Risk based regulatory compliance: What is it?

Exploring the intricate landscape of Risk-Based Regulatory Compliance (RBRC), we delved into its significance, technological integration, human-centric approach, and ROI.

Ensuring regulatory compliance within the financial services industry has evolved from merely meeting minimal standards into a crucial strategic discipline. Given that global banks have incurred compliance fines totaling nearly $55 billion since the 2008 financial crisis, financial institutions are now increasingly transitioning from traditional compliance models to a more advanced Risk-Based Regulatory Compliance (RBRC) framework.

RBRC strategically prioritizes regulatory activities based on assessed risks rather than uniformly applying compliance obligations. This targeted compliance methodology helps institutions avoid significant financial penalties by addressing high-risk areas proactively. Additionally, a risk-based approach optimizes resource allocation, enhances operational efficiency, and may even deliver distinct competitive advantages within the highly regulated financial sector.

The following analysis deeply examines the benefits and implementation of RBRC, compares it explicitly with traditional regulatory compliance methods, and outlines future trends, ensuring financial institutions uphold experience, expertise, authority, and trustworthiness in their compliance functions.

Traditional vs. Risk-Based Regulatory Compliance Approaches

To clearly understand the strategic impact of RBRC, it’s essential to compare it directly with traditional compliance approaches. Historically, regulatory compliance programs have typically enforced rules uniformly, neglecting the varying levels of risk associated with specific regulatory obligations. Conversely, the Risk-Based Regulatory Compliance approach directs resources proactively toward areas posing the highest risks, enabling more efficient and proportional compliance management.

The following table clearly summarizes key differences between Traditional Regulatory Compliance and Risk-Based Regulatory Compliance:

| Aspect | Traditional Regulatory Compliance | Risk-Based Regulatory Compliance |

|---|---|---|

| Focus | Treats all compliance obligations equally, often reactively addressing issues post-occurrence. | Prioritizes compliance activities based on identified risk levels, proactively managing high-risk regulatory threats. |

| Approach | Applies static, uniform regulatory controls regardless of context or risk exposure. | Employs dynamic, tailored controls that are adjusted based on assessed risk levels associated with activities, clients, and transactions. |

| Resource Allocation | Spreads compliance resources thinly across all areas, resulting in inefficiencies and unnecessary complexity. | Allocates compliance resources strategically, investing more heavily in high-risk areas and less in lower-risk activities, thereby optimizing compliance effectiveness. |

| Outcome & Effectiveness | Frequently inefficient and reactive, causing compliance fatigue and potential gaps in critical regulatory areas. | Efficient, proactive, and agile in identifying and mitigating emerging compliance risks early, significantly reducing potential regulatory breaches. |

| Integration with Strategy | Typically siloed as a standalone legal or audit function with limited alignment to broader organizational strategy. | Integrated as a strategic function, aligning compliance objectives with broader business goals and risk management practices, thereby contributing to competitive advantage. |

By adopting a Risk-Based Regulatory Compliance approach, financial institutions transform their compliance operations from a burdensome obligation into a strategic asset, effectively managing regulatory risks and driving organizational value. The subsequent sections of this analysis further explore the strategic benefits of RBRC and provide practical guidelines for its successful implementation.

The Strategic Value of Risk-Based Regulatory Compliance (RBRC) in the Financial Sector

Implementing Risk-Based Regulatory Compliance (RBRC) offers substantial strategic benefits in the highly regulated financial sector. Unlike traditional regulatory compliance methods, RBRC enables financial institutions to proactively manage risks, prevent severe regulatory failures, and capitalize on opportunities efficiently. Below are the primary strategic benefits provided by a well-executed RBRC framework:

1. Preventing Catastrophic Compliance Losses

A risk regulatory compliance model significantly decreases the likelihood of major compliance breaches, protecting financial institutions from heavy fines, legal expenses, and severe reputational damage. By strategically directing compliance controls towards high-risk areas, such as fraud detection, data privacy, and market integrity, firms effectively mitigate the most impactful threats. For instance, regulatory frameworks like MiFID II explicitly mandate banks adopt risk-based compliance monitoring, highlighting the necessity to focus on the most relevant and prevalent risks. Similarly, the General Data Protection Regulation (GDPR) embraces a risk-based compliance approach, adjusting security and privacy measures in line with the potential harm to individuals. Thus, a targeted compliance program acts as a robust defense, proactively shielding institutions from potential regulatory pitfalls.

2. Resource Efficiency and Compliance Cost Reduction

Adopting Risk-Based Regulatory Compliance leads to efficient allocation of compliance resources. Rather than implementing uniform controls across all regulatory obligations, which often results in excessive and unnecessary expenditures, institutions can prioritize efforts and investments in high-risk areas. This focused approach significantly improves operational efficiency, reducing overall compliance costs. For example, a major European bank successfully reduced manual compliance reporting efforts by 80% after automating MiFID II trade reporting processes through RegTech solutions. Consequently, compliance teams become capable of addressing rising regulatory demands without proportionately expanding their workforce or budgets, thereby improving the overall return on investment (ROI) for compliance activities.

3. Enhanced Agility and Competitive Advantage

Financial institutions adopting RBRC can quickly and proactively adapt to evolving regulations and market dynamics. A continuous risk assessment and compliance process enables these firms to swiftly respond to new regulatory requirements without significant disruption. This regulatory agility translates into a substantial competitive advantage, facilitating faster product roll-outs and smoother market entries, assured by comprehensive risk management. For example, under the EU’s PSD2 regulation, banks utilizing AI-driven, risk-based authentication for payments can efficiently process legitimate transactions, resulting in higher payment acceptance rates, enhanced customer satisfaction, and increased revenues. Thus, effective risk regulatory compliance serves as more than a preventive measure, it becomes a strategic enabler that drives business growth.

4. Building Trust, Reputation, and Credibility

Financial services fundamentally rely on trust. Demonstrating robust and proactive risk-based regulatory compliance significantly boosts an institution’s credibility with regulators, customers, and the broader public. It highlights a firm's comprehensive understanding of regulatory obligations and commitment to managing the inherent risks facing customers and the marketplace. Over time, institutions recognized for their proactive compliance gain enhanced reputational value, translating into greater customer loyalty, reduced regulatory scrutiny, and potentially more favorable regulatory relationships, such as quicker regulatory approvals and increased influence in shaping future rules.

In summary, Risk-Based Regulatory Compliance strategically positions financial institutions to prevent catastrophic compliance failures, optimize resource allocation, foster competitive agility, and enhance overall reputation and trustworthiness. This transforms regulatory compliance from a burdensome obligation into a powerful strategic asset. The following section details a structured methodology for effectively implementing RBRC within financial institutions.

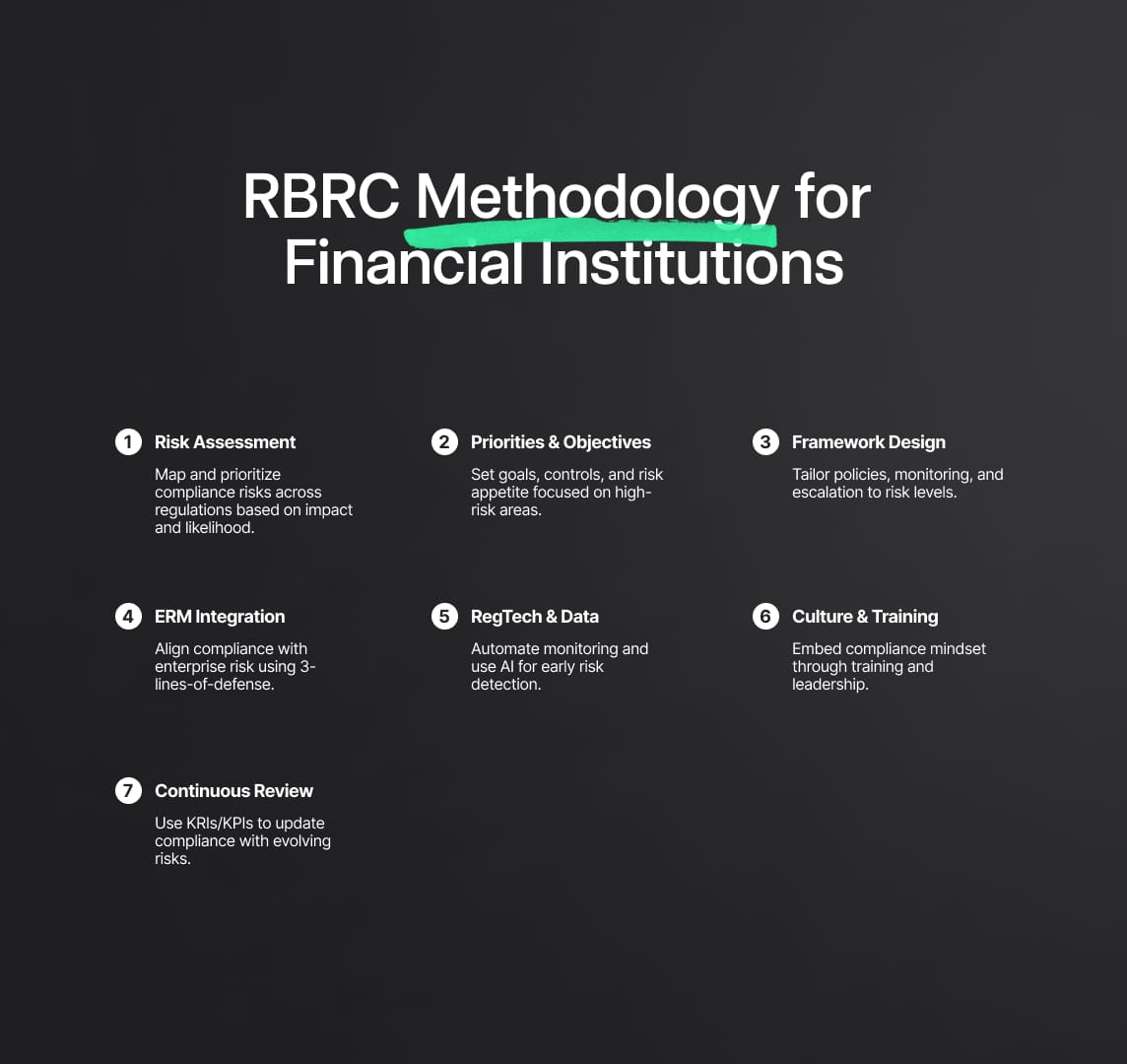

Implementation Methodology for Risk-Based Regulatory Compliance in Financial Institutions

Effectively implementing Risk-Based Regulatory Compliance (RBRC) demands a structured, systematic approach tailored to each financial institution's unique regulatory environment and risk profile. Below is a comprehensive, step-by-step methodology for implementing RBRC:

Step 1: Comprehensive Regulatory Compliance Risk Assessment

A robust regulatory compliance framework begins with a thorough risk assessment to identify and prioritize compliance risks. Institutions must:

- Identify all applicable regulations (MiFID II, GDPR, PSD2, Basel III, AML/KYC laws).

- Systematically assess the likelihood and impact of non-compliance considering transaction volumes, product complexity, client profiles, jurisdictional exposure, historical incidents, and existing control gaps.

- Produce a prioritised compliance risk map, clearly distinguishing between high-risk areas (e.g., client data privacy, anti-money laundering) and low-risk regulatory obligations.

- Formalize this assessment to meet regulatory expectations, such as those mandated by MiFID II, ensuring compliance monitoring programs reflect these identified risks.

Step 2: Define Risk-Based Compliance Priorities and Objectives

Based on risk assessment outcomes:

- Establish enhanced controls and monitoring for high-risk regulatory obligations.

- Set clear compliance goals (e.g., specific targets to reduce regulatory breaches or increase coverage of high-risk compliance activities).

- Formulate explicit risk appetite statements, approved at board level, that guide the intensity of compliance efforts (e.g., zero tolerance for fraud versus a more balanced approach for minor reporting delays).

Step 3: Design a Risk-Based Compliance Framework

Align compliance programs specifically with identified risk levels through the following actions:

- Policies and Controls: Develop risk-sensitive compliance policies, applying stringent controls for high-risk operations, such as stricter AML due diligence or enhanced product governance measures.

- Compliance Monitoring Plan: Create risk-adjusted compliance monitoring schedules; higher-risk areas require frequent oversight, whereas lower-risk areas can be reviewed periodically, aligning with MiFID II guidelines.

- Reporting and Escalation Processes: Clearly define criteria for immediate escalation of significant compliance issues to senior management and board-level oversight.

- Documentation: Maintain comprehensive records of risk assessments, policies, and monitoring outcomes to demonstrate regulatory compliance rigorously.

Step 4: Integration into Enterprise Risk Management (ERM)

RBRC must be seamlessly integrated into broader enterprise risk management:

- Adopt the three-lines-of-defense model to distribute compliance accountability across the business (first line), compliance/risk management (second line), and internal audit (third line).

- Foster cross-functional collaboration, involving operations, IT, finance, and legal departments to embed compliance into daily operations.

- Use unified risk language, metrics, and governance structures, aligning compliance risk appetite with enterprise-wide risk management strategies.

Step 5: Leverage Regulatory Technology (RegTech) and Data

Implement technology solutions that enhance risk-based regulatory compliance efficiency:

- Deploy automated systems to streamline compliance reporting and continuously monitor risks.

- Utilize data analytics and AI to identify anomalies indicative of emerging compliance threats early.

- Integrate data across multiple sources (e.g., transaction monitoring, client information) to provide comprehensive, real-time risk visibility.

Step 6: Foster a Risk-Aware Compliance Culture

RBRC success critically depends on human behavior:

- Conduct targeted employee training on recognizing and responding to compliance risks effectively.

- Embed compliance awareness into organizational culture through leadership messaging, compliance champions, and aligning performance incentives with compliance objectives.

- Regularly update training and education initiatives to address regulatory changes proactively.

Step 7: Continuous Compliance Monitoring and Improvement

Maintain an ongoing cycle of RBRC review and enhancement:

- Establish continuous monitoring systems using Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs) to assess compliance effectiveness.

- Regularly revisit risk assessments and update compliance programs to accommodate regulatory shifts or emerging threats.

- Engage with regulators proactively to validate your compliance approach and respond to evolving regulatory expectations promptly.

Human and Technological Enablers of Risk-Based Regulatory Compliance

Even the most robust risk-based regulatory compliance (RBRC) framework depends on critical enablers, specifically, people and technology, to succeed. These enablers form the backbone of effective regulatory compliance programs, empowering institutions to manage complex risk environments proactively.

Human Enablers: Governance, Expertise, and Culture

Leadership commitment is foundational for risk-based regulatory compliance to thrive. Boards and senior executives must actively champion compliance initiatives, allocate sufficient resources, and ensure risk-oriented reporting is prioritized. Many leading financial institutions have elevated the Chief Compliance Officer (CCO) to report directly to the CEO or board, reflecting the strategic importance of compliance governance. Establishing a dedicated compliance risk committee can further ensure oversight and continuous improvement of the RBRC framework. When leadership demonstrates a strong compliance ethos, it signals the importance of compliance across the organization and empowers teams to uphold regulatory obligations confidently.

Skilled Compliance and Risk Teams

A well-functioning RBRC program relies on multidisciplinary expertise within compliance teams. Beyond legal and regulatory specialists, modern risk-based regulatory compliance requires data analysts, technologists, and operational risk experts who can interpret complex data and assess emerging risks. Financial institutions are increasingly hiring compliance professionals with quantitative and technical skills, equipping them to leverage advanced tools and data analytics. Continuous professional development, through certifications, workshops, and training, is essential to maintain up-to-date knowledge of evolving regulatory landscapes. Equipped with comprehensive risk assessment capabilities and regulatory insights, compliance teams can proactively refine risk-based approaches to align with business objectives and evolving risks.

Cross-Functional Collaboration

Risk regulatory compliance extends beyond the compliance function itself. Cross-departmental collaboration is vital for embedding compliance into everyday operations. Tactics include joint training sessions, shared compliance goals across business units, and incentive structures linking bonuses or performance metrics to compliance outcomes. For instance, some institutions integrate compliance KPIs into business unit performance reviews, fostering a sense of ownership across all departments. A culture of collaboration enables firms to address new regulatory challenges holistically, breaking down silos and integrating compliance considerations early in the development of products and services, an approach akin to the “Compliance by Design” philosophy.

Culture and Ethical Conduct

The final human enabler is an organizational culture built on ethics and accountability. Employees must feel safe to raise potential compliance concerns without fear of retaliation. Open-door policies, confidential reporting channels, and internal campaigns reinforcing the value of proactive compliance encourage staff to speak up. A culture that values regulatory compliance ensures that written policies translate into practical, risk-conscious behaviors, supporting the effectiveness of RBRC programs in practice.

Technological Enablers: Tools, Data, and Automation

Governance, Risk & Compliance (GRC) Platforms

Integrated GRC systems serve as a central hub for risk-based regulatory compliance programs. These platforms map regulatory obligations to internal controls, track risk assessments, and document compliance activities. By consolidating data into a single source of truth, GRC tools reduce gaps and inconsistencies, offering real-time dashboards that provide leadership with visibility into risk levels and compliance status, critical for effective decision-making and regulatory oversight.

RegTech Solutions and Automation

Technological advancements, particularly RegTech, play a transformative role in enabling RBRC. Examples include:

- Automated Reporting and Data Management: RegTech platforms automate the collection and submission of regulatory reports (e.g., MiFID II trade reporting, AML transaction monitoring), enhancing accuracy and efficiency in meeting complex, multi-jurisdictional obligations.

- Risk Analytics and Monitoring: Advanced algorithms and AI-powered systems continuously scan for compliance anomalies, such as suspicious trading patterns or unusual customer behavior, aligning with the RBRC focus on proactive detection of high-risk activities.

- Compliance Automation & Workflow: Routine tasks like sanction list screening, KYC checks, and document reviews can be automated, freeing up compliance teams to focus on higher-level risk analysis. Automation not only reduces errors and manual effort but also ensures consistent, scalable execution of compliance controls.

- Data Integration and Quality Management: Clean, integrated data is essential for effective risk regulatory compliance. Modern platforms aggregate data from disparate sources, trades, payments, customer records, into central repositories for analysis, helping to identify risks and ensure data integrity.

- AI and Predictive Analytics: Cutting-edge AI systems enable predictive compliance, forecasting future regulatory risks and identifying potential compliance breaches before they occur. Machine learning models can also simulate the impact of changing market or regulatory conditions, enhancing the proactive capabilities of RBRC frameworks.

- Real-Time Dashboards and Alerts: Compliance teams can leverage real-time alerts and visual dashboards to monitor high-risk activities, track regulatory news, and respond immediately to critical incidents. This immediacy supports the dynamic, risk-focused nature of risk-based regulatory compliance.

- Continuous Regulatory Update Services: Technology solutions also automate tracking of regulatory changes globally, reducing the risk of missing new compliance requirements. These tools integrate regulatory updates directly into compliance workflows, ensuring risk assessments remain current and aligned with emerging obligations.

Enabling a Resilient Risk-Based Compliance Framework

The synergy of skilled human resources and advanced technology empowers financial institutions to navigate the increasingly complex regulatory landscape with confidence. By investing in experienced compliance teams, fostering ethical conduct, and adopting AI-driven RegTech solutions, firms can transform regulatory compliance from a reactive obligation into a proactive, strategic driver of resilience and competitive advantage.

The next section will address the practical challenges financial institutions face when implementing risk-based regulatory compliance, along with actionable strategies to overcome them.

Key Challenges in Risk-Based Regulatory Compliance and Mitigation Strategies

Transitioning to and sustaining a risk-based regulatory compliance (RBRC) framework presents multiple challenges. Below, we identify the principal obstacles financial institutions face and outline targeted mitigation strategies to ensure robust regulatory compliance, optimize risk allocation, and maintain ongoing program effectiveness.

Challenge 1: Evolving Regulatory Complexity

The volume and pace of new regulations: MiFID II, GDPR, PSD2, DORA, ESG disclosures, and more, can overwhelm compliance teams, making it difficult to keep risk assessments and control frameworks current.

Mitigation Strategies:

- Regulatory Intelligence: Establish a dedicated regulatory change committee or assign specialists to monitor rule-making bodies, interpret new requirements, and update risk assessments on a rolling basis.

- Modular Frameworks: Architect compliance policies and controls in modular components so that new obligations can be slotted in quickly without overhauling the entire program.

- Horizon Scanning Tools: Leverage RegTech platforms to automate tracking of regulatory updates, triggering alerts when relevant laws change.

- External Partnerships: Engage industry associations, external advisors, or peer networks to summarize complex regulatory changes, reducing the burden on internal teams.

Challenge 2: Data Silos and Quality Issues

Effective risk-based regulatory compliance demands integrated, high-quality data across transactions, customer records, system logs, and more. Disparate systems and inconsistent data undermine accurate risk monitoring.

Mitigation Strategies:

- Centralized Data Lake: Implement a unified repository for compliance and risk data, consolidating feeds from core banking, CRM, and other systems.

- Data Governance: Appoint data stewards in each business unit to enforce data standards, master data management, and regular cleansing.

- Software Integration: Select compliance platforms with robust API capabilities to ensure seamless data exchange and real-time risk visibility.

- Quality Monitoring: Deploy data validation tools to detect gaps or anomalies, minimizing false positives and negatives in compliance alerts.

Challenge 3: Legacy Systems and Manual Processes

Many banks rely on outdated IT infrastructure and spreadsheet-based compliance workflows, limiting agility and preventing real-time risk detection.

Mitigation Strategies:

- Technology Roadmap: Prioritize modernization initiatives by impact—begin with automating high-risk tasks such as KYC screening or trade surveillance.

- Robotic Process Automation (RPA): Use RPA for quick wins by automating repetitive manual tasks while planning full system upgrades.

- Pilot Programs: Run controlled pilots of new RegTech solutions, demonstrate ROI, and scale incrementally to build organizational confidence.

- IT–Compliance Collaboration: Ensure upcoming core system upgrades include native compliance and reporting modules, reducing reliance on external workarounds.

Challenge 4: Organizational Resistance and Change Management

Shifting from a “tick-the-box” mindset to risk-based compliance often encounters pushback from staff accustomed to uniform controls or skeptical of differentiated risk priorities.

Mitigation Strategies:

- Stakeholder Education: Use real-world examples, past incidents averted, efficiency gains achieved, to illustrate benefits and address misconceptions.

- Inclusive Risk Assessment: Involve front-line managers and compliance champions in risk scoring to build trust in the process.

- Clear Policies and Communication: Emphasize that baseline compliance remains non-negotiable; only control intensity varies by risk level.

- Incentive Alignment: Tie performance metrics and reward structures to compliance outcomes and risk management behaviors, reinforcing the cultural shift.

Challenge 5: Calibrating the Risk Methodology

Assigning appropriate risk levels (“high”, “medium”, “low”) and matching control rigor can be subjective, risking underestimation of serious threats or over-engineering of minor ones.

Mitigation Strategies:

- Data-Driven Scoring: Leverage historical loss data, incident frequencies, and quantitative risk metrics to inform risk ratings.

- Expert Consensus: Convene a panel of compliance, risk, and business experts, internally and externally, to validate risk classifications.

- Scenario Analysis: Conduct stress tests and “what-if” exercises to test control effectiveness and refine risk thresholds.

- Documentation and Review: Record rationale behind risk and control decisions; revisit and recalibrate ratings after incidents or near-miss events.

Challenge 6: Multiple Jurisdictions and Regulatory Overlap

International operations face divergent rules and potential conflicts across EU, US, APAC, and other regulators, complicating unified risk-based regulatory compliance.

Mitigation Strategies:

- Global Framework with Local Appendices: Define a core compliance standard based on the strictest applicable rules, then layer jurisdiction-specific addenda.

- Local Expertise Integration: Deploy regional compliance officers to interpret nuances and feed insights into the global risk assessment.

- Requirement Mapping Matrix: Maintain a cross-jurisdictional matrix mapping each regulation to internal policies and controls to ensure full coverage.

- Regulator Engagement: Proactively discuss your harmonized approach with regulators to secure alignment and reduce conflicting expectations.

Challenge 7: Measuring Effectiveness and ROI

Quantifying the success of risk-based regulatory compliance can be challenging, as value often lies in prevented losses and avoided fines rather than observable outputs.

Mitigation Strategies:

- Key Metrics: Define and track KPIs/KRIs such as trend in compliance incidents, mean time to remediation, training completion rates, and audit finding reductions.

- Efficiency Gains: Quantify reductions in manual effort (e.g., hours saved through automation) and improvements in processing capacity.

- Value Framing: Present compliance spend as insurance, calculate avoided penalty costs or incremental revenue unlocked by enabling entry into new markets with strong compliance protocols.

- Periodic Reporting: Provide management and the board with clear dashboards showing compliance program impact, reinforcing support for ongoing investment.

Measurable ROI of Risk-Based Regulatory Compliance

Transforming regulatory compliance from a cost center into a value driver requires clear measurement of returns. A structured Risk-Based Regulatory Compliance (RBRC) program delivers both quantitative and qualitative ROI across multiple dimensions:

1. Avoided Fines and Operational Losses

- Direct Cost Savings: Preventing major compliance incidents eliminates fines, penalties, and litigation costs. For example, enhanced anti–money laundering controls can avert multi-million-euro sanctions.

- Operational Loss Prevention: Stopping fraud, data breaches, or service disruptions spares remediation expenses, customer compensation, and lost revenue. One global firm reported a 35 % reduction in breach incidents after deploying risk-focused privacy tools, translating into substantial cost avoidance.

2. Efficiency Gains and Compliance Cost Reduction

- Automation Savings: RegTech and workflow automation can cut manual reporting effort by up to 80 %, freeing staff hours and avoiding incremental hires.

- Process Streamlining: Consolidating duplicate controls in low-risk areas reduces audit fees, consultant costs, and rework expenses. Early compliance involvement in product design prevents expensive remedial projects post-launch.

3. Enhanced Revenue and Market Opportunities

- New Market Access: Robust risk regulatory compliance enables entry into high-growth markets previously considered too risky, unlocking additional revenue streams.

- Customer Trust Premium: Strong data-privacy and fraud-prevention measures become selling points for corporate clients, improving client retention and attracting new business. Surveys and retention metrics can approximate the revenue uplift linked to enhanced trust.

4. Improved Risk Profile and Capital Efficiency

- Lower Capital Charges: By reducing operational-risk exposures, banks can decrease the economic capital held against compliance risk, freeing funds for lending or investment. Even a small percentage reduction in required capital can equate to millions in productive capital redeployment.

5. Workforce Productivity and Morale

- Employee Efficiency: Simplified, risk-focused controls minimize time spent on low-value compliance tasks, allowing staff to focus on client service and innovation.

- Talent Attraction and Retention: A strong ethical culture and streamlined compliance environment improve morale, reduce turnover costs, and enhance employer brand, factors that contribute to long-term performance.

6. Stronger Regulatory Relationships and Flexibility

- Faster Approvals: Demonstrating a mature risk-based regulatory compliance framework can lead regulators to grant faster product approvals or lighter inspection schedules.

- Sandbox Participation: Firms may qualify for simplified regimes or sandbox programs, reducing time-to-market friction and compliance overhead in new initiatives.

Future Trends in Risk-Based Regulatory Compliance: AI, RegTech, and Predictive Compliance

As the financial services industry evolves, regulatory compliance will increasingly leverage cutting-edge technologies and forward-looking methodologies. Institutions that embrace these innovations in risk-based regulatory compliance (RBRC) will gain deeper insights, stronger controls, and true predictive capabilities. Key future trends include:

1. Artificial Intelligence & Machine Learning in Compliance

- Predictive Compliance Analytics: AI models will ingest historical and real-time transaction, customer, and market data to forecast emerging compliance risks before they materialize. This enables compliance teams to preemptively adjust controls and avoid incidents rather than reacting after the fact.

- Continuous Learning & False-Positive Reduction: Advanced machine learning algorithms will refine themselves over time, reducing benign alerts and focusing human attention on genuine threats, improving both efficiency and effectiveness. In anti–money laundering, for example, AI already identifies complex laundering schemes that rules-based systems miss.

- Natural Language Processing (NLP): NLP tools will automate the review of internal communications and regulatory texts, flagging policy breaches and extracting new obligations. AI-powered virtual assistants, trained on an institution’s policies and regulatory frameworks, will guide staff through complex compliance queries in real time.

- SupTech Collaboration: Regulators will adopt AI in supervisory technology, using machine learning to analyze firm submissions, detect anomalies, and issue early warnings—creating a more data-driven regulatory ecosystem.

2. Maturing RegTech Ecosystem and Collaborative Platforms

- RegTech-as-a-Service (RaaS): Cloud-based compliance modules will allow institutions of all sizes to access automated AML monitoring, real-time fraud detection, and risk analytics on demand, without heavy infrastructure.

- Blockchain for Auditability: Distributed ledger technologies will provide immutable, auditable trails for compliance documentation, streamlining evidence gathering for regulators. Integration of blockchain-verified digital identities will accelerate KYC and reduce identity fraud.

- Consortium Solutions: Industry consortia will pool resources, shared KYC utilities or joint fraud-monitoring platforms, to reduce duplication and costs, fostering collective resilience against financial crime.

- Regulatory Sandboxes: Controlled testing environments will accelerate adoption of novel RegTech solutions, enabling safe experimentation with emerging compliance tools.

3. Predictive and Preventive Compliance Frameworks

- Digital Compliance Twins: Virtual replicas of an institution’s processes will allow teams to simulate control effectiveness under various scenarios, identifying vulnerabilities before they occur.

- Integrated Business Planning: Compliance risk models will be embedded in product development and market-entry strategies, ensuring new offerings are vetted for compliance outcomes via predictive simulations.

- Privacy-by-Design & Up-Front Controls: Driven by regulations like GDPR and upcoming AI rules, preventive compliance will demand that controls be built into solutions from inception rather than retrofitted post-launch.

4. Convergence of Compliance, Enterprise AI, and Analytics

- Shared Data Ecosystems: AI models used for credit risk, marketing, and operations will feed compliance dashboards, enabling holistic risk assessments and cross-validation of data for fair-lending, conduct, and privacy compliance.

- Privacy-Preserving Analytics: Techniques like federated learning will allow compliance monitoring on encrypted or decentralized data, balancing supervisory needs with data-protection requirements.

5. Evolving Regulatory Expectations & AI Governance

- AI and Model Risk Management: Compliance functions will extend to monitoring AI-driven systems, ensuring transparency, fairness, and accountability of algorithms used in credit scoring, trading, or customer segmentation.

- AI Act Preparedness: Institutions will establish AI governance frameworks under their compliance umbrellas to meet transparency, documentation, and risk-management obligations mandated by emerging AI regulations.

6. Predictive Regulatory Change and Foresight

- Regulatory Scenario Planning: Firms will use big-data analytics to anticipate areas of likely future regulation, modeling impact on compliance frameworks and preparing modular controls in advance.

- Dynamic Compliance Roadmaps: Instead of static policy manuals, institutions will maintain living compliance roadmaps that adapt as projected regulatory trends unfold.

7. Human Oversight and Ethical Assurance

- “Human-in-the-Loop” Controls: Despite automation, final compliance judgments will remain with trained professionals. Audit trails for AI decisions and override capabilities will ensure accountability.

- Ethics-First Culture: As technology drives compliance, firms will reinforce ethical standards and train staff on responsible AI use, bias detection, and customer-centric risk management.

Reduce your

compliance risks