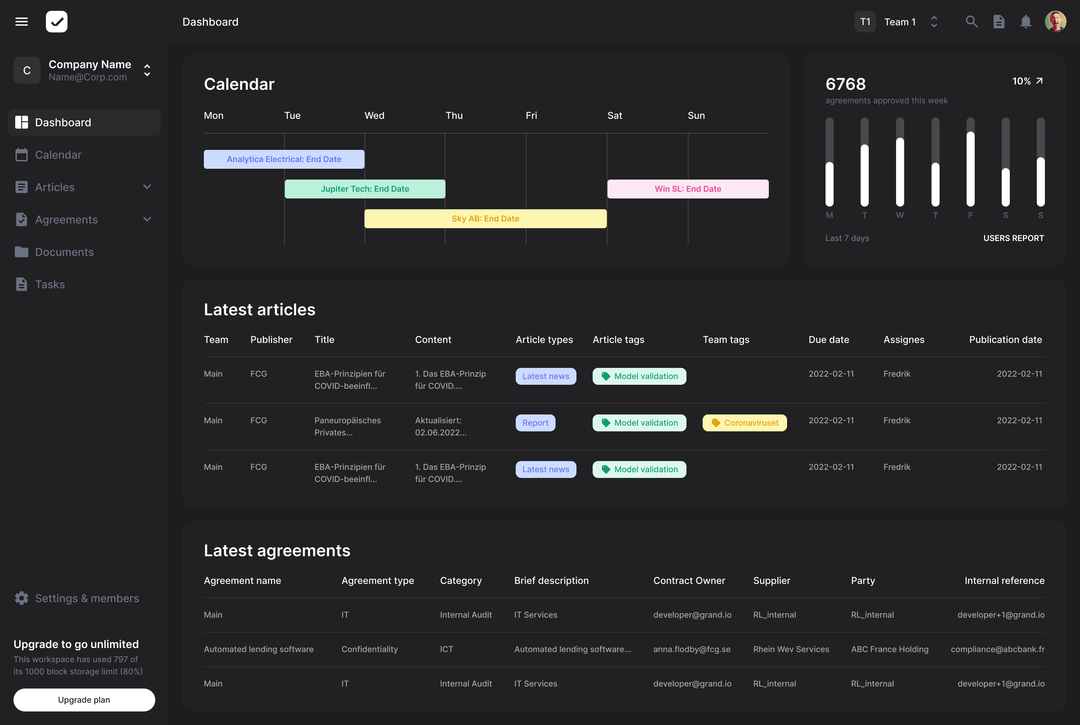

Regulatory Compliance: What is it?

Understanding regulatory compliance is crucial for organisations and individuals. This concept involves adhering to laws, rules, and guidelines, and is often interpreted through deterrence theory. It plays a vital role in preventing legal complications and ensuring smooth business operations."

Definition and Purpose of Regulatory Compliance

Regulatory compliance is the concerted effort an organisation makes to conform to the external laws, rules and industry standards that govern its activities. From broad‑based corporate statutes such as the Companies Act to sector‑specific rules like the EU’s GDPR or the US Foreign Corrupt Practices Act, it requires a mix of internal controls, clear policies, regular training and ongoing monitoring.

Why it matters:

| Purpose | What it delivers | Illustrative examples |

|---|---|---|

| Protect stakeholders | Prevents harm, fraud and abuse by placing guard‑rails around products, workplaces, finances and the environment. | Product‑safety directives, OSHA workplace standards, environmental‑impact limits. |

| Ensure legal operation | Keeps day‑to‑day activities within statutory boundaries, shielding the firm from fines, litigation or criminal exposure. | Anti‑bribery laws, anti‑money‑laundering (AML) rules, tax‑reporting mandates. |

| Promote transparency & accountability | Requires accurate disclosures and auditable records that build public and investor trust. | Annual financial filings under IFRS/GAAP, sustainability reporting, whistle‑blower channels. |

| Standardise best practice | Codifies proven methods so firms operate efficiently and ethically, often via recognised frameworks (e.g., ISO 37301 for compliance management). | Harmonised internal controls that map overlapping rules into a single control matrix. |

| Navigate cross‑border obligations | Integrates multiple jurisdictions’ requirements into one cohesive programme, reducing duplication and conflict. | A cloud provider aligning both EU GDPR and US state privacy statutes in its data‑handling playbook. |

When embedded effectively, regulatory compliance not only safeguards an organisation’s licence to operate but also becomes a strategic asset—demonstrating integrity, attracting investment and differentiating the brand in increasingly transparent markets. In the following sections we will examine how a robust compliance culture underpins business integrity and how key industries tailor their programmes to meet unique obligations.

The Role of Regulatory Compliance in Business Integrity and Reputation

A visible, well‑governed regulatory compliance programme is inseparable from a company’s integrity and public standing. When an organisation rigorously follows the rules and rewards ethical conduct, it signals that honesty, safety and accountability are non‑negotiable. The results are far‑reaching:

- Trust and credibility – Customers, partners and investors are more willing to engage with firms that prove they can protect personal data, treat consumers fairly and disclose information accurately. High‑profile lapses—‑from fraud scandals to data breaches—‑show how quickly trust evaporates when compliance fails, whereas a reputation for playing by the rules becomes a trust badge.

- Integrity of operations – Regulations frequently embed core ethical values (e.g. anti‑bribery statutes enshrine fair competition). Systematic compliance hard‑wires those norms into everyday decision‑making and makes “doing the right thing” the default, not an optional extra.

- Avoidance of scandals and penalties – Ignoring costly rules may create a short‑term edge, but environmental violations, financial mis‑statements or unsafe products can annihilate brand equity overnight. Robust compliance acts as reputational insurance, preventing headline‑grabbing incidents and the legal fines that follow.

- Regulatory relationships – Proactive, transparent companies enjoy smoother audits and a more collaborative rapport with supervisory bodies. Being seen as a responsible actor can secure leniency in borderline cases and shorten resolution times.

- Employee morale and recruiting – Top talent gravitates toward employers known for principled conduct. A culture that prizes ethical standards boosts staff pride, retention and loyalty, further reinforcing the organisation’s integrity from the inside out.

Over time, consistent regulatory compliance builds a reservoir of goodwill that differentiates a business in crowded markets. Stakeholders gain confidence that the enterprise is well managed, resilient to legal shocks and committed to long‑term value creation, benefits no marketing campaign can replicate.

Industry‑Specific Regulatory Compliance Obligations: Finance & Banking

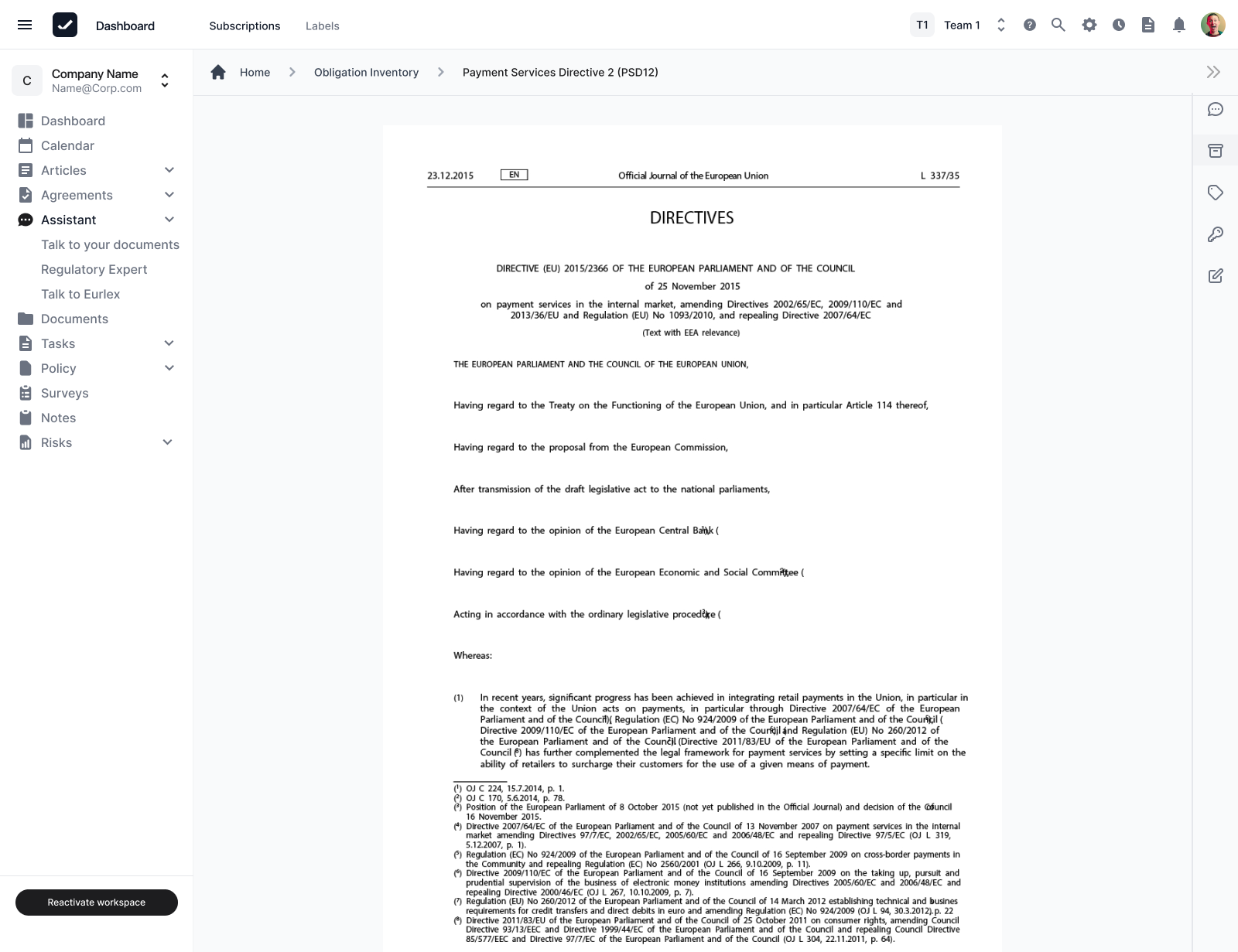

The umbrella concept of regulatory compliance applies across every sector, but few industries face a denser rule‑set than financial services. Because banks and investment firms sit at the heart of the global economy, and because fraud, money‑laundering or capital shortfalls can trigger systemic crises, law‑makers have imposed detailed, sector‑specific obligations. Below are the core compliance domains that every financial institution must navigate, with an emphasis on both European (EU) and worldwide frameworks.

1. Banking Regulations: Capital Adequacy & Risk Management

- Basel III Accord – Drafted by global central bankers in the wake of the 2007‑‑2009 financial crisis, Basel III raises minimum Tier 1 capital ratios, introduces liquidity‑coverage and net‑stable‑funding requirements, and caps excessive leverage. By maintaining larger, higher‑quality capital buffers and tighter risk controls, banks reduce the probability of failure and better protect depositors.

2. Financial Markets & Investor Protection

- MiFID II (EU) – The Markets in Financial Instruments Directive II makes European markets more transparent and strengthens retail and institutional investor safeguards. Investment firms must:

- Act in the best interests of clients when designing or selling products.

- Provide clearer, fuller information disclosure (e.g., costs, risks, performance).

- Implement stronger governance and conflict‑of‑interest controls.

- Report trades in granular detail to regulators for real‑time market oversight.

Equivalent conduct regimes outside the EU pursue the same goals of fairness and transparency.

3. Anti‑Money Laundering (AML) & Know‑Your‑Customer (KYC)

- U.S. Bank Secrecy Act & USA PATRIOT Act

- EU Anti‑Money Laundering Directives

These laws obligate banks to establish rigorous AML programmes, including:

- Customer due diligence and identity verification at onboarding.

- Ongoing transaction monitoring to flag unusual patterns.

- Screening clients against sanctions lists (e.g., OFAC in the United States).

- Filing Suspicious Activity Reports whenever money‑laundering or terrorism‑financing indicators appear.

Collectively, these steps keep illicit funds, organised crime and terror finance out of the legitimate financial system.

4. Corporate Governance & Financial Reporting

- Sarbanes‑Oxley Act (SOX, United States) – Sections 302 and 404 impose strict internal‑control and executive‑certification duties, holding CEOs and CFOs personally liable for inaccurate statements.

- EU Transparency & Accounting Directives / IFRS – Listed companies must publish timely, truthful financials prepared under International Financial Reporting Standards and maintain audit‑ready control environments.

These measures deter accounting fraud and give investors reliable data for capital‑allocation decisions.

5. Data Protection & Cybersecurity

- General Data Protection Regulation (GDPR, EU) – With banking increasingly data‑driven, GDPR overlays privacy obligations on top of prudential rules. A bank operating in Europe must:

- Obtain clear legal bases for processing personal data.

- Implement “privacy‑by‑design” controls and strong cyber defences.

- Notify regulators and affected individuals swiftly after a breach.

Many multinationals now apply GDPR principles globally to simplify compliance and bolster customer trust.

Healthcare & Life Sciences

In healthcare and life sciences, regulatory compliance safeguards patient safety, privacy and research integrity. Because failures can endanger individual lives and public health, the sector’s rule‑set is exhaustive and strictly enforced across both US and EU jurisdictions.

1. Patient‑privacy laws

HIPAA (US) – The Health Insurance Portability and Accountability Act of 1996 sets national standards for the confidentiality, integrity and authorised use of protected health information (PHI). Key provisions include:

- A Privacy Rule that limits disclosure without patient consent and grants individuals the right to access and amend their medical records.

- Breach‑notification and civil‑penalty mechanisms that can reach millions of dollars for wilful neglect.

GDPR (EU) – Classifies health data as “special‑category” personal data, requiring explicit patient consent, strict minimisation and strong technical safeguards. EU regulators can levy fines of up to €20 million or 4 % of global turnover for violations.

2. Healthcare‑quality & safety regulations

- Good Manufacturing Practice (GMP) – Drug and medical‑device makers must validate manufacturing processes, control contamination and maintain exhaustive batch records before products reach patients.

- Regulatory approvals – The US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) review dossiers on safety, efficacy and quality before granting market authorisations.

- Provider accreditation – Hospitals and clinics often seek certification from bodies such as The Joint Commission (US) or comply with national health‑inspectorate standards covering sanitation, medication management and surgical protocols.

3. Clinical‑research ethics

- Declaration of Helsinki – Sets the global ethical framework for medical research on humans, demanding risk–benefit analysis and independent review.

- Good Clinical Practice (GCP) – Governs study design, informed consent, data integrity and adverse‑event reporting. Investigators must secure ethics‑committee approval and protect participant confidentiality throughout every trial phase.

4. Public‑health & safety mandates

Healthcare organisations must also:

- Segregate and dispose of biohazardous waste in line with environmental‑health regulations.

- Report immunisation data to public registries and comply with vaccine‑tracking requirements.

- Follow emergency orders—such as pandemic‑specific infection‑control protocols—issued by health authorities.

Real‑world compliance in action

A US hospital, for example, must train every staff member on HIPAA rules, configure its electronic health‑record (EHR) system with encryption and role‑based access, and limit data use to treatment, payment or other legally permitted purposes. Routine audit logs, breach‑response drills and patient‑access workflows complete the compliance loop—delivering legal conformity and reinforcing public trust.

Bottom line: In healthcare and life sciences, seamless regulatory compliance is the linchpin of patient protection, ethical innovation and organisational credibility, ensuring that privacy is upheld, therapies are safe, research is transparent and communities remain secure.

Technology & Data

For software vendors, cloud providers, and digital platforms, regulatory compliance is now a moving target that spans privacy, cybersecurity, consumer protection, intellectual‑property, and even sustainability mandates. Because online services ignore geographic borders, a single product launch can trigger obligations in dozens of jurisdictions. Below is a detailed, regulation‑by‑regulation roadmap that preserves every critical requirement in the original brief.

1 · Data‑protection & privacy laws

GDPR (EU) – Gives individuals granular control over personal data: lawful collection (often explicit consent), purpose limitation, strict retention windows, data‑subject rights (access, erasure, portability), breach notification, and heavy fines, up to €20 million or 4 % of global turnover, for violations. Any firm handling EU‑resident data must comply, even if located abroad.

CCPA/CPRA (California) – Grants residents the right to know, delete, and opt out of the sale or sharing of personal information; imposes notice and non‑discrimination duties on businesses.

Compliance take‑away: Tech companies must build consent flows, data‑inventory maps, and automated request portals that work across multiple privacy regimes.

2 · Cybersecurity & information security

- NIS Directive → NIS2 (EU) – Requires “operators of essential services” and digital‑service providers to implement risk‑management measures and report significant incidents within 24 hours.

- Gramm‑Leach‑Bliley Act (US finance) + state breach‑notification statutes – Mandate technical, physical, and administrative safeguards plus rapid customer notification if data is compromised.

- ISO/IEC 27001 – A voluntary but widely adopted management‑system standard that proves alignment with regulator expectations on encryption, access control, logging, and continual improvement.

Compliance take‑away: A certified ISMS (information‑security management system) can harmonise global cybersecurity requirements and streamline audit evidence.

3 · Consumer‑protection & digital‑services rules

- Digital Services Act (DSA) & Digital Markets Act (DMA) – EU

- DSA: content‑moderation transparency, illegal‑content takedown deadlines, annual risk assessments for very‑large online platforms.

- DMA: anti‑self‑preferencing, data‑sharing duties, interoperability obligations for “gatekeeper” platforms.

- ePrivacy Directive (EU) – Governs cookies, metadata, and electronic communications secrecy until the forthcoming ePrivacy Regulation replaces it.

- FCC & communications‑privacy laws (US) – Cover lawful intercept, customer proprietary network information (CPNI), and net‑neutrality‑style disclosure.

- Product‑safety & export‑control rules – Hardware or software using strong encryption may trigger US Export Administration Regulations (EAR) or EU dual‑use controls.

Compliance take‑away: Platform operators must blend content policies with competition and telecom rules, while developers shipping encryption tech need export licences.

4 · Intellectual‑property & licensing obligations

- Copyright & patent law – Protect proprietary code, algorithms, and digital assets; infringement can lead to statutory damages, injunctions, and import bans.

- Open‑source licences (GPL, Apache 2.0, MIT, etc.) – Each licence dictates redistribution terms; ignoring attribution or copyleft triggers breach of contract and IP claims.

Compliance take‑away: A Software Bill of Materials (SBOM) and licence‑compliance scanner are now essential risk‑controls in any DevSecOps pipeline.

5 · Emerging regulatory frontiers: AI & ESG

- EU Artificial Intelligence Act (draft) – Classifies AI systems by risk tier; high‑risk models will need conformity assessments, transparency disclosures, human oversight, and post‑market monitoring.

- ESG & supply‑chain transparency – Regulations such as the EU Corporate Sustainability Reporting Directive (CSRD) and US conflict‑minerals rules compel tech firms to audit carbon footprints, labour practices, and raw‑material sourcing.

Compliance take‑away: Expect mandatory AI‑risk registers and climate‑impact metrics to join the core compliance dashboard within the next few years.

Putting it all together

A modern tech‑sector compliance programme is dominated by privacy and security but must also track consumer‑protection, IP, and ESG developments. A social‑media or cloud provider, for instance, needs:

- A consent‑driven data lifecycle that fulfils GDPR and CCPA/CPRA.

- An ISO 27001‑aligned security stack that satisfies NIS2 and breach laws.

- Content‑moderation workflows and transparency reports for DSA.

- Open‑source governance to honour licence terms.

- Forward‑looking controls to meet AI‑Act and sustainability disclosures.

Because legislation evolves faster than software updates, tech compliance officers must maintain real‑time regulatory monitoring and bake adaptability into product design. Firms that master this complexity turn regulatory compliance from a reactive burden into a proactive trust and market‑access advantage.

Manufacturing & Product Safety

Manufacturers sit at the intersection of regulatory compliance for worker welfare, product integrity, and environmental stewardship. Because factories convert raw materials into finished goods, mistakes can harm employees, consumers, and the planet—so lawmakers impose a broad, overlapping rule‑set that spans multiple jurisdictions.

1 · Workplace health & safety

OSHA (United States) – Requires employers to keep the workplace “free from recognised hazards,” install machine guards, issue personal protective equipment (PPE), train staff on dangerous substances, and log injuries and illnesses.

EU directives & national laws – Under the EU Occupational Safety & Health framework, plants must conduct risk assessments, maintain safe equipment, and involve workers in safety planning.

Why it matters: Compliance prevents accidents, saves lives, and avoids costly shutdowns or fines.

2 · Product safety & standards

- EU CE marking – Toys, electronics, machinery, and countless other goods must meet specific safety directives before they can carry the CE mark and enter the EU market.

- U.S. Consumer Product Safety Act (CPSA) – Enforces testing, certification, and recall obligations; the Consumer Product Safety Commission (CPSC) can levy penalties or ban unsafe items.

- International standards – ISO 9001 (quality‑management systems), IEC electrical‑safety specs, automotive crash and emissions rules, etc., often serve as de facto regulatory benchmarks worldwide.

Why it matters: Conformity assessments shield consumers from hazards such as toxic paints, electric shocks, or vehicle failures.

3 · Environmental regulations

- Air & water permits – Clean Air Act (US) and EU Industrial Emissions Directive cap pollutants; facilities must monitor stacks, treat wastewater, and file periodic reports.

- Chemical controls – REACH (EU) obliges companies to register, evaluate, and authorise hazardous substances, while RoHS restricts lead, mercury, cadmium, and other toxins in electronics.

- ISO 14001 – A voluntary environmental‑management standard that many firms adopt to systematise compliance and demonstrate eco‑credibility.

Why it matters: Reduces legal risk, protects ecosystems, and supports a responsible brand image.

4 · Sector‑specific layers

- Food & beverage – FDA rules (US) and EU food‑safety laws mandate Hazard Analysis & Critical Control Points (HACCP) plans.

- Aerospace – FAA regulations and AS9100 certifications ensure flight‑critical parts meet stringent reliability thresholds.

- Medical devices – ISO 13485 quality‑system requirements backstop EU MDR and FDA 21 CFR 820 regulations.

Why it matters: Special‑use products—whether edible, implantable, or airborne—demand precision compliance to guarantee safety and efficacy.

5 · Practical illustration

A toy manufacturer exporting worldwide must:

- Earn the CE mark under the EU Toy Safety Directive (no choking hazards, toxic chemicals, or sharp edges).

- Pass CPSC testing for the U.S. market and respect state‑level rules such as California Proposition 65 chemical warnings.

- Protect workers by following OSHA or local labour‑safety laws—issuing PPE and recording incidents.

- Manage chemicals & waste under REACH/RoHS and local environmental permits.

- Maintain ISO 9001 & ISO 14001 systems to knit these obligations into one auditable framework.

Manufacturing regulations are not static; new risks—cyber‑physical threats, AI‑driven machinery, climate‑change reporting—will add fresh layers of oversight. Vigilant monitoring, cross‑functional training, and standards‑based management systems are therefore essential to keep regulatory compliance programmes current and effective.

Challenges in Regulatory Compliance and How to Overcome Them

1 · Rapid Regulatory Changes

The challenge – Governments continually revise privacy statutes, expand sanctions lists, tweak tax codes, and issue new sector directives. Thomson Reuters notes that compliance teams now confront a near‑real‑time stream of rule updates, especially tricky for multinationals juggling dozens of jurisdictions.

How to overcome it

- Regulatory‑intelligence tools – Subscribe to legal‑update feeds, industry‑association alerts, and compliance software dashboards that flag changes as they happen.

- Regulatory‑watch function – Stand up an internal task‑force, or appoint external advisers, whose sole job is to scan pending legislation and brief the business before laws take effect.

- Proactive monitoring & adaptable, principle‑based policies – Track draft bills; write controls around core obligations (e.g., “obtain verifiable consent”) rather than hard‑coding clause numbers.

- Continuous training loops – Deliver short, regular refreshers to compliance staff and front‑line departments so new expectations never come as a surprise.

2 · Complexity and Volume of Regulations

The challenge – A midsize firm can face hundreds of overlapping requirements across labour, tax, data protection, and industry‑specific domains; sometimes one country’s mandate contradicts another’s.

How to overcome it

- Integrated compliance programme – Consolidate wherever possible: a single control mapped to several statutes. Many organisations deploy unified compliance‑management platforms (as referenced on Wikipedia) to keep requirements and evidence in one place.

- Compliance matrix – List every rule, link it to internal policies, owners, and evidence locations; visualise overlaps and gaps.

- Risk‑based prioritisation – Rank laws by potential fines or operational impact and tackle the highest‑risk first.

- ISO 37301 – Adopt this Compliance Management Systems standard to provide structure and international credibility.

3 · Resource Constraints

The challenge – Tight budgets and lean headcounts mean a single compliance officer may cover multiple high‑stakes areas, yet regulators expect flawless performance (“do more with less,” per Thomson Reuters).

How to overcome it

- Automation – Deploy compliance software to:

- monitor transactions for AML red flags,

- manage GDPR data‑subject requests, and

- track training completion—alerting humans only when escalation is needed.

- Distributed ownership – Train line managers and department heads to own compliance in their spheres, with oversight from the central team.

- Selective outsourcing – Engage specialist firms for discrete tasks such as external audits or counsel on niche regulations when internal bandwidth is thin.

4 · Employee Awareness and Culture

The challenge – Policies succeed only if employees understand and follow them; human error or misconduct—intentional or accidental—is a leading breach trigger.

How to overcome it

- Regular, engaging training – Blend general ethics courses with topic‑specific modules (anti‑harassment, privacy, safety).

- Tone at the top – Executives must champion compliance, allocate resources, and apply consistent discipline for violations.

- Speak‑up mechanisms – Provide anonymous whistle‑blower hotlines and non‑retaliatory reporting channels to surface issues early.

- Recognition and accountability – Reward compliant behaviour, embed adherence in performance reviews, and enforce penalties for breaches—making compliance part of daily decision‑making rather than a box‑tick.

5 · Cross‑Border and Multi‑Jurisdiction Operations

The challenge – What is lawful in one country may be illegal in another; some rules (e.g., GDPR) extend extraterritorially, complicating global operations.

How to overcome it

- Global baseline at the strictest standard – Many multinationals roll out GDPR‑level privacy controls worldwide to simplify processes and demonstrate commitment.

- Local expertise – Engage regional counsel or compliance specialists to address jurisdiction‑specific nuances and liaise with regulators.

- Central–local coordination – Maintain clear communication channels so headquarters and field teams reconcile conflicting requirements swiftly.

- Conflict‑management playbooks – Where laws clash (e.g., one nation demands data disclosure that another forbids), prepare plans that may include exemption requests or data‑localisation strategies.

Turning Risk into Routine

By recognising these five pressure points and applying the detailed tactics above—regulatory intelligence, integrated frameworks, smart automation, culture building, and cross‑border harmonisation, organisations convert regulatory compliance from a reactive burden into a streamlined, risk‑managed process. The payoff: fewer surprises, lower fines, and stronger signals of expertise, authority, and trust.

The Role of Compliance Officers in Driving Regulatory Compliance

A Compliance Officer (or broader compliance team) is the in‑house guardian of integrity—charged with steering the organisation through every law, regulation and internal policy that applies to its business model. As regulatory demands multiply, their remit has become essential, wide‑ranging and, in many sectors, legally mandated.

Core Responsibilities

| Function | What it involves | Why it matters |

|---|---|---|

| Identifying requirements | Continually tracks statutes, rules and guidance that affect the firm; maintains an up‑to‑date inventory of obligations. | Ensures nothing falls through the cracks when laws change. |

| Developing policies & procedures | Translates “the law says we must do X” into step‑by‑step internal processes—e.g., drafting customer due‑diligence procedures when new KYC rules land. | Gives staff clear, actionable instructions. |

| Training & communication | Runs ethics and rule‑specific courses (anti‑bribery for sales, data‑privacy for all employees) and fields day‑to‑day queries. | Embeds a culture where everyone knows the rules that govern their role. |

| Monitoring, auditing & risk assessment | Reviews sample transactions, system‑access logs, safety inspections, etc., verifying that policies are followed and risks are controlled. | Detects issues early before regulators—or headlines—do. |

| Incident handling & investigations | Leads or coordinates probes when a breach is suspected, determines scope, orders corrective action and files any legally required reports (e.g., breach notifications). | Limits damage, satisfies statutory reporting clocks. |

| Advising the business | Briefs management and the board on compliance risks; weighs in on strategic moves such as new‑market entry or product launches. | Aligns commercial decisions with legal tolerance. |

| Regulator liaison | Serves as the point of contact during exams, files certifications, and negotiates remediation plans. | Builds trust and transparency with supervisory bodies. |

Independence, Authority & Reporting Lines

Best practice—sometimes codified in regulation—demands that the compliance function hold sufficient authority, direct access to senior leadership and operational independence. Ideally, the Chief Compliance Officer (CCO) reports to the CEO or board, ensuring serious issues cannot be buried by short‑term business pressures.

When a Compliance Officer Is Legally Required

- Financial services: Banks and investment firms must appoint a qualified CCO under sector rules.

- Data privacy: Under the EU GDPR, entities engaged in large‑scale processing of personal or sensitive data must designate a Data Protection Officer (DPO), a privacy‑focused counterpart who monitors data‑protection compliance and liaises with authorities.

- Numerous industry‑specific statutes (e.g., healthcare, gaming, insurance) impose similar mandates.

Sector Example — Healthcare

A hospital CCO must juggle:

- HIPAA privacy safeguards and breach notifications to HHS.

- Billing‑integrity reviews to prevent Medicare/Medicaid fraud.

- Patient‑safety standards and incident investigations.

They develop privacy policies, train clinical staff, audit billing records, probe tips about improper claims, and brief executives—helping the organisation avoid fines while preserving patient trust.

Achieving Regulatory Compliance: A Detailed, Step‑by‑Step Guide

Building a robust regulatory compliance programme feels daunting, but it follows a repeatable cycle: identify obligations → embed controls → verify performance → remediate & improve. Below is a refined—yet fully detailed—playbook that keeps every fact and example from your source text.

1. Map the Regulatory Landscape ( Risk Assessment )

- Catalogue all applicable laws by sector (finance, healthcare, manufacturing, etc.) and jurisdiction (local, national, international).

- Conduct a regulatory risk assessment to prioritise areas where non‑compliance would be most damaging—e.g., privacy if you handle personal data, securities rules if you are publicly traded, multi‑country statutes if you operate globally.

- Engage legal counsel or external experts at this stage to ensure no duty is overlooked.

2. Translate Rules into Policies & Procedures

- Draft internal controls for every obligation:

- Example: A statute that requires five‑year record retention becomes a written Records‑Retention Policy detailing which documents, how long, and where they are stored.

- Example: A new safety‑training mandate triggers a procedure that enrols every hire within their first 30 days.

- Create a central Code of Conduct expressing the firm’s commitment to compliance and ethics.

- Support with topic‑specific manuals—Anti‑Corruption, Data Privacy, Workplace Safety, etc.

- Ensure accessibility via an intranet, employee handbook or learning portal.

3. Assign Clear Ownership & Resources

- Appoint a Compliance Officer or team (or in a small firm, designate a manager) to coordinate the programme.

- Allocate departmental accountability—HR for labour law, IT for cybersecurity, Finance for financial‑reporting, all under compliance oversight.

- Secure board and C‑suite backing so leadership sets the tone and funds the budget, tools and staffing required.

4. Train Employees & Build Awareness

- All‑hands training on core ethics, Code of Conduct basics and how to report concerns.

- Role‑specific modules:

- Sales → anti‑bribery & trade‑sanctions rules.

- IT → data protection & cybersecurity.

- Managers → monitoring and enforcing compliance within their teams.

- Use real‑world scenarios to keep sessions practical and engaging.

- Reinforce messages continually via newsletters, posters (e.g., factory safety reminders) and law‑change bulletins.

5. Monitor, Audit & Enforce

- Set metrics and checkpoints to track adherence.

- Run routine audits and inspections—financial‑control reviews, random data‑access checks, facility safety walk‑throughs.

- Leverage automated systems that flag unusual payments (AML), overdue training (HRIS), or policy violations.

- Discuss compliance in regular team meetings so managers can raise issues or near‑misses.

- Investigate and remediate promptly: pinpoint root causes, retrain staff, adjust procedures, and apply consistent disciplinary action where misconduct occurred.

6. Document Everything

“If you didn’t document it, it didn’t happen.” Maintain evidence—training logs, audit reports, policy sign‑off sheets, investigation files—so you can prove diligence to regulators and benchmark progress internally.

7. Prepare an Incident‑Response Plan

- Define roles in advance for events such as a data breach, fraud allegation, or filing lapse.

- Comply with legal timelines—e.g., GDPR’s 72‑hour breach‑notification window.

- Coordinate communications to authorities, customers and the media.

- Consult counsel immediately and weigh voluntary self‑reporting to reduce penalties.

A swift, transparent response mitigates damage and demonstrates good faith.

8. Review & Improve Continuously

- Conduct annual (or more frequent) programme reviews using audit findings, employee feedback and incident analyses.

- Scan legislative horizons for emerging laws and sector guidance—regulators and peer cases often signal enforcement trends.

- Update policies, controls and training to close gaps and keep pace with change.

(Note: These steps echo the U.S. DOJ’s own compliance‑programme guidance, which emphasises risk assessment, controls, training, reporting, auditing and continuous improvement.)

The Pay‑Off

Following this cycle reduces the risk and cost of violations, creates a culture of integrity, and—far from being mere risk avoidance—can become a competitive differentiator in markets where customers and investors prize trustworthy, well‑governed businesses.

Turning Regulatory Compliance into a Competitive Edge

Many firms still treat compliance as a line‑item expense, but market leaders use it to differentiate, win customers, and accelerate growth.

1. Build Customer Trust & Loyalty

Frequent data breaches make consumers wary. Brands that prove they safeguard personal information—by meeting or exceeding GDPR, CCPA, and similar regimes—earn confidence and wallet share. Surveys show nearly half of shoppers avoid companies that mishandle data, while ≈ 90 % share information only with brands they believe will protect it. A flawless privacy‑compliance record therefore becomes a selling point, just as strict food‑safety adherence sways grocery buyers.

2. Strengthen Reputation & Brand Value

Ethics and compliance now sit at the heart of brand identity. Firms with zero scandals enjoy stronger loyalty and free “halo” publicity—especially in trust‑heavy sectors like finance and healthcare. Staying out of the headlines for the wrong reasons keeps attention on innovation and customer wins.

3. Drive Operational Efficiency & Quality

Regulatory frameworks such as ISO quality‑management standards often streamline workflows, reduce waste, and cut rework. In other words: the same discipline that satisfies regulators also lowers costs and raises product consistency—turning compliance rigour into margin.

4. Unlock New Markets & Customers

Large enterprises and governments increasingly demand that suppliers hold specific attestations (ISO/IEC 27001, SOC 2, CE markings, export‑control clearances). Being able to present those certificates wins contracts that under‑compliant rivals cannot touch, while global trade flows smoothly when export and sanctions rules are already baked in.

5. Avoid Disruption & Reallocate Resources

Fines, recalls, and injunctions drain cash and executive attention. Firms with robust compliance programmes sidestep those crises, freeing leadership to focus on R&D, marketing, and growth while competitors fight lawsuits or manage recalls.

6. Elevate Culture & Talent Brand

Mission‑driven professionals want principled employers. A “do‑it‑right” culture anchored in strong compliance attracts high‑calibre talent, keeps turnover low, and turns employees into brand ambassadors—fuel for innovation and productivity.

7. Spark Innovation Within Regulatory Bounds

Deep mastery of rules often inspires fresh solutions—witness the boom in regtech tools that automate AML checks or privacy management. Companies that collaborate with regulators can even influence upcoming standards, gaining early insight that rivals lack.

8. Real‑World Proof Points

- Privacy‑first software vendor: By offering controls that exceed GDPR (e.g., granular consent dashboards, real‑time data‑deletion toggles), the firm positions itself as the “privacy‑friendly” alternative to big‑tech incumbents.

- Ethics‑driven investment house: A spotless governance record reassures institutional investors, turning “no compliance surprises” into a core pitch: “Entrust funds to us—our controls are rock‑solid.”

Embracing Compliance for Long‑Term Success

Compliance is more than a tick‑box; it’s a strategic pillar of sustainable, ethical business. Treating regulatory duties as integral to corporate culture delivers:

- Resilience to rule changes and geopolitical shifts.

- Reputation gains that translate to pricing power and customer stickiness.

- Process efficiencies that lift the bottom line.

Stakeholders—from EU regulators to global consumers—scrutinise corporate conduct more than ever. Companies that weave compliance into everyday decisions earn lasting trust and create a foundation for principled growth across every market they enter. In short, when done right, compliance is not a burden—it’s an asset that secures the enterprise today and propels it forward tomorrow.

Reduce your

compliance risks