SFDR Regulation: ESMA's 2024 Timeline and Changes

ESMA’s SFDR Regulation update highlights the 2025 review, emphasizing sustainability risk integration and EU Taxonomy alignment for transparency in finance.

On 14 October 2024, the European Securities and Markets Authority (ESMA) released an updated implementation timeline for sustainable finance regulations. The timeline includes key regulations such as the Sustainable Finance Disclosure Regulation (SFDR), the Taxonomy Regulation, the Corporate Sustainability Reporting Directive (CSRD), the Benchmarks Regulation, and the European Green Bonds Regulation.

This update highlights the ongoing regulatory developments, including a potential review of the SFDR by the European Commission in mid-2025. The timeline reflects the growing emphasis on sustainability-related disclosures and the integration of environmental considerations into financial services and investment frameworks across the EU.

Source

[1]

SFDR Implementation Timeline (2023–2029)

The SFDR implementation follows a multi-year phased approach that aligns with the timelines of other sustainable finance regulations. The timeline can be segmented as follows:

- Since January 1, 2023:

- Non-financial undertakings have been required to disclose KPIs regarding their alignment with the EU Taxonomy Regulation, particularly focusing on climate-related objectives (e.g., climate change mitigation and adaptation).

- January 1, 2024:

- Financial undertakings will join this disclosure regime by reporting their alignment with the same climate objectives under the Taxonomy Regulation.

- From January 2025 Onwards:

- New requirements begin to take effect for financial undertakings to disclose KPIs related to additional environmental objectives, such as sustainable use of water resources, transition to a circular economy, pollution prevention, and the protection of biodiversity.

- Mid-2025 SFDR L1 Review:

- A Level 1 review of SFDR is anticipated around mid-2025. This review will likely refine disclosure obligations based on feedback from stakeholders and the evolving regulatory landscape.

- 2026 to 2027:

- Large undertakings that were not previously subject to the Non-Financial Reporting Directive (NFRD) will begin reporting under the European Sustainability Reporting Standards (ESRS) Set 1.

- Listed Small and Medium-Sized Enterprises (SMEs) and small, non-complex financial institutions can begin optional reporting under the ESRS for LSMEs (Listed SMEs). Reporting for these institutions will become mandatory by 2029.

- End of 2025 Transition Periods:

- Several key transitional provisions under the Benchmark Regulation (BMR) and SFDR come to an end, specifically concerning existing funds and third-country benchmarks.

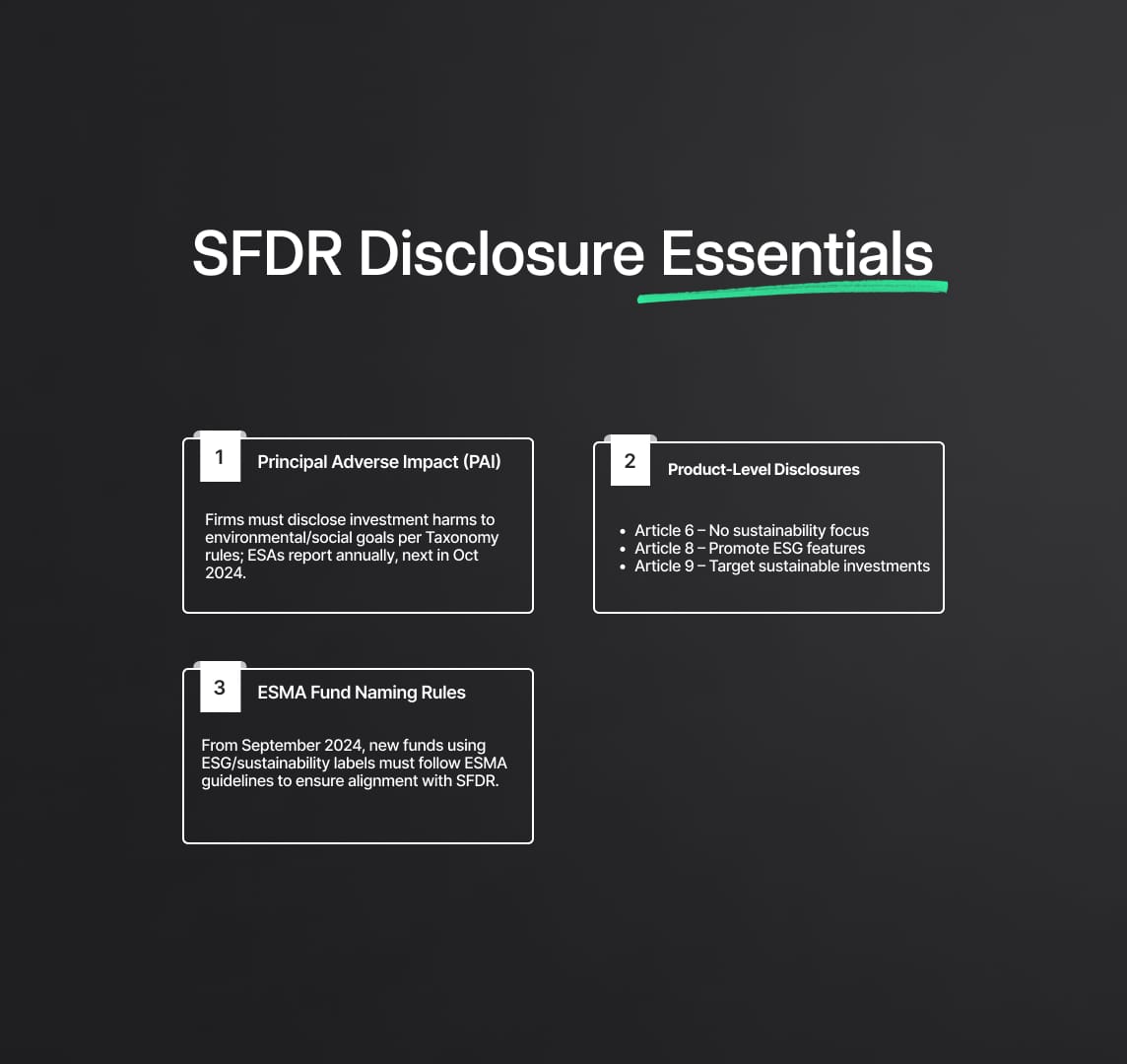

Key SFDR Disclosure Requirements

The SFDR mandates that financial market participants disclose how they integrate sustainability risks in their investment decision-making processes. The disclosures are divided into two key categories:

- Principal Adverse Impact (PAI) Indicators:

- Institutions must disclose how their investments adversely impact environmental and social objectives. These indicators are further enhanced through Taxonomy Regulation Disclosures Delegated Acts (DA), which provide specific criteria for reporting on both climate and non-climate objectives.

- The European Supervisory Authorities (ESAs) issue periodic reports on the voluntary disclosures under SFDR. For instance, by October 2024, the ESAs will have released their third annual report, summarizing trends and improvements in PAI disclosures.

- Product-Level Disclosures:

- SFDR also requires financial products to be classified based on sustainability criteria into three categories:

- Article 6: Financial products that do not integrate any sustainability considerations.

- Article 8: Products promoting environmental or social characteristics but do not have a specific sustainable investment objective.

- Article 9: Products that specifically target sustainable investments, aligning directly with taxonomy-defined objectives.

- By September 2024, the ESMA (European Securities and Markets Authority) guidelines on the naming of funds using ESG or sustainability-related terms will apply to all newly created funds. These guidelines ensure that products labeled as sustainable or environmentally friendly are compliant with SFDR’s stringent standards.

- SFDR also requires financial products to be classified based on sustainability criteria into three categories:

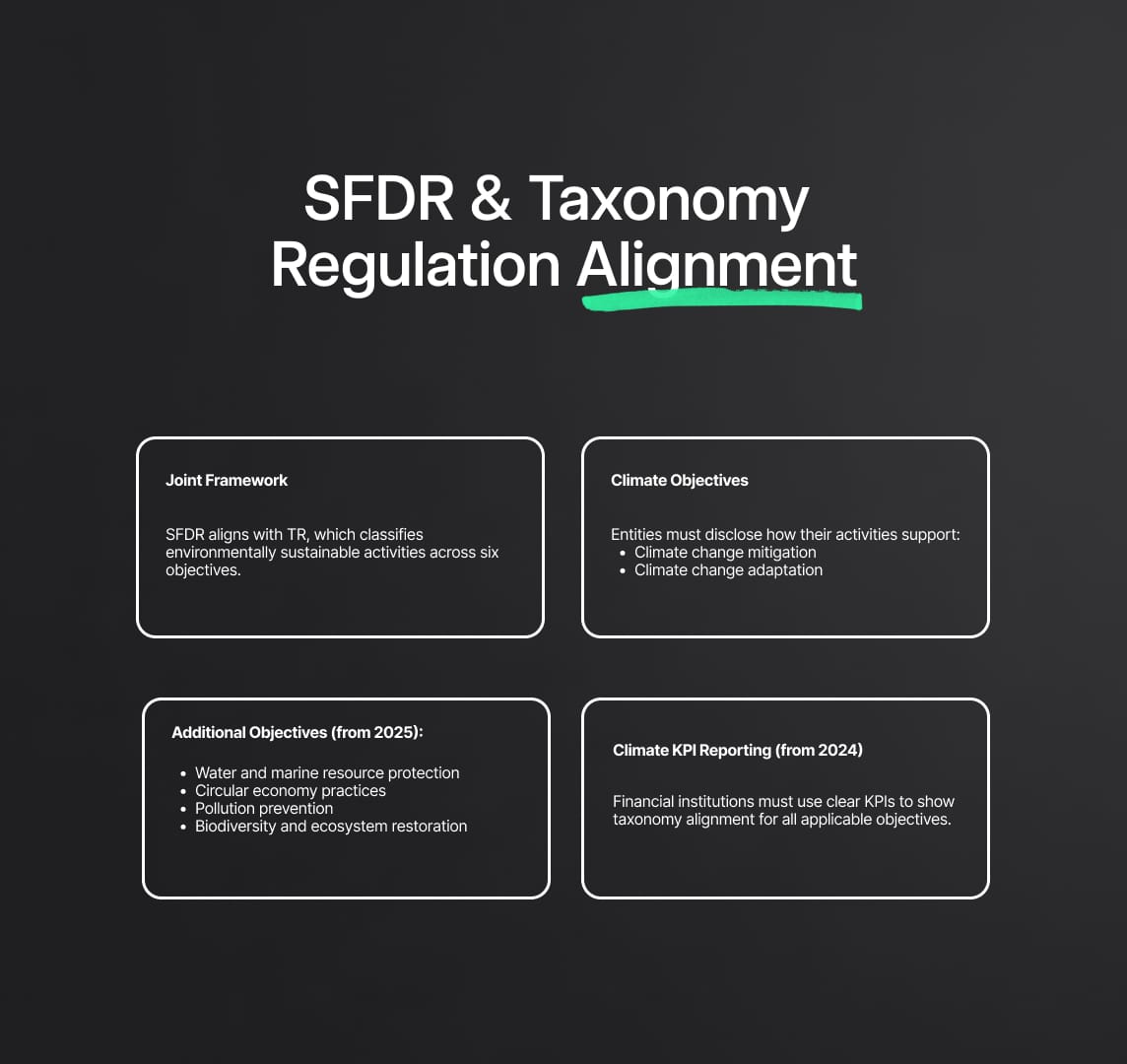

SFDR Integration with the Taxonomy Regulation (TR)

SFDR works in close conjunction with the Taxonomy Regulation, which establishes a classification system for environmentally sustainable activities. Under TR, financial and non-financial undertakings must disclose their alignment with the six environmental objectives defined by the regulation.

- Climate Objectives:

- These objectives include climate change mitigation and adaptation, requiring entities to report how their activities or investments reduce greenhouse gas emissions or build resilience against climate change.

- Additional Environmental Objectives:

- From 2025 onwards, financial and non-financial entities will need to provide data on their alignment with four additional objectives:

- Sustainable use and protection of water and marine resources.

- Transition to a circular economy, which includes waste reduction and the use of sustainable raw materials.

- Pollution prevention and control, requiring reporting on activities that contribute to reducing or controlling emissions and pollutants.

- Protection and restoration of biodiversity and ecosystems, focusing on the preservation of natural habitats and wildlife.

- From 2025 onwards, financial and non-financial entities will need to provide data on their alignment with four additional objectives:

The TR disclosure framework, particularly the Delegated Acts for climate and additional environmental objectives, significantly shapes the nature of SFDR disclosures. For example, from 2024, financial institutions must present clear KPIs demonstrating their taxonomy alignment for these objectives.

Article 69/70 Transition Period (2026)

One notable aspect of the regulatory timeline is the Article 69/70 transition period, ending in June 2026. This period allows existing financial products and benchmarks, which were developed before the SFDR's full application, to transition to compliance with SFDR and TR standards.

This transition is critical for firms that need to adjust their disclosure systems to align with SFDR’s reporting templates, particularly the Annex I of the SFDR Delegated Regulation (DR). The reporting templates focus on PAI indicators, sustainability risks, and taxonomy alignment, and are intended to harmonize disclosures across the EU.

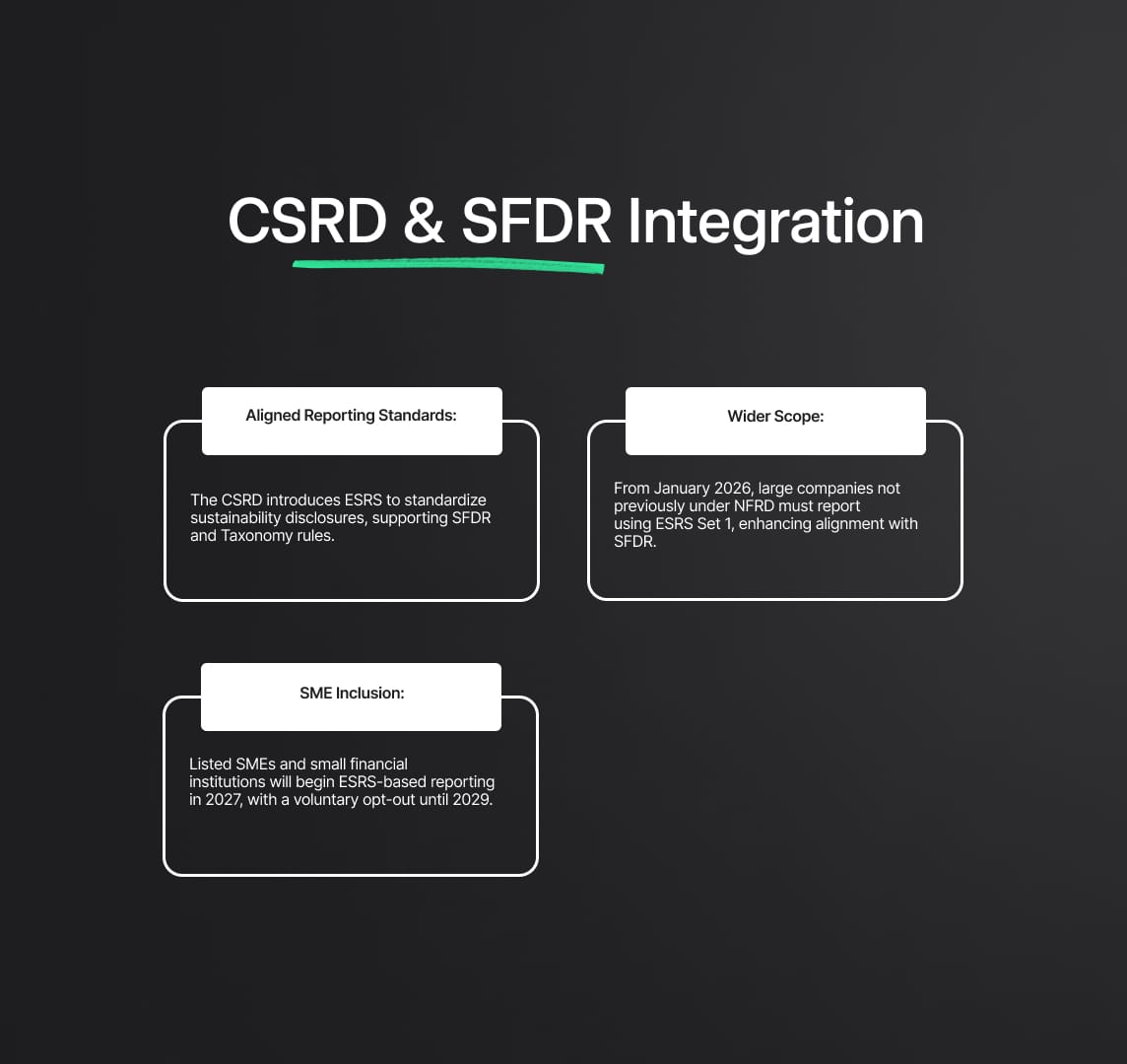

Corporate Sustainability Reporting Directive (CSRD) Alignment

The CSRD, which has been applicable since January 2023, expands the scope of sustainability reporting beyond what was required under the NFRD. The CSRD integrates with SFDR in multiple ways:

- Consistency in Reporting Standards:

- The European Sustainability Reporting Standards (ESRS) introduced by CSRD ensures that non-financial undertakings follow a structured approach to disclose sustainability data, which complements the SFDR requirements. This means that undertakings previously required to report under NFRD will now have to meet more stringent reporting standards, particularly for environmental disclosures that tie directly to SFDR and TR obligations.

- Extended Scope:

- By January 2026, large undertakings that were not previously subject to the NFRD will have to start reporting under ESRS Set 1. This transition aligns with SFDR’s requirements for more comprehensive and detailed sustainability disclosures.

- SME Reporting:

- Listed SMEs and small, non-complex financial institutions will begin reporting under ESRS for LSMEs starting from 2027, with an opt-out provision available until 2029.

Benchmark Regulation (BMR) and SFDR Alignment

The Benchmark Regulation (BMR), which focuses on the governance and transparency of financial benchmarks, also aligns with SFDR. BMR requires that benchmarks used by financial market participants integrate sustainability factors, especially those aligned with the EU Taxonomy. By end-2025, the transition period for third-country benchmarks under BMR will expire, aligning with SFDR's disclosure timelines for funds and other financial instruments.

European Green Bonds Regulation (EuGBR)

Another critical regulation in the EU's sustainable finance framework is the European Green Bonds Regulation (EuGBR), which sets standards for issuing green bonds. EuGBR is expected to fully integrate with SFDR, particularly concerning how issuers of green bonds report their alignment with the Taxonomy Regulation.

The Future Impact of SFDR and Related Regulatory Updates on Sustainable Finance

The evolving landscape of Sustainable Finance Disclosure Regulation (SFDR), alongside its integration with the Taxonomy Regulation (TR), Corporate Sustainability Reporting Directive (CSRD), and European Green Bonds Regulation (EuGBR), marks a significant transformation in how financial and non-financial undertakings disclose their sustainability impacts. As we move toward the 2025–2029 period, the implications of these updates will reshape the financial sector, ensuring that sustainability becomes an integral part of investment decision-making.

The heightened transparency requirements will not only drive greater accountability but also encourage investors to allocate capital more effectively towards environmentally and socially responsible activities. As taxonomy-aligned disclosures expand to cover broader environmental objectives, and as SMEs and large undertakings come under the regulatory umbrella, these updates will likely enhance market confidence in sustainable finance products. The expected alignment of green bonds under EuGBR with SFDR standards further cements the EU’s commitment to a robust framework for sustainable finance.

In the future, these developments will likely increase competition among financial institutions to offer more transparent and genuinely sustainable products. At the same time, the enhanced reporting obligations under SFDR, especially for non-financial undertakings, will catalyze companies to adopt greener and more sustainable business practices. This comprehensive regulatory ecosystem will play a crucial role in accelerating the EU’s goals towards achieving carbon neutrality and fostering long-term sustainable growth.

Reduce your

compliance risks