financial rulebook.

- MiFID II primarily outlines the operational standards for investment firms. Its scope covers firm authorisation, conduct of business rules, and stringent organisational requirements, all designed to ensure firms act in their clients' best interests within a fair and orderly market.

- MiFIR, as a directly applicable regulation, concentrates on enhancing market transparency. Its key provisions mandate pre- and post-trade transparency obligations, detailed transaction reporting to national competent authorities for market surveillance, and specific rules governing trading venues.

Together, MiFID II and MiFIR work to forge a more integrated, efficient, and resilient EU financial system.

The 2024 MiFIR Review and Legislative Context

The ESMA updates from October 2024 are an integral part of the wider MiFIR Review. This legislative overhaul, which includes the MiFID II Review Directive published on March 8, 2024, and effective from March 29, 2024, highlights the EU’s commitment to regulatory evolution. Since the initial implementation of MiFID II and MiFIR in January 2018, the review process seeks to address lessons learned and adapt to technological advancements. The primary objectives are to bolster the competitiveness of EU capital markets, simplify regulations where possible, and further the goals of the Capital Markets Union (CMU) by improving access to high-quality market data.

The Cycle of Regulatory Refinement and Its Impact

The progression from MiFID I (2007) to MiFID II/MiFIR (2018) and into the current MiFIR Review demonstrates a clear cycle of evaluation and refinement. ESMA is central to this process, tasked with developing detailed technical standards and providing ongoing clarity through Q&As, manuals, and opinions.

For market participants, this constant evolution demands perpetual vigilance and adaptive compliance strategies. Regulatory change is not a singular event but an ongoing process. Firms must maintain robust regulatory watch functions and build flexible compliance infrastructures capable of swiftly integrating new and highly specific guidance from ESMA.

ESMA Pronouncements: A Detailed Examination

On October 16, 2024, the European Securities and Markets Authority (ESMA) released a critical package of documents aimed at providing further clarity and detailed guidance on the application of the MiFID II and MiFIR frameworks.These publications are particularly significant as they reflect the ongoing MiFIR Review and address several complex areas related to transparency and market structure. The package included updated Questions and Answers (Q&As) on transparency and market structure issues, a revised Manual on post-trade transparency, and an updated Opinion on the assessment of pre-trade transparency waivers, considering the MiFIR Review's transitional provisions.

Table 1: Overview of ESMA's October 16, 2024, MiFID II/MiFIR Updates

| Document Type | Specific Title/Focus Area | Core Update Summary / Key Purpose | Key MiFID II/MiFIR Articles Addressed (Examples) |

|---|---|---|---|

| Q&A Document | Q&As on transparency and market structure issues | Clarifying application of transparency for equity/non-equity instruments, liquidity calculations (e.g., ADT), specific instrument nuances (e.g., emission allowance derivatives, gas derivatives). | MiFIR Art. 3–11, RTS 1, RTS 2, MiFID II Art. 57 |

| Manual | Manual on Post-Trade Transparency | Providing detailed operational guidance on reporting obligations, deferral mechanisms, DPE regime considerations, and alignment with MiFIR Review transitional provisions (e.g., DVC). | MiFIR Art. 6, 7, 10, 11, 20, 21; RTS 1; RTS 2 |

| Opinion | Opinion on the assessment of pre-trade transparency waivers under MiFIR Review transitional provisions | Clarifying conditions for NCAs granting pre-trade waivers (LIS, negotiated trades, CLOBs, package orders) under MiFIR Arts. 4 & 9, ensuring consistent application across the EU. | MiFIR Art. 4, 5, 9 |

Unpacking the Q&As on Transparency and Market Structure

ESMA's updated Questions and Answers (Q&As) on transparency are vital for promoting a harmonised application of the Markets in Financial Instruments Directive (MiFID II) and MiFIR across the EU. Although this guidance is technically non-binding, it provides essential clarity for market participants and national competent authorities (NCAs) on how to interpret and implement these complex regulations. The October 16, 2024, updates provide critical clarifications in several key areas.

The Q&As are expected to provide further detail on the following topics:

- Equity and Non-Equity Instrument Transparency: The Q&As will likely refine the criteria for determining a "liquid market." This classification is fundamental, as it directly triggers the pre- and post-trade transparency obligations mandated by MiFIR.

- Liquidity Indicators and Thresholds: Further clarity is anticipated on the calculation methods for key liquidity metrics, such as Average Daily Turnover (ADT) and Average Value of Transactions (AVT). These indicators are essential for setting the thresholds that govern transparency requirements.

- Guidance for Specific Instruments: The Q&As often address the unique challenges of applying transparency rules to niche financial instruments. For example, past guidance has clarified the reporting status of derivatives on emission allowances outside the EU Emissions Trading System (EU ETS) and the calculation of open interest for gas derivatives related to MiFID II position limits. The October updates may build upon this specific guidance.

- Package Orders and Transactions: Executing package orders, which bundle multiple financial instruments, presents significant compliance complexities, especially when components have different liquidity profiles. Any new clarifications from ESMA are crucial for firms that utilise these trading strategies.

The continuous updating of such detailed Q&As highlights the inherent complexity of the Markets in Financial Instruments Regulation. Translating the high-level principles of MiFIR into daily operational practice is a significant challenge due to the sheer diversity of financial instruments and market structures.

ESMA's Q&A process serves as an indispensable tool for resolving ambiguities and fostering a uniform application of the rules. For financial firms, this means that relying solely on the primary legislative texts is insufficient. It is imperative to actively monitor and integrate ESMA's Level 3 guidance into compliance frameworks, a task that demands significant internal expertise and advanced RegTech solutions to manage this level of regulatory detail.

Mastering the Manual on Post-Trade Transparency

The updated Manual on Post-Trade Transparency, released by ESMA on October 16, 2024, is a cornerstone document providing operational guidance for implementing MiFIR. Building on the foundation of the July 2023 version, this latest manual incorporates amendments from the ongoing MiFIR Review and addresses new stakeholder questions, solidifying its role as a user-friendly yet comprehensive tool.

Key areas of focus within the updated manual include:

- Scope of Application: The manual meticulously defines which financial instruments and transactions fall under post-trade transparency rules. It covers shares, ETFs, bonds, structured finance products (SFPs), and derivatives, clarifying complex concepts like "traded on a trading venue" (TOTV), especially as it applies to derivatives and transactions with a third-country dimension.

- Reporting Responsibilities: A major section clarifies the "who, what, and when" of trade reporting. It details who is responsible for public disclosure, the precise timelines for publication, and the specific data fields required. This guidance is particularly important in light of the new Designated Publishing Entity (DPE) regime and includes detailed instructions on using appropriate data flags for cancellations, amendments, and algorithmic trades.

- Deferral Mechanisms: The manual provides granular detail on applying post-trade transparency deferrals. These mechanisms, which allow for delayed publication of large-in-scale (LIS) or illiquid trades, are critical for preventing undue market impact while still ensuring eventual transparency.

- Alignment with MiFIR Review: The guidance is fully aligned with changes introduced by the MiFIR Review. This includes addressing transitional provisions, such as the continued use of the Double Volume Cap (DVC) mechanism during the shift to the new single volume cap (SVC) system. It also details the transparency calculations performed by ESMA through its IT systems (e.g., FITRS, FIRDS).

The detail within the Post-Trade Transparency Manual underscores how effective regulation under MiFID II and MiFIR depends on robust data reporting infrastructure and highly standardised data. The precise specifications for data fields and reporting logic demand sophisticated IT systems within financial firms.

Ultimately, compliance with post-trade transparency is far more than a legal exercise; it is a significant data management and technological challenge. The accuracy of data is paramount for the entire transparency regime and is a foundational requirement for the MiFIR Review's long-term goal of establishing Consolidated Tapes (CTPs). Achieving high-quality, standardised post-trade data—which this manual is designed to produce—is essential for the future of EU market transparency.

Interpreting the Opinion on Pre-Trade Transparency Waivers

ESMA’s Opinion on pre-trade transparency waivers, issued on October 16, 2024, provides vital clarification for both National Competent Authorities (NCAs) and market participants. Pre-trade transparency is a central pillar of the Markets in Financial Instruments Regulation (MiFIR), requiring trading venues and systematic internalisers to publicly display bid-offer prices and trading depth.

However, MiFIR allows for waivers under specific conditions to prevent the market disruption that could result from displaying very large orders or orders in illiquid instruments. This ESMA Opinion is particularly important as it considers the transitional provisions of the broader MiFIR Review.

The Opinion addresses several key aspects of the waiver regime:

- Waiver Types under MiFIR: The guidance focuses on waivers for both equity (MiFIR Article 4) and non-equity (MiFIR Article 9) instruments. These include the Large-in-Scale (LIS) waiver, the Order Management Facility (OMF) waiver, the reference price waiver, and the negotiated trade waiver.

- Consistent Application: A primary goal of the Opinion is to ensure NCAs grant these waivers consistently across the EU. This is essential to prevent regulatory arbitrage and maintain a level playing field for all market participants.

- Package Orders: The application of waivers to package transactions—orders involving multiple instruments traded as one unit—is a notoriously complex area. New guidance here is significant because the individual components of a package often have different liquidity profiles and waiver eligibility under MiFIR.

- Recurring Issues and Clarifications: ESMA uses these opinions to resolve common ambiguities that arise during its oversight of waiver notifications submitted by NCAs, thereby promoting more consistent supervisory practices.

The regulatory framework for pre-trade waivers illustrates a fundamental balancing act. On one hand, transparency is essential for price discovery. On the other, rigid application of these rules could lead to adverse market impact, harming investors. The waiver regime under the Markets in Financial Instruments Regulation is the mechanism designed to mitigate these negative consequences.

ESMA's role in issuing opinions and overseeing their use is crucial to ensure waivers facilitate efficient market functioning without undermining transparency. For firms, particularly those executing large orders or operating in less liquid markets, a sophisticated understanding of this waiver regime is non-negotiable for achieving best execution while remaining fully compliant with MiFID II and MiFIR.

Pivotal MiFIR Review Developments Reshaping Market Operations

Beyond the specific guidance documents released on October 16, 2024, the broader MiFIR Review is introducing fundamental changes to EU market structure. These reforms are engineered to significantly enhance transparency, streamline reporting, and improve the quality and accessibility of market data. Among the most impactful changes are the introduction of the Designated Publishing Entity (DPE) framework and major revisions to the Systematic Internaliser (SI) regime.

The Dawn of the Designated Publishing Entity (DPE) Framework

The Designated Publishing Entity (DPE) framework, introduced by the new Article 21a of MiFIR, represents a major evolution in post-trade transparency for Over-the-Counter (OTC) transactions. This new regime simplifies reporting duties, moving away from the complex and often ambiguous SI-centric model.

Key operational aspects of the DPE framework include:

- Role and Responsibilities: A DPE is an investment firm authorised by its NCA to publish trade reports for specific asset classes. Its primary duty is to make details of its OTC transactions public through an Approved Publication Arrangement (APA).

- Reporting Hierarchy: The new MiFIR rules establish a clear logic for determining who reports an OTC trade:

- If one party is a DPE, that DPE must report the trade.

- If neither party is a DPE, or if both are, the responsibility falls to the seller.

- Implementation Timeline: The DPE regime is being phased in. While its legal basis applies from March 28, 2024, ESMA published the DPE register by September 29, 2024. The core reporting hierarchy becomes fully operational on February 3, 2025. Until then, existing post-trade reporting rules under RTS 1 and RTS 2 remain in effect.

- ESMA DPE Register: ESMA maintains a central, public register of all DPEs, including their LEI and the specific financial instrument classes for which they are designated. This register is the definitive tool for identifying the correct reporting party for an OTC trade.

The DPE framework was designed to fix the known shortcomings of the previous reporting system, where responsibility was tied to a firm's SI status in a specific instrument. That system was cumbersome and could lead to firms opting into the full SI regime just to manage reporting, creating disproportionate burdens.

By establishing a clear, registered role for OTC trade publication that is decoupled from SI pre-trade quoting obligations, the DPE regime creates clearer lines of responsibility. This shift is expected to significantly improve the quality and reliability of OTC post-trade data, a critical input for regulatory surveillance and the planned Consolidated Tapes.

For firms active in OTC markets, this is a significant operational change. They must understand the new reporting hierarchy, determine if they need to register as a DPE for relevant asset classes, and update all systems and counterparty processes well ahead of the February 3, 2025, deadline.

Table 2: Designated Publishing Entity (DPE) Regime: Key Features and Implementation Milestones

| Document Type | Specific Title/Focus Area | Core Update Summary / Key Purpose | Key MiFID II/MiFIR Articles Addressed (Examples) |

|---|---|---|---|

| Q&A Document | Q&As on transparency and market structure issues | Clarifying application of transparency for equity/non-equity instruments, liquidity calculations (e.g., ADT), specific instrument nuances (e.g., emission allowance and gas derivatives). | MiFIR Art. 3–11, RTS 1, RTS 2, MiFID II Art. 57 |

| Manual | Manual on Post-Trade Transparency | Providing detailed operational guidance on reporting obligations, deferral mechanisms, DPE regime considerations, and alignment with MiFIR Review transitional provisions (e.g., DVC). | MiFIR Art. 6, 7, 10, 11, 20, 21; RTS 1; RTS 2 |

| Opinion | Opinion on the assessment of pre-trade transparency waivers under MiFIR Review transitional provisions | Clarifying conditions for NCAs granting pre-trade waivers (LIS, negotiated trades, CLOBs, package orders) under MiFIR Arts. 4 & 9, ensuring consistent application across the EU. | MiFIR Art. 4, 5, 9 |

Recalibrating the Systematic Internaliser (SI) Regime

The MiFIR Review introduces significant amendments to the Systematic Internaliser (SI) regime, fundamentally altering the obligations for firms that fall under this classification. An SI is an investment firm that executes client orders on its own account in an organised, frequent, and systematic way outside of a regulated trading venue.

The key changes to the SI regime include:

- Revised Threshold Calculations: The quantitative criteria for determining if a firm qualifies as an SI have been updated. ESMA has published new Implementing Technical Standards (ITS) on the notification process, which are crucial for firms self-assessing their SI status under the revised MiFIR framework.

- Modified Quoting Obligations: A pivotal change involves pre-trade quoting obligations. For most non-equity instruments (including bonds, derivatives, and SFPs), the obligation for SIs to provide quotes has been removed. For equities, however, the MiFIR Review aims to strengthen SI quoting obligations, including adjustments to minimum quote sizes, reinforcing their role in this market.

- Decoupling from OTC Reporting: The introduction of the Designated Publishing Entity (DPE) framework severs the link between SI status and OTC post-trade reporting. With DPEs handling OTC trade publication from February 3, 2025, the mandatory SI regime for reporting purposes will cease on February 1, 2025. Consequently, ESMA will discontinue its quarterly SI data publications from September 2025.

- Midpoint Matching Clarifications: The new rules clarify how SIs can conduct midpoint matching (executing at the midpoint of the bid-offer spread). Proposals have included prohibiting SIs from matching orders at the midpoint for certain trade sizes unless specific conditions, such as respecting tick sizes, are met.

- Ban on Payment for Order Flow (PFOF): The MiFID II Review introduces a comprehensive ban preventing SIs and other firms from receiving payments from third parties for forwarding client orders for execution (PFOF). The ban is effective immediately, with a transitional period for EU Member States where the practice was previously established.

The MiFIR Review is fundamentally reshaping the Systematic Internaliser regime. Historically, SIs performed a dual role: acting as key liquidity providers with pre-trade quoting obligations and serving as the primary entities for post-trade reporting of their OTC transactions. This created significant operational complexity.

The latest reforms effectively separate these two functions. The DPE framework carves out the OTC post-trade reporting responsibility, while the changes to quoting obligations reflect a more tailored and sophisticated approach to market transparency under the Markets in Financial Instruments Regulation. The removal of quoting duties for most non-equity instruments acknowledges their unique market structure, whereas the focus on strengthening equity quoting obligations reinforces the SI's role as a regulated source of off-venue liquidity.

This transforms the SI regime into a more specialised function focused on liquidity provision, particularly in equity markets. Firms currently operating as SIs must meticulously reassess their status and strategic approach in light of these changes. Many may find the mandatory SI regime no longer applies to them after February 2025, potentially reducing their compliance burden. However, those remaining SIs, especially in the equity space, will face a more refined and demanding set of rules under MiFID II and MiFIR.

Table 3: Evolution of OTC Post-Trade Reporting: SI Regime vs. DPE Regime

```html

| Feature | Systematic Internaliser (SI) Regime (Pre-Feb 3, 2025, for OTC reporting) | Designated Publishing Entity (DPE) Regime (From Feb 3, 2025) | Key Regulatory Shift / Implication |

|---|---|---|---|

| Primary Reporting Obligation Basis | Often linked to the SI status of one of the counterparties in the specific financial instrument traded. | Based on DPE status of counterparties in specific classes of financial instruments. If one DPE, it reports. If no DPE or both are DPEs, the seller reports. | Simplification of determining reporting responsibility; moves away from complex SI status checks for each trade. |

| Scope of Reporting Entity | Firm-level SI status for an instrument class, but reporting determination could be trade-by-trade if SI status was borderline or instrument-specific. | Firm-level DPE status for designated classes of financial instruments. | Clearer designation of reporting entities for specific asset classes. |

| Pre-trade Obligations Linkage | SI status inherently linked to pre-trade quoting obligations for liquid instruments (though nuanced by asset class). | DPE status is decoupled from pre-trade quoting obligations. A DPE is not automatically an SI and vice-versa. | Reduces burden for firms wishing to report OTC trades without undertaking SI quoting obligations. Allows for specialization. |

| Register / Identification | SI register exists, but identifying the SI in a specific transaction for reporting could be complex. | Central ESMA DPE register clearly lists DPEs and their designated instrument classes. | Easier and more transparent identification of the party responsible for reporting an OTC transaction. |

| Key Driver for Reporting | Executing an OTC trade as an SI in that instrument. | Being a party to an OTC transaction as a registered DPE for that instrument class, or being the seller in transactions where DPE status doesn't dictate. | Focus shifts from a broader market-making/internalisation status (SI) to a specific designated publishing role (DPE) for OTC transparency. |

| Overall Complexity | Considered complex, potentially leading to firms opting into SI status for reporting convenience, which could inflate SI volumes. | Designed to be simpler and more streamlined, with clearer rules of engagement. | Aims to reduce operational friction and improve the consistency and reliability of OTC post-trade data, facilitating better market oversight and data for consolidated tapes. |

Implications and Strategic Considerations for Market Participants

The ESMA updates from October 16, 2024, combined with the structural shifts from the MiFIR Review, present significant practical implications for all market participants. The new Designated Publishing Entity (DPE) framework and the recalibrated Systematic Internaliser (SI) regime require investment firms, trading venues, and data reporting service providers (DRSPs) to move beyond mere compliance. Successfully navigating this evolved regulatory landscape, governed by the Markets in Financial Instruments Directive (MiFID II) and MiFIR, demands proactive adaptation in technology, operations, and overall business strategy.

Key Operational and Compliance Challenges

Implementing these regulatory changes imposes several considerable burdens that firms must address:

- Infrastructure and Technology Investment: Firms must invest in upgrading IT systems and data management workflows. Infrastructure must be adapted to handle the new DPE reporting logic, revised SI obligations, and the intense focus on data accuracy required by the Markets in Financial Instruments Regulation (MiFIR).

- Navigating Regulatory Detail: The granular guidance within ESMA's Q&As, manuals, and opinions, while helpful, requires substantial internal expertise to interpret and implement correctly.

- DPE Framework Adoption: Firms active in OTC markets must immediately assess if they need to register as a DPE. This includes engaging with their National Competent Authority (NCA) and, crucially, updating systems to identify DPE counterparties to ensure the new reporting hierarchy is correctly applied.

- SI Regime Adjustments: Firms operating as SIs must adapt to new calculation methods, the strengthened quoting rules for equities, and the fundamental shift of OTC post-trade reporting responsibility to DPEs.

- Data Quality and Validation: With the future development of Consolidated Tapes, the premium on data quality is higher than ever. Firms need robust validation processes for identifiers like LEIs and ISINs to meet the heightened expectations of MiFIR.

- Buy-Side Reporting Oversight: All investment firms, including the buy-side, are ultimately responsible for the accuracy of their transaction reports, even when delegated. This mandates robust oversight of any third-party reporting service.

- Cross-Functional Coordination: These changes impact the entire organisation—from the front office to compliance and IT. Effective implementation requires seamless cross-departmental collaboration.

Strategic Opportunities in the New Framework

While challenging, these regulatory evolutions also create distinct strategic opportunities:

- Enhanced Regulatory Clarity: The detailed guidance from ESMA, despite its complexity, provides a clearer compliance roadmap, reducing the ambiguity that previously existed under MiFID II and MiFIR.

- Strategic DPE Positioning: For firms with strong data management capabilities, registering as a DPE can become a strategic advantage, offered as a value-added service to clients or used to efficiently manage their own OTC reporting.

- Efficient Large-Order Execution: Greater clarity on pre-trade transparency waivers, particularly for Large-in-Scale (LIS) orders, allows firms to execute large transactions more efficiently by mitigating adverse market impact.

- Streamlined SI Obligations: For SIs focused on non-equity markets, the removal of pre-trade quoting obligations for most instruments reduces operational costs and allows them to refine their business models.

The cumulative weight of these changes from the MiFIR Review compels firms to undertake more than just tactical compliance fixes. It necessitates a strategic re-evaluation of business models, operational structures, and technology roadmaps. Firms must now decide whether to embrace new roles, such as DPE status, which carries strategic implications far beyond simple regulatory adherence.

The associated costs of compliance may lead some firms to reconsider their participation in certain markets if the regulatory burden outweighs the commercial benefit.

Ultimately, this regulatory inflection point will favour firms that view these changes not as a cost, but as a catalyst for modernization. Those that make strategic investments in state-of-the-art compliance and data infrastructure will not only satisfy their obligations under the Markets in Financial Instruments Directive and Regulation but will also unlock a significant competitive edge in the new European market landscape.

The Future Trajectory of EU Financial Markets Post-MiFIR Review

The MiFIR Review, including the October 2024 ESMA updates and transformative reforms like the Designated Publishing Entity (DPE) framework, is set to fundamentally reshape the architecture of EU financial markets. The overarching goal is to cultivate a market ecosystem that is more efficient, transparent, and integrated, thereby strengthening investor protection and advancing the Capital Markets Union (CMU).

The Push for Greater Transparency: CTPs and Fragmentation

A central ambition of the Markets in Financial Instruments Regulation (MiFIR) review is to dramatically improve the quality and accessibility of market data. The flagship initiative is the development of Consolidated Tapes (CTPs) for equities, bonds, and OTC derivatives. By aggregating trade data from the EU's many trading venues and Approved Publication Arrangements (APAs), CTPs aim to provide a single, comprehensive view of pricing and trading activity. This is designed to reduce information asymmetry, improve price discovery, and empower better-informed trading decisions.

This initiative also directly addresses the market fragmentation that resulted from MiFID I. While increased competition among venues had benefits, it also made it difficult to see a complete picture of market liquidity. The CTP aims to solve this by providing a unified view that transcends individual platforms. Furthermore, the DPE framework for OTC markets brings greater order and consistency to a traditionally opaque market segment, fostering fairer practices and reducing opportunities for market abuse.

The Critical Role of Technology and RegTech Solutions

The data-intensive and real-time nature of the MiFID II / MiFIR framework makes advanced technology indispensable. Regulatory Technology (RegTech) has become a critical partner for firms navigating these complex obligations.

- Automation of Compliance: RegTech platforms are essential for automating transaction and trade reporting, market surveillance, and regulatory change management. Given that MiFIR transaction reports can have up to 65 distinct data fields, manual processing is unfeasible and prone to error.

- Real-Time Data Analytics: The regulatory emphasis on real-time transparency drives demand for high-speed data processing systems. Beyond mere compliance, the vast datasets generated under MiFIR are a valuable asset. Firms using advanced analytics can unlock business insights to inform trading strategies and enhance risk management.

Cross-Border Impact and UK-EU Divergence

EU financial regulations like MiFID II often have a significant extraterritorial impact, positioning the EU as a global standard-setter. Non-EU firms operating within the Union must typically comply with relevant aspects of the regime.

The post-Brexit landscape, however, has introduced new complexity. The UK has implemented its own UK MiFIR and is pursuing a separate reform agenda. While core principles remain aligned, divergences are growing. For example, the UK's Designated Reporter Regime (DRR) for OTC reporting differs from the EU's DPE framework.

This divergence creates a dual regulatory burden for firms operating across both jurisdictions, requiring careful management of two distinct sets of rules. This increases operational complexity and compliance costs for global market participants.

Strengthening Investor Protection and Market Confidence

At its heart, the entire MiFID II and MiFIR framework is designed to enhance investor protection. The latest updates contribute to this goal in several key ways:

- Enhanced Transparency: Greater clarity on market liquidity and execution costs empowers investors and fosters confidence in market integrity.

- Improved Best Execution: The MiFID II review includes further refinements to best execution rules, building on the requirement for firms to take "all sufficient steps" to secure the best possible outcome for their clients.

- Reduced Market Abuse: High-quality, comprehensive transaction reporting provides regulators with superior tools to detect and investigate market abuse, such as insider dealing and manipulation.

The Evolving Regulatory Cycle

While the MiFIR Review is a major step forward, it is essential to recognise that complex regulation operates within a dynamic cycle. The initial MiFID framework, for instance, while increasing competition, also contributed to the market fragmentation that the Consolidated Tape now seeks to remedy. Similarly, the complexity of the original SI regime led to the creation of the more streamlined DPE framework.

This evolutionary process is ongoing. The unbundling of payments for investment research under MiFID II, for example, led to a decrease in analyst coverage for smaller firms, an unintended consequence that continues to be debated. The significant costs associated with compliance also influence business decisions, potentially leading to market consolidation or firms exiting certain activities, which can have unforeseen impacts on liquidity and competition.

As RegTech solutions evolve to meet new regulatory demands, new ways of interacting with markets and data will emerge, which regulators will, in turn, need to monitor. This underscores the constant interplay between regulation, market behaviour, and technological innovation. The MiFIR Review is a significant and defining chapter in this narrative, but it is unlikely to be the final word.

Strategic Pathways to MiFID II and MiFIR Compliance

Successfully navigating the revamped MiFID II and MiFIR landscape requires more than baseline compliance. It demands a proactive strategy that integrates operational adjustments, technological investment, and robust governance. Firms that effectively adapt to these new standards will not only mitigate regulatory risk but will also uncover opportunities for greater efficiency and a distinct competitive advantage.

An Actionable Checklist for MiFIR Compliance

To thrive in this new regulatory environment, firms should consider the following strategic actions:

- Conduct a Comprehensive Gap Analysis: The first step is a thorough assessment of all business areas impacted by the MiFIR Review. This must cover the October 16, 2024, ESMA updates, the new DPE regime, and revised SI obligations.

- Invest in Flexible Technology: The data-intensive nature of MiFIR compliance makes RegTech solutions critical. Firms must invest in flexible platforms for transaction reporting, data management, and transparency monitoring that can adapt to evolving rules.

- Enhance Data Governance: Strong data governance is paramount. Firms must establish robust frameworks to ensure the accuracy, completeness, and integrity of all data required for MiFID II / MiFIR reporting, including clear data ownership and quality controls.

- Update Internal Policies: All relevant internal policies, from best execution to product governance and conflict of interest, must be meticulously updated to reflect the latest regulatory requirements.

- Invest in Training and Expertise: The nuances of MiFID II and MiFIR demand a high level of understanding. Firms must invest in comprehensive training and ensure access to sufficient regulatory expertise.

- Make Strategic DPE and SI Decisions: Firms active in OTC markets must decide whether to register as a DPE. Likewise, firms near the SI thresholds must make strategic decisions about their SI operations in light of the revised rules.

- Embrace Proactive Regulatory Intelligence: A reactive approach is no longer viable. Firms must establish robust processes to monitor publications from ESMA and national regulators to anticipate and prepare for regulatory trends.

- Build a Resilient Operational Framework: The focus should be on creating systems and processes designed with adaptability in mind. This involves clear lines of accountability and regular auditing of compliance processes to ensure ongoing effectiveness.

In the stringently enforced sphere of MiFID II and MiFIR, a firm’s ability to achieve robust and proactive compliance is a significant competitive differentiator. Regulatory authorities are actively enforcing reporting rules, and failures carry both financial penalties and severe reputational risk.

The Transformative Impact of the MiFID II and MiFIR Review

The MiFID II and MiFIR Review, incorporating the pivotal ESMA updates of October 16, 2024, and fundamental reforms like the DPE framework, represents a significant maturation of the EU’s financial market regulation. These revisions are not mere technical adjustments; they signal a profound evolution in the EU's approach to market transparency, oversight, and structure. The enhanced focus on data quality, the drive towards creating Consolidated Tapes, and the simplification of OTC reporting all contribute to this transformative agenda.

These comprehensive reforms underscore the EU's unwavering commitment to fostering robust and investor-centric financial markets. This commitment is deeply intertwined with the strategic objectives of the Capital Markets Union (CMU), which aims to create more integrated and resilient capital markets to support economic growth across the Member States. The MiFIR Review is a clear testament to this ongoing effort to perfect the regulatory framework in response to evolving market realities.

The path forward involves considerable implementation efforts for all market participants. Challenges related to technology, data management, and interpreting complex rules are undeniable. However, the long-term vision is one of an EU financial system with greater integration, efficiency, and investor confidence.

Firms that proactively embrace these changes, making the necessary strategic investments in technology and fostering a culture of robust compliance, will be best positioned to thrive in the sophisticated European financial markets of the future. This ongoing narrative of regulatory refinement is a key chapter in the ambitious project of European capital market integration, and its success depends on the continued commitment of all participants.

Reduce your

compliance risks