MREL and BRRD: EU Banks’ Progress and Remaining Shortfalls

The Minimum Requirement for Own Funds and Eligible Liabilities (MREL) and the Bank Recovery and Resolution Directive (BRRD) are vital to EU financial stability. The EBA’s 2024 MREL Dashboard highlights 94% compliance among banks, reducing shortfalls and strengthening crisis resilience.

The Minimum Requirement for Own Funds and Eligible Liabilities (MREL) and the Bank Recovery and Resolution Directive (BRRD) are pivotal components of the European Union's strategy for financial stability. On November 27, 2024, the European Banking Authority (EBA) published its 2024 MREL Dashboard, providing comprehensive insights into the progress and challenges of MREL implementation across EU banks.

Source

[1]

[2]

Introduction to MREL and BRRD

In the European Union's financial regulatory framework, the Minimum Requirement for Own Funds and Eligible Liabilities (MREL) and the Bank Recovery and Resolution Directive (BRRD) are cornerstone mechanisms designed to ensure the resilience and stability of the banking system. Together, these tools aim to enhance banks’ capacity to absorb losses and recover from financial distress, safeguarding the broader economy and society from systemic risks.

What is MREL?

MREL ensures that banks maintain adequate loss-absorbing capacity. Specifically, it requires banks to hold a combination of own funds and eligible liabilities that can be used to absorb losses in the event of severe financial difficulty. This requirement allows regulators to implement resolution strategies effectively, such as:

- Bail-in: Creditors bear part or all of the losses, protecting depositors and taxpayers.

- Asset Transfer: Critical assets are transferred to a healthy financial entity, ensuring the continuity of essential banking functions.

The level of MREL required varies depending on the size, systemic importance, and risk profile of each bank. Global Systemically Important Institutions (G-SIIs) and other key banks face higher requirements due to their potential impact on the financial system.

External and Internal MREL Requirements: A Dual-Layered Framework

External MREL

External MREL requirements are binding for resolution entities, particularly Global Systemically Important Institutions (G-SIIs). For G-SIIs, the average MREL requirement is 28.5% of their total risk exposure amount (TREA), reflecting their pivotal role in maintaining systemic stability. Banks categorized as Top-Tier or Other Banks also face tailored MREL requirements based on their size and risk exposure. Compliance with these stringent thresholds underscores the importance of capital planning and robust loss-absorbing structures.

Internal MREL

Internal MREL applies to non-resolution entities within a resolution group, ensuring the resilience of subsidiary structures and preventing contagion risks within financial groups. These requirements are calibrated based on the size and systemic importance of the entity, with smaller institutions often subject to relatively lower thresholds. The dual application of external and internal MREL enhances the integrity of the resolution framework across the banking sector.

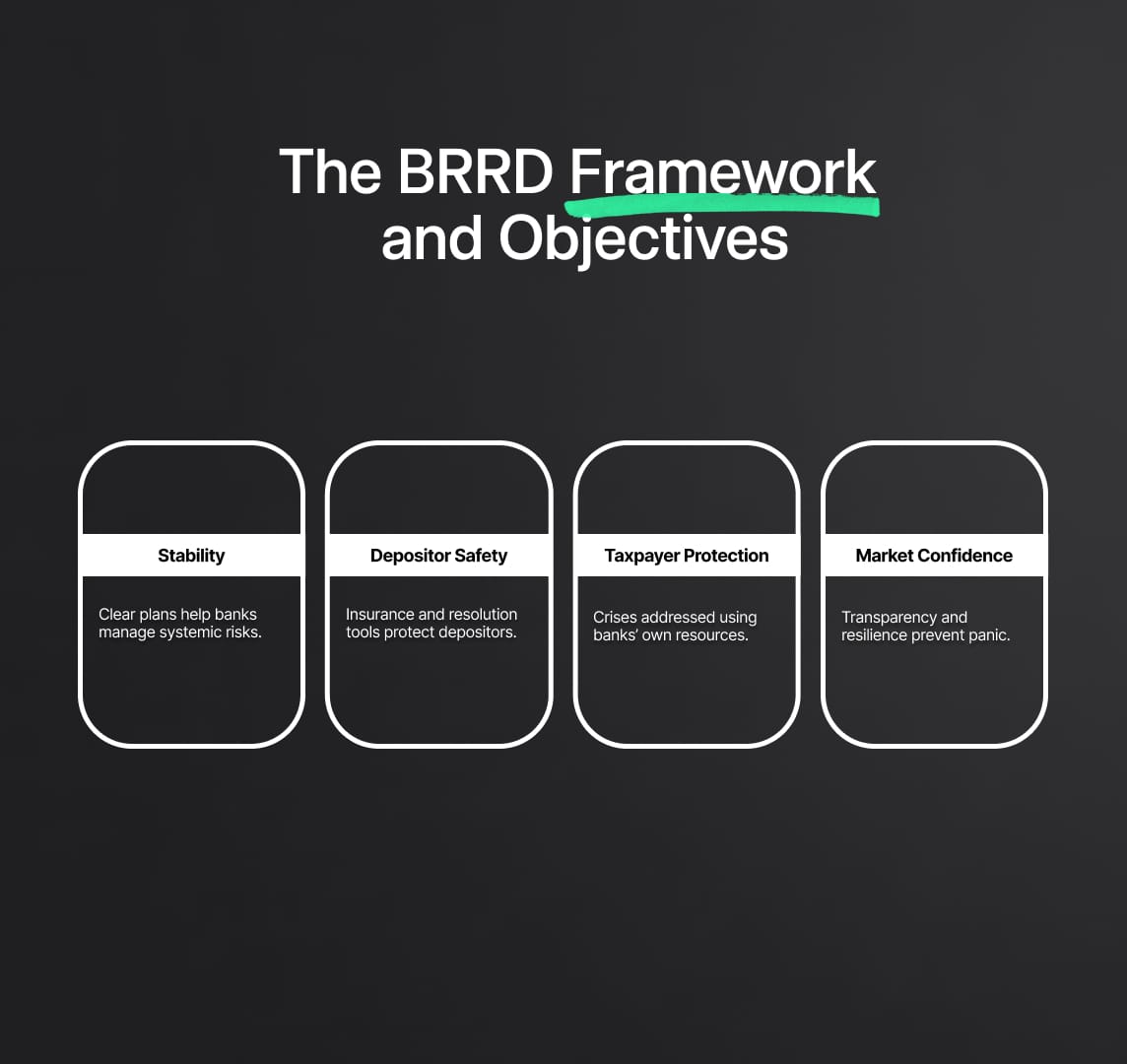

The BRRD Framework and Objectives

The BRRD, introduced by the EU in 2014, provides a unified and robust crisis management framework applicable to banks across all member states. Its primary objectives include:

- Protecting Financial Stability: By ensuring banks have clear recovery and resolution plans to mitigate systemic risks.

- Safeguarding Depositors: By leveraging deposit insurance schemes and orderly resolution processes to prevent depositor losses.

- Minimizing Taxpayer Burden: By using banks’ internal resources, such as capital and eligible liabilities, to address crises and avoid government bailouts.

- Maintaining Market Confidence: By fostering resilience and transparency in the banking sector, reducing the likelihood of market panic.

The BRRD also mandates the establishment of independent resolution authorities in each member state. These authorities oversee the implementation of resolution plans and monitor banks’ compliance with regulatory requirements. The directive outlines specific processes for preventing, managing, and resolving crises, ensuring clarity and efficiency in handling bank failures.

Key Findings from the EBA’s 2024 Dashboard

High Compliance Rate

As of Q2 2024, 94% of EU banks (318 out of 339 monitored) have successfully met their Minimum Requirement for Own Funds and Eligible Liabilities (MREL) targets. This reflects the resilience and adaptability of the EU banking system under the Bank Recovery and Resolution Directive (BRRD) guidelines. Banks achieving compliance underscore the effectiveness of regulatory oversight and strategic planning, contributing to market confidence and financial stability.

Shortfall Trends

The number of banks reporting MREL shortfalls has decreased significantly, dropping from 30 at the end of 2023 to 21 by mid-2024. The remaining banks in transition periods have a combined shortfall of €6.1 billion, equivalent to 2.6% of their total risk-weighted assets (RWAs). Despite this progress, additional efforts are required to close these gaps before the mid-2025 compliance deadline. Banks must proactively address resource planning and align with the broader EU regulatory expectations.

BRRD Resolution Strategies: Tailored Approaches for Financial Resilience

The BRRD mandates customized resolution strategies to address the diverse needs of EU financial institutions effectively. These strategies ensure that systemic disruptions are minimized, while critical banking services remain operational.

Bail-in

The bail-in strategy remains the dominant resolution tool for large financial institutions, covering 94% of RWAs. This approach enables losses to be absorbed by creditors and shareholders, preventing reliance on taxpayer funds. Bail-ins preserve the operational integrity of banks, ensuring continuity while protecting financial stability.

Transfer Strategies

For smaller banks, transfer strategies are a preferred resolution method, accounting for 61% of decisions. These strategies involve transferring critical assets and liabilities to a healthier financial entity, providing a more straightforward pathway to resolution. This approach ensures minimal market disruption while safeguarding depositors and maintaining public trust in the banking system.

Minimum Requirement for Own Funds and Eligible Liabilities (MREL): Challenges and Opportunities

As the implementation of the Minimum Requirement for Own Funds and Eligible Liabilities (MREL) under the Bank Recovery and Resolution Directive (BRRD) progresses, banks face several interconnected challenges. These include managing maturity risks, addressing shortfalls, and balancing the costs of compliance.

Managing Maturity Risks

A significant portion of MREL-eligible liabilities, totaling over €220 billion, will become ineligible due to residual maturities falling below one year by mid-2025. This represents approximately 18.6% of non-equity MREL instruments, creating a refinancing challenge for banks. To address this:

- Proactive Refinancing Strategies: Banks must develop and execute plans to issue new MREL-eligible liabilities to replace maturing instruments.

- Market Sensitivity: Monitoring market conditions is essential to optimize refinancing terms and reduce costs.

- Investor Engagement: Transparent communication with investors can facilitate smoother refinancing processes and maintain confidence.

Addressing Shortfalls

Despite overall compliance improvements, 21 banks remain in transition periods, collectively reporting a shortfall of €6.1 billion (2.6% of RWAs). Key actions include:

- Timely Compliance: Banks must align their capital strategies with the mid-2025 BRRD compliance deadline to avoid regulatory penalties.

- Resource Allocation: Strategic capital planning is crucial to address shortfalls without disrupting other operational priorities.

Balancing Cost and Compliance

Issuing MREL-eligible liabilities, particularly subordinated debt, imposes significant financial burdens on banks. To balance compliance costs:

- Cost-Benefit Analysis: Banks must weigh the costs of issuing new liabilities against the strategic benefits of maintaining regulatory compliance and investor confidence.

- Innovative Financial Instruments: Exploring cost-effective instruments that meet MREL requirements can alleviate financial pressure.

- Operational Efficiency: Streamlining operations can help offset the costs associated with compliance, ensuring a sustainable approach.

By addressing these challenges holistically, banks can enhance their resilience, meet regulatory expectations, and maintain financial stability within the evolving MREL and BRRD framework.

Resource Adequacy and Composition: Strengthening Financial Foundations

Banks have made significant progress in meeting MREL requirements by diversifying their resource composition. MREL-eligible resources typically include:

- Common Equity Tier 1 (CET1): A core component of MREL resources, ensuring high-quality capital adequacy.

- Subordinated Debt: Plays a pivotal role in absorbing losses, providing additional layers of financial protection.

- Senior Unsecured Liabilities: Widely used to meet MREL thresholds, contributing to compliance flexibility.

Differences in resource allocation across bank categories reflect varied strategic priorities. Large institutions prioritize subordinated instruments to comply with subordination requirements, while smaller banks leverage a mix of senior unsecured debt and structured notes to optimize cost efficiency. However, with €220 billion in MREL-eligible liabilities set to become ineligible by mid-2025, proactive refinancing and capital planning are critical to maintaining compliance and ensuring long-term resilience.

MREL and BRRD: Strategic Implications for Stakeholders

For Banks: Resilience through Adaptation

Banks must embed MREL compliance into their long-term strategic goals to manage risks effectively and maintain profitability. Key actions include:

- Proactive Planning: Develop comprehensive capital plans aligned with regulatory timelines and market conditions to address maturity risks and MREL shortfalls.

- Strategic Capital Allocation: Allocate resources judiciously to meet MREL requirements without compromising operational efficiency.

- Scenario Analysis: Conduct stress tests and scenario analyses to anticipate challenges and formulate mitigation strategies.

- Digital Tools for Compliance Monitoring: Leverage advanced digital tools and AI-driven analytics for real-time tracking of MREL compliance, streamlined reporting, and enhanced risk management capabilities.

- Diversification of MREL Liabilities: Prioritize the diversification of MREL-eligible liabilities to hedge against market volatility and mitigate refinancing risks, particularly in tightening global financial conditions.

- Innovation in Financial Instruments: Develop cost-effective MREL-eligible instruments, such as hybrid financial products, to reduce compliance costs while maintaining flexibility.

- Collaboration with Investors: Work closely with investors to design instruments that meet regulatory requirements and align with market preferences.

For Regulators: Proactive Oversight

Regulators play a critical role in maintaining systemic stability by offering forward-looking guidance and ensuring accountability. Recommended strategies include:

- Enhanced Monitoring: Regularly update MREL dashboards and compliance metrics to provide transparency and hold institutions accountable for their status.

- Data Analytics: Utilize advanced data analytics to identify emerging risks and preemptively address compliance issues.

- Public Disclosure: Foster trust by providing accessible information on banks' MREL compliance through public reports.

- Flexibility for Transition Banks: Offer tailored regulatory support, including phased implementation for certain institutions, to facilitate smoother compliance without market disruption.

- Targeted Guidance for Smaller Banks: Address the unique challenges faced by smaller banks with specialized regulatory guidance and advisory services.

- Adaptation to Emerging Risks: Refine MREL requirements to account for evolving risks, such as climate-related financial impacts or geopolitical disruptions, ensuring the framework remains robust.

For Investors: Strategic Opportunities

MREL compliance serves as a critical marker of institutional resilience, offering investors valuable insights into risk and return potential. Key actions include:

- Risk Assessment: Treat MREL compliance metrics as vital indicators of a bank’s stability and incorporate them into risk profiling and portfolio strategies.

- Due Diligence: Integrate MREL compliance status into due diligence processes to evaluate investment risks comprehensively.

- Portfolio Management: Adjust investment portfolios based on compliance levels, optimizing returns while mitigating exposure to underperforming institutions.

- Leveraging Dashboards for Risk Profiling: Utilize tools like the EBA’s MREL dashboards to access real-time data and gain insights into banks’ operational health.

- Opportunities in ESG-Aligned Instruments: As sustainability becomes a global priority, explore opportunities in MREL instruments tied to ESG metrics, combining financial returns with societal goals.

Reduce your

compliance risks