What Is a Risk Register in Compliance?

A risk register, often referred to as a risk log, is a critical tool that serves as a centralized repository for identifying, assessing, and tracking potential risks. This guide offers an in-depth exploration of risk registers, covering their definition and role in regulatory compliance.

Defining Risk Registers

A risk register in finance is a comprehensive, structured document or database that systematically identifies, assesses, and records all potential risks an organization might face, whether on an enterprise-wide basis or within a specific project or operational process. It functions as the single source of truth for risk data, consolidating essential details to support informed decision-making and regulatory compliance.

Key Details Captured in a Risk Register

A risk register typically includes, but is not limited to, the following elements:

- Likelihood of Occurrence:

This field quantifies how probable it is that a particular risk event may occur. It may use qualitative terms (e.g., Low, Medium, High) or a numerical scale (such as 1–5 or percentages) to indicate risk probability. - Potential Impact:

This parameter assesses the consequences of the risk event, considering factors such as financial loss, reputational damage, regulatory fines, operational disruption, and safety issues. Impact ratings help prioritize risks by highlighting those that could severely affect organizational objectives. - Responsible Parties:

The risk register assigns ownership for each risk, designating individuals or departments accountable for monitoring and mitigating the risk. This ensures clear accountability and ongoing management of each risk element. - Current Control Measures and Mitigation Plans:

It details the existing controls, processes, and strategies that are implemented to reduce the likelihood or impact of each risk. Mitigation plans outline additional steps or enhancements needed to address gaps in risk management.

Regulatory Emphasis on Risk Registers

Regulatory bodies and industry standards consistently stress the importance of maintaining detailed and up-to-date risk inventories. Frameworks such as Basel III, EBA guidelines, GDPR, SOX, ISO 31000, and COSO ERM require organizations—particularly in the financial sector—to adopt a systematic approach to risk identification and management. Key regulatory expectations include:

- Basel III and Banking Supervision:

Under Basel III, banks are required to manage operational risks alongside capital adequacy, with risk registers serving as a critical tool to document, assess, and monitor these risks. A detailed risk register supports a bank’s Internal Capital Adequacy Assessment Process (ICAAP) by ensuring all significant operational risks, including cybersecurity and fraud, are tracked and controlled. - EBA Guidelines:

The European Banking Authority expects financial institutions to document risk assessments—such as those related to anti-money laundering (AML) and outsourcing. A comprehensive risk register provides the necessary framework for capturing these risk profiles, thereby enhancing transparency and regulatory oversight. - GDPR and Data Protection Compliance:

Data privacy risks must be rigorously managed, and regulators like the UK ICO require organizations to integrate privacy risks into their overall risk register. This linkage ensures that potential breaches of data protection regulations are identified, assessed, and mitigated systematically. - SOX and Internal Control Reporting:

Although SOX 404 does not explicitly mandate a risk register, it requires that companies maintain robust risk assessments for financial reporting controls. A risk register in this context functions as a foundational document that supports the identification of material misstatements and the implementation of appropriate internal controls. - ISO 31000 and COSO ERM:

These international standards advocate for a holistic risk management process, where a risk register is essential for documenting risk identification, evaluation, and treatment. By adhering to these guidelines, organizations ensure that their risk management practices are consistent, integrated, and aligned with global best practices.

Expert Perspective on Risk Registers

Industry experts often describe a risk register as “a comprehensive document used to identify, assess, prioritize, and manage risks that could impact an organization’s objectives, operations, and stakeholders.” In the context of compliance, a specialized risk register focuses on regulatory risks, such as those related to Basel III capital adequacy, anti-money laundering practices, or data protection under GDPR, thereby demonstrating an organization’s proactive approach to managing compliance risks.

By centralizing risk data and linking it to specific controls and mitigation strategies, a risk register not only meets regulatory requirements but also enhances internal communication and decision-making. It enables organisations to promptly address emerging risks, allocate resources effectively, and maintain a culture of accountability and continuous improvement, all of which are crucial for sustaining long-term financial stability and regulatory trust.

Key Components of a Risk Register

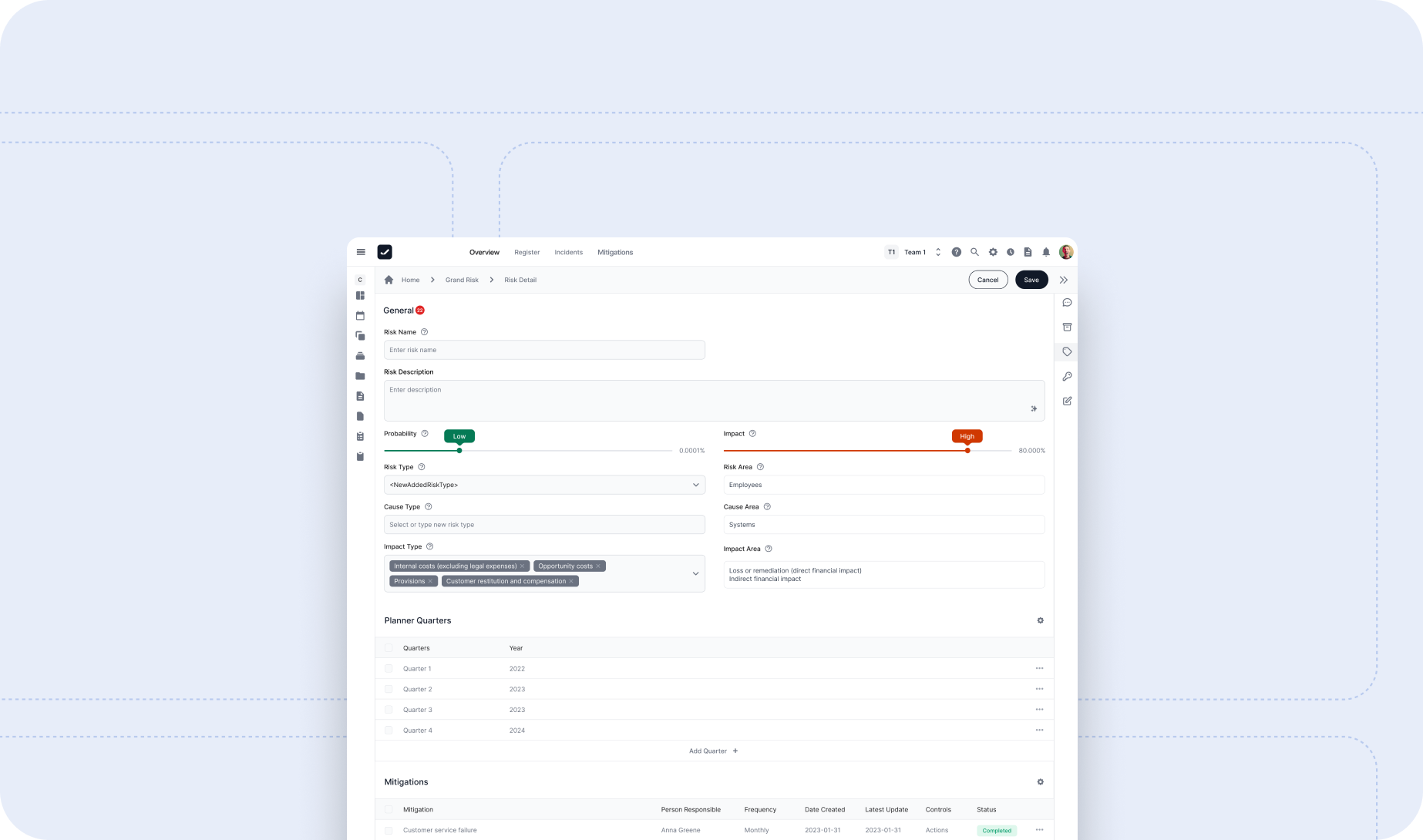

A well-designed risk register is built with multiple interrelated fields that collectively offer a complete and dynamic picture of each risk. These components not only facilitate day-to-day risk management but also ensure that organizations meet stringent regulatory and internal control requirements. Below is an expanded breakdown of the core elements:

- Risk ID:

A unique identifier or reference code for each risk entry. This is essential for tracking and linking the risk to related documentation, control measures, and regulatory reports. It also aids in categorizing and indexing risks for efficient retrieval. - Risk Description:

A clear and concise explanation of the risk event, detailing both its causes and potential consequences. For example, “Non-compliance with XYZ regulation resulting in financial penalties and reputational damage” not only outlines the event but also its likely outcomes. Detailed descriptions help stakeholders understand the nuances of the risk, ensuring informed decision-making. - Risk Category:

Classification of the risk based on its nature and impact. Common categories include:- Strategic: Risks that affect long-term goals and market positioning.

- Credit: Risks associated with borrowers’ ability to repay.

- Market: Risks stemming from fluctuations in market variables.

- Operational: Risks related to internal processes, systems, or human factors.

- Compliance: Risks of non-adherence to laws, regulations, or internal policies.

- Reputational: Risks that could harm the organization’s public image.

Categorizing risks is crucial for aggregating similar risk types, facilitating comprehensive analysis and regulatory reporting.

- Likelihood (Probability):

An assessment of how likely the risk event is to occur. This can be expressed qualitatively (e.g., Low, Medium, High) or quantitatively (using a numerical scale such as 1 to 5). A well-calibrated likelihood rating assists in forecasting and planning, especially in scenarios requiring regulatory compliance where probability data is scrutinized. - Impact (Severity):

An evaluation of the potential consequences if the risk materializes. This considers factors like financial loss, operational disruption, regulatory fines, or reputational harm. Impact ratings are essential in regulatory contexts, where even a low-frequency risk may have severe consequences that need immediate mitigation. - Risk Score (Inherent Risk Level):

A combined rating often derived from multiplying the Likelihood and Impact scores (sometimes with additional factors). This inherent risk score represents the risk’s overall severity before any controls or mitigation measures are applied. It is pivotal in prioritizing risk management actions and ensuring that high-risk areas receive the necessary attention and resources. - Risk Owner:

The designated individual or role accountable for monitoring and managing the risk. This ensures clear accountability and a direct point of contact for each risk. In regulatory audits, demonstrating clear risk ownership is critical, as it reflects the organization’s proactive approach to risk management. - Existing Controls/Mitigation Measures:

A detailed summary of the controls, policies, and processes currently in place to mitigate or manage the risk. This can include technological solutions, internal policies, training programs, or manual interventions. Proper documentation of these measures supports compliance with frameworks. - Control Effectiveness:

An evaluation of how well the current controls manage the risk. This assessment can indicate whether controls are effective, need improvement, or have failed. Continuous monitoring of control effectiveness is often required by regulatory bodies to ensure that residual risks remain within acceptable limits. - Residual Risk:

The level of risk that remains after considering the impact of all existing controls and mitigation measures. This concept is critical, as even the best controls rarely eliminate risk completely. Documenting residual risk allows organizations to compare it against their risk appetite and to plan further mitigation if necessary. - Risk Priority (Ranking):

A categorization, often labeled as Critical, High, Medium, or Low, that helps management prioritize risks based on their overall severity and urgency. This prioritization is crucial for resource allocation and is often used in strategic planning and board reporting. - Risk Response Plan:

A detailed plan outlining specific actions, deadlines, and target dates for additional risk mitigation. This plan is vital for moving beyond risk identification to proactive management. It often includes contingency plans, escalation procedures, and resource requirements, ensuring that risks are addressed in a timely manner. - Status/Next Review Date:

The current status of the risk (e.g., Active, Mitigated, Monitoring) along with scheduled dates for the next review. Regular reviews are essential to capture changes in risk profiles due to evolving internal and external environments. This field ensures that the risk register remains a living document that accurately reflects the current risk landscape.

The Purpose of a Risk Register in Regulatory Compliance

In the highly regulated financial sector, a risk register is an indispensable tool that underpins an organization’s ability to manage risks, comply with stringent regulatory requirements, and foster informed decision-making. Its significance can be viewed through several key perspectives:

Centralization of Risk Data

Unified Risk Overview:

A comprehensive risk register consolidates risk data from across the organization into a single repository. This unified view is critical for regulators, auditors, and internal stakeholders because it provides a clear snapshot of the organization’s overall risk exposure. By centralizing risk data, organizations can quickly identify trends, patterns, and emerging threats that might otherwise go unnoticed if data were siloed within different departments.

Compliance Evidence:

Regulatory bodies demand tangible proof that an organization has a robust system in place for managing risks. A well-maintained risk register serves as concrete evidence that the organization has identified, assessed, and is actively managing significant risks—ranging from money laundering and data breaches to market abuse. During regulatory audits or examinations, the risk register demonstrates that the institution adheres to best practices in risk management, thereby building trust with oversight bodies.

Meeting Regulatory Standards

Global Best Practices:

Risk registers are not only best practice in risk management; they are also a regulatory imperative. Frameworks and standards all emphasize the need for detailed risk documentation. By aligning a risk register with these global standards, financial institutions ensure that their risk management processes are comprehensive, consistent, and capable of meeting international expectations.

Proactive Compliance:

The risk register is a cornerstone of a proactive risk management strategy. It does more than just document risks; it actively guides the organization’s efforts to mitigate potential threats before they escalate. This proactive stance is crucial during regulatory audits. When regulators review a company’s risk register, they are looking for evidence that risks are not only identified but are also continuously monitored and addressed. A dynamic risk register can reduce the scope of regulatory scrutiny by showcasing a mature risk management process that anticipates and mitigates risks effectively.

Informed Decision-Making and Strategic Planning

Prioritization:

Risk registers provide a structured framework for prioritizing risks based on factors such as likelihood, impact, and inherent risk scores. This prioritization enables management to focus their resources and efforts on the most critical threats—those that could have the most severe impact on the organization. By clearly distinguishing between high-priority risks and less critical issues, a risk register supports efficient resource allocation and targeted risk mitigation strategies.

Risk Appetite Alignment:

A fundamental aspect of strategic planning is aligning the organization’s risk exposure with its defined risk appetite. The risk register serves as a continuous feedback loop that informs adjustments to business strategies and operational decisions. When trends in the risk register indicate that certain risks are approaching or exceeding the organization’s risk tolerance levels, leadership can reassess their strategies, implement additional controls, or adjust their risk appetite accordingly.

Fostering a Robust Risk Culture

Beyond its technical and compliance functions, a risk register is a vital tool for fostering a proactive and transparent risk culture across the organization. By mandating regular updates and cross-departmental reviews, the risk register encourages open communication about risk management issues at all levels. This culture of transparency ensures that risk awareness becomes ingrained in everyday decision-making processes and that emerging risks are promptly addressed. It also instills confidence among stakeholders, including regulators, that the organization is committed to continuous improvement in managing its risk landscape.

The Institutionalisation of Risk Registers in Modern Banking Governance

Risk registers have become foundational in banking risk management, transitioning from optional best practice to an essential, regulated component of financial governance. Global regulatory bodies, including the Basel Committee on Banking Supervision (BCBS), the European Banking Authority (EBA), and the European Central Bank’s Single Supervisory Mechanism (ECB-SSM), now uniformly require banks to maintain comprehensive, enterprise-wide risk inventories. These registers are expected to capture all material risk exposures, categorised systematically across credit, market, operational, liquidity, conduct, and emerging risks, ensuring clear ownership and supervisory transparency.

The BCBS Principles for the Sound Management of Operational Risk (2021) explicitly require banks to consolidate risks and controls across all business units within a central risk inventory. This framework aligns with the three-lines-of-defense model: business units identify and document risks, risk management functions consolidate and challenge them, and internal audit provides independent verification. Critically, the BCBS extends this to climate-related risks, mandating integration of both physical and transition risks into the register. Banks must map these risks to traditional categories, such as credit and operational risks, ensuring a consistent, auditable taxonomy. The 2024 Basel Core Principles reinforce this integration, with Principle 15 compelling banks to embed emerging risks like climate change within their capital adequacy and governance frameworks, preparing them for future regulatory scrutiny.

European Regulatory Convergence: Risk Registers as the Backbone of Governance

In the European Union, risk registers are deeply embedded in regulatory expectations under CRD IV/V and the EBA’s internal governance guidelines. EU law requires banks to establish clear organisational structures and effective processes for risk identification, assessment, monitoring, and reporting. The EBA’s Guidelines on Internal Governance (EBA/GL/2021/05) and Supervisory Review and Evaluation Process (SREP) Guidelines (EBA/GL/2022/03, effective 2023) demand that banks maintain formal, dynamic risk inventories, covering the full spectrum of risks.

Supervisory Review Teams (JSTs) now systematically assess these inventories, ensuring that banks have captured:

- Cybersecurity risks and evolving ICT threats.

- Conduct risks and operational vulnerabilities.

- ESG risks, including environmental, social, and governance exposures.

The EBA’s Final Guidelines on ESG Risks (January 2025) further solidify this approach, requiring banks to map ESG drivers into their existing risk frameworks. Rather than treating ESG as a parallel process, banks must embed these factors directly into their primary risk inventories, supporting integration with ICAAP/ILAAP, capital allocation, and Pillar 3 disclosures. By doing so, financial institutions create a coherent risk governance narrative, linking identification, ownership, mitigation, and supervisory reporting.

ECB–SSM: Elevating Risk Registers in Supervisory Practice

The ECB-SSM has elevated risk registers to a core supervisory expectation, embedding them within thematic reviews and day-to-day supervision. While ECB publications often refer to "risk identification," the practical implication is clear: a comprehensive, maintained risk register is mandatory. Under the ECB’s Guide on Climate-Related and Environmental Risks (2020), banks were required to integrate climate risks into their risk inventories by the end of 2023, facing supervisory consequences for non-compliance.

Joint Supervisory Teams, during ICAAP and ILAAP assessments, actively review whether risk registers are:

- Comprehensive, spanning all categories of material risk, from operational failures to model risks and reputational threats.

- Dynamic, reflecting changes in business models and emerging risks.

- Embedded into governance structures, with board-level ownership and oversight.

Complementary to this, the ECB’s Draft Guide on Governance and Risk Culture (2024) stresses the importance of risk ownership and robust internal control functions. Supervisors expect risk registers not only to list risks but also to show clear linkages between risk appetite, strategic objectives, and operational execution. Even specialised entities, like custodians, are expected to maintain operational risk registers, as reflected in ECB Occasional Paper 256 (2021), which underscores the need for risk documentation even in niche business lines.

National Supervisory Convergence: Consistent Standards Across Jurisdictions

Across Europe, national supervisory authorities have aligned closely with EU and Basel expectations, embedding risk registers within their regulatory frameworks. The Central Bank of Ireland’s Operational Risk Handbook (September 2024) mandates that all operational risks—whether linked to people, processes, systems, or external events—be fully documented and monitored through an institution’s risk register. BaFin in Germany, through its Sustainability Risk Guidelines, similarly requires banks to integrate ESG risks into their core inventories, promoting consistency across supervisory regimes.

Supervisors now expect risk registers to be actively maintained and regularly reported at board level, serving as:

- A decision-making tool for risk committees.

- A reference for internal audits and compliance testing.

- A critical resource during supervisory inspections.

Failure to maintain an accurate, up-to-date risk register can result in serious consequences under SREP evaluations, including capital add-ons, remediation requirements, or heightened supervisory measures. This convergence of regulatory expectations has positioned the risk register as an essential, living document — central to risk governance and institutional accountability.

Risk Registers: The Operational Core of Risk Governance and Regulatory Compliance

Risk registers are now recognised globally as the operational core of enterprise risk management. They function as a critical nexus, linking the Risk Appetite Framework (RAF), ICAAP/ILAAP processes, operational risk self-assessments (RCSA), and Pillar 3 disclosures. Banks are expected to:

- Map each identified risk to risk appetite thresholds and capital planning processes.

- Continuously update the register to reflect changes in the external environment, internal business model, and emerging risks.

- Demonstrate alignment between risk inventories and board-level governance.

Investment firms regulated under MiFID II and subject to DORA are equally required to maintain formal risk inventories. These inventories must capture market risk, liquidity risks in client assets, and ICT vulnerabilities. ESMA’s supervisory briefings and common supervisory actions in 2023 have made clear that properly maintained risk inventories are integral to supervisory reviews and resilience planning.

Across all regulatory environments, the expectation is now unequivocal: the risk register is no longer optional. It must be a dynamic, proactive instrument enabling early identification of risks, informing strategic decisions, and ensuring full regulatory compliance. Institutions that neglect this obligation face not only operational vulnerabilities but also material supervisory repercussions. Today, the risk register is the linchpin of sound governance, enterprise resilience, and supervisory transparency in the evolving global financial system.

Integration with Internal Controls, Audits, and ERM Frameworks

A risk register is not a stand-alone document—it is deeply integrated into an organization’s risk management and internal control systems:

- Linking Risks to Controls:

- Each risk entry should correlate with one or more controls that mitigate it. This creates a risk-control matrix that is vital for frameworks like SOX and COSO.

- Regular evaluations of control effectiveness ensure that residual risks are accurately updated.

- Supporting Internal and External Audits:

- Internal Audit: Uses the risk register to focus on high-risk areas and verify that risk management processes are robust.

- External Audit: Relies on the register to assess management’s risk awareness and the effectiveness of mitigation strategies.

- Driving Enterprise Risk Management:

- The risk register acts as the central repository in an ERM framework, linking departmental risks into a consolidated “risk universe” for review by the board and risk committees.

- Trends in risk data, such as Key Risk Indicators (KRIs), are derived from the risk register and guide strategic decisions.

- Enhancing the Internal Control Environment:

- Identifying and addressing control gaps through regular risk register updates improves the overall control framework, ensuring that risks remain within acceptable limits.

Leveraging Technology and RegTech Solutions

Modern financial institutions are increasingly moving away from manual spreadsheets to advanced GRC (Governance, Risk & Compliance) and RegTech platforms, which offer:

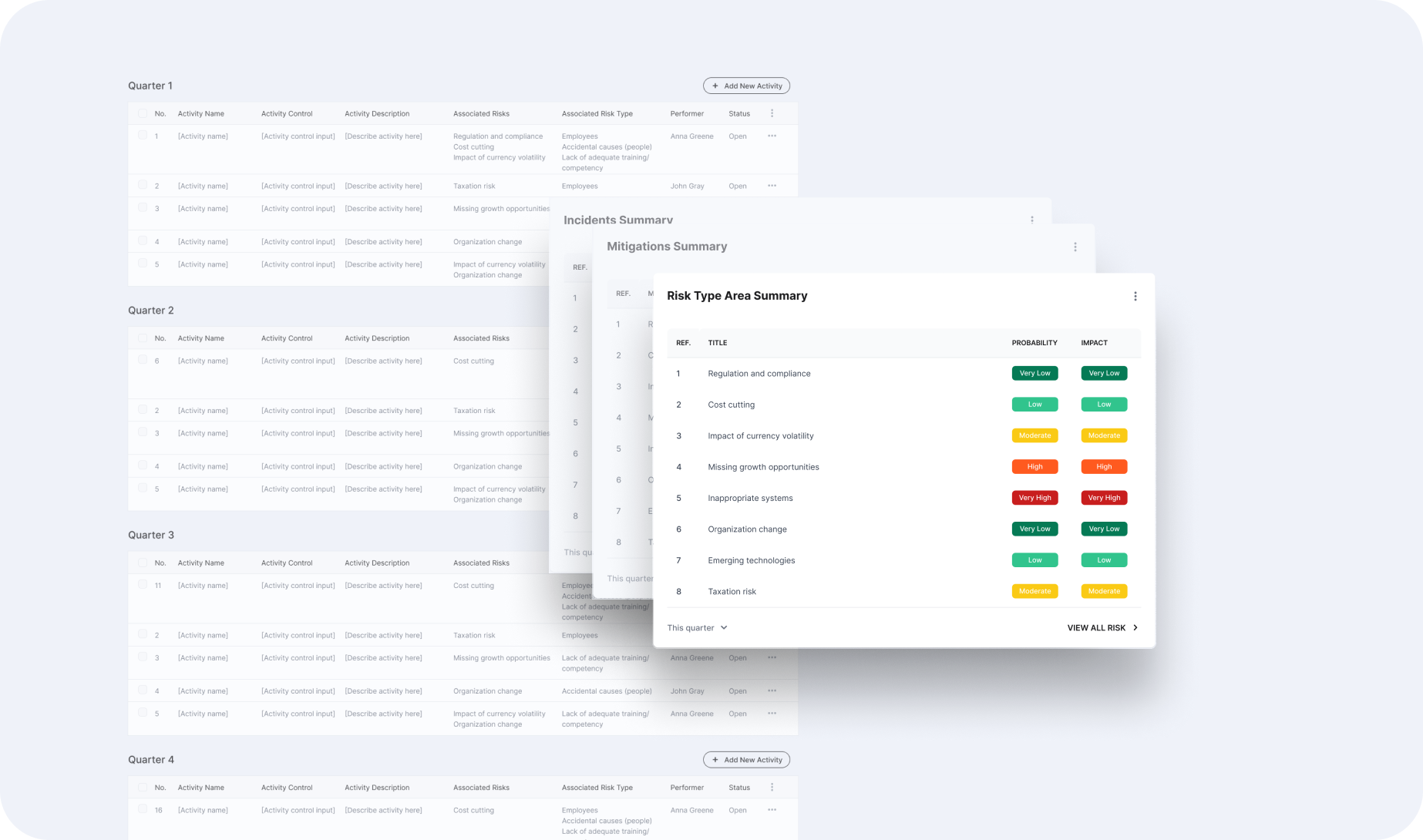

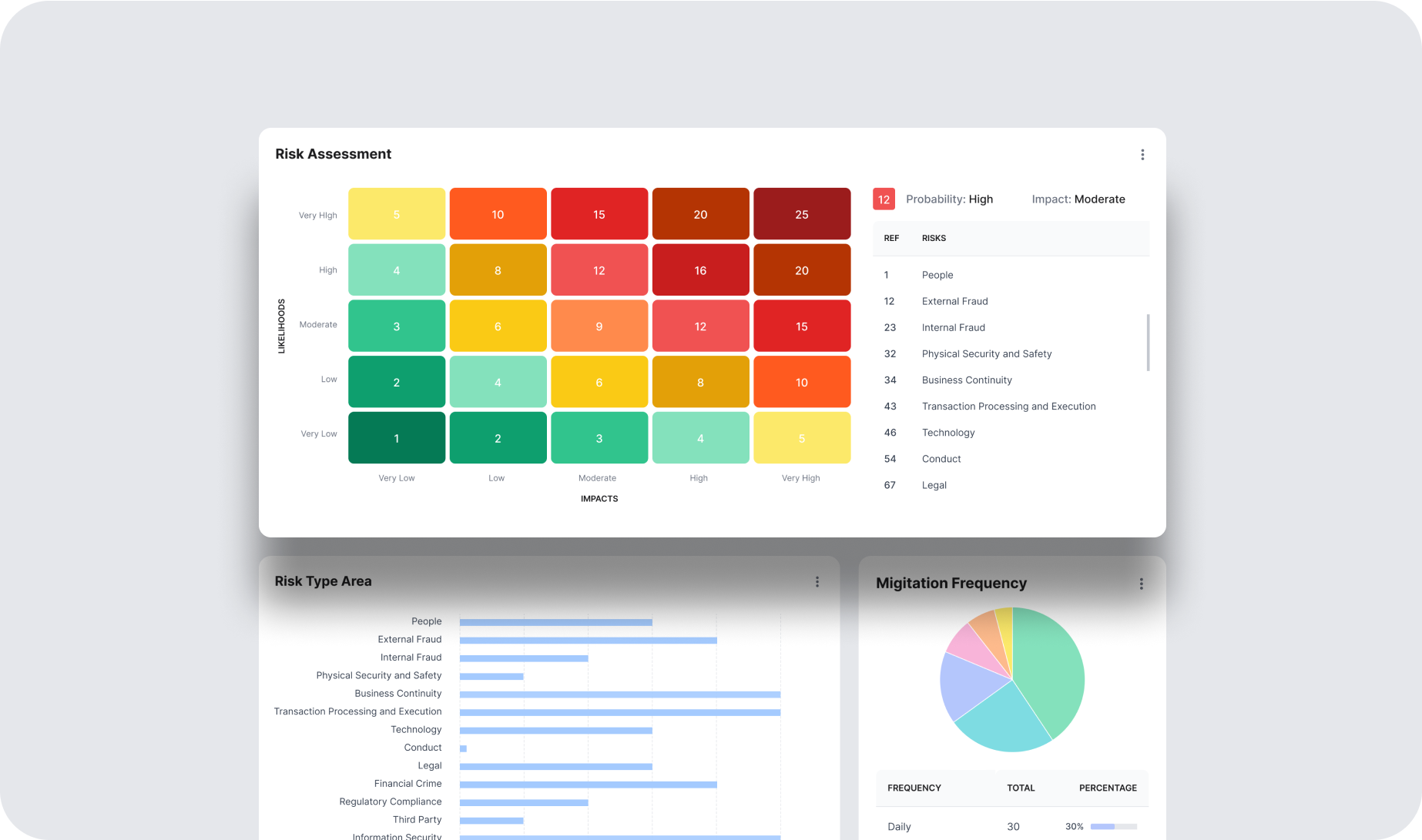

GRC Software Platforms

- Centralized Data Repository: All risk information is stored in one secure location with customizable fields.

- Dynamic Risk Scoring: Automated calculation of risk scores and prioritization based on current data.

- Real-Time Updates: Notifications and escalation workflows ensure timely review and mitigation.

- Dashboards and Reporting: Visualizations such as heat maps and trend charts enhance management reporting and regulatory submissions.

Automation and Artificial Intelligence (AI)

- Predictive Analytics: AI algorithms analyze internal and external data to identify emerging risks.

- Regulatory Change Monitoring: Natural Language Processing (NLP) tools scan regulatory updates and suggest risk register modifications.

- Scenario Analysis and Stress Testing: Integrates risk registers with simulation tools to assess potential impacts under various scenarios.

- Workflow Automation: Streamlines risk data collection, assessments, and updates, freeing up risk management teams for more strategic tasks.

Risk Register Examples in Financial Institutions

Bank Compliance Risk Register

A mid-sized bank maintains a dedicated compliance risk register that documents risks such as violations of anti-money laundering regulations, data privacy breaches under GDPR, and MiFID II reporting failures. Risk owners update this register quarterly. For instance, after implementing a new transaction monitoring system, the bank noted a reduction in AML risk from High to Medium. During regulatory reviews, examiners can clearly see how each risk is being managed through detailed entries and action plans.

Trading Firm’s Operational Risk Register

A securities trading firm uses its risk register to cover a wide range of risks—including trading errors, system outages, fraud, and compliance issues. An entry for “Insider Trading or Market Manipulation” includes mitigation measures like employee training and real-time surveillance. When a near-miss incident occurs related to algorithmic trading, the firm promptly adds this risk, reviews its controls, and updates the register to reflect new measures, illustrating the dynamic nature of risk management.

Insurance Company’s ORSA Risk Register

Insurance companies often integrate their risk registers into the Own Risk and Solvency Assessment (ORSA) process. For example, an insurer might list “Regulatory Non-Compliance in Sales Practices” as a key risk. With assigned owners and robust controls such as comprehensive training programs, the insurer continuously monitors and updates risk ratings, ensuring capital is set aside for potential fines while demonstrating adherence to regulatory requirements.

Best Practices for Maintaining an Effective Risk Register

To ensure your risk register remains an active and strategic tool, consider the following best practices:

- Regular Updates and Reviews: Schedule frequent reviews—monthly for high-risk areas, quarterly for others—to capture emerging risks and update existing assessments.

- Embed into Decision-Making: Use the risk register as a foundational document for strategic decisions, product launches, and audit planning.

- Clarity and Consistency: Develop a standardized risk taxonomy and consistent rating scales to ensure that risk descriptions and mitigation plans are easily understood.

- Prioritize Material Risks: Focus on significant risks while keeping minor ones documented separately to avoid cluttering key views.

- Assign Accountability: Clearly designate risk owners and require their sign-off on regular updates.

- Training and Communication: Educate staff about the importance of the risk register and encourage a culture of proactive risk reporting.

- Document Evidence and Rationale: Maintain comments or attachments that explain changes in risk ratings, ensuring an audit trail for decisions.

- Analyze Trends and Scenarios: Use historical data to spot trends and perform scenario analyses to assess the potential impact of emerging risks.

- Integrate with Incident Management: Ensure a feedback loop so that actual risk events update the register, reinforcing continuous improvement.

Reduce your

compliance risks