REMIT 2 Regulation: Guidelines on PPAETs and Non-EU Obligations

REMIT 2 Regulation update by ACER requires non-EU participants to appoint EU representatives and strengthens PPAETs' obligations to prevent market manipulation and ensure transparency in the EU energy market.

The revised REMIT 2 Regulation (Regulation (EU) No 1227/2011 on wholesale energy market integrity and transparency) introduces key changes that significantly impact market participants and Persons Professionally Arranging or Executing Transactions (PPAETs). On 25 September 2024, the European Union Agency for the Cooperation of Energy Regulators (ACER) issued an Open Letter outlining specific guidelines and requirements. These developments bring attention to non-EU market participants' need to designate representatives and impose new obligations on PPAETs under the revised REMIT 2 Regulation.

Source

[1]

Designated Representatives Under REMIT 2

One of the major revisions in REMIT 2 Regulation is the mandatory requirement for non-EU market participants to designate an EU-based representative. This new mandate, effective from 8 November 2024, applies to all non-EU entities involved in the wholesale energy market. Non-EU market participants are required to appoint a designated representative via a written mandate, ensuring that this representative becomes the point of contact for ACER and the national regulatory authorities (NRAs). This regulatory change under REMIT 2 Regulation aims to improve market oversight and enforce compliance with EU energy market transparency rules.

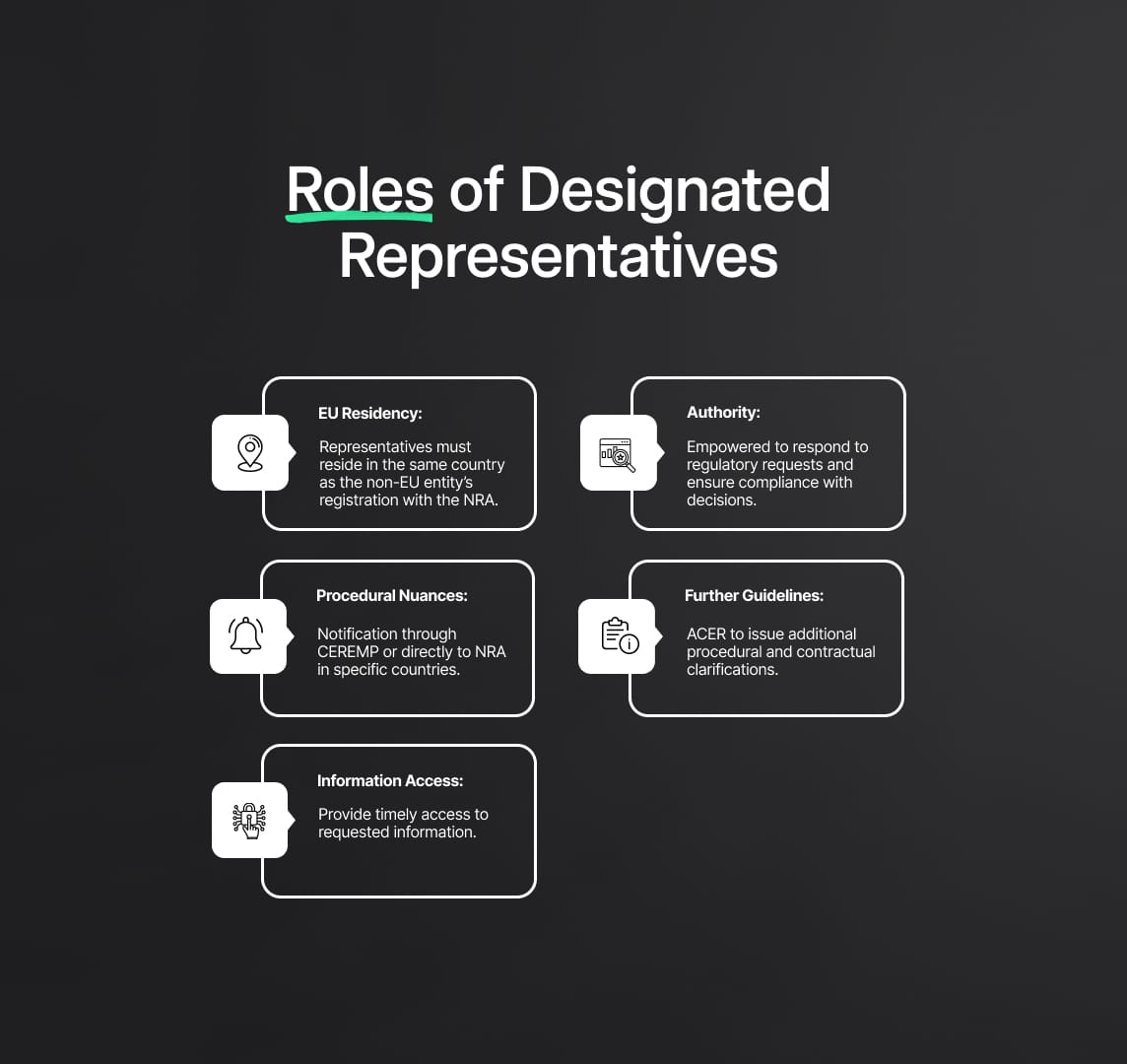

REMIT 2: Obligations for Designated Representatives

- EU Residency Requirement: The designated representative must be a legal or natural person based in the same country where the non-EU market participant is registered with the NRA, aligning with local regulatory frameworks under the REMIT 2 Regulation. For example, a non-EU market participant active in Germany must have its designated representative based in Germany, ensuring compliance with Bundesnetzagentur (BNetzA).

- Powers and Responsibilities: The designated representative will liaise with ACER and NRAs. Non-EU market participants must empower the representative with the necessary authority to respond to regulatory requests, ensure compliance with decisions, and cooperate effectively with ACER and the respective NRAs. The representative must also provide timely access to requested information to maintain compliance with REMIT 2 Regulation.

- Notification Procedures: Non-EU market participants must notify their NRA of their designated representative’s contact details, including name, postal address, email, and telephone number. This must be done via the Central European Registry for Energy Market Participants (CEREMP) platform, except for entities in Italy, Romania, and Slovenia, where notification must be made directly to the NRA. Understanding these country-specific procedural nuances is essential for compliance with REMIT 2 Regulation.

- Group Structures: Even if multiple non-EU market participants operate within the same EU Member State, each entity must appoint its own designated representative under REMIT 2 Regulation. For instance, two subsidiaries of a US energy company operating in France must each appoint a designated representative, even if the same individual represents both entities. This ensures accountability across all entities under REMIT 2 Regulation.

ACER has also committed to issuing further guidelines on the application of the designated representative requirement, providing clarification on procedural and contractual aspects to ensure proper implementation under REMIT 2 Regulation.

Obligations for Persons Professionally Arranging or Executing Transactions (PPAETs)

The revised REMIT 2 Regulation imposes stricter obligations on PPAETs, aiming to enhance surveillance of suspicious energy market transactions. The updated definition of PPAETs under REMIT 2 Regulation expands the scope of regulatory requirements, setting out comprehensive measures to prevent market manipulation and insider trading in wholesale energy markets.

PPAETs: Key Definitions and Responsibilities

ACER's Open Letter provides a detailed interpretation of PPAETs under REMIT 2 Regulation, differentiating between "persons professionally arranging transactions" and "persons professionally executing transactions."

- Persons Professionally Arranging Transactions: This includes individuals or entities acting as intermediaries in the wholesale energy market, particularly those involved in the reception and transmission of orders related to energy products. ACER outlines three cumulative criteria for identifying such entities:

- Person: A legal or natural person operating in the wholesale energy market.

- Professional Capacity: The entity must be acting in a professional and remunerated role.

- Arranging Transactions: This involves facilitating wholesale energy product transactions. For example, a brokerage firm arranging trades between energy producers and distributors must comply with the reporting and surveillance requirements set forth by REMIT 2 Regulation.

- Persons Professionally Executing Transactions: This refers to individuals or entities executing trades on their own behalf or for third parties within the wholesale energy market. For instance, a company trading natural gas futures for its own portfolio would fall under this category and must ensure that its transaction monitoring systems comply with the enhanced requirements of REMIT 2 Regulation.

The REMIT 2 Regulation strengthens the obligations for such market participants to ensure robust systems are in place to prevent, detect, and report market manipulation and insider trading. These systems must align with the regulatory requirements set forth by REMIT 2 Regulation and applicable financial market regulations where relevant, ensuring comprehensive oversight of wholesale energy transactions.

REMIT 2 Regulation: Surveillance and Reporting Requirements

Under REMIT 2 Regulation, Persons Professionally Arranging or Executing Transactions (PPAETs) face stringent obligations to ensure the integrity of the wholesale energy market. PPAETs must put in place robust systems and procedures to detect, report, and address suspicious transactions, orders, and potential violations, including insider trading and market manipulation. These obligations align with REMIT 2’s goal to safeguard transparency and fairness in the EU wholesale energy market by preventing abusive practices.

Key Obligations Include:

Establishment of Detection Systems:

PPAETs are required to implement advanced surveillance systems capable of monitoring suspicious activities, including orders or breaches related to the publication of inside information. Under REMIT 2 Regulation, surveillance systems must be sophisticated enough to detect irregularities such as abnormal trading patterns or price manipulation tactics like spoofing or layering, especially in algorithmic trading environments. For instance, energy market participants using algorithmic trading must ensure their platforms have automated detection tools that can flag manipulative activities, including rapid price fluctuations or large canceled orders.

This focus on algorithmic trading surveillance is a significant regulatory update under REMIT 2 Regulation, which expands the definition of PPAETs to include participants using high-frequency trading strategies. These entities must establish detection systems and comply with the regulatory reporting requirements, ensuring that ACER and NRAs are promptly notified of any irregularities.

Independence of Surveillance Personnel:

To maintain impartiality, REMIT 2 Regulation mandates that PPAETs ensure personnel responsible for surveillance activities act independently and are insulated from operational or trading functions. This is particularly crucial for firms where compliance staff and traders might otherwise have close interactions, potentially affecting the objectivity of internal monitoring. For example, large energy trading firms must ensure surveillance teams are not only physically separated from trading desks but also functionally independent, enabling objective and unbiased reporting.

Timely Reporting of Suspicious Transactions:

One of the critical obligations under REMIT 2 Regulation is the timely and detailed reporting of suspicious transactions. If PPAETs suspect market manipulation, insider trading, or a breach of the obligation to publish inside information, they must report these suspicions to ACER and the relevant NRA within four weeks. Reports must be based on substantive evidence and include details such as the nature of the order, trading patterns, and relevant market context.

For instance, if a PPAET detects unusual price movements in energy futures contracts following non-public information about a supply disruption, it must report this activity to ACER. Failure to report suspicious transactions within the four-week timeframe can result in penalties, including fines or operational restrictions, under REMIT 2 Regulation.

REMIT 2: Practical Application for PPAETs

ACER’s guidance on REMIT 2 Regulation stresses the importance of proportionate and reasonable reporting practices. PPAETs should establish internal processes to determine when transactions or events are suspicious and ensure timely notification to authorities. This includes maintaining documentation to substantiate any suspicion and ensuring that notifications are well-documented and detailed.

Additionally, PPAETs must conduct regular reviews and audits of their surveillance systems to ensure compliance with the evolving requirements under REMIT 2 Regulation. If new forms of market abuse, such as sophisticated algorithmic trading schemes, are detected, PPAETs are required to update their detection systems accordingly.

Failure to comply with these obligations can lead to severe consequences, including significant financial penalties or restrictions on market participation. A company that neglects to report suspicious transactions within the prescribed four-week window may face enforcement actions under REMIT 2 Regulation, such as being temporarily barred from participating in EU energy markets.

Impact on Non-EU Market Participants

A US-based energy company trading across multiple EU Member States must meet heightened regulatory obligations under REMIT 2 Regulation. If this company operates in markets like Germany, France, or Spain, it must ensure compliance by appointing designated representatives in each country where it conducts business. For example, if the company is active in the German market, it must appoint a representative based in Germany who can act as a liaison with ACER and the German NRA.

Failure to appoint a designated representative by the 8 November 2024 deadline would expose the company to enforcement actions, including potential fines and suspension of trading rights within the EU. The designated representatives must also have access to all necessary trading data and be capable of responding to regulatory inquiries, ensuring the company’s compliance with REMIT 2 Regulation.

If the US company uses a third-party intermediary to arrange trades in the EU, that intermediary would be classified as a PPAET under REMIT 2 Regulation. In this case, the intermediary must establish surveillance systems to monitor trades for potential insider trading or market manipulation. Any suspicious trades or orders must be reported to both ACER and the relevant NRAs without delay. These reporting requirements ensure that all participants in the wholesale energy market, regardless of geographic location, are held accountable under REMIT 2 Regulation.

By adhering to the stringent reporting and surveillance obligations outlined in REMIT 2 Regulation, non-EU market participants can continue their operations in the EU wholesale energy market without disruption, contributing to the integrity and transparency of the market.

Reduce your

compliance risks