Capital Requirements Regulation: Risk Management and Capital Stability

EBA’s CRR regulation updates establish precise thresholds for eligible FX positions and streamline reporting, strengthening EU banks’ capital stability amid currency risks.

The Capital Requirements Regulation (CRR), underpinned by the European Banking Authority (EBA), has been pivotal in structuring the financial stability and capital adequacy framework across the EU. The latest updates to CRR, particularly the new Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS) for structural foreign exchange (FX) positions, propose substantial advancements aimed at harmonizing practices, reducing inconsistencies, and fortifying risk management frameworks.

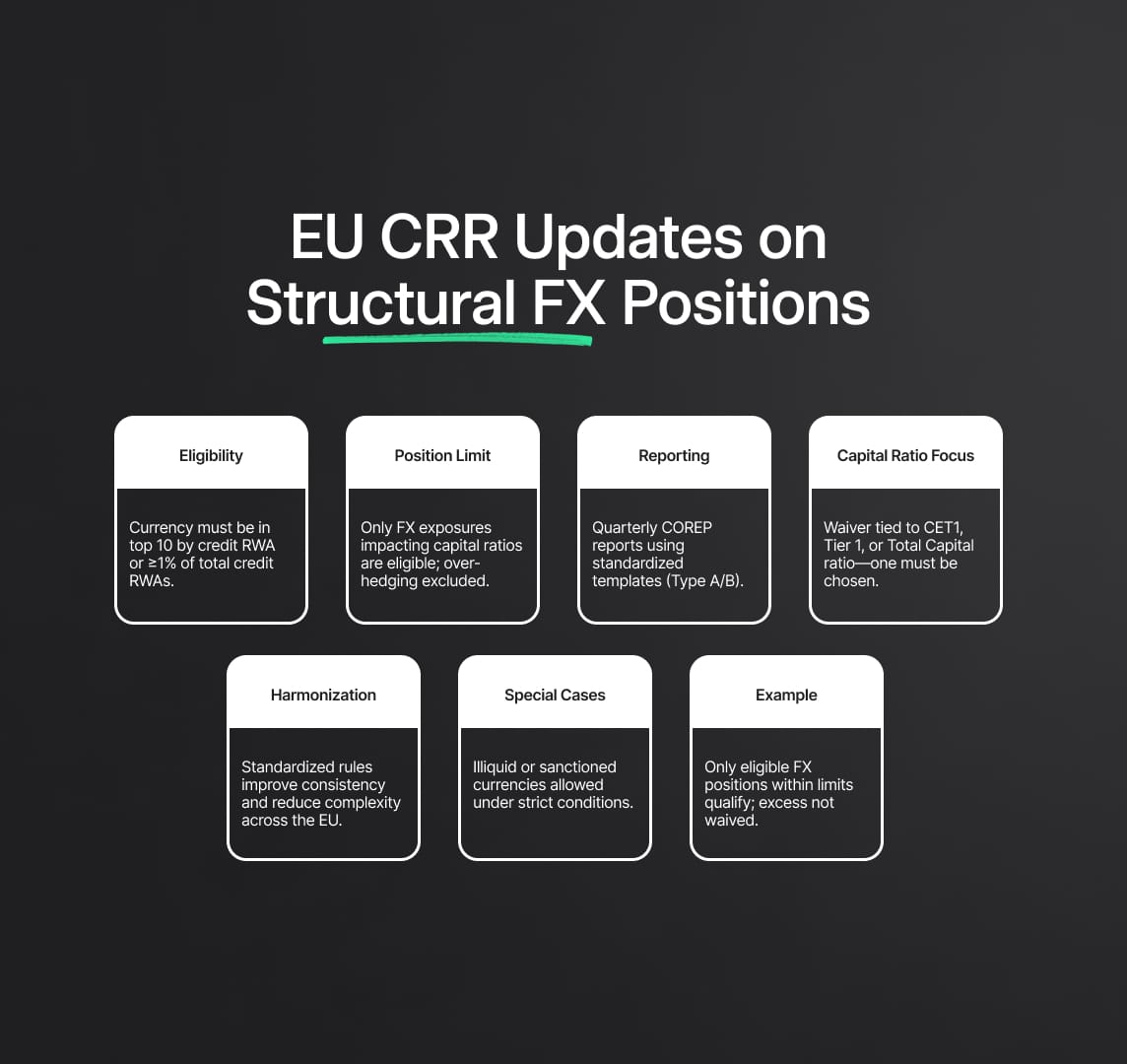

Specifically, these updates align with Article 104c of Regulation (EU) No 575/2013, detailing the eligibility criteria for FX positions and addressing capital ratio impacts driven by FX fluctuations. With a defined structure, these standards empower institutions by introducing thresholds and reporting requirements for the first time under CRR. This article explores the recent changes, including implications for the banking sector, the enhanced treatment of structural FX positions, and the future landscape of regulatory compliance under CRR.

Source

[1]

1. Background on Structural FX in the CRR

Under the CRR, structural FX positions allow financial institutions to offset risks associated with foreign currency fluctuations that affect capital ratios. Initially framed in the CRR’s 2020 guidelines, these positions aim to mitigate the impact of adverse foreign exchange movements on banks' capital ratios, primarily through the option of applying a waiver for these exposures under Article 325(1) CRR. However, varying interpretations across jurisdictions have led to inconsistent applications, motivating the EBA to introduce standardized RTS and ITS under Article 104c of the CRR3, the latest iteration under CRR.

The recent updates largely maintain the core guidelines but introduce new quantitative thresholds and clearer methodologies for calculating maximum open positions that qualify for exemption. These RTS further align with CRR’s stipulations to consider significant currencies and the method to calculate position size, including stipulations to differentiate between eligible positions and over-hedging scenarios. This standardization provides uniform criteria and guidance on establishing risk positions, thus ensuring consistent treatment across the EU.

2. Key Updates to the CRR on Structural FX Positions

A. Quantitative Thresholds for Eligible Currencies

One of the most significant updates is the introduction of a quantitative threshold that clarifies when a currency qualifies for structural FX treatment. For a currency to be eligible, it must either rank among an institution's top ten foreign currencies by credit risk-weighted assets (RWA) or represent at least 1% of total credit RWAs in non-reporting currencies.

The EBA has emphasized that meeting these thresholds allows banks to exclude FX risk positions from own funds requirements, provided they are held for hedging purposes, not trading. This threshold ensures that only materially significant currencies are considered, aligning CRR's risk mitigation approach with the actual exposure landscape of institutions and facilitating a uniform approach to handling structural FX risks across the EU.

B. Maximum Open Position Computation

The updated RTS provide specific guidelines for computing maximum open positions, allowing institutions to neutralize the sensitivity of capital ratios to foreign currency risks. The formula proposed by the EBA calculates maximum open positions that institutions can exclude, focusing on aligning with the capital ratio, as per Article 92 of the CRR. Notably, institutions can now exclude only those positions driven primarily by credit risk RWAs in a foreign currency, which streamline the calculation and alleviate some operational burdens. This approach is designed to prevent over-hedging and ensures that only necessary exposures are included, maximizing capital efficiency while managing FX risks effectively. The ITS also allow simplifications in the formula when credit risk RWAs make up over 80% of exposures in the currency concerned, further reducing complexity.

C. Enhanced Reporting and Monitoring Framework

The ITS introduces a standardized template for reporting structural FX positions, improving transparency and simplifying monitoring for supervisory authorities. Institutions are required to classify FX positions into either "Type A" (those stemming from cross-border investment in subsidiaries) or "Type B" (those that need further analysis to determine structural status). This framework mandates quarterly reporting within COREP, covering positions that qualify for the structural FX waiver, and ensures detailed documentation on significant FX exposures, sensitivity analyses, and risk management criteria. The approach aims to integrate structural FX data with broader supervisory reporting, promoting an all-encompassing view of institutions' FX exposures and harmonizing reporting practices across the EU.

D. Differentiating Risk Positions by Capital Ratios

The updated RTS clarify that structural FX treatment can apply to various capital ratios, such as CET1, Tier 1, or total capital ratios, based on the institution's risk management objectives. Institutions must select a target capital ratio for which to apply the structural FX waiver, ensuring that hedging aligns directly with the ratio’s sensitivity to FX changes.

For instance, an institution focusing on CET1 would follow different criteria than those managing Tier 1 or total capital. This flexibility enables institutions to optimize FX exposure management according to specific capital targets, potentially impacting the volatility and structure of capital buffers in alignment with Basel III requirements. Furthermore, the waiver application can be pursued both on an individual basis and on a consolidated basis, contingent on approval from competent authorities, as set out in CRR guidelines.

3. Future Implications of the CRR Updates on Structural FX Positions

A. Reduced Operational Complexity and Enhanced Precision

By setting a clear framework for identifying eligible currencies and computing maximum open positions, the updated CRR alleviates the previous operational ambiguities. With the inclusion of specific quantitative thresholds—such as the requirement that a currency must constitute at least 1% of total RWAs in foreign currencies or be among the top ten currencies by RWA size—the updates streamline identification processes, ensuring institutions meet eligibility requirements precisely.

This not only reduces compliance burdens for banks but also supports more precise FX risk management by limiting the waiver to currencies materially impacting capital ratios. Institutions can now allocate resources more effectively, focusing on positions genuinely critical to their financial stability and regulatory capital requirements, thus enhancing overall risk efficiency.

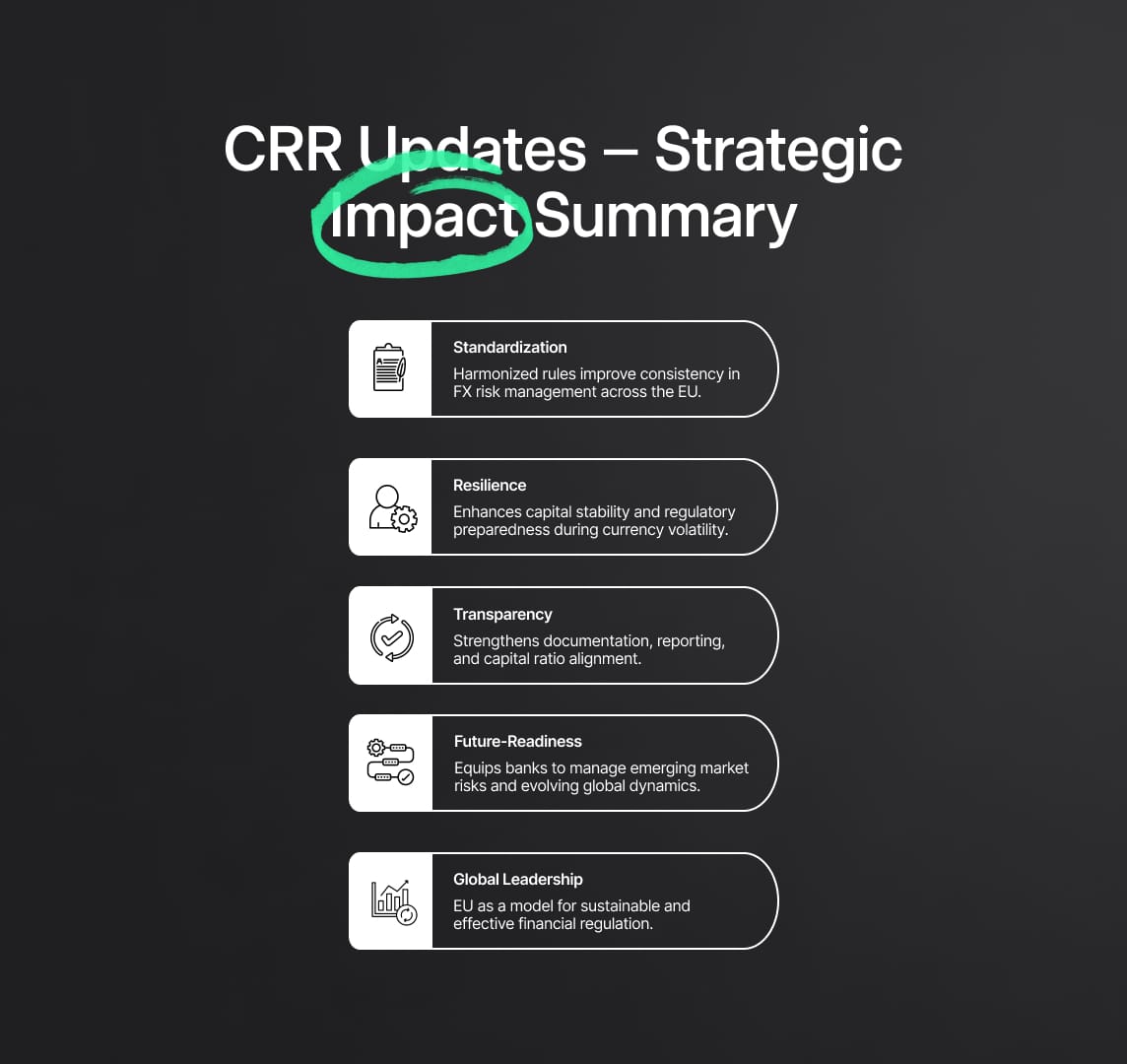

B. Greater Consistency Across the EU Banking Sector

The harmonization of criteria and reporting standards under the Capital Requirements Regulation (CRR) will likely foster greater consistency in FX risk treatment across EU banks. By establishing a standardized template for reporting FX positions under the ITS, the CRR now requires institutions to report quarterly through COREP, ensuring comprehensive data on structural FX exposures.

This could create a level playing field, especially for cross-border banking groups, by ensuring that similar FX exposures are managed and reported similarly across jurisdictions. Enhanced consistency is anticipated to improve supervisory assessments across EU member states, thus enhancing transparency and bolstering investor confidence in EU banking institutions.

C. Increased Resilience in Times of Currency Volatility

The EBA’s standardized approach to structural FX waivers can mitigate capital volatility, especially in times of significant currency fluctuations. The CRR framework’s strengthened focus on consolidated approaches and clear waiver criteria for individual and group-level applications (aligned with Articles 352 and 104c CRR) ensures a cohesive risk management approach across entities.

By mandating that banks choose one primary ratio—such as CET1, Tier 1, or total capital ratio—to hedge, and providing conditions for alignment, banks are better positioned to withstand market stress without compromising capital adequacy ratios. This resilience is expected to play a critical role in economic downturns, safeguarding both individual institutions and the broader financial ecosystem.

D. Forward-Looking Adjustments for Emerging Market Risks

The updated CRR addresses unique conditions, such as illiquidity in certain currencies due to Union restrictive measures. Under Article 325b, institutions can apply for structural FX waivers on illiquid currencies with specific regulatory allowances, ensuring compliance flexibility.

These adjustments, including stringent risk management frameworks and designated requirements for FX positions related to sanctions, provide institutions with the flexibility to manage structural FX positions under these constrained conditions while meeting their prudential obligations. As emerging markets continue to gain prominence, these adjustments may prove essential in adapting to the growing complexities of global banking operations and aligning with CRR’s broader risk management principles.

4. Practical Applications: Examples and Scenarios

To illustrate these updates, consider an institution with substantial operations in multiple countries. Under the revised RTS, this institution would calculate its maximum allowable position based on its top ten RWAs in foreign currencies, focusing on CET1 sensitivity to exchange rate changes. For example, if the institution finds that its exposure to a particular currency significantly impacts the CET1 ratio, it may classify this position as eligible for the waiver based on the quantitative thresholds in place.

Suppose this calculation reveals a structural position exceeding the maximum allowed threshold; in such cases, only the portion up to the threshold qualifies for the waiver, preventing over-hedging and reinforcing a balanced FX position. The CRR also requires clear documentation and quarterly reporting to support supervisory reviews, enabling institutions to demonstrate ongoing compliance.

Furthermore, should the institution require exemptions for illiquid currencies, it would seek special provisions by adhering to Article 104c’s criteria, which necessitate justifying the currency’s business relevance and demonstrating alignment with the institution's risk management framework. For instance, if a bank maintains structural FX positions in a sanctioned currency, it must prove that its strategy aligns with supervisory expectations on hedging and reporting, avoiding regulatory arbitrage. These examples demonstrate how the CRR’s updated guidelines empower banks to navigate FX complexities within a rigorous regulatory structure.

Impact of CRR Updates on Structural FX Risk Management

The recent updates to the Capital Requirements Regulation (CRR) represent a forward-looking shift toward a more resilient, adaptable, and standardized framework for managing structural FX risks across the EU. By creating a harmonized approach to currency eligibility, maximum open positions, and reporting standards, these changes prepare EU financial institutions to better handle the complexities of foreign exchange volatility. The standardized requirements for capital ratio alignment and risk position documentation will not only streamline compliance but also foster a culture of precision and transparency in risk management.

Looking ahead, these updates are expected to significantly impact the EU banking sector by reinforcing capital stability in times of market stress, aligning risk practices across borders, and enabling institutions to respond flexibly to emerging market risks. As global economic landscapes evolve, particularly in response to regulatory shifts and currency market dynamics, these adjustments will support EU banks in maintaining robust capital adequacy ratios and managing FX risks in a disciplined, future-ready manner. With this reinforced foundation, EU banks are positioned to achieve greater resilience, increased investor confidence, and stronger alignment with international standards, establishing the EU as a global leader in sustainable and effective financial regulation.

Reduce your

compliance risks