EMIR III Trilogue Agreement Approved

The EMIR clearing review, adopted by the plenary, aims to boost competitiveness against UK CCPs. Despite contentious negotiations, targeted measures are set to improve the framework. Final publication is expected in late Q3 or early Q4 2024.

On February 7, 2024, the European Parliament formally endorsed the trilogue agreement on the EMIR clearing review. Improving the EU central clearing framework's competitiveness is its primary goal, especially in comparison to UK CCPs. The planned active account requirement was watered down despite heated arguments. Before being published in the EU Official Journal, the document will go through a linguistic review and need confirmation from the Parliament and Council. This is anticipated to happen in late Q3 or early Q4 of 2024. The majority of changes will take effect soon after they are published.

Source

[1]

EMIR 3.0: Enhancements and Implications for European Clearing

The European Market Infrastructure Regulation, or EMIR 3.0, is currently undergoing its third amendment. The main goal of this most recent version is to strengthen the European central clearing system, specifically with regard to UK central counterparties (CCPs) after Brexit. After a drawn-out and politically charged debate over where Euro clearing should be located, the European Commission put forth a "active account requirement," which became a central bone of contention during the discussions. In addition, certain steps are included to improve the EMIR architecture as a whole. We highlight ten critical facets of EMIR 3.0 and the corresponding measures in the Capital Markets Union (CMU) Clearing Package as the legislative process draws to a close.

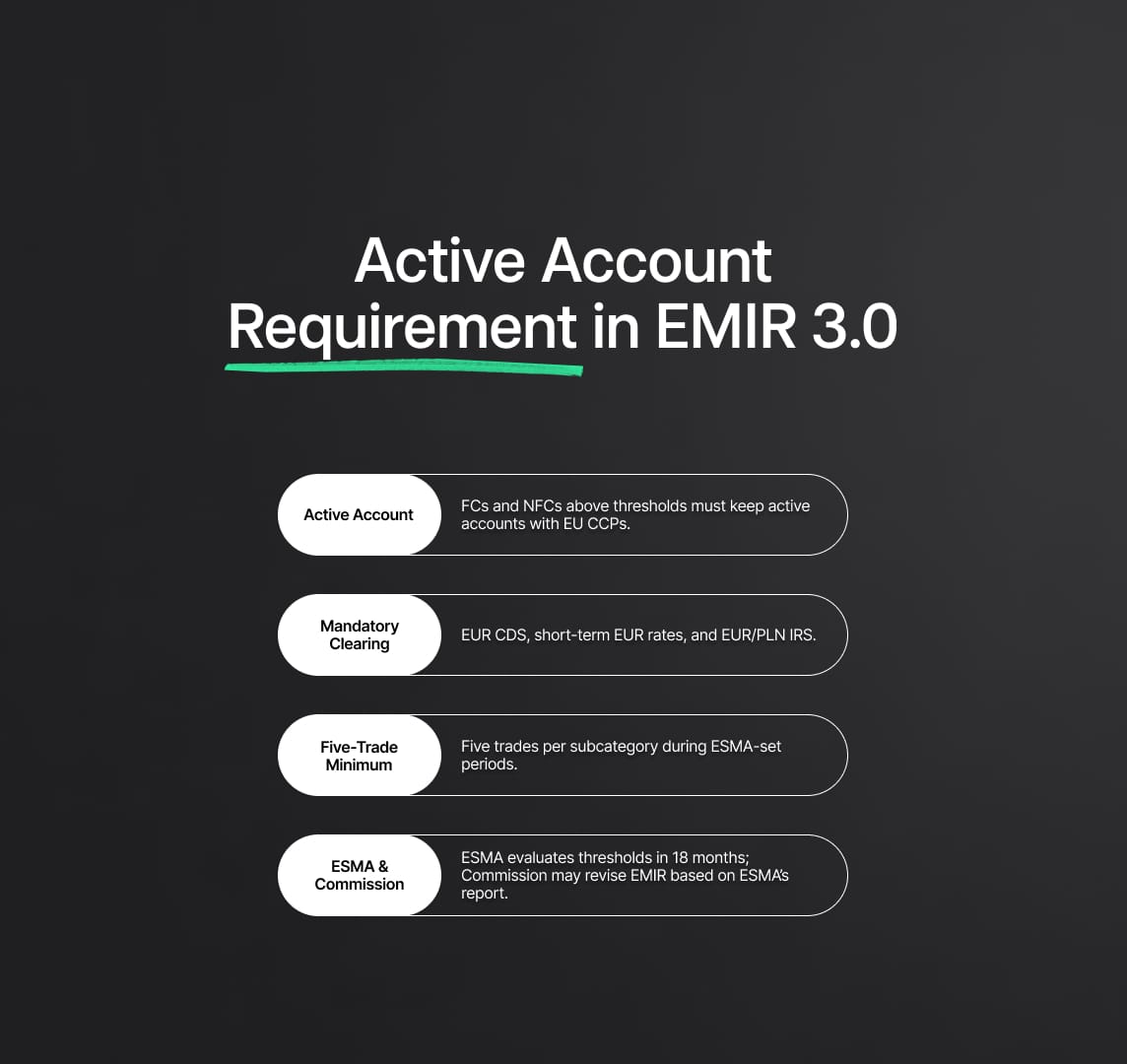

Active Account Requirement in EMIR 3.0

The European Commission adds a contentious requirement for financial and non-financial counterparties (FCs and NFCs) subject to clearing in the planned EMIR 3.0 version. The provision, which sparked discussion during discussions between the European Parliament and the Council of the EU, requires the opening of an active account with an EU central counterparty clearinghouse (CCP) for certain derivative contracts.

Main obligations:

- FCs and NFCs that are required to clear must keep an open account with an EU CCP.

- Credit default swaps in EUR, short-term interest rate derivatives in EUR, and interest rate derivatives in EUR and PLN are among the contracts for which clearing is required.

- As per the compromise, FCs and NFCs that above the clearing threshold for designated financial products are required to have an active account with an EU CCP.

- For a significant number of derivative transactions, the active account needs to be accessible and permanent.

- With certain exceptions, in-scope companies are required to clear a minimum of five trades in each pertinent subcategory for each class of derivative contracts within a predetermined reference period.

- The reference period and the most pertinent subcategories will be determined by ESMA.

- ESMA will evaluate the necessity for further quantitative clearing thresholds after a period of 18 months.

- The Commission will have six months to consider possible legislative changes to EMIR based on the findings of ESMA's report.

EMIR 3.0's Information Provision Obligation for Clearing Services

A significant new requirement brought about by EMIR 3.0 is intended to support clearing operations in the EU. This legislation requires clearing service providers to advise their clients of the possibility of clearing contracts at EU central counterparties (CCPs) as well as approved CCPs in third countries. By promoting increased use of EU clearing services, this transparency effort hopes to strengthen the stability and resilience of the EU financial system. Furthermore, organizations that are based in the EU or under EU consolidated supervision and that conduct clearing operations with approved third-country CCPs are required to disclose the extent of their clearing operations to the competent authority (NCA) of the relevant Member State.

The purpose of this reporting obligation is to give regulators thorough insights into clearing operations so they may manage risk and oversee operations more effectively. Moreover, within a year of the regulation's adoption, EMIR 3.0 gives the European Securities and Markets Authority (ESMA) the authority to create comprehensive technical standards defining reporting requirements. ESMA seeks to enhance investor trust and regulatory compliance throughout the EU financial environment by creating uniformity and transparency in clearing service disclosures through the establishment of standardized reporting frameworks.

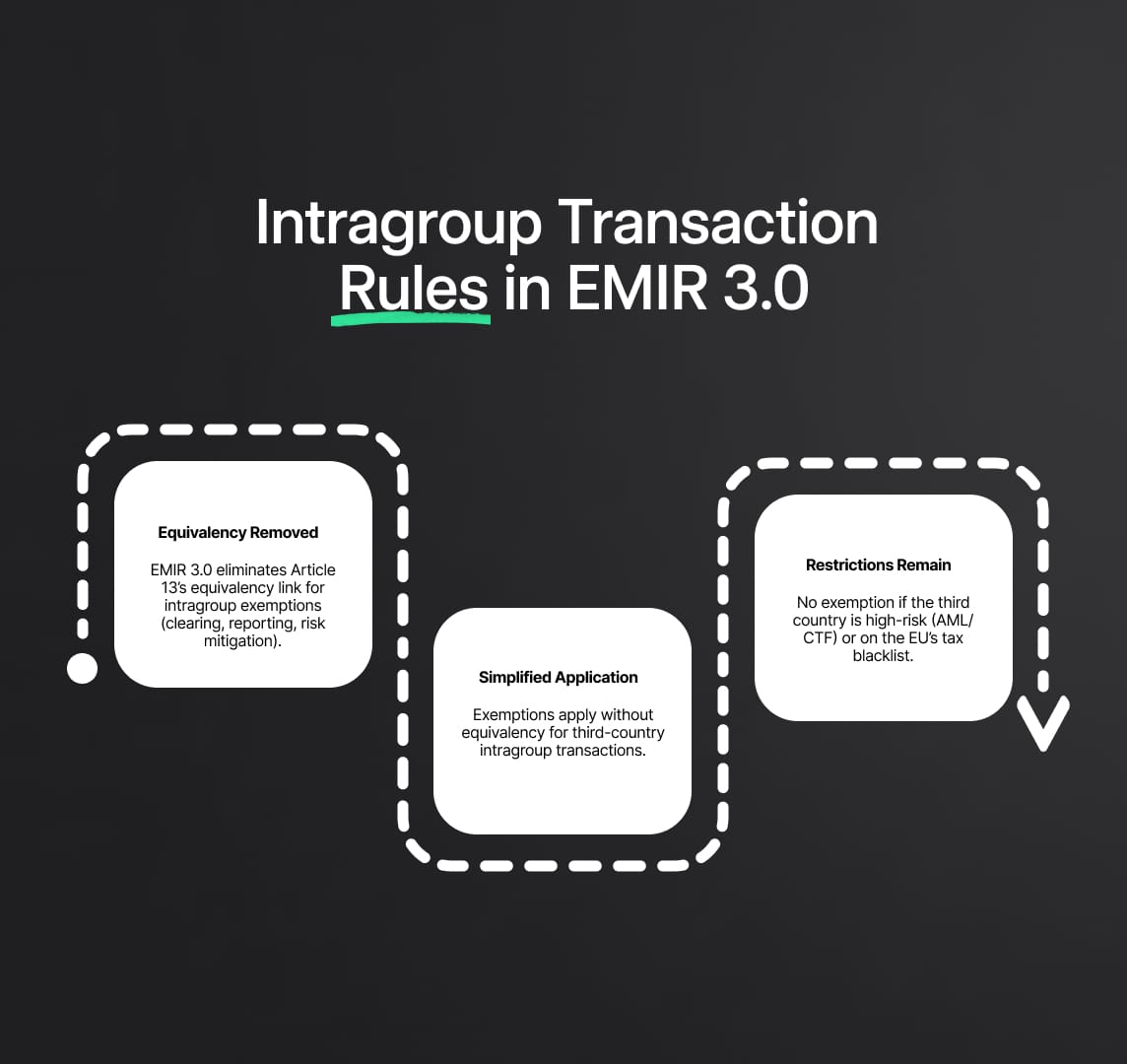

Intragroup Transactions: Key Amendments in EMIR 3.0

To give entities within the same group freedom, EMIR exempts intragroup transactions from both margin requirements and clearing obligations. The goal of the most current EMIR amendment proposal, EMIR 3.0, is to improve the intragroup transaction definition criteria listed in EMIR Article 3. The changes aim to streamline the procedure for approved intragroup transactions by getting rid of some conditions connected to the Commission's equivalency rulings. Now let's examine the primary changes that EMIR 3.0 proposes for intragroup transactions:

- Elimination of Equivalency Requirement: The Article 13 requirements that formerly connected the Commission's equivalency rulings to exemptions for intragroup clearing, reporting, and risk mitigation are to be removed by EMIR 3.0.

- Simplified Application: In third countries where one of the financial or non-financial companies concerned is established, the exemption for intragroup transactions is applicable under the compromise text without requiring an equivalency analysis.

- Exemptions for High-Risk Jurisdictions: Although the equivalency requirement has been eliminated, some restrictions still hold true. If the third nation in question is classified as high-risk for anti-money laundering and counter-terrorist financing, or if it is included on the EU's list of non-cooperative jurisdictions for tax reasons, the intragroup transaction exemption could not be applicable.

The purpose of these revisions is to ensure regulatory compliance and risk management while streamlining and clarifying the intragroup transaction procedure, so enabling multinational firms to operate more smoothly.

Improvements in Clearing Obligation and Reporting Measures under EMIR 3.0

Important changes to the clearing requirement under the European Market Infrastructure Regulation (EMIR) for financial and non-financial counterparties (FCs and NFCs) are introduced in EMIR 3.0. Interestingly, it adds an exemption from the clearing requirement for EU counterparties doing business with third-country exempted pension systems.

The computation of clearing obligation thresholds for FCs is further made simpler by EMIR 3.0, which does not include derivative contracts cleared at EU or approved third-country CCPs. In addition, the need for EU parent undertakings to report on an aggregated basis for intragroup derivatives transactions has been changed. In addition, NFCs that are required to provide collateral for OTC derivative contracts that have not been cleared are given a four-month window for implementation during which they can work out and test arrangements for collateral, which improves operational flexibility and compliance. The purpose of these modifications is to improve risk management, efficiency, and transparency in the derivatives markets under EMIR.

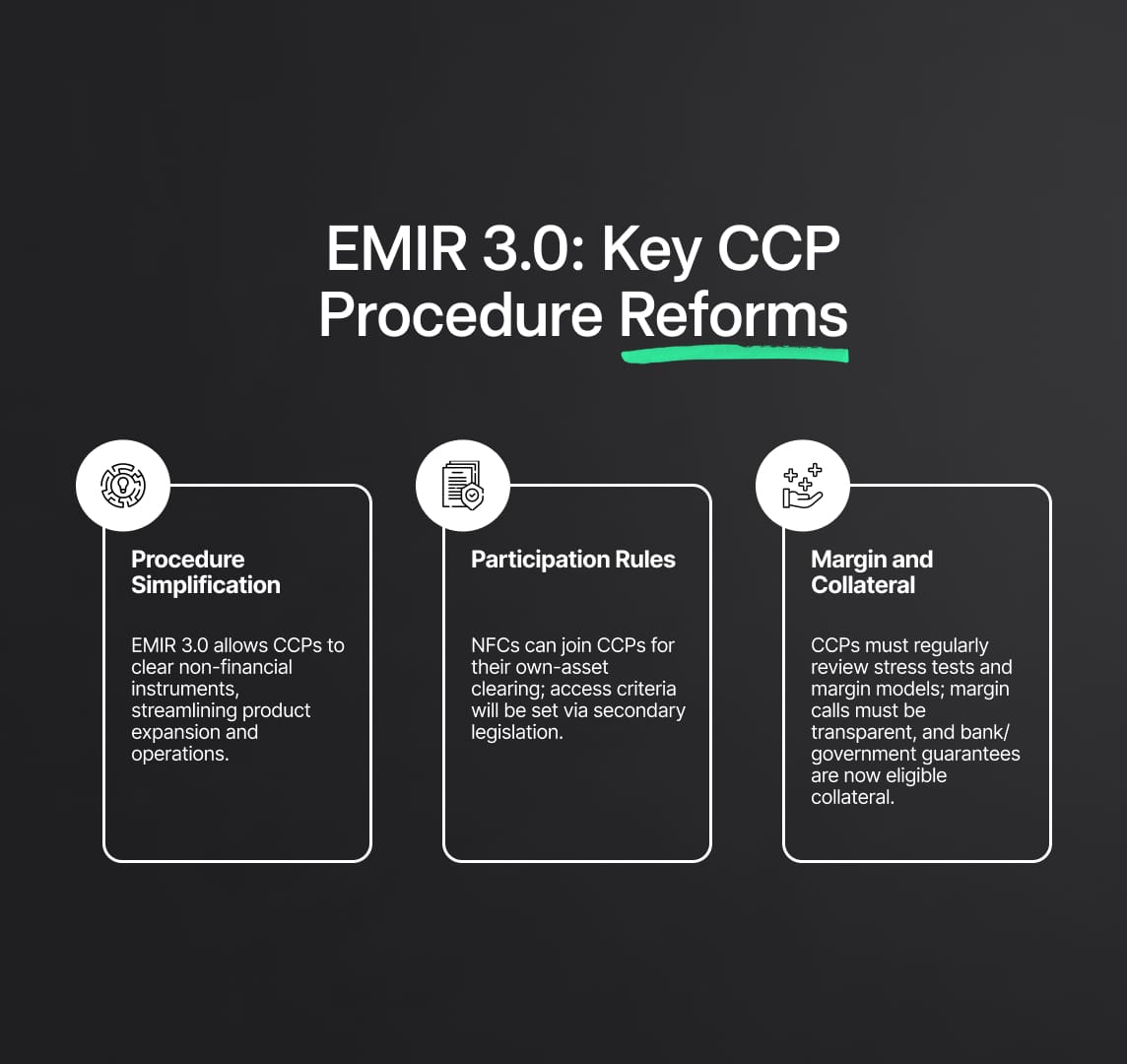

CCP Procedures and Amending Participation Rules according to EMIR 3.0

Significant modifications are made as part of EMIR 3.0 with the goal of expanding CCPs' operations and services while expediting the processes for their authorization and recognition. It also modifies the regulations controlling collateral, margin, and participation requirements for CCPs with the intention of improving risk management and transparency:

- Procedure Simplification:

- Authorized CCPs may now provide clearing services for non-financial instruments in addition to financial ones thanks to EMIR 3.0.

- Modifications expedite and streamline processes for CCPs to increase the range of products they offer, improving operational effectiveness.

- Amending Participation Rules:

- The following is a list of requirements for CCPs onboarding members of non-financial clearing.

- The involvement of NFCs is restricted to maintaining records for their own assets.

- Secondary legislation will contain specific access requirements.

- Enhancing Margin and Collateral Requirements:

- CCPs are required to assess stress test parameters and margin calculation models on a regular basis.

- Clearing members are required to guarantee client margin calls are transparent.

- Bank and governmental guarantees were added to the list of acceptable collateral, in accordance with interim regulations that took effect in November 2022.

EMIR 3.0 Regulatory Framework: Amendments to UCITS, IFD, CRD, and CRR

The UCITS Directive, IFD, and CRD are modified by a directive that comes with EMIR 3.0, eliminating counterparty risk limitations for UCITS' exposure to OTC derivatives. The amendments aim to control the risk of concentration towards CCPs by targeting credit institutions and investment organisations. NCAs will assess if active accounts correspond with EU policy.

The Capital Requirements Regulation has been amended to make intragroup transactions more transparent for credit value adjustments. Furthermore, barriers to transferring exposures—such as worries about the TARGET2 payment system's operation hours—are addressed, and public bodies are urged to clear derivatives at EU CCPs.

Reduce your

compliance risks