Blog

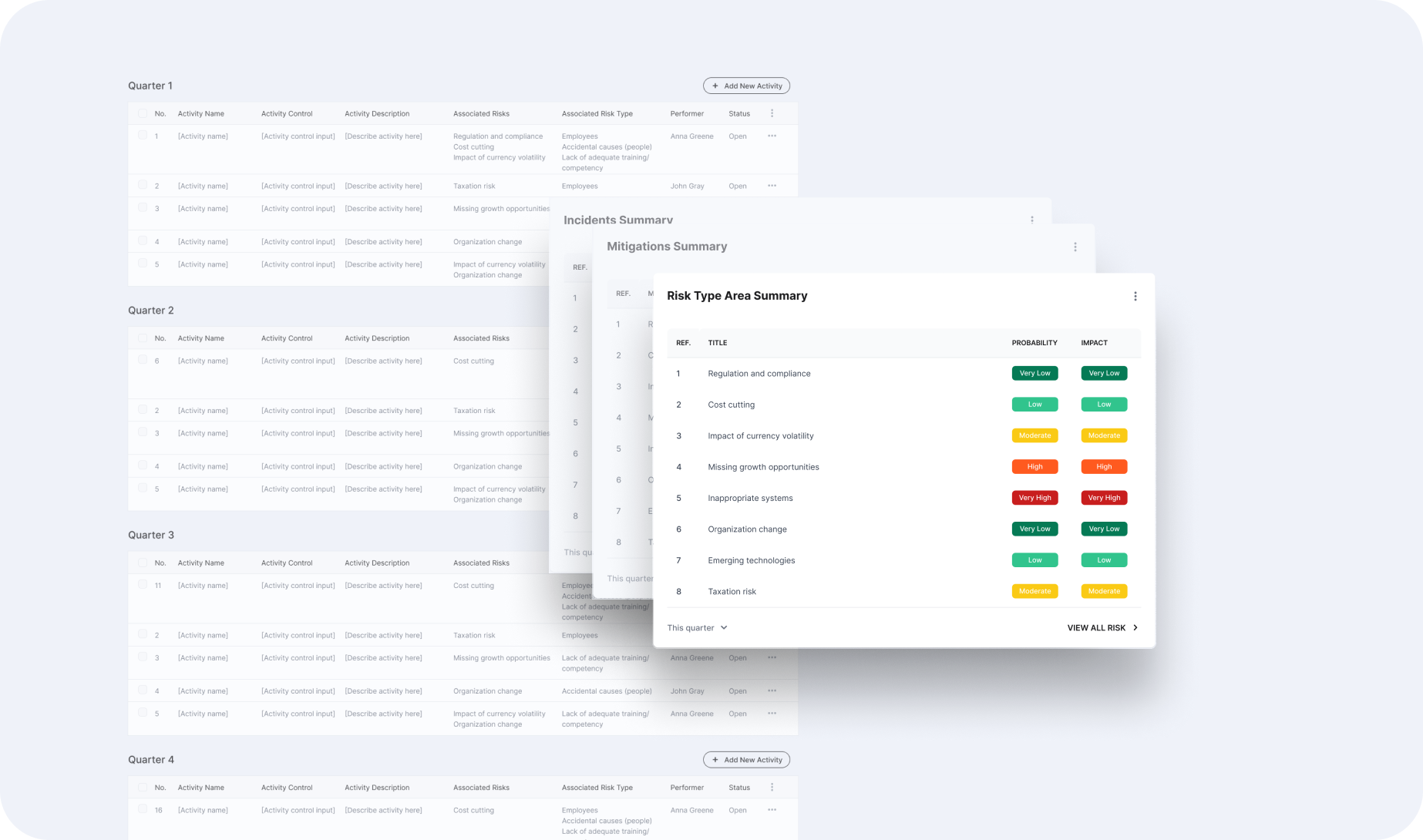

What Is a Risk Register in Compliance?

A risk register, often referred to as a risk log, is a critical tool that serves as a centralized repository for identifying, assessing, and tracking potential risks. This guide offers an in-depth exploration of risk registers, covering their definition and role in regulatory compliance.

Compliance Technology: The Backbone of Finance

Advanced compliance technology is revolutionizing financial institutions. Leveraging AI-driven risk management, automated regulatory reporting, and integrated GRC platforms, innovative solutions tackle global regulatory challenges, boost operational efficiency, and drive strategic resilience.

Corporate Compliance: Insights for a Robust Framework

Advanced corporate compliance strategies integrate robust governance, rigorous risk assessment, automated internal controls, and real-time monitoring to ensure regulatory adherence and operational excellence. This technical framework drives sustainable success globally.

Operational Resilience: A new Financial Imperative

Major IT outages, cyberattacks, and unforeseen disruptions can devastate financial institutions. Learn how operational resilience ensures stability, protects consumer trust, and meets regulatory demands, from scenario testing to vendor risk management and advanced cybersecurity solutions.

Regulatory Intelligence: How to Achieve it?

Regulatory intelligence unifies dynamic requirements and advanced data pipelines, enabling rapid detection and classification. Automated horizon scanning with obligation mapping reduces complexity, bridging global mandates and risk controls for seamless oversight.

Reduce your

compliance risks