REMIT II: Wholesale Energy Market Regulation in the EU

REMIT amendments approach finalization: European Parliament voted on 29 Feb 2024, followed by Council approval on 18 Mar 2024. Pending Official Journal publication, certainty arises regarding upcoming changes.

The legislative evaluation of proposed modifications to Regulation (EU) 1227/2011 concerns wholesale energy market integrity and transparency (REMIT) is coming to an end after nearly a year of intense debate. The reforms were formally adopted by the European Parliament in a plenary vote on February 29, 2024, marking a turning point in the regulation of the European energy market. The Council then approved the revisions on March 18, 2024.

Clarity about the impending changes is heralded by the co-legislators' adoption of the REMIT amending legislation, which awaits the last procedural step of publishing in the EU's Official Journal. These revisions, known as REMIT II, have the potential to drastically alter the European wholesale energy market environment.

These changes have their roots in the extensive package for electricity market design that the European Commission put forth on March 14, 2024. The goal of this package is to update and simplify the regulatory frameworks controlling the European energy sector.

It includes revisions to Regulation (EU) 2019/943 (the Electricity Regulation) and Directive (EU) 2019/944 (the Electricity Directive). The modifications to REMIT, which address crucial elements of market integrity and transparency, take center stage in this larger context. Notably, since REMIT's founding more than ten years ago, these modifications represent the most significant redesign.

Regarding players in the European wholesale energy markets, REMIT II has significant ramifications. Their operations are immediately impacted by this legislation, which strengthens oversight procedures and adds new regulatory requirements. Therefore, it is essential to comprehend the extent and ramifications of REMIT II in order to effectively navigate the changing European energy markets. We explore the main features of REMIT II in this piece, along with its implications for various parties involved in the energy industry.

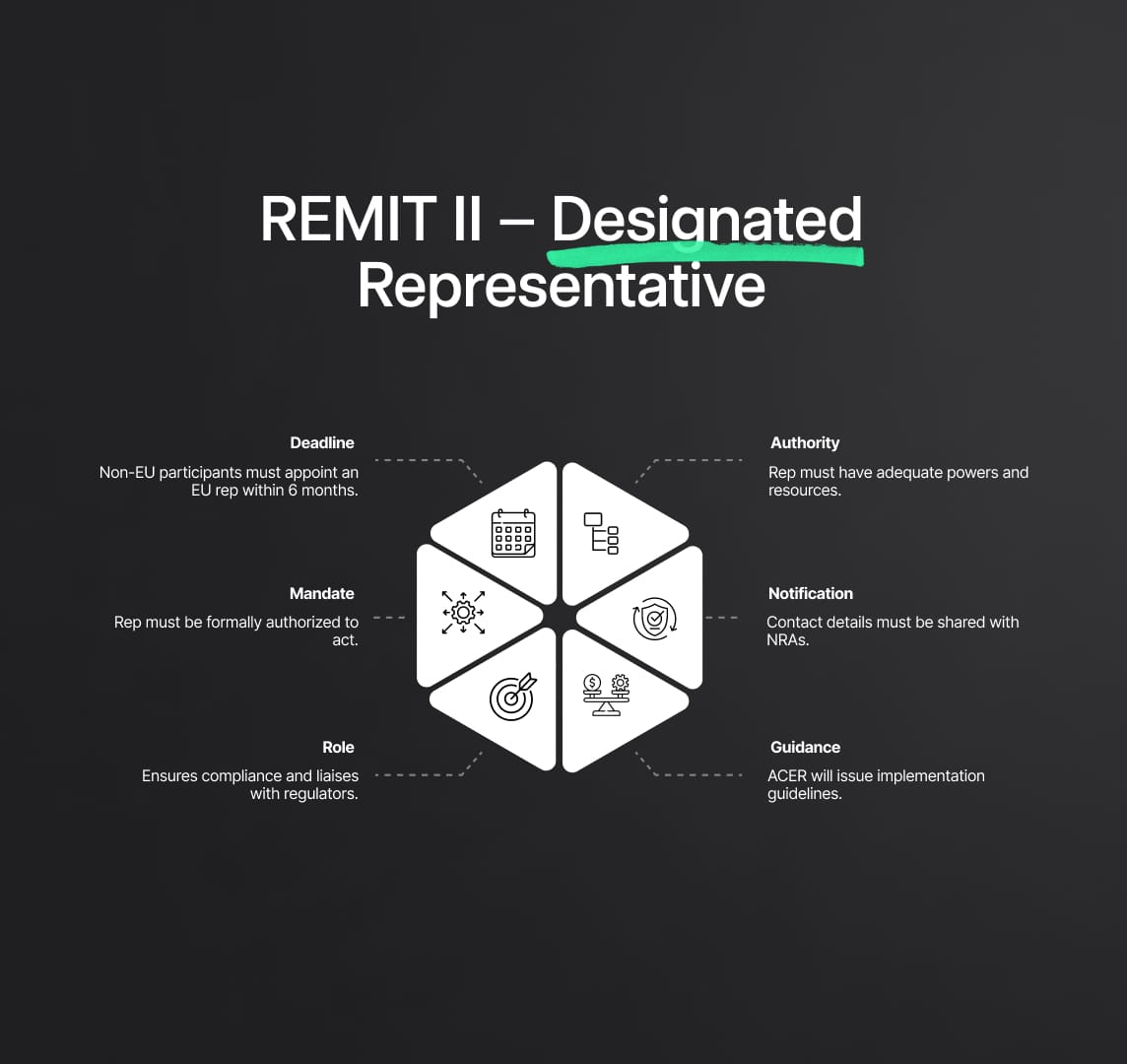

Mandatory Designation of Representatives for Third-Country Market Participants under REMIT II

Regarding the requirement for third-country market participants to choose a representative within the EU, one of the main points of contention around the revisions to Regulation (EU) 1227/2011, or REMIT II, is how the regulation of the European energy market is changing. The objective of this clause, which is being negotiated extensively and was put forth by the European Commission, is to improve regulatory compliance and oversight. The compromise positions that have been reached and the changes that have followed represent a big step in the direction of enhancing integrity and openness in the wholesale energy markets:

- Requirement for Designation: Within six months of REMIT II coming into effect, third-country market participants who are not residents nor established within the EU must designate a representative in the EU.

- Written Mandate: In order for the designated representative to represent a market participant in interactions with regulatory bodies, such as the Agency for the Cooperation of Energy Regulators (ACER) or national regulatory authorities (NRAs), the market participant must give written authorization to the representative.

- Role of Designated Representative: The designated representative's role is to facilitate communication, ensure that regulatory decisions are followed, and provide requested information. They are an essential point of contact for ACER and/or NRAs.

- Powers and Means: Market players operating in third countries must provide the essential powers and means to their chosen representatives in order to guarantee prompt and effective regulatory compliance as well as effective cooperation with regulatory bodies.

- Notification Requirements: Market participants must give their NRAs access to the name, email address, postal address, and phone number of their designated representatives.

- ACER Guidelines: In order to provide market participants with clarity and direction in carrying out their responsibilities, REMIT II requires ACER to release guidelines and recommendations for the application of the designated representative requirement.

These salient features highlight the importance of the requirement that market players operating in third countries appoint a representative within the EU, underscoring its function in advancing regulatory compliance, facilitating transparency, and cultivating productive collaboration between market players and regulatory bodies.

REMIT and MAR Alignment for Market Manipulation and Inside Information

To better align its requirements with Regulation (EU) 596/2014 on market abuse (MAR), REMIT underwent revisions in response to the increased interconnectedness between the wholesale energy and financial markets. The amendments broaden the definition of market manipulation under REMIT to include a range of actions pertaining to wholesale energy products that may mislead consumers regarding supply, demand, or prices, or manipulate prices unfairly. Furthermore, it is now acknowledged that disseminating inaccurate information about benchmarks may constitute possible market manipulation. Moreover, REMIT II harmonizes the concept of insider information with MAR, enabling the process as a whole as well as individual steps to be considered inside knowledge. Included is information that has a direct or indirect bearing on wholesale energy products and how it affects supply, demand, and pricing. The revisions further make it clear that, with regard to operations involving financial instruments, REMIT's application does not override MAR, Regulation (EU) No 648/2012 (EMIR), Regulation No 600/2014 (MiFIR), Directive 2014/65/EU (MiFID), or EU competition law.

Expansion of Wholesale Energy Product Definition: Enriching REMIT's Scope

The definition of wholesale energy products under Regulation (EU) 1227/2011 (REMIT) has undergone major changes in an effort to improve regulatory supervision and transparency in the European energy markets. With these modifications, REMIT's purview is expanded to include a greater range of energy-related derivatives and contracts. This extension takes into account new developments in technology and developing market practices to reflect the changing dynamics of the energy industry.

Main regulatory changes:

- Inclusion of LNG in Natural Gas Definition: Liquefied natural gas (LNG) is now specifically included in the definition of natural gas, acknowledging its growing importance in energy markets.

- Expanded Protection for Power Purchase Agreements: REMIT is now able to handle power purchase agreements that could result in delivery inside the EU using single day-ahead and intraday coupling methods. The interconnectivity of the European electricity markets is acknowledged by this extension.

- Contracts for the Storage of Gas and Electricity: Contracts for the storage of natural gas or electricity inside the European Union, as well as derivatives related to those storage activities, are now included in the category of wholesale energy products. The increasing significance of energy storage in maintaining system flexibility and stability is reflected in this addition.

- Included in the Derivatives: REMIT now expressly covers derivatives related to electricity, including those that might be delivered within the EU through day-ahead and intraday coupling methods.

By guaranteeing thorough control of the wholesale energy markets, these regulatory modifications represent a critical step in bringing REMIT into line with the changing energy world. Furthermore, the upcoming revisions to the draft Gas Regulation indicate additional extensions, bringing REMIT's coverage to hydrogen and reiterating its flexibility in response to new energy trends.

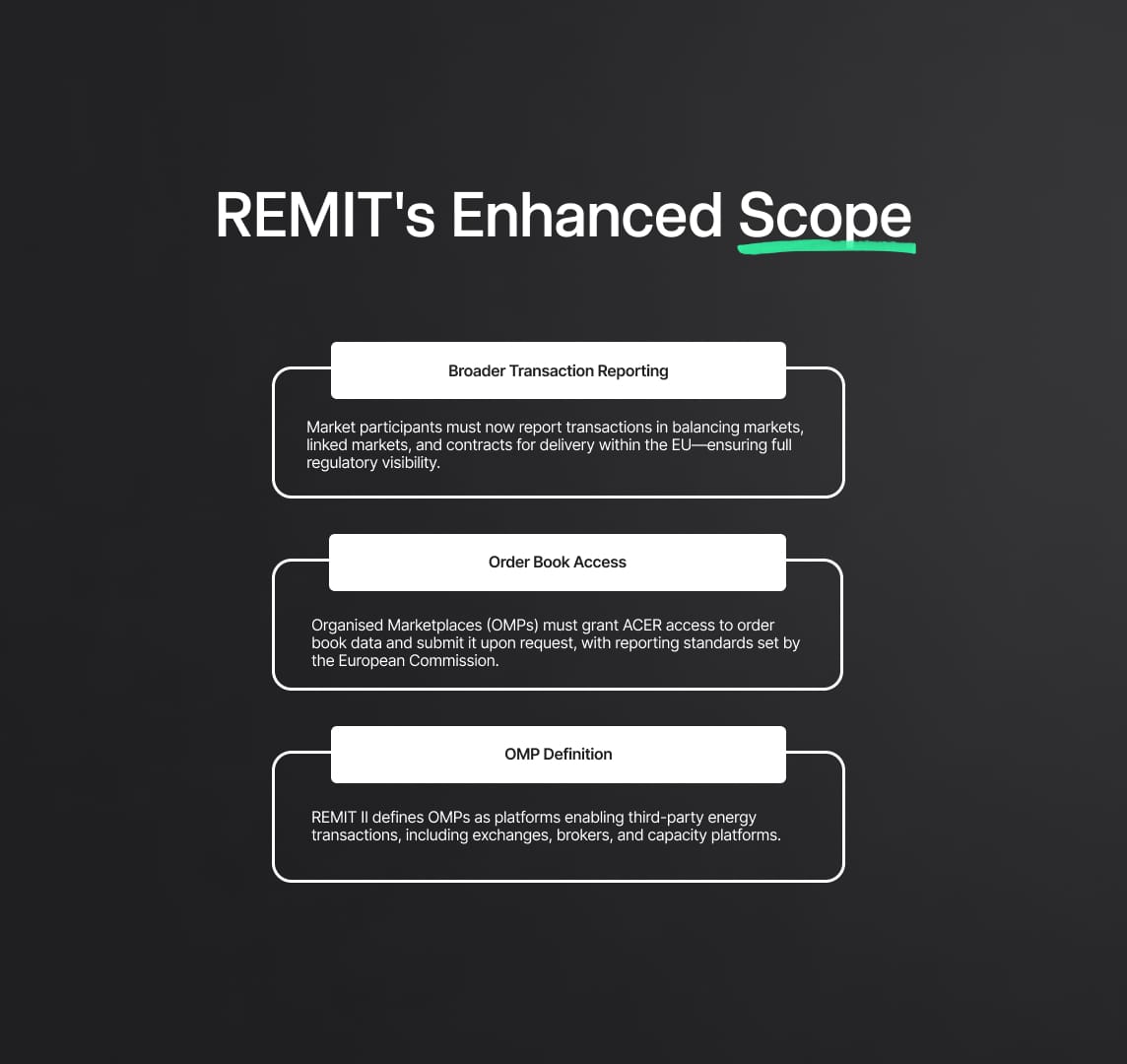

Reporting Obligations: REMIT's Enhanced Scope

Significant changes have been made to Regulation (EU) 1227/2011 (REMIT) in order to broaden the range of reporting requirements for market participants involved in the European energy markets. These modifications include new requirements for transaction reporting in linked markets, balancing markets, and other pertinent activities. They are intended to improve transparency and regulatory control. To reinforce transparency efforts, organized marketplaces (OMPs) are required to submit data to the Agency for the Cooperation of Energy Regulators (ACER). This essay explores the significant changes to the REMIT II reporting obligations and clarifies the ramifications for both market players and regulatory bodies:

- Expanded Reporting Capabilities: Market players must disclose transactions in linked markets, newly created balancing markets, contracts pertaining to balancing markets, assigned transmission capacities, and goods that may be delivered inside the European Union. The goal of this expansion is to guarantee thorough reporting and regulatory supervision for all activities related to the energy market.

- Organised Marketplaces (OMPs): OMPs are required to give ACER access to the order book data and to furnish ACER with this data upon request. It is the responsibility of the European Commission to create efficient data reporting arrangements by an implementing act and to define reporting records for transactions carried out on OMPs.

- Definition of OMPs: OMPs are defined under REMIT II as platforms that enable transactions between several third parties interested in purchasing or disposing of wholesale energy goods. Energy exchanges, brokers, capacity platforms, and other systems that enable wholesale energy transactions are all included in this description.

Authorisation Requirement for Inside Information Platforms

Important modifications have been made to the Regulation (EU) 1227/2011 (REMIT) concerning market players' disclosure of inside information via Inside Information Platforms (IIPs). Market players are now obligated by REMIT to reveal inside information about IIPs, which need approval from the Agency for the Cooperation of Energy Regulators (ACER). For insider information disclosures particular to a given industry, ACER will run a specialized electronic access point and keep track of approved IIPs. Additionally, by means of a delegated act, the European Commission is charged with setting minimum thresholds for the identification of events that could materially affect wholesale energy product prices if made public. The purpose of these changes is to improve regulatory control and market transparency in the European energy sector.

Regulatory Compliance: Mandate for Registered Reporting Mechanisms (RRMs)

Significant modifications are made to the authorization of Registered Reporting Mechanisms (RRMs) under REMIT II. In addition to the current mandate for Inside Information Platforms (IIPs), REMIT II requires approval from the Agency for the Cooperation of Energy Regulators (ACER) for RRMs. Authorization is only available to RRMs that were founded within the European Union. RRMs are defined as legal entities that have the authority to submit basic data and transaction information to ACER on behalf of themselves or other market participants. The purpose of these changes is to improve regulatory control in the European energy markets and streamline the reporting procedure.

Reporting Obligations and Algorithmic Trading Regulations in Wholesale Energy Markets

Considerable new regulatory actions are included in the REMIT revision with the goal of improving wholesale energy market supervision. These include the rules governing algorithmic trading and the responsibilities placed on Persons Professionally Arranging or Executing Transactions (PPAETs). The main obligations and specifications imposed on PPAETs as well as the regulatory structure controlling algorithmic trading under REMIT II are:

- Obligations for PPAETs:

- Reporting Suspicious Transactions: PPAETs are obligated to report suspicious orders, suspected violations of insider information publication responsibilities, and suspicious transactions that violate REMIT restrictions on insider trading and market manipulation.

- Creation of Efficient Arrangements: In order to detect any REMIT infractions, PPAETs must create and preserve efficient systems, processes, and arrangements.

- Mitigation of Conflicts of Interest: Procedures must be in place to guarantee that workers engaged in surveillance operations perform impartially and are free from conflicts of interest.

- Identification and Reporting: In the wholesale energy markets, PPAETs have a duty to identify and report any suspicious orders or transactions.

- Regulations for Algorithmic Trading:

- Definition: In REMIT II, the term "algorithmic trading" is defined to include trading operations in which order parameters are determined by computer algorithms with little or no human interaction.

- System and Risk Controls: Market players using algorithmic trading need to put in place efficient business continuity plans, risk controls, and systems.

- Notification Requirement: Market participants using algorithmic trading have to report their Member State registration to the National Regulatory Authority (NRA).

- Record Keeping: Market participants engaged in algorithmic trading are required under REMIT II to maintain certain records.

- Extra Rules for DEA Providers: There are extra rules pertaining to algorithmic trading that apply to market players who give Direct Electronic Access (DEA) to Organized Marketplaces (OMPs).

These actions demonstrate REMIT II's dedication to enhancing oversight and guaranteeing honesty in the wholesale energy markets.

LNG Price Assessments, Benchmarks, and Market Data Reporting

In accordance with Council Regulation (EU) 2022/2576, the modified REMIT incorporates long-term measures pertaining to LNG price assessments, an LNG benchmark, and market data reporting duties. Market participants trading LNG are required to promptly transmit market data to ACER following trades or bids/offers. With the goal of making these benchmarks and assessments of LNG prices become reference rates for derivative contracts, ACER is responsible for disseminating them on a daily basis. A spread between ACER's daily evaluation and the settlement price for front-month TTF Gas Futures contracts is known as the LNG benchmark. To improve market transparency and enable trustworthy pricing benchmarks, REMIT II defines LNG trading and lays forth reporting requirements.

ACER: Strengthening Investigation Powers for Cross-Border REMIT Breaches

Increasing ACER's investigative and enforcement capabilities was a major topic of discussion throughout the REMIT review, especially with regard to cross-border violations. As instances of cross-border market abuse increased, the co-legislators decided to give ACER more power to deal with these violations. This means simplifying on-site inspections and information requests, as well as conducting investigations through an EU-level mechanism including ACER and national regulatory authorities (NRAs). Furthermore, ACER is now able to require periodic penalty payments in order to enforce compliance. Nonetheless, the Member States continue to have the power to impose fines for REMIT infractions.

In order to address cross-border market abuse in the wholesale energy markets, ACER's investigative powers have been strengthened. The amended REMIT strengthens regulatory control and ensures market integrity by providing ACER with increased enforcement powers and facilitating tighter coordination with NRAs. Although Member States have the last say when it comes to penalties, ACER's expanded role helps to build a stronger regulatory framework that promotes openness and confidence in the European energy markets.

Reduce your

compliance risks