Solvency II Directive: Sustainability Risk Plans

The Solvency II Directive's 2022 update integrates sustainability risks, aligning with the EU Green Deal. Enhancements include mandatory sustainability risk plans and the proportionality principle to ease the burden on smaller firms.

The Solvency II Directive has long been the bedrock of insurance regulation within the European Union (EU), providing a comprehensive framework to ensure the financial stability and prudent management of insurance firms. Initially implemented on January 1, 2016, Solvency II aims to harmonise insurance regulation across EU member states, focusing on three main pillars:

Source

[1]

[2]

Pillar 1: Quantitative Requirements

This pillar ensures that insurance firms hold sufficient capital reserves to cover their risk exposure. The capital requirements are calculated using a risk-based approach, which involves:

- Solvency Capital Requirement (SCR): This represents the amount of capital needed to ensure that the insurer can meet its obligations over the next 12 months with a 99.5% probability. The SCR is calculated using either a standard formula provided by the regulator or an internal model developed by the insurer, subject to regulatory approval.

- Minimum Capital Requirement (MCR): This is the minimum level of capital below which policyholders would be exposed to an unacceptable level of risk. The MCR is a simpler calculation compared to the SCR and serves as a threshold to trigger regulatory intervention if breached.

Pillar 2: Governance and Risk Management

Pillar 2 mandates robust governance structures and effective risk management practices within insurance firms. This includes:

- Own Risk and Solvency Assessment (ORSA): Insurers must conduct a comprehensive assessment of their risk profile, capital needs, and solvency position regularly. The ORSA process ensures that firms consider all material risks, including emerging risks and those not captured fully by Pillar 1 capital requirements.

- Governance Requirements: Firms must establish clear governance frameworks, including the roles and responsibilities of the board and senior management. Key functions such as risk management, compliance, actuarial, and internal audit must be effectively segregated and integrated into the overall governance structure.

- Supervisory Review Process: Regulators conduct regular reviews and evaluations of insurers' risk management systems, governance structures, and overall solvency. This process ensures that firms maintain adequate controls and risk mitigation strategies.

Pillar 3: Reporting and Disclosure

Pillar 3 requires transparent disclosure of financial and risk information to regulators and the public. The key components include:

- Solvency and Financial Condition Report (SFCR): This public report provides comprehensive information on the insurer’s business and performance, system of governance, risk profile, valuation for solvency purposes, and capital management. It aims to enhance market discipline by providing stakeholders with relevant and reliable information.

- Regular Supervisory Report (RSR): This confidential report is submitted to regulators and includes more detailed information than the SFCR. The RSR facilitates ongoing supervisory dialogue between insurers and regulators.

Solvency II Directive: Evolution Towards Sustainability

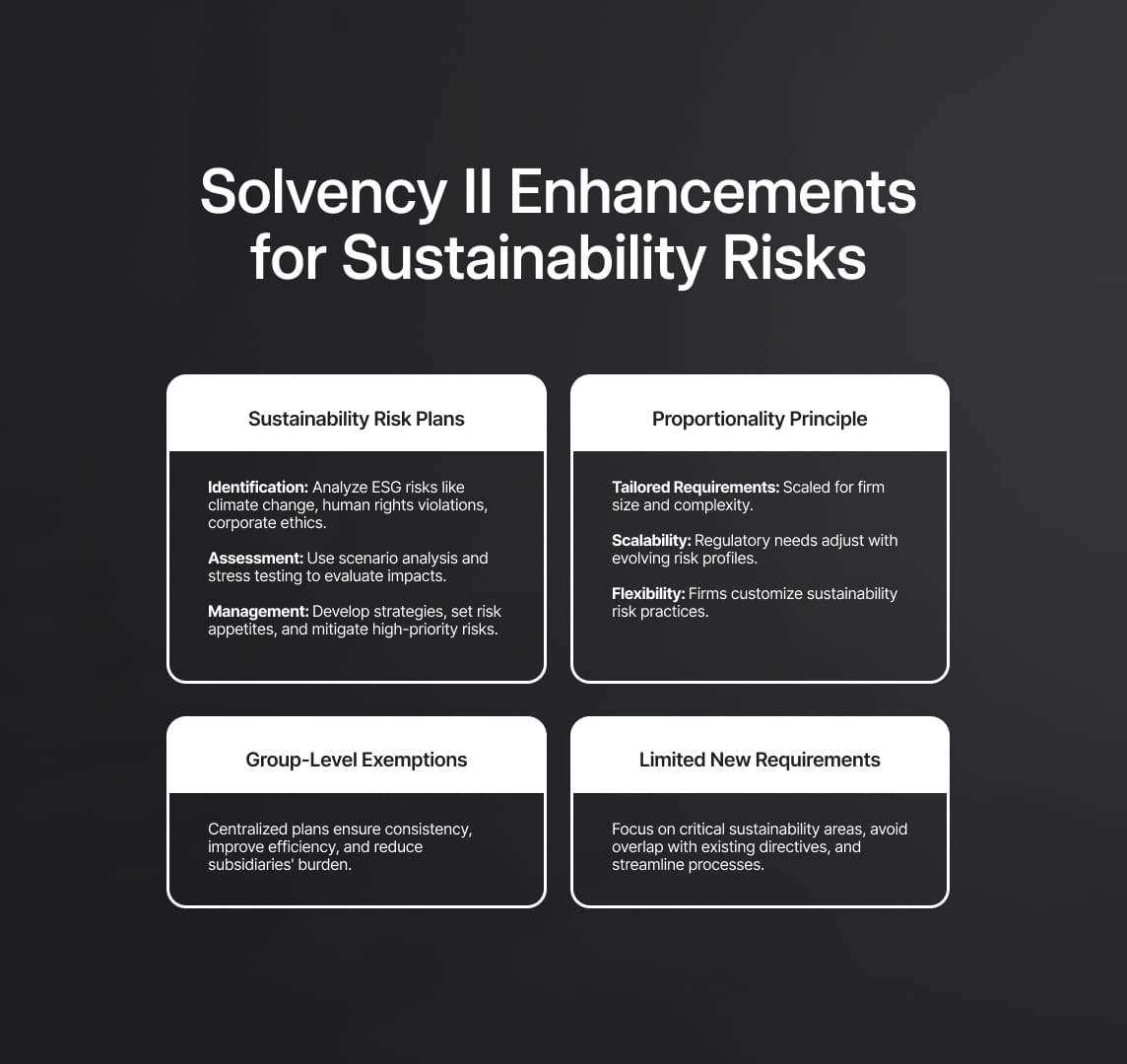

As the EU progresses towards a more sustainable society, the Solvency II Directive has evolved to incorporate sustainability risk plans, aligning with the EU Green Deal targets. These enhancements aim to address environmental, social, and governance (ESG) factors more comprehensively. The integration of sustainability risks involves:

- Sustainability Risk Plans: Detailed in Article 44 of the draft amending Directive, these plans are now a requirement under Solvency II. They focus on identifying, assessing, and managing financial risks arising from sustainability factors, ensuring a comprehensive risk management approach.

- Proportionality Principle: Regulatory requirements are scaled according to the size, complexity, and risk profile of the insurance firm, ensuring that smaller entities are not disproportionately burdened.

- Group-Level Exemptions: The directive allows for group-level plans to cover subsidiaries, reducing the regulatory load on smaller entities within large insurance groups.

- Limited New Requirements: The Level 2 texts stemming from the Level 1 Solvency Review emphasize that any new requirements should be strictly limited to those essential for managing sustainability risks and should avoid overlapping with other legislation.

Enhancements in Solvency II for Sustainability Risks

In August 2022, the Solvency II Directive underwent significant enhancements to integrate sustainability risks more comprehensively. These changes are a response to the growing importance of environmental, social, and governance (ESG) factors in the financial sector, and they aim to ensure that insurers can effectively manage these risks. The key aspects of these enhancements are as follows:

Sustainability Risk Plans

Detailed in Article 44 of the draft amending Directive, sustainability risk plans have become a crucial requirement under Solvency II. These plans focus on the identification, assessment, and management of financial risks arising from sustainability factors. The core components of sustainability risk plans include:

- Risk Identification: Insurers must identify all potential ESG-related risks that could impact their financial stability. This involves analyzing the full spectrum of environmental risks (such as climate change and natural disasters), social risks (such as human rights violations and labor practices), and governance risks (such as corporate ethics and regulatory compliance).

- Risk Assessment: Once identified, these risks need to be assessed in terms of their potential impact on the insurer's financial health. This includes scenario analysis and stress testing to evaluate how various ESG risks could affect the firm under different conditions.

- Risk Management: Effective strategies must be developed to manage and mitigate identified ESG risks. This includes integrating ESG considerations into the overall risk management framework, setting risk appetite levels for sustainability risks, and implementing specific measures to address high-priority risks.

Proportionality Principle

A cornerstone of the Solvency II enhancements is the proportionality principle. This principle ensures that regulatory requirements are scaled according to the size, complexity, and risk profile of each insurance firm. The main elements of this principle include:

- Tailored Requirements: Smaller firms or those with less complex operations are subject to less stringent requirements compared to larger, more complex entities. This approach prevents smaller firms from being disproportionately burdened by regulatory obligations.

- Scalability: The regulatory framework is designed to be scalable, allowing for adjustments based on the evolving risk profile of the firm. This ensures that as firms grow or their risk profiles change, the regulatory requirements adapt accordingly.

- Flexibility: Insurers are given flexibility in how they implement sustainability risk management practices, allowing them to develop tailored approaches that align with their specific business models and operational contexts.

Group-Level Exemptions

The directive provides for group-level exemptions, allowing group-level sustainability risk plans to cover all subsidiaries. This approach offers several benefits:

- Consistency: Group-level plans ensure a consistent approach to managing sustainability risks across all entities within the group. This helps in maintaining uniform standards and practices.

- Efficiency: By centralizing the sustainability risk management process, groups can reduce redundancy and streamline efforts, thereby enhancing operational efficiency.

- Reduced Burden: Subsidiaries are relieved from the need to develop individual sustainability risk plans, significantly reducing their regulatory burden and allowing them to focus on core business activities.

Limited New Requirements

To avoid regulatory overload, the Solvency II enhancements emphasize that any new requirements should be strictly limited to those essential for managing sustainability risks. The Level 2 texts stemming from the Level 1 Solvency Review underline the importance of this limitation to prevent unnecessary duplication with existing legislation. Key points include:

- Essential Focus: New requirements are focused only on critical areas necessary for the effective management of sustainability risks, ensuring that insurers can concentrate their efforts on the most impactful aspects.

- Avoiding Overlap: Care is taken to ensure that the new sustainability requirements do not overlap with other existing regulations, such as those under the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). This helps to avoid redundancy and streamline compliance efforts.

- Streamlined Processes: By limiting new requirements, the directive aims to streamline regulatory processes, making it easier for insurers to integrate sustainability risk management into their existing frameworks without excessive additional burdens.

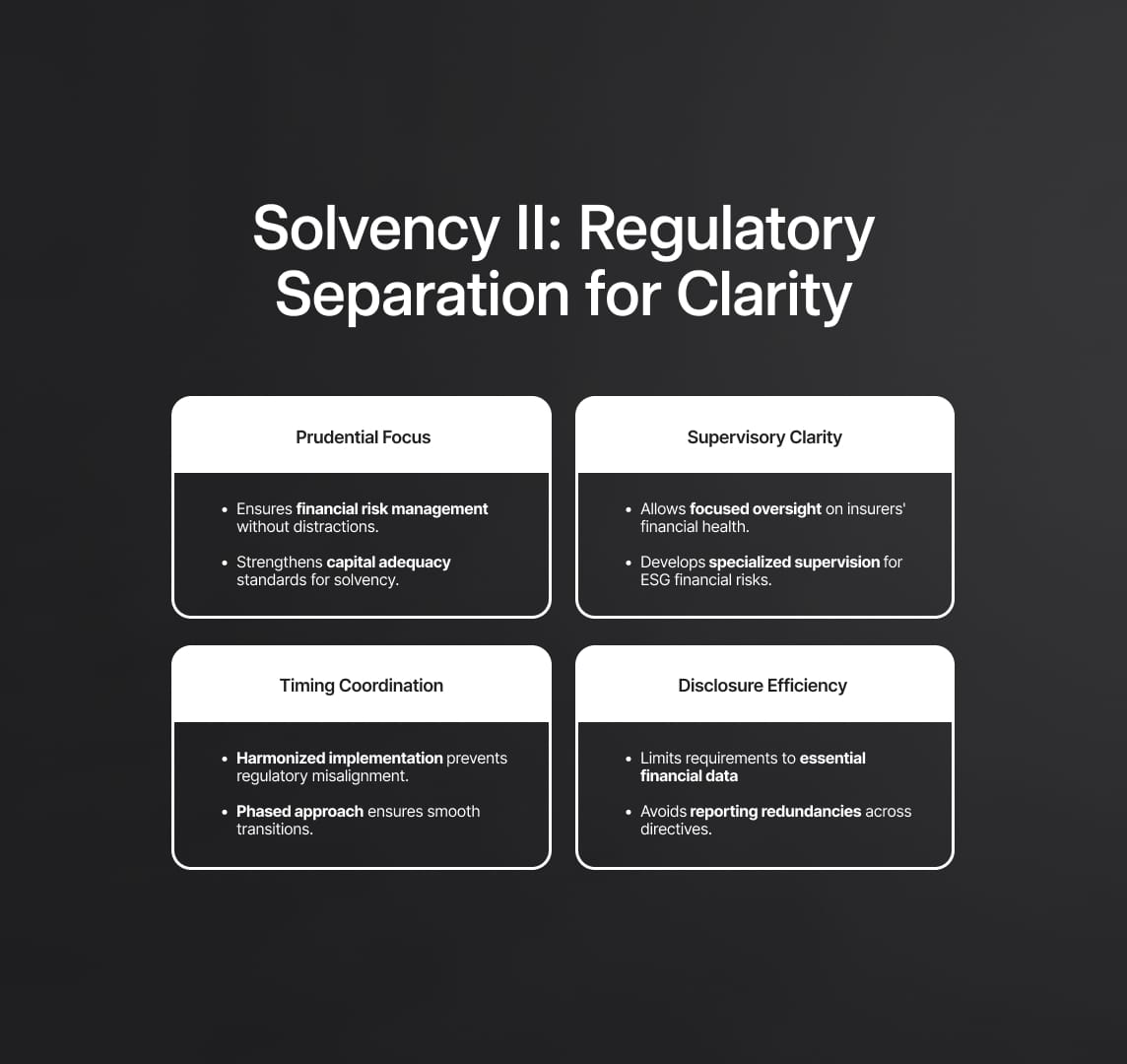

Solvency II: Regulatory Separation and Consistency

To ensure that the Solvency II Directive maintains its focus on prudential aspects, a clear regulatory separation between sustainability risk plans and net-zero transition plans is essential. This separation is strategically important for several reasons:

Prudential Focus

Maintaining a clear distinction allows Solvency II requirements to remain centered on the financial risk aspects of sustainability. This focus ensures that:

- Financial Risk Management: Insurers can concentrate on identifying, assessing, and mitigating financial risks arising from environmental, social, and governance (ESG) factors without the distraction of broader sustainability goals that might dilute the financial risk focus.

- Capital Adequacy: The separation helps in ensuring that capital adequacy standards, critical for solvency, are met by considering the specific financial implications of sustainability risks on an insurer's balance sheet and solvency capital requirements.

Supervisory Clarity

By separating the regulatory requirements, national supervisory authorities (NSAs) can focus their supervisory efforts more effectively:

- Focused Oversight: NSAs can concentrate on the prudential aspects of sustainability risks, ensuring robust oversight of insurers' financial health without the added complexity of supervising broader net-zero transition plans.

- Specialized Supervision: Supervisors can develop specialized expertise in financial risk assessment related to ESG factors, enhancing the quality and precision of regulatory oversight.

Timing Coordination

Coordination of implementation timelines is crucial to avoid regulatory confusion and ensure smooth transitions:

- Harmonized Implementation: Differing timelines for the implementation of Solvency II requirements and other directives like the Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) can create timing issues. Regulatory separation helps in aligning these timelines effectively.

- Phased Approach: A phased implementation approach allows insurers to adapt progressively to new requirements, mitigating the risk of operational disruptions.

Disclosure Efficiency

Efficient disclosure practices are essential to avoid redundancy and administrative burdens:

- Essential Information: Limiting disclosure requirements for sustainability risk plans to essential information ensures that insurers are not overburdened with reporting obligations. This focus on key disclosures enhances transparency while maintaining efficiency.

- Avoiding Redundancy: By avoiding overlap with other reporting obligations under directives like CSRD and CSDDD, the Solvency II Directive ensures that disclosure practices are streamlined and consistent, reducing the risk of duplication and confusion.

Relevant Regulations and Their Interplay

Several other directives interact with the Solvency II Directive, creating a cohesive regulatory environment for sustainability:

Corporate Sustainability Reporting Directive (CSRD)

Effective from January 1, 2024, with a three-year compliance period, the CSRD mandates comprehensive sustainability reporting from companies. Key aspects include:

- Comprehensive Reporting: The CSRD requires detailed disclosures on ESG factors, providing stakeholders with consistent and comparable information on companies' sustainability practices.

- Biodiversity Disclosures: Companies have the option to include biodiversity elements as part of their transition plans, enhancing the scope of sustainability reporting.

Corporate Sustainability Due Diligence Directive (CSDDD)

The CSDDD requires companies to conduct due diligence on their supply chains to ensure that their operations do not negatively impact the environment or human rights:

- Supply Chain Accountability: Companies must assess and manage sustainability risks throughout their supply chains, ensuring responsible business practices.

- Human Rights and Environmental Impact: The directive emphasizes the importance of mitigating adverse impacts on human rights and the environment, aligning business operations with broader societal goals.

Net-Zero Transition Plans

Required under both the CSRD and CSDDD, net-zero transition plans are crucial for aligning companies' business models and strategies with the goal of limiting global warming to 1.5°C in line with the Paris Agreement:

- Strategic Alignment: These plans ensure that companies' long-term strategies are compatible with the transition to a sustainable economy.

- Emission Reduction Targets: Companies must set specific emission reduction targets, integrating climate goals into their core business strategies.

Implementation and Sequencing of the Solvency II Directive

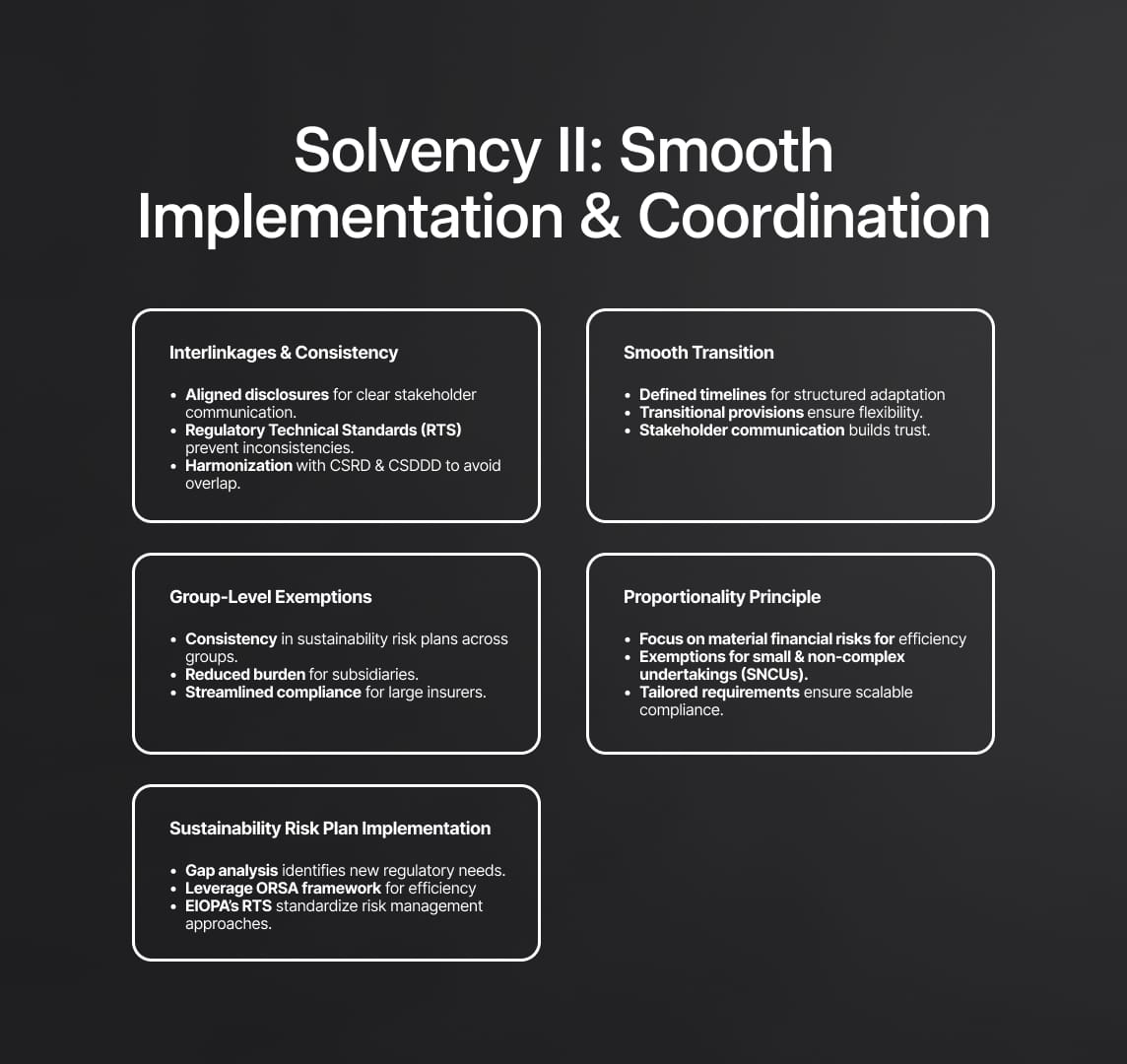

Ensuring a smooth transition period is critical to minimising disruptions to insurers' operations amid simultaneous legislative implementations. The integration of sustainability risk plans into the Solvency II Directive requires meticulous planning and coordination with other related directives to maintain operational continuity and regulatory compliance.

Interlinkages and Consistency

The successful integration of sustainability risk plans into the Solvency II Directive hinges on recognizing and managing the significant interlinkages between these plans and net-zero transition plans. Key considerations include:

- Consistency in Disclosures: Both sustainability risk plans and net-zero transition plans require consistent disclosures regarding the business model and strategy. This consistency ensures that stakeholders receive clear, cohesive information, facilitating better decision-making and enhancing transparency.

- Regulatory Technical Standards (RTS): Given that the Corporate Sustainability Due Diligence Directive (CSDDD) is likely to be applied later than Solvency II, the Regulatory Technical Standards (RTS) prepared by the European Insurance and Occupational Pensions Authority (EIOPA) must aim to avoid inconsistencies. This involves aligning timelines and requirements to ensure that insurers are not faced with conflicting or redundant obligations.

- Harmonization Efforts: Efforts must be made to harmonize the requirements of Solvency II with those of CSRD and CSDDD, reducing the risk of regulatory overlap and ensuring a coherent approach to sustainability risk management across different regulatory frameworks.

Smooth Transition

A phased implementation approach is vital for ensuring a smooth transition, allowing insurers to adapt gradually to new requirements without significant operational disruptions. The approach involves:

- Defined Timelines: Clear and well-defined timelines for the implementation of sustainability risk plans help insurers plan and allocate resources effectively. This phased approach ensures that firms can progressively integrate new requirements into their existing frameworks.

- Transitional Provisions: Transitional provisions provide insurers with the necessary flexibility to adapt to new requirements over time. These provisions may include temporary exemptions, phased-in compliance deadlines, and guidance on the gradual adoption of new practices.

- Stakeholder Communication: Continuous communication with stakeholders, including regulators, policyholders, and investors, is essential during the transition period. Keeping stakeholders informed about the implementation progress and any potential impacts ensures transparency and builds trust.

Group-Level Exemptions

The Solvency II Directive foresees exemptions from individual plans for subsidiaries covered by a group sustainability risk plan (Directive Article 44 2e). This provision is crucial for several reasons:

- Consistency Within Groups: Group-level sustainability risk plans ensure a consistent approach to managing sustainability risks across all entities within an insurance group. This consistency enhances the overall strategic coherence and operational efficiency of the group.

- Reduced Operational Burden: By allowing subsidiaries to be covered by a group-level plan, the directive reduces the operational burden on individual entities. This approach prevents duplication of efforts and allows subsidiaries to focus on their core activities.

- Streamlined Compliance: Group-level exemptions simplify compliance processes, making it easier for large insurance groups to implement sustainability risk management practices across their operations.

Proportionality Principle

The proportionality principle is a fundamental aspect of the Solvency II Directive, ensuring that regulatory requirements are appropriately scaled to the nature, scale, and complexity of an insurer's business model. Key elements include:

- Material Financial Risks: The directive specifies that the targets, processes, and actions in sustainability risk plans should be restricted to material financial risks. This focus ensures that insurers concentrate their efforts on significant threats to financial stability, enhancing the effectiveness of risk management practices.

- Small and Non-Complex Undertakings (SNCUs): While SNCUs are not automatically exempted from sustainability risk plan requirements, there is a strong case for their exemption. Aligning with the exemptions provided for climate change scenario analysis, this approach balances the need for regulatory oversight with the practical capabilities of smaller entities.

- Tailored Requirements: Regulatory requirements are tailored to the size, complexity, and risk profile of each insurance firm. This tailored approach prevents smaller or less complex firms from being disproportionately burdened by regulatory obligations, ensuring that compliance efforts are proportionate and manageable.

Content and Implementation of Sustainability Risk Plans

Sustainability risk plans are incorporated into the risk management requirements of Article 44, leveraging existing work conducted within the Own Risk and Solvency Assessment (ORSA) context. This approach ensures company ownership and responsibility for analysis and conclusions. Key steps include:

- Gap Analysis: Conducting a gap analysis is a logical starting point for developing sustainability risk plans. This analysis identifies any additional requirements by comparing current practices with new regulatory expectations. For climate change risks, the gap analysis can be straightforward, given the similarities to ORSA's climate change scenario analysis.

- Leverage Existing Work: By leveraging work already conducted within the ORSA framework, insurers can build on existing risk management practices. This approach enhances efficiency and ensures that sustainability risk plans are grounded in established methodologies and analytical frameworks.

- EIOPA's Role: EIOPA has the mandate to draft Regulatory Technical Standards (RTS) on various aspects of sustainability risk management. These standards provide a level of standardization while allowing insurers the flexibility to fulfill requirements in ways that align with their specific business models and operational contexts.

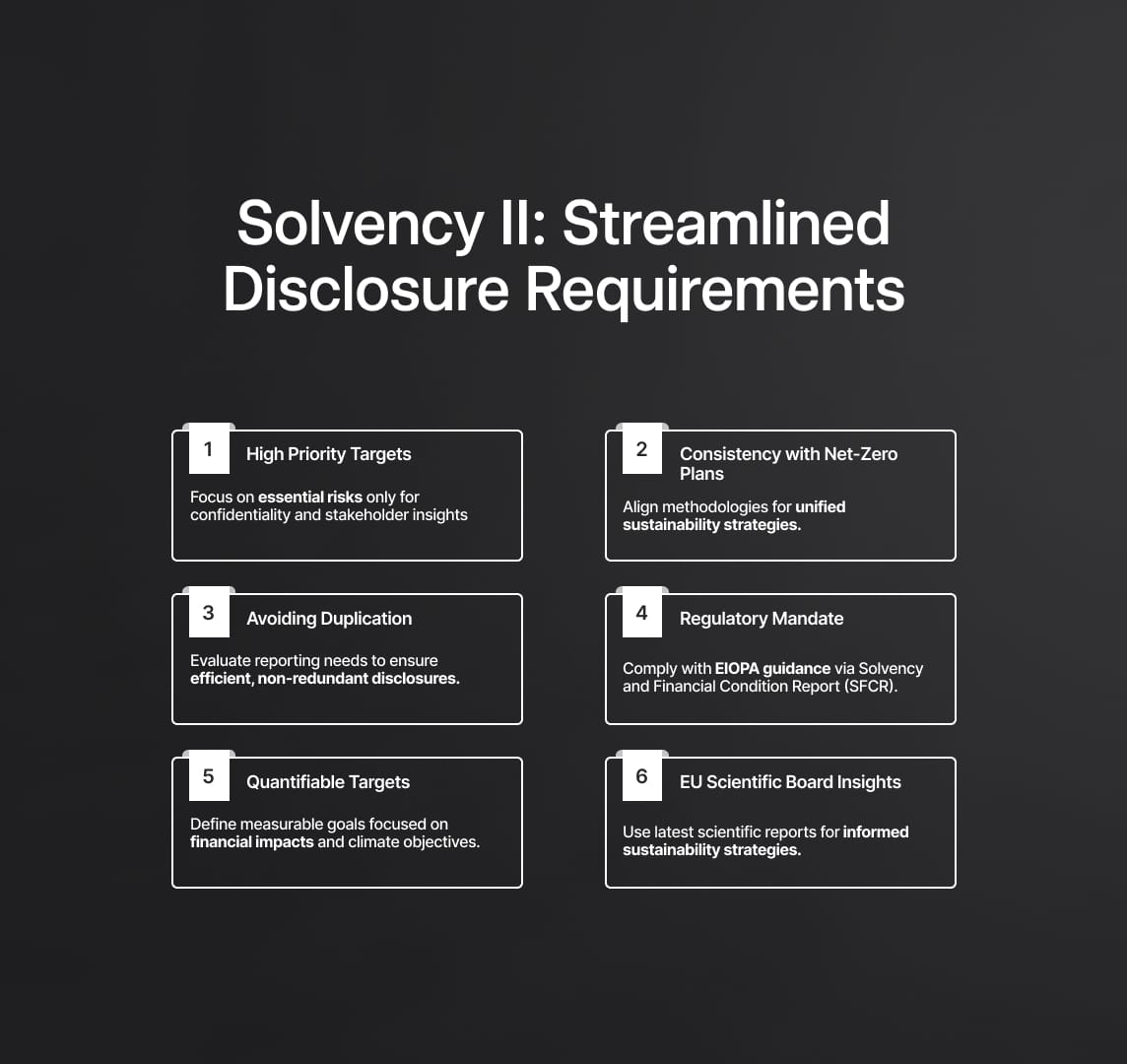

Disclosure Requirements in Solvency II

Disclosure requirements under the Solvency II Directive are designed to ensure transparency while avoiding unnecessary duplication and complexity. These requirements are critical for maintaining stakeholder trust and meeting regulatory obligations effectively. The key components of the disclosure requirements include:

High Priority Targets

Insurers must disclose only the highest priority targets within their sustainability risk plans. This selective disclosure serves multiple purposes:

- Confidentiality: By focusing on high-priority targets, insurers can protect sensitive strategic information that could be detrimental if disclosed publicly.

- Stakeholder Insights: Providing stakeholders with essential insights into the most significant sustainability risks and mitigation strategies ensures that they are well-informed about the insurer’s risk management efforts.

Consistency with Net-Zero Transition Plans

Ensuring consistency between the methodologies and assumptions underpinning the targets of net-zero transition plans and sustainability risk plans is crucial. This consistency involves:

- Unified Approach: A coherent approach to managing sustainability risks across all business aspects ensures that the firm’s overall strategy aligns with its sustainability commitments.

- Harmonized Methodologies: Utilizing consistent methodologies across both types of plans avoids discrepancies and enhances the reliability of disclosed information.

Avoiding Duplication

To prevent redundancy, the targets should consider all current and forthcoming required sustainability information. This approach includes:

- Comprehensive Assessment: Evaluating existing and anticipated reporting requirements ensures that disclosures are not repeated unnecessarily.

- Stakeholder Usefulness: Tailoring disclosures to provide useful and relevant information to stakeholders, including policyholders and beneficiaries, enhances the value of the reported data.

Regulatory Mandate

Article 51 1c (cc) of the Solvency II Directive mandates the disclosure of relevant sustainability risk plan items in the Solvency and Financial Condition Report (SFCR). Specific elements include:

- EIOPA Guidance: The European Insurance and Occupational Pensions Authority (EIOPA) specifies the items that need to be disclosed, ensuring consistency and compliance with regulatory standards.

- Market Professional Focus: These elements are primarily disclosed to other market professionals, ensuring that the information is used by those with the requisite expertise to interpret it correctly.

Setting and Disclosing Targets

Insurance companies are required to set and disclose quantifiable targets as part of their sustainability risk plans. These targets must be carefully defined and aligned with broader sustainability commitments. Key aspects include:

Consistency with Net-Zero Plans

The methodologies and assumptions for sustainability risk plans should be consistent with those used in net-zero transition plans. This ensures:

- Integrated Risk Management: A unified approach to managing sustainability risks and meeting climate commitments, enhancing the effectiveness of risk mitigation strategies.

- Alignment with Climate Goals: Consistency in methodologies ensures that both plans contribute towards achieving the firm’s long-term climate objectives.

Financial Impact Focus

Sustainability risk plans should concentrate on the financial impacts of sustainability factors on the insurer. This involves:

- Risk to Financial Health: Rather than merely reporting greenhouse gas (GHG) emissions, the focus should be on how these emissions and other sustainability factors impact the insurer's financial stability and performance.

- Strategic Adaptation: Developing strategies to adapt to these impacts, ensuring that the insurer remains resilient in the face of sustainability-related financial risks.

EU Scientific Advisory Board Guidance

Targets should consider the latest reports and measures prescribed by the EU Scientific Advisory Board on Climate Change. This ensures:

- Alignment with EU Climate Targets: Incorporating the latest scientific guidance helps insurers align their targets with the EU’s climate goals, contributing to broader sustainability efforts.

- Informed Decision-Making: Utilizing up-to-date scientific data enhances the robustness and relevance of the targets set within sustainability risk plans.

Potential Targets

Insurance companies should define specific, actionable targets within their sustainability risk plans. Potential targets include:

- Climate Change-Related Risks: Detailed exposure to climate change-related risks by main perils and zones, with a plan for managing these exposures. This includes assessing the risk of natural disasters, extreme weather events, and other climate-related hazards.

- Prevention Index: A prevention index based on internal plans to mitigate targeted risks, such as annual expenses on flood or subsidence prevention. This index could track investments in risk prevention measures and their effectiveness in reducing potential losses.

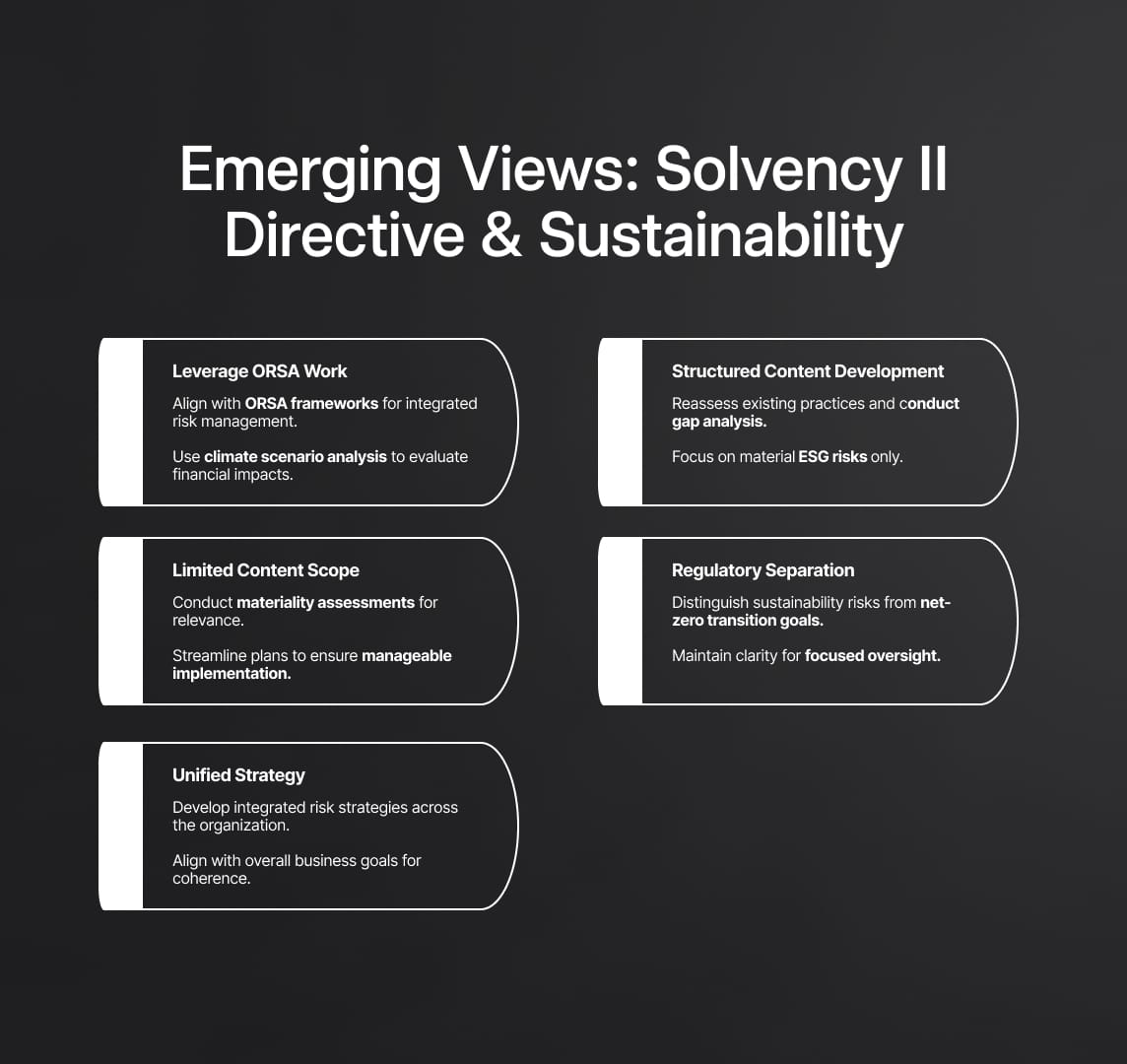

Emerging Industry Views on the Solvency II Directive

Insurance Europe, representing the insurance industry, provides a clear perspective on the implementation of sustainability risk plans under the Solvency II Directive. These insights emphasize the importance of leveraging existing frameworks, adopting a structured approach to content development, and maintaining a focused scope to manage sustainability risks effectively.

Leverage ORSA Work

The integration of sustainability risk plans should be built upon the foundation established by the Own Risk and Solvency Assessment (ORSA). This approach ensures consistency and leverages existing analytical frameworks, particularly the climate change scenario analysis. Key points include:

- Consistency with ORSA: By aligning sustainability risk plans with ORSA, insurers can ensure that their risk management processes are comprehensive and integrated. This alignment avoids redundancy and enhances the robustness of risk assessments.

- Climate Change Scenario Analysis: Utilizing the climate change scenario analysis from ORSA helps insurers to systematically evaluate the financial impacts of climate-related risks under various scenarios. This approach provides a solid analytical basis for developing effective sustainability risk management strategies.

Step-by-Step Content Development

Developing the content of sustainability risk plans requires a structured, step-by-step approach. This process involves reassessing existing requirements, conducting a gap analysis, and focusing on material ESG factors. Detailed steps include:

- Reassessing Existing Requirements: Insurers should start by reviewing current regulatory and internal requirements to identify any areas that already address sustainability risks. This reassessment helps in understanding the existing baseline and avoiding duplication of efforts.

- Conducting a Gap Analysis: A gap analysis identifies additional requirements that need to be incorporated into sustainability risk plans. This involves comparing current practices with new regulatory expectations and pinpointing areas that require further development.

- Focusing on Material ESG Factors: The content of sustainability risk plans should be limited to ESG factors and risks that are deemed material by the undertaking. This focus ensures that the plans remain manageable and relevant to the insurer’s specific risk profile.

Limited Content Scope

The scope of sustainability risk plans should be strictly limited to material ESG factors and risks. This approach ensures that the plans are focused and manageable, avoiding unnecessary complexity. Key considerations include:

- Materiality Assessment: Conducting a thorough materiality assessment helps insurers to identify which ESG factors are most relevant to their operations and risk profile. This ensures that the sustainability risk plans are targeted and effective.

- Manageable Implementation: Limiting the scope of the plans to material factors helps in managing the implementation process more efficiently, reducing the operational burden on insurers.

Clear Regulatory Separation

Ensuring a clear regulatory separation between sustainability risk plans and net-zero transition plans is crucial to avoid duplicating requirements. This separation provides several benefits:

- Distinct Focus Areas: Sustainability risk plans focus on financial risk management, while net-zero transition plans concentrate on achieving specific environmental goals such as carbon neutrality. Clear separation allows insurers to address each area comprehensively without overlap.

- Regulatory Clarity: A clear distinction helps regulatory authorities to provide focused oversight and guidance, enhancing the effectiveness of supervision.

Single Strategy

A unified strategy should underlie the requirements for sustainability risk plans. This approach allows for consistent and coherent risk management across the organization. Key elements include:

- Integrated Risk Management: Developing a single, integrated strategy for managing sustainability risks ensures that all parts of the organization are aligned and working towards common goals. This integration enhances the effectiveness of risk management efforts.

- Strategic Coherence: A unified strategy ensures that sustainability risk management is coherent with the insurer’s overall business strategy, enhancing strategic alignment and operational efficiency.

EIOPA and NSA Supervision

Only sustainability risk plans should fall under the mandate of the European Insurance and Occupational Pensions Authority (EIOPA) and national supervisory authorities (NSAs). This focused oversight ensures effective regulation and avoids overburdening insurers with multiple supervisory layers. Key points include:

- Focused Supervision: Limiting supervision to sustainability risk plans allows EIOPA and NSAs to concentrate their efforts on ensuring that insurers effectively manage sustainability risks within the Solvency II framework.

- Enhanced Regulatory Efficiency: This focused approach enhances regulatory efficiency by avoiding unnecessary complexity and duplication in the supervisory process.

Reduce your

compliance risks