SASB Standards: Introduction of IFRS S1 and IFRS S2 Disclosures

Financial world shifts with ISSB IFRS S1 and IFRS S2 Sustainability Disclosure Standards. Harmonizing global approaches, they offer guidance on risks, opportunities, and climate disclosures. Preparation is key for convergence towards high-quality sustainability disclosures.

The Evolution of SASB Standards and the Introduction of IFRS S1 and IFRS S2 Disclosures

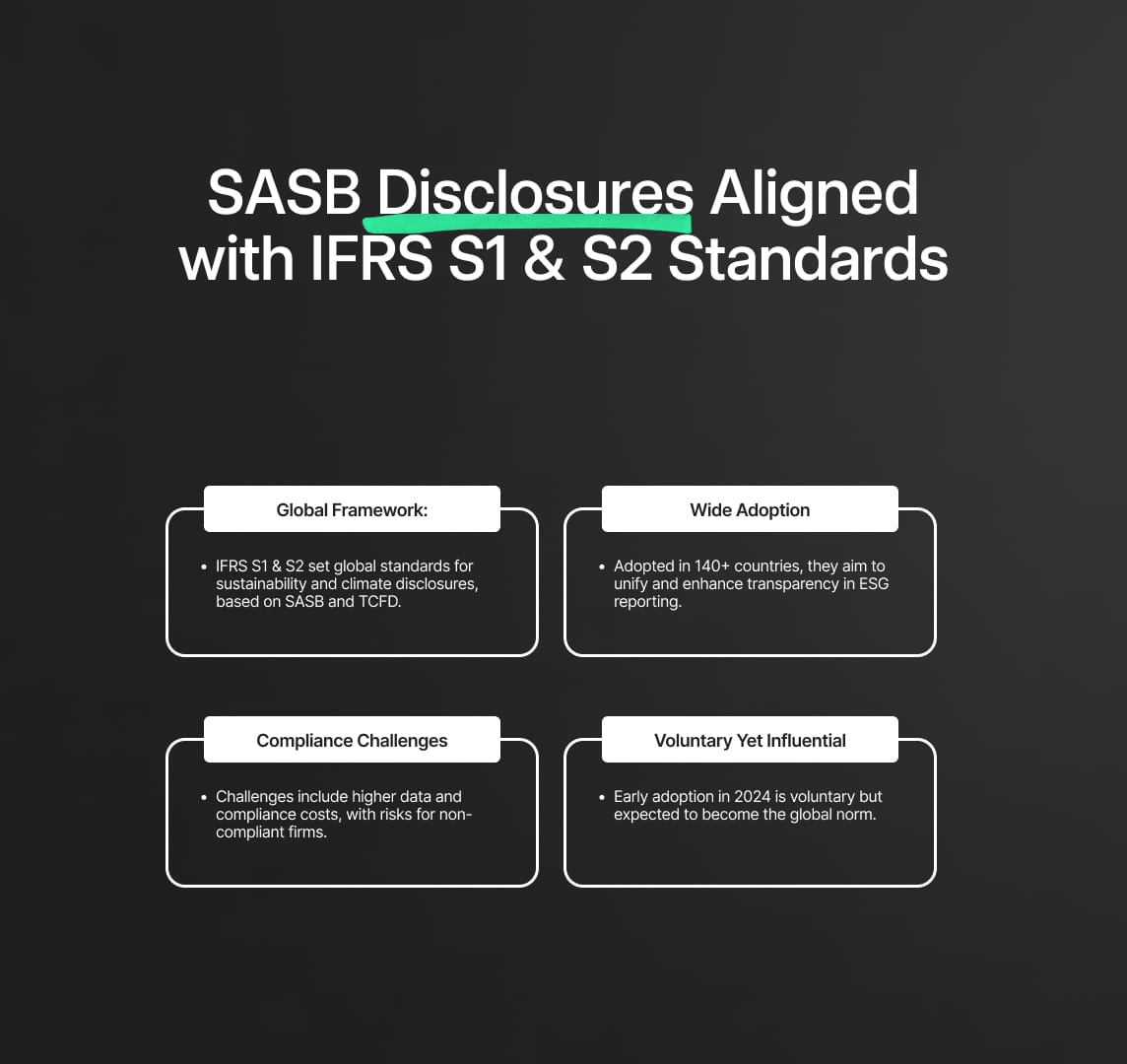

The Sustainability Accounting Standards Board (SASB) Standards have been a major factor in the dramatic evolution of the global landscape for investor-focused sustainability reporting. Built upon the already-existing SASB Standards, Integrated Reporting Framework, and CDSB Framework, the International Sustainability Standards Board (ISSB) just released the first-ever worldwide IFRS Sustainability Disclosure Standards, known as IFRS S1 and IFRS S2 in June 2023. While IFRS S2 focuses on specific climate-related disclosures, IFRS S1 provides disclosure obligations to assist businesses in communicating about their sustainability-related risks and opportunities. The recommendations of the Task Force on Climaterelated Financial Disclosures (TCFD) are embodied in both of these standards. It is believed that the use of these new ISSB Standards depends on the continuous use of SASB Standards. Businesses have the option to voluntarily adopt IFRS S1 and S2 for reporting periods beginning in 2024, which will allow them to develop the capacity to fully comply with the standards.

SASB Sustainability Disclosures: IFRS S1 and IFRS S2 Standards

The introduction of the IFRS S1 and S2 Sustainability Disclosure Standards by the International Sustainability Standards Board (ISSB) has brought about a significant change in the investor-focused sustainability disclosure landscape for the financial industry. Based on the Sustainability Accounting Standards Board (SASB) Standards, this innovative innovation has the potential to completely transform the way financial institutions throughout the world discuss possibilities and risks associated to sustainability.

The widely accepted framework of IFRS S1 and S2 standards unifies the many approaches to sustainability disclosures. This change affects all kinds of financial institutions that operate in countries that use or recognize International Financial Reporting Standards (IFRS)—more than 140 countries in total, including major players like the European Union, Australia, and Canada, as well as many countries in Asia and Africa.

While IFRS S2 focuses on disclosures connected to climate change, IFRS S1 provides guidance for communicating sustainability-related risks and opportunities. These rules, which also have the added benefit of easing reporting requirements for multinational corporations, represent a new era of enhanced transparency and cross-border comparability as they implement the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

The adoption of these new sustainability standards reflects a more comprehensive viewpoint that integrates problems that are unique to entities as well as industries. Investors are promised a more thorough and useful understanding of businesses' sustainability performance with this more expansive approach.

But there are difficulties with this change. Businesses may have to pay more for compliance because of the requirements for gathering and confirming new kinds of data. The increased emphasis on climate-related concerns may lead to a reallocation of funds to sustainable projects. Furthermore, when sustainability policies come under closer scrutiny, businesses that don't meet these criteria may run the danger of losing their brand. Reluctant adopters may also have trouble luring investments with an emphasis on environment, social justice, and governance (ESG).

While companies may initially disclose at different levels due to the voluntary nature of IFRS S1 and S2 implementation, it is anticipated that familiarity with the ISSB standards will eventually lead to a convergence towards high-quality, consistent sustainability disclosures.

Institutions must be well-prepared to handle this new environment. Smooth sailing depends on a number of factors, including the incorporation of SASB standards into the reporting systems now in use, enhanced data management capabilities, the creation of cross-functional teams to handle a variety of disclosure requirements, and proactive stakeholder communication with sustainability goals. Institutions may choose to use IFRS S1 and S2 starting with reporting months in 2024.

The continual improvement of the SASB Standards is essential in this changing environment, particularly with regard to expanding their global application. It serves as the cornerstone for the effective application of IFRS S1 and S2, influencing sustainability disclosures going forward and opening the door for a more open, environmentally friendly financial industry.

Reduce your

compliance risks