Blog

NIS 2 Directive Compliance in the Age of DORA

Navigate the EU's NIS 2 Directive & DORA for the financial sector. This guide details NIS2 compliance, DORA's ICT risk rules, TPRM, incident reporting & testing. Understand their interplay, enforcement, challenges & strategies for robust digital operational resilience and cybersecurity.

Risk Mitigation Strategies for Financial Institutions

Overview of risk mitigation strategies for banks, insurers and investment firms, highlighting EU regulators, Basel III, FATF, stress testing, capital and liquidity buffers, AML, cyber resilience, ESG, governance culture, diversification across credit, market, liquidity, operational risks.

Risk Taxonomy in Financial Compliance

Risk Taxonomy empowers banks and investment firms to map every credit, market, operational, AML and ESG threat, aligning with Basel III, MiFID II and FATF guidelines. Discover best-practice frameworks, governance tips and board-ready reporting that drive trusted compliance.

Compliance Metrics: Definition, Key KPIs, and Best Practices

Defining Compliance Metrics Compliance metrics are measurable indicators used by financial institutions to determine how effectively they adhere to legal requirements, regulatory standards, and internal procedures. These quantifiable data points—often referred to as Key Compliance Indicators (KCIs) or compliance Key Performance Indicators (KPIs)—serve as a crucial “health check”

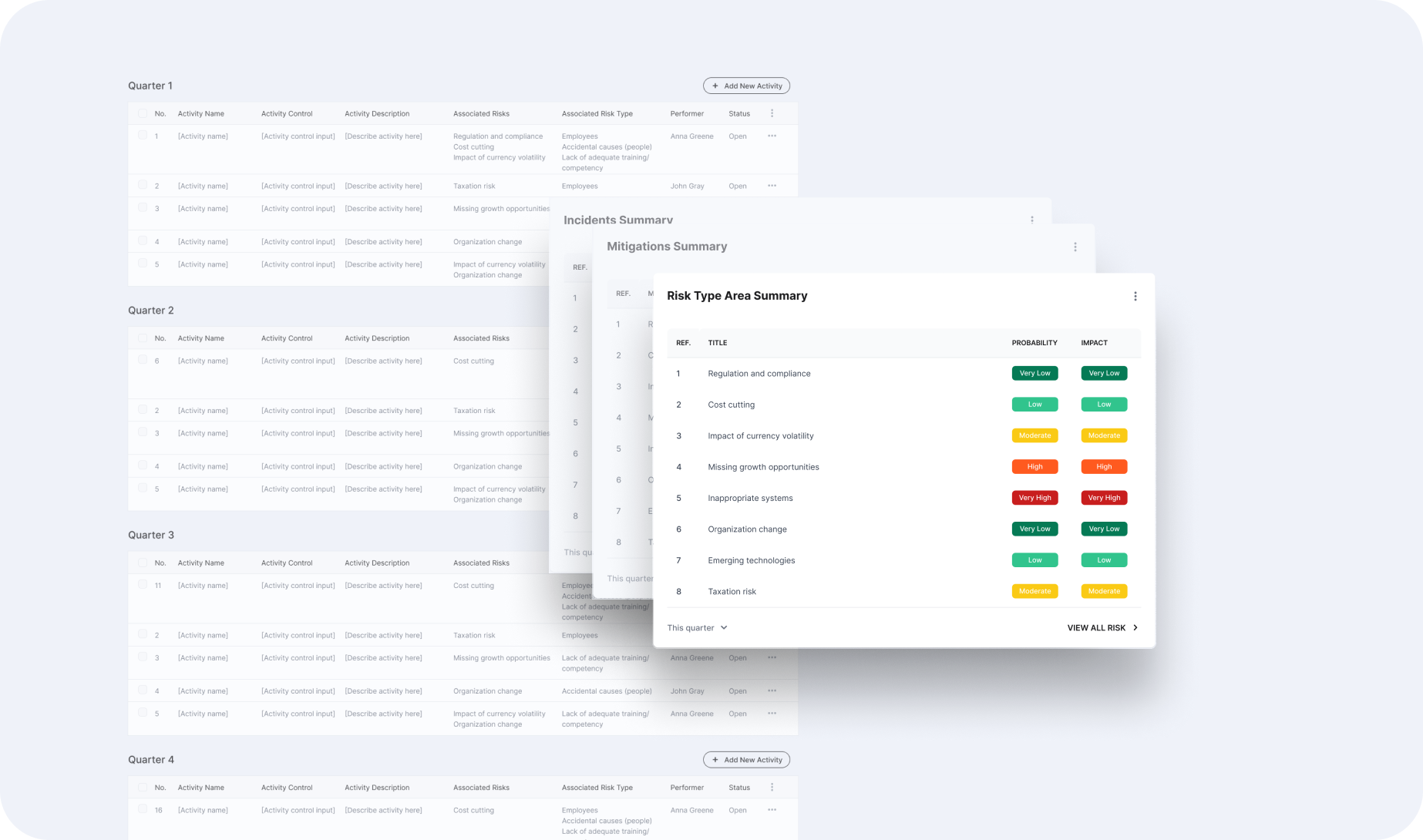

What Is a Risk Register in Compliance?

A risk register, often referred to as a risk log, is a critical tool that serves as a centralized repository for identifying, assessing, and tracking potential risks. This guide offers an in-depth exploration of risk registers, covering their definition and role in regulatory compliance.

Reduce your

compliance risks