Residual Risks, RRAO, and FRTB Under the CRR Regulation

Discover the EBA’s Draft RTS for Residual Risks under the CRR Regulation. Learn how these standards enhance regulatory clarity, optimize capital efficiency, and align with Basel III reforms. Explore detailed criteria for RRAO exemptions, fostering risk resilience and compliance.

Introduction to the Residual Risk Add-On (RRAO) under FRTB and CRR

The Residual Risk Add-On (RRAO) is a vital safeguard introduced by the Fundamental Review of the Trading Book (FRTB) as part of Basel III, and transposed into EU law via the Capital Requirements Regulation (CRR). Its purpose is to ensure that banks maintain additional own funds against residual risks, those exposures not fully captured by standard market‐risk metrics. In the forthcoming CRR3 package, the European Banking Authority’s (EBA) draft Regulatory Technical Standards (RTS) on RRAO clarify:

- Scope: Which trading‐book instruments qualify for the add-on

- Exemptions: Criteria for relief from RRAO charges

- Calibration: Methodology to calculate the extra capital buffer

This guide offers an expert, granular analysis, drawing on official EBA drafts and industry studies, to help risk managers, compliance officers, and financial professionals navigate the evolving RRAO landscape.

RRAO in the Basel III / FRTB and CRR Frameworks

Under Basel III’s revamped market-risk regime, FRTB divides capital charges into:

- Sensitivity-based Method (SbM) for delta, vega and curvature risks

- Default Risk Charge (DRC) for credit events

The RRAO sits on top of these, acting as a conservative “catch-all” for instruments whose risks, such as exotic underlyings or model inadequacies, are not adequately captured. EU lawmakers embedded this in Article 325u CRR, refined through CRR2 and now CRR3, mandating:

- 1% of gross notional for products with exotic underlyings (e.g., volatility drivers outside standard market factors)

- 0.1% of gross notional for other residual risk exposures (e.g., complex pay-offs or modelling gaps)

Although these percentages appear modest, they can translate into significant capital requirements. Industry data shows RRAO contributions averaging 15% of total FRTB-SA capital, with certain structured desks, like CMS spread options, seeing RRAO account for up to 87% of their market-risk capital. Such figures underscore why precise definition and calibration of residual risks under the Capital Requirements Regulation (CRR) is crucial for EU banks.

Residual Risks in FRTB / CRR: Definition & Categories

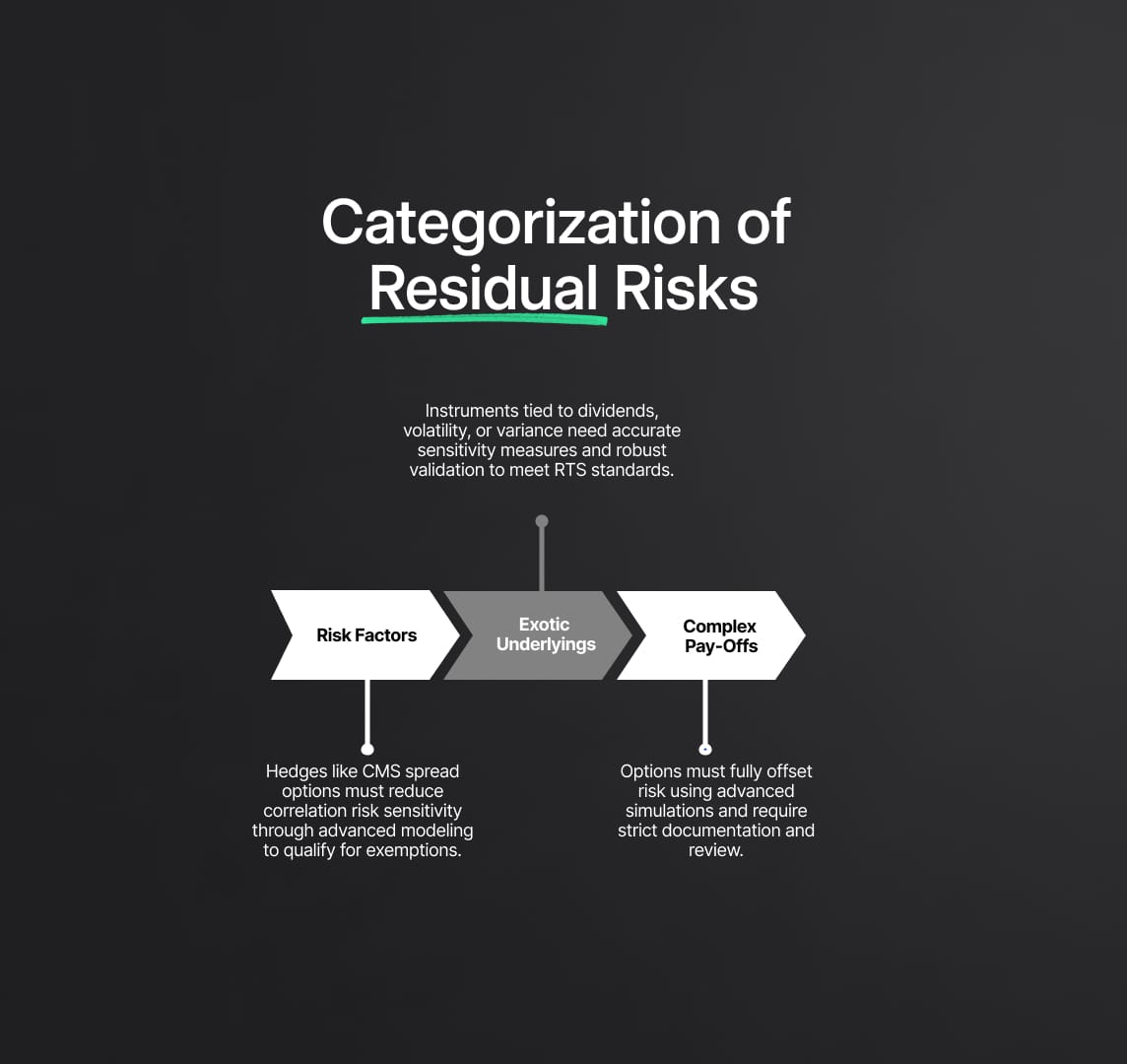

An instrument is deemed to bear residual risk when its payoff or underlying features cannot be fully captured by the standard Sensitivity-based Method (SbM) or Default Risk Charge (DRC) under the Fundamental Review of the Trading Book (FRTB). The Capital Requirements Regulation (CRR) then mandates a Residual Risk Add-On (RRAO) to ensure adequate own funds. Basel III and the EBA identify three primary residual-risk archetypes:

- Gap Risk: Sudden jumps in option value sensitivity (vega) caused by small moves in the underlying, leading to potential hedge slippage. Classic examples include barrier options and digital (“binary”) options with discontinuous pay-offs.

- Correlation Risk: Value shifts arising from changes in correlation assumptions for multi-underlying products (e.g., CMS spread options, equity-basket options).

- Behavioral Risk: Unmodelled exercise or prepayment behaviors driven by human decision-making rather than pure financial optimization, most relevant in credit-linked or loan-linked trading-book instruments.

The EBA’s final RTS (CRR2) supplies a non-exhaustive list: any instrument whose payoff cannot be replicated by a finite linear combination of vanilla single-underlying options (e.g., equity, FX, commodity, bond, credit spread or interest-rate options) triggers RRAO.

Certain underlyings are deemed exotic and automatically attract a 1% RRAO weight (per Article 325u(3) CRR), including:

- Longevity risk (e.g., longevity swaps)

- Weather / natural-event indices (e.g., temperature swaps)

- Future realized volatility (e.g., variance/volatility swaps)

By contrast, plain-vanilla options on a single equity or rate, even if deeply out-of-the-money or long-dated, do not incur RRAO, as their pay-offs remain within standard delta/vega/curvature sensitivities.

Common RRAO-Relevant Instruments

| Instrument Example | Residual Risk Characteristic | RRAO Category | RRAO Charge (% of Notional) |

|---|---|---|---|

| Barrier option on equity | Path-dependent, jump payoff (gap risk) | Other residual risk | 0.1% |

| CMS spread option (interest rates) | Multi-underlying correlation risk | Other residual risk | 0.1% |

| Longevity swap (mortality index) | Exotic underlying (longevity risk) | Exotic underlying risk | 1% |

| Variance swap on equity index | Exotic underlying (future realized volatility) | Exotic underlying risk | 1% |

| Weather derivative (temperature) | Exotic underlying (non-financial index) | Exotic underlying risk | 1% |

| Digital option on FX | Discontinuous payoff (gap risk) | Other residual risk | 0.1% |

Table Notes: “Exotic underlying” = any non-standard market driver (e.g., longevity, weather, realized volatility). “Other residual risk” = complex pay-offs or modeling gaps on standard underlyings. Risk weights follow CRR Article 325u(3).

CRR3 and RRAO Hedge Exemptions

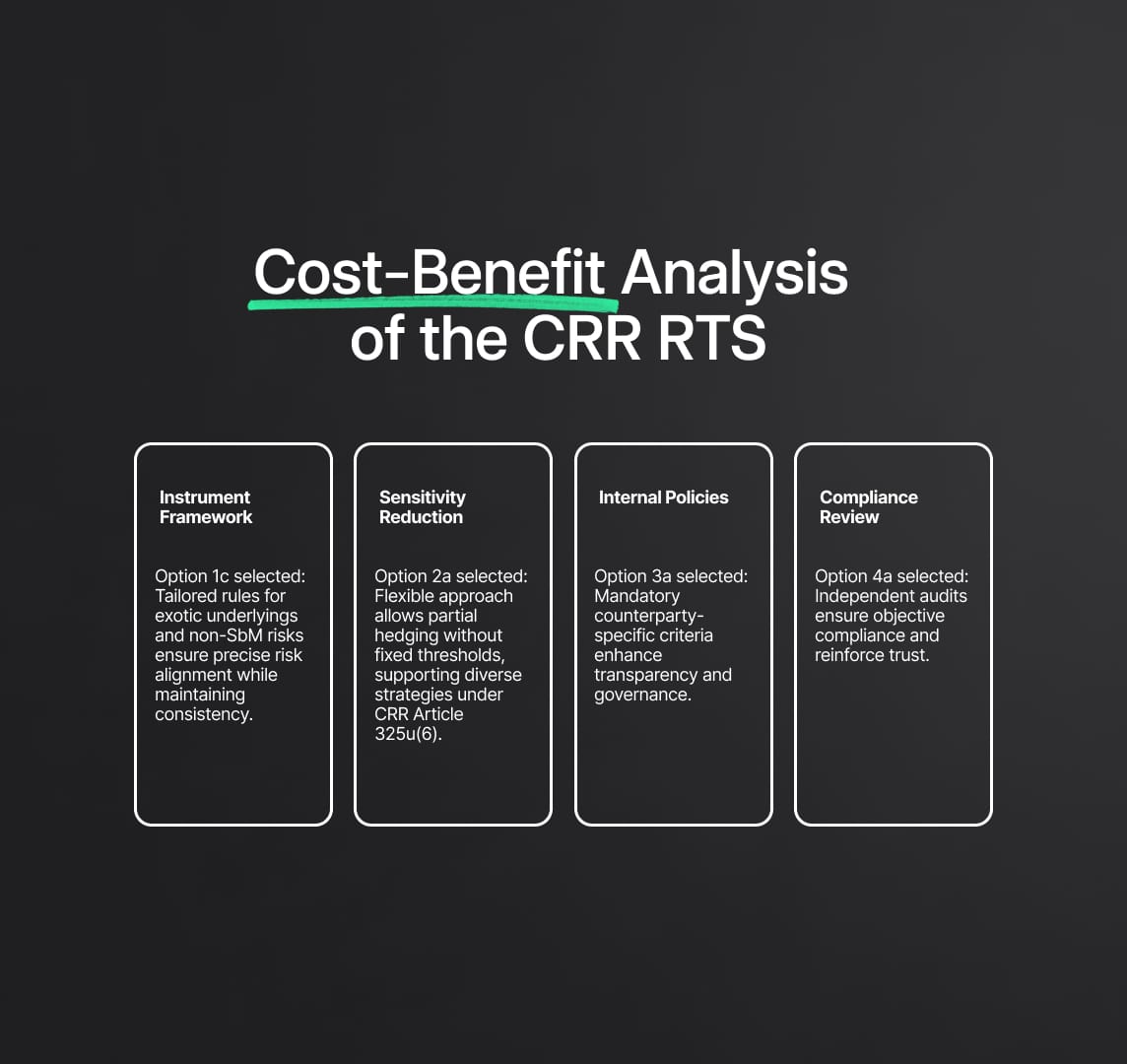

While RRAO closes capital-coverage gaps, it initially penalized both an exotic position and its hedge, doubling the add-on burden. CRR3 corrects this by introducing a targeted hedge exemption under Article 325u(4a) CRR:

- Exemption Scope: A hedge instrument bearing residual risk may be exempt from RRAO if it demonstrably offsets another RRAO-charged position.

- Capital Treatment: The original exotic position still incurs RRAO, while the bona fide hedge position can attract zero add-on capital, aligning capital charges with true net exposure.

- EBA RTS on Hedge Criteria: In February 2024, the EBA published draft RTS detailing stringent conditions for qualifying hedges, covering hedge effectiveness, documentation standards, and risk-offset demonstration.

Key Provisions of the EBA’s Draft RTS on RRAO Hedge Exemptions

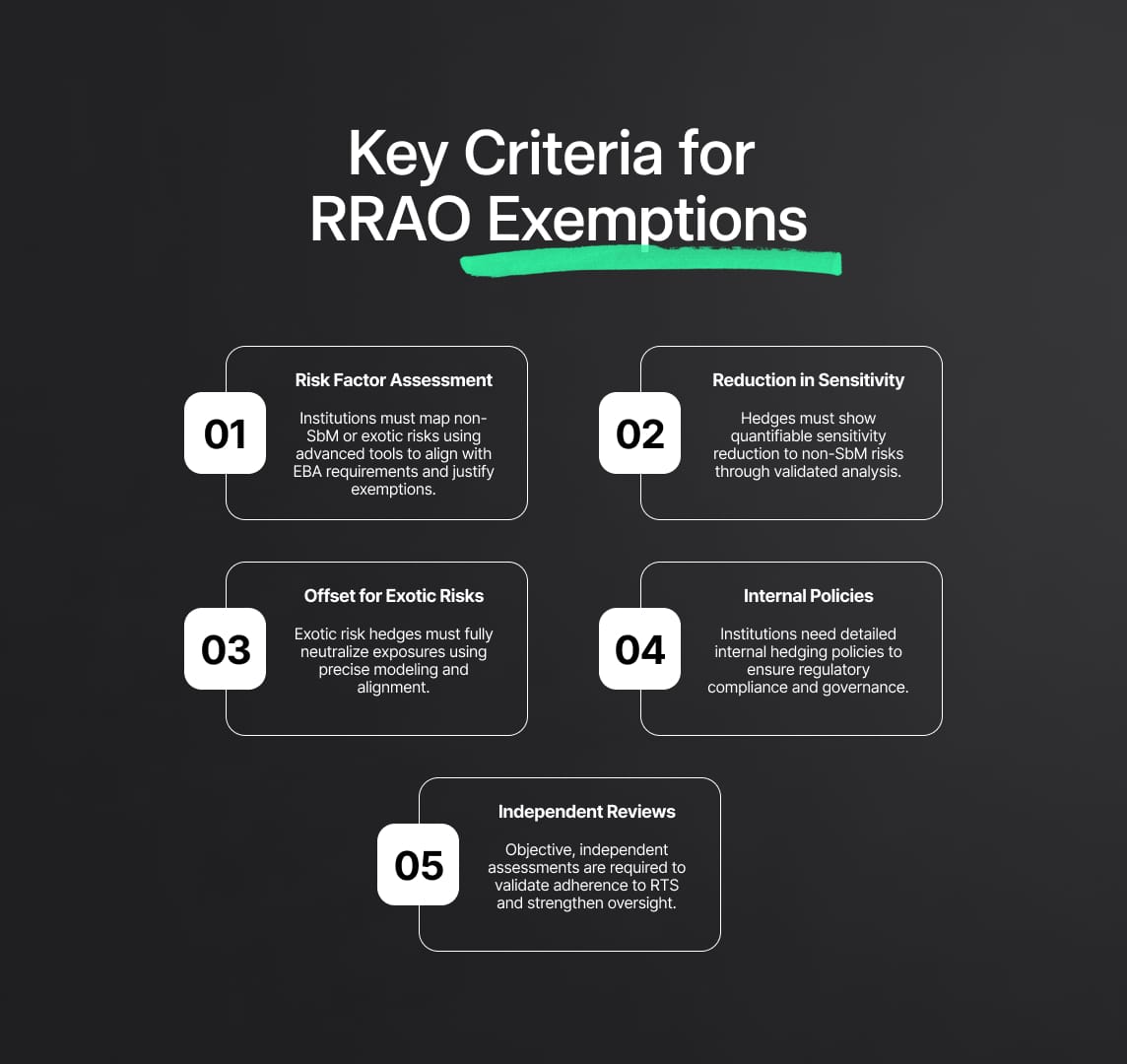

The EBA’s draft Regulatory Technical Standards (RTS) on Residual Risk Add-On (RRAO) hedges establish clear rules under CRR3 for when a hedging instrument can be exempted from RRAO charges. Banks must complete two main stages of assessment and then satisfy robust governance safeguards before claiming the exemption.

1. Two-Step Assessment for Hedge Exemption

Step 1: Identify the Source of Residual Risk

- Non-SbM Risk Factors: Risks not captured by the Sensitivity-based Method (SbM), such as implied correlations in multi-rate products (e.g., CMS spread options).

- Other Residual Risks: Complex pay-off structures or exotic underlyings (e.g., barrier features, natural-disaster indices).

Step 2: Apply the Relevant Hedge-Effectiveness Test

- Case A – Non-SbM Risk Factor

- The hedge must materially reduce the sensitivity to the non-modeled risk factor.

- Example: Hedging a CMS spread option with another CMS spread option to offset correlation risk, demonstrated via sensitivity-reduction analysis.

- Case B – Other Residual Risks

- The hedge must fully offset the original instrument’s residual risk, no partial relief.

- Applies to truly exotic underlyings (e.g., disaster-index options) and path-dependent pay-offs (e.g., barrier options) that require a one-for-one neutralization of jump or exotic features.

- Measurable Exotics Middle Ground

- Underlyings like future realized volatility or dividends can be quantified; here, the test resembles Case A, requiring a significant sensitivity reduction rather than full offset.

- Truly idiosyncratic factors (weather, longevity) remain under Case B’s strict full-offset rule.

2. Prudential Safeguards & Governance

To ensure integrity and consistency, the draft RTS mandate:

- Internal Policy Framework

- Banks must document clear hedge identification criteria, define what constitutes an effective hedge, and set monitoring thresholds for residual-risk positions.

- Policies must include ex-ante sensitivity analyses and require approval by an independent risk control function.

- Independent Review Process

- A separate control unit (e.g., internal audit or risk oversight) must verify each hedge exemption claim against RTS criteria.

- This reviewer confirms that the hedge achieves the required sensitivity reduction or full offset and that all documentation standards are met.

Practical Implications & Implementation Considerations for EU Banks

EU institutions must navigate both challenges and opportunities when embedding the Residual Risk Add-On (RRAO) and its hedge exemption into capital- and risk-management frameworks. Below, we dissect key areas of impact, aligning with CRR3, FRTB-SA, and the EBA’s draft RTS.

1. Capital Management & Product Strategy

- Exotic Product Pricing: Bespoke derivatives and long-dated options now carry a 0.1%–1% RRAO uplift on notional, which materially increases capital costs. Banks typically pass these charges through to clients or adjust bid-ask spreads to preserve return on equity.

- Hedge-Efficiency Play: Under CRR3 Article 325u(4a), qualifying hedges escape RRAO. For example, a CMS spread desk can deploy offsetting CMS trades—knowing the hedge leg avoids a second 0.1% charge, to lower net capital usage and offer tighter pricing to clients.

Risk Management & Hedging Practices

- Incentivised Hedging: RRAO penalties on unhedged exotics drive banks to build targeted hedges that meet EBA RTS effectiveness tests (material reduction or full offset).

- Model Enhancements: Firms will refine models to capture sensitivities to non-SbM factors (e.g., correlation, dividends, realized volatility), enabling robust sensitivity-reduction analyses to support Case A exemptions.

3. Systems & Data Requirements

- Instrument Classification: Banks need automated routines or checklists to flag “residual-risk” instruments, those with exotic underlyings or path-dependent pay-offs, across the trading book.

- Exotic Factor Shocks: Risk engines must be extended to shock non-standard drivers (e.g., weather indices, longevity curves) or approximate their impact. This often requires new risk-factor libraries and scenario workflows within FRTB-SA platforms.

- Hedge Monitoring: Continuous tracking of sensitivity metrics against defined thresholds is essential to evidence Case A or Case B effectiveness at quarter-end and upon significant market moves.

4. Governance & Documentation

- Internal Policy Framework: Banks should codify:

- Hedge Identification: Criteria distinguishing bona fide RRAO hedges from mere directional trades.

- Effectiveness Metrics: Pre-trade sensitivity reports and post-trade performance reviews.

- Approval Workflow: Mandatory sign-off by a risk control or model-validation function.

- Independent Review Process: In line with CRR Article 325c(4), an impartial unit (e.g., internal audit) must validate each exemption claim, confirming that documentation and quantitative tests satisfy the draft RTS requirements.

5. Regulator Engagement & Audit

- Supervisory Scrutiny: National regulators and the ECB’s SSM will probe RRAO classification, exemption claims, and underlying governance during SREP assessments.

- Audit Readiness: Independent auditors are likely to examine RRAO compliance as part of annual reviews. Banks should maintain clear trails of:

- Instrument classification decisions

- Hedge-effectiveness analyses

- Independent review sign-offs

6. Strategic Benefits & Trade-Offs

- Capital Efficiency: Properly documented hedge exemptions can yield simultaneous capital savings and risk reduction, supporting competitive exotic-product offerings without excessive capital drag.

- Selective Focus: Given the operational burden of documentation and review, firms may elect to apply exemptions only to material residual-risk exposures, balancing cost-benefit for smaller positions.

Conclusion: Shaping the Evolving Landscape of Market Risk Management

The Residual Risk Add-On (RRAO) and the EBA’s draft RTS on hedge exemptions represent a pivotal advancement in the EU’s market-risk framework. By requiring banks to hold capital against “unknown unknowns”, exotic pay-offs and model gaps, regulators fortify the financial system against hidden vulnerabilities. At the same time, CRR3’s targeted exemptions ensure that prudent hedging of those residual risks is not unduly penalized, striking a balance between stringency and flexibility.

Looking forward, as the Basel III final reforms (often dubbed “Basel IV”) come into full force via CRR3, RRAO and its hedge exemptions will be integral to capital planning. Banks that invest in robust systems, clear governance frameworks, and skilled personnel will be best positioned to manage residual risks effectively , resulting in a safer trading environment where even the most complex instruments are either backed by commensurate capital or intelligently hedged to minimize systemic impact.

FAQ: Residual Risk Add-On (RRAO) and EBA RTS – Key Questions Answered

Q1: What is the Residual Risk Add-On (RRAO) in the context of FRTB and CRR?

A1: The RRAO is an additional capital charge under Basel III’s Fundamental Review of the Trading Book, implemented in the EU via the Capital Requirements Regulation (CRR). It serves as a conservative buffer for risks not covered by the Sensitivity-based Method and Default Risk Charge, namely exotic underlyings or complex pay-offs. Banks calculate it at 1% or 0.1% of gross notional, depending on the residual-risk category.

Q2: Which types of instruments typically attract an RRAO charge?

A2: Instruments with exotic underlyings (e.g., longevity swaps, weather derivatives, variance swaps) incur a 1% charge, while those with non-linear or path-dependent pay-offs (e.g., barrier or digital options, CMS spread options) incur 0.1%. Essentially, any instrument whose pay-off cannot be replicated by vanilla single-underlying options triggers RRAO.

Q3: How is the RRAO capital add-on calculated?

RRAO Capital = Gross Notional × Risk Weight

- Risk Weight: 1% for exotic underlyings; 0.1% for other residual risks.

- Gross Notional: Contract notional amount or equivalent regulatory measure.

For example, a €100 million longevity swap requires €1 million extra capital; a €100 million equity barrier option requires €100 000.

Q4: What did CRR3 change regarding the Residual Risk Add-On?

A4: CRR3 introduced Article 325u(4a), allowing genuine hedges of residual-risk positions to be exempt from RRAO. The original position remains charged, but the qualifying hedge leg is not, provided it demonstrably offsets the same residual risk.

Q5: What are the criteria for a hedge to qualify for the RRAO exemption?

A5: As per the EBA’s draft RTS:

- Non-SbM Risk Factors (Case A): Hedge must materially reduce sensitivity to the non-modeled factor (e.g., correlation, dividend risk).

- Other Residual Risks (Case B): Hedge must fully offset the original residual risk (e.g., disaster-index options, path-dependent pay-offs).

- Measurable Exotics (Middle Ground): For factors like realized volatility, a material sensitivity reduction suffices.

Q6: Who or what is the “independent reviewer” mentioned in the RTS conditions?

A6: The independent reviewer is a unit separate from the trading desk (e.g., internal audit, risk oversight team under CRR Article 325c(4)) tasked with verifying that the hedge meets all RTS conditions before capital relief is applied.

Q7: What internal policies should banks have for RRAO and the new hedging exemption?

A7: Banks must document:

- Identification Criteria for residual-risk instruments (product taxonomy).

- Hedge Designation Rules and pairing methodology.

- Effectiveness Metrics (pre- and post-trade sensitivity analyses).

- Documentation Standards (trade tickets, risk reports, approvals).

- Governance & Oversight processes with periodic independent reviews.

Q8: How do RRAO and its exemptions benefit banks and risk management?

A8: RRAO strengthens bank stability by mandating capital for elusive risks, exposing model blind spots and prompting model improvements. The hedge exemption aligns capital with net risk, avoiding double charges and incentivizing active, prudent hedging, ultimately enabling banks to offer exotic products more capital-efficiently.

Q9: When will the RRAO hedge exemption rules take effect in the EU?

A9: RRAO reporting began under CRR2, with binding capital requirements effective as of 20 December 2022 for jump-to-default and RRAO. The CRR3 package (including hedge exemptions) is expected to be phased in around 2025–2026, following final EBA RTS adoption and Official Journal publication.

Q10: How does the RRAO framework tie into the overall Basel III (Basel IV) reforms?

A10: RRAO is a key element of Basel III’s FRTB overhaul, closing gaps left by SbM and DRC. It complements reforms across credit, operational risk, and the output floor under the Basel III final package, ensuring comprehensive capital coverage for all risk dimensions, a true embodiment of Basel’s “identify and hold capital” philosophy.

Reduce your

compliance risks